Analysts’ Viewpoint on Paints & Coatings Market Scenario

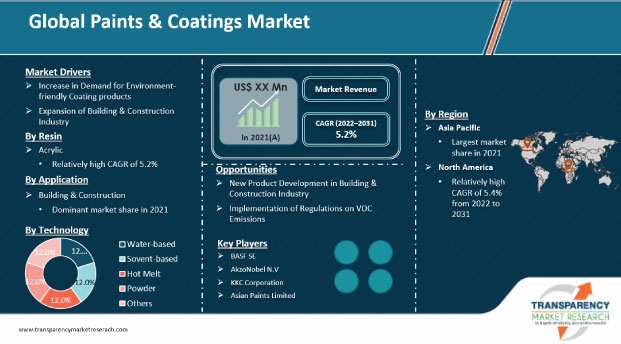

Leading players in the global market are focusing on developing new products, such as antibacterial paints and color-changing pigment technologies, to keep their business growing post the COVID-19 pandemic. Paints & coatings companies are enhancing their market footprint by increasing the production capacity of their existing plants through strategic collaborations in new regions. Efforts are being made to introduce innovation in the fields of water-based coatings, UV cured coatings, and powder coatings in order to reduce carbon emissions. Companies in the paints & coatings business should focus on manufacturing renewable bio-based resins vis-à-vis traditionally used coating resins.

Paints & coatings are substances applied on a substrate to decorate and protect the surface. Paints & coatings improve the durability and esthetics of the surface when used for decorative purposes. They also protect the surface from adverse environmental conditions, weathering, rust, and exposure to chemicals. Paints & coatings also provide specific properties such as anti-fouling, flame retardancy, and anti-microbial properties in certain applications.

The building & construction industry in Asia Pacific has been expanding significantly owing to economic growth and the resultant improvement in the standard of living of the people in developing countries of the region. This is boosting the demand for paints & coatings in the Asia Pacific. The global paints & coatings market is significantly driven by the extensive usage of paints & coatings in the construction, automotive & transportation, and healthcare industries.

Request a sample to get extensive insights into the Paints & Coatings Market

The paints & coatings industry is witnessing a trend of usage of low-VOC and environment-friendly technologies such as water-based coatings, powder coatings, and UV-curable coatings. The shift is attributed to the enactment of stringent regulations on VOC emissions in several regions, especially in North America and Europe. Awareness about VOC emissions is rising in the Asia Pacific. This is anticipated to boost the demand for low-VOC water-based coatings during the forecast period. A rise in awareness about the impact of coating products on the environment and human health, and an increase in focus on sustainable alternative technologies are augmenting the demand for water-based paints & coatings.

Manufacturers are focusing on water-based paints & coatings, as they are cost-effective alternatives to traditionally used solvent-based paints & coatings. Solvent-based paints & coatings are also marked by rising feedstock prices and supply instability. Water-based coatings are extensively employed as architectural coatings. Technologies such as powder coatings and high solids are also gaining momentum due to their low VOC content, which makes them environment-friendly vis-à-vis solvent-based coatings. Thus, the usage of environment-friendly coating products is expected to propel the paints & coating market during the forecast period.

The building & construction industry is projected to grow at a rapid pace in the next few years due to the rise in urbanization and population. Urbanization and changing lifestyles are expected to drive the global construction industry in the next few years. Growth in population and improvement in economic conditions have boosted the expenditure on housing and infrastructure development across the globe. Paints & coatings are widely used to decorate and protect infrastructure and buildings.

Interior and exterior house paint, floor paint, epoxy floor paint, primers, sealers, varnishes, and stains are some of the architectural enhancements used to improve the aesthetics of a home. Architectural paints are low-VOC, odorless, and scrub-resistant, and are available in various textures, ranging from semi-gloss to high-gloss sheens. The market is expected to grow due to the increase in construction activities and government investment in various public infrastructure projects. Furthermore, advanced technologies are being adopted across the building industry. These factors are estimated to drive the paints & coatings market during the forecast period.

Request a custom report on the Paints & Coatings Market

Based on resin, the global paints & coatings market has been classified into acrylic, polyurethane, polyester, alkyds, epoxy, and others. The acrylic segment is estimated to hold a prominent share of the global market during the forecast period. The acrylic segment held a 40.3% share of the market in 2021. It is estimated to expand at a growth rate of 5.2% during the forecast period. Acrylic resins can be used in solvent-based and water-based formulations; hence, they are widely used in architectural coatings, industrial coatings, and protective coatings.

The polyurethane segment is expected to maintain the status quo and expand at a growth rate of more than 6.0% during the forecast period. Polyurethane coatings are durable and impart excellent weather resistance, gloss, and color retention to surfaces. Therefore, they are widely used in topcoats of automotive coatings. Polyurethane coatings are also used in wood finishes, marine coatings, architectural coatings, and other high-performance applications. They can be used as one-, two-, or three-part formulations. Moreover, they are compatible with water-based coating systems.

In terms of technology, the paints & coatings market has been split into the water-based, solvent-based, hot melt, powder, and others. The water-based segment dominated the global paints & coatings market with a 45.2% share in 2021. Furthermore, the segment is estimated to grow at a CAGR of 5.8% during the forecast period.

Water-based coating is an eco-friendly surface treatment that uses water as a solvent to disperse the resin employed to form the coating or paint. These coatings are widely used due to their low VOC (volatile organic compound) content (less than 3.5 pounds per gallon of water). Water-based coatings have better surface coverage compared to solvent-based coatings. However, they offer slightly poor adhesion to substrates vis-à-vis solvent-based coatings.

Asia Pacific dominated the global paints & coatings market in 2021. In terms of volume, the region held a 45.5% share of the global market in 2021. Its share is anticipated to increase to 46.5% by 2031. Asia Pacific is a prominent producer of paints & coatings, owing to the presence of a large number of manufacturers in China. Improving economic conditions in the region is further fuelling the demand for paints & coatings in the region. Demand for epoxy paint, waterproof paint, Clearcoat spray paint, vinyl ester coatings, wood coatings, and roof coatings is high in Asia Pacific.

North America and Europe are other notable markets for paints & coatings. The market for paints & coatings in these regions is mature. It is estimated to grow at a sluggish pace during the forecast period, due to the enactment of stringent regulations on VOC emissions in these regions. The market in North America and Europe has valued at US$ 34.92 Bn and US$ 42.47 Bn, respectively, in 2021. The market in these regions is estimated to grow at a CAGR of 5.45% and 5.0%, respectively, during the forecast period. Latin America and Middle East & Africa accounted for a relatively minor share of the global market in 2021. However, the market in these regions is projected to grow at a rapid pace during the forecast period.

The global paints & coatings market is consolidated, with a small number of large-scale vendors controlling the majority of the share. Most of the firms are investing significantly in comprehensive research & development activities, primarily to introduce environment-friendly products. Expansion of product portfolios and mergers and acquisitions are the major strategies adopted by key players. Akzo Nobel N.V., BASF SE, The Sherwin Williams Company, PPG Industries, Inc., Axalta Coating System, RPM International Inc., KCC Corporation, Berger Paints India Limited, Nippon Paints Holdings Co., Ltd, The Valspar Corporation, Jotun A/S, Hempel A/S, Asian Paints Limited, Kansai Paint Co., Ltd., Dow Corning, Helios Group, Masco Corporation, TIKKURILAOYJ, Diamond Vogel, and Beckers Group are the leading players in the paints & coatings market.

Each of these players has been profiled in the paints & coatings market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 181.89 Bn |

|

Market Forecast Value in 2031 |

US$ 369.85 Bn |

|

Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Mn for Value & Kilo Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The paints & coatings market stood at US$ 181.89 Bn in 2021.

The market is expected to expand at a CAGR of 5.2% from 2022 to 2031.

Increase in demand for environment-friendly coating products and expansion of the building & construction industry are key drivers of the paints & coatings market.

Acrylic was the largest resin segment that held 40.3% share in 2021.

Asia Pacific was the most lucrative region of the global market in 2021.

Akzo Nobel N.V., BASF SE, The Sherwin Williams Company, PPG Industries, Inc., Axalta Coating System, RPM International Inc., KCC Corporation, Berger Paints India Limited, and Nippon Paints Holdings Co., Ltd.

1. Executive Summary

1.1. Paints & Coatings Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Material Providers

2.6.2. List of Key Manufacturers

2.6.3. List of Suppliers/ Distributors

2.6.4. List of Potential Customers

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2021

5. Price Trend Analysis

6. Global Paints & coatings Market Analysis and Forecast, by Resin, 2020–2031

6.1. Introduction and Definitions

6.2. Global Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

6.2.1. Acrylic

6.2.2. Polyurethane

6.2.3. Polyester

6.2.4. Alkyds

6.2.5. Epoxy

6.2.6. Others

6.3. Global Paints & Coatings Market Attractiveness, by Resin

7. Global Paints & coatings Market Analysis and Forecast, by Technology, 2020–2031

7.1. Introduction and Definitions

7.2. Global Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

7.2.1. Water-based

7.2.2. Solvent-based

7.2.3. Hot Melt

7.2.4. Powder

7.2.5. Others

7.3. Global Paints & Coatings Market Attractiveness, by Technology

8. Global Paints & coatings Market Analysis and Forecast, by Application, 2020–2031

8.1. Introduction and Definitions

8.2. Global Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.2.1. Automation & transportation

8.2.2. Aerospace

8.2.3. Building & Construction

8.2.4. Healthcare & Medical Devices

8.2.5. Marine

8.2.6. Electrical & Electronics

8.2.7. Packaging

8.2.8. Others

8.3. Global Paints & Coatings Market Attractiveness, by Application

9. Global Paints & coatings Market Analysis and Forecast, by Region, 2020–2031

9.1. Key Findings

9.2. Global Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Global Paints & Coatings Market Attractiveness, by Region

10. North America Paints & coatings Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. North America Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.3. North America Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

10.4. North America Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5. North America Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

10.5.1. U.S. Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.5.2. U.S. Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

10.5.3. U.S. Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.4. Canada Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

10.5.5. Canada Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

10.5.6. Canada Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.6. North America Paints & Coatings Market Attractiveness Analysis

11. Europe Paints & coatings Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Europe Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

11.3. Europe Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.4. Europe Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5. Europe Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022‒2031

11.5.1. Germany Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Form, 2020–2031

11.5.2. Germany Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.5.3. Germany Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.4. France Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

11.5.5. France Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.5.6. France Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.7. U.K. Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

11.5.8. U.K. Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.5.9. U.K. Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.10. Italy Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

11.5.11. Italy. Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.5.12. Italy Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.13. Russia & CIS Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

11.5.14. Russia & CIS Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.5.15. Russia & CIS Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.16. Rest of Europe Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

11.5.17. Rest of Europe Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

11.5.18. Rest of Europe Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.6. Europe Paints & Coatings Market Attractiveness Analysis

12. Asia Pacific Paints & coatings Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Asia Pacific Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin

12.3. Asia Pacific Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

12.4. Asia Pacific Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5. Asia Pacific Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022‒2031

12.5.1. China Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

12.5.2. China Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

12.5.3. China Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.4. Japan Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

12.5.5. Japan Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

12.5.6. Japan Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.7. India Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

12.5.8. India Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

12.5.9. India Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.10. ASEAN Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

12.5.11. ASEAN Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

12.5.12. ASEAN Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.13. Rest of Asia Pacific Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

12.5.14. Rest of Asia Pacific Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

12.5.15. Rest of Asia Pacific Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.6. Asia Pacific Paints & Coatings Market Attractiveness Analysis

13. Latin America Paints & coatings Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Latin America Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

13.3. Latin America Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

13.4. Latin America Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5. Latin America Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022‒2031

13.5.1. Brazil Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

13.5.2. Brazil Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

13.5.3. Brazil Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5.4. Mexico Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

13.5.5. Mexico Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

13.5.6. Mexico Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5.7. Rest of Latin America Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

13.5.8. Rest of Latin America Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

13.5.9. Rest of Latin America Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.6. Latin America Paints & Coatings Market Attractiveness Analysis

14. Middle East & Africa Paints & coatings Market Analysis and Forecast, 2020–2031

14.1. Key Findings

14.2. Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

14.3. Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

14.4. Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.5. Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022‒2031

14.5.1. GCC Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

14.5.2. GCC Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

14.5.3. GCC Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.5.4. South Africa Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

14.5.5. South Africa Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

14.5.6. South Africa Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.5.7. Rest of Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Resin, 2020–2031

14.5.8. Rest of Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Technology, 2020–2031

14.5.9. Rest of Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.6. Middle East & Africa Paints & Coatings Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Ink Company Market Share Analysis, 2021

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. AkzoNobel N.V.

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Overview

15.2.1.4. Strategic Overview

15.2.2. BASF SE

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Overview

15.2.2.4. Strategic Overview

15.2.3. The Sherwin Williams Company

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Financial Overview

15.2.3.4. Strategic Overview

15.2.4. PPG industries, In.

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Overview

15.2.4.4. Strategic Overview

15.2.5. Axalta Coating System

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. Financial Overview

15.2.5.4. Strategic Overview

15.2.6. RPM International Inc.

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.6.3. Financial Overview

15.2.6.4. Strategic Overview

15.2.7. KKC Corporation

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. Financial Overview

15.2.7.4. Strategic Overview

15.2.8. Berger Paints India Limited

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.8.3. Financial Overview

15.2.8.4. Strategic Overview

15.2.9. Nippon Paints Holdings Co., Ltd.

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.9.3. Financial Overview

15.2.9.4. Strategic Overview

15.2.10. The Valspar Corporation

15.2.10.1. Company Description

15.2.10.2. Business Overview

15.2.10.3. Financial Overview

15.2.10.4. Strategic Overview

15.2.11. Jotun A/S

15.2.11.1. Company Description

15.2.11.2. Business Overview

15.2.11.3. Financial Overview

15.2.11.4. Strategic Overview

15.2.12. Asian Paints Limited

15.2.12.1. Company Description

15.2.12.2. Business Overview

15.2.12.3. Financial Overview

15.2.12.4. Strategic Overview

15.2.13. Kansai Paints Co, Ltd.

15.2.13.1. Company Description

15.2.13.2. Business Overview

15.2.13.3. Financial Overview

15.2.13.4. Strategic Overview

15.2.14. Dow Coring

15.2.14.1. Company Description

15.2.14.2. Business Overview

15.2.14.3. Financial Overview

15.2.14.4. Strategic Overview

15.2.15. Hellos group

15.2.15.1. Company Description

15.2.15.2. Business Overview

15.2.15.3. Financial Overview

15.2.15.4. Strategic Overview

15.2.16. Moscow Corporation

15.2.16.1. Company Description

15.2.16.2. Business Overview

15.2.16.3. Financial Overview

15.2.16.4. Strategic Overview

15.2.17. TIKKURILAOYJ

15.2.17.1. Company Description

15.2.17.2. Business Overview

15.2.17.3. Financial Overview

15.2.17.4. Strategic Overview

15.2.18. Diamond Vogel

15.2.18.1. Company Description

15.2.18.2. Business Overview

15.2.18.3. Financial Overview

15.2.18.4. Strategic Overview

15.2.19. Backers Group

15.2.19.1. Company Description

15.2.19.2. Business Overview

15.2.19.3. Financial Overview

15.2.19.4. Strategic Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 2: Global Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 3: Global Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 4: Global Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 5: Global Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 6: Global Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 7: Global Paints & Coatings Market Volume (Kilo Tons) Forecast, by Region, 2020–2031

Table 8: Global Paints & coatings Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 9: North America Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 10: North America Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 11: North America Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 12: North America Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 13: North America Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 14: North America Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 15: North America Paints & Coatings Market Volume (Kilo Tons) Forecast, by Country, 2020–2031

Table 16: North America Paints & coatings Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 17: U.S. Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 18: U.S. Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 19: U.S. Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 20: U.S. Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 21: U.S. Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 22: U.S. Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 23: Canada Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 24: Canada Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 25: Canada Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 26: Canada Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 27: Canada Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 28: Canada Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 29: Europe Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 30: Europe Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 31: Europe Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 32: Europe Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 33: Europe Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 34: Europe Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 35: Europe Paints & Coatings Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 36: Europe Paints & coatings Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 37: Germany Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 38: Germany Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 39: Germany Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 40: Germany Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 41: Germany Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 42: Germany Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: France Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 44: France Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 45: France Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 46: France Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 47: France Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 48: France Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 49: U.K. Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 50: U.K. Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 51: U.K. Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 52: U.K. Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 53: U.K. Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 54: U.K. Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 55: Italy Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 56: Italy Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 57: Italy Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 58: Italy Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 59: Italy Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 60: Italy Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 61: Spain Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 62: Spain Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 63: Spain Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 64: Spain Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 65: Spain Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 66: Spain Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 67: Russia & CIS Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 68: Russia & CIS Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 69: Russia & CIS Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 70: Russia & CIS Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 71: Russia & CIS Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 72: Russia & CIS Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 73: Rest of Europe Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 74: Rest of Europe Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 75: Rest of Europe Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 76: Rest of Europe Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 77: Rest of Europe Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 78: Rest of Europe Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 79: Asia Pacific Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 80: Asia Pacific Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 81: Asia Pacific Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 82: Asia Pacific Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 83: Asia Pacific Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 84: Asia Pacific Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 85: Asia Pacific Paints & Coatings Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 86: Asia Pacific Paints & coatings Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 87: China Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 88: China Paints & coatings Market Value (US$ Mn) Forecast, by Resin 2020–2031

Table 89: China Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 90: China Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 91: China Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 92: China Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 93: Japan Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 94: Japan Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 95: Japan Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 96: Japan Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 97: Japan Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 98: Japan Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 99: India Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 100: India Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 101: India Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 102: India Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 103: India Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 104: India Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 105: India Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 106: India Paints & coatings Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 107: ASEAN Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 108: ASEAN Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 109: ASEAN Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 110: ASEAN Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 111: ASEAN Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 112: ASEAN Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 113: Rest of Asia Pacific Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 114: Rest of Asia Pacific Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 115: Rest of Asia Pacific Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 116: Rest of Asia Pacific Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 117: Rest of Asia Pacific Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 118: Rest of Asia Pacific Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 119: Latin America Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 120: Latin America Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 121: Latin America Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 122: Latin America Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 123: Latin America Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 124: Latin America Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 125: Latin America Paints & Coatings Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 126: Latin America Paints & coatings Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 127: Brazil Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 128: Brazil Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 129: Brazil Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 130: Brazil Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 131: Brazil Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 132: Brazil Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 133: Mexico Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 134: Mexico Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 135: Mexico Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 136: Mexico Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 137: Mexico Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 138: Mexico Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 139: Rest of Latin America Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 140: Rest of Latin America Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 141: Rest of Latin America Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 142: Rest of Latin America Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 143: Rest of Latin America Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 144: Rest of Latin America Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 145: Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 146: Middle East & Africa Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 147: Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 148: Middle East & Africa Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 149: Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 150: Middle East & Africa Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 151: Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 152: Middle East & Africa Paints & coatings Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 153: GCC Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 154: GCC Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 155: GCC Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 156: GCC Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 157: GCC Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 158: GCC Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 159: South Africa Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 160: South Africa Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 161: South Africa Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 162: South Africa Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 163: South Africa Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 164: South Africa Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 165: Rest of Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2020–2031

Table 166: Rest of Middle East & Africa Paints & coatings Market Value (US$ Mn) Forecast, by Resin, 2020–2031

Table 167: Rest of Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) Forecast, by Technology, 2020–2031

Table 168: Rest of Middle East & Africa Paints & coatings Market Value (US$ Mn) Forecast, by Technology, 2020–2031

Table 169: Rest of Middle East & Africa Paints & Coatings Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 170: Rest of Middle East & Africa Paints & coatings Market Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Global Paints & Coatings Market Volume Share Analysis, by Resin, 2021, 2025, and 2031

Figure 2: Global Paints & Coatings Market Attractiveness, by Resin

Figure 3: Global Paints & Coatings Market Volume Share Analysis, by Technology, 2021, 2025, and 2031

Figure 4: Global Paints & Coatings Market Attractiveness, by Technology

Figure 5: Global Paints & Coatings Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 6: Global Paints & Coatings Market Attractiveness, by Application

Figure 7: Global Paints & Coatings Market Volume Share Analysis, by Region, 2021, 2025, and 2031

Figure 8: Global Paints & Coatings Market Attractiveness, by Region

Figure 9: North America Paints & Coatings Market Volume Share Analysis, by Resin, 2021, 2025, and 2031

Figure 10: North America Paints & Coatings Market Attractiveness, by Resin

Figure 11: North America Paints & Coatings Market Attractiveness, by Resin

Figure 12: North America Paints & Coatings Market Volume Share Analysis, by Technology, 2021, 2025, and 2031

Figure 13: North America Paints & Coatings Market Attractiveness, by Technology

Figure 14: North America Paints & Coatings Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 15: North America Paints & Coatings Market Attractiveness, by Application

Figure 16: North America Paints & Coatings Market Attractiveness, by Country

Figure 17: Europe Paints & Coatings Market Volume Share Analysis, by Resin, 2021, 2025, and 2031

Figure 18: Europe Paints & Coatings Market Attractiveness, by Resin

Figure 19: Europe Paints & Coatings Market Volume Share Analysis, by Technology, 2021, 2025, and 2031

Figure 20: Europe Paints & Coatings Market Attractiveness, by Technology

Figure 21: Europe Paints & Coatings Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 22: Europe Paints & Coatings Market Attractiveness, by Application

Figure 23: Europe Paints & Coatings Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 24: Europe Paints & Coatings Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Paints & Coatings Market Volume Share Analysis, by Resin, 2021, 2025, and 2031

Figure 26: Asia Pacific Paints & Coatings Market Attractiveness, by Resin

Figure 27: Asia Pacific Paints & Coatings Market Volume Share Analysis, by Technology, 2021, 2025, and 2031

Figure 28: Asia Pacific Paints & Coatings Market Attractiveness, by Technology

Figure 29: Asia Pacific Paints & Coatings Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 30: Asia Pacific Paints & Coatings Market Attractiveness, by Application

Figure 31: Asia Pacific Paints & Coatings Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 32: Asia Pacific Paints & Coatings Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Paints & Coatings Market Volume Share Analysis, by Resin, 2021, 2025, and 2031

Figure 34: Latin America Paints & Coatings Market Attractiveness, by Resin

Figure 35: Latin America Paints & Coatings Market Volume Share Analysis, by Technology, 2021, 2025, and 2031

Figure 36: Latin America Paints & Coatings Market Attractiveness, by Technology

Figure 37: Latin America Paints & Coatings Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 38: Latin America Paints & Coatings Market Attractiveness, by Application

Figure 39: Latin America Paints & Coatings Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 40: Latin America Paints & Coatings Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Paints & Coatings Market Volume Share Analysis, by Resin, 2021, 2025, and 2031

Figure 42: Middle East & Africa Paints & Coatings Market Attractiveness, by Resin

Figure 43: Middle East & Africa Paints & Coatings Market Volume Share Analysis, by Technology, 2021, 2025, and 2031

Figure 44: Middle East & Africa Paints & Coatings Market Attractiveness, by Technology

Figure 45: Middle East & Africa Paints & Coatings Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 46: Middle East & Africa Paints & Coatings Market Attractiveness, by Application

Figure 47: Middle East & Africa Paints & Coatings Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 48: Middle East & Africa Paints & Coatings Market Attractiveness, by Country and Sub-region