Reports

Reports

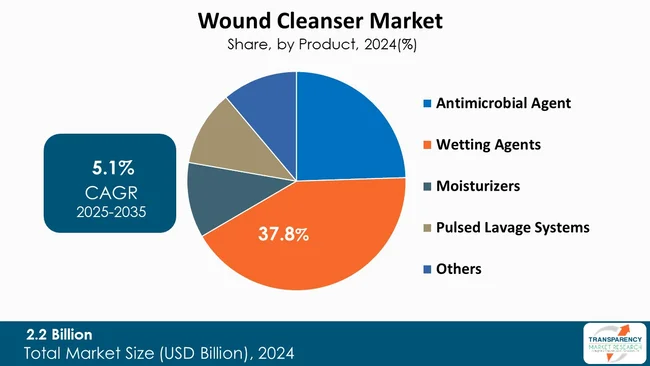

The global wound cleanser market size was valued at US$ 2.2 Billion in 2024 and is projected to reach US$ 3.9 Billion by 2035, expanding at a CAGR of 5.1 % from 2025 to 2035. The wound cleanser industry, as a whole, is heavily dependent on the increase of chronic and acute wounds. Given factors are a consequence of the ageing populations, the rising rates of diabetes and obesity, and the growing numbers of surgical and trauma procedures. Besides these factors, a greater clinical focus on infection prevention and faster healing is also contributing to the market growth.

The global wound cleanser market has been witnessing consistency over the last few years and the status quo is expected to continue during the forecast period. This is credited to factors such as rising incidences of chronic wounds, increasing geriatric population, and rise in surgical and trauma cases globally. As medical professionals are concentrating on minimizing the risk of infections and facilitating quick healing, the need for efficient wound care products has been continuously growing.

Furthermore, the progress in wound care devices and the increased use of specially formulated wound cleansers in medical facilities, nursing stations, and the home-care sector are the major contributors to the market growth. Nevertheless, the expensive prices of the advanced products and the low level of awareness in the underdeveloped regions might restrain the market.

The market is likely to be sustained by continuous innovations and a greater focus on patient outcomes in wound care management. In addition to this, the players in the market are progressively putting more money into the research and development activities with the aim to bring to the market the products with even more antimicrobial properties and biocompatibility. The orchestrated collaborations between the medical care givers and the manufacturers are also facilitating the improvement of the product availability and their effectiveness in clinical practice.

The wound cleanser market implies products that serve the purpose of hydrating, cleaning, and preparing wounds for quick healing by the removal of debris, and contaminants without causing any injury to the healthy tissue.

These solutions are the essentials that provide the very first line of defense against infection, thereby, enabling effective wound management in diverse healthcare settings such as clinics, hospitals, and home care. There are different formulations available in the market. They include antiseptic cleansers, saline solutions, and surfactant-based products, which are specially designed for healing acute as well as chronic wounds.

Moreover, as chronic diseases such as diabetes are becoming a concern worldwide and the number of surgeries is also increasing, the need for safe and effective wound cleansing products is growing on a continual basis. The wound cleanser market, in essence, does represent an essential sector of the larger wound care business, which is basically focused on patient safety, thereby preventing infections and enabling faster healing.

For instance, in order to improve the monitoring system and guarantee product safety, the U.S. Food and Drug Administration (FDA) has launched draft regulatory changes that would lead to the reclassification of certain liquid wound washes and wound dressings, which would also include antimicrobial wound cleansers.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing incidences of both - chronic and acute wounds is one of the major reasons leading to the global demand for wound cleansers. As a result of the increasing rate of obesity, diabetes, and the aging population, chronic wounds, e.g., pressure ulcers, diabetic foot ulcers, and venous leg ulcers are getting more common. As per the study published by the National Library of Medicine in May 2023, nearly 450,000 individuals receive treatment for burns every year, and around 30,000 require specialized care at burn centers.

Moreover, the prevalence of acute wounds owing to trauma, accidents, and surgical operations is increasing as well with the development of healthcare services and an increase in the number of surgeries. These situations call for the use of efficient wound cleansing products for avoiding infection, accelerating healing, burns, and improving the general health of the patient.

For instance, as per the WHO report published in October 2023, around 180,000 morbidities occur each year across the globe due to burn injuries. Burns are among the leading causes of disability-adjusted life-years (DALYs) lost in middle- and low-income countries.

Globally, the rising count of surgical interventions and trauma injuries is the major factor behind the escalating demand for wound cleansing products. The need for proper post-operative wound care is becoming vital as the surgical volumes increase globally due to medical technology advancements and healthcare access expansion. As a result, hospitals and the other healthcare facilities are progressively turning to sophisticated wound cleansing products to not only expedite the recovery of their patients but also to reduce the chances of the occurrence of infections. The Global Outcomes After Laparotomy for Trauma (GOAL-Trauma) Study (a recent worldwide study conducted in 51 countries) revealed that patients in the least developed countries who had to undergo an emergency abdominal operation due to trauma ended up having a mortality rate within 30 days that is more than three times higher than that of patients in highly developed areas.

Similarly, the increase in trauma cases following accidents, burns, and the other injuries highlights the need for situational cleaning of wounds in order to avoid infections and help quick recovery. Wound cleaning agents should be looked upon as the mainstay of healthcare practice as they help reduce the number of bacteria and prepare the wound for healing.

For instance, the World Health Organization (2023) reported that two-wheeler riders contribute to 30% of global traffic-related fatalities, with delivery service riders being remarkably vulnerable. These circumstances necessitate a comprehensive understanding and approach to addressing increase in wounds.

In product segments, the wetting agents are the leading contributors to the global wound cleanser market with market share of 37.8%. Such products are designed to loosen debris, minimize tissue trauma, and improve the penetration of other wound care solutions. As the use of moist wound healing methods is being advocated, the role of wetting agents has been significantly raised in both - clinical and home care environments. Their mild, non-stimulating compositions render them applicable to almost any kind of wound, which, in turn, facilitates their global spread.

Their use has been extended in an effective way to the treatment of chronic and acute wounds, and as such, they are preferred choice of healthcare professionals. The rise in the number of wound-related infections and the awareness of infection control practices have been additional factors that have contributed to the demand for wetting wound cleansers.

In addition, progress in formulation technology has allowed for the creation of more biocompatible and longer-lasting wetting agents. The medical community is progressively aware of their use as a means of supporting tissue repair and at the same time, lessening pain and discomfort in the process of wound cleansing.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Currently, North America holds 40.1% of the market share, and this is mainly due to the region's robust healthcare system, numerous surgeries, and the quick uptake of the advanced wound care technology in the region. The aging population of the region along with the increasing rate of lifestyle-related diseases such as diabetes and obesity is the main factor leading to the escalating demand for wound care products in the region.

Additionally, positive reimbursement policies, large healthcare spending, and continuous product innovation by the top players of the market are the main factors that contribute to the leadership of North America.

Stryker, Smith+Nephew, Coloplast, B. Braun SE, Convatec Inc., Johnson & Johnson, 3M, URGO Medical, Medtronic, Medline Industries, LP., Advancis Medical, Cardinal Health, Integra LifeSciences Corporation, Zimmer Biomet, Mölnlycke AB. and others are some of the leading manufacturers operating in the global wound cleanser market.

Each of these companies has been profiled in the wound cleanser market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 2.2 Bn |

| Forecast Value in 2035 | More than US$ 3.9 Bn |

| CAGR | 5.1 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global wound cleanser market was valued at US$ 2.2 Bn in 2024

The global wound cleanser industry is projected to reach more than US$ 3.9 Bn by the end of 2035

Rising chronic and acute wounds drive demand for advanced wound cleansers and rising surgeries and trauma cases boost demand for wound cleansing products are some of the factors driving the expansion of wound cleanser market.

The CAGR is anticipated to be 5.1% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Stryker, Smith+Nephew, Coloplast, B. Braun SE, Convatec Inc., Johnson & Johnson, 3M, URGO Medical, Medtronic, Medline Industries, LP., Advancis Medical, Cardinal Health, Integra LifeSciences Corporation, Zimmer Biomet, Mölnlycke AB, and the other prominent players.

Table 01: Global Wound Cleanser Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 02: Global Wound Cleanser Market Value (US$ Bn) Forecast, By Wound Type, 2020 to 2035

Table 03: Global Wound Cleanser Market Value (US$ Bn), By Acute Wounds, 2020 to 2035

Table 04: Global Wound Cleanser Market Value (US$ Bn), By Chronic Wounds, 2020 to 2035

Table 05: Global Wound Cleanser Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 06: Global Wound Cleanser Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Wound Cleanser Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 08: North America Wound Cleanser Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 09: North America Wound Cleanser Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 10: North America Wound Cleanser Market Value (US$ Bn), By Acute Wounds, 2020 to 2035

Table 11: North America Wound Cleanser Market Value (US$ Bn), By Chronic Wounds, 2020 to 2035

Table 12: North America Wound Cleanser Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 13: Europe Wound Cleanser Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 14: Europe Wound Cleanser Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 15: Europe Wound Cleanser Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 16: Europe Wound Cleanser Market Value (US$ Bn), By Acute Wounds, 2020 to 2035

Table 17: Europe Wound Cleanser Market Value (US$ Bn), By Chronic Wounds, 2020 to 2035

Table 18: Europe Wound Cleanser Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 19: Asia Pacific Wound Cleanser Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 20: Asia Pacific Wound Cleanser Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 21: Asia Pacific Wound Cleanser Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 22: Asia Pacific Wound Cleanser Market Value (US$ Bn), By Acute Wounds, 2020 to 2035

Table 23: Asia Pacific Wound Cleanser Market Value (US$ Bn), By Chronic Wounds, 2020 to 2035

Table 24: Asia Pacific Wound Cleanser Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 25: Latin America Wound Cleanser Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 26: Latin America Wound Cleanser Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 27: Latin America Wound Cleanser Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 28: Latin America Wound Cleanser Market Value (US$ Bn), By Acute Wounds, 2020 to 2035

Table 29: Latin America Wound Cleanser Market Value (US$ Bn), By Chronic Wounds, 2020 to 2035

Table 30: Latin America Wound Cleanser Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 31: Middle East & Africa Wound Cleanser Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 32: Middle East & Africa Wound Cleanser Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 33: Middle East & Africa Wound Cleanser Market Value (US$ Bn) Forecast, by Wound Type, 2020 to 2035

Table 34: Middle East & Africa Wound Cleanser Market Value (US$ Bn), By Acute Wounds, 2020 to 2035

Table 35: Middle East & Africa Wound Cleanser Market Value (US$ Bn), By Chronic Wounds, 2020 to 2035

Table 36: Middle East & Africa Wound Cleanser Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Wound Cleanser Market Value Share Analysis, by Product, 2024 and 2035

Figure 02: Global Wound Cleanser Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 03: Global Wound Cleanser Market Revenue (US$ Bn), by Antimicrobial Agent, 2020 to 2035

Figure 04: Global Wound Cleanser Market Revenue (US$ Bn), by Wetting Agents, 2020 to 2035

Figure 05: Global Wound Cleanser Market Revenue (US$ Bn), by Moisturizers, 2020 to 2035

Figure 06: Global Wound Cleanser Market Revenue (US$ Bn), by Pulsed Lavage Systems, 2020 to 2035

Figure 07: Global Wound Cleanser Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 08: Global Wound Cleanser Market Value Share Analysis, by Wound Type, 2024 and 2035

Figure 09: Global Wound Cleanser Market Attractiveness Analysis, by Wound Type, 2024 and 2035

Figure 10: Global Wound Cleanser Market Revenue (US$ Bn), by Acute Wounds, 2020 to 2035

Figure 11: Global Wound Cleanser Market Revenue (US$ Bn), by Chronic Wounds, 2020 to 2035

Figure 12: Global Wound Cleanser Market Value Share Analysis, by End-user, 2024 and 2035

Figure 13: Global Wound Cleanser Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 14: Global Wound Cleanser Market Revenue (US$ Bn), by Hospitals & Clinics, 2025 to 2035

Figure 15: Global Wound Cleanser Market Revenue (US$ Bn), by Ambulatory Surgical Centers, 2020 to 2035

Figure 16: Global Wound Cleanser Market Revenue (US$ Bn), by Long Term Care Facilities, 2020 to 2035

Figure 17: Global Wound Cleanser Market Revenue (US$ Bn), by Home Care Settings, 2020 to 2035

Figure 18: Global Wound Cleanser Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 19: Global Wound Cleanser Market Value Share Analysis, By Region, 2024 and 2035

Figure 20: Global Wound Cleanser Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 21: North America Wound Cleanser Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 22: North America Wound Cleanser Market Value Share Analysis, by Country, 2024 and 2035

Figure 23: North America Wound Cleanser Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 24: North America Wound Cleanser Market Value Share Analysis, by Product, 2024 and 2035

Figure 25: North America Wound Cleanser Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 26: North America Wound Cleanser Market Value Share Analysis, by Wound Type, 2024 and 2035

Figure 27: North America Wound Cleanser Market Attractiveness Analysis, by Wound Type, 2025 to 2035

Figure 28: North America Wound Cleanser Market Value Share Analysis, by End-user, 2024 and 2035

Figure 29: North America Wound Cleanser Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 30: Europe Wound Cleanser Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 31: Europe Wound Cleanser Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 32: Europe Wound Cleanser Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 33: Europe Wound Cleanser Market Value Share Analysis, by Product, 2024 and 2035

Figure 34: Europe Wound Cleanser Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 35: Europe Wound Cleanser Market Value Share Analysis, By Wound Type, 2024 and 2035

Figure 36: Europe Wound Cleanser Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 37: Europe Wound Cleanser Market Value Share Analysis, by End-user, 2024 and 2035

Figure 38: Europe Wound Cleanser Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 39: Asia Pacific Wound Cleanser Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 40: Asia Pacific Wound Cleanser Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 41: Asia Pacific Wound Cleanser Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 42: Asia Pacific Wound Cleanser Market Value Share Analysis, by Product, 2024 and 2035

Figure 43: Asia Pacific Wound Cleanser Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 44: Asia Pacific Wound Cleanser Market Value Share Analysis, By Wound Type, 2024 and 2035

Figure 45: Asia Pacific Wound Cleanser Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 46: Asia Pacific Wound Cleanser Market Value Share Analysis, by End-user, 2024 and 2035

Figure 47: Asia Pacific Wound Cleanser Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 48: Latin America Wound Cleanser Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 49: Latin America Wound Cleanser Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 50: Latin America Wound Cleanser Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 51: Latin America Wound Cleanser Market Value Share Analysis, by Product, 2024 and 2035

Figure 52: Latin America Wound Cleanser Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 53: Latin America Wound Cleanser Market Value Share Analysis, By Wound Type, 2024 and 2035

Figure 54: Latin America Wound Cleanser Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 55: Latin America Wound Cleanser Market Value Share Analysis, by End-user, 2024 and 2035

Figure 56: Latin America Wound Cleanser Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 57: Middle East & Africa Wound Cleanser Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 58: Middle East & Africa Wound Cleanser Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 59: Middle East & Africa Wound Cleanser Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 60: Middle East & Africa Wound Cleanser Market Value Share Analysis, by Product, 2024 & 2035

Figure 61: Middle East & Africa Wound Cleanser Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 62: Middle East & Africa Wound Cleanser Market Value Share Analysis, by Wound Type, 2024 & 2035

Figure 63: Middle East & Africa Wound Cleanser Market Attractiveness Analysis, By Wound Type, 2025 to 2035

Figure 64: Middle East & Africa Wound Cleanser Market Value Share Analysis, by End-user, 2024 & 2035

Figure 65: Middle East & Africa Wound Cleanser Market Attractiveness Analysis, by End-user, 2025 to 2035