Analysts’ Viewpoint

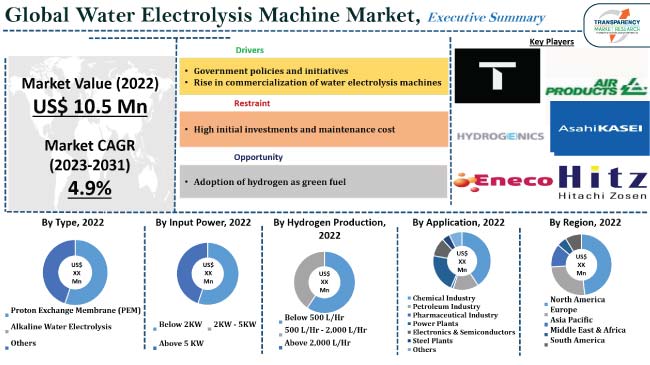

Rise in regulatory pressure for environment protection, increase in government investment, and support for the development of water electrolysis machines for hydrogen production are the primary factors leading to the water electrolysis machine market development.

Water electrolysis machine manufacturers are focusing on production expansion and product innovation, which is expected to drive the water electrolysis machine market growth. Additionally, electrolyzer commercialization can increase the accessibility of green hydrogen and allow for substantial changes in energy systems across the world to minimize emissions and lessen environmental harm. These factors are anticipated to create lucrative water electrolysis machine market opportunities in the next few years.

Water electrolysis machine, or electrolyzed water machine, is a device used for hydrogen production through renewable sources. Water electrolysis machine uses electric current for splitting water molecules into hydrogen and oxygen. Two reactions occur at each of the two electrodes, the negatively charged cathode and the positively charged anode, when voltage is supplied.

At the anode, the oxygen evolution reaction (OER) generates oxygen, while at the cathode, the hydrogen evolution reaction (HER) generates hydrogen. Hydrogen gas can be stored either compressed or liquefied, while the produced oxygen is either returned to the atmosphere or collected and stored for use in other industrial operations. The charge of the generated gases is equalized using an electrolyte, which conducts electricity, and a membrane separates them to avoid mixing and contamination.

Water electrolyzer machine produces low-emission hydrogen from renewable or nuclear electricity. Several types of water electrolysis machine are available on the basis of size and function to meet the need of different industries. Manufacturing of ammonia for fertilizers and the fuel for fuel cell vehicles, including buses, lorries, and trains, depends on hydrogen. Hence, there has been a visible growth in the electrolysis capacity for dedicated hydrogen production in the global water electrolysis machine industry in the past few years.

One of the key prerequisites for emission reduction, particularly in areas where it is difficult to reduce emissions, is the switch to green hydrogen and green ammonia. Water electrolysis machine plays a major role, as the machine splits water molecules into hydrogen and oxygen. The hydrogen gas, which is stored in compressed or liquefied states, can be further used as a green fuel.

Manufacturers of water electrolysis machine are focusing on the expansion of production capacities to cater to the rising demand for the machines for hydrogen production. Technologies, such as alkaline and proton exchange membrane, are more mature and already commercially available, while solid oxyde electrolysis (SOEC) and anion exchange membrane technologies, are maturing.

As per a report published by International Energy Agency, commercialization of SOEC is rapidly increasing. A 2.6 MW SOEC electrolyzer was installed in a Neste refinery in the Netherlands and a 4 MW SOEC system at the NASA research facility in California in April 2023.

Manufacturers of electrolyzer are increasing production capacities. For instance, to prepare for GW-scale operations in the U.S., Bloom Energy boosted its SOEC production capacity in 2022 with the installation of a new high volume plant in Newark. Topsoe is moving ahead with the development of a 500 MW/yr industrial manufacturing facility in Denmark, which is scheduled to open in 2025.

The development of anion exchange membrane (AEM) electrolyzer is still in the early phase. However, they are produced and sold on a moderate scale. Hence, rise in commercialization has a significant impact on the water electrolysis machine industry growth.

Increasing number of governments are setting objectives for the deployment of low-emission hydrogen production capacity to fulfill the net zero emission target and communicate their long-term vision for hydrogen technologies. A number of countries have started to introduce policies to encourage first movers, including grants, loans, tax benefits, and carbon contracts for difference (CCfDs).

Governments have started adopting new mechanisms to support project developers and reduce risks with numerous notable announcements in the past few years. The U.S. Congress enacted the Bipartisan Infrastructure Law in 2021, which includes incentives to promote infrastructure and electrolysis production as well as funding for the establishment of hydrogen hubs, with chosen projects scheduled to be disclosed in Q3 2023.

The IRA, which was signed in August 2022, provides a number of tax credits and grant financing to boost hydrogen technology. All such projects are anticipated to enhance water electrolysis machine market demand.

In terms of type, the water electrolysis machine market segmentation includes proton exchange membrane (PEM), alkaline water electrolysis, and others. The proton exchange membrane (PEM) segment is anticipated to account for major market share in the next few years.

PEM effectively operates on high current densities and variable power levels within seconds. Other features of PEM include low gas permeability, high energy efficiency, and fast hydrogen production rate, which are expected to propel the segment.

According to the water electrolysis machine market forecast, Asia Pacific is anticipated to account for the largest global water electrolysis machine market share during the forecast period. This can be ascribed to technological advancements in water electrolysis technology, leading to better efficiency and reduced cost. These elements increase the water electrolysis machine's appeal for industrial use.

The market in North America is anticipated to grow at a rapid pace in the near future owing to government initiatives. For instance, the Inflation Reduction Act (IRA), under which the U.S. announced important incentives in 2022, acts as a credit to support industrial initiatives. The IRA provisions are beginning to pay off, and several more announcements are made for raising new electrolyzer production plants across the nation.

Detailed profiles of companies are provided in the water electrolysis machine market research report to evaluate their financials, key product offerings, recent developments, and strategies. Prominent manufacturers have adopted strategies such as investment in R&D, product expansion, and merger & acquisition to increase market share.

The water electrolysis machine market analysis suggests product development as a major strategy of top manufacturers. The market is highly competitive with the presence of various global and regional players.

Air Products and Chemical, Inc., AREVA H2Gen, Asahi Kasei Corporation, C&E Environmental Technology Co., Ltd., Enagic International, Inc., Eneco Holdings, Inc., ErreDue spa, Hitachi Zosen Corporation, Hydrogenics Corporation, ITM Power plc, Siemens Energy, and TOPSOE are the prominent entities profiled in the water electrolysis machine market report.

Each of these players has been profiled in the water electrolysis machine industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 10.5 Mn |

|

Forecast (Value) in 2031 |

US$ 16.1 Mn |

|

Growth Rate (CAGR) |

4.9% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value & Thousand Units for Volume |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 10.5 Mn in 2022

It is projected to reach US$ 16.1 Mn by 2031

Government policies & initiatives and rise in commercialization of water electrolysis machines

The proton exchange membrane (PEM) segment accounted for the largest share in 2022

Asia Pacific is a highly prominent region for vendors

Air Products and Chemical, Inc., AREVA H2Gen, Asahi Kasei Corporation, C&E Environmental Technology Co., Ltd., Enagic International, Inc., Eneco Holdings, Inc., ErreDue spa, Hitachi Zosen Corporation, Hydrogenics Corporation, ITM Power plc, Siemens Energy, and TOPSOE

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Global Water Electrolysis Machine Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projections (US$ Mn)

5.8.2. Market Volume Projections (Thousand Units)

6. Global Water Electrolysis Machine Market Analysis and Forecast, by Type

6.1. Global Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

6.1.1. Proton Exchange Membrane (PEM)

6.1.2. Alkaline Water Electrolysis

6.1.3. Others

6.2. Incremental Opportunity, by Type

7. Global Water Electrolysis Machine Market Analysis and Forecast, by Input Power

7.1. Global Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Input Power, 2017- 2031

7.1.1. Below 2KW

7.1.2. 2KW - 5KW

7.1.3. Above 5 KW

7.2. Incremental Opportunity, by Input Power

8. Global Water Electrolysis Machine Market Analysis and Forecast, by Hydrogen Production

8.1. Global Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Hydrogen Production, 2017- 2031

8.1.1. Below 500 L/Hr

8.1.2. 500 L/Hr - 2,000 L/Hr

8.1.3. Above 2,000 L/Hr

8.2. Incremental Opportunity, by Hydrogen Production

9. Global Water Electrolysis Machine Market Analysis and Forecast, by Application

9.1. Global Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

9.1.1. Chemical Industry

9.1.2. Petroleum Industry

9.1.3. Pharmaceutical Industry

9.1.4. Power Plants

9.1.5. Electronics & Semiconductors

9.1.6. Steel Plants

9.1.7. Others

9.2. Incremental Opportunity, by Application

10. Global Water Electrolysis Machine Market Analysis and Forecast, by Region

10.1. Global Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Region, 2017- 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Water Electrolysis Machine Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Key Trends Analysis

11.3.1. Supply side

11.3.2. Demand Side

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (US$)

11.5. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

11.5.1. Proton Exchange Membrane (PEM)

11.5.2. Alkaline Water Electrolysis

11.5.3. Others

11.6. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Input Power, 2017- 2031

11.6.1. Below 2KW

11.6.2. 2KW - 5KW

11.6.3. Above 5 KW

11.7. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Hydrogen Production, 2017- 2031

11.7.1. Below 500 L/Hr

11.7.2. 500 L/Hr - 2,000 L/Hr

11.7.3. Above 2,000 L/Hr

11.8. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

11.8.1. Chemical Industry

11.8.2. Petroleum Industry

11.8.3. Pharmaceutical Industry

11.8.4. Power Plants

11.8.5. Electronics & Semiconductors

11.8.6. Steel Plants

11.8.7. Others

11.9. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Water Electrolysis Machine Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Supply side

12.3.2. Demand Side

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

12.5.1. Proton Exchange Membrane (PEM)

12.5.2. Alkaline Water Electrolysis

12.5.3. Others

12.6. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Input Power, 2017- 2031

12.6.1. Below 2KW

12.6.2. 2KW - 5KW

12.6.3. Above 5 KW

12.7. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Hydrogen Production, 2017- 2031

12.7.1. Below 500 L/Hr

12.7.2. 500 L/Hr - 2,000 L/Hr

12.7.3. Above 2,000 L/Hr

12.8. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

12.8.1. Chemical Industry

12.8.2. Petroleum Industry

12.8.3. Pharmaceutical Industry

12.8.4. Power Plants

12.8.5. Electronics & Semiconductors

12.8.6. Steel Plants

12.8.7. Others

12.9. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Water Electrolysis Machine Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Supply side

13.3.2. Demand Side

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

13.5.1. Proton Exchange Membrane (PEM)

13.5.2. Alkaline Water Electrolysis

13.5.3. Others

13.6. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Input Power, 2017- 2031

13.6.1. Below 2KW

13.6.2. 2KW - 5KW

13.6.3. Above 5 KW

13.7. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Hydrogen Production, 2017- 2031

13.7.1. Below 500 L/Hr

13.7.2. 500 L/Hr - 2,000 L/Hr

13.7.3. Above 2,000 L/Hr

13.8. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

13.8.1. Chemical Industry

13.8.2. Petroleum Industry

13.8.3. Pharmaceutical Industry

13.8.4. Power Plants

13.8.5. Electronics & Semiconductors

13.8.6. Steel Plants

13.8.7. Others

13.9. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Water Electrolysis Machine Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

14.5.1. Proton Exchange Membrane (PEM)

14.5.2. Alkaline Water Electrolysis

14.5.3. Others

14.6. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Input Power, 2017- 2031

14.6.1. Below 2KW

14.6.2. 2KW - 5KW

14.6.3. Above 5 KW

14.7. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Hydrogen Production, 2017- 2031

14.7.1. Below 500 L/Hr

14.7.2. 500 L/Hr - 2,000 L/Hr

14.7.3. Above 2,000 L/Hr

14.8. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

14.8.1. Chemical Industry

14.8.2. Petroleum Industry

14.8.3. Pharmaceutical Industry

14.8.4. Power Plants

14.8.5. Electronics & Semiconductors

14.8.6. Steel Plants

14.8.7. Others

14.9. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Water Electrolysis Machine Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Supply side

15.3.2. Demand Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Type, 2017- 2031

15.5.1. Proton Exchange Membrane (PEM)

15.5.2. Alkaline Water Electrolysis

15.5.3. Others

15.6. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Input Power, 2017- 2031

15.6.1. Below 2KW

15.6.2. 2KW - 5KW

15.6.3. Above 5 KW

15.7. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Hydrogen Production, 2017- 2031

15.7.1. Below 500 L/Hr

15.7.2. 500 L/Hr - 2,000 L/Hr

15.7.3. Above 2,000 L/Hr

15.8. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Application, 2017- 2031

15.8.1. Chemical Industry

15.8.2. Petroleum Industry

15.8.3. Pharmaceutical Industry

15.8.4. Power Plants

15.8.5. Electronics & Semiconductors

15.8.6. Steel Plants

15.8.7. Others

15.9. Water Electrolysis Machine Market Size (US$ Mn) (Thousand Units), by Country/Sub-region, 2017- 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Competition Dashboard

16.2. Market Share Analysis % (2022)

16.3. Company Profiles [Company Overview, Product Portfolio, Financial Information (Subject to Data Availability), Business Strategies Recent Developments]

16.3.1. Air Products and Chemical, Inc.

16.3.1.1. Company Overview

16.3.1.2. Product Portfolio

16.3.1.3. Financial Information (Subject to Data Availability)

16.3.1.4. Business Strategies Recent Developments

16.3.2. AREVA H2Gen

16.3.2.1. Company Overview

16.3.2.2. Product Portfolio

16.3.2.3. Financial Information (Subject to Data Availability)

16.3.2.4. Business Strategies Recent Developments

16.3.3. Asahi Kasei Corporation

16.3.3.1. Company Overview

16.3.3.2. Product Portfolio

16.3.3.3. Financial Information (Subject to Data Availability)

16.3.3.4. Business Strategies Recent Developments

16.3.4. C&E Environmental Technology Co., Ltd.

16.3.4.1. Company Overview

16.3.4.2. Product Portfolio

16.3.4.3. Financial Information (Subject to Data Availability)

16.3.4.4. Business Strategies Recent Developments

16.3.5. Enagic International, Inc.

16.3.5.1. Company Overview

16.3.5.2. Product Portfolio

16.3.5.3. Financial Information (Subject to Data Availability)

16.3.5.4. Business Strategies Recent Developments

16.3.6. Eneco Holdings, Inc.

16.3.6.1. Company Overview

16.3.6.2. Product Portfolio

16.3.6.3. Financial Information (Subject to Data Availability)

16.3.6.4. Business Strategies Recent Developments

16.3.7. ErreDue spa

16.3.7.1. Company Overview

16.3.7.2. Product Portfolio

16.3.7.3. Financial Information (Subject to Data Availability)

16.3.7.4. Business Strategies Recent Developments

16.3.8. Hitachi Zosen Corporation

16.3.8.1. Company Overview

16.3.8.2. Product Portfolio

16.3.8.3. Financial Information (Subject to Data Availability)

16.3.8.4. Business Strategies Recent Developments

16.3.9. Hydrogenics Corporation

16.3.9.1. Company Overview

16.3.9.2. Product Portfolio

16.3.9.3. Financial Information (Subject to Data Availability)

16.3.9.4. Business Strategies Recent Developments

16.3.10. ITM Power Plc.

16.3.10.1. Company Overview

16.3.10.2. Product Portfolio

16.3.10.3. Financial Information (Subject to Data Availability)

16.3.10.4. Business Strategies Recent Developments

16.3.11. Siemens Energy

16.3.11.1. Company Overview

16.3.11.2. Product Portfolio

16.3.11.3. Financial Information (Subject to Data Availability)

16.3.11.4. Business Strategies Recent Developments

16.3.12. TOPSOE

16.3.12.1. Company Overview

16.3.12.2. Product Portfolio

16.3.12.3. Financial Information (Subject to Data Availability)

16.3.12.4. Business Strategies Recent Developments

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Understanding the Buying Process of the Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Water Electrolysis Machine Market Value (US$ Mn), By Type, 2017 - 2031

Table 2: Global Water Electrolysis Machine Market Volume (Thousand Units), By Type, 2017 - 2031

Table 3: Global Water Electrolysis Machine Market Value (US$ Mn), By Input Power, 2017 - 2031

Table 4: Global Water Electrolysis Machine Market Volume (Thousand Units), By Input Power, 2017 - 2031

Table 5: Global Water Electrolysis Machine Market Value (US$ Mn), By Hydrogen Production, 2017 - 2031

Table 6: Global Water Electrolysis Machine Market Volume (Thousand Units), By Hydrogen Production, 2017 - 2031

Table 7: Global Water Electrolysis Machine Market Value (US$ Mn), By Application, 2017 - 2031

Table 8: Global Water Electrolysis Machine Market Volume (Thousand Units), By Application, 2017 - 2031

Table 9: Global Water Electrolysis Machine Market Value (US$ Mn), By Region, 2017 - 2031

Table 10: Global Water Electrolysis Machine Market Volume (Thousand Units), By Region, 2017 - 2031

Table 11: North America Water Electrolysis Machine Market Value (US$ Mn), By Type, 2017 - 2031

Table 12: North America Water Electrolysis Machine Market Volume (Thousand Units), By Type, 2017 - 2031

Table 13: North America Water Electrolysis Machine Market Value (US$ Mn), By Input Power, 2017 - 2031

Table 14: North America Water Electrolysis Machine Market Volume (Thousand Units), By Input Power, 2017 - 2031

Table 15: North America Water Electrolysis Machine Market Value (US$ Mn), By Hydrogen Production, 2017 - 2031

Table 16: North America Water Electrolysis Machine Market Volume (Thousand Units), By Hydrogen Production, 2017 - 2031

Table 17: North America Water Electrolysis Machine Market Value (US$ Mn), By Application, 2017 - 2031

Table 18: North America Water Electrolysis Machine Market Volume (Thousand Units), By Application, 2017 - 2031

Table 19: North America Water Electrolysis Machine Market Value (US$ Mn), By Country/Sub-region, 2017 - 2031

Table 20: North America Water Electrolysis Machine Market Volume (Thousand Units), By Country/Sub-region, 2017 - 2031

Table 21: Europe Water Electrolysis Machine Market Value (US$ Mn), By Type, 2017 - 2031

Table 22: Europe Water Electrolysis Machine Market Volume (Thousand Units), By Type, 2017 - 2031

Table 23: Europe Water Electrolysis Machine Market Value (US$ Mn), By Input Power, 2017 - 2031

Table 24: Europe Water Electrolysis Machine Market Volume (Thousand Units), By Input Power, 2017 - 2031

Table 25: Europe Water Electrolysis Machine Market Value (US$ Mn), By Hydrogen Production, 2017 - 2031

Table 26: Europe Water Electrolysis Machine Market Volume (Thousand Units), By Hydrogen Production, 2017 - 2031

Table 27: Europe Water Electrolysis Machine Market Value (US$ Mn), By Application, 2017 - 2031

Table 28: Europe Water Electrolysis Machine Market Volume (Thousand Units), By Application, 2017 - 2031

Table 29: Europe Water Electrolysis Machine Market Value (US$ Mn), By Country/Sub-region, 2017 - 2031

Table 30: Europe Water Electrolysis Machine Market Volume (Thousand Units), By Country/Sub-region, 2017 - 2031

Table 31: Asia Pacific Water Electrolysis Machine Market Value (US$ Mn), By Type, 2017 - 2031

Table 32: Asia Pacific Water Electrolysis Machine Market Volume (Thousand Units), By Type, 2017 - 2031

Table 33: Asia Pacific Water Electrolysis Machine Market Value (US$ Mn), By Input Power, 2017 - 2031

Table 34: Asia Pacific Water Electrolysis Machine Market Volume (Thousand Units), By Input Power, 2017 - 2031

Table 35: Asia Pacific Water Electrolysis Machine Market Value (US$ Mn), By Hydrogen Production, 2017 - 2031

Table 36: Asia Pacific Water Electrolysis Machine Market Volume (Thousand Units), By Hydrogen Production, 2017 - 2031

Table 37: Asia Pacific Water Electrolysis Machine Market Value (US$ Mn), By Application, 2017 - 2031

Table 38: Asia Pacific Water Electrolysis Machine Market Volume (Thousand Units), By Application, 2017 - 2031

Table 39: Asia Pacific Water Electrolysis Machine Market Value (US$ Mn), By Country/Sub-region, 2017 - 2031

Table 40: Asia Pacific Water Electrolysis Machine Market Volume (Thousand Units), By Country/Sub-region, 2017 - 2031

Table 41: Middle East & Africa Water Electrolysis Machine Market Value (US$ Mn), By Type, 2017 - 2031

Table 42: Middle East & Africa Water Electrolysis Machine Market Volume (Thousand Units), By Type, 2017 - 2031

Table 43: Middle East & Africa Water Electrolysis Machine Market Value (US$ Mn), By Input Power, 2017 - 2031

Table 44: Middle East & Africa Water Electrolysis Machine Market Volume (Thousand Units), By Input Power, 2017 - 2031

Table 45: Middle East & Africa Water Electrolysis Machine Market Value (US$ Mn), By Hydrogen Production, 2017 - 2031

Table 46: Middle East & Africa Water Electrolysis Machine Market Volume (Thousand Units), By Hydrogen Production, 2017 - 2031

Table 47: Middle East & Africa Water Electrolysis Machine Market Value (US$ Mn), By Application, 2017 - 2031

Table 48: Middle East & Africa Water Electrolysis Machine Market Volume (Thousand Units), By Application, 2017 - 2031

Table 49: Middle East & Africa Water Electrolysis Machine Market Value (US$ Mn), By Country/Sub-region, 2017 - 2031

Table 50: Middle East & Africa Water Electrolysis Machine Market Volume (Thousand Units), By Country/Sub-region, 2017 - 2031

Table 51: South America Water Electrolysis Machine Market Value (US$ Mn), By Type, 2017 - 2031

Table 52: South America Water Electrolysis Machine Market Volume (Thousand Units), By Type, 2017 - 2031

Table 53: South America Water Electrolysis Machine Market Value (US$ Mn), By Input Power, 2017 - 2031

Table 54: South America Water Electrolysis Machine Market Volume (Thousand Units), By Input Power, 2017 - 2031

Table 55: South America Water Electrolysis Machine Market Value (US$ Mn), By Hydrogen Production, 2017 - 2031

Table 56: South America Water Electrolysis Machine Market Volume (Thousand Units), By Hydrogen Production, 2017 - 2031

Table 57: South America Water Electrolysis Machine Market Value (US$ Mn), By Application, 2017 - 2031

Table 58: South America Water Electrolysis Machine Market Volume (Thousand Units), By Application, 2017 - 2031

Table 59: South America Water Electrolysis Machine Market Value (US$ Mn), By Country/Sub-region, 2017 - 2031

Table 60: South America Water Electrolysis Machine Market Volume (Thousand Units), By Country/Sub-region, 2017 - 2031

List of Figures

Figure 1: Global Water Electrolysis Machine Market Value (US$ Mn), By Type, 2017 - 2031

Figure 2: Global Water Electrolysis Machine Market Volume (Thousand Units), By Type, 2017 - 2031

Figure 3: Global Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Type, 2017 - 2031

Figure 4: Global Water Electrolysis Machine Market Value (US$ Mn), By Input Power, 2017 - 2031

Figure 5: Global Water Electrolysis Machine Market Volume (Thousand Units), By Input Power, 2017 - 2031

Figure 6: Global Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Input Power, 2017 - 2031

Figure 7: Global Water Electrolysis Machine Market Value (US$ Mn), By Hydrogen Production, 2017 - 2031

Figure 8: Global Water Electrolysis Machine Market Volume (Thousand Units), By Hydrogen Production, 2017 - 2031

Figure 9: Global Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Hydrogen Production, 2017 - 2031

Figure 10: Global Water Electrolysis Machine Market Value (US$ Mn), By Application, 2017 - 2031

Figure 11: Global Water Electrolysis Machine Market Volume (Thousand Units), By Application, 2017 - 2031

Figure 12: Global Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Application, 2017 - 2031

Figure 13: Global Water Electrolysis Machine Market Value (US$ Mn), By Region, 2017 - 2031

Figure 14: Global Water Electrolysis Machine Market Volume (Thousand Units), By Region, 2017 - 2031

Figure 15: Global Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Region, 2017 - 2031

Figure 16: North America Water Electrolysis Machine Market Value (US$ Mn), By Type, 2017 - 2031

Figure 17: North America Water Electrolysis Machine Market Volume (Thousand Units), By Type, 2017 - 2031

Figure 18: North America Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Type, 2017 - 2031

Figure 19: North America Water Electrolysis Machine Market Value (US$ Mn), By Input Power, 2017 - 2031

Figure 20: North America Water Electrolysis Machine Market Volume (Thousand Units), By Input Power, 2017 - 2031

Figure 21: North America Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Input Power, 2017 - 2031

Figure 22: North America Water Electrolysis Machine Market Value (US$ Mn), By Hydrogen Production, 2017 - 2031

Figure 23: North America Water Electrolysis Machine Market Volume (Thousand Units), By Hydrogen Production, 2017 - 2031

Figure 24: North America Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Hydrogen Production, 2017 - 2031

Figure 25: North America Water Electrolysis Machine Market Value (US$ Mn), By Application, 2017 - 2031

Figure 26: North America Water Electrolysis Machine Market Volume (Thousand Units), By Application, 2017 - 2031

Figure 27: North America Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Application, 2017 - 2031

Figure 28: North America Water Electrolysis Machine Market Value (US$ Mn), By Country/Sub-region, 2017 - 2031

Figure 29: North America Water Electrolysis Machine Market Volume (Thousand Units), By Country/Sub-region, 2017 - 2031

Figure 30: North America Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Country/Sub-region, 2017 - 2031

Figure 31: Europe Water Electrolysis Machine Market Value (US$ Mn), By Type, 2017 - 2031

Figure 32: Europe Water Electrolysis Machine Market Volume (Thousand Units), By Type, 2017 - 2031

Figure 33: Europe Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Type, 2017 - 2031

Figure 34: Europe Water Electrolysis Machine Market Value (US$ Mn), By Input Power, 2017 - 2031

Figure 35: Europe Water Electrolysis Machine Market Volume (Thousand Units), By Input Power, 2017 - 2031

Figure 36: Europe Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Input Power, 2017 - 2031

Figure 37: Europe Water Electrolysis Machine Market Value (US$ Mn), By Hydrogen Production, 2017 - 2031

Figure 38: Europe Water Electrolysis Machine Market Volume (Thousand Units), By Hydrogen Production, 2017 - 2031

Figure 39: Europe Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Hydrogen Production, 2017 – 2031

Figure 40: Europe Water Electrolysis Machine Market Value (US$ Mn), By Application, 2017 - 2031

Figure 41: Europe Water Electrolysis Machine Market Volume (Thousand Units), By Application, 2017 - 2031

Figure 42: Europe Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Application, 2017 - 2031

Figure 43: Europe Water Electrolysis Machine Market Value (US$ Mn), By Country/Sub-region, 2017 - 2031

Figure 44: Europe Water Electrolysis Machine Market Volume (Thousand Units), By Country/Sub-region, 2017 - 2031

Figure 45: Europe Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Country/Sub-region, 2017 - 2031

Figure 46: Asia Pacific Water Electrolysis Machine Market Value (US$ Mn), By Type, 2017 - 2031

Figure 47: Asia Pacific Water Electrolysis Machine Market Volume (Thousand Units), By Type, 2017 - 2031

Figure 48: Asia Pacific Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Type, 2017 - 2031

Figure 49: Asia Pacific Water Electrolysis Machine Market Value (US$ Mn), By Input Power, 2017 - 2031

Figure 50: Asia Pacific Water Electrolysis Machine Market Volume (Thousand Units), By Input Power, 2017 - 2031

Figure 51: Asia Pacific Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Input Power, 2017 - 2031

Figure 52: Asia Pacific Water Electrolysis Machine Market Value (US$ Mn), By Hydrogen Production, 2017 - 2031

Figure 53: Asia Pacific Water Electrolysis Machine Market Volume (Thousand Units), By Hydrogen Production, 2017 - 2031

Figure 54: Asia Pacific Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Hydrogen Production, 2017 - 2031

Figure 55: Asia Pacific Water Electrolysis Machine Market Value (US$ Mn), By Application, 2017 - 2031

Figure 56: Asia Pacific Water Electrolysis Machine Market Volume (Thousand Units), By Application, 2017 - 2031

Figure 57: Asia Pacific Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Application, 2017 - 2031

Figure 58: Asia Pacific Water Electrolysis Machine Market Value (US$ Mn), By Country/Sub-region, 2017 - 2031

Figure 59: Asia Pacific Water Electrolysis Machine Market Volume (Thousand Units), By Country/Sub-region, 2017 - 2031

Figure 60: Asia Pacific Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Country/Sub-region, 2017 - 2031

Figure 61: Middle East & Africa Water Electrolysis Machine Market Value (US$ Mn), By Type, 2017 - 2031

Figure 62: Middle East & Africa Water Electrolysis Machine Market Volume (Thousand Units), By Type, 2017 - 2031

Figure 63: Middle East & Africa Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Type, 2017 - 2031

Figure 64: Middle East & Africa Water Electrolysis Machine Market Value (US$ Mn), By Input Power, 2017 - 2031

Figure 65: Middle East & Africa Water Electrolysis Machine Market Volume (Thousand Units), By Input Power, 2017 - 2031

Figure 66: Middle East & Africa Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Input Power, 2017 - 2031

Figure 67: Middle East & Africa Water Electrolysis Machine Market Value (US$ Mn), By Hydrogen Production, 2017 - 2031

Figure 68: Middle East & Africa Water Electrolysis Machine Market Volume (Thousand Units), By Hydrogen Production, 2017 - 2031

Figure 69: Middle East & Africa Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Hydrogen Production, 2017 - 2031

Figure 70: Middle East & Africa Water Electrolysis Machine Market Value (US$ Mn), By Application, 2017 - 2031

Figure 71: Middle East & Africa Water Electrolysis Machine Market Volume (Thousand Units), By Application, 2017 - 2031

Figure 72: Middle East & Africa Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Application, 2017 - 2031

Figure 73: Middle East & Africa Water Electrolysis Machine Market Value (US$ Mn), By Country/Sub-region, 2017 - 2031

Figure 74: Middle East & Africa Water Electrolysis Machine Market Volume (Thousand Units), By Country/Sub-region, 2017 - 2031

Figure 75: Middle East & Africa Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Country/Sub-region, 2017 – 2031

Figure 76: South America Water Electrolysis Machine Market Value (US$ Mn), By Type, 2017 - 2031

Figure 77: South America Water Electrolysis Machine Market Volume (Thousand Units), By Type, 2017 - 2031

Figure 78: South America Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Type, 2017 - 2031

Figure 79: South America Water Electrolysis Machine Market Value (US$ Mn), By Input Power, 2017 - 2031

Figure 80: South America Water Electrolysis Machine Market Volume (Thousand Units), By Input Power, 2017 - 2031

Figure 81: South America Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Input Power, 2017 - 2031

Figure 82: South America Water Electrolysis Machine Market Value (US$ Mn), By Hydrogen Production, 2017 - 2031

Figure 83: South America Water Electrolysis Machine Market Volume (Thousand Units), By Hydrogen Production, 2017 - 2031

Figure 84: South America Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Hydrogen Production, 2017 - 2031

Figure 85: South America Water Electrolysis Machine Market Value (US$ Mn), By Application, 2017 - 2031

Figure 86: South America Water Electrolysis Machine Market Volume (Thousand Units), By Application, 2017 - 2031

Figure 87: South America Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Application, 2017 - 2031

Figure 88: South America Water Electrolysis Machine Market Value (US$ Mn), By Country/Sub-region, 2017 - 2031

Figure 89: South America Water Electrolysis Machine Market Volume (Thousand Units), By Country/Sub-region, 2017 - 2031

Figure 90: South America Water Electrolysis Machine Market Incremental Opportunity (US$ Mn), By Country/Sub-region, 2017 - 2031