Reports

Reports

Analysts’ Viewpoint on Vinyl Sulfone Market Scenario

Vinyl sulfone is majorly used in the manufacturing of reactive dyes. The textile industry is a major consumer of reactive dyes that are utilized for the tinting of textiles. Change in buying patterns of textiles in developing countries is propelling the demand for dye intermediates and their raw materials. This, in turn, is positively impacting the vinyl sulfone market. China and India are witnessing rapid growth, which has resulted in notable achievements, particularly widening of the rural-urban income gap. Rise in income level is resulting in change of lifestyle of the people and consequently, boosting the demand for textiles and garments.

In Asia Pacific, supportive government regulations in China and India aimed at promoting investments in their respective textile manufacturing sectors are expected to boost the market. The textile industry in China is booming due to the low cost of labor, inexpensive land, government policies, large domestic consumer market, and abundant availability of human resource. India has abundant availability of raw materials such as cotton, wool, silk and jute; which fuels the textile industry in the country. Significant investments have been made by the government under the scheme for Integrated Textile Parks (SITP) and Technology Upgradation Fund scheme to encourage more private equity and to train the workforce. Such supportive approach for the textile industry is projected to drive the vinyl sulfone market in the near future.

Vinyl sulfone is a reagent used as raw material in the manufacturing of reactive dyes that are employed primarily in textiles. Vinyl sulfones, or vinyl sulphones (alpha & beta -unsaturated sulfones), are widely used intermediates in organic synthesis. Apart from opportunities in the dyestuff and textile industry, manufacturers of vinyl sulfone are increasing applications in the proteomics and healthcare space. For instance, vinyl sulfone is increasingly being used in the easy functionalization of tags and solid supports in biological sciences. After numerous clinical trials, it has been found that the vinyl sulfone molecule is a potential therapeutic agent that is used in the development of drugs for the treatment of Parkinson’s disease.

Vinyl sulfone is a cross-linker reagent used as a raw material for manufacturing of reactive dyes that have applications primarily in textiles and leathers. The synthesis of such a reactive dye is achieved by coupling two moles of diazotized vinyl sulfone with one mole of H-Acid. Demand for vinyl sulfone is largely dependent on reactive dyes; therefore, growth in the production of reactive dyes boosts the demand for vinyl sulfone.

The textile sector is a major consumer of reactive dyes. Reactive dyes were initially introduced commercially for application on cellulosic fibers. These have also been developed for application on protein and polyamide fibers. Reactive dyes comprise highly colored organic substances and are primarily employed in tinting textiles. Reactive dyes offer high resistance to fading and bright shade range, which makes them suitable for coloring cotton and rayon.

The global industry for reactive dye is expanding due to growth of the textile industry. In Asia Pacific, expansion of various industries such as textile, leather, paper, and wood, is a major driver of the reactive dye market. Asia Pacific is major consumer of reactive dyes, and India is the major player in the reactive dyes industry in the region. Increase in demand for textiles in China, India, Taiwan, and South Korea and rise in consumption of dyes are driving the reactive dye industry in the region.

China is a leading producer and exporter of raw textiles and garments, globally. The textiles industry in China is market leader in terms of dye consumption, majorly due to high demand for natural fibers and recycled fibers. Asia Pacific accounted for a major share of the global textile market in 2021. The market in the region is anticipated to expand further, owing to the positive outlook toward the apparel & garments market in China and India.

Rising sales volume of apparel and clothing through e-commerce portals in India, China, Bangladesh, and Thailand is also expected to drive the textile market in these countries. In Asia Pacific, supportive government regulations in China and India aimed at promoting investments in their textile manufacturing sectors are expected to fuel the vinyl sulfomne market in the region.

In Asia Pacific, governments of China and India have formulated policies to enhance agricultural yield of cotton, jute, and other crops, which is anticipated to drive the textile industry in the region. Consequently, expansion in the textile industry, wherein textile dyes are primarily used as colorants or coloring agents for the production of clothing with color esthetics, is also boosting the demand for textile dyes.

In Asia Pacific, rise in demand for textile dyes and policies mandating the use of environment-friendly and low Volatile Organic Compounds (VOC) products have led to innovation in the textile dyes industry. The textile industry extensively utilizes reactive dyes, and vinyl sulfone is commonly employed in the manufacturing of reactive dyes. Therefore, rise in demand for textiles is likely to boost the vinyl sulfone market demand.

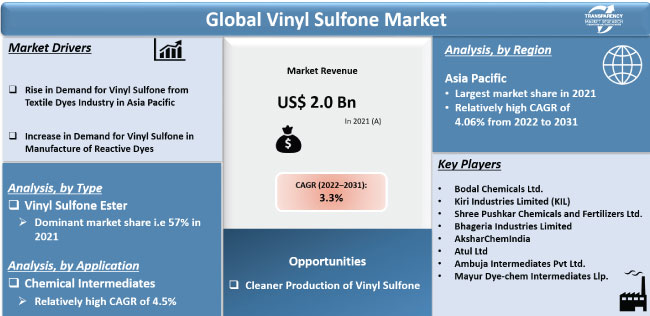

Based on type, the global vinyl sulfone market has been segmented into divinyl sulfone, phenyl vinyl sulfone, methyl vinyl sulfone, and vinyl sulfone ester. In terms of volume as well as value, the vinyl sulfone ester segment dominated the global vinyl sulfone market in 2021. It is likely to maintain its dominance during the forecast period. Vinyl sulfone esters are primarily utilized in the manufacture of dyes such as reactive dyes. Growth in various industries, such as paper, textile, wood, leather, is a major factor boosting the demand for vinyl sulfone ester in the reactive dyes industry.

In terms of application, the global vinyl sulfone market has been split into dyestuff manufacturing, chemical intermediate, proteomics, others. The dyestuff manufacturing segment held a major share, i.e., nearly 61.0%, of the global market in 2021. In terms of value and volume, dyestuff manufacturing was the dominant segment of the global vinyl sulfone market. It is likely to maintain its dominance during the forecast period. Demand for dyestuff manufacturing has been increasing significantly due to rise in demand from end-user industries such as food, textile, printing inks, and paints & coatings.

In terms of volume, Asia Pacific held a major share of 65.0% of the global vinyl sulfone market in 2021. Asia Pacific is a major consumer and producer of vinyl sulfone. Asia Pacific is home to a prominent dyestuff industry due to high demand for dyestuff in various industries, such as textile, leather, and paper, in China, followed by India. Growth of industries, such as textile and leather, is driving the vinyl sulfone market in Asia Pacific. Robust expansion of the dye and textile industry is also anticipated to drive the vinyl sulfone market. Increase in usage of paints & coatings in residential construction activities is boosting the demand for vinyl sulfone. Furthermore, vinyl sulfone uses in paints & coatings is also likely to drive the market in the region. In terms of the demand, Asia Pacific is followed by Europe and North America. In terms of the growth, the market in Latin America is expected to expand at a rapid pace during the forecast period.

The global vinyl sulfone market is consolidated with a small number of large-scale vendors controlling majority of the market share. A majority of vinyl sulfone manufacturers are spending significantly on comprehensive research and development activities, primarily to develop environment-friendly products. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Bodal Chemicals Ltd., Kiri Industries Limited (KIL), Shree Pushkar Chemicals and Fertilizers Ltd., Bhageria Industries Limited, AksharChemIndia, Atul Ltd, Ambuja Intermediates Pvt Ltd., and Mayur Dye-chem Intermediates Llp. are the prominent entities operating in the market.

Key players have been profiled in the vinyl sulfone market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.0 Bn |

|

Market Forecast Value in 2031 |

US$ 2.8 Bn |

|

Growth Rate (CAGR) |

3.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value & Kilo Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The vinyl sulfone market stood at US$ 2.0 Bn in 2021

The market is expected to grow at a CAGR of 3.3% from 2022 to 2031

Rise in demand for vinyl sulfone from the textile dyes industry

Vinyl sulfone ester was the largest segment and held nearly 57% share in 2021

Asia Pacific was the most lucrative region of the vinyl sulfone market in 2021.

Bodal Chemicals Ltd., Kiri Industries Limited (KIL), Shree Pushkar Chemicals and Fertilizers Ltd., Bhageria Industries Limited, AksharChemIndia, Atul Ltd, Ambuja Intermediates Pvt Ltd., and Mayur Dye-chem Intermediates Llp.

1. Executive Summary

1.1. Vinyl Sulfone Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Material

2.6.2. List of Manufacturer

2.6.3. List of Dealers/Distributors

2.6.4. List of Potential Customers

2.7. Production Analysis/Route of Synthesis

2.8. Product Specification Analysis

3. COVID-19 Impact Analysis

4. Vinyl Sulfone Market Production Outlook

5. Vinyl Sulfone Price Trend Analysis, 2020–2031

5.1. By Type

5.2. By Region

6. Global Vinyl Sulfone Market Analysis and Forecast, by Type, 2020–2031

6.1. Key Findings

6.2. Global Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

6.2.1. Divinyl sulfone

6.2.2. Phenyl vinyl sulfone

6.2.3. Methyl vinyl sulfone

6.2.4. Vinyl Sulfone Ester

6.3. Global Vinyl Sulfone Market Attractiveness, By Type

7. Global Vinyl Sulfone Market Analysis and Forecast, by Application, 2020–2031

7.1. Key Findings

7.2. Global Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.2.1. Dyestuff Manufacturing

7.2.2. Chemical Intermediate

7.2.3. Proteomics

7.2.4. Others (color, paints, pigments, rubber, plastics and leathers)

7.3. Global Vinyl Sulfone Market Attractiveness, by Application

8. Global Vinyl Sulfone Market Analysis and Forecast, by Region, 2020–2031

8.1. Key Findings

8.2. Global Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Vinyl Sulfone Market Attractiveness, by Region

9. North America Vinyl Sulfone Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. North America Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.3. North America Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4. North America Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

9.4.1. U.S. Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.4.2. U.S. Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4.3. Canada Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

9.4.4. Canada Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.5. North America Vinyl Sulfone Market Attractiveness Analysis

10. Europe Vinyl Sulfone Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Europe Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.3. Europe Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4. Europe Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

10.4.1. Germany Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.2. Germany Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.3. France Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.4. France Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.5. U.K. Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.6. U.K. Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.7. Italy Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.8. Italy Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.9. Spain Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.10. Spain Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.11. Russia & CIS Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.12. Russia & CIS Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.13. Rest of Europe Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

10.4.14. Rest of Europe Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5. Europe Vinyl Sulfone Market Attractiveness Analysis

11. Asia Pacific Vinyl Sulfone Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Asia Pacific Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.3. Asia Pacific Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4. Asia Pacific Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

11.4.1. China Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.2. China Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.3. Japan Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.4. Japan Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.5. India Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.6. India Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.7. ASEAN Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.8. ASEAN Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.9. Rest of Asia Pacific Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

11.4.10. Rest of Asia Pacific Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5. Asia Pacific Vinyl Sulfone Market Attractiveness Analysis

12. Latin America Vinyl Sulfone Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Latin America Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.3. Latin America Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4. Latin America Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

12.4.1. Brazil Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.4.2. Brazil Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4.3. Mexico Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.4.4. Mexico Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4.5. Rest of Latin America Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

12.4.6. Rest of Latin America Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.5. Latin America Vinyl Sulfone Market Attractiveness Analysis

13. Middle East & Africa Vinyl Sulfone Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Middle East & Africa Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.3. Middle East & Africa Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4. Middle East & Africa Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

13.4.1. South Africa Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.4.2. South Africa Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4.3. GCC Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.4.4. GCC Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4.5. Rest of Middle East & Africa Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2020–2031

13.4.6. Rest of Middle East & Africa Vinyl Sulfone Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.5. Middle East & Africa Vinyl Sulfone Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Vinyl Sulfone Company Market Share Analysis, 2021

14.2. Competition Matrix

14.3. Market Footprint Analysis

14.3.1. By Type

14.3.2. By Application

14.4. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.4.1. Bodal Chemicals Ltd.

14.4.1.1. Company Description

14.4.1.2. Business Overview

14.4.1.3. Financial Details

14.4.1.4. Strategic Overview

14.4.2. Kiri Industries Limited (KIL)

14.4.2.1. Company Description

14.4.2.2. Business Overview

14.4.2.3. Financial Details

14.4.2.4. Strategic Overview

14.4.3. Shree Pushkar Chemicals and Fertilizers Ltd.

14.4.3.1. Company Description

14.4.3.2. Business Overview

14.4.4. Bhageria Industries Limited

14.4.4.1. Company Description

14.4.4.2. Business Overview

14.4.5. AksharChemIndia

14.4.5.1. Company Description

14.4.5.2. Business Overview

14.4.6. Atul Ltd

14.4.6.1. Company Description

14.4.6.2. Business Overview

14.4.7. Ambuja Intermediates Pvt Ltd.

14.4.7.1. Company Description

14.4.7.2. Business Overview

14.4.8. Mayur Dye-chem Intermediates Llp

14.4.8.1. Company Description

14.4.8.2. Business Overview

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 2: Global Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 3: Global Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 4: Global Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 5: Global Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Region, 2020–2031

Table 6: Global Vinyl Sulfone Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 7: North America Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 8: North America Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 9: North America Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 10: North America Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 11: North America Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Country, 2020–2031

Table 12: North America Vinyl Sulfone Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 13: U.S. Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 14: U.S. Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 15: U.S. Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 16: U.S. Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 17: Canada Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 18: Canada Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 19: Canada Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 20: Canada Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 21: Europe Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 22: Europe Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 23: Europe Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 24: Europe Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 25: Europe Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 26: Europe Vinyl Sulfone Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 27: Germany Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 28: Germany Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 29: Germany Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 30: Germany Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 31: U.K. Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 32: U.K. Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 33: U.K. Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 34: U.K. Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 35: France Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 36: France Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 37: France Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 38: France Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 39: Italy Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 40: Italy Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 41: Italy Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 42: Italy Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: Spain Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 44: Spain Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 45: Spain Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 46: Spain Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 47: Russia & CIS Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 48: Russia & CIS Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 49: Russia & CIS Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 50: Russia & CIS Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 51: Rest of Europe Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 52: Rest of Europe Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 53: Rest of Europe Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 54: Rest of Europe Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 55: Asia Pacific Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 56: Asia Pacific Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 57: Asia Pacific Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 58: Asia Pacific Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 59: Asia Pacific Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 60: Asia Pacific Vinyl Sulfone Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 61: China Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 62: China Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 63: China Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 64: China Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 65: Japan Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 66: Japan Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 67: Japan Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 68: Japan Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 69: India Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 70: India Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 71: India Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 72: India Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 73: ASEAN Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 74: ASEAN Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 75: ASEAN Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 76: ASEAN Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 77: Rest of Asia Pacific Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 78: Rest of Asia Pacific Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 79: Rest of Asia Pacific Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 80: Rest of Asia Pacific Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 81: Latin America Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 82: Latin America Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 83: Latin America Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 84: Latin America Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 85: Latin America Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 86: Latin America Vinyl Sulfone Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 87: Brazil Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 88: Brazil Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 89: Brazil Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 90: Brazil Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 91: Mexico Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 92: Mexico Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 93: Mexico Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 94: Mexico Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 95: Rest of Latin America Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 96: Rest of Latin America Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 97: Rest of Latin America Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 98: Rest of Latin America Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 99: Middle East & Africa Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 100: Middle East & Africa Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 101: Middle East & Africa Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 102: Middle East & Africa Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 103: Middle East & Africa Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 104: Middle East & Africa Vinyl Sulfone Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 105: GCC Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 106: GCC Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 107: GCC Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 108: GCC Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 109: South Africa Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 110: South Africa Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 111: South Africa Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 112: South Africa Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 113: Rest of Middle East & Africa Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Type, 2020–2031

Table 114: Rest of Middle East & Africa Vinyl Sulfone Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 115: Rest of Middle East & Africa Vinyl Sulfone Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 116: Rest of Middle East & Africa Vinyl Sulfone Market Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Global Vinyl Sulfone Price Trend, by Type, 2020–2031 (US$/Ton)

Figure 2: Global Vinyl Sulfone Price Trend, by Region, 2020–2031 (US$/Ton)

Figure 3: Global Vinyl Sulfone Market Volume Share, by Type, 2021, 2025, and 2031

Figure 4: Global Vinyl Sulfone Market Attractiveness, by Type

Figure 5: Global Vinyl Sulfone Market Volume Share, by Application, 2021, 2025, and 2031

Figure 6: Global Vinyl Sulfone Market Attractiveness, by Application

Figure 7: Global Vinyl Sulfone Market Volume Share, by Region, 2021, 2025, and 2031

Figure 8: Global Vinyl Sulfone Market Attractiveness, by Region

Figure 9: North America Vinyl Sulfone Market Volume Share, by Type, 2021, 2025, and 2031

Figure 10: North America Vinyl Sulfone Market Attractiveness, by Type

Figure 11: North America Vinyl Sulfone Market Volume Share, by Application, 2021, 2025, and 2031

Figure 12: North America Vinyl Sulfone Market Attractiveness, by Application

Figure 13: North America Vinyl Sulfone Market Volume Share, by Country, 2021, 2025, and 2031

Figure 14: North America Vinyl Sulfone Market Attractiveness, by Country

Figure 15: Europe Vinyl Sulfone Market Volume Share, by Type, 2021, 2025, and 2031

Figure 16: Europe Vinyl Sulfone Market Attractiveness, by Type

Figure 17: Europe Vinyl Sulfone Market Volume Share, by Application, 2021, 2025, and 2031

Figure 18: Europe Vinyl Sulfone Market Attractiveness, by Application

Figure 19: Europe Vinyl Sulfone Market Volume Share, by Country and Sub-region, 2021, 2025, and 2031

Figure 20: Europe Vinyl Sulfone Market Attractiveness, by Country and Sub-region

Figure 21: Asia Pacific Vinyl Sulfone Market Volume Share, by Type, 2021, 2025, and 2031

Figure 22: Asia Pacific Vinyl Sulfone Market Attractiveness, by Type

Figure 23: Asia Pacific Vinyl Sulfone Market Volume Share, by Application, 2021, 2025, and 2031

Figure 24: Asia Pacific Vinyl Sulfone Market Attractiveness, by Application

Figure 25: Asia Pacific Vinyl Sulfone Market Volume Share, by Country and Sub-region, 2021, 2025, and 2031

Figure 26: Asia Pacific Vinyl Sulfone Market Attractiveness, by Country and Sub-region

Figure 27: Latin America Vinyl Sulfone Market Volume Share, By Type, 2021, 2025, and 2031

Figure 28: Latin America Vinyl Sulfone Market Attractiveness, By Type

Figure 29: Latin America Vinyl Sulfone Market Volume Share, by Application, 2021, 2025, and 2031

Figure 30: Latin America Vinyl Sulfone Market Attractiveness, by Application

Figure 31: Latin America Vinyl Sulfone Market Volume Share, by Country and Sub-region, 2021, 2025, and 2031

Figure 32: Latin America Vinyl Sulfone Market Attractiveness, by Country and Sub-region

Figure 33: Middle East & Africa Vinyl Sulfone Market Volume Share, By Type, 2021, 2025, and 2031

Figure 34: Middle East & Africa Vinyl Sulfone Market Attractiveness, By Type

Figure 35: Middle East & Africa Vinyl Sulfone Market Volume Share, by Application, 2021, 2025, and 2031

Figure 36: Middle East & Africa Vinyl Sulfone Market Attractiveness, by Application

Figure 37: Middle East & Africa Vinyl Sulfone Market Volume Share, by Country and Sub-region, 2021, 2025, and 2031

Figure 38: Middle East & Africa Vinyl Sulfone Market Attractiveness, by Country and Sub-region

Figure 39: Global Vinyl Sulfone Market Share Analysis, by Company, 2020