Reports

Reports

Analysts’ Viewpoint

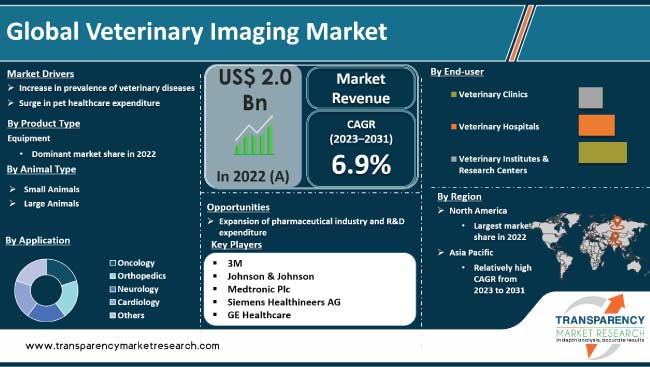

The veterinary imaging market is witnessing substantial growth, fueled by diverse factors shaping its landscape. Increase in R&D expenditure in the pharmaceutical industry is a key factor fueling the veterinary imaging industry size. The evolution of multimodal imaging devices and the growth in focus on advanced technologies in healthcare offers lucrative opportunities for market expansion.

Emphasis of manufacturers on incorporating cutting-edge imaging solutions into veterinary practices further propels market growth. The future scope of the veterinary imaging market is promising, driven by continued R&D initiatives, technological advancements, and the exploration of emerging markets. The symbiotic relationship between pharmaceutical industry investments and the evolution of veterinary imaging technologies positions the market for sustained growth, offering a fertile ground for innovations and strategic advancements.

Veterinary practices and hospitals are increasingly adopting state-of-the-art imaging modalities. Adoption of multimodal imaging devices has become pivotal in enhancing diagnostic accuracy and treatment planning for diverse animal species. Veterinary clinics and hospitals catering to small animals are increasingly investing in state-of-the-art imaging equipment to offer comprehensive diagnostic services.

Integration of cutting-edge technologies, such as digital imaging and artificial intelligence, is becoming prevalent, offering more precise and efficient diagnostic capabilities. Furthermore, the market is responsive to the growth in trend of companion animal ownership, leading to a surge in veterinary imaging procedures. The market's future holds promise, driven by ongoing technological advancements, increased awareness of veterinary healthcare, and strategic maneuvers by industry participants to capitalize on the expanding opportunities within the global veterinary imaging landscape.

Frequent disease outbreaks among animals have surged the demand for advanced veterinary imaging products. Heightened awareness about these diseases and the imperative for early diagnosis to prevent outbreaks are key factors propelling the veterinary imaging market revenue.

The potential loss of lives and economic repercussions stemming from the spread of animal diseases underscore the critical need for timely diagnosis in veterinary healthcare. Countries heavily reliant on animals for their economies face a substantial burden during livestock disease outbreaks. Consequently, the emphasis on early and accurate diagnosis becomes paramount.

The rise in concerns surrounding veterinary diseases, including cardiovascular issues, cancer, and orthopedic disorders, is driving veterinary imaging market value. Notably, the surge in conditions such as osteoarthritis in pets, as evidenced by a 66 percent increase in dogs and a 150 percent increase in cats, underscores the importance of sophisticated veterinary imaging solutions. In this landscape, the veterinary imaging industry is strategically positioned to grow as a vital ally in the battle against the rise in prevalence of veterinary diseases.

The veterinary imaging market segmentation in terms of product type includes equipment, imaging reagents, and imaging software. The equipment segment held significant share in 2022. Veterinary imaging equipment encompasses a range of devices crucial for diagnostic purposes in animal healthcare. The segment includes X-ray systems, which provide veterinarians with the flexibility to conduct diagnostic imaging procedures on-site or in diverse settings, enhancing accessibility and convenience.

Pricing variations accommodate diverse budget considerations. This pricing diversity allows veterinary professionals to choose equipment tailored to their specific diagnostic needs and practice requirements, contributing to the overall market dynamism and growth.

Based on animal type, the small animals segment accounted for largest veterinary imaging market share in 2022. This segment encompasses imaging technologies specifically designed for pets, including dogs, cats, and other smaller animals.

The rise in pet ownership, coupled with an increase in focus on their well-being, drives the demand for advanced imaging solutions in veterinary care. Diagnostic imaging modalities, such as X-rays, ultrasound, MRI, and CT scans, tailored for small animals, are witnessing heightened adoption. These technologies aid in the early detection of ailments, contributing to more effective treatment plans.

The small animals segment, characterized by a surge in veterinary imaging procedures for companion animals, is poised for sustained growth, presenting lucrative opportunities for market players to cater to the evolving needs of pet healthcare.

In terms of application, the market is classified into oncology, orthopedics, neurology, cardiology, and others. The orthopedics segment is projected to account for major share during the forecast period. The rise in occurrence of fractures, joint disorders, and musculoskeletal injuries in animals, has propelled the demand for advanced imaging solutions.

Radiography, computed tomography (CT), and magnetic resonance imaging (MRI) are pivotal modalities employed for precise orthopedic diagnostics in veterinary care. These imaging technologies enable comprehensive evaluations of bone structures, joints, and soft tissues, aiding veterinarians in accurate diagnosis and treatment planning.

Market players are focusing on developing specialized imaging systems tailored for orthopedic applications, further driving segmental growth. With the continuous evolution of veterinary orthopedics and the demand for non-invasive diagnostic solutions, the orthopedics segment in the veterinary imaging market is poised for sustained expansion in the near future.

As per the latest veterinary imaging market forecast, North America dominates the landscape, with the United States leading the region in 2022. The U.S. benefits from a well-established veterinary healthcare infrastructure, high level of awareness regarding advanced diagnostic technologies, and a substantial pet ownership culture.

The country's progressive approach to animal healthcare, coupled with a growing demand for advanced diagnostic procedures, propels market statistics. Moreover, the presence of key industry players, continuous technological advancements, and strategic investments in veterinary imaging solutions enable the U.S. to maintain a leading position within the North American veterinary imaging market.

The dominance of North America, particularly the U.S., underscores the region's pivotal role in shaping the trajectory of the global veterinary imaging market, and it is expected to continue driving significant advancements and growth in the near future.

The global veterinary imaging market is consolidated, with the presence of a few leading players. Expansion of product portfolios, and mergers & acquisitions are the key strategies implemented by leading players. Market players are leveraging strategic collaborations, partnerships, and mergers to strengthen their market presence and broaden their product portfolios.

3M, Johnson & Johnson, Medtronic Plc, Siemens Healthineers AG, GE Healthcare, Koninklijke Philips N.V., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., and Samsung, are the leading entities operating in the global veterinary imaging market.

Key players have been profiled in the veterinary imaging market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 2.0 Bn |

| Market Forecast Value in 2031 | More than US$ 3.6 Bn |

| Growth Rate (CAGR) | 6.9% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2020 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 2.0 Bn in 2022

It is projected to reach more than US$ 3.6 Bn by the end of 2031

The CAGR is anticipated to be 6.9% from 2023 to 2031

Based on product type, the equipment segment accounted for leading share in 2022

North America is anticipated to account for leading share during the forecast period

3M, Johnson & Johnson, Medtronic Plc, Siemens Healthineers AG, GE Healthcare, Koninklijke Philips N.V., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., and Samsung

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Veterinary Imaging Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

5. Key Insights

5.1. Technological Advancements

5.2. Veterinary Imaging & Prevalence Rate of Veterinary Conditions

5.3. COVID-19 Pandemic Impact on Industry

6. Global Veterinary Imaging Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Equipment

6.3.1.1. Radiography (X-ray)

6.3.1.2. Ultrasound Imaging

6.3.1.3. Magnetic Resonance Imaging (MRI)

6.3.1.4. Computed Tomography

6.3.1.5. Endoscopy

6.3.1.6. Others

6.3.2. Imaging Reagents

6.3.3. Imaging Software

6.4. Market Attractiveness Analysis, by Product Type

7. Global Veterinary Imaging Market Analysis and Forecast, by Animal Type

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Animal Type, 2017–2031

7.3.1. Small Animals

7.3.2. Large Animals

7.4. Market Attractiveness Analysis, by Animal Type

8. Global Veterinary Imaging Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Oncology

8.3.2. Orthopedics

8.3.3. Neurology

8.3.4. Cardiology

8.3.5. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Veterinary Imaging Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Veterinary Clinics

9.3.2. Veterinary Hospitals

9.3.3. Veterinary Institutes & Research Centers

9.4. Market Attractiveness Analysis, by End-user

10. Global Veterinary Imaging Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2017–2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Country/Region

11. North America Veterinary Imaging Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Equipment

11.2.1.1. Radiography (X-ray)

11.2.1.2. Ultrasound Imaging

11.2.1.3. Magnetic Resonance Imaging (MRI)

11.2.1.4. Computed Tomography

11.2.1.5. Endoscopy

11.2.1.6. Others

11.2.2. Imaging Reagents

11.2.3. Imaging Software

11.3. Market Value Forecast, by Animal Type, 2017–2031

11.3.1. Small Animals

11.3.2. Large Animals

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Oncology

11.4.2. Orthopedics

11.4.3. Neurology

11.4.4. Cardiology

11.4.5. Others

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Veterinary Clinics

11.5.2. Veterinary Hospitals

11.5.3. Veterinary Institutes & Research Centers

11.6. Market Value Forecast, by Country/Sub-region, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Animal Type

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country/Sub-region

12. Europe Veterinary Imaging Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Equipment

12.2.1.1. Radiography (X-ray)

12.2.1.2. Ultrasound Imaging

12.2.1.3. Magnetic Resonance Imaging (MRI)

12.2.1.4. Computed Tomography

12.2.1.5. Endoscopy

12.2.1.6. Others

12.2.2. Imaging Reagents

12.2.3. Imaging Software

12.3. Market Value Forecast, by Animal Type, 2017–2031

12.3.1. Small Animals

12.3.2. Large Animals

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Oncology

12.4.2. Orthopedics

12.4.3. Neurology

12.4.4. Cardiology

12.4.5. Others

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Veterinary Clinics

12.5.2. Veterinary Hospitals

12.5.3. Veterinary Institutes & Research Centers

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. UK

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Animal Type

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Veterinary Imaging Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Equipment

13.2.1.1. Radiography (X-ray)

13.2.1.2. Ultrasound Imaging

13.2.1.3. Magnetic Resonance Imaging (MRI)

13.2.1.4. Computed Tomography

13.2.1.5. Endoscopy

13.2.1.6. Others

13.2.2. Imaging Reagents

13.2.3. Imaging Software

13.3. Market Value Forecast, by Animal Type, 2017–2031

13.3.1. Small Animals

13.3.2. Large Animals

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Oncology

13.4.2. Orthopedics

13.4.3. Neurology

13.4.4. Cardiology

13.4.5. Others

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Veterinary Clinics

13.5.2. Veterinary Hospitals

13.5.3. Veterinary Institutes & Research Centers

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Animal Type

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Veterinary Imaging Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Equipment

14.2.1.1. Radiography (X-ray)

14.2.1.2. Ultrasound Imaging

14.2.1.3. Magnetic Resonance Imaging (MRI)

14.2.1.4. Computed Tomography

14.2.1.5. Endoscopy

14.2.1.6. Others

14.2.2. Imaging Reagents

14.2.3. Imaging Software

14.3. Market Value Forecast, by Animal Type, 2017–2031

14.3.1. Small Animals

14.3.2. Large Animals

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Oncology

14.4.2. Orthopedics

14.4.3. Neurology

14.4.4. Cardiology

14.4.5. Others

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Veterinary Clinics

14.5.2. Veterinary Hospitals

14.5.3. Veterinary Institutes & Research Centers

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product Type

14.7.2. By Animal Type

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Veterinary Imaging Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product Type, 2017–2031

15.2.1. Equipment

15.2.1.1. Radiography (X-ray)

15.2.1.2. Ultrasound Imaging

15.2.1.3. Magnetic Resonance Imaging (MRI)

15.2.1.4. Computed Tomography

15.2.1.5. Endoscopy

15.2.1.6. Others

15.2.2. Imaging Reagents

15.2.3. Imaging Software

15.3. Market Value Forecast, by Animal Type, 2017–2031

15.3.1. Small Animals

15.3.2. Large Animals

15.4. Market Value Forecast, by Application, 2017–2031

15.4.1. Oncology

15.4.2. Orthopedics

15.4.3. Neurology

15.4.4. Cardiology

15.4.5. Others

15.5. Market Value Forecast, by End-user, 2017–2031

15.5.1. Veterinary Clinics

15.5.2. Veterinary Hospitals

15.5.3. Veterinary Institutes & Research Centers

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product Type

15.7.2. By Animal Type

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis By Company (2022)

16.3. Company Profiles

16.3.1. 3M

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Johnson & Johnson

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Medtronic Plc

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Siemens Healthineers AG

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. GE Healthcare

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Koninklijke Philips N.V.

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Samsung

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

List of Tables

Table 01: Global Veterinary Imaging Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 02: Global Veterinary Imaging Market Value (US$ Mn) Forecast, by Animal Type, 2017-2031

Table 03: Global Veterinary Imaging Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 04: Global Veterinary Imaging Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 05: North America Veterinary Imaging Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 06: North America Veterinary Imaging Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 07: North America Veterinary Imaging Market Value (US$ Mn) Forecast, by Animal Type, 2017-2031

Table 08: North America Veterinary Imaging Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 09: North America Veterinary Imaging Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 10: Europe Veterinary Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 11: Europe Veterinary Imaging Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 12: Europe Veterinary Imaging Market Value (US$ Mn) Forecast, by Animal Type, 2017-2031

Table 13: Europe Veterinary Imaging Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 14: Europe Veterinary Imaging Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 15: Asia Pacific Veterinary Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 16: Asia Pacific Veterinary Imaging Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 17: Asia Pacific Veterinary Imaging Market Value (US$ Mn) Forecast, by Animal Type, 2017-2031

Table 18: Asia Pacific Veterinary Imaging Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 19: Asia Pacific Veterinary Imaging Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 20: Latin America Veterinary Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 21: Latin America Veterinary Imaging Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 22: Latin America Veterinary Imaging Market Value (US$ Mn) Forecast, by Animal Type, 2017-2031

Table 23: Latin America Veterinary Imaging Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 24: Latin America Veterinary Imaging Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 25: Middle East & Africa Veterinary Imaging Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 26: Middle East & Africa Veterinary Imaging Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 27: Middle East & Africa Veterinary Imaging Market Value (US$ Mn) Forecast, by Animal Type, 2017-2031

Table 28: Middle East & Africa Veterinary Imaging Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 29: Middle East & Africa Veterinary Imaging Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Veterinary Imaging Market Size, by Product Type, 2022

Figure 02: Global Veterinary Imaging Market Share (%), by Product Type, 2022

Figure 03: Global Veterinary Imaging Market Size, by Animal Type, 2022

Figure 04: Global Veterinary Imaging Market Share (%), by Animal Type, 2022

Figure 05: Global Veterinary Imaging Market Share (%), by Application, 2022

Figure 06: Global Veterinary Imaging Market Share (%), by Application, 2022

Figure 07: Global Veterinary Imaging Market Size, by End-user, 2022

Figure 08: Global Veterinary Imaging Market share (%), by End-user, 2022

Figure 09: Global Veterinary Imaging Market, by Region (2022 and 2031)

Figure 10: Global Veterinary Imaging Market Value (US$ Mn) Forecast, 2017–2031

Figure 11: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 12: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Product Type, 2022

Figure 13: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Product Type, 2031

Figure 14: Global Veterinary Imaging Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 15: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Animal Type, 2022 and 2031

Figure 16: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Animal Type, 2022

Figure 17: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Animal Type, 2031

Figure 18: Global Veterinary Imaging Market Attractiveness Analysis, by Animal Type, 2023–2031

Figure 19: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 20: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Application, 2022

Figure 21: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Application, 2031

Figure 22: Global Veterinary Imaging Market Attractiveness Analysis, by Application, 2023–2031

Figure 23: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 24: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by End-user, 2022

Figure 25: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by End-user, 2031

Figure 26: Global Veterinary Imaging Market Attractiveness Analysis, by End-user, 2023–2031

Figure 27: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Region, 2022 and 2031

Figure 28: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Region, 2022

Figure 29: Global Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Region, 2031

Figure 30: Global Veterinary Imaging Market Attractiveness Analysis, by Region, 2023–2031

Figure 31: North America Veterinary Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 32: North America Veterinary Imaging Market Value Share Analysis, by Country, 2022 and 2031

Figure 33: North America Veterinary Imaging Market Attractiveness Analysis, by Country, 2023–2031

Figure 34: North America Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 35: North America Veterinary Imaging Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 36: North America Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Animal Type, 2022 and 2031

Figure 37: North America Veterinary Imaging Market Attractiveness Analysis, by Animal Type, 2023-31

Figure 38: North America Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 39: North America Veterinary Imaging Market Attractiveness Analysis, by Application, 2023-31

Figure 40: North America Veterinary Imaging Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 41: North America Veterinary Imaging Market Attractiveness Analysis, by End-user, 2023-2031

Figure 42: Europe Veterinary Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 43: Europe Veterinary Imaging Market Value Share Analysis, by Country, 2022 and 2031

Figure 44: Europe Veterinary Imaging Market Attractiveness Analysis, by Country, 2023–2031

Figure 45: Europe Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 46: Europe Veterinary Imaging Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 47: Europe Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Animal Type, 2022 and 2031

Figure 48: Europe Veterinary Imaging Market Attractiveness Analysis, by Animal Type, 2023-2031

Figure 49: Europe Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 50: Europe Veterinary Imaging Market Attractiveness Analysis, by Application, 2023-2031

Figure 51: Europe Veterinary Imaging Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 52: Europe Veterinary Imaging Market Attractiveness Analysis, by End-user, 2023-2031

Figure 53: Asia Pacific Veterinary Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 54: Asia Pacific Veterinary Imaging Market Value Share Analysis, by Country, 2022 and 2031

Figure 55: Asia Pacific Veterinary Imaging Market Attractiveness Analysis, by Country, 2023–2031

Figure 56: Asia Pacific Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 57: Asia Pacific Veterinary Imaging Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 58: Asia Pacific Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Animal Type, 2022 and 2031

Figure 59: Asia Pacific Veterinary Imaging Market Attractiveness Analysis, by Animal Type, 2023-2031

Figure 60: Asia Pacific Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 61: Asia Pacific Veterinary Imaging Market Attractiveness Analysis, by Application, 2023-2031

Figure 62: Asia Pacific Veterinary Imaging Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 63: Asia Pacific Veterinary Imaging Market Attractiveness Analysis, by End-user, 2023-2031

Figure 64: Latin America Veterinary Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 65: Latin America Veterinary Imaging Market Value Share Analysis, by Country, 2022 and 2031

Figure 66: Latin America Veterinary Imaging Market Attractiveness Analysis, by Country, 2023–2031

Figure 67: Latin America Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 68: Latin America Veterinary Imaging Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 69: Latin America Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Animal Type, 2022 and 2031

Figure 70: Latin America Veterinary Imaging Market Attractiveness Analysis, by Animal Type, 2023-2031

Figure 71: Latin America Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 72: Latin America Veterinary Imaging Market Attractiveness Analysis, by Application, 2023-2031

Figure 73: Latin America Veterinary Imaging Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 74: Latin America Veterinary Imaging Market Attractiveness Analysis, by End-user, 2023-2031

Figure 75: Middle East & Africa Veterinary Imaging Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 76: Middle East & Africa Veterinary Imaging Market Value Share Analysis, by Country, 2022 and 2031

Figure 77: Middle East & Africa Veterinary Imaging Market Attractiveness Analysis, by Country, 2023–2031

Figure 78: Middle East & Africa Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 79: Middle East & Africa Veterinary Imaging Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 80: Middle East & Africa Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Animal Type, 2022 and 2031

Figure 81: Middle East & Africa Veterinary Imaging Market Attractiveness Analysis, by Animal Type, 2023-2031

Figure 82: Middle East & Africa Veterinary Imaging Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 83: Middle East & Africa Veterinary Imaging Market Attractiveness Analysis, by Application, 2023-2031

Figure 84: Middle East & Africa Veterinary Imaging Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 85: Middle East & Africa Veterinary Imaging Market Attractiveness Analysis, by End-user, 2023-2031