Reports

Reports

Analysts’ Viewpoint on Market Scenario

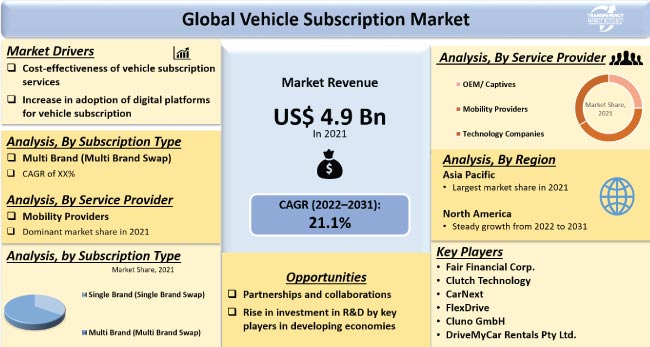

The global automotive subscription industry is witnessing a key transition phase due to the advent of digital platforms. Customer mobility expectations are evolving as a result of the penetration of new technologies that give rise to creative goods and services. This is augmenting vehicle subscription industry growth.

Owning a car is still significant for many people; however, service-oriented businesses are predicted to have tremendous development potential in the near future. Additionally, presently, automakers, rental businesses, and innovators are introducing car subscription programs that are risk-free and highly flexible, owing to the present economic unrest. Among the subscription type, multi-brand subscription services are gaining popularity, as they offer the freedom of switching brands.

Vehicle subscription is an entirely new method of getting a brand new car without having to buy or own one. It is a much more flexible process than conventional car ownership, and even more affordable. Consumers can lease a brand new car of their choice with zero down payment and zero road tax. After completing a lock-in period stated by the service provider, there is an option to keep using it for as long as the consumer wants at flat monthly charges, or he can opt-out anytime between the given time period. Furthermore, if the consumer wants to own the car, he can acquire (buy) it from the service provider at a pre-determined settlement charge.

Automotive OEMs and technology companies are making significant investments to develop their core business models such as own vehicles vs. management of 3rd party fleets and new vs. used vehicles, by variable subscription offerings. Additionally, they are implying brand strategy such as own brand only vs. own brand plus white label offerings for vehicle owners. Based on service type, the mobility providers segment is expected to dominate the global market during the forecast period.

The flexibility and ease of exploring new products and mobility alternatives via online platforms have driven the market for car subscriptions in the last decade. Rising propensity among consumers to use new services has sparked a significant shift in the car retailing industry. Car dealership is one of the most important aspects in determining consumer choices; however, penetration of various digital platforms is likely to increase considerably in the next few years. Additionally, modern consumers are more willing to pay their bills through digital channels, which has led to a consistent rise in demand for vehicle subscriptions, particularly in developed nations.

The advantages offered by vehicle subscription services over the conventional method of car leasing are fueling vehicle subscription market growth. OEMs and car dealers are focused on providing subscription services with zero registrations & road tax liabilities. Zero down payment and no maintenance or registration charges are grabbing the attention of consumers. Rise in number of working professionals who frequently migrate from one state to another and are susceptible to wasting extra time and money to resell and register their vehicles are greatly benefitted through vehicle subscription services.

North America and Europe are the key regions where the vehicle subscription market demand is high. Therefore, the global vehicle subscription market size in increasing with the rise in number of service provides across the globe. China, India, Brazil, and South Korea are also other major countries offering vehicle subscription services.

Asia Pacific is likely to hold major share of the global market during the forecast period, owing to the increase in population, urbanization, industrialization, and improvement in the living standards of people. According to vehicle subscription industry analysis, automobile sales in developing countries such as China and India are rising at a steady pace. Additionally, the launch of vehicle subscription services in various nations in Asia Pacific is anticipated to fuel market development during the forecast period.

Middle-class residents of the region can easily obtain four-wheelers at flexible monthly half yearly or annual packages through subscription services. Based on the package segment, the standard segment is predicted to account for a sizable portion of the market in the near future, as it provides flexible usage models.

The global market is consolidated, with the presence of large players that control majority of the share. Key market players are investing in comprehensive R&D to explore vehicle subscription business opportunities across the globe.

Some of the prominent players identified in the vehicle subscription market across the globe are Fair Financial Corp., Volvo Car Corporation, Access By BMW, Porsche Smart Monility, Inc., DriveMyCar Rentals Pty Ltd., Hyundai Motor Company, Audi on demand, FlexDrive, Mercedes -Benz USA, CarNext, Mobiliti, Inc., Fresh Car, General Motors, Clutch Technology, Cluno GmbH, FlexWheels, Drivemate, Less Technologies Inc., LMP Motors, and Upshift, Inc.

Key players have been profiled in the vehicle subscription market forecast report based on parameters such as company overview, business strategies, business segments, product portfolio, recent developments, and financial overview.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 4.9 Bn |

|

Market Forecast Value in 2031 |

US$ 33.2 Bn |

|

Growth Rate (CAGR) |

21.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It is valued at US$ 4.9 Bn in 2021.

It is expected to grow at a CAGR of 21.1% by 2031.

It would be worth US$ 33.2 Bn in 2031.

Increase in adoption of digital platforms for vehicle subscription and cost-effectiveness of vehicle subscription services.

The multi brand subscription type segment accounted for largest share in 2021.

Asia Pacific is expected to hold major share during the forecast period.

Fair Financial Corp., Volvo Car Corporation, Access By BMW, Porsche Smart Monility, Inc., Hyundai Motor Company, Audi on demand, Mercedes -Benz USA, Mobiliti, Inc., Fresh Car, General Motors, Clutch Technology, CarNext, FlexDrive, Cluno GmbH, DriveMyCar Rentals Pty Ltd., FlexWheels, Drivemate, Less Technologies Inc., LMP Motors, and Upshift, Inc.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Vehicle Subscription Market

4. Global Vehicle Subscription Market, By Subscription Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Subscription Type

4.2.1. Single Brand (Single Brand Swap)

4.2.2. Multi Brand (Multi Brand Swap)

5. Global Vehicle Subscription Market, By Service Provider

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Service Provider

5.2.1. OEM/Captives

5.2.2. Mobility Providers

5.2.3. Technology Companies

6. Global Vehicle Subscription Market, By Package

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Package

6.2.1. Budget

6.2.2. Standard

6.2.3. Premium

7. Global Vehicle Subscription Market, By End-user

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By End-user

7.2.1. Business

7.2.2. Private

8. Global Vehicle Subscription Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Vehicle Subscription Market

9.1. Market Snapshot

9.2. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Subscription Type

9.2.1. Single Brand (Single Brand Swap)

9.2.2. Multi Brand (Multi Brand Swap)

9.3. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Service Provider

9.3.1. OEM/Captives

9.3.2. Mobility Providers

9.3.3. Technology Companies

9.4. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Package

9.4.1. Budget

9.4.2. Standard

9.4.3. Premium

9.5. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By End-user

9.5.1. Business

9.5.2. Private

9.6. Key Country Analysis – North America Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031

9.6.1. The U. S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Vehicle Subscription Market

10.1. Market Snapshot

10.2. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Subscription Type

10.2.1. Single Brand (Single Brand Swap)

10.2.2. Multi Brand (Multi Brand Swap)

10.3. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Service Provider

10.3.1. OEM/Captives

10.3.2. Mobility Providers

10.3.3. Technology Companies

10.4. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Package

10.4.1. Budget

10.4.2. Standard

10.4.3. Premium

10.5. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By End-user

10.5.1. Business

10.5.2. Private

10.6. Key Country Analysis – Europe Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Vehicle Subscription Market

11.1. Market Snapshot

11.2. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Subscription Type

11.2.1. Single Brand (Single Brand Swap)

11.2.2. Multi Brand (Multi Brand Swap)

11.3. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Service Provider

11.3.1. OEM/Captives

11.3.2. Mobility Providers

11.3.3. Technology Companies

11.4. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Package

11.4.1. Budget

11.4.2. Standard

11.4.3. Premium

11.5. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By End-user

11.5.1. Business

11.5.2. Private

11.6. Key Country Analysis – Asia Pacific Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Vehicle Subscription Market

12.1. Market Snapshot

12.2. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Subscription Type

12.2.1. Single Brand (Single Brand Swap)

12.2.2. Multi Brand (Multi Brand Swap)

12.3. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Service Provider

12.3.1. OEM/Captives

12.3.2. Mobility Providers

12.3.3. Technology Companies

12.4. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Package

12.4.1. Budget

12.4.2. Standard

12.4.3. Premium

12.5. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By End-user

12.5.1. Business

12.5.2. Private

12.6. Key Country Analysis – Middle East & Africa Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Vehicle Subscription Market

13.1. Market Snapshot

13.2. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Subscription Type

13.2.1. Single Brand (Single Brand Swap)

13.2.2. Multi Brand (Multi Brand Swap)

13.3. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Service Provider

13.3.1. OEM/Captives

13.3.2. Mobility Providers

13.3.3. Technology Companies

13.4. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By Package

13.4.1. Budget

13.4.2. Standard

13.4.3. Premium

13.5. Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031, By End-user

13.5.1. Business

13.5.2. Private

13.6. Key Country Analysis – South America Vehicle Subscription Market Value (US$ Bn) Analysis & Forecast, 2017-2031

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2021

14.2. Key Strategy Analysis

14.2.1. Strategic Overview - Expansion, M&A, Partnership

14.2.2. Product & Marketing Strategy

14.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profile/ Key Players

15.1. Fair Financial Corp.

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. Volvo Car Corporation

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Production Locations

15.2.4. Product Portfolio

15.2.5. Competitors & Customers

15.2.6. Subsidiaries & Parent Organization

15.2.7. Recent Developments

15.2.8. Financial Analysis

15.2.9. Profitability

15.2.10. Revenue Share

15.3. Access By BMW

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Production Locations

15.3.4. Product Portfolio

15.3.5. Competitors & Customers

15.3.6. Subsidiaries & Parent Organization

15.3.7. Recent Developments

15.3.8. Financial Analysis

15.3.9. Profitability

15.3.10. Revenue Share

15.4. Porsche Smart Monility, Inc.

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Production Locations

15.4.4. Product Portfolio

15.4.5. Competitors & Customers

15.4.6. Subsidiaries & Parent Organization

15.4.7. Recent Developments

15.4.8. Financial Analysis

15.4.9. Profitability

15.4.10. Revenue Share

15.5. Hyundai Motor Company

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Production Locations

15.5.4. Product Portfolio

15.5.5. Competitors & Customers

15.5.6. Subsidiaries & Parent Organization

15.5.7. Recent Developments

15.5.8. Financial Analysis

15.5.9. Profitability

15.5.10. Revenue Share

15.6. Audi on demand

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Production Locations

15.6.4. Product Portfolio

15.6.5. Competitors & Customers

15.6.6. Subsidiaries & Parent Organization

15.6.7. Recent Developments

15.6.8. Financial Analysis

15.6.9. Profitability

15.6.10. Revenue Share

15.7. Mercedes -Benz USA

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Production Locations

15.7.4. Product Portfolio

15.7.5. Competitors & Customers

15.7.6. Subsidiaries & Parent Organization

15.7.7. Recent Developments

15.7.8. Financial Analysis

15.7.9. Profitability

15.7.10. Revenue Share

15.8. Mobiliti, Inc.

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Production Locations

15.8.4. Product Portfolio

15.8.5. Competitors & Customers

15.8.6. Subsidiaries & Parent Organization

15.8.7. Recent Developments

15.8.8. Financial Analysis

15.8.9. Profitability

15.8.10. Revenue Share

15.9. Fresh Car

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Production Locations

15.9.4. Product Portfolio

15.9.5. Competitors & Customers

15.9.6. Subsidiaries & Parent Organization

15.9.7. Recent Developments

15.9.8. Financial Analysis

15.9.9. Profitability

15.9.10. Revenue Share

15.10. General Motors

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Production Locations

15.10.4. Product Portfolio

15.10.5. Competitors & Customers

15.10.6. Subsidiaries & Parent Organization

15.10.7. Recent Developments

15.10.8. Financial Analysis

15.10.9. Profitability

15.10.10. Revenue Share

15.11. Clutch Technology

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Production Locations

15.11.4. Product Portfolio

15.11.5. Competitors & Customers

15.11.6. Subsidiaries & Parent Organization

15.11.7. Recent Developments

15.11.8. Financial Analysis

15.11.9. Profitability

15.11.10. Revenue Share

15.12. CarNext

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Production Locations

15.12.4. Product Portfolio

15.12.5. Competitors & Customers

15.12.6. Subsidiaries & Parent Organization

15.12.7. Recent Developments

15.12.8. Financial Analysis

15.12.9. Profitability

15.12.10. Revenue Share

15.13. FlexDrive

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Production Locations

15.13.4. Product Portfolio

15.13.5. Competitors & Customers

15.13.6. Subsidiaries & Parent Organization

15.13.7. Recent Developments

15.13.8. Financial Analysis

15.13.9. Profitability

15.13.10. Revenue Share

15.14. Cluno GmbH

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Production Locations

15.14.4. Product Portfolio

15.14.5. Competitors & Customers

15.14.6. Subsidiaries & Parent Organization

15.14.7. Recent Developments

15.14.8. Financial Analysis

15.14.9. Profitability

15.14.10. Revenue Share

15.15. DriveMyCar Rentals Pty Ltd.

15.15.1. Company Overview

15.15.2. Company Footprints

15.15.3. Production Locations

15.15.4. Product Portfolio

15.15.5. Competitors & Customers

15.15.6. Subsidiaries & Parent Organization

15.15.7. Recent Developments

15.15.8. Financial Analysis

15.15.9. Profitability

15.15.10. Revenue Share

15.16. FlexWheels

15.16.1. Company Overview

15.16.2. Company Footprints

15.16.3. Production Locations

15.16.4. Product Portfolio

15.16.5. Competitors & Customers

15.16.6. Subsidiaries & Parent Organization

15.16.7. Recent Developments

15.16.8. Financial Analysis

15.16.9. Profitability

15.16.10. Revenue Share

15.17. Drivemate

15.17.1. Company Overview

15.17.2. Company Footprints

15.17.3. Production Locations

15.17.4. Product Portfolio

15.17.5. Competitors & Customers

15.17.6. Subsidiaries & Parent Organization

15.17.7. Recent Developments

15.17.8. Financial Analysis

15.17.9. Profitability

15.17.10. Revenue Share

15.18. Less Technologies Inc.

15.18.1. Company Overview

15.18.2. Company Footprints

15.18.3. Production Locations

15.18.4. Product Portfolio

15.18.5. Competitors & Customers

15.18.6. Subsidiaries & Parent Organization

15.18.7. Recent Developments

15.18.8. Financial Analysis

15.18.9. Profitability

15.18.10. Revenue Share

15.19. LMP Motors

15.19.1. Company Overview

15.19.2. Company Footprints

15.19.3. Production Locations

15.19.4. Product Portfolio

15.19.5. Competitors & Customers

15.19.6. Subsidiaries & Parent Organization

15.19.7. Recent Developments

15.19.8. Financial Analysis

15.19.9. Profitability

15.19.10. Revenue Share

15.20. Upshift, Inc.

15.20.1. Company Overview

15.20.2. Company Footprints

15.20.3. Production Locations

15.20.4. Product Portfolio

15.20.5. Competitors & Customers

15.20.6. Subsidiaries & Parent Organization

15.20.7. Recent Developments

15.20.8. Financial Analysis

15.20.9. Profitability

15.20.10. Revenue Share

15.21. Others

15.21.1. Company Overview

15.21.2. Company Footprints

15.21.3. Production Locations

15.21.4. Product Portfolio

15.21.5. Competitors & Customers

15.21.6. Subsidiaries & Parent Organization

15.21.7. Recent Developments

15.21.8. Financial Analysis

15.21.9. Profitability

15.21.10. Revenue Share

List of Tables

Table 1: Global Vehicle Subscription Market Value (US$ Bn) Forecast, by Subscription Type, 2017-2031

Table 2: Global Vehicle Subscription Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 3: Global Vehicle Subscription Market Value (US$ Bn) Forecast, by Package, 2017-2031

Table 4: Global Vehicle Subscription Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 5: Global Vehicle Subscription Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 6: North America Vehicle Subscription Market Value (US$ Bn) Forecast, by Subscription Type, 2017-2031

Table 7: North America Vehicle Subscription Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 8: North America Vehicle Subscription Market Value (US$ Bn) Forecast, by Package, 2017-2031

Table 9: North America Vehicle Subscription Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 10: North America Vehicle Subscription Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 11: Europe Vehicle Subscription Market Value (US$ Bn) Forecast, by Subscription Type, 2017-2031

Table 12: Europe Vehicle Subscription Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 13: Europe Vehicle Subscription Market Value (US$ Bn) Forecast, by Package, 2017-2031

Table 14: Europe Vehicle Subscription Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 15: Europe Vehicle Subscription Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 16: Asia Pacific Vehicle Subscription Market Value (US$ Bn) Forecast, by Subscription Type, 2017-2031

Table 17: Asia Pacific Vehicle Subscription Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 18: Asia Pacific Vehicle Subscription Market Value (US$ Bn) Forecast, by Package, 2017-2031

Table 19: Asia Pacific Vehicle Subscription Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 20: Asia Pacific Vehicle Subscription Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Middle East & Africa Vehicle Subscription Market Value (US$ Bn) Forecast, by Subscription Type, 2017-2031

Table 22: Middle East & Africa Vehicle Subscription Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 23: Middle East & Africa Vehicle Subscription Market Value (US$ Bn) Forecast, by Package, 2017-2031

Table 24: Middle East & Africa Vehicle Subscription Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 25: Middle East & Africa Vehicle Subscription Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 26: South America Vehicle Subscription Market Value (US$ Bn) Forecast, by Subscription Type, 2017-2031

Table 27: South America Vehicle Subscription Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Table 28: South America Vehicle Subscription Market Value (US$ Bn) Forecast, by Package, 2017-2031

Table 29: South America Vehicle Subscription Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 30: South America Vehicle Subscription Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Vehicle Subscription Market Value (US$ Bn) Forecast, by Subscription Type, 2017-2031

Figure 2: Global Vehicle Subscription Market, Incremental Opportunity, by Subscription Type, Value (US$ Bn), 2022-2031

Figure 3: Global Vehicle Subscription Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 4: Global Vehicle Subscription Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2022-2031

Figure 5: Global Vehicle Subscription Market Value (US$ Bn) Forecast, by Package, 2017-2031

Figure 6: Global Vehicle Subscription Market, Incremental Opportunity, by Package, Value (US$ Bn), 2022-2031

Figure 7: Global Vehicle Subscription Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Figure 8: Global Vehicle Subscription Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2022-2031

Figure 9: Global Vehicle Subscription Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 10: Global Vehicle Subscription Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 11: North America Vehicle Subscription Market Value (US$ Bn) Forecast, by Subscription Type, 2017-2031

Figure 12: North America Vehicle Subscription Market, Incremental Opportunity, by Subscription Type, Value (US$ Bn), 2022-2031

Figure 13: North America Vehicle Subscription Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 14: North America Vehicle Subscription Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2022-2031

Figure 15: North America Vehicle Subscription Market Value (US$ Bn) Forecast, by Package, 2017-2031

Figure 16: North America Vehicle Subscription Market, Incremental Opportunity, by Package, Value (US$ Bn), 2022-2031

Figure 17: North America Vehicle Subscription Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Figure 18: North America Vehicle Subscription Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2022-2031

Figure 19: North America Vehicle Subscription Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 20: North America Vehicle Subscription Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 21: Europe Vehicle Subscription Market Value (US$ Bn) Forecast, by Subscription Type, 2017-2031

Figure 22: Europe Vehicle Subscription Market, Incremental Opportunity, by Subscription Type, Value (US$ Bn), 2022-2031

Figure 23: Europe Vehicle Subscription Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 24: Europe Vehicle Subscription Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2022-2031

Figure 25: Europe Vehicle Subscription Market Value (US$ Bn) Forecast, by Package, 2017-2031

Figure 26: Europe Vehicle Subscription Market, Incremental Opportunity, by Package, Value (US$ Bn), 2022-2031

Figure 27: Europe Vehicle Subscription Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Figure 28: Europe Vehicle Subscription Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2022-2031

Figure 29: Europe Vehicle Subscription Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: Europe Vehicle Subscription Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 31: Asia Pacific Vehicle Subscription Market Value (US$ Bn) Forecast, by Subscription Type, 2017-2031

Figure 32: Asia Pacific Vehicle Subscription Market, Incremental Opportunity, by Subscription Type, Value (US$ Bn), 2022-2031

Figure 33: Asia Pacific Vehicle Subscription Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 34: Asia Pacific Vehicle Subscription Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2022-2031

Figure 35: Asia Pacific Vehicle Subscription Market Value (US$ Bn) Forecast, by Package, 2017-2031

Figure 36: Asia Pacific Vehicle Subscription Market, Incremental Opportunity, by Package, Value (US$ Bn), 2022-2031

Figure 37: Asia Pacific Vehicle Subscription Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Figure 38: Asia Pacific Vehicle Subscription Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2022-2031

Figure 39: Asia Pacific Vehicle Subscription Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 40: Asia Pacific Vehicle Subscription Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 41: Middle East & Africa Vehicle Subscription Market Value (US$ Bn) Forecast, by Subscription Type, 2017-2031

Figure 42: Middle East & Africa Vehicle Subscription Market, Incremental Opportunity, by Subscription Type, Value (US$ Bn), 2022-2031

Figure 43: Middle East & Africa Vehicle Subscription Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 44: Middle East & Africa Vehicle Subscription Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2022-2031

Figure 45: Middle East & Africa Vehicle Subscription Market Value (US$ Bn) Forecast, by Package, 2017-2031

Figure 46: Middle East & Africa Vehicle Subscription Market, Incremental Opportunity, by Package, Value (US$ Bn), 2022-2031

Figure 47: Middle East & Africa Vehicle Subscription Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Figure 48: Middle East & Africa Vehicle Subscription Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2022-2031

Figure 49: Middle East & Africa Vehicle Subscription Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 50: Middle East & Africa Vehicle Subscription Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 51: South America Vehicle Subscription Market Value (US$ Bn) Forecast, by Subscription Type, 2017-2031

Figure 52: South America Vehicle Subscription Market, Incremental Opportunity, by Subscription Type, Value (US$ Bn), 2022-2031

Figure 53: South America Vehicle Subscription Market Value (US$ Bn) Forecast, by Service Provider, 2017-2031

Figure 54: South America Vehicle Subscription Market, Incremental Opportunity, by Service Provider, Value (US$ Bn), 2022-2031

Figure 55: South America Vehicle Subscription Market Value (US$ Bn) Forecast, by Package, 2017-2031

Figure 56: South America Vehicle Subscription Market, Incremental Opportunity, by Package, Value (US$ Bn), 2022-2031

Figure 57: South America Vehicle Subscription Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Figure 58: South America Vehicle Subscription Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2022-2031

Figure 59: South America Vehicle Subscription Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: South America Vehicle Subscription Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031