Reports

Reports

The COVID-19 outbreak has brought increased emphasis on hygiene and sanitization in cities. This involves proper maintenance of septic tanks and fully lined tanks whose outlets are connected to sewerage networks. As a result, sanitization of public areas, shelter homes for migrants, and sanitization of tunnels in government offices & hospitals becomes imperative. Such applications are anticipated to fuel the demand for new tanks and contribute to the growth of the U.S. lined tank market.

Stakeholders from essential industries such as pharmaceuticals, food & beverages, and water storage are anticipated to trigger the demand for lined tanks. Tank manufacturers are ensuring stable supply chains to ensure business continuity. Manufacturers in the U.S. lined tank market are paying attention to mission-critical projects in essential industries to ensure continuous revenue flow. As such, the chemicals industry is creating stable revenue streams for tank manufacturers.

The U.S. lined tank market is predicted to expand at a modest CAGR of 4.2% throughout the assessment period. However, costly spills and damage to the environment, especially in off-shore applications are creating challenges for stakeholders in the oil & gas industry. Hence, manufacturers are diversifying their production in lining for steel vessels. Poly Processing - a leader in polyethylene storage tanks, is publicizing PolyGard™ for lining steel vessels for increased performance and better chemical storage solutions. Thus, companies in the U.S. lined tank market are taking cues from such innovations to develop linings for steel vessels.

ISO tank linings, on the other hand, are gaining prominence in shipping liquid chemicals and solids. However, sulfuric acid and hydrochloric acid can be potentially damaging to ISO tanks. Thus, initial investment for lining in ISO tanks is expensive, but it provides protective coating for shipping aggressive chemicals.

The oil & gas industry is creating stable revenue streams for companies in the U.S. lined tank market. The Novolac technology from Sherwin-Williams Company - a Cleveland, Ohio–based company in the paint and coating manufacturing industry, is gaining popularity for enhancing corrosion and abrasion resistance in oil & gas applications.

Tank linings are the workhorses of asset protection in the oil & gas industry. There is a high demand for tank linings in oil & gas applications, since they provide critical barrier between a stored product and the tank in which it is contained. Such demands are translating into revenue opportunities for manufacturers in the U.S. lined tank market.

Glass lined tanks are emerging as an alternative to conventional fixed storage tanks, ISO containers, and truck trailers. Companies in the U.S. lined tank market are diversifying their production capabilities in the glass-fused-to-steel technology for water storage tanks. CST Industries, Inc. - a complete storage system provider for engineering and manufacturing professionals, is creating awareness about AQUASTORE® liquid storage tanks that are built with the glass-fused-to-steel technology for water storage. Manufacturers in the U.S. lined tank market are gaining awareness about such technologies to innovate in water storage applications.

Manufacturers are developing glass lined tanks that are eliminating the need for painting. They are increasing the availability of tanks that provide optimum glass encapsulation. Glass lined steel tanks are found to provide greater lifetime value as compared to other tank designs. These tanks are offering time efficiency, since they can be assembled without cranes or special equipment. Moreover, low life cycle costs as compared to other available tank designs are fueling the demand for glass lined steel tanks. High quality and recognized standards are being preferred in glass lined steel tanks. These tanks are being deployed for long-lasting municipal and industrial service water storage.

Analysts’ Viewpoint

The increased emphasis on hygiene and sanitization due to the coronavirus outbreak is anticipated to create revenue opportunities for lined tank manufacturers in essential industries such as pharmaceuticals, chemicals, and food & beverage. The U.S. lined tank market is expected to cross the valuation of US$ 1.9 Bn by 2023. However, costly spills and damage to the environment in off-shore applications are concerning stakeholders in the oil & gas industry. Hence, manufacturers should increase their R&D in lining for steel vessels to offer increased performance and better chemical storage in oil & gas applications. Manufacturers are innovating in glass lined steel tanks to tap incremental opportunities in water storage applications.

U.S. Lined Tank Market: Overview

Significant Demand for Lined Tanks in Oil & Gas Industry: Key Driver of U.S. Lined Tank Market

Fixed Storage Tanks Dominate U.S. Lined Tank Market

Rise in Application of Lined Tanks in Oil & Gas Industry

U.S. Lined Tank Market: Competition Landscape

U.S. Lined Tank Market: Major Players

1. Executive Summary

1.1. Lined Tank Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

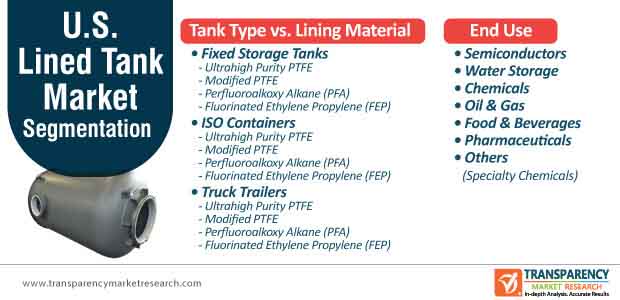

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Potential Customers

2.6.2. List of Suppliers/Manufacturers

2.6.3. List of Lined Tank Maintenance/Service Providers in U.S.

3. COVID-19 Impact Analysis

4. U.S. Lined Tank Market Analysis and Forecast, by Tank Type vs. Lining Material, 2019–2023

4.1. Introduction and Definitions

4.2. U.S. Lined Tank Market Volume (units) and Value (US$ Mn) Forecast, by Tank Type vs. Lining Material, 2019–2023

4.2.1. Fixed Storage Tanks

4.2.1.1. Ultrahigh Purity PTFE

4.2.1.2. Modified PTFE

4.2.1.3. Perfluoroalkoxy Alkane (PFA)

4.2.1.4. Fluorinated Ethylene Propylene (FEP)

4.2.2. ISO Containers

4.2.2.1. Ultrahigh Purity PTFE

4.2.2.2. Modified PTFE

4.2.2.3. Perfluoroalkoxy Alkane (PFA)

4.2.2.4. Fluorinated Ethylene Propylene (FEP)

4.2.3. Truck Trailers

4.2.3.1. Ultrahigh Purity PTFE

4.2.3.2. Modified PTFE

4.2.3.3. Perfluoroalkoxy Alkane (PFA)

4.2.3.4. Fluorinated Ethylene Propylene (FEP)

4.3. U.S. Lined Tank Market Attractiveness Analysis, Tank Type vs. Lining Material

5. U.S. Lined Tank Market Analysis and Forecast, by End-use, 2019–2023

5.1. Introduction and Definitions

5.2. U.S. Lined Tank Market Volume (Units) and Value (US$ Mn) Forecast, by End-use, 2019–2023

5.2.1.1. Semiconductors

5.2.1.2. Water Storage

5.2.1.3. Chemicals

5.2.1.4. Oil & Gas

5.2.1.5. Food & Beverage

5.2.1.6. Pharmaceuticals

5.2.1.7. Others

5.3. U.S. Lined Tank Market Attractiveness Analysis, by End-use

6. Competition Landscape

6.1. U.S. Lined Tank Company Market Share Analysis, 2020

6.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

6.2.1. Praxair S.T. Technology, Inc.

6.2.1.1. Company Description

6.2.1.2. Business Overview

6.2.1.3. Financial Overview

6.2.1.4. Strategic Overview

6.2.2. Electro Chemical Engineering & Manufacturing Co.

6.2.2.1. Company Description

6.2.2.2. Business Overview

6.2.2.3. Financial Overview

6.2.2.4. Strategic Overview

6.2.3. FISHER COMPANY

6.2.3.1. Company Description

6.2.3.2. Business Overview

6.2.3.3. Financial Overview

6.2.3.4. Strategic Overview

6.2.4. Pfaudler Group

6.2.4.1. Company Description

6.2.4.2. Business Overview

6.2.4.3. Financial Overview

6.2.4.4. Strategic Overview

6.2.5. CG Thermal

6.2.5.1. .Company Description

6.2.5.2. Business Overview

6.2.5.3. Financial Overview

6.2.5.4. Strategic Overview

6.2.6. ACRON

6.2.6.1. Company Description

6.2.6.2. Business Overview

6.2.6.3. Financial Overview

6.2.6.4. Strategic Overview

6.2.7. ASTON FLUOROTECH CORP

6.2.7.1. Company Description

6.2.7.2. Business Overview

6.2.7.3. Financial Overview

6.2.7.4. Strategic Overview

6.2.8. Chemours Company FC

6.2.8.1. Company Description

6.2.8.2. Business Overview

6.2.8.3. Financial Overview

6.2.8.4. Strategic Overview

6.2.9. US Coatings

6.2.9.1. Company Description

6.2.9.2. Business Overview

6.2.9.3. Financial Overview

6.2.9.4. Strategic Overview

6.2.10. Moon Fabricating Corporation

6.2.10.1. Company Description

6.2.10.2. Business Overview

6.2.10.3. Financial Overview

6.2.10.4. Strategic Overview

6.2.11. TMI Coatings Inc.

6.2.11.1. Company Description

6.2.11.2. Business Overview

6.2.11.3. Financial Overview

6.2.11.4. Strategic Overview

6.2.12. AmTech Tank Lining & Tank Repair

6.2.12.1. Company Description

6.2.12.2. Business Overview

6.2.12.3. Financial Overview

6.2.12.4. Strategic Overview

6.2.13. Flexi-Liner Corporation

6.2.13.1. Company Description

6.2.13.2. Business Overview

6.2.13.3. Financial Overview

6.2.13.4. Strategic Overview

6.2.14. G.C. Zarnas, Inc.

6.2.14.1. Company Description

6.2.14.2. Business Overview

6.2.14.3. Financial Overview

6.2.14.4. Strategic Overview

7. Primary Research: Key Insights

8. Appendix

List of Tables

Table 1: U.S. Lined Tank Market Volume (Units) Forecast, by Tank Type vs. Lining Material, 2019–2023

Table 2: U.S. Lined Tank Market Value (US$ Mn) Forecast, by Tank Type vs. Lining Material, 2019–2023

Table 3: U.S. Lined Tank Market Volume (Units) Forecast, by End-use, 2019–2023

Table 4: U.S. Lined Tank Market Value (US$ Mn) Forecast, by End-use, 2019–2023

List of Figures

Figure 1: U.S. Lined Tank Price Trend, by Tank Type vs. Lining Material, 2019–2023 (US$/Unit)

Figure 2: U.S. Lined Tank Market Volume Share Analysis, by Tank Type vs. Lining Material, 2019, 2020, and 2023

Figure 3: U.S. Lined Tank Market Attractiveness Analysis, by Tank Type vs. Lining Material

Figure 4: U.S. Lined Tank Market Volume Share Analysis, by End-use, 2019, 2020, and 2023

Figure 5: U.S. Lined Tank Market Attractiveness Analysis, by End-use

Figure 6: U.S. Lined Tank Market Share Analysis, by Company, 2020