Reports

Reports

Analysts’ Viewpoint

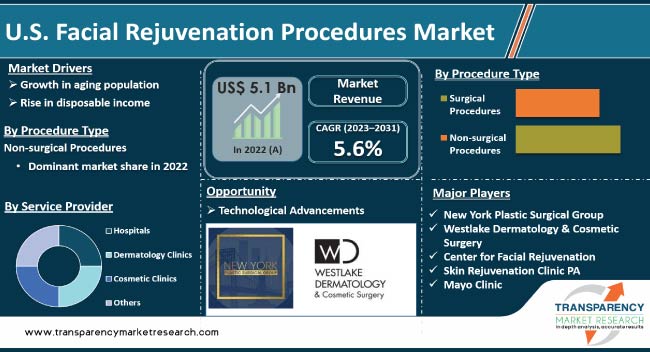

Increase in aging population and rise in disposable income of the people are primarily driving the U.S. facial rejuvenation procedures industry growth. Surge in awareness about non-invasive and minimally invasive facial rejuvenation procedures is also augmenting the U.S. facial rejuvenation procedures market value. Furthermore, cultural factors, such as emphasis on youth and beauty, are boosting market dynamics.

New technologies and techniques have made facial rejuvenation procedures safer and more effective, with minimal downtime and scarring. These procedures have become more accessible to a wider range of people, including those who may have been hesitant to undergo invasive surgeries in the past. Market participants are offering innovative products and services for surgical as well as non-surgical facial rejuvenation procedures.

Facial rejuvenation procedures are cosmetic treatments designed to reduce the signs of aging on the face and restore youthful appearance. These procedures can be surgical as well as non-surgical.

Surgical facial rejuvenation procedures include facelifts, brow lifts, and eyelid surgeries. Facelifts involve lifting and tightening of the skin on the face and neck to reduce sagging and wrinkles. Brow lifts target the forehead and brow area to reduce sagging and wrinkles. Eyelid surgery, or blepharoplasty, targets eyelids to reduce sagging and wrinkles in the area.

Non-surgical facial rejuvenation procedures include injectables such as Botox and dermal fillers, which smoothen out wrinkles and fine lines by relaxing or filling in the skin. Skin rejuvenation treatments such as lasers and chemical peels help remove the outer layers of the skin to reveal smoother, more youthful skin beneath.

People are living longer, healthier lives with advancements in healthcare. Baby boomers are increasingly looking for ways to maintain a youthful appearance as they age. This has led to a rise in demand for facial rejuvenation procedures.

Facial rejuvenation procedures boost self-confidence in adults by enhancing their looks. Demand for facial rejuvenation procedures is rising in the U.S. in order to look attractive, especially in industries such as fashion and modeling.

The proliferation of social media and the internet has led to an increase in awareness about facial rejuvenation procedures, thus making them more acceptable and accessible to a wider range of people. This is expected to contribute to U.S. facial rejuvenation procedures market development in the near future.

Facial rejuvenation procedures have been evolving rapidly with advancements in technology. Technological innovations have made these procedures more effective, safer, and less invasive.

As per the U.S. facial rejuvenation procedures industry analysis, non-surgical procedures, such as Botox and dermal fillers, are gaining traction due to their noticeable results with little or no downtime.

Botox is a neurotoxin that is injected into the muscles to temporarily paralyze them. It is commonly used to treat wrinkles, frown lines, and crow's feet. The procedure is quick, and the results are visible within a few days. Botox carries minimal side effects; patients can resume their normal activities almost immediately.

Dermal filler is another popular non-surgical facial rejuvenation procedure. These fillers are injectables that are used to restore volume and smoothen out wrinkles and fine lines. Dermal fillers are commonly used to treat nasolabial folds, marionette lines, and lip lines. they are quick and safe, and results can last up to 18 months.

Several types of dermal fillers are available in the market. These include hyaluronic acid fillers, collagen stimulators, and synthetic fillers. Each type offers unique properties and is used for specific purposes.

Lasers have also become increasingly popular for facial rejuvenation. Under laser resurfacing, a laser is used to remove damaged skin cells, thus promoting the growth of new, healthier skin. The procedure helps improve skin texture, reduce wrinkles, and eliminate sun damage. Lasers are also used for hair removal, treatment of acne scars, and removal of pigmentation.

Thus, technological advancements have revolutionized the field of facial rejuvenation procedures, thereby influencing market progress.

According to the latest U.S. facial rejuvenation procedures market report, the non-surgical procedures segment is likely to dominate during the forecast period. People are more likely to opt for non-surgical treatments due to their lower cost and minimal downtime vis-à-vis surgical procedures.

Non-surgical treatments are available at several cosmetic clinics, hospitals, and dermatology clinics in the U.S. These procedures have become increasingly popular among younger patients who seek to maintain their appearance without undergoing surgery. Older patients also undergo these treatments to repair the damage caused by wrinkles. Professionals make use of injectables, chemical peels, and laser therapy to rejuvenate faces.

As per the latest U.S. facial rejuvenation procedures market trends, the cosmetic clinic's service provider segment is expected to account for a major share during the forecast period. These clinics provide a broad range of non-surgical facial rejuvenation procedures and laser treatments. They use injectables and chemical peels to perform these treatments.

Cosmetic clinics offer specialized expertise in facial esthetics along with personalized treatment plans and a comfortable, relaxing environment for patients. Hence, cosmetic clinics are gaining popularity among patients.

According to the latest U.S. facial rejuvenation procedures market research analysis, technological advancements in non-surgical treatments and an increase in consumer awareness about such procedures are fueling the popularity of cosmetic clinics. The rise in the availability of a range of non-surgical treatments in cosmetics clinics is projected to contribute to U.S. facial rejuvenation procedures market growth in the next few years.

Mayo Clinic, New York Plastic Surgical Group, Westlake Dermatology & Cosmetic Surgery, Nazarian Plastic Surgery, Skin Rejuvenation Clinic PA, Center for Facial Rejuvenation, Knoxville Oral & Maxillofacial Surgery, JOHNS HOPKINS MEDICINE, and Cleveland Clinic are the prominent U.S. facial rejuvenation procedures market players.

These players are engaged in mergers & acquisitions, strategic collaborations, and new product launches to increase their U.S. facial rejuvenation procedures market share.

Key players have been profiled in the U.S. facial rejuvenation procedures market forecast report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size in 2022 |

US$ 5.1 Bn |

|

Forecast (Value) in 2031 |

More than US$ 8.4 Bn |

|

Growth Rate (CAGR) |

5.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 5.1 Bn in 2022.

It is projected to reach more than US$ 8.4 Bn by 2031.

The CAGR is anticipated to be 5.6% from 2023 to 2031.

The non-surgical procedure type segment held major share in 2022.

Mayo Clinic, New York Plastic Surgical Group, Westlake Dermatology & Cosmetic Surgery, Nazarian Plastic Surgery, Skin Rejuvenation Clinic PA, Center for Facial Rejuvenation, Knoxville Oral & Maxillofacial Surgery, JOHNS HOPKINS MEDICINE, and Cleveland Clinic.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: U.S. Facial Rejuvenation Procedures Market

4. Market Overview

4.1. Introduction

4.1.1. Procedure Type Definition

4.1.2. Industry Evolution / Development

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. U.S. Facial Rejuvenation Procedures Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

4.5. Porter’s Five Forces Analysis

5. Key Insights

5.1. Porter’s Five Force Analysis

5.2. Disease Prevalence & Incidence Rate

5.3. Pricing Analysis

5.4. COVID-19 Impact Analysis

6. U.S. Facial Rejuvenation Procedures Market Analysis and Forecast, by Procedure Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Procedure Type, 2017–2031

6.3.1. Surgical Procedures

6.3.1.1. Facelift

6.3.1.2. Rhinoplasty

6.3.1.3. Eyelid Procedures

6.3.1.4. Facial Implants

6.3.1.5. Endoscopic Brow Lift

6.3.2. Non-surgical Procedures

6.3.2.1. Dermal Fillers

6.3.2.2. Botox

6.3.2.3. Laser Lift

6.3.2.4. Ultrasound

6.3.2.5. Others (Injection Lipolysis)

6.4. Market Attractiveness Analysis, by Procedure Type

7. U.S. Facial Rejuvenation Procedures Market Analysis and Forecast, by Service Provider

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Service Provider, 2017–2031

7.3.1. Hospitals

7.3.2. Dermatology Clinics

7.3.3. Cosmetic Clinics

7.3.4. Others

7.4. Market Attractiveness Analysis, by Service Provider

8. Competition Landscape

8.1. Market Player – Competition Matrix (By Tier and Size of Companies)

8.2. Market Share Analysis, by Company (2021)

8.3. Company Profiles

8.3.1. Mayo Clinic

8.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.1.2. Product Portfolio

8.3.1.3. Financial Overview

8.3.1.4. SWOT Analysis

8.3.1.5. Strategic Overview

8.3.2. New York Plastic Surgical Group

8.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.2.2. Product Portfolio

8.3.2.3. Financial Overview

8.3.2.4. SWOT Analysis

8.3.2.5. Strategic Overview

8.3.3. Westlake Dermatology & Cosmetic Surgery

8.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.3.2. Product Portfolio

8.3.3.3. Financial Overview

8.3.3.4. SWOT Analysis

8.3.3.5. Strategic Overview

8.3.4. Nazarian Plastic Surgery

8.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.4.2. Product Portfolio

8.3.4.3. Financial Overview

8.3.4.4. SWOT Analysis

8.3.4.5. Strategic Overview

8.3.5. Skin Rejuvenation Clinic PA

8.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.5.2. Product Portfolio

8.3.5.3. Financial Overview

8.3.5.4. SWOT Analysis

8.3.5.5. Strategic Overview

8.3.6. Center for Facial Rejuvenation

8.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.6.2. Product Portfolio

8.3.6.3. Financial Overview

8.3.6.4. SWOT Analysis

8.3.6.5. Strategic Overview

8.3.7. Knoxville Oral & Maxillofacial Surgery

8.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.7.2. Product Portfolio

8.3.7.3. Financial Overview

8.3.7.4. SWOT Analysis

8.3.7.5. Strategic Overview

8.3.8. JOHNS HOPKINS MEDICINE

8.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.8.2. Product Portfolio

8.3.8.3. Financial Overview

8.3.8.4. SWOT Analysis

8.3.8.5. Strategic Overview

8.3.9. Cleveland Clinic

8.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

8.3.9.2. Product Portfolio

8.3.9.3. Financial Overview

8.3.9.4. SWOT Analysis

8.3.9.5. Strategic Overview

List of Tables

Table 01: U.S. Facial Rejuvenation Procedures Market Value (US$ Mn) Forecast, by Procedure Type, 2017–2031

Table 02: U.S. Facial Rejuvenation Procedures Market Volume (Thousand Units) Forecast, by Procedure Type, 2017–2031

Table 03: U.S. Facial Rejuvenation Procedures Market Value (US$ Mn) Forecast, by Surgical Procedures, 2017–2031

Table 04: U.S. Facial Rejuvenation Procedures Market Volume (Thousand Units) Forecast, by Surgical Procedures, 2017–2031

Table 05: U.S. Facial Rejuvenation Procedures Market Value (US$ Mn) Forecast, by Non-Surgical Procedures, 2017–2031

Table 06: U.S. Facial Rejuvenation Procedures Market Volume (Thousand Units) Forecast, by Non-Surgical Procedures, 2017–2031

Table 07: U.S. Facial Rejuvenation Procedures Market Value (US$ Mn) Forecast, by Service Provider, 2017–2031

List of Figures

Figure 01: U.S. Facial Rejuvenation Procedures Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Facial Rejuvenation Procedures Market Value Share, by Procedure Type, 2022

Figure 03: Facial Rejuvenation Procedures Market Value Share, by Service Provider, 2022

Figure 04: U.S. Facial Rejuvenation Procedures Market Value Share Analysis, by Procedure Type, 2022 and 2031

Figure 05: U.S. Facial Rejuvenation Procedures Market Attractiveness Analysis, by Procedure Type, 2023–2031

Figure 06: U.S. Facial Rejuvenation Procedures Market (US$ Mn), by Surgical Procedures, 2017–2031

Figure 07: U.S. Facial Rejuvenation Procedures Market (US$ Mn), by Non-Surgical Procedures, 2017–2031

Figure 08: U.S. Facial Rejuvenation Procedures Market Value Share Analysis, by Service Provider, 2022 and 2031

Figure 09: U.S. Facial Rejuvenation Procedures Market Attractiveness Analysis, by Service Provider, 2023–2031

Figure 10: U.S. Facial Rejuvenation Procedures Market (US$ Mn), by Hospitals, 2017–2031

Figure 11: U.S. Facial Rejuvenation Procedures Market (US$ Mn), by Dermatology Clinics, 2017-2031

Figure 12: U.S. Facial Rejuvenation Procedures Market (US$ Mn), by Cosmetic Clinics, 2017–2031

Figure 13: U.S. Facial Rejuvenation Procedures Market (US$ Mn), by Others, 2017-2031