Reports

Reports

Researchers of Nutritional Medicine at the University of Surrey are identifying a link between dietary selenium and its cure rate for COVID-19. This has led to the popularity of Brazil nut oil, seafood, and poultry, among others, and is helping in improving potential outcomes in coronavirus patients, as these foods are rich source of selenium. Since several individuals are found with selenium deficiency, the growing awareness about the benefits of these foods can create sales opportunities for companies in the Brazil nut oil market in the U.S.

The ever-evolving nature of coronavirus is anticipated to create incremental opportunities for manufacturers in the Brazil nut oil market in the U.S. who are focusing on eCommerce sales for essential foods, household, and personal care products.

Brazil nut oil is being highly publicized for its high selenium levels that play an instrumental role in preventing cancer, aid proper functioning of thyroid glands, and enhance immunity. This oil has become the need of the hour due to the ongoing pandemic, since consumers are becoming conscious about ways to maintain optimum immunity and health. However, side effects of this oil pose risks of selenium toxicity, resulting in brittle nails and hair. Manufacturers and brands in the Brazil nut oil market in the U.S. are creating awareness to avoid overconsumption of products that may lead to diarrhea, irritability, nail abnormalities, and the likes. As such, manufacturers are establishing robust supply streams from South America during the wet season of the rain forest.

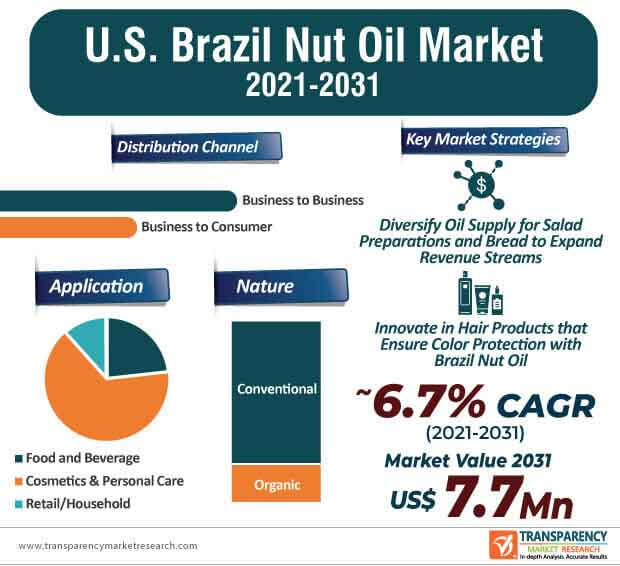

Cosmetics and personal care products are popular end-use cases for Brazil nut oil. The Schwarzkopf Professional Bonacure Talent 10 Brazil Nut Oil hair therapy is among the many products that offer color protection, ultimate shine, and detangling. Brazil nut oil in hair care products is providing advantages of anti-breakage, moisture, and conditioning, among consumers. Manufacturers in the Brazil nut oil market in the U.S. are increasing their production capabilities in rich, milky, leave-in hair sprays that contain a complex of Brazil nut oil, vitamin E, and hydrolyzed keratin, among other compounds.

Hair care brands in the Brazil nut oil market in the U.S. are developing leave-in sprays with micro-encapsulated fragrance that offer 24-hour long sensorial experience to users.

The Brazil nut oil market in the U.S. is undergoing a significant change as brands are producing flagship cosmetic oils that increase skin suppleness and elasticity. The Brazil nut oil is being highly publicized for its rich & balanced omega 6 & 9 levels, phytosterols, and antioxidant properties that serve as a natural cosmetic treatment for dry, irritated or sensitive skin. Consumers are mixing blends of sweet almond, camellia seed, and Brazil nut oil to rejuvenate dull skin.

Anti-aging skincare products and body lotions are emerging as bright spots for sales opportunities for brands in the Brazil nut oil market in the U.S.

Brazil nut oil is not recommended for cooking since its temperature deteriorates, owing to the vitamin E content. Manufacturers in the Brazil nut oil market in the U.S. are boosting their production capabilities to meet the demand for health-conscious consumers that are using it for salad preparations and with bread. The high prevalence of bad cholesterol, arthritis, and menstrual pain is driving the Brazil nut oil market in the U.S.

Patients with cardiovascular diseases are being recommended Brazil nut oil, which is effective in preventing blood clots by reducing flow of blood. Moreover, the omega 6 fats in Brazil nut oil help improve circulation.

Analysts’ Viewpoint

Selenium deficiency in individuals has boosted the consumption of Brazil nut oil through salads and bread dressing to prevent contraction of COVID-19 and maintain optimum immunity. The moderate consumption of Brazil nut oil helps to preserve heart health and acts as an effective solution to prevent hypertension. However, this oil may lead to side effects such as spotty colored teeth, hair loss, and nausea. Hence, companies in the Brazil nut oil market in the U.S. should increase awareness to avoid excess consumption of the oil to benefit the health of consumers. Hair and skincare products are key applications of Brazil nut oil. Manufacturers are bolstering their production capacities of leave-in sprays, organic shampoos, and body lotions to meet the demanding needs of consumers.

Brazil Nut Oil Market in U.S.: Overview

Brazil Nut Oil Market in U.S.: Market Frontrunners

Brazil Nut Oil Market in U.S.: Dynamics

Brazil Nut Oil Market in U.S.: Major Strategies

Brazil Nut Oil Market in U.S.: Key Players

1. Executive Summary

1.1. U.S. Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Product USPs / Features

5. U.S. Brazil Nut Oil Market Size and Volume Analysis 2016-2020 and Forecast, 2021–2031

5.1. Historical Market Volume (Tons) Analysis, 2016–2020

5.2. Current and Future Market Volume (Tons) Projections, 2021–2031

6. U.S. Brazil Nut Oil Market - Pricing Analysis

6.1. Regional Pricing Analysis

6.2. U.S. Average Pricing Analysis Benchmark

7. U.S. Brazil Nut Oil Market Size and Value Demand Analysis 2016–2020 and Forecast, 2021–2031

7.1. Historical Market Value (US$ Mn) Analysis, 2016–2020

7.2. Current and Future Market Value (US$ Mn) Projections, 2021–2031

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ opportunity Analysis

8. Market Background

8.1. Macro-Economic Factors

8.2. Impact of COVID-19 on Brazil Nut Oil Market

8.2.1. Manufacturer/Processors

8.2.2. Supply Chain and Logistics

8.2.3. Wholesalers/Traders

8.2.4. Retailers

8.3. U.S. Food and Beverage Industry Outlook

8.4. U.S. Cosmetics & Personal Care Industry Outlook

8.5. Brazil Nut Production Analysis

8.6. Import Trade Analysis of Brazil Nuts by Top 20 Countries

8.7. Export Trade Analysis of Brazil Nuts by Top 20 Countries

8.8. Overview of Brazil Nut Production

8.9. Brazil Nut Products

8.10. Brazil Nut – Varieties, Forms & Applications

8.11. Brazil Nut Processing

8.12. Types of Cosmetics

8.13. U.S. – Top Cosmetics & Personal Care Brands

8.14. U.S. Cosmetic & Personal Care Product Certifications

8.15. Key Regulations

8.16. Industry Value and Supply Chain Analysis

8.16.1. Profit Margin Analysis at each point of sales

8.16.1.1. Brazil Nut Oil Processors/Manufacturers

8.16.1.2. Distributors/Suppliers/Wholesalers

8.16.1.3. Traders/Retailers

8.16.1.4. End-Users

8.17. Market Dynamics

8.17.1. Drivers

8.17.2. Restraints

8.17.3. Opportunity Analysis

8.18. Forecast Factors - Relevance & Impact

9. U.S. Brazil Nut Oil Market Analysis 2016–2020 and Forecast 2021–2031, By Nature

9.1. Introduction / Key Findings

9.2. Historical Market Size (US$ Mn) and Volume Analysis By Nature, 2016–2020

9.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Nature, 2021–2031

9.3.1. Organic

9.3.2. Conventional

9.4. Market Attractiveness Analysis By Nature

10. U.S. Brazil Nut Oil Market Analysis 2016–2020 and Forecast 2021–2031, By Application

10.1. Introduction / Key Findings

10.2. Historical Market Size (US$ Mn) and Volume Analysis By Application, 2016–2020

10.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Application, 2021–2031

10.3.1. Food and Beverage

10.3.2. Cosmetics & Personal Care

10.3.2.1. Skin Care

10.3.2.2. Hair Care

10.3.2.3. Personal Care

10.3.2.4. Fragrance

10.3.3. Retail/Household

10.4. Market Attractiveness Analysis By Application

11. U.S. Brazil Nut Oil Market Analysis 2016–2020 and Forecast 2021–2031, By Distribution Channel

11.1. Introduction / Key Findings

11.2. Historical Market Size (US$ Mn) and Volume Analysis By Distribution Channel, 2016–2020

11.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Distribution Channel, 2021–2031

11.3.1. Business to Business

11.3.2. Business to Consumer

11.3.2.1. Hypermarkets/Supermarkets

11.3.2.2. Pharmacy/Drug Store

11.3.2.3. Specialty Stores

11.3.2.4. Online Retail

11.4. Market Attractiveness Analysis By Distribution Channel

12. Market Structure Analysis

12.1. Market Concentration

12.2. Market Presence Analysis

13. Competition Analysis

13.1. Competition Dashboard

13.2. Competition Deep Dive

13.2.1. Croda International Plc

13.2.1.1. Overview

13.2.1.2. Product Portfolio

13.2.1.3. Sales Footprint

13.2.1.4. Key Developments

13.2.1.5. Strategy Overview

13.2.2. Caribbean Natural Products, Inc.

13.2.2.1. Overview

13.2.2.2. Product Portfolio

13.2.2.3. Sales Footprint

13.2.2.4. Key Developments

13.2.2.5. Strategy Overview

13.2.3. Beraca Ingredientes Naturais SA.

13.2.3.1. Overview

13.2.3.2. Product Portfolio

13.2.3.3. Sales Footprint

13.2.3.4. Key Developments

13.2.3.5. Strategy Overview

13.2.4. Best Natures

13.2.4.1. Overview

13.2.4.2. Product Portfolio

13.2.4.3. Sales Footprint

13.2.4.4. Key Developments

13.2.4.5. Strategy Overview

13.2.5. Jedwards International, Inc.

13.2.5.1. Overview

13.2.5.2. Product Portfolio

13.2.5.3. Sales Footprint

13.2.5.4. Key Developments

13.2.5.5. Strategy Overview

13.2.6. YBI Brazil

13.2.6.1. Overview

13.2.6.2. Product Portfolio

13.2.6.3. Sales Footprint

13.2.6.4. Key Developments

13.2.6.5. Strategy Overview

13.2.7. Hallstar

13.2.7.1. Overview

13.2.7.2. Product Portfolio

13.2.7.3. Sales Footprint

13.2.7.4. Key Developments

13.2.7.5. Strategy Overview

13.2.8. Green Forest Products S.A.

13.2.8.1. Overview

13.2.8.2. Product Portfolio

13.2.8.3. Sales Footprint

13.2.8.4. Key Developments

13.2.8.5. Strategy Overview

13.2.9. SULU ORGANICS

13.2.9.1. Overview

13.2.9.2. Product Portfolio

13.2.9.3. Sales Footprint

13.2.9.4. Key Developments

13.2.9.5. Strategy Overview

13.2.10. Biopurus

13.2.10.1. Overview

13.2.10.2. Product Portfolio

13.2.10.3. Sales Footprint

13.2.10.4. Key Developments

13.2.10.5. Strategy Overview

13.2.11. Aromantic UK

13.2.11.1. Overview

13.2.11.2. Product Portfolio

13.2.11.3. Sales Footprint

13.2.11.4. Key Developments

13.2.11.5. Strategy Overview

13.2.12. Para Food s.r.o & Seanergy spol. s r.o.

13.2.12.1. Overview

13.2.12.2. Product Portfolio

13.2.12.3. Sales Footprint

13.2.12.4. Key Developments

13.2.12.5. Strategy Overview

13.2.13. Oshadhi Ltd.

13.2.13.1. Overview

13.2.13.2. Product Portfolio

13.2.13.3. Sales Footprint

13.2.13.4. Key Developments

13.2.13.5. Strategy Overview

13.2.14. Rainforest Chica

13.2.14.1. Overview

13.2.14.2. Product Portfolio

13.2.14.3. Sales Footprint

13.2.14.4. Key Developments

13.2.14.5. Strategy Overview

14. Assumptions and Acronyms Used

15. Research Methodology

List of Tables:-

Table 01: U.S. Brazil Nut Oil Market Value (US$ '000) Analysis and Forecast by Nature, 2016-2031

Table 02: U.S. Brazil Nut Oil Market Volume (Kg) Analysis and Forecast by Nature, 2016-2031

Table 03: U.S. Brazil Nut Oil Market Value Share Analysis by Nature, 2021 E

Table 04: U.S. Brazil Nut Oil Market Volume (Kg) Analysis and Forecast by Application, 2016-2031

Table 05: U.S. Brazil Nut Oil Market Value (US$ '000) Analysis and Forecast by Cosmetics & Personal Care, 2016-2031

Table 06: U.S. Brazil Nut Oil Market Volume (Kg) Analysis and Forecast by Cosmetics & Personal Care, 2016-2031

Table 07: U.S. Brazil Nut Oil Market Value (US$ '000) Analysis and Forecast by Distribution Channel, 2016-2031

Table 08: U.S. Brazil Nut Oil Market Volume (Kg) Analysis and Forecast by Distribution Channel, 2016-2031

Table 09: U.S. Brazil Nut Oil Market Value (US$ '000) Analysis and Forecast by Business to Consumer, 2016-2031

Table 10: U.S. Brazil Nut Oil Market Volume (Kg) Analysis and Forecast by Business to Consumer, 2016-2031

List of Figure:-

Figure 01: U.S. Brazil Nut Oil Market Value (US$ ‘000) Forecast, 2021–2031

Figure 02: U.S. Brazil Nut Oil Market Volume (Kg) Forecast, 2021–2031

Figure 03: U.S. Brazil Nut Oil Market Value Share Analysis by Nature, 2021 E

Figure 04: U.S. Brazil Nut Oil Market Y-o-Y Growth Rate by Nature, 2021-2031

Figure 05: U.S. Brazil Nut Oil Market Value (US$ '000) Analysis & Forecast by Nature, 2021–2031

Figure 06: U.S. Brazil Nut Oil Market Volume (Kg) Analysis & Forecast by Nature, 2021–2031

Figure 07: U.S. Brazil Nut Oil Market Value Share Analysis by Application, 2021 E

Figure 08: U.S. Brazil Nut Oil Market Y-o-Y Growth Rate by Application, 2021-2031

Figure 09: U.S. Brazil Nut Oil Market Value (US$ '000) Analysis & Forecast by Application, 2021–2031

Figure 10: U.S. Brazil Nut Oil Market Volume (Kg) Analysis & Forecast by Application, 2021–2031

Figure 11: U.S. Brazil Nut Oil Market Value Share Analysis by Distribution Channel, 2021 E

Figure 12: U.S. Brazil Nut Oil Market Y-o-Y Growth Rate by Distribution Channel, 2021-2031

Figure 13: U.S. Brazil Nut Oil Market Value (US$ '000) Analysis & Forecast by Distribution Channel, 2021–2031

Figure 14: U.S. Brazil Nut Oil Market Volume (Kg) Analysis & Forecast by Distribution Channel, 2021–2031

Figure 15: U.S. Brazil Nut Oil Market Attractiveness Analysis by Nature, 2021–2031

Figure 16: U.S. Brazil Nut Oil Market Attractiveness Analysis by Application, 2021–2031

Figure 17: U.S. Brazil Nut Oil Market Attractiveness Analysis by Distribution Channel, 2021–2031