Reports

Reports

Global Ureteroscopes Market: Snapshot

Ureteroscope is a medical device, which is thin tube like device with illuminating light and lens to capture images of complex urinary tract organs for the presence of calculi or tumors. It is passed through the urethra to the bladder and then into the ureter for the diagnosis and treatment of kidney stones. The device helps to understand the position of the kidney stone and also in treatment of kidney stone removal It is a minimally invasive procedure to remove the kidney stone and has shown higher accuracy and least rate of complications when compare to traditional methods of kidney stone removal such as extracorporeal shock wave lithotripsy (ESWL), percutaneous nephrolithotomy (PCNL) etc. Kidney stone can either be removed by using basket attached the ureteroscope or it can be broken down into fragments which are excreted through urine outside the body.

Increasing incidence of kidney stones diseases and rising prevalence of urologic cancers globally owing to the changing dietary habits and climatic conditions are anticipated to boost the growth of the global ureteroscopes market during forecast period. Moreover, growing research and development activities in flexible video-ureteroscopes, invention of disposable ureteroscopes devices, and increasing adoption of technologically advanced ureteroscopes are also propelling the growth of the global ureteroscopes market. However, high cost of digital and reusable ureteroscopes devices is the factors restraining the growth of the global ureteroscopes market during 2017-2025

Among Product Type, Flexible Ureteroscopes Expected to Hold Largest Share

The global ureteroscopes market is segmented based on the product type, applications, end-user, and regions. In terms of product type, the global ureteroscopes market can be segmented into flexible ureteroscopes, semi-rigid ureteroscopes, and rigid ureteroscopes. The flexible ureteroscopes segment is projected to hold highest share in the global ureteroscopes market owing to evolution of imaging technology in the form of fiberoptic and digital ureteroscopes, and high success rate of the stone removal procedure using flexible ureteroscopes devices. The flexible ureteroscope segment is further classified into fiberoptic flexible ureteroscopes and digital ureteroscopes based on the type of imaging technology. The digital ureteroscopes segment is anticipated to grow at highest CAGR during the forecast period owing to higher success rate and ease in usage of digital ureteroscopes compared to traditional ureteroscopes. In terms of applications, the global ureteroscopes market is segmented into therapeutic applications and diagnostic applications. The therapeutic applications segment is further classified into urolithiasis, kidney stone, urinary stinctures and other urological procedures. Therapeutic applications segment is expected to dominate the global ureteroscopes market during forecast period owing to increasing number of kidney stone procedures and rising prevalence of urolithiasis globally.

In terms of end-user, the global ureteroscopes market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and diagnostic imaging centers. The hospitals segment dominated the global ureteroscopes market in 2016, due to rising patient preference for minimally invasive interventional procedures in hospitals and favorable reimbursement assessment in hospitals. Rapid evolution of digital ureteroscope has resulted in rising adoptions of ureteroscopes application from therapeutic to diagnostic purposes, and is thus likely to boost the growth of diagnostic imaging centers segment in the global ureteroscopes market during the forecast period.

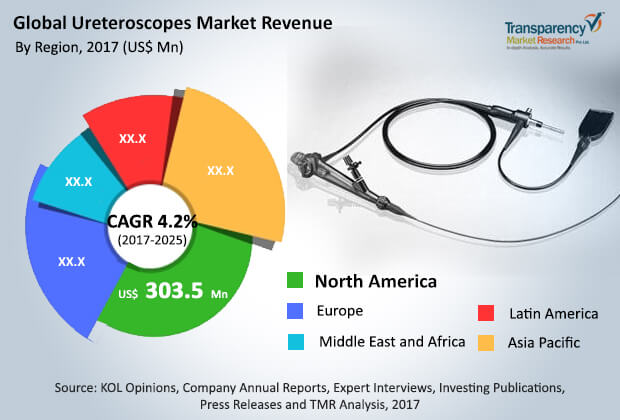

High Prevalence of Urolithiasis Puts North America at Global Market’s fore

Geographically, the global ureteroscopes market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America accounted for the highest market share, in terms of revenue, in 2016, due to high prevalence of urolithiasis, high adoption rate of minimally invasive surgeries, launch of new products by key players and high class healthcare infrastructure. Europe is the second largest market for the ureteroscopes owing to rapidly growing aging population demanding advanced medical devices, increasing number of kidney stone treatment procedures, favorable reimbursement policies, and presence of key players with strong distribution channels in the Germany and other parts of Western Europe. Asia Pacific is anticipated to be the most attractive market for ureteroscopes registering relatively higher CAGR during the forecast period, in terms of value. Growing prevalence of kidney stones by changing dietary habits, less consumption of water and increasing healthcare awareness are the factors expected to boost the demand for ureteroscopes in Asia Pacific region.

Major payers operating in the global ureteroscopes market includes Olympus Corporation, Boston Scientific Corporation, Stryker, Richard Wolf, KARL STORZ SE & Co. KG, PENTAX Medical, Elmed Electronics & Medical Industry & Trade Inc., AED.MD, SCHÖLLY FIBEROPTIC GMBH, OPCOM Inc.,

Prosurg, Inc., SOPRO-COMEG GmbH and others. The emerging players in the global ureteroscopes market includes Maxerendoscopy, LocaMed Limited, EMOS Technology GmbH, ROCAMED, Vimex Sp. z o.o. and others.

Ureteroscopes Market Players Lean on Leveraging Minimally Invasive Percutaneous Techniques

Ureteroscopes have been mainstreamed as a key modality for diagnosing and treating an overwhelmingly large number of upper urinary tract pathologies. Manufacturers in the ureteroscopes market have been relentlessly making constant technological advancements to meet the needs of patient population needs. One of the key areas that have seen vast improvements in ureteroscopes is minimally invasive percutaneous techniques for stone diseases in upper urinary tract. The growing preference of use of ureteroscopes over shock wave lithotripsy has considerably expanded the revenue prospects for players in the ureteroscopes market. The landscape has seen a new horizon from the advent of single-use ureteroscopes. However, the scale is still tilted toward the use of disposable ureteroscopes in all clinical settings. On the other hand, there seems to be unmet need for single-use devices due to marked prevalence of urolithiasis. Technological advancements in this realm focus on numerous parameters such as maneuverability, deflection, weight, and vision ability. Growing hospitalization of young adults and older adults due to recurrent kidney stones has propelled the demand for disposable ureteroscopes. The cost-effectiveness of these is one of the value propositions propelling demand for these in the ureteroscopes market.

The emerging Covid-19 pandemic has led people postponing elective surgeries. Also, the high risks of virus transmission has also led people to delay the kidney stone procedures for some time. However, in the last quarter of 2020, when the economies started opening up and businesses started picking up pace in numerous countries, hospital setting saw a rise in cases of people looking to undergo urolithiasis. A part of this was also propelled by the adoption of diagnosis taken in this direction. In 2021, the ureteroscopes market will see manufacturers working to get new devices approved to ascertain their return on investments. Further, the ureteroscopes market is likely to see high sales of contemporary technologies in emerging economies.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Ureteroscopes Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Ureteroscopes Market Analysis and Forecasts, 2015–2025

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

4.6. Market Outlook

4.7. Regulatory Scenario by Region/Country

4.8. Comparative analysis of key features of product/Brand in the market

4.9. Narrow Band Imaging: A new wave In the Diagnostic Field

5. Global Ureteroscopes Market Analysis and Forecasts, By Product Type

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Market Value Forecast by Product Type, 2015–2025

5.3.1. Flexible Ureteroscope

5.3.1.1. Fiberoptic Ureteroscope

5.3.1.2. Digital Ureteroscope

5.3.2. Semi-rigid Ureteroscope

5.3.3. Rigid Ureteroscope

5.4. Market Attractiveness by Product Type

6. Global Ureteroscopes Market Analysis and Forecasts, By Applications

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast by Applications, 2015–2025

6.3.1. Therapeutic Applications

6.3.1.1. Urolithiasis

6.3.1.2. Kidney Cancer

6.3.1.3. Ureteral Stinctures

6.3.1.4. Others

6.3.2. Diagnostic Applications

6.4. Market Attractiveness by Applications

7. Global Ureteroscopes Market Analysis and Forecasts, By End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast by End-user, 2015–2025

7.3.1. Hospitals

7.3.2. Specialty Clinics

7.3.3. Ambulatory Surgical Centers

7.3.4. Diagnostic Imaging Centers

7.4. Market Attractiveness by End-user

8. Global Ureteroscopes Market Analysis and Forecasts, By Region

8.1. Key Findings

8.2. Market Value Forecast by Region, 2017-2025

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness by Region

9. North America Ureteroscopes Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast by Product Type, 2015–2025

9.2.1. Flexible Ureteroscope

9.2.1.1. Fiberoptic Ureteroscope

9.2.1.2. Digital Ureteroscope

9.2.2. Semi-rigid Ureteroscope

9.2.3. Rigid Ureteroscope

9.3. Market Value Forecast by Applications, 2015–2025

9.3.1. Therapeutic Applications

9.3.1.1. Urolithiasis

9.3.1.2. Kidney Cancer

9.3.1.3. Ureteral Stinctures

9.3.1.4. Others

9.3.2. Diagnostic Applications

9.4. Market Value Forecast by End-user, 2015–2025

9.4.1. Hospitals

9.4.2. Specialty Clinics

9.4.3. Ambulatory Surgical Centers

9.4.4. Diagnostic Imaging Centers

9.5. Market Value Forecast by Country, 2015–2025

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Product Type

9.6.2. By Applications

9.6.3. By End-user

9.6.4. By Country

10. Europe Ureteroscopes Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast by Product Type, 2015–2025

10.2.1. Flexible Ureteroscope

10.2.1.1. Fiberoptic Ureteroscope

10.2.1.2. Digital Ureteroscope

10.2.2. Semi-rigid Ureteroscope

10.2.3. Rigid Ureteroscope

10.3. Market Value Forecast by Applications, 2015–2025

10.3.1. Therapeutic Applications

10.3.1.1. Urolithiasis

10.3.1.2. Kidney Cancer

10.3.1.3. Ureteral Stinctures

10.3.1.4. Others

10.3.2. Diagnostic Applications

10.4. Market Value Forecast by End-user, 2015–2025

10.4.1. Hospitals

10.4.2. Specialty Clinics

10.4.3. Ambulatory Surgical Centers

10.4.4. Diagnostic Imaging Centers

10.5. Market Value Forecast by Country / Sub-region, 2015–2025

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Spain

10.5.5. Italy

10.5.6. Russia

10.5.7. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Applications

10.6.3. By End-user

10.6.4. By Country / Sub-region

11. Asia Pacific Ureteroscopes Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast by Product Type, 2015–2025

11.2.1. Flexible Ureteroscope

11.2.1.1. Fiberoptic Ureteroscope

11.2.1.2. Digital Ureteroscope

11.2.2. Semi-rigid Ureteroscope

11.2.3. Rigid Ureteroscope

11.3. Market Value Forecast by Applications, 2015–2025

11.3.1. Therapeutic Applications

11.3.1.1. Urolithiasis

11.3.1.2. Kidney Cancer

11.3.1.3. Ureteral Stinctures

11.3.1.4. Others

11.3.2. Diagnostic Applications

11.4. Market Value Forecast by End-user, 2015–2025

11.4.1. Hospitals

11.4.2. Specialty Clinics

11.4.3. Ambulatory Surgical Centers

11.4.4. Diagnostic Imaging Centers

11.5. Market Value Forecast by Country / Sub-region, 2015–2025

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. Australia & New Zealand

11.5.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Applications

11.6.3. By End-user

11.6.4. By Country / Sub-region

12. Latin America Ureteroscopes Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast by Product Type, 2015–2025

12.2.1. Flexible Ureteroscope

12.2.1.1. Fiberoptic Ureteroscope

12.2.1.2. Digital Ureteroscope

12.2.2. Semi-rigid Ureteroscope

12.2.3. Rigid Ureteroscope

12.3. Market Value Forecast by Applications, 2015–2025

12.3.1. Therapeutic Applications

12.3.1.1. Urolithiasis

12.3.1.2. Kidney Cancer

12.3.1.3. Ureteral Stinctures

12.3.1.4. Others

12.3.2. Diagnostic Applications

12.4. Market Value Forecast by End-user, 2015–2025

12.4.1. Hospitals

12.4.2. Specialty Clinics

12.4.3. Ambulatory Surgical Centers

12.4.4. Diagnostic Imaging Centers

12.5. Market Value Forecast by Country / Sub-region, 2015–2025

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Applications

12.6.3. By End-user

12.6.4. By Country / Sub-region

13. Middle East & Africa Ureteroscopes Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast by Product Type, 2015–2025

13.2.1. Flexible Ureteroscope

13.2.1.1. Fiberoptic Ureteroscope

13.2.1.2. Digital Ureteroscope

13.2.2. Semi-rigid Ureteroscope

13.2.3. Rigid Ureteroscope

13.3. Market Value Forecast by Applications, 2015–2025

13.3.1. Therapeutic Applications

13.3.1.1. Urolithiasis

13.3.1.2. Kidney Cancer

13.3.1.3. Ureteral Stinctures

13.3.1.4. Others

13.3.2. Diagnostic Applications

13.4. Market Value Forecast by End-user, 2015–2025

13.4.1. Hospitals

13.4.2. Specialty Clinics

13.4.3. Ambulatory Surgical Centers

13.4.4. Diagnostic Imaging Centers

13.5. Market Value Forecast by Country / Sub-region, 2015–2025

13.5.1. GCC Countries

13.5.2. Israel

13.5.3. South Africa

13.5.4. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Applications

13.6.3. By End-user

13.6.4. By Country / Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis by Company (2016)

14.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

14.3.1. Olympus Corporation

14.3.1.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.1.2 Financial Overview

14.3.1.3 Product Portfolio

14.3.1.4 SWOT Analysis

14.3.1.5 Strategic Overview

14.3.2. Boston Scientific Corporation

14.3.2.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.2.2 Financial Overview

14.3.2.3 Product Portfolio

14.3.2.4 SWOT Analysis

14.3.2.5 Strategic Overview

14.3.3. Stryker

14.3.3.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.3.2 Financial Overview

14.3.3.3 Product Portfolio

14.3.3.4 SWOT Analysis

14.3.3.5 Strategic Overview

14.3.4. Richard Wolf

14.3.4.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.4.2 Financial Overview

14.3.4.3 Product Portfolio

14.3.4.4 SWOT Analysis

14.3.4.5 Strategic Overview

14.3.5. KARL STORZ SE & Co. KG

14.3.5.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.5.2 Financial Overview

14.3.5.3 Product Portfolio

14.3.5.4 SWOT Analysis

14.3.5.5 Strategic Overview

14.3.6. PENTAX Medical

14.3.6.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.6.2 Financial Overview

14.3.6.3 Product Portfolio

14.3.6.4 SWOT Analysis

14.3.6.5 Strategic Overview

14.3.7. Elmed Electronics & Medical Industry & Trade Inc.

14.3.7.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.7.2 Financial Overview

14.3.7.3 Product Portfolio

14.3.7.4 SWOT Analysis

14.3.7.5 Strategic Overview

14.3.8. AED.MD

14.3.8.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.8.2 Financial Overview

14.3.8.3 Product Portfolio

14.3.8.4 SWOT Analysis

14.3.8.5 Strategic Overview

14.3.9. SCHOLLY FIBEROPTIC GMBH

14.3.9.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.9.2 Financial Overview

14.3.9.3 Product Portfolio

14.3.9.4 SWOT Analysis

14.3.9.5 Strategic Overview

14.3.10. OPCOM Inc.

14.3.10.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.10.2 Financial Overview

14.3.10.3 Product Portfolio

14.3.10.4 SWOT Analysis

14.3.10.5 Strategic Overview

14.3.11. SOPRO-COMEG GmbH

14.3.11.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.11.2 Financial Overview

14.3.11.3 Product Portfolio

14.3.11.4 SWOT Analysis

14.3.11.5 Strategic Overview

14.3.12. Prosurg, Inc. (NeoScope Inc.)

14.3.12.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.12.2 Financial Overview

14.3.12.3 Product Portfolio

14.3.12.4 SWOT Analysis

14.3.12.5 Strategic Overview

14.3.13. Maxerendoscopy

14.3.13.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.13.2 Financial Overview

14.3.13.3 Product Portfolio

14.3.13.4 SWOT Analysis

14.3.13.5 Strategic Overview

14.3.14. EMOS Technology GmbH

14.3.14.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.14.2 Financial Overview

14.3.14.3 Product Portfolio

14.3.14.4 SWOT Analysis

14.3.14.5 Strategic Overview

14.3.15. ROCAMED

14.3.15.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.15.2 Financial Overview

14.3.15.3 Product Portfolio

14.3.15.4 SWOT Analysis

14.3.15.5 Strategic Overview

15. Key Take Aways

List of Tables

Table 01: Global Ureteroscopes Market Size Value (US$ Mn) Forecast, by Product, 2015–2025

Table 02: Global Ureteroscopes Market Volume (Units) Forecast, by Product, 2015–2025

Table 03: Global Ureteroscopes Market Size Value (US$ Mn) Forecast, by Flexible Ureteroscopes, 2015–2025

Table 04: Global Ureteroscopes Market Size Volume (Units) Forecast, by Flexible Ureteroscopes, 2015–2025

Table 05: Global Ureteroscopes Market Size Value (US$ Mn) Forecast, by Applications, 2015–2025

Table 06: Global Ureteroscopes Market Size Value (US$ Mn) Forecast, by End-user, 2015–2025

Table 07: Global Ureteroscopes Market Size Value (US$ Mn) Forecast, by Region, 2015–2025

Table 08: North America Ureteroscopes Market Size Value (US$ Mn) Forecast, by Country, 2015–2025

Table 09: North America Ureteroscopes Market Value (US$ Mn) Forecast, by Product, 2015–2025

Table 10: North America Ureteroscopes Market Value (US$ Mn) Forecast, by Flexible Ureteroscopes, 2015–2025

Table 11: North America Ureteroscopes Market Value (US$ Mn) Forecast, by Applications, 2015–2025

Table 12: North America Ureteroscopes Market Value (US$ Mn) Forecast, by Therapeutic Applications, 2015–2025

Table 13: North America Ureteroscopes Market Value (US$ Mn) Forecast, by End-user, 2015–2025

Table 14: Europe Ureteroscopes Market Value (US$ Mn) Forecast, by Country, 2015–2025

Table 15: Europe Ureteroscopes Market Value (US$ Mn) Forecast, by Product, 2015–2025

Table 16: Europe Ureteroscopes Market Value (US$ Mn) Forecast, by Flexible Ureteroscopes, 2015–2025

Table 17: Europe Ureteroscopes Market Value (US$ Mn) Forecast, by Applications, 2015–2025

Table 18: Europe Ureteroscopes Market Value (US$ Mn) Forecast, by Therapeutic Applications, 2015–2025

Table 19: Europe Ureteroscopes Market Value (US$ Mn) Forecast, by End-user, 2015–2025

Table 20: Asia Pacific Ureteroscopes Market Value (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 21: Asia Pacific Ureteroscopes Market Value (US$ Mn) Forecast, by Product Type, 2015–2025

Table 22: Asia Pacific Ureteroscopes Market Value (US$ Mn) Forecast, by Flexible Ureteroscopes, 2015–2025

Table 23: Asia Pacific Ureteroscopes Market Value (US$ Mn) Forecast, by Applications, 2015–2025

Table 25: Asia Pacific Ureteroscopes Market Value (US$ Mn) Forecast, by Therapeutic Applications, 2015–2025

Table 26: Asia Pacific Ureteroscopes Market Value (US$ Mn) Forecast, by End-user, 2015–2025

Table 27: Latin America Ureteroscopes Market Value (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 28: Latin America Ureteroscopes Market Value (US$ Mn) Forecast, by Product, 2015–2025

Table 29: Latin America Ureteroscopes Market Value (US$ Mn) Forecast, by Flexible Ureteroscopes, 2015–2025

Table 30 : Latin America Ureteroscopes Market Value (US$ Mn) Forecast, by Applications, 2015–2025

Table 31: Latin America Ureteroscopes Market Value (US$ Mn) Forecast, by Therapeutic Applications, 2015–2025

Table 32: Latin America Ureteroscopes Market Value (US$ Mn) Forecast, by End-user, 2015–2025

Table 33: Middle East & Africa Ureteroscopes Market Value (US$ Mn) Forecast, by Country/Sub-region, 2015–2025

Table 34: Middle East & Africa Ureteroscopes Market Value (US$ Mn) Forecast, by Product, 2015–2025

Table 35: Middle East & Africa Ureteroscopes Market Value (US$ Mn) Forecast, by Flexible Ureteroscopes, 2015–2025

Table 36: Middle East & Africa Ureteroscopes Market Value (US$ Mn) Forecast, by Applications, 2015–2025

Table 37: Middle East & Africa Ureteroscopes Market Value (US$ Mn) Forecast, by Therapeutic Applications, 2015–2025

Table 38: Middle East & Africa Ureteroscopes Market Value (US$ Mn) Forecast, by End-user, 2015–2025

List of Figures

Figure 01: Global Ureteroscopes Market Snapshot

Figure 02: Global Breast Pump Market Size (US$ Mn) and Distribution by Geography, 2017 and 2025

Figure 03: Global Ureteroscopes Market Size Value (US$ Mn) Volume (Units) Forecast, 2015–2025

Figure 04: Market Value Share (%), by Product (2016)

Figure 05: Market Value Share (%), by Application (2016)

Figure 06: Market Value Share (%), by Region (2016)

Figure 07: Market Value Share (%), by End-user (2016)

Figure 08: Global Ureteroscopes Market Value Share (%), by Product, 2017 and 2025

Figure 09: Global Ureteroscopes Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Flexible Ureteroscopes, 2015–2025

Figure 10: Global Ureteroscopes Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Semi-Rigid Ureteroscopes, 2015–2025

Figure 11: Global Ureteroscopes Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Rigid Ureteroscopes, 2015–2025

Figure 12: Global Ureteroscopes Market Attractiveness, by Product, 2017–2025

Figure 13: Global Ureteroscopes Market Value Share (%), by Applications, 2017 and 2025

Figure 14: Global Ureteroscopes Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Therapeutic Applications, 2015–2025

Figure 15: Global Ureteroscopes Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Diagnostic Applications, 2015–2025

Figure 16: Global Ureteroscopes Market Attractiveness, by Applications, 2017–2025

Figure 17: Global Ureteroscopes Market Value Share (%), by End-user, 2017 and 2025

Figure 18: Global Ureteroscopes Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Hospitals, 2017–2025

Figure 19: Global Ureteroscopes Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Specialty Clinics, 2017–2025

Figure 20: Global Ureteroscopes Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, by Ambulatory Surgical Centers, 2017–2025

Figure 21: Global Ureteroscopes Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, Diagnostic Imaging Centers, 2017–2025

Figure 22: Global Ureteroscopes Market Attractiveness, by End-user, 2017–2025

Figure 23: Global Ureteroscopes Market Value Share (%), by Region, 2017 and 2025

Figure 24: Global Ureteroscopes Market Attractiveness, by Region, 2017–2025

Figure 25: North America Ureteroscopes Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2025

Figure 26: North America Market Attractiveness, by Country, 2017–2025

Figure 27: North America Ureteroscopes Market Value Share (%), by Country, 2017 and 2025

Figure 28: North America Ureteroscopes Market Value (%) Share, by Product, 2017 and 2025

Figure 29: North America Market Attractiveness, by Product, 2017–2025

Figure 30: North America Ureteroscopes Market Value Share (%), by Applications, 2017 and 2025

Figure 31: North America Ureteroscopes Market Value Share (%), by End-user, 2017 and 2025

Figure 32: North America Market Attractiveness, by Applications 2017–2025

Figure 33: North America Market Attractiveness, By End-user, 2017–2025

Figure 34: Europe Ureteroscopes Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2025

Figure 35: Europe Market Attractiveness, by Country, 2017–2025

Figure 36: Europe Ureteroscopes Market Value Share (%), by Country, 2017 and 2025

Figure 37: Europe Ureteroscopes Market Value Share (%), by Product, 2017 and 2025

Figure 38: Europe Market Attractiveness, by Product, 2017–2025

Figure 39: Europe Ureteroscopes Market Value (%) Share, by Applications, 2017 and 2025

Figure 40: Europe Ureteroscopes Market Value Share (%), by End-user, 2017 and 2025

Figure 41: Europe Market Attractiveness, by Applications,

Figure 42: Europe Market Attractiveness, by End-user, 2017–2025

Figure 43: Asia Pacific Ureteroscopes Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 44: Asia Pacific Ureteroscopes Market Attractiveness, by Country/Sub-region, 2017–2025

Figure 45: Asia Pacific Ureteroscopes Market Value Share (%), by Country/Sub-region, 2017 and 2025

Figure 46: Asia Pacific Ureteroscopes Market Value Share (%), by Product, 2017 and 2025

Figure 47: Asia Pacific Ureteroscopes Market Attractiveness, by Product, 2017 and 2025

Figure 48: Asia Pacific Ureteroscopes Market Value (%) Share, by Applications, 2017 and 2025

Figure 49: Asia Pacific Ureteroscopes Market Value Share (%), by End-user, 2017 and 2025

Figure 50: Asia Pacific Ureteroscopes Market Attractiveness, by Applications, 2017–2025

Figure 51: Asia Pacific Ureteroscopes Market Attractiveness, by End-user, 2017–2025

Figure 52: Latin America Ureteroscopes Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 53: Latin America Ureteroscopes Market Attractiveness, by Country/Sub-region, 2017–2025

Figure 54: Latin America Ureteroscopes Market Value Share (%), by Country/Sub-region, 2017 and 2025

Figure 55: Latin America Ureteroscopes Market Value Share, by Product, 2017 and 2025

Figure 56: Latin America Ureteroscopes Market Attractiveness, by Product, 2017 and 2025

Figure 57: Latin America Ureteroscopes Market Value Share (%), by Applications, 2017 and 2025

Figure 58: Latin America Ureteroscopes Market Value Share (%), by End-user, 2017 and 2025

Figure 59: Latin America Ureteroscopes Market Attractiveness, by Applications, 2017–2025

Figure 60: Latin America Ureteroscopes Market Attractiveness, by End-user, 2017–2025

Figure 61: Middle East & Africa Ureteroscopes Market Size (US$ Mn) Forecast, 2015–2025

Figure 62: Middle East & Africa Ureteroscopes Market Attractiveness, by Country/Sub-region, 2017–2025

Figure 63: Middle East & Africa Ureteroscopes Market Value Share (%), by Country/Sub-region, 2017 and 2025

Figure 64: Middle East & Africa Ureteroscopes Market Value Share (%), by Product, 2017 and 2025

Figure 65: Middle East & Africa Ureteroscopes Market Attractiveness (%), by Product, 2017 and 2025

Figure 66: Europe Ureteroscopes Market Value Share (%), by Applications, 2017 and 2025

Figure 67: Middle East & Africa Ureteroscopes Market Value Share (%), by End-user, 2017 and 2025

Figure 68: Middle East & Africa Ureteroscopes Market Attractiveness, by Applications, 2017–2025

Figure 69: Middle East & Africa Ureteroscopes Market Attractiveness, by End-user, 2017–2025

Figure 70: Global Ureteroscopes Market Share, by Company, 2016