Reports

Reports

Analysts’ Viewpoint

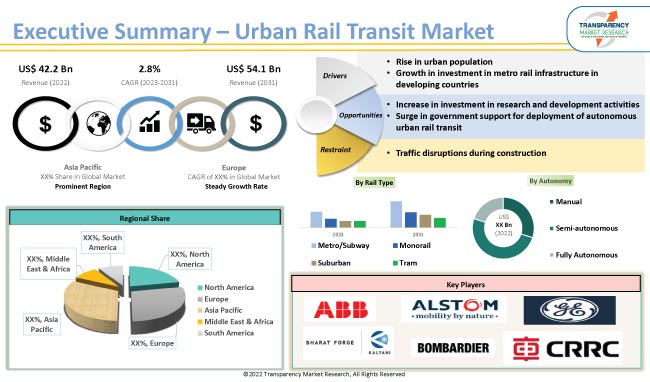

Rise in government investment toward decongesting urban traffic is projected to drive the global urban rail transit market size in the near future. Major cities around the globe are deploying urban rail transit systems for hassle-free movement of commuters, thereby avoiding traffic jams and making city life easier and more comfortable.

Introduction of autonomous rail technology is projected to offer lucrative opportunities for vendors in the urban rail transit industry. Better accessibility, more mobility, and improved land utilization are some of the few advantages of autonomous urban rail technology. Electric trains and AV technology are gaining traction to help reduce pollution and safeguard the environment.

Urban rail transit is a public transportation system that utilizes trains and tracks to move passengers within a city or metropolitan area. It is often used to relieve traffic congestion and provide a more efficient and environment-friendly means of getting around.

Urban rail transit systems have a considerable impact on the reduction of traffic congestion and sustainable development of urban traffic systems, as they are effective in terms of speed, land occupation, and low emissions.

Growth in urban population and expansion of metropolitan areas have led to increase in investment in transportation infrastructure. Traffic congestion is a major issue in cities worldwide due to rise in the number of private vehicles. It often causes accidents, thereby endangering lives. Thus, policymakers across the globe are implementing alternative strategies to achieve sustainable mobility. This, in turn, is projected to spur the urban rail transit market growth in the near future.

Increase in need for affordable, green, and quick modes of transportation is boosting investment in metro rail infrastructure, especially in developing countries. Moreover, governments across the globe are supporting the development of smart cities. These factors are propelling the urban rail transit market progress.

Driverless train operations with Grade of Automation (GoA) Level 4 are gaining traction in developed and developing economies such as China, Japan, Brazil, and India. Mainline, regional, and tram operators are increasing the capacity, flexibility, and energy efficiency of their train operations. These advancements are likely to augment the market trajectory in the next few years. However, significant capital outlay, rigid routes, and traffic disruptions during construction are expected to lead to market limitations in the near future.

According to the latest urban rail transit market trends, the metro/subway rail type segment is projected to hold largest share from 2023 to 2031. Governments across the globe are heavily investing in metro infrastructure to tackle traffic congestion. In Australia, Sydney Metro offers driverless trains and a digital signaling system. In India, Delhi Metro started driverless train operations on its 59 km Pink line in November 2021.

According to the latest urban rail transit market analysis, the semi-autonomous autonomy level segment is expected to dominate the industry in the near future. Rise in adoption of driverless or autonomous technology in urban transit rails, such as metro rails, monorails, and trams, is boosting the segment.

According to the latest urban rail transit market forecast, Asia Pacific is anticipated to hold largest share from 2023 to 2031. Rapid industrialization and rise in urban population in developing countries, such as China, India, and South Korea, are driving market development in the region. By 2050, more than 50% of the population in India is estimated to reside in cities. Emerging economies in Asia Pacific are investing significantly in urban rail transit infrastructure projects to enhance public transportation.

ABB, Alstom S.A., Beijing Traffic Control Technology Co., Ltd., Bharat Forge Limited, Bombardier, BYD Auto Co., Ltd., Construcciones y Auxiliar de Ferrocarriles, S.A., CRRC Corporation Limited, FTD Fahrzeugtechnik Bahnen Dessau GmbH, General Electric, GHH-BONATRANS, Hitachi Ltd., Kawasaki Heavy Industries, Ltd., Kinki Sharyo Co., Ltd., Knorr-Bremse AG, Larsen & Toubro Limited, Mitsubishi Electric, Samvardhana Motherson, Niigata Transys Co., Ltd., Robert Bosch GmbH, Siemens, Skoda Transportation AS, Thales Group, The Greenbrier Companies Inc., and Wabtec Corporation are major players operating in this industry.

Key players have been profiled in the urban rail transit market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Vendors are using advanced software and data analytics to optimize their routes and schedules. They are also creating more sustainable, reliable, and customer-focused systems that help cater to the needs of their communities and increase their urban rail transit market share.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 42.2 Bn |

|

Market Forecast Value in 2031 |

US$ 54.1 Bn |

|

Growth Rate (CAGR) |

2.8% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Kms for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 42.2 Bn in 2022

It is projected to grow at a CAGR of 2.8% from 2023 to 2031

It is estimated to reach US$ 54.1 Bn by the end of 2031

Rise in urban population and growth in investment in metro rail infrastructure in developing countries

The metro/subway rail type segment is likely to hold largest share in 2031

Asia Pacific is likely to be the most lucrative region from 2023 to 2031

ABB, Alstom S.A., Beijing Traffic Control Technology Co., Ltd., Bharat Forge Limited, Bombardier, BYD Auto Co., Ltd., Construcciones y Auxiliar de Ferrocarriles, S.A., CRRC Corporation Limited, FTD Fahrzeugtechnik Bahnen Dessau GmbH, General Electric, GHH-BONATRANS, Hitachi Ltd., Kawasaki Heavy Industries, Ltd., Kinki Sharyo Co., Ltd., Knorr-Bremse AG, Larsen & Toubro Limited, Mitsubishi Electric, Samvardhana Motherson, Niigata Transys Co., Ltd., Robert Bosch GmbH, Siemens

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, value in US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Go to Market Strategy

2.1. Demand & Supply Side Trends

2.1.1. GAP Analysis

2.2. Identification of Potential Market Spaces

2.3. Understanding Buying Process of Customers

2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Market Coverage / Taxonomy

3.2. Market Definition / Scope / Limitations

3.3. Macro-economic Factors

3.3.1. Disposable Income

3.3.2. Gross Domestic Product (GDP)

3.3.3. Increased Suburban Areas

3.4. Market Indicators

3.4.1. Government Policies on Climate Change

3.4.2. Growth in Government Expenditure Towards Infrastructure Development

3.4.3. Hub Spoke Architecture

3.4.4. Increase in Daily Commutation

3.4.5. Paradigm Shift Toward Commutation

3.4.6. Rise in Urban Population

3.5. Market Dynamics

3.5.1. Drivers

3.5.2. Restraints

3.5.3. Opportunity

3.6. Market Factor Analysis

3.6.1. Porter’s Five Force Analysis

3.6.2. PESTEL Analysis

3.6.3. Value Chain Analysis

3.6.3.1. List of Key Manufacturers

3.6.3.2. List of Customers

3.6.3.3. Level of Integration

3.6.4. SWOT Analysis

3.7. Impact Factors

3.7.1. Energy & Resources

3.7.2. Environmental Factors

3.7.3. Government Support

3.7.4. Inflation

3.7.5. Infrastructure

3.7.6. Shared Mobility

3.7.7. Smart Communication in Mobility

3.7.8. Rail Technology

3.8. Urban Rail Transit Project Details

3.8.1. Upcoming /Ongoing Projects

3.9. Urban Rail Transit Market: Automation Impact Analysis

3.10. Technology/ Product Trend

3.10.1. Technology Roadmap

3.10.2. Futuristic Trends

4. Global Urban Rail Transit Market, by Rail Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Urban Rail Transit Market Size & Forecast, 2017-2031, by Rail Type

4.2.1. Metro/Subway

4.2.2. Monorail

4.2.3. Suburban

4.2.4. Tram

5. Global Urban Rail Transit Market, by Autonomy

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Urban Rail Transit Market Size & Forecast, 2017-2031, by Autonomy

5.2.1. Manual

5.2.2. Semi-autonomous

5.2.3. Fully Autonomous

6. Global Urban Rail Transit Market, by Autonomy Level

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Urban Rail Transit Market Size & Forecast, 2017-2031, by Autonomy Level

6.2.1. GoA-0 (On-sight)

6.2.2. GoA-1 (Manual)

6.2.3. GoA-2 (Semi-automatic Train Operation [STO])

6.2.4. GoA-3 (Driverless Train Operation [DTO])

6.2.5. GoA-4 (Unattended Train Operation [UTO])

7. Global Urban Rail Transit Market, by Region

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Urban Rail Transit Market Size & Forecast, 2017-2031, by Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Urban Rail Transit Market

8.1. Market Snapshot

8.2. Urban Rail Transit Market Size & Forecast, 2017-2031, by Rail Type

8.2.1. Metro/Subway

8.2.2. Monorail

8.2.3. Suburban

8.2.4. Tram

8.3. Urban Rail Transit Market Size & Forecast, 2017-2031, by Autonomy

8.3.1. Manual

8.3.2. Semi-autonomous

8.3.3. Fully Autonomous

8.4. Urban Rail Transit Market Size & Forecast, 2017-2031, by Autonomy Level

8.4.1. GoA-0 (On-sight)

8.4.2. GoA-1 (Manual)

8.4.3. GoA-2 (Semi-automatic Train Operation [STO])

8.4.4. GoA-3 (Driverless Train Operation [DTO])

8.4.5. GoA-4 (Unattended Train Operation [UTO])

8.5. Key Country Analysis – North America Urban Rail Transit Market Size & Forecast, 2017-2031

8.5.1. U. S.

8.5.2. Canada

8.5.3. Mexico

9. Europe Urban Rail Transit Market

9.1. Market Snapshot

9.2. Urban Rail Transit Market Size & Forecast, 2017-2031, by Rail Type

9.2.1. Metro/Subway

9.2.2. Monorail

9.2.3. Suburban

9.2.4. Tram

9.3. Urban Rail Transit Market Size & Forecast, 2017-2031, by Autonomy

9.3.1. Manual

9.3.2. Semi-autonomous

9.3.3. Fully Autonomous

9.4. Urban Rail Transit Market Size & Forecast, 2017-2031, by Autonomy Level

9.4.1. GoA-0 (On-sight)

9.4.2. GoA-1 (Manual)

9.4.3. GoA-2 (Semi-automatic Train Operation [STO])

9.4.4. GoA-3 (Driverless Train Operation [DTO])

9.4.5. GoA-4 (Unattended Train Operation [UTO])

9.5. Key Country Analysis - Europe Urban Rail Transit Market Size & Forecast, 2017-2031

9.5.1. Germany

9.5.2. U.K.

9.5.3. France

9.5.4. Italy

9.5.5. Spain

9.5.6. Nordic Countries

9.5.7. Russia & CIS

9.5.8. Rest of Europe

10. Asia Pacific Urban Rail Transit Market

10.1. Market Snapshot

10.2. Urban Rail Transit Market Size & Forecast, 2017-2031, by Rail Type

10.2.1. Metro/Subway

10.2.2. Monorail

10.2.3. Suburban

10.2.4. Tram

10.3. Urban Rail Transit Market Size & Forecast, 2017-2031, by Autonomy

10.3.1. Manual

10.3.2. Semi-autonomous

10.3.3. Fully Autonomous

10.4. Urban Rail Transit Market Size & Forecast, 2017-2031, by Autonomy Level

10.4.1. GoA-0 (On-sight)

10.4.2. GoA-1 (Manual)

10.4.3. GoA-2 (Semi-automatic Train Operation [STO])

10.4.4. GoA-3 (Driverless Train Operation [DTO])

10.4.5. GoA-4 (Unattended Train Operation [UTO])

10.5. Key Country Analysis - Asia Pacific Urban Rail Transit Market Size & Forecast, 2017-2031, by Country

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. ASEAN Countries

10.5.5. South Korea

10.5.6. ANZ

10.5.7. Rest of Asia Pacific

11. Middle East & Africa Urban Rail Transit Market

11.1. Market Snapshot

11.2. Urban Rail Transit Market Size & Forecast, 2017-2031, by Rail Type

11.2.1. Metro/Subway

11.2.2. Monorail

11.2.3. Suburban

11.2.4. Tram

11.3. Urban Rail Transit Market Size & Forecast, 2017-2031, by Autonomy

11.3.1. Manual

11.3.2. Semi-autonomous

11.3.3. Fully Autonomous

11.4. Urban Rail Transit Market Size & Forecast, 2017-2031, by Autonomy Level

11.4.1. GoA-0 (On-sight)

11.4.2. GoA-1 (Manual)

11.4.3. GoA-2 (Semi-automatic Train Operation [STO])

11.4.4. GoA-3 (Driverless Train Operation [DTO])

11.4.5. GoA-4 (Unattended Train Operation [UTO])

11.5. Key Country Analysis - Middle East & Africa Urban Rail Transit Market Size & Forecast, 2017-2031, by Country

11.5.1. GCC

11.5.2. South Africa

11.5.3. Turkey

11.5.4. Rest of Middle East & Africa

12. South America Urban Rail Transit Market

12.1. Market Snapshot

12.2. Urban Rail Transit Market Size & Forecast, 2017-2031, by Rail Type

12.2.1. Metro/Subway

12.2.2. Monorail

12.2.3. Suburban

12.2.4. Tram

12.3. Urban Rail Transit Market Size & Forecast, 2017-2031, by Autonomy

12.3.1. Manual

12.3.2. Semi-autonomous

12.3.3. Fully Autonomous

12.4. Urban Rail Transit Market Size & Forecast, 2017-2031, by Autonomy Level

12.4.1. GoA-0 (On-sight)

12.4.2. GoA-1 (Manual)

12.4.3. GoA-2 (Semi-automatic Train Operation [STO])

12.4.4. GoA-3 (Driverless Train Operation [DTO])

12.4.5. GoA-4 (Unattended Train Operation [UTO])

12.5. Key Country Analysis - South America Urban Rail Transit Market Size & Forecast, 2017-2031

12.5.1. Brazil

12.5.2. Argentina

12.5.3. Rest of South America

13. Competitive Landscape

13.1. Company Share Analysis/ Brand Share Analysis, 2022

13.2. Key Strategy Analysis

13.2.1. Strategic Overview - Expansion, M&A, Partnership

13.2.2. Product & Marketing Strategy

13.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

14. Company Profile/ Key Players

14.1. ABB

14.1.1. Company Overview

14.1.2. Company Footprints

14.1.3. Production Locations

14.1.4. Product Portfolio

14.1.5. Competitors & Customers

14.1.6. Subsidiaries & Parent Organization

14.1.7. Recent Developments

14.1.8. Financial Analysis

14.1.9. Profitability

14.1.10. Revenue Share

14.2. Alstom S.A.

14.2.1. Company Overview

14.2.2. Company Footprints

14.2.3. Production Locations

14.2.4. Product Portfolio

14.2.5. Competitors & Customers

14.2.6. Subsidiaries & Parent Organization

14.2.7. Recent Developments

14.2.8. Financial Analysis

14.2.9. Profitability

14.2.10. Revenue Share

14.3. Beijing Traffic Control Technology Co., Ltd.

14.3.1. Company Overview

14.3.2. Company Footprints

14.3.3. Production Locations

14.3.4. Product Portfolio

14.3.5. Competitors & Customers

14.3.6. Subsidiaries & Parent Organization

14.3.7. Recent Developments

14.3.8. Financial Analysis

14.3.9. Profitability

14.3.10. Revenue Share

14.4. Bharat Forge Limited

14.4.1. Company Overview

14.4.2. Company Footprints

14.4.3. Production Locations

14.4.4. Product Portfolio

14.4.5. Competitors & Customers

14.4.6. Subsidiaries & Parent Organization

14.4.7. Recent Developments

14.4.8. Financial Analysis

14.4.9. Profitability

14.4.10. Revenue Share

14.5. Bombardier

14.5.1. Company Overview

14.5.2. Company Footprints

14.5.3. Production Locations

14.5.4. Product Portfolio

14.5.5. Competitors & Customers

14.5.6. Subsidiaries & Parent Organization

14.5.7. Recent Developments

14.5.8. Financial Analysis

14.5.9. Profitability

14.5.10. Revenue Share

14.6. BYD Auto Co., Ltd.

14.6.1. Company Overview

14.6.2. Company Footprints

14.6.3. Production Locations

14.6.4. Product Portfolio

14.6.5. Competitors & Customers

14.6.6. Subsidiaries & Parent Organization

14.6.7. Recent Developments

14.6.8. Financial Analysis

14.6.9. Profitability

14.6.10. Revenue Share

14.7. Construcciones y Auxiliar de Ferrocarriles, S.A.

14.7.1. Company Overview

14.7.2. Company Footprints

14.7.3. Production Locations

14.7.4. Product Portfolio

14.7.5. Competitors & Customers

14.7.6. Subsidiaries & Parent Organization

14.7.7. Recent Developments

14.7.8. Financial Analysis

14.7.9. Profitability

14.7.10. Revenue Share

14.8. CRRC Corporation Limited

14.8.1. Company Overview

14.8.2. Company Footprints

14.8.3. Production Locations

14.8.4. Product Portfolio

14.8.5. Competitors & Customers

14.8.6. Subsidiaries & Parent Organization

14.8.7. Recent Developments

14.8.8. Financial Analysis

14.8.9. Profitability

14.8.10. Revenue Share

14.9. FTD Fahrzeugtechnik Bahnen Dessau GmbH

14.9.1. Company Overview

14.9.2. Company Footprints

14.9.3. Production Locations

14.9.4. Product Portfolio

14.9.5. Competitors & Customers

14.9.6. Subsidiaries & Parent Organization

14.9.7. Recent Developments

14.9.8. Financial Analysis

14.9.9. Profitability

14.9.10. Revenue Share

14.10. General Electric

14.10.1. Company Overview

14.10.2. Company Footprints

14.10.3. Production Locations

14.10.4. Product Portfolio

14.10.5. Competitors & Customers

14.10.6. Subsidiaries & Parent Organization

14.10.7. Recent Developments

14.10.8. Financial Analysis

14.10.9. Profitability

14.10.10. Revenue Share

14.11. GHH-BONATRANS

14.11.1. Company Overview

14.11.2. Company Footprints

14.11.3. Production Locations

14.11.4. Product Portfolio

14.11.5. Competitors & Customers

14.11.6. Subsidiaries & Parent Organization

14.11.7. Recent Developments

14.11.8. Financial Analysis

14.11.9. Profitability

14.11.10. Revenue Share

14.12. Hitachi Ltd.

14.12.1. Company Overview

14.12.2. Company Footprints

14.12.3. Production Locations

14.12.4. Product Portfolio

14.12.5. Competitors & Customers

14.12.6. Subsidiaries & Parent Organization

14.12.7. Recent Developments

14.12.8. Financial Analysis

14.12.9. Profitability

14.12.10. Revenue Share

14.13. Kawasaki Heavy Industries, Ltd.

14.13.1. Company Overview

14.13.2. Company Footprints

14.13.3. Production Locations

14.13.4. Product Portfolio

14.13.5. Competitors & Customers

14.13.6. Subsidiaries & Parent Organization

14.13.7. Recent Developments

14.13.8. Financial Analysis

14.13.9. Profitability

14.13.10. Revenue Share

14.14. Kinki Sharyo Co., Ltd.

14.14.1. Company Overview

14.14.2. Company Footprints

14.14.3. Production Locations

14.14.4. Product Portfolio

14.14.5. Competitors & Customers

14.14.6. Subsidiaries & Parent Organization

14.14.7. Recent Developments

14.14.8. Financial Analysis

14.14.9. Profitability

14.14.10. Revenue Share

14.15. Knorr-Bremse AG

14.15.1. Company Overview

14.15.2. Company Footprints

14.15.3. Production Locations

14.15.4. Product Portfolio

14.15.5. Competitors & Customers

14.15.6. Subsidiaries & Parent Organization

14.15.7. Recent Developments

14.15.8. Financial Analysis

14.15.9. Profitability

14.15.10. Revenue Share

14.16. Larsen & Toubro Limited

14.16.1. Company Overview

14.16.2. Company Footprints

14.16.3. Production Locations

14.16.4. Product Portfolio

14.16.5. Competitors & Customers

14.16.6. Subsidiaries & Parent Organization

14.16.7. Recent Developments

14.16.8. Financial Analysis

14.16.9. Profitability

14.16.10. Revenue Share

14.17. Mitsubishi Electric

14.17.1. Company Overview

14.17.2. Company Footprints

14.17.3. Production Locations

14.17.4. Product Portfolio

14.17.5. Competitors & Customers

14.17.6. Subsidiaries & Parent Organization

14.17.7. Recent Developments

14.17.8. Financial Analysis

14.17.9. Profitability

14.17.10. Revenue Share

14.18. Samvardhana Motherson

14.18.1. Company Overview

14.18.2. Company Footprints

14.18.3. Production Locations

14.18.4. Product Portfolio

14.18.5. Competitors & Customers

14.18.6. Subsidiaries & Parent Organization

14.18.7. Recent Developments

14.18.8. Financial Analysis

14.18.9. Profitability

14.18.10. Revenue Share

14.19. Niigata Transys Co., Ltd.

14.19.1. Company Overview

14.19.2. Company Footprints

14.19.3. Production Locations

14.19.4. Product Portfolio

14.19.5. Competitors & Customers

14.19.6. Subsidiaries & Parent Organization

14.19.7. Recent Developments

14.19.8. Financial Analysis

14.19.9. Profitability

14.19.10. Revenue Share

14.20. Robert Bosch GmbH

14.20.1. Company Overview

14.20.2. Company Footprints

14.20.3. Production Locations

14.20.4. Product Portfolio

14.20.5. Competitors & Customers

14.20.6. Subsidiaries & Parent Organization

14.20.7. Recent Developments

14.20.8. Financial Analysis

14.20.9. Profitability

14.20.10. Revenue Share

14.21. Siemens

14.21.1. Company Overview

14.21.2. Company Footprints

14.21.3. Production Locations

14.21.4. Product Portfolio

14.21.5. Competitors & Customers

14.21.6. Subsidiaries & Parent Organization

14.21.7. Recent Developments

14.21.8. Financial Analysis

14.21.9. Profitability

14.21.10. Revenue Share

14.22. Skoda Transportation AS

14.22.1. Company Overview

14.22.2. Company Footprints

14.22.3. Production Locations

14.22.4. Product Portfolio

14.22.5. Competitors & Customers

14.22.6. Subsidiaries & Parent Organization

14.22.7. Recent Developments

14.22.8. Financial Analysis

14.22.9. Profitability

14.22.10. Revenue Share

14.23. Thales Group

14.23.1. Company Overview

14.23.2. Company Footprints

14.23.3. Production Locations

14.23.4. Product Portfolio

14.23.5. Competitors & Customers

14.23.6. Subsidiaries & Parent Organization

14.23.7. Recent Developments

14.23.8. Financial Analysis

14.23.9. Profitability

14.23.10. Revenue Share

14.24. The Greenbrier Companies Inc.

14.24.1. Company Overview

14.24.2. Company Footprints

14.24.3. Production Locations

14.24.4. Product Portfolio

14.24.5. Competitors & Customers

14.24.6. Subsidiaries & Parent Organization

14.24.7. Recent Developments

14.24.8. Financial Analysis

14.24.9. Profitability

14.24.10. Revenue Share

14.25. Wabtec Corporation

14.25.1. Company Overview

14.25.2. Company Footprints

14.25.3. Production Locations

14.25.4. Product Portfolio

14.25.5. Competitors & Customers

14.25.6. Subsidiaries & Parent Organization

14.25.7. Recent Developments

14.25.8. Financial Analysis

14.25.9. Profitability

14.25.10. Revenue Share

14.26. Others

14.26.1. Company Overview

14.26.2. Company Footprints

14.26.3. Production Locations

14.26.4. Product Portfolio

14.26.5. Competitors & Customers

14.26.6. Subsidiaries & Parent Organization

14.26.7. Recent Developments

14.26.8. Financial Analysis

14.26.9. Profitability

14.26.10. Revenue Share

List of Tables

Table 1: Global Urban Rail Transit Market Volume (Kms) Forecast, by Rail Type, 2017-2031

Table 2: Global Urban Rail Transit Market Value (US$ Bn) Forecast, by Rail Type, 2017-2031

Table 3: Global Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy, 2017-2031

Table 4: Global Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy, 2017-2031

Table 5: Global Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy Level, 2017-2031

Table 6: Global Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy Level, 2017-2031

Table 7: Global Urban Rail Transit Market Volume (Kms) Forecast, by Region, 2017-2031

Table 8: Global Urban Rail Transit Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 9: North America Urban Rail Transit Market Volume (Kms) Forecast, by Rail Type, 2017-2031

Table 10: North America Urban Rail Transit Market Value (US$ Bn) Forecast, by Rail Type, 2017-2031

Table 11: North America Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy, 2017-2031

Table 12: North America Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy, 2017-2031

Table 13: North America Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy Level, 2017-2031

Table 14: North America Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy Level, 2017-2031

Table 15: North America Urban Rail Transit Market Volume (Kms) Forecast, by Country, 2017-2031

Table 16: North America Urban Rail Transit Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 17: Europe Urban Rail Transit Market Volume (Kms) Forecast, by Rail Type, 2017-2031

Table 18: Europe Urban Rail Transit Market Value (US$ Bn) Forecast, by Rail Type, 2017-2031

Table 19: Europe Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy, 2017-2031

Table 20: Europe Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy, 2017-2031

Table 21: Europe Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy Level, 2017-2031

Table 22: Europe Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy Level, 2017-2031

Table 23: Europe Urban Rail Transit Market Volume (Kms) Forecast, by Country, 2017-2031

Table 24: Europe Urban Rail Transit Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Asia Pacific Urban Rail Transit Market Volume (Kms) Forecast, by Rail Type, 2017-2031

Table 26: Asia Pacific Urban Rail Transit Market Value (US$ Bn) Forecast, by Rail Type, 2017-2031

Table 27: Asia Pacific Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy, 2017-2031

Table 28: Asia Pacific Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy, 2017-2031

Table 29: Asia Pacific Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy Level, 2017-2031

Table 30: Asia Pacific Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy Level, 2017-2031

Table 31: Asia Pacific Urban Rail Transit Market Volume (Kms) Forecast, by Country, 2017-2031

Table 32: Asia Pacific Urban Rail Transit Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 33: Middle East & Africa Urban Rail Transit Market Volume (Kms) Forecast, by Rail Type, 2017-2031

Table 34: Middle East & Africa Urban Rail Transit Market Value (US$ Bn) Forecast, by Rail Type, 2017-2031

Table 35: Middle East & Africa Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy, 2017-2031

Table 36: Middle East & Africa Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy, 2017-2031

Table 37: Middle East & Africa Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy Level, 2017-2031

Table 38: Middle East & Africa Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy Level, 2017-2031

Table 39: Middle East & Africa Urban Rail Transit Market Volume (Kms) Forecast, by Country, 2017-2031

Table 40: Middle East & Africa Urban Rail Transit Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 41: South America Urban Rail Transit Market Volume (Kms) Forecast, by Rail Type, 2017-2031

Table 42: South America Urban Rail Transit Market Value (US$ Bn) Forecast, by Rail Type, 2017-2031

Table 43: South America Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy, 2017-2031

Table 44: South America Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy, 2017-2031

Table 45: South America Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy Level, 2017-2031

Table 46: South America Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy Level, 2017-2031

Table 47: South America Urban Rail Transit Market Volume (Kms) Forecast, by Country, 2017-2031

Table 48: South America Urban Rail Transit Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Urban Rail Transit Market Volume (Kms) Forecast, by Rail Type, 2017-2031

Figure 2: Global Urban Rail Transit Market Value (US$ Bn) Forecast, by Rail Type, 2017-2031

Figure 3: Global Urban Rail Transit Market, Incremental Opportunity, by Rail Type, Value (US$ Bn), 2023-2031

Figure 4: Global Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy, 2017-2031

Figure 5: Global Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy, 2017-2031

Figure 6: Global Urban Rail Transit Market, Incremental Opportunity, by Autonomy, Value (US$ Bn), 2023-2031

Figure 7: Global Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy Level, 2017-2031

Figure 8: Global Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy Level, 2017-2031

Figure 9: Global Urban Rail Transit Market, Incremental Opportunity, by Autonomy Level, Value (US$ Bn), 2023-2031

Figure 10: Global Urban Rail Transit Market Volume (Kms) Forecast, by Region, 2017-2031

Figure 11: Global Urban Rail Transit Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Urban Rail Transit Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 13: North America Urban Rail Transit Market Volume (Kms) Forecast, by Rail Type, 2017-2031

Figure 14: North America Urban Rail Transit Market Value (US$ Bn) Forecast, by Rail Type, 2017-2031

Figure 15: North America Urban Rail Transit Market, Incremental Opportunity, by Rail Type, Value (US$ Bn), 2023-2031

Figure 16: North America Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy, 2017-2031

Figure 17: North America Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy, 2017-2031

Figure 18: North America Urban Rail Transit Market, Incremental Opportunity, by Autonomy, Value (US$ Bn), 2023-2031

Figure 19: North America Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy Level, 2017-2031

Figure 20: North America Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy Level, 2017-2031

Figure 21: North America Urban Rail Transit Market, Incremental Opportunity, by Autonomy Level, Value (US$ Bn), 2023-2031

Figure 22: North America Urban Rail Transit Market Volume (Kms) Forecast, by Country, 2017-2031

Figure 23: North America Urban Rail Transit Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Urban Rail Transit Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 25: Europe Urban Rail Transit Market Volume (Kms) Forecast, by Rail Type, 2017-2031

Figure 26: Europe Urban Rail Transit Market Value (US$ Bn) Forecast, by Rail Type, 2017-2031

Figure 27: Europe Urban Rail Transit Market, Incremental Opportunity, by Rail Type, Value (US$ Bn), 2023-2031

Figure 28: Europe Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy, 2017-2031

Figure 29: Europe Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy, 2017-2031

Figure 30: Europe Urban Rail Transit Market, Incremental Opportunity, by Autonomy, Value (US$ Bn), 2023-2031

Figure 31: Europe Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy Level, 2017-2031

Figure 32: Europe Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy Level, 2017-2031

Figure 33: Europe Urban Rail Transit Market, Incremental Opportunity, by Autonomy Level, Value (US$ Bn), 2023-2031

Figure 34: Europe Urban Rail Transit Market Volume (Kms) Forecast, by Country, 2017-2031

Figure 35: Europe Urban Rail Transit Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Urban Rail Transit Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Urban Rail Transit Market Volume (Kms) Forecast, by Rail Type, 2017-2031

Figure 38: Asia Pacific Urban Rail Transit Market Value (US$ Bn) Forecast, by Rail Type, 2017-2031

Figure 39: Asia Pacific Urban Rail Transit Market, Incremental Opportunity, by Rail Type, Value (US$ Bn), 2023-2031

Figure 40: Asia Pacific Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy, 2017-2031

Figure 41: Asia Pacific Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy, 2017-2031

Figure 42: Asia Pacific Urban Rail Transit Market, Incremental Opportunity, by Autonomy, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy Level, 2017-2031

Figure 44: Asia Pacific Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy Level, 2017-2031

Figure 45: Asia Pacific Urban Rail Transit Market, Incremental Opportunity, by Autonomy Level, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Urban Rail Transit Market Volume (Kms) Forecast, by Country, 2017-2031

Figure 47: Asia Pacific Urban Rail Transit Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Urban Rail Transit Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Urban Rail Transit Market Volume (Kms) Forecast, by Rail Type, 2017-2031

Figure 50: Middle East & Africa Urban Rail Transit Market Value (US$ Bn) Forecast, by Rail Type, 2017-2031

Figure 51: Middle East & Africa Urban Rail Transit Market, Incremental Opportunity, by Rail Type, Value (US$ Bn), 2023-2031

Figure 52: Middle East & Africa Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy, 2017-2031

Figure 53: Middle East & Africa Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy, 2017-2031

Figure 54: Middle East & Africa Urban Rail Transit Market, Incremental Opportunity, by Autonomy, Value (US$ Bn), 2023-2031

Figure 55: Middle East & Africa Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy Level, 2017-2031

Figure 56: Middle East & Africa Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy Level, 2017-2031

Figure 57: Middle East & Africa Urban Rail Transit Market, Incremental Opportunity, by Autonomy Level, Value (US$ Bn), 2023-2031

Figure 58: Middle East & Africa Urban Rail Transit Market Volume (Kms) Forecast, by Country, 2017-2031

Figure 59: Middle East & Africa Urban Rail Transit Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Urban Rail Transit Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: South America Urban Rail Transit Market Volume (Kms) Forecast, by Rail Type, 2017-2031

Figure 62: South America Urban Rail Transit Market Value (US$ Bn) Forecast, by Rail Type, 2017-2031

Figure 63: South America Urban Rail Transit Market, Incremental Opportunity, by Rail Type, Value (US$ Bn), 2023-2031

Figure 64: South America Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy, 2017-2031

Figure 65: South America Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy, 2017-2031

Figure 66: South America Urban Rail Transit Market, Incremental Opportunity, by Autonomy, Value (US$ Bn), 2023-2031

Figure 67: South America Urban Rail Transit Market Volume (Kms) Forecast, by Autonomy Level, 2017-2031

Figure 68: South America Urban Rail Transit Market Value (US$ Bn) Forecast, by Autonomy Level, 2017-2031

Figure 69: South America Urban Rail Transit Market, Incremental Opportunity, by Autonomy Level, Value (US$ Bn), 2023-2031

Figure 70: South America Urban Rail Transit Market Volume (Kms) Forecast, by Country, 2017-2031

Figure 71: South America Urban Rail Transit Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Urban Rail Transit Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031