Reports

Reports

Analysts’ Viewpoint on Market Scenario

Rapid identification and location of underwater threat is essential around the world due to the development of extremely quiet conventional submarines and a new generation of quieter and more advanced torpedoes. Consequently, several companies are actively involved in providing various sonar systems for underwater security, including passive sonar, active sonar, diver detection sonar, and torpedo detection sonar for marine warfare.

Additionally, companies are offer consulting and training services regarding underwater acoustics, environmental analysis, and signal analysis. Rise in need for various under water security systems to protect against attack on commercial harbour, navy vessel, private yacht, important national infrastructure site, or waterfront property is boosting the underwater security (systems and services) market expansion.

It is a historically challenging task to use sonar to accurately locate underwater targets in the acoustically hostile environment of a seaport, harbor, or marine terminal. Therefore, leading manufacturers are developing reliable, efficient, and cost-effective security solutions and systems to meet these challenges and capture significant market share.

Unmanned systems are gaining popularity as an emerging technology to reduce human exposure to risk, keep workers safe, and eliminate as many threats as possible in the shortest amount of time. North America dominates the global underwater security market, due to the increasing deployment of UUVs and other modern technology for maritime surveillance in support of coast guards to secure its maritime borders and commercially navigable waterways.

The underwater security system is a 360-degree surveillance system used to identify underwater interlopers, especially at permanent sites such as sea bottom towers or tripods, offshore platforms and wind farms, naval bases, LNG terminals, ports, and harbors, among others. These systems guard port entrances as well as a large number of ships that are simultaneously anchored there. They also detect hostile swimmers and sabotage attempts.

According to the latest underwater security (systems and services) market forecast, rise in demand for security of critical civilian and naval infrastructure, assets, and vessels in all types of ports and harbors has fueled the underwater security (systems and services) industry.

Furthermore, underwater site security typically involves the security of specific and well-defined zones, such as a narrow river section, a water intake channel, and an anchored ship. This further fuels the underwater security systems market expansion.

Unmanned vehicles for underwater research and security, including remotely operated vehicles (ROVs), hybrid vehicles, autonomous underwater vehicles (AUVs), and unmanned surface boats (USVs), can travel faster than boats and can go deeper than many tethered machines or human divers. AUVs can stay underwater for a long period once they are deployed and submerged. AUVs can work efficiently in poor weather.

These maritime unmanned systems are crucial for the exploration of marine resources, naval combat, and disaster rescue. They can be used for enemy reconnaissance, military assistance, and other purposes in the military.

Diverse segments in the marine industry utilize underwater robotic systems for a wide range of challenging tasks, such as surveillance, diver support, deep tunnel and dam inspection, light construction and intervention, marine science, repair & maintenance, drill support, salvage support, security, search and rescue operations, ordnance clearance, archaeology, and environmental monitoring.

In November 2022, Huntington Ingalls Industries, Inc. (HII) launched REMUS 620, a medium-class unmanned underwater vehicle (UUV). The REMUS 620 offers battery life of up to 110 hours and a range up to 275 nautical miles. This UUV provides unparalleled mission capabilities for mine countermeasures, intelligence data collection, surveillance, hydrographic surveys, and electronic warfare. Thus, rise in development of innovative products for underwater security by key players is propelling market demand.

Port security is essential since sea transportation is a very active and widely used mode of transportation, particularly for the transportation of cargo. Ports on the sea are essential to the world economy. Every year, ports handle billions of tons of cargo. In 2019, EU maritime ports handled 3.6 billion tons of freight, with the U.K. alone handling 486.1 million tons of cargo. In terms of cargo tonnage, the Port of Shanghai is the busiest port in the world, which handled around 43.6 million containers and 542.46 million tons of cargo in 2019.

Ports play a significant role in global supply chains. A significant disruptive event in any of these ports would have a significant impact on a huge number of businesses. Seaports are among the challenging places to protect, because they cover enormous regions, have several entrance points, and are extremely busy. Therefore, it is quite simple for criminal activities to go unnoticed.

Governments around the world have taken action to protect ports and maritime transportation against terrorism. The International Ship and Port Facility Security Code (ISPS) established to identify terrorist threats and stop terrorist acts at ports and sea. The ISPS Code describes three security levels, including level one, level 2, and level 3. Regulation (EC) No. 2004/725, enacted and amended by the European Union, standardized through IASP Code. The Government of the Netherlands included these worldwide and European security criteria in the Schepenbesluit 2004 (Shipping Decree), Havenbeveiligingswet (Port Security Act), and various ministerial regulations.

Intelligent analytics can aid in significantly easing and improving the work of port security officers because of recent advancements in artificial intelligence. Thus, bases and harbors are strategically protected from the surface and underwater enemy threats by underwater security systems using various types of sonars.

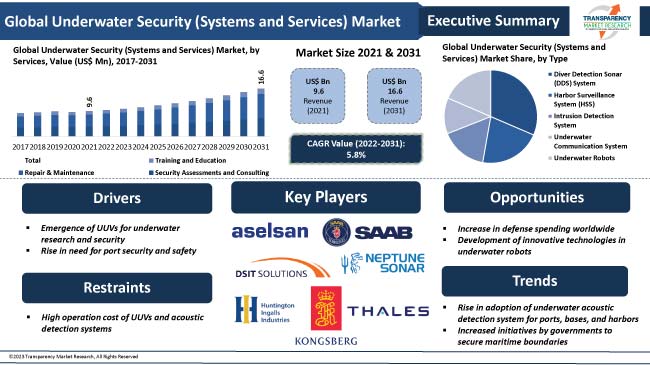

In terms of type, the global underwater security (systems and services) market segmentation comprises diver detection sonar (DDS) System, harbor surveillance system (HSS), intrusion detection system, underwater communication system, and underwater robots. The diver detection sonar system segment is anticipated to expand at a CAGR of 5.3% during the forecast period.

Deployment of DDS system can easily detect and prevent underwater threats. DDS is widely deployed at power stations, oil rigs, military and commercial ports, petrochemical plants, anchored ships, and other valuable assets with access to water mass.

The diver detector sonar system automatically detects and segregates closed and open circuit divers, minimizes false alarms for biologicals and wakes caused by boats, tracks multiple divers with the aid of software, and offers data recording, replaying, and integration to third-party command and control systems.

Regional analysis of the global underwater security market forecast reveals that North America is expected to hold 36.2% of the global underwater security (systems and services) market share during the forecast period.

According to the U.S. Department of Transportation's Bureau of Transportation Statistics, in terms of tonnage, the port of South Louisiana is the second-largest water port in the U.S. In 2020, the port handled over 250 million short tons of consignment. Underwater security provides the ability to check, detect, and identify anomalies on ships; and channel bottoms, bulkheads as well as anti-swimmer technologies, to eliminate any threat to the security of the port.

Asia Pacific and Europe are witnessing rapid underwater security (systems and services) industry growth. The People's Republic of China (PRC) is a significant industrial and shipping hub in Eastern Asia. According to the World Bank, China's container port traffic was around 245 million TEU in 2020. Thus, underwater security systems are essential to secure ports and other government properties.

The global underwater security (systems and services) market is fragmented with a large number of large-medium scale vendors controlling the majority of the market share. A majority of the companies are spending significantly on comprehensive research and development activities and new product development.

Expansion of product portfolios and mergers and acquisitions are prominent strategies adopted by key players. ASELSAN A.Ş., DA-GROUP, DSIT Solutions Ltd., Huntington Ingalls Industries, Inc., Kongsberg Mesotech Ltd., Neptune Sonar Limited, NORBIT ASA, RBtec Perimeter Security Systems, Saab, SAES, Sidus Solutions LLC, Sonardyne, SonarTech Underwater Systems LLC, Thales Group, and Ultra Group, are key underwater security (systems and services) companies operating in the market.

The underwater security (systems and services) market report comprises profiles of key players who have been analyzed based on company overview, business strategies, product portfolio, financial overview, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 9.6 Bn |

|

Market Forecast Value in 2031 |

US$ 16.6 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis and COVID-19 Impact Analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The underwater security (systems and services) market was valued at US$ 9.6 Bn in 2021.

It is expected to grow at a CAGR of 5.8% from 2022 to 2031.

The market is likely to reach a value of 16.6 Bn in 2031.

Rise in adoption of underwater acoustic detection system by ports, bases, and harbors and increased initiatives by governments to secure maritime boundaries and ports.

North America was the more lucrative region in 2021.

ASELSAN A.Ş., DA-GROUP, DSIT Solutions Ltd., Huntington Ingalls Industries, Inc., Kongsberg Mesotech Ltd., Neptune Sonar Limited, NORBIT ASA, RBtec Perimeter Security Systems, Saab, SAES, Sidus Solutions LLC, Sonardyne, SonarTech Underwater Systems LLC, Thales Group, and Ultra Group.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Underwater Security (Systems and Services) Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Scenario

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Offshore Security Industry Overview

4.2. Ecosystem Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

4.6. COVID-19 Impact and Recovery Analysis

5. Underwater Security (Systems and Services) Market Analysis, by Type

5.1. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

5.1.1. Diver Detection Sonar (DDS) System

5.1.2. Harbor Surveillance System (HSS)

5.1.3. Intrusion Detection System

5.1.4. Underwater Communication System

5.1.5. Underwater Robots

5.2. Market Attractiveness Analysis, By Type

6. Underwater Security (Systems and Services) Market Analysis, by Services

6.1. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Services, 2017–2031

6.1.1. Security Assessments and Consulting

6.1.2. Repair & Maintenance

6.1.3. Training and Education

6.2. Market Attractiveness Analysis, By Services

7. Underwater Security (Systems and Services) Market Analysis, by End-use

7.1. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

7.1.1. Naval Defense

7.1.2. Maritime Security

7.1.3. Offshore Rigs

7.1.4. Ports & Terminals

7.2. Market Attractiveness Analysis, By End-use

8. Underwater Security (Systems and Services) Market Analysis and Forecast, by Region

8.1. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America Underwater Security (Systems and Services) Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

9.3.1. Diver Detection Sonar (DDS) System

9.3.2. Harbor Surveillance System (HSS)

9.3.3. Intrusion Detection System

9.3.4. Underwater Communication System

9.3.5. Underwater Robots

9.4. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Services, 2017–2031

9.4.1. Security Assessments and Consulting

9.4.2. Repair & Maintenance

9.4.3. Training and Education

9.5. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

9.5.1. Naval Defense

9.5.2. Maritime Security

9.5.3. Offshore Rigs

9.5.4. Ports & Terminals

9.6. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of America

9.7. Market Attractiveness Analysis

9.7.1. By Type

9.7.2. By Services

9.7.3. By End-use

9.7.4. By Country/Sub-region

10. Europe Underwater Security (Systems and Services) Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

10.3.1. Diver Detection Sonar (DDS) System

10.3.2. Harbor Surveillance System (HSS)

10.3.3. Intrusion Detection System

10.3.4. Underwater Communication System

10.3.5. Underwater Robots

10.4. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Services, 2017–2031

10.4.1. Security Assessments and Consulting

10.4.2. Repair & Maintenance

10.4.3. Training and Education

10.5. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

10.5.1. Naval Defense

10.5.2. Maritime Security

10.5.3. Offshore Rigs

10.5.4. Ports & Terminals

10.6. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.6.1. Germany

10.6.2. U.K.

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Type

10.7.2. By Services

10.7.3. By End-use

10.7.4. By Country/Sub-region

11. Asia Pacific Underwater Security (Systems and Services) Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

11.3.1. Diver Detection Sonar (DDS) System

11.3.2. Harbor Surveillance System (HSS)

11.3.3. Intrusion Detection System

11.3.4. Underwater Communication System

11.3.5. Underwater Robots

11.4. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Services, 2017–2031

11.4.1. Security Assessments and Consulting

11.4.2. Repair & Maintenance

11.4.3. Training and Education

11.5. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

11.5.1. Naval Defense

11.5.2. Maritime Security

11.5.3. Offshore Rigs

11.5.4. Ports & Terminals

11.6. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Services

11.7.3. By End-use

11.7.4. By Country/Sub-region

12. Middle East & Africa Underwater Security (Systems and Services) Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

12.3.1. Diver Detection Sonar (DDS) System

12.3.2. Harbor Surveillance System (HSS)

12.3.3. Intrusion Detection System

12.3.4. Underwater Communication System

12.3.5. Underwater Robots

12.4. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Services, 2017–2031

12.4.1. Security Assessments and Consulting

12.4.2. Repair & Maintenance

12.4.3. Training and Education

12.5. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

12.5.1. Naval Defense

12.5.2. Maritime Security

12.5.3. Offshore Rigs

12.5.4. Ports & Terminals

12.6. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Services

12.7.3. By End-use

12.7.4. By Country/Sub-region

13. South America Underwater Security (Systems and Services) Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

13.3.1. Diver Detection Sonar (DDS) System

13.3.2. Harbor Surveillance System (HSS)

13.3.3. Intrusion Detection System

13.3.4. Underwater Communication System

13.3.5. Underwater Robots

13.4. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Services, 2017–2031

13.4.1. Security Assessments and Consulting

13.4.2. Repair & Maintenance

13.4.3. Training and Education

13.5. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

13.5.1. Naval Defense

13.5.2. Maritime Security

13.5.3. Offshore Rigs

13.5.4. Ports & Terminals

13.6. Underwater Security (Systems and Services) Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Services

13.7.3. By End-use

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Underwater Security (Systems and Services) Market Competition Matrix - a Dashboard View

14.1.1. Global Underwater Security (Systems and Services) Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ASELSAN A.Ş.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. DA-GROUP

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. DSIT Solutions Ltd.

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Huntington Ingalls Industries, Inc.

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. KONGSBERG MESOTECH LTD.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Neptune Sonar Limited

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. NORBIT ASA

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. RBtec Perimeter Security Systems

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Saab

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. SAES

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Sidus Solutions LLC

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Sonardyne

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. SonarTech Underwater Systems LLC

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

15.14. Thales Group

15.14.1. Overview

15.14.2. Product Portfolio

15.14.3. Sales Footprint

15.14.4. Key Subsidiaries or Distributors

15.14.5. Strategy and Recent Developments

15.14.6. Key Financials

15.15. Ultra Group

15.15.1. Overview

15.15.2. Product Portfolio

15.15.3. Sales Footprint

15.15.4. Key Subsidiaries or Distributors

15.15.5. Strategy and Recent Developments

15.15.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Type

16.1.2. By Services

16.1.3. By End-use

16.1.4. By Region

List of Tables

Table 1: Global Underwater Security (Systems and Services) Market Size & Forecast, by Type, Value (US$ Billion), 2017-2031

Table 2: Global Underwater Security (Systems and Services) Market Size & Forecast, by Services, Value (US$ Billion), 2017-2031

Table 3: Global Underwater Security (Systems and Services) Market Size & Forecast, by End-use, Value (US$ Billion), 2017-2031

Table 4: Global Underwater Security (Systems and Services) Market Size & Forecast, by Region, Value (US$ Billion), 2017-2031

Table 5: North America Underwater Security (Systems and Services) Market Size & Forecast, by Type, Value (US$ Billion), 2017-2031

Table 6: North America Underwater Security (Systems and Services) Market Size & Forecast, by Services, Value (US$ Billion), 2017-2031

Table 7: North America Underwater Security (Systems and Services) Market Size & Forecast, by End-use, Value (US$ Billion), 2017-2031

Table 8: North America Underwater Security (Systems and Services) Market Size & Forecast, by Country, Value (US$ Billion), 2017-2031

Table 9: Europe Underwater Security (Systems and Services) Market Size & Forecast, by Type, Value (US$ Billion), 2017-2031

Table 10: Europe Underwater Security (Systems and Services) Market Size & Forecast, by Services, Value (US$ Billion), 2017-2031

Table 11: Europe Underwater Security (Systems and Services) Market Size & Forecast, by End-use, Value (US$ Billion), 2017-2031

Table 12: Europe Underwater Security (Systems and Services) Market Size & Forecast, by Country, Value (US$ Billion), 2017-2031

Table 13: Asia Pacific Underwater Security (Systems and Services) Market Size & Forecast, by Type, Value (US$ Billion), 2017-2031

Table 14: Asia Pacific Underwater Security (Systems and Services) Market Size & Forecast, by Services, Value (US$ Billion), 2017-2031

Table 15: Asia Pacific Underwater Security (Systems and Services) Market Size & Forecast, by End-use, Value (US$ Billion), 2017-2031

Table 16: Asia Pacific Underwater Security (Systems and Services) Market Size & Forecast, by Country, Value (US$ Billion), 2017-2031

Table 17: Middle East & Africa Underwater Security (Systems and Services) Market Size & Forecast, by Type, Value (US$ Billion), 2017-2031

Table 18: Middle East & Africa Underwater Security (Systems and Services) Market Size & Forecast, by Services, Value (US$ Billion), 2017-2031

Table 19: Middle East & Africa Underwater Security (Systems and Services) Market Size & Forecast, by End-use, Value (US$ Billion), 2017-2031

Table 20: Middle East & Africa Underwater Security (Systems and Services) Market Size & Forecast, by Country, Value (US$ Billion), 2017-2031

Table 21: South America Underwater Security (Systems and Services) Market Size & Forecast, by Type, Value (US$ Billion), 2017-2031

Table 22: South America Underwater Security (Systems and Services) Market Size & Forecast, by Services, Value (US$ Billion), 2017-2031

Table 23: South America Underwater Security (Systems and Services) Market Size & Forecast, by End-use, Value (US$ Billion), 2017-2031

Table 24: South America Underwater Security (Systems and Services) Market Size & Forecast, by Country, Value (US$ Billion), 2017-2031

List of Figures

Figure 1: Global Underwater Security (Systems and Services) Market, Value (US$ Bn), 2017-2031

Figure 2: Global Underwater Security (Systems and Services) Market Size & Forecast, by Type, Revenue (US$ Billion), 2017-2031

Figure 3: Global Underwater Security (Systems and Services) Market Attractiveness, By Type, Value (US$ Billion), 2022-2031

Figure 4: Global Underwater Security (Systems and Services) Market Share Analysis, by Type, 2022

Figure 5: Global Underwater Security (Systems and Services) Market Share Analysis, by Type, 2031

Figure 6: Global Underwater Security (Systems and Services) Market Size & Forecast, by Services, Revenue (US$ Billion), 2017-2031

Figure 7: Global Underwater Security (Systems and Services) Market Attractiveness, By Services, Value (US$ Billion), 2022-2031

Figure 8: Global Underwater Security (Systems and Services) Market Share Analysis, by Services, 2022

Figure 9: Global Underwater Security (Systems and Services) Market Share Analysis, by Services, 2031

Figure 10: Global Underwater Security (Systems and Services) Market Size & Forecast, by End-use, Revenue (US$ Billion), 2017-2031

Figure 11: Global Underwater Security (Systems and Services) Market Attractiveness, By End-use, Value (US$ Billion), 2022-2031

Figure 12: Global Underwater Security (Systems and Services) Market Share Analysis, by End-use, 2022

Figure 13: Global Underwater Security (Systems and Services) Market Share Analysis, by End-use, 2031

Figure 14: Global Underwater Security (Systems and Services) Market Size & Forecast, by Region, Revenue (US$ Billion), 2017-2031

Figure 15: Global Underwater Security (Systems and Services) Market Attractiveness, By Region, Value (US$ Billion), 2022-2031

Figure 16: Global Underwater Security (Systems and Services) Market Share Analysis, by Region, 2022

Figure 17: Global Underwater Security (Systems and Services) Market Share Analysis, by Region, 2031

Figure 18: North America Underwater Security (Systems and Services) Market, Value (US$ Bn), 2017-2031

Figure 19: North America Underwater Security (Systems and Services) Market Size & Forecast, by Type, Revenue (US$ Billion), 2017-2031

Figure 20: North America Underwater Security (Systems and Services) Market Attractiveness, By Type, Value (US$ Billion), 2022-2031

Figure 21: North America Underwater Security (Systems and Services) Market Share Analysis, by Type, 2022

Figure 22: North America Underwater Security (Systems and Services) Market Share Analysis, by Type, 2031

Figure 23: North America Underwater Security (Systems and Services) Market Size & Forecast, by Services, Revenue (US$ Billion), 2017-2031

Figure 24: North America Underwater Security (Systems and Services) Market Attractiveness, By Services, Value (US$ Billion), 2022-2031

Figure 25: North America Underwater Security (Systems and Services) Market Share Analysis, by Services, 2022

Figure 26: North America Underwater Security (Systems and Services) Market Share Analysis, by Services, 2031

Figure 27: North America Underwater Security (Systems and Services) Market Size & Forecast, by End-use, Revenue (US$ Billion), 2017-2031

Figure 28: North America Underwater Security (Systems and Services) Market Attractiveness, By End-use, Value (US$ Billion), 2022-2031

Figure 29: North America Underwater Security (Systems and Services) Market Share Analysis, by End-use, 2022

Figure 30: North America Underwater Security (Systems and Services) Market Share Analysis, by End-use, 2031

Figure 31: North America Underwater Security (Systems and Services) Market Size & Forecast, by Country, Revenue (US$ Billion), 2017-2031

Figure 32: North America Underwater Security (Systems and Services) Market Attractiveness, By Country, Value (US$ Billion), 2022-2031

Figure 33: North America Underwater Security (Systems and Services) Market Share Analysis, by Country, 2022

Figure 34: North America Underwater Security (Systems and Services) Market Share Analysis, by Country, 2031

Figure 35: Europe Underwater Security (Systems and Services) Market, Value (US$ Bn), 2017-2031

Figure 36: Europe Underwater Security (Systems and Services) Market Size & Forecast, by Type, Revenue (US$ Billion), 2017-2031

Figure 37: Europe Underwater Security (Systems and Services) Market Attractiveness, By Type, Value (US$ Billion), 2022-2031

Figure 38: Europe Underwater Security (Systems and Services) Market Share Analysis, by Type, 2022

Figure 39: Europe Underwater Security (Systems and Services) Market Share Analysis, by Type, 2031

Figure 40: Europe Underwater Security (Systems and Services) Market Size & Forecast, by Services, Revenue (US$ Billion), 2017-2031

Figure 41: Europe Underwater Security (Systems and Services) Market Attractiveness, By Services, Value (US$ Billion), 2022-2031

Figure 42: Europe Underwater Security (Systems and Services) Market Share Analysis, by Services, 2022

Figure 43: Europe Underwater Security (Systems and Services) Market Share Analysis, by Services, 2031

Figure 44: Europe Underwater Security (Systems and Services) Market Size & Forecast, by End-use, Revenue (US$ Billion), 2017-2031

Figure 45: Europe Underwater Security (Systems and Services) Market Attractiveness, By End-use, Value (US$ Billion), 2022-2031

Figure 46: Europe Underwater Security (Systems and Services) Market Share Analysis, by End-use, 2022

Figure 47: Europe Underwater Security (Systems and Services) Market Share Analysis, by End-use, 2031

Figure 48: Europe Underwater Security (Systems and Services) Market Size & Forecast, by Country, Revenue (US$ Billion), 2017-2031

Figure 49: Europe Underwater Security (Systems and Services) Market Attractiveness, By Country, Value (US$ Billion), 2022-2031

Figure 50: Europe Underwater Security (Systems and Services) Market Share Analysis, by Country, 2022

Figure 51: Europe Underwater Security (Systems and Services) Market Share Analysis, by Country, 2031

Figure 52: Asia Pacific Underwater Security (Systems and Services) Market, Value (US$ Bn), 2017-2031

Figure 53: Asia Pacific Underwater Security (Systems and Services) Market Size & Forecast, by Type, Revenue (US$ Billion), 2017-2031

Figure 54: Asia Pacific Underwater Security (Systems and Services) Market Attractiveness, By Type, Value (US$ Billion), 2022-2031

Figure 55: Asia Pacific Underwater Security (Systems and Services) Market Share Analysis, by Type, 2022

Figure 56: Asia Pacific Underwater Security (Systems and Services) Market Share Analysis, by Type, 2031

Figure 57: Asia Pacific Underwater Security (Systems and Services) Market Size & Forecast, by Services, Revenue (US$ Billion), 2017-2031

Figure 58: Asia Pacific Underwater Security (Systems and Services) Market Attractiveness, By Services, Value (US$ Billion), 2022-2031

Figure 59: Asia Pacific Underwater Security (Systems and Services) Market Share Analysis, by Services, 2022

Figure 60: Asia Pacific Underwater Security (Systems and Services) Market Share Analysis, by Services, 2031

Figure 61: Asia Pacific Underwater Security (Systems and Services) Market Size & Forecast, by End-use, Revenue (US$ Billion), 2017-2031

Figure 62: Asia Pacific Underwater Security (Systems and Services) Market Attractiveness, By End-use, Value (US$ Billion), 2022-2031

Figure 63: Asia Pacific Underwater Security (Systems and Services) Market Share Analysis, by End-use, 2022

Figure 64: Asia Pacific Underwater Security (Systems and Services) Market Share Analysis, by End-use, 2031

Figure 65: Asia Pacific Underwater Security (Systems and Services) Market Size & Forecast, by Country, Revenue (US$ Billion), 2017-2031

Figure 66: Asia Pacific Underwater Security (Systems and Services) Market Attractiveness, By Country, Value (US$ Billion), 2022-2031

Figure 67: Asia Pacific Underwater Security (Systems and Services) Market Share Analysis, by Country, 2022

Figure 68: Asia Pacific Underwater Security (Systems and Services) Market Share Analysis, by Country, 2031

Figure 69: Middle East & Africa Underwater Security (Systems and Services) Market, Value (US$ Bn), 2017-2031

Figure 70: Middle East & Africa Underwater Security (Systems and Services) Market Size & Forecast, by Type, Revenue (US$ Billion), 2017-2031

Figure 71: Middle East & Africa Underwater Security (Systems and Services) Market Attractiveness, By Type, Value (US$ Billion), 2022-2031

Figure 72: Middle East & Africa Underwater Security (Systems and Services) Market Share Analysis, by Type, 2022

Figure 73: Middle East & Africa Underwater Security (Systems and Services) Market Share Analysis, by Type, 2031

Figure 74: Middle East & Africa Underwater Security (Systems and Services) Market Size & Forecast, by Services, Revenue (US$ Billion), 2017-2031

Figure 75: Middle East & Africa Underwater Security (Systems and Services) Market Attractiveness, By Services, Value (US$ Billion), 2022-2031

Figure 76: Middle East & Africa Underwater Security (Systems and Services) Market Share Analysis, by Services, 2022

Figure 77: Middle East & Africa Underwater Security (Systems and Services) Market Share Analysis, by Services, 2031

Figure 78: Middle East & Africa Underwater Security (Systems and Services) Market Size & Forecast, by End-use, Revenue (US$ Billion), 2017-2031

Figure 79: Middle East & Africa Underwater Security (Systems and Services) Market Attractiveness, By End-use, Value (US$ Billion), 2022-2031

Figure 80: Middle East & Africa Underwater Security (Systems and Services) Market Share Analysis, by End-use, 2022

Figure 81: Middle East & Africa Underwater Security (Systems and Services) Market Share Analysis, by End-use, 2031

Figure 82: Middle East & Africa Underwater Security (Systems and Services) Market Size & Forecast, by Country, Revenue (US$ Billion), 2017-2031

Figure 83: Middle East & Africa Underwater Security (Systems and Services) Market Attractiveness, By Country, Value (US$ Billion), 2022-2031

Figure 84: Middle East & Africa Underwater Security (Systems and Services) Market Share Analysis, by Country, 2022

Figure 85: Middle East & Africa Underwater Security (Systems and Services) Market Share Analysis, by Country, 2031

Figure 86: South America Underwater Security (Systems and Services) Market, Value (US$ Bn), 2017-2031

Figure 87: South America Underwater Security (Systems and Services) Market Size & Forecast, by Type, Revenue (US$ Billion), 2017-2031

Figure 88: South America Underwater Security (Systems and Services) Market Attractiveness, By Type, Value (US$ Billion), 2022-2031

Figure 89: South America Underwater Security (Systems and Services) Market Share Analysis, by Type, 2022

Figure 90: South America Underwater Security (Systems and Services) Market Share Analysis, by Type, 2031

Figure 91: South America Underwater Security (Systems and Services) Market Size & Forecast, by Services, Revenue (US$ Billion), 2017-2031

Figure 92: South America Underwater Security (Systems and Services) Market Attractiveness, By Services, Value (US$ Billion), 2022-2031

Figure 93: South America Underwater Security (Systems and Services) Market Share Analysis, by Services, 2022

Figure 94: South America Underwater Security (Systems and Services) Market Share Analysis, by Services, 2031

Figure 95: South America Underwater Security (Systems and Services) Market Size & Forecast, by End-use, Revenue (US$ Billion), 2017-2031

Figure 96: South America Underwater Security (Systems and Services) Market Attractiveness, By End-use, Value (US$ Billion), 2022-2031

Figure 97: South America Underwater Security (Systems and Services) Market Share Analysis, by End-use, 2022

Figure 98: South America Underwater Security (Systems and Services) Market Share Analysis, by End-use, 2031

Figure 99: South America Underwater Security (Systems and Services) Market Size & Forecast, by Country, Revenue (US$ Billion), 2017-2031

Figure 100: South America Underwater Security (Systems and Services) Market Attractiveness, By Country, Value (US$ Billion), 2022-2031

Figure 101: South America Underwater Security (Systems and Services) Market Share Analysis, by Country, 2022

Figure 102: South America Underwater Security (Systems and Services) Market Share Analysis, by Country, 2031