Reports

Reports

Analysts’ Viewpoint

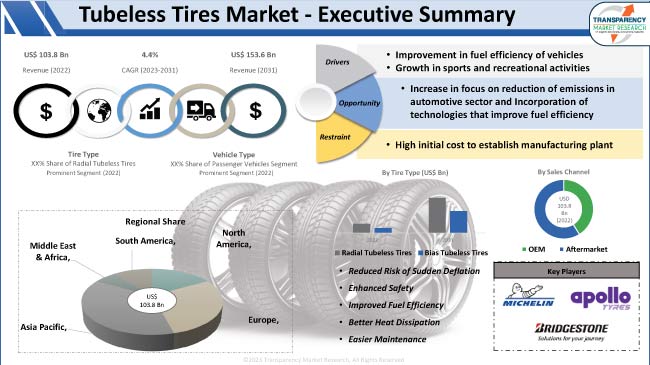

Implementation of stringent road safety regulations and increase in focus on fuel efficiency and environmental sustainability are key factors driving the global tubeless tires industry. Tube-free tires, with their ability to reduce the risk of punctures, provide a safer and more reliable driving experience. Growth in emphasis on vehicle performance is also augmenting the tubeless tires market size. Furthermore, improved traction, stability, and handling, particularly in high-performance vehicles and off-road applications, is boosting market progress.

Key players in the global tubeless tires market are concentrating on providing customers with a cost-effective and diverse product portfolio. In line with the latest tubeless tires market trends, leading automakers are investing in cutting-edge technologies to offer innovative tubeless tires.

Tubeless tire is a type of tire used in various vehicles, including motorcycles, passenger cars, commercial vehicles, and even some heavy-duty applications. These airless tires do not require an inner tube to hold the air pressure. Instead, they form an airtight seal between the tire and the rim, thus preventing air leakage and maintaining proper tire pressure. Radial tubeless tires and bias tubeless tires are the two types of tubeless tires.

Tubeless tires have revolutionized the automotive sector by eliminating the need for inner tubes and offering several advantages over traditional tube-type tires. Increase in consumer demand for safer, more efficient, and low-maintenance tires is augmenting the tubeless tires market demand.

Various industries, including automotive, motorcycle, and bicycle, have embraced the tubeless tire technology, particularly in high-performance and off-road applications. Key tire manufacturers have responded to the rising demand by offering an extensive range of tubeless tire options.

Advancements in tire sealant technology have further boosted market expansion. The tire sealant technology helps seal small punctures effectively on the go. As the market continues to expand and the benefits of using tubeless tires for improved vehicle performance and safety become more apparent, it is likely that they will become the standard choice for vehicles across the board. This is anticipated to accelerate market development in the near future.

The pursuit of improved fuel efficiency in vehicles is a key factor propelling market statistics. As environmental concerns and fuel costs rise, consumers and vehicle manufacturers alike are seeking ways to enhance the efficiency of vehicles.

Tubeless tires, with their lower rolling resistance and lighter weight compared to traditional tube-type tires, help reduce the amount of energy required to move the vehicle. This translates into better fuel economy and reduced emissions, making tubeless tires an attractive choice for environmentally-conscious consumers and a practical solution for automakers aiming to meet stringent fuel efficiency standards.

Governments and regulatory bodies are increasingly focusing on fuel efficiency and emission reduction in the automotive sector. Incentives, regulations, and fuel economy standards encourage vehicle manufacturers to incorporate technologies that improve fuel efficiency. As a result, tubeless tires are gaining prominence as effective and accessible means to achieve better fuel economy.

Growth in sports and recreational activities has been instrumental in driving the tubeless tires market due to the unique advantages these tires offer in such activities. Tubeless tires provide superior traction and reduced risk of flat tires in sports such as mountain biking, where riders face rugged terrains and encounter potential puncture hazards.

The ability to run tubeless tires at lower pressures allows for better shock absorption and improved handling, giving riders greater control and confidence on challenging trails. Similarly, in motorsports, tubeless tires have become increasingly popular due to their enhanced performance capabilities. Racing vehicles equipped with tubeless tires can achieve better grip and accessibility, thus enabling faster lap times and greater control in high-speed situations.

As per the latest tubeless tires market insights, radial tires dominate the global landscape due to their numerous advantages that make them the preferred choice for a wide range of vehicles. The radial tire design allows for improved tread contact with the road, thus offering better traction and handling compared to bias-ply tires. This enhanced grip on the road surface translates into increased safety and stability, especially during cornering and braking.

Safety remains a top priority for consumers and manufacturers. Therefore, the superior performance of radial tubeless tires has led to their widespread adoption in passenger cars, commercial vehicles, motorcycles, and even high-performance sports cars, thus boosting tubeless tires industry growth.

Fuel efficiency is another critical factor driving the popularity of radial tubeless tires. Radial construction reduces rolling resistance, which refers to the force required to maintain tire movement. With lower rolling resistance, vehicles equipped with radial tubeless tires consume less fuel to travel the same distance. This fuel-saving advantage not only appeals to consumers seeking to reduce their operating costs, but also aligns with environmental concerns, as it contributes to lower carbon emissions.

Passenger vehicles represent a substantial portion of the overall automotive market. Vast number of cars, SUVs, and light trucks being manufactured and sold globally offers significant tubeless tires business opportunities for manufacturers of passenger vehicles. Advantages offered by tubeless tires, such as reduced risk of punctures, better handling, and improved fuel economy, align well with the needs of passenger vehicle owners.

Advancements in tire technology and manufacturing processes have resulted in a wide variety of tubeless tire options, specifically designed for passenger vehicles. Tire manufacturers have developed specialized tread patterns, compounds, and designs to cater to different driving conditions and preferences.

In terms of region, Asia Pacific accounts for significant tubeless tires market share across the globe. Rapid economic growth, increase in disposable income of consumers, and expansion in the automotive sector have fueled the demand for tubeless tires in countries such as China, India, Japan, and South Korea.

Growth in urban population and infrastructure development have led to an increase in vehicle ownership, further boosting market dynamics of Asia Pacific.

North America is another key region for tubeless tires, as per the tubeless tires market forecast report. Well-established automotive industry, high consumer purchasing power, and preference for fuel-efficient vehicles have driven the adoption of tubeless tires in passenger cars, light trucks, and SUVs in the region. Furthermore, increase in popularity of sports and recreational activities, such as mountain biking and off-road adventures, is augmenting market trajectory in North America.

Europe has significant presence in the global landscape, with Germany, France, and the U.K being major destinations for tubeless tires. Implementation of stringent regulations regarding emissions and fuel efficiency has encouraged the adoption of technologies such as tubeless tires, which offer better fuel economy, in the region. Demand for tubeless tires is particularly strong in high-performance and luxury vehicle segments, where safety, performance, and comfort are essential factors.

The global landscape is consolidated, with a few manufacturers controlling majority of the market share. Leading companies are offering advanced tubeless tires to strengthen their market position. Expansion of product offerings is a key tubeless tires marketing strategy adopted by the key players.

Apollo Tyres Ltd., Bridgestone Corp., Goodyear Tire & Rubber Company, Michelin, Trelleborg AB, Madras Rubber Factory, Yokohama Rubber CO. Ltd., CEAT Tyres Ltd., Continental AG, Toyo Tire & Rubber Company, Cooper Tire & Rubber Company, KUMHO Tire Co., Inc., Hankook Tire & Technology Co. Ltd., and Sumitomo Rubber Industries Ltd. are prominent players operating in the global market.

These players have been summarized in the global tubeless tires market report based on parameters such as company overview, financial overview, business strategies, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 103.8 Bn |

|

Market Forecast Value in 2031 |

US$ 153.6 Bn |

|

Growth Rate (CAGR) |

4.4% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

|

|

Market Analysis |

It includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, key trend analysis, market size, market share, and forecast. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 103.8 Bn in 2022

It is anticipated to grow at a CAGR of 4.4% from 2023 to 2031

It is likely to reach US$ 153.6 Bn by 2031

The radial tubeless tires segment is projected to hold significant share during the forecast period

The passenger vehicles segment accounted for major share in 2022

Asia Pacific is estimated to be a highly lucrative region during the forecast period

Apollo Tyres Ltd., Bridgestone Corp., Goodyear Tire & Rubber Company, Michelin, Trelleborg AB, Madras Rubber Factory, Yokohama Rubber CO. Ltd., CEAT Tyres Ltd., Continental AG, Toyo Tire & Rubber Company, Cooper Tire & Rubber Company, KUMHO Tire Co., Inc., Hankook Tire & Technology Co. Ltd., and Sumitomo Rubber Industries Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.1.1. GAP Analysis

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding Buying Process of Customers

1.2.4. Preferred Sales & Marketing Strategy

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

2.9. Value Chain Analysis

3. Pricing Analysis

3.1. Cost Structure Analysis

3.2. Profit Margin Analysis

4. Global Tubeless Tires Market, By Tire Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Tire Type

4.2.1. Radial Tubeless Tires

4.2.2. Bias Tubeless Tires

5. Global Tubeless Tires Market, By Rim Size

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Rim Size

5.2.1. Below 15 Inches

5.2.2. 15-17 Inches

5.2.3. 18-20 Inches

5.2.4. Above 20 Inches

6. Global Tubeless Tires Market, By Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

6.2.1. Two/Three Wheelers

6.2.2. Passenger Vehicles

6.2.2.1. Hatchbacks

6.2.2.2. Sedans

6.2.2.3. SUVs

6.2.3. Light Commercial Vehicles

6.2.4. Heavy Duty Trucks

6.2.5. Buses and Coaches

6.2.6. Off-road Vehicles

7. Global Tubeless Tires Market, By End-use Industry

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By End-use Industry

7.2.1. Automotive

7.2.2. Construction

7.2.3. Agriculture

7.2.4. Mining

7.2.5. Others

8. Global Tubeless Tires Market, By Sales Channel

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Sales Channel

8.2.1. OEM

8.2.2. Aftermarket

9. Global Tubeless Tires Market, By Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Tubeless Tires Market

10.1. Market Snapshot

10.2. North America Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Tire Type

10.2.1. Radial Tubeless Tires

10.2.2. Bias Tubeless Tires

10.3. North America Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Rim Size

10.3.1. Below 15 Inches

10.3.2. 15-17 Inches

10.3.3. 18-20 Inches

10.3.4. Above 20 Inches

10.4. North America Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

10.4.1. Two/Three Wheelers

10.4.2. Passenger Vehicles

10.4.2.1. Hatchbacks

10.4.2.2. Sedans

10.4.2.3. SUVs

10.4.3. Light Commercial Vehicles

10.4.4. Heavy Duty Trucks

10.4.5. Buses and Coaches

10.4.6. Off-road Vehicles

10.5. North America Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By End-use Industry

10.5.1. Automotive

10.5.2. Construction

10.5.3. Agriculture

10.5.4. Mining

10.5.5. Others

10.6. North America Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Sales Channel

10.6.1. OEM

10.6.2. Aftermarket

10.7. Key Country Analysis - North America Tubeless Tires Market Size Analysis & Forecast, 2017-2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Mexico

11. Europe Tubeless Tires Market

11.1. Market Snapshot

11.2. Europe Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Tire Type

11.2.1. Radial Tubeless Tires

11.2.2. Bias Tubeless Tires

11.3. Europe Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Rim Size

11.3.1. Below 15 Inches

11.3.2. 15-17 Inches

11.3.3. 18-20 Inches

11.3.4. Above 20 Inches

11.4. Europe Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

11.4.1. Two/Three Wheelers

11.4.2. Passenger Vehicles

11.4.2.1. Hatchbacks

11.4.2.2. Sedans

11.4.2.3. SUVs

11.4.3. Light Commercial Vehicles

11.4.4. Heavy Duty Trucks

11.4.5. Buses and Coaches

11.4.6. Off-road Vehicles

11.5. Europe Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By End-use Industry

11.5.1. Automotive

11.5.2. Construction

11.5.3. Agriculture

11.5.4. Mining

11.5.5. Others

11.6. Europe Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Sales Channel

11.6.1. OEM

11.6.2. Aftermarket

11.7. Key Country Analysis - Europe Tubeless Tires Market Size Analysis & Forecast, 2017-2031

11.7.1. Germany

11.7.2. U. K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Nordic Countries

11.7.7. Russia & CIS

11.7.8. Rest of Europe

12. Asia Pacific Tubeless Tires Market

12.1. Market Snapshot

12.2. Asia Pacific Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Tire Type

12.2.1. Radial Tubeless Tires

12.2.2. Bias Tubeless Tires

12.3. Asia Pacific Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Rim Size

12.3.1. Below 15 Inches

12.3.2. 15-17 Inches

12.3.3. 18-20 Inches

12.3.4. Above 20 Inches

12.4. Asia Pacific Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.4.1. Two/Three Wheelers

12.4.2. Passenger Vehicles

12.4.2.1. Hatchbacks

12.4.2.2. Sedans

12.4.2.3. SUVs

12.4.3. Light Commercial Vehicles

12.4.4. Heavy Duty Trucks

12.4.5. Buses and Coaches

12.4.6. Off-road Vehicles

12.5. Asia Pacific Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By End-use Industry

12.5.1. Automotive

12.5.2. Construction

12.5.3. Agriculture

12.5.4. Mining

12.5.5. Others

12.6. Asia Pacific Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Sales Channel

12.6.1. OEM

12.6.2. Aftermarket

12.7. Key Country Analysis - Asia Pacific Tubeless Tires Market Size Analysis & Forecast, 2017-2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. ASEAN Countries

12.7.5. South Korea

12.7.6. ANZ

12.7.7. Rest of Asia Pacific

13. Middle East & Africa Tubeless Tires Market

13.1. Market Snapshot

13.2. Middle East & Africa Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Tire Type

13.2.1. Radial Tubeless Tires

13.2.2. Bias Tubeless Tires

13.3. Middle East & Africa Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Rim Size

13.3.1. Below 15 Inches

13.3.2. 15-17 Inches

13.3.3. 18-20 Inches

13.3.4. Above 20 Inches

13.4. Middle East & Africa Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.4.1. Two/Three Wheelers

13.4.2. Passenger Vehicles

13.4.2.1. Hatchbacks

13.4.2.2. Sedans

13.4.2.3. SUVs

13.4.3. Light Commercial Vehicles

13.4.4. Heavy Duty Trucks

13.4.5. Buses and Coaches

13.4.6. Off-road Vehicles

13.5. Middle East & Africa Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By End-use Industry

13.5.1. Automotive

13.5.2. Construction

13.5.3. Agriculture

13.5.4. Mining

13.5.5. Others

13.6. Middle East & Africa Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Sales Channel

13.6.1. OEM

13.6.2. Aftermarket

13.7. Key Country Analysis - Middle East & Africa Tubeless Tires Market Size Analysis & Forecast, 2017-2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Turkey

13.7.4. Rest of Middle East & Africa

14. South America Tubeless Tires Market

14.1. Market Snapshot

14.2. South America Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Tire Type

14.2.1. Radial Tubeless Tires

14.2.2. Bias Tubeless Tires

14.3. South America Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Rim Size

14.3.1. Below 15 Inches

14.3.2. 15-17 Inches

14.3.3. 18-20 Inches

14.3.4. Above 20 Inches

14.4. South America Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

14.4.1. Two/Three Wheelers

14.4.2. Passenger Vehicles

14.4.2.1. Hatchbacks

14.4.2.2. Sedans

14.4.2.3. SUVs

14.4.3. Light Commercial Vehicles

14.4.4. Heavy Duty Trucks

14.4.5. Buses and Coaches

14.4.6. Off-road Vehicles

14.5. South America Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By End-use Industry

14.5.1. Automotive

14.5.2. Construction

14.5.3. Agriculture

14.5.4. Mining

14.5.5. Others

14.6. South America Tubeless Tires Market Size Analysis & Forecast, 2017-2031, By Sales Channel

14.6.1. OEM

14.6.2. Aftermarket

14.7. Key Country Analysis - South America Tubeless Tires Market Size Analysis & Forecast, 2017-2031

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Company Analysis for Each Player (Company Overview, Company Footprint, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1. Apollo Tyres Ltd.

16.1.1. Company Overview

16.1.2. Company Footprint

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. Michelin

16.2.1. Company Overview

16.2.2. Company Footprint

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. Trelleborg AB

16.3.1. Company Overview

16.3.2. Company Footprint

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. Bridgestone Corp.

16.4.1. Company Overview

16.4.2. Company Footprint

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. Goodyear Tire & Rubber Company

16.5.1. Company Overview

16.5.2. Company Footprint

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. Madras Rubber Factory

16.6.1. Company Overview

16.6.2. Company Footprint

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. Yokohama Rubber CO. Ltd.

16.7.1. Company Overview

16.7.2. Company Footprint

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Ceat Tyres Ltd.

16.8.1. Company Overview

16.8.2. Company Footprint

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. Continental AG

16.9.1. Company Overview

16.9.2. Company Footprint

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. Toyo Tire & Rubber Company

16.10.1. Company Overview

16.10.2. Company Footprint

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. Cooper Tire & Rubber Company

16.11.1. Company Overview

16.11.2. Company Footprint

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. KUMHO Tire Co., Inc.

16.12.1. Company Overview

16.12.2. Company Footprint

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. Hankook Tire & Technology Co. Ltd.

16.13.1. Company Overview

16.13.2. Company Footprint

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Sumitomo Rubber Industries Ltd.

16.14.1. Company Overview

16.14.2. Company Footprint

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

16.15. Other Key Players

16.15.1. Company Overview

16.15.2. Company Footprint

16.15.3. Production Locations

16.15.4. Product Portfolio

16.15.5. Competitors & Customers

16.15.6. Subsidiaries & Parent Organization

16.15.7. Recent Developments

16.15.8. Financial Analysis

16.15.9. Profitability

16.15.10. Revenue Share

List of Tables

Table 1: Global Tubeless Tires Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 2: Global Tubeless Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Table 3: Global Tubeless Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 4: Global Tubeless Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 5: Global Tubeless Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 6: Global Tubeless Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 7: Global Tubeless Tires Market Volume (Thousand Units) Forecast, by End-use Industry, 2017-2031

Table 8: Global Tubeless Tires Market Value (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 9: Global Tubeless Tires Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 10: Global Tubeless Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 11: Global Tubeless Tires Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 12: Global Tubeless Tires Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 13: North America Tubeless Tires Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 14: North America Tubeless Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Table 15: North America Tubeless Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 16: North America Tubeless Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 17: North America Tubeless Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 18: North America Tubeless Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 19: North America Tubeless Tires Market Volume (Thousand Units) Forecast, by End-use Industry, 2017-2031

Table 20: North America Tubeless Tires Market Value (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 21: North America Tubeless Tires Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 22: North America Tubeless Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 23: North America Tubeless Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 24: North America Tubeless Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Europe Tubeless Tires Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 26: Europe Tubeless Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Table 27: Europe Tubeless Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 28: Europe Tubeless Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 29: Europe Tubeless Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 30: Europe Tubeless Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 31: Europe Tubeless Tires Market Volume (Thousand Units) Forecast, by End-use Industry, 2017-2031

Table 32: Europe Tubeless Tires Market Value (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 33: Europe Tubeless Tires Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 34: Europe Tubeless Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 35: Europe Tubeless Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 36: Europe Tubeless Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 37: Asia Pacific Tubeless Tires Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 38: Asia Pacific Tubeless Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Table 39: Asia Pacific Tubeless Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 40: Asia Pacific Tubeless Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 41: Asia Pacific Tubeless Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 42: Asia Pacific Tubeless Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 43: Asia Pacific Tubeless Tires Market Volume (Thousand Units) Forecast, by End-use Industry, 2017-2031

Table 44: Asia Pacific Tubeless Tires Market Value (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 45: Asia Pacific Tubeless Tires Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 46: Asia Pacific Tubeless Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 47: Asia Pacific Tubeless Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Tubeless Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 49: Middle East & Africa Tubeless Tires Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 50: Middle East & Africa Tubeless Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Table 51: Middle East & Africa Tubeless Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 52: Middle East & Africa Tubeless Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 53: Middle East & Africa Tubeless Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 54: Middle East & Africa Tubeless Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 55: Middle East & Africa Tubeless Tires Market Volume (Thousand Units) Forecast, by End-use Industry, 2017-2031

Table 56: Middle East & Africa Tubeless Tires Market Value (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 57: Middle East & Africa Tubeless Tires Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 58: Middle East & Africa Tubeless Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 59: Middle East & Africa Tubeless Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Tubeless Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 61: South America Tubeless Tires Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Table 62: South America Tubeless Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Table 63: South America Tubeless Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Table 64: South America Tubeless Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Table 65: South America Tubeless Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 66: South America Tubeless Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 67: South America Tubeless Tires Market Volume (Thousand Units) Forecast, by End-use Industry, 2017-2031

Table 68: South America Tubeless Tires Market Value (US$ Bn) Forecast, by End-use Industry, 2017-2031

Table 69: South America Tubeless Tires Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 70: South America Tubeless Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 71: South America Tubeless Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 72: South America Tubeless Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Tubeless Tires Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 2: Global Tubeless Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 3: Global Tubeless Tires Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 4: Global Tubeless Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 5: Global Tubeless Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 6: Global Tubeless Tires Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 7: Global Tubeless Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Tubeless Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 9: Global Tubeless Tires Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 10: Global Tubeless Tires Market Volume (Thousand Units) Forecast, by End-use Industry, 2017-2031

Figure 11: Global Tubeless Tires Market Value (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 12: Global Tubeless Tires Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 13: Global Tubeless Tires Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 14: Global Tubeless Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 15: Global Tubeless Tires Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 16: Global Tubeless Tires Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 17: Global Tubeless Tires Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Tubeless Tires Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 19: North America Tubeless Tires Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 20: North America Tubeless Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 21: North America Tubeless Tires Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 22: North America Tubeless Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 23: North America Tubeless Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 24: North America Tubeless Tires Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 25: North America Tubeless Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 26: North America Tubeless Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 27: North America Tubeless Tires Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 28: North America Tubeless Tires Market Volume (Thousand Units) Forecast, by End-use Industry, 2017-2031

Figure 29: North America Tubeless Tires Market Value (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 30: North America Tubeless Tires Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 31: North America Tubeless Tires Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 32: North America Tubeless Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 33: North America Tubeless Tires Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 34: North America Tubeless Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: North America Tubeless Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Tubeless Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Europe Tubeless Tires Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 38: Europe Tubeless Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 39: Europe Tubeless Tires Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 40: Europe Tubeless Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 41: Europe Tubeless Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 42: Europe Tubeless Tires Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 43: Europe Tubeless Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 44: Europe Tubeless Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 45: Europe Tubeless Tires Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 46: Europe Tubeless Tires Market Volume (Thousand Units) Forecast, by End-use Industry, 2017-2031

Figure 47: Europe Tubeless Tires Market Value (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 48: Europe Tubeless Tires Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 49: Europe Tubeless Tires Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 50: Europe Tubeless Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 51: Europe Tubeless Tires Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 52: Europe Tubeless Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 53: Europe Tubeless Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Tubeless Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Tubeless Tires Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 56: Asia Pacific Tubeless Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 57: Asia Pacific Tubeless Tires Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Tubeless Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 59: Asia Pacific Tubeless Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 60: Asia Pacific Tubeless Tires Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 61: Asia Pacific Tubeless Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 62: Asia Pacific Tubeless Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 63: Asia Pacific Tubeless Tires Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 64: Asia Pacific Tubeless Tires Market Volume (Thousand Units) Forecast, by End-use Industry, 2017-2031

Figure 65: Asia Pacific Tubeless Tires Market Value (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 66: Asia Pacific Tubeless Tires Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 67: Asia Pacific Tubeless Tires Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 68: Asia Pacific Tubeless Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 69: Asia Pacific Tubeless Tires Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 70: Asia Pacific Tubeless Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Tubeless Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Tubeless Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Tubeless Tires Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 74: Middle East & Africa Tubeless Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 75: Middle East & Africa Tubeless Tires Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 76: Middle East & Africa Tubeless Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 77: Middle East & Africa Tubeless Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 78: Middle East & Africa Tubeless Tires Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 79: Middle East & Africa Tubeless Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 80: Middle East & Africa Tubeless Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 81: Middle East & Africa Tubeless Tires Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 82: Middle East & Africa Tubeless Tires Market Volume (Thousand Units) Forecast, by End-use Industry, 2017-2031

Figure 83: Middle East & Africa Tubeless Tires Market Value (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 84: Middle East & Africa Tubeless Tires Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Tubeless Tires Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 86: Middle East & Africa Tubeless Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: Middle East & Africa Tubeless Tires Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 88: Middle East & Africa Tubeless Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Tubeless Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Tubeless Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 91: South America Tubeless Tires Market Volume (Thousand Units) Forecast, by Tire Type, 2017-2031

Figure 92: South America Tubeless Tires Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 93: South America Tubeless Tires Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 94: South America Tubeless Tires Market Volume (Thousand Units) Forecast, by Rim Size, 2017-2031

Figure 95: South America Tubeless Tires Market Value (US$ Bn) Forecast, by Rim Size, 2017-2031

Figure 96: South America Tubeless Tires Market, Incremental Opportunity, by Rim Size, Value (US$ Bn), 2023-2031

Figure 97: South America Tubeless Tires Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 98: South America Tubeless Tires Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 99: South America Tubeless Tires Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 100: South America Tubeless Tires Market Volume (Thousand Units) Forecast, by End-use Industry, 2017-2031

Figure 101: South America Tubeless Tires Market Value (US$ Bn) Forecast, by End-use Industry, 2017-2031

Figure 102: South America Tubeless Tires Market, Incremental Opportunity, by End-use Industry, Value (US$ Bn), 2023-2031

Figure 103: South America Tubeless Tires Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 104: South America Tubeless Tires Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 105: South America Tubeless Tires Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 106: South America Tubeless Tires Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 107: South America Tubeless Tires Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Tubeless Tires Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031