Reports

Reports

Analysts’ Viewpoint on Transplant Drug Monitoring Assay Market Scenario

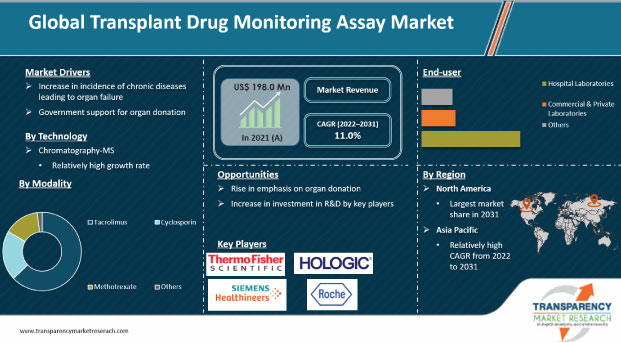

Therapeutic drug monitoring (TDM) of transplant medicine plays a crucial role in helping health care professionals maintain plasma and blood levels of immunosuppressants within their respective therapeutic ranges. TDM ensures that concentrations are not too low or too high, thereby minimizing the risks of rejection or toxicity, respectively. Leading players operating in the healthcare industry offer a full line of Immunosuppressant Drug Monitoring (ISD) assays, such as mycophenolic acid, cyclosporine, everolimus, and tacrolimus, to aid in patient monitoring. Rise in healthcare expenditure, improvement in healthcare infrastructure, increase in global per capita income, and government reimbursement programs are likely to create lucrative opportunities for companies operating in the transplant drug monitoring assay market in the next few years.

The global transplant drug monitoring assay market is expected to grow at a rapid pace during the forecast period from 2022 to 2031, owing to the increase in need for organ transplantation, surge in R&D funding, and rise in prevalence of chronic liver and kidney diseases. Increase in need for point-of-care therapeutic drug monitoring and home-based therapeutic drug monitoring is likely to create lucrative opportunities for players operating in the global transplant drug monitoring assay market during the forecast period.

Rise in incidence of chronic diseases of the liver, heart, kidney, and pancreas along with blood disorders such as leukemia and aplastic anemia are driving the demand for organ transplants/replacements. This is expected to boost the global transplant drug monitoring assay market. According to the Health Resources & Services Administration (HRSA), around 40,000+ transplants were performed across the globe in 2021. According to the World Health Organization (WHO), the global geriatric population stood at around 524 million in 2010 and is anticipated to reach 1.5 billion by 2050. The world is aging at a rapid pace, especially in developed countries such as the U.S., Germany, and Japan. For instance, the U.S. Census Bureau stated in 2010 that people older than 65 years represented around 12.4% of the total population in 2000, and the percentage is expected to reach 19% in the U.S. by 2030. Surge in geriatric population directly affects the growth and demand for organ transplants, primarily due to their higher susceptibility to kidney and heart diseases.

The number of organ donors across the globe has been rising due to the initiatives by government organizations. Various government authorities across developed and developing countries support organ donation through awareness programs, financial assistance, and effective schemes and policies. In April 2022, the Government of Canada announced the investment of US$ 2 Mn for research in innovative organ and tissue donation.

In November 2019, the Spanish Ministry of Health, Consumer Affairs and Social Welfare and the World Health Organization (WHO) signed an agreement for fostering cooperation in the field of donation and transplantation of organs, cells, and tissues. This technical agreement will lead to the creation of the Global Observatory on Donation and Transplantation 'GODT', which will collect and manage global data on clinical and regulatory information regarding organ transplants. Thus, government support for organ donation is expected to create significant opportunities in the global transplant drug monitoring assay market.

In terms of product, the global transplant drug monitoring assay market has been bifurcated into equipment and consumables. The equipment segment held major share of the global market in 2021. The segment is projected to grow at a rapid pace during the forecast period. Clinical chemistry analyzers and immunoassay analyzers provide mid-to high-volume laboratories the flexibility to improve efficiencies and economics. With a throughput of excellent onboard parameters, this equipment delivers field-proven reliability and efficiency to laboratories worldwide. Additionally, leading players such as Thermo Scientific are coming up with innovative solutions such as ‘QMS Everolimus’. This analyzer carries the CE mark for usage in the European Union for liver transplant drug monitoring.

Based on technology, the global transplant drug monitoring assay market has been classified into chromatography-MS and immunoassays. Chromatography-MS is a rapidly growing segment of the global transplant drug monitoring assay market. The segment is expected to advance at a CAGR of 12.2% during the forecast period. Growth of the segment can be ascribed to the rise in demand for organ transplantation across the globe. Currently, 121,678 people are waiting for lifesaving organ transplants in the U.S.

Based on drug, the global transplant drug monitoring assay market has been split into tacrolimus, cyclosporin, methotrexate, and others. The tacrolimus segment held major share of the global market in 2021. Recent FDA approval for tacrolimus as a transplantation drug is projected to drive the segment during the forecast period. In July 2021, the U.S. Food and Drug Administration (FDA) approved the usage of the transplant drug tacrolimus for the prevention of organ rejection in pediatric and adult patients receiving lung transplants. Furthermore, nearly 85% of kidney transplant recipients have been prescribed tacrolimus as a maintenance immunosuppressive regimen, primarily due to its higher potency, and lower rejection and nephrotoxicity compared to cyclosporine.

Based on end-user, the global transplant drug monitoring assay market has been divided into hospital laboratories, commercial & private laboratories, and others. The hospital laboratories segment held prominent share of the global market in 2021. The segment is likely to expand at the fastest CAGR during the forecast period. TDM assays are increasingly provided in hospitals and ambulatory surgical centers with multiple medical specialties. These services are managed entirely by hospital pharmacists. Hence, these pharmacists assume a crucial role in ensuring the optimal use of TDM assays. Additionally, rise in number of government and private hospital laboratories in emerging economies, such as China and India, and increase in incidence of cardiovascular and chronic liver diseases are driving the segment. Surge in patient base is encouraging hospital laboratories to form alliances and strategic partnerships. This is also likely to propel the segment.

North America accounted for major share of around 35% of the global transplant drug monitoring assay market in 2021. North America’s dominance can be ascribed to improvements in technology, surgical techniques, and immunosuppressive drugs along with rise in success rate of organ transfer procedures. Additionally, rapid adoption of advanced treatments, increase in R&D activities, high affordability, and rise in prevalence of chronic diseases, including chronic kidney diseases and CVDs, are driving the demand for organ transplantation. This is likely to boost the transplant drug monitoring assay market in North America.

Europe and Asia Pacific are also large markets for transplant drug monitoring assays. These regions held the second and third largest share, respectively, of the global market in 2021. The transplant drug monitoring assay market in Asia Pacific is driven by the rise in focus on organ donation. Strong presence of Siemens Healthineers AG, Hologic, Inc., Danaher Corporation, and Bio-Rad Laboratories, Inc., specifically in China, India, and South Korea, is also expected to augment the market in Asia Pacific. The market in Latin America is projected to grow at a faster pace than that in Middle East & Africa.

The global transplant drug monitoring assay market is consolidated, with the presence of a small number of leading players. Most of the companies are investing significantly in research & development activities, primarily to introduce innovative assays. Furthermore, diversification of product portfolios and mergers & acquisitions are the key strategies adopted by the leading players. Abbott, Thermo Fisher Scientific Inc., H.U. Group Holdings, Inc. (Fujirebio Holdings, Inc.), Hoffmann-La Roche Ltd., Siemens Healthineers AG, Hologic, Inc., Danaher Corporation, and Bio-Rad Laboratories, Inc. are the key players in the transplant drug monitoring assay market.

Each of these players has been profiled in the transplant drug monitoring assay market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 198.0 Mn |

|

Market Forecast Value in 2031 |

More than US$ 542 Mn |

|

Growth Rate (CAGR) |

11.0% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global transplant drug monitoring assay market was valued at US$ 198.0 Mn in 2021.

The global transplant drug monitoring assay market is projected to reach more than US$ 542 Mn by 2031.

The global transplant drug monitoring assay market grew at a CAGR of 1% from 2017 to 2021.

The global transplant drug monitoring assay market is anticipated to grow at a CAGR of 11.0% from 2022 to 2031.

Increase in incidence of chronic diseases leading to organ failure and technologically advanced products propel the global transplant drug monitoring assay market.

The tacrolimus segment held over 60% share of the global transplant drug monitoring assay market in 2021.

Prominent players in the global transplant drug monitoring assay market include Hologic, Inc., Abbott, Thermo Fisher Scientific Inc., H.U. Group Holdings, Inc. (Fujirebio Holdings, Inc.), and Siemens Healthineers AG.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Transplant Drug Monitoring Assay Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Transplant Drug Monitoring Assay Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pricing Analysis of Drugs (Tacrolimus, Methotrexate and Cyclosporin)

5.2. Volume Units of Transplant Drugs in 2018-2021 (Tacrolimus, Methotrexate and Cyclosporin)

5.3. Key Industry Events (mergers, acquisitions, partnerships, collaborations, etc.)

5.4. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long-term impact)

6. Global Transplant Drug Monitoring Assay Market Analysis and Forecast, By Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Consumables

6.3.2. Equipment

6.3.2.1. Immunoassay Analyzers

6.3.2.2. Chromatography & MS Detectors

6.3.2.3. Clinical Chemistry Analyzers

6.4. Market Attractiveness Analysis, By Product

7. Global Transplant Drug Monitoring Assay Market Analysis and Forecast, By Drug

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Drug, 2017–2031

7.3.1. Tacrolimus

7.3.2. Methotrexate

7.3.3. Cyclosporin

7.3.4. Others

7.4. Market Attractiveness Analysis, By Drug

8. Global Transplant Drug Monitoring Assay Market Analysis and Forecast, By Technology

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Technology , 2017–2031

8.3.1. Immunoassays

8.3.2. Chromatography-MS

8.3.3. Others

8.4. Market Attractiveness Analysis, By Technology

9. Global Transplant Drug Monitoring Assay Market Analysis and Forecast, By End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospital Laboratories

9.3.2. Commercial & Private Laboratories

9.3.3. Others

9.4. Market Attractiveness Analysis, By End-user

10. Global Transplant Drug Monitoring Assay Market Analysis and Forecast, By Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, By Region

11. North America Transplant Drug Monitoring Assay Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Consumables

11.2.2. Equipment

11.2.2.1. Immunoassay Analyzers

11.2.2.2. Chromatography & MS Detectors

11.2.2.3. Clinical Chemistry Analyzers

11.3. Market Value Forecast, by Drug, 2017–2031

11.3.1. Tacrolimus

11.3.2. Methotrexate

11.3.3. Cyclosporin

11.3.4. Others

11.4. Market Value Forecast, by Technology, 2017–2031

11.4.1. Immunoassays

11.4.2. Chromatography-MS

11.4.3. Others

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Hospital Laboratories

11.5.2. Commercial & Private Laboratories

11.5.3. Others

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Drug

11.7.3. By Technology

11.7.4. By End-user

11.7.5. By Country

12. Europe Transplant Drug Monitoring Assay Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Consumables

12.2.2. Equipment

12.2.2.1. Immunoassay Analyzers

12.2.2.2. Chromatography & MS Detectors

12.2.2.3. Clinical Chemistry Analyzers

12.3. Market Value Forecast, by Drug, 2017–2031

12.3.1. Tacrolimus

12.3.2. Methotrexate

12.3.3. Cyclosporin

12.3.4. Others

12.4. Market Value Forecast, by Technology, 2017–2031

12.4.1. Immunoassays

12.4.2. Chromatography-MS

12.4.3. Others

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Hospital Laboratories

12.5.2. Commercial & Private Laboratories

12.5.3. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Drug

12.7.3. By Technology

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Transplant Drug Monitoring Assay Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Consumables

13.2.2. Equipment

13.2.2.1. Immunoassay Analyzers

13.2.2.2. Chromatography & MS Detectors

13.2.2.3. Clinical Chemistry Analyzers

13.3. Market Value Forecast, by Drug, 2017–2031

13.3.1. Tacrolimus

13.3.2. Methotrexate

13.3.3. Cyclosporin

13.3.4. Others

13.4. Market Value Forecast, by Technology, 2017–2031

13.4.1. Immunoassays

13.4.2. Chromatography-MS

13.4.3. Others

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Hospital Laboratories

13.5.2. Commercial & Private Laboratories

13.5.3. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Drug

13.7.3. By Technology

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Transplant Drug Monitoring Assay Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Consumables

14.2.2. Equipment

14.2.2.1. Immunoassay Analyzers

14.2.2.2. Chromatography & MS Detectors

14.2.2.3. Clinical Chemistry Analyzers

14.3. Market Value Forecast, by Drug, 2017–2031

14.3.1. Tacrolimus

14.3.2. Methotrexate

14.3.3. Cyclosporin

14.3.4. Others

14.4. Market Value Forecast, by Technology , 2017–2031

14.4.1. Immunoassays

14.4.2. Chromatography-MS

14.4.3. Others

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Hospital Laboratories

14.5.2. Commercial & Private Laboratories

14.5.3. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Drug

14.7.3. By Technology

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Transplant Drug Monitoring Assay Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product, 2017–2031

15.2.1. Consumables

15.2.2. Equipment

15.2.2.1. Immunoassay Analyzers

15.2.2.2. Chromatography & MS Detectors

15.2.2.3. Clinical Chemistry Analyzers

15.3. Market Value Forecast, by Drug, 2017–2031

15.3.1. Tacrolimus

15.3.2. Methotrexate

15.3.3. Cyclosporin

15.3.4. Others

15.4. Market Value Forecast, by Technology , 2017–2031

15.4.1. Immunoassays

15.4.2. Chromatography-MS

15.4.3. Others

15.5. Market Value Forecast, by End-user, 2017–2031

15.5.1. Hospital Laboratories

15.5.2. Commercial & Private Laboratories

15.5.3. Others

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product

15.7.2. By Drug

15.7.3. By Technology

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company, 2021

16.3. Company Profiles

16.3.1. Abbott

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Company Financials

16.3.1.3. Growth Strategies

16.3.1.4. SWOT Analysis

16.3.2. Thermo Fisher Scientific, Inc.

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Company Financials

16.3.2.3. Growth Strategies

16.3.2.4. SWOT Analysis

16.3.3. H.U. Group Holdings Inc. (Fujirebio Holdings, Inc.)

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Company Financials

16.3.3.3. Growth Strategies

16.3.3.4. SWOT Analysis

16.3.4. Hoffmann-La Roche Ltd.

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Company Financials

16.3.4.3. Growth Strategies

16.3.4.4. SWOT Analysis

16.3.5. Siemens Healthineers AG

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Company Financials

16.3.5.3. Growth Strategies

16.3.5.4. SWOT Analysis

16.3.6. Hologic, Inc.

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Company Financials

16.3.6.3. Growth Strategies

16.3.6.4. SWOT Analysis

16.3.7. Danaher Corporation

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Company Financials

16.3.7.3. Growth Strategies

16.3.7.4. SWOT Analysis

16.3.8. Bio-Rad Laboratories, Inc.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Company Financials

16.3.8.3. Growth Strategies

16.3.8.4. SWOT Analysis

List of Tables

Table 01: Global Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Equipment, 2017–2031

Table 03: Global Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 04: Global Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Drug, 2017–2031

Table 05: Global Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: Global Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 08: North America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 09: North America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Equipment, 2017–2031

Table 10: North America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 11: North America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Drug, 2017–2031

Table 12: North America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Europe Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Europe Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Europe Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Equipment, 2017–2031

Table 16: Europe Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 17: Europe Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Drug, 2017–2031

Table 18: Europe Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 19: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 20: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 21: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Equipment, 2017–2031

Table 22: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 23: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Drug, 2017–2031

Table 24: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 25: Latin America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 26: Latin America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 27: Latin America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Equipment, 2017–2031

Table 28: Latin America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 29: Latin America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Drug, 2017–2031

Table 30: Latin America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 31: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 32: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 33: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Equipment, 2017–2031

Table 34: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Technology, 2017–2031

Table 35: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by Drug, 2017–2031

Table 36: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Transplant Drug Monitoring (TDM) Assay Market, by Product, 2021 and 2031

Figure 02: Global Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Product, 2022–2031

Figure 03: Global Transplant Drug Monitoring (TDM) Assay Market (US$ Mn), by Consumables, 2017–2031

Figure 04: Global Transplant Drug Monitoring (TDM) Assay Market (US$ Mn), by Equipment, 2017–2031

Figure 05: Global Transplant Drug Monitoring (TDM) Assay Market, by Technology, 2021 and 2031

Figure 06: Global Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Technology, 2022–2031

Figure 07: Global Transplant Drug Monitoring (TDM) Assay Market (US$ Mn), by Immunoassays, 2017–2031

Figure 08: Global Transplant Drug Monitoring (TDM) Assay Market (US$ Mn), by Chromatography-MS, 2017–2031

Figure 09: Global Transplant Drug Monitoring (TDM) Assay Market (US$ Mn), by Others, 2017–2031

Figure 10: Global Transplant Drug Monitoring (TDM) Assay Market, by Drug, 2021 and 2031

Figure 11: Global Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Drug, 2022–2031

Figure 12: Global Transplant Drug Monitoring (TDM) Assay Market (US$ Mn), by Tacrolimus, 2017–2031

Figure 13: Global Transplant Drug Monitoring (TDM) Assay Market (US$ Mn), by Methotrexate, 2017–2031

Figure 14: Global Transplant Drug Monitoring (TDM) Assay Market (US$ Mn), by Cyclosporin, 2017–2031

Figure 15: Global Transplant Drug Monitoring (TDM) Assay Market (US$ Mn), by Others, 2017–2031

Figure 16: Global Transplant Drug Monitoring (TDM) Assay Market, by End-user, 2021 and 2031

Figure 17: Global Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by End-user, 2022–2031

Figure 18: Global Transplant Drug Monitoring (TDM) Assay Market (US$ Mn), by Hospital Laboratories, 2017–2031

Figure 19: Global Transplant Drug Monitoring (TDM) Assay Market (US$ Mn), by Commercial & Private Laboratories, 2017–2031

Figure 20: Global Transplant Drug Monitoring (TDM) Assay Market (US$ Mn), by Others, 2017–2031

Figure 21: Global Transplant Drug Monitoring (TDM) Assay Market, by Region, 2021 and 2031

Figure 22: Global Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Region, 2022–2031

Figure 23: North America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, 2017–2031

Figure 24: North America Transplant Drug Monitoring (TDM) Assay Market, by Country, 2021 and 2031

Figure 25: North America Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Country, 2022–2031

Figure 26: North America Transplant Drug Monitoring (TDM) Assay Market, by Product, 2021 and 2031

Figure 27: North America Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Product, 2022–2031

Figure 28: North America Transplant Drug Monitoring (TDM) Assay Market, by Technology, 2021 and 2031

Figure 29: North America Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Technology, 2022–2031

Figure 30: North America Transplant Drug Monitoring (TDM) Assay Market, by Drug, 2021 and 2031

Figure 31: North America Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Drug, 2022–2031

Figure 32: North America Transplant Drug Monitoring (TDM) Assay Market, by End-user, 2021 and 2031

Figure 33: North America Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by End-user, 2022–2031

Figure 34: Europe Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, 2017–2031

Figure 35: Europe Transplant Drug Monitoring (TDM) Assay Market, by Country/Sub-region, 2021 and 2031

Figure 36: Europe Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 37: Europe Transplant Drug Monitoring (TDM) Assay Market, by Product, 2021 and 2031

Figure 38: Europe Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Product, 2022–2031

Figure 39: Europe Transplant Drug Monitoring (TDM) Assay Market, by Technology, 2021 and 2031

Figure 40: Europe Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Technology, 2022–2031

Figure 41: Europe Transplant Drug Monitoring (TDM) Assay Market, by Drug, 2021 and 2031

Figure 42: Europe Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Drug, 2022–2031

Figure 43: Europe Transplant Drug Monitoring (TDM) Assay Market, by End-user, 2021 and 2031

Figure 44: Europe Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by End-user, 2022–2031

Figure 45: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, 2017–2031

Figure 46: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market, by Country/Sub-region/Sub-region, 2021 and 2031

Figure 47: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 48: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market, by Product, 2021 and 2031

Figure 49: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Product, 2022–2031

Figure 50: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market, by Technology, 2021 and 2031

Figure 51: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Technology, 2022–2031

Figure 52: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market, by Drug, 2021 and 2031

Figure 53: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Drug, 2022–2031

Figure 54: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market, by End-user, 2021 and 2031

Figure 55: Asia Pacific Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by End-user, 2022–2031

Figure 56: Latin America Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, 2017–2031

Figure 57: Latin America Transplant Drug Monitoring (TDM) Assay Market, by Country/Sub-region, 2021 and 2031

Figure 58: Latin America Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 59: Latin America Transplant Drug Monitoring (TDM) Assay Market, by Product, 2021 and 2031

Figure 60: Latin America Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Product, 2022–2031

Figure 61: Latin America Transplant Drug Monitoring (TDM) Assay Market, by Technology, 2021 and 2031

Figure 62: Latin America Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Technology, 2022–2031

Figure 63: Latin America Transplant Drug Monitoring (TDM) Assay Market, by Drug, 2021 and 2031

Figure 64: Latin America Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Drug, 2022–2031

Figure 65: Latin America Transplant Drug Monitoring (TDM) Assay Market, by End-user, 2021 and 2031

Figure 66: Latin America Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by End-user, 2022–2031

Figure 67: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market Value (US$ Mn) Forecast, 2017–2031

Figure 68: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market, by Country/Sub-region, 2021 and 2031

Figure 69: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 70: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market, by Product, 2021 and 2031

Figure 71: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Product, 2022–2031

Figure 72: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market, by Technology, 2021 and 2031

Figure 73: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Technology, 2022–2031

Figure 74: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market, by Drug, 2021 and 2031

Figure 75: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by Drug, 2022–2031

Figure 76: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market, by End-user, 2021 and 2031

Figure 77: Middle East & Africa Transplant Drug Monitoring (TDM) Assay Market Attractiveness Analysis, by End-user, 2022–2031

Figure 78: Global Transplant Drug Monitoring (TDM) Assay Market Share Analysis/Ranking, by Company, 2021