Reports

Reports

Analysts’ Viewpoint

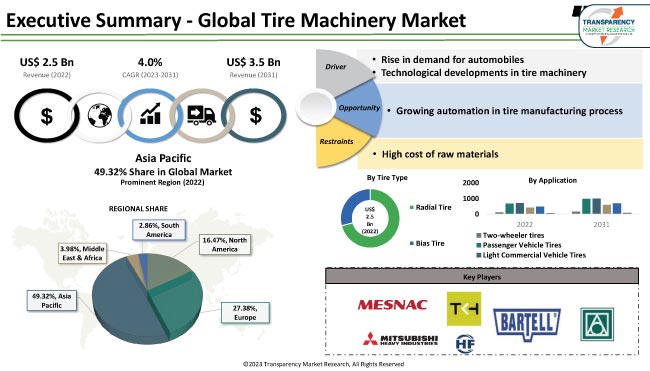

Exponential rise in demand for passenger and commercial motor vehicles is a key factor boosting the tire machinery industry. The prevailing tire machinery market trend witnessed across the globe is the increasing production and usage of specialized machinery required to manufacture radial and tubeless tires. Increased focus on Industry 4.0 applications in the tire industry, growing sales and production of automobiles, major capacity expansions by tire manufacturers to cater to the increased tire demand, and the growing demand for replacement tires in the aftermarket segment are also some of the prominent factors responsible for the increased demand for tire machinery.

Based on application, the light commercial vehicle segment held a major share of the market, while the off-road vehicle segment is expanding at a rapid pace due to a rise in the demand for light commercial vehicles for last-mile deliveries induced by the rapidly growing e-commerce sector. Manufacturers are also tapping into incremental opportunities in the tire machinery industry to broaden their revenue streams by offering Industry 4.0-related services to tire manufacturers.

Tire machinery is the equipment used in the process of tire manufacturing. Tire machinery is used to assemble different tire parts such as body ply, sidewall, bead, tread and inner liner into one single tire unit.

Rising automobile sales and increase in production of tires to meet the growing demand for automobiles are estimated to positively impact the tire machinery market outlook in the next few years. Furthermore, the market is also estimated to expand due to the accelerated digitization caused by increasing adoption of Industry 4.0 applications in the tire manufacturing process.

In most cases, especially in developing countries, automobile sales are continuously rising due to increase in per capita income, decent economic growth, and rapid urbanization leading to increased distances between places of work and residence as well as psychological factors such as viewing automobile ownership as a big status symbol. According International Energy Agency, passenger car sales in the emerging and developing economies accounted for 40.90 million units in 2022, and this number is estimated to grow in the near future. This, in turn, has led to a significant demand for tires.

In passenger vehicles, buyers are increasingly demanding greater safety and better ride and handling characteristics, and tires play a crucial role in the safety and handling of any vehicle. Thus, it has led to the increased sales of radial tires. This demand for increased safety in automobiles is also anticipated to create significant tire machinery market opportunities for manufacturers across the globe.

Automobile production is increasing at a healthy pace to meet the ever growing demand for automobiles. Rising sales of electric, connected and autonomous vehicles is further propelling the demand for automobiles, worldwide. This has benefitted the global tire industry also.

The tire manufacturing industry is estimated to witness rapid increase in adoption of smart and connected technologies such as Internet of Things (IoT) technologies and other Industry 4.0 applications such as 3D printing. These new technologies are anticipated to drive the market for tire machinery due to increased focus of tire manufacturers in streamlining their manufacturing processes to achieve greater efficiency resulting into fewer breakdowns, lesser downtime, better capacity utilization, and more plant safety, resulting into improved profitability.

Additionally, new revenue opportunities such as back end data processing and the analysis of the real-time data collected by these smart technologies are likely to emerge for prominent tire machinery market players. Digitization of tire manufacturing process is setting the trend for the future in the tire machinery business. Thus, technological developments in the tire machinery are anticipated to boost the tire machinery market progress in the near future.

In terms of tire type, the radial tire segment accounted for 70.97% of the global tire machinery market share in 2022. The segment is estimated to maintain is dominant share and expand at a healthy CAGR during the forecast period primarily due to the rising demand for radial tires, globally.

Radial tires provide good safety and stability to a vehicle as compared to other types of tires. Furthermore, rapid rise in sales of luxury and premium vehicles is expected to ensure the dominance of the radial tire machinery application segment in the tire machinery market. The bias tire segment is projected to expand at a sluggish pace due to the decline in demand for bias tires.

In terms of application, the global tire machinery market segmentation comprises two-wheeler tires, passenger vehicle tires, light commercial vehicle tires, medium & heavy comer vehicle tires, off-road vehicle tires and aircraft tires. The light commercial vehicle segment dominated the global tire machinery business in 2022.

Rise in sales of light commercial vehicles due to growing demand for last mile deliveries caused by growth of e-commerce and online shopping has increased the demand for light commercial vehicle tires considerably. This has contributed to the dominant share held by the segment. The off-road vehicle tire segment is estimated to expand at rapid pace primarily due to growing sales of off-road equipment in mining and construction industries across the globe.

According to the latest tire machinery market analysis, in terms of volume, Asia Pacific held a prominent share of the global tire machinery market in 2022. This was majorly attributed to the significant demand for automobiles, presence of large number of tire manufacturers, easy availability of raw materials and the presence of major OEMs, such as Larsen & Toubro Ltd. Nakata Engineering, Guilin Zhonghao Mechl & Elec Equipment Co. Ltd., Tianjin Saixiang Technology Co., Ltd. and Mitsubishi Heavy Industries Ltd., in the region. China, India, and ASEAN accounted for 48.87%, 16.16% and 20.72% shares, respectively, of the Asia Pacific market.

North America and Europe are also prominent markets for tire machinery, which held 16.47% and 27.38% share, respectively, of the global market in 2022. Growth of the North America tire machinery market can attributed to rise in sales of passenger vehicles in the region. Additionally, in Europe, demand for off-highway vehicles is projected to grow at a healthy pace during the forecast period.

The global tire machinery market is fairly consolidated with the largest vendors controlling a majority of the market share. A majority of the firms are spending significantly on comprehensive research and development, primarily to develop highly advanced products. Expansion of product portfolios and strategic partnerships are major strategies adopted by key players. All Well Industry Co., Ltd., AS Tyre Machines, Bartell Machinery Systems Llc., Double Star Machinery, Erhardt+Leimer GmbH, Guilin Zhonghao Mechl & Elec Equipment Co. Ltd., Herbert Maschinenbau Gmbh & Co., HF Tire Tech, KONŠTRUKTA, TireTech, a.s., Larsen & Toubro Limited (L&T Rubber Processing Machinery), Marangoni, MERTC, MESNAC, Mitsubishi Heavy Industries, Ltd, Nakata Engineering Co. Ltd, Pelmar Group Ltd., Plastea Group, Samson Machinery, Shenyang Blue Silver Industry Automatic Equipment Co., Ltd., Suzhou Safe Run, Tianjin Saixiang Technology Co., Ltd., TKH Group NV are the prominent entities operating in the market.

Key players in the tire machinery market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 (Base Year) | US$ 2.5 Bn |

| Market Forecast Value in 2031 | US$ 3.5 Bn |

| Growth Rate (CAGR) | 4.0% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Units for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, Value chain analysis, industry trend analysis, etc. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global market was valued at US$ 2.5 Bn in 2022

It is expected to expand at a CAGR of 4.0% by 2031

The global business is expected to be worth US$ 3.5 Bn in 2031

All Well Industry Co., Ltd., AS Tyre Machines, Bartell Machinery Systems Llc., Double Star Machinery, Erhardt+Leimer GmbH, Guilin Zhonghao Mechl & Elec Equipment Co. Ltd., Herbert Maschinenbau Gmbh & Co., HF Tire Tech, KONŠTRUKTA, TireTech, a.s., Larsen & Toubro Limited (L&T Rubber Processing Machinery), Marangoni, MERTC, MESNAC, Mitsubishi Heavy Industries, Ltd, Nakata Engineering Co. Ltd, Pelmar Group Ltd., Plastea Group, Samson Machinery, Shenyang Blue Silver Industry Automatic Equipment Co.

The tire machinery market in the U.S. is estimated to be valued at US$ 313.14 Mn

In terms of machine type, the extrusion machines segment accounted for highest share in 2022

Introduction of IoT-enabled tire manufacturing machines, application of Industry 4.0 applications in tire machinery and rising sales of specialised tire machinery used in making radial tires

Asia Pacific is the most lucrative region in 2022

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Units, US$ Bn, 2017-2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Market Definition / Scope / Limitations

3.2. Macro-Economic Factors

3.3. Market Dynamics

3.3.1. Drivers

3.3.2. Restraints

3.3.3. Opportunity

3.4. Market Factor Analysis

3.4.1. Porter’s Five Force Analysis

3.4.2. SWOT Analysis

3.5. Regulatory Scenario

4. Key Trend Analysis

4.1. Automation & Industry 4.0

4.1.1. Process for Automation in Tire Machinery Industry

4.1.2. Sales Channel Approach, System/ Application Procurement, Business model for key players

4.1.3. Business Case Study – Tire Machinery

4.1.4. RFID, AI, MOM, IOT Tire Types

4.1.5. PLCs & Panels, Motors & Drivers, Logistics & Software, HMIs

4.2. Emergence of Smart Tire

5. Who Supplies Whom

5.1. Key Suppliers of Machines

5.1.1. By Machine Type

5.2. Customers of Tire Machines/ Tire Manufacturers

6. Industry Ecosystem Analysis

6.1. Value Chain Analysis

6.1.1. Raw Material Supplier

6.1.2. Application Manufacturer

6.1.3. System Suppliers

6.1.4. Tier 1 Players

6.1.5. 0.5 Tier Players/ Technology Providers

6.1.6. OEMs/ End-users

7. Global Tire Machinery Market Demand (in Volume (Units) or Value in US$ Bn) Analysis and Forecast, 2017-2031

7.1. Current and Future Market Value (US$ Bn) Projections, 2017-2031

7.1.1. Y-o-Y Growth Trend Analysis

7.1.2. Absolute $ Opportunity Analysis

8. Pricing Analysis

8.1. Regional Tire Machinery Sales Pricing (US$), 2017-2031

8.2. Cost Structure Analysis

8.3. Profit Margin Analysis

9. COVID-19 Impact Analysis – Tire Machinery Market

10. Impact Factors

10.1. Sustainability Related Trends – Growing Popularity of Retreading

10.2. Key Strategies Adopted by Tire Manufacturers

10.3. Advent of 3D printed tires

10.4. Changing requirements of tires for new age vehicles

11. Global Tire Machinery Market, by Machine Type

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Machine Type

11.2.1. Mixing Machine/ Rubber Mixers

11.2.2. Calendaring Machine

11.2.3. Extrusion Machines

11.2.3.1. Multi Extrusion Lines

11.2.3.2. Inner Liner Lines

11.2.3.3. Extruders

11.2.3.4. Cooling Units

11.2.4. Cutting Machines

11.2.4.1. Textile Cord Cutting Lines

11.2.4.2. Steel Cord Cutting Lines

11.2.5. Bead Winding Machines

11.2.6. Strip Winding Systems

11.2.7. Tire Building Machines

11.2.8. Tire Painting Machine

11.2.9. Curing Press Machine

11.2.10. Inspection System

12. Global Tire Machinery Market, by Tire Type

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Tire Type

12.2.1. Radial Tire

12.2.2. Bias Tire

13. Global Tire Machinery Market, by Application

13.1. Market Snapshot

13.1.1. Introduction, Definition, and Key Findings

13.1.2. Market Growth & Y-o-Y Projections

13.1.3. Base Point Share Analysis

13.2. Global Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

13.2.1. Two-wheeler tires

13.2.2. Passenger Vehicle Tires

13.2.2.1. Hatchback

13.2.2.2. Sedan

13.2.2.3. Utility Vehicles

13.2.3. Light Commercial Vehicle Tires

13.2.4. Medium & Heavy Commercial Vehicle Tires

13.2.5. Off-road Vehicle Tires

13.2.5.1. Agriculture Equipment

13.2.5.2. Construction & Mining Equipment

13.2.5.3. Others (ATVs, UTVs, etc.)

13.2.6. Aircraft Tires

14. Global Tire Machinery Market, by Region

14.1. Market Snapshot

14.1.1. Introduction, Definition, and Key Findings

14.1.2. Market Growth & Y-o-Y Projections

14.1.3. Base Point Share Analysis

14.2. Global Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Region

14.2.1. North America

14.2.2. Europe

14.2.3. Asia Pacific

14.2.4. Middle East & Africa

14.2.5. South America

15. North America Tire Machinery Market

15.1. Market Snapshot

15.2. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Machine Type

15.2.1. Mixing Machine/ Rubber Mixers

15.2.2. Calendaring Machine

15.2.3. Extrusion Machines

15.2.3.1. Multi Extrusion Lines

15.2.3.2. Inner Liner Lines

15.2.3.3. Extruders

15.2.3.4. Cooling Units

15.2.4. Cutting Machines

15.2.4.1. Textile Cord Cutting Lines

15.2.4.2. Steel Cord Cutting Lines

15.2.5. Bead Winding Machines

15.2.6. Strip Winding Systems

15.2.7. Tire Building Machines

15.2.8. Tire Painting Machine

15.2.9. Curing Press Machine

15.2.10. Inspection System

15.3. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Tire Type

15.3.1. Radial Tire

15.3.2. Bias Tire

15.4. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

15.4.1. Two-wheeler tires

15.4.2. Passenger Vehicle Tires

15.4.2.1. Hatchback

15.4.2.2. Sedan

15.4.2.3. Utility Vehicles

15.4.3. Light Commercial Vehicle Tires

15.4.4. Medium & Heavy Commercial Vehicle Tires

15.4.5. Off-road Vehicle Tires

15.4.5.1. Agriculture Equipment

15.4.5.2. Construction & Mining Equipment

15.4.5.3. Others (ATVs, UTVs, etc.)

15.4.6. Aircraft Tires

15.5. Key Country Analysis – North America Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

15.5.1. The U. S.

15.5.2. Canada

15.5.3. Mexico

16. Europe Tire Machinery Market

16.1. Market Snapshot

16.2. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Machine Type

16.2.1. Mixing Machine/ Rubber Mixers

16.2.2. Calendaring Machine

16.2.3. Extrusion Machines

16.2.3.1. Multi Extrusion Lines

16.2.3.2. Inner Liner Lines

16.2.3.3. Extruders

16.2.3.4. Cooling Units

16.2.4. Cutting Machines

16.2.4.1. Textile Cord Cutting Lines

16.2.4.2. Steel Cord Cutting Lines

16.2.5. Bead Winding Machines

16.2.6. Strip Winding Systems

16.2.7. Tire Building Machines

16.2.8. Tire Painting Machine

16.2.9. Curing Press Machine

16.2.10. Inspection System

16.3. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Tire Type

16.3.1. Radial Tire

16.3.2. Bias Tire

16.4. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

16.4.1. Two-wheeler tires

16.4.2. Passenger Vehicle Tires

16.4.2.1. Hatchback

16.4.2.2. Sedan

16.4.2.3. Utility Vehicles

16.4.3. Light Commercial Vehicle Tires

16.4.4. Medium & Heavy Commercial Vehicle Tires

16.4.5. Off-road Vehicle Tires

16.4.5.1. Agriculture Equipment

16.4.5.2. Construction & Mining Equipment

16.4.5.3. Others (ATVs, UTVs, etc.)

16.4.6. Aircraft Tires

16.5. Key Country Analysis – Europe Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

16.5.1. Germany

16.5.2. U. K.

16.5.3. France

16.5.4. Italy

16.5.5. Spain

16.5.6. Nordic Countries

16.5.7. Russia & CIS

16.5.8. Rest of Europe

17. Asia Pacific Tire Machinery Market

17.1. Market Snapshot

17.2. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Machine Type

17.2.1. Mixing Machine/ Rubber Mixers

17.2.2. Calendaring Machine

17.2.3. Extrusion Machines

17.2.3.1. Multi Extrusion Lines

17.2.3.2. Inner Liner Lines

17.2.3.3. Extruders

17.2.3.4. Cooling Units

17.2.4. Cutting Machines

17.2.4.1. Textile Cord Cutting Lines

17.2.4.2. Steel Cord Cutting Lines

17.2.5. Bead Winding Machines

17.2.6. Strip Winding Systems

17.2.7. Tire Building Machines

17.2.8. Tire Painting Machine

17.2.9. Curing Press Machine

17.2.10. Inspection System

17.3. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Tire Type

17.3.1. Radial Tire

17.3.2. Bias Tire

17.4. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

17.4.1. Two-wheeler tires

17.4.2. Passenger Vehicle Tires

17.4.2.1. Hatchback

17.4.2.2. Sedan

17.4.2.3. Utility Vehicles

17.4.3. Light Commercial Vehicle Tires

17.4.4. Medium & Heavy Commercial Vehicle Tires

17.4.5. Off-road Vehicle Tires

17.4.5.1. Agriculture Equipment

17.4.5.2. Construction & Mining Equipment

17.4.5.3. Others (ATVs, UTVs, etc.)

17.4.6. Aircraft Tires

17.5. Key Country Analysis – Asia Pacific Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

17.5.1. China

17.5.2. India

17.5.3. Japan

17.5.4. ASEAN Countries

17.5.5. South Korea

17.5.6. ANZ

17.5.7. Rest of Asia Pacific

18. Middle East & Africa Tire Machinery Market

18.1. Market Snapshot

18.2. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Machine Type

18.2.1. Mixing Machine/ Rubber Mixers

18.2.2. Calendaring Machine

18.2.3. Extrusion Machines

18.2.3.1. Multi Extrusion Lines

18.2.3.2. Inner Liner Lines

18.2.3.3. Extruders

18.2.3.4. Cooling Units

18.2.4. Cutting Machines

18.2.4.1. Textile Cord Cutting Lines

18.2.4.2. Steel Cord Cutting Lines

18.2.5. Bead Winding Machines

18.2.6. Strip Winding Systems

18.2.7. Tire Building Machines

18.2.8. Tire Painting Machine

18.2.9. Curing Press Machine

18.2.10. Inspection System

18.3. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Tire Type

18.3.1. Radial Tire

18.3.2. Bias Tire

18.4. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

18.4.1. Two-wheeler tires

18.4.2. Passenger Vehicle Tires

18.4.2.1. Hatchback

18.4.2.2. Sedan

18.4.2.3. Utility Vehicles

18.4.3. Light Commercial Vehicle Tires

18.4.4. Medium & Heavy Commercial Vehicle Tires

18.4.5. Off-road Vehicle Tires

18.4.5.1. Agriculture Equipment

18.4.5.2. Construction & Mining Equipment

18.4.5.3. Others (ATVs, UTVs, etc.)

18.4.6. Aircraft Tires

18.5. Key Country Analysis – Middle East & Africa Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

18.5.1. GCC

18.5.2. South Africa

18.5.3. Turkey

18.5.4. Rest of Middle East & Africa

19. South America Tire Machinery Market

19.1. Market Snapshot

19.2. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Machine Type

19.2.1. Mixing Machine/ Rubber Mixers

19.2.2. Calendaring Machine

19.2.3. Extrusion Machines

19.2.3.1. Multi Extrusion Lines

19.2.3.2. Inner Liner Lines

19.2.3.3. Extruders

19.2.3.4. Cooling Units

19.2.4. Cutting Machines

19.2.4.1. Textile Cord Cutting Lines

19.2.4.2. Steel Cord Cutting Lines

19.2.5. Bead Winding Machines

19.2.6. Strip Winding Systems

19.2.7. Tire Building Machines

19.2.8. Tire Painting Machine

19.2.9. Curing Press Machine

19.2.10. Inspection System

19.3. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Tire Type

19.3.1. Radial Tire

19.3.2. Bias Tire

19.4. Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031, By Application

19.4.1. Two-wheeler tires

19.4.2. Passenger Vehicle Tires

19.4.2.1. Hatchback

19.4.2.2. Sedan

19.4.2.3. Utility Vehicles

19.4.3. Light Commercial Vehicle Tires

19.4.4. Medium & Heavy Commercial Vehicle Tires

19.4.5. Off-road Vehicle Tires

19.4.5.1. Agriculture Equipment

19.4.5.2. Construction & Mining Equipment

19.4.5.3. Others (ATVs, UTVs, etc.)

19.4.6. Aircraft Tires

19.5. Key Country Analysis – South America Tire Machinery Market Size (Units) & Value (US$ Bn) Analysis & Forecast, 2017-2031

19.5.1. Brazil

19.5.2. Argentina

19.5.3. Rest of South America

20. Competitive Landscape

20.1. Company Share Analysis/ Brand Share Analysis, 2022

20.2. Key Strategy Analysis

20.2.1. Strategic Overview - Expansion, M&A, Partnership

20.2.2. Product & Marketing Strategy

20.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

21. Company Profile/ Key Players – Tire Machinery Manufacturers

21.1. All Well Industry Co., Ltd.

21.1.1. Company Overview

21.1.2. Company Footprints

21.1.3. Production Locations

21.1.4. Product Portfolio

21.1.5. Competitors & Customers

21.1.6. Subsidiaries & Parent Organization

21.1.7. Recent Developments

21.1.8. Financial Analysis

21.1.9. Profitability

21.1.10. Revenue Share

21.1.11. Executive Bios

21.2. Astyremachines

21.2.1. Company Overview

21.2.2. Company Footprints

21.2.3. Production Locations

21.2.4. Product Portfolio

21.2.5. Competitors & Customers

21.2.6. Subsidiaries & Parent Organization

21.2.7. Recent Developments

21.2.8. Financial Analysis

21.2.9. Profitability

21.2.10. Revenue Share

21.2.11. Executive Bios

21.3. Bartell Machinery Systems Llc.

21.3.1. Company Overview

21.3.2. Company Footprints

21.3.3. Production Locations

21.3.4. Product Portfolio

21.3.5. Competitors & Customers

21.3.6. Subsidiaries & Parent Organization

21.3.7. Recent Developments

21.3.8. Financial Analysis

21.3.9. Profitability

21.3.10. Revenue Share

21.3.11. Executive Bios

21.4. Double Star Machinery

21.4.1. Company Overview

21.4.2. Company Footprints

21.4.3. Production Locations

21.4.4. Product Portfolio

21.4.5. Competitors & Customers

21.4.6. Subsidiaries & Parent Organization

21.4.7. Recent Developments

21.4.8. Financial Analysis

21.4.9. Profitability

21.4.10. Revenue Share

21.4.11. Executive Bios

21.5. Erhardt+Leimer GmbH

21.5.1. Company Overview

21.5.2. Company Footprints

21.5.3. Production Locations

21.5.4. Product Portfolio

21.5.5. Competitors & Customers

21.5.6. Subsidiaries & Parent Organization

21.5.7. Recent Developments

21.5.8. Financial Analysis

21.5.9. Profitability

21.5.10. Revenue Share

21.5.11. Executive Bios

21.6. Guilin Zhonghao Mechl & Elec Equipment Co. Ltd.

21.6.1. Company Overview

21.6.2. Company Footprints

21.6.3. Production Locations

21.6.4. Product Portfolio

21.6.5. Competitors & Customers

21.6.6. Subsidiaries & Parent Organization

21.6.7. Recent Developments

21.6.8. Financial Analysis

21.6.9. Profitability

21.6.10. Revenue Share

21.6.11. Executive Bios

21.7. Herbert Maschinenbau Gmbh & Co.

21.7.1. Company Overview

21.7.2. Company Footprints

21.7.3. Production Locations

21.7.4. Product Portfolio

21.7.5. Competitors & Customers

21.7.6. Subsidiaries & Parent Organization

21.7.7. Recent Developments

21.7.8. Financial Analysis

21.7.9. Profitability

21.7.10. Revenue Share

21.7.11. Executive Bios

21.8. HF Tire Tech

21.8.1. Company Overview

21.8.2. Company Footprints

21.8.3. Production Locations

21.8.4. Product Portfolio

21.8.5. Competitors & Customers

21.8.6. Subsidiaries & Parent Organization

21.8.7. Recent Developments

21.8.8. Financial Analysis

21.8.9. Profitability

21.8.10. Revenue Share

21.8.11. Executive Bios

21.9. KONŠTRUKTA-TireTech, a.s.

21.9.1. Company Overview

21.9.2. Company Footprints

21.9.3. Production Locations

21.9.4. Product Portfolio

21.9.5. Competitors & Customers

21.9.6. Subsidiaries & Parent Organization

21.9.7. Recent Developments

21.9.8. Financial Analysis

21.9.9. Profitability

21.9.10. Revenue Share

21.9.11. Executive Bios

21.10. Larsen & Toubro Limited (L&T Rubber Processing Machinery)

21.10.1. Company Overview

21.10.2. Company Footprints

21.10.3. Production Locations

21.10.4. Product Portfolio

21.10.5. Competitors & Customers

21.10.6. Subsidiaries & Parent Organization

21.10.7. Recent Developments

21.10.8. Financial Analysis

21.10.9. Profitability

21.10.10. Revenue Share

21.10.11. Executive Bios

21.11. Marangoni

21.11.1. Company Overview

21.11.2. Company Footprints

21.11.3. Production Locations

21.11.4. Product Portfolio

21.11.5. Competitors & Customers

21.11.6. Subsidiaries & Parent Organization

21.11.7. Recent Developments

21.11.8. Financial Analysis

21.11.9. Profitability

21.11.10. Revenue Share

21.11.11. Executive Bios

21.12. MERTC

21.12.1. Company Overview

21.12.2. Company Footprints

21.12.3. Production Locations

21.12.4. Product Portfolio

21.12.5. Competitors & Customers

21.12.6. Subsidiaries & Parent Organization

21.12.7. Recent Developments

21.12.8. Financial Analysis

21.12.9. Profitability

21.12.10. Revenue Share

21.12.11. Executive Bios

21.13. MESNAC

21.13.1. Company Overview

21.13.2. Company Footprints

21.13.3. Production Locations

21.13.4. Product Portfolio

21.13.5. Competitors & Customers

21.13.6. Subsidiaries & Parent Organization

21.13.7. Recent Developments

21.13.8. Financial Analysis

21.13.9. Profitability

21.13.10. Revenue Share

21.13.11. Executive Bios

21.14. Mitsubishi Heavy Industries, Ltd

21.14.1. Company Overview

21.14.2. Company Footprints

21.14.3. Production Locations

21.14.4. Product Portfolio

21.14.5. Competitors & Customers

21.14.6. Subsidiaries & Parent Organization

21.14.7. Recent Developments

21.14.8. Financial Analysis

21.14.9. Profitability

21.14.10. Revenue Share

21.14.11. Executive Bios

21.15. Nakata Engineering Co. Ltd

21.15.1. Company Overview

21.15.2. Company Footprints

21.15.3. Production Locations

21.15.4. Product Portfolio

21.15.5. Competitors & Customers

21.15.6. Subsidiaries & Parent Organization

21.15.7. Recent Developments

21.15.8. Financial Analysis

21.15.9. Profitability

21.15.10. Revenue Share

21.15.11. Executive Bios

21.16. Pelmar Group Ltd.

21.16.1. Company Overview

21.16.2. Company Footprints

21.16.3. Production Locations

21.16.4. Product Portfolio

21.16.5. Competitors & Customers

21.16.6. Subsidiaries & Parent Organization

21.16.7. Recent Developments

21.16.8. Financial Analysis

21.16.9. Profitability

21.16.10. Revenue Share

21.16.11. Executive Bios

21.17. Plastea Group

21.17.1. Company Overview

21.17.2. Company Footprints

21.17.3. Production Locations

21.17.4. Product Portfolio

21.17.5. Competitors & Customers

21.17.6. Subsidiaries & Parent Organization

21.17.7. Recent Developments

21.17.8. Financial Analysis

21.17.9. Profitability

21.17.10. Revenue Share

21.17.11. Executive Bios

21.18. Samson Machinery

21.18.1. Company Overview

21.18.2. Company Footprints

21.18.3. Production Locations

21.18.4. Product Portfolio

21.18.5. Competitors & Customers

21.18.6. Subsidiaries & Parent Organization

21.18.7. Recent Developments

21.18.8. Financial Analysis

21.18.9. Profitability

21.18.10. Revenue Share

21.18.11. Executive Bios

21.19. Shenyang Blue Silver Industry Automatic Equipment Co., Ltd.

21.19.1. Company Overview

21.19.2. Company Footprints

21.19.3. Production Locations

21.19.4. Product Portfolio

21.19.5. Competitors & Customers

21.19.6. Subsidiaries & Parent Organization

21.19.7. Recent Developments

21.19.8. Financial Analysis

21.19.9. Profitability

21.19.10. Revenue Share

21.19.11. Executive Bios

21.20. Suzhou Safe Run

21.20.1. Company Overview

21.20.2. Company Footprints

21.20.3. Production Locations

21.20.4. Product Portfolio

21.20.5. Competitors & Customers

21.20.6. Subsidiaries & Parent Organization

21.20.7. Recent Developments

21.20.8. Financial Analysis

21.20.9. Profitability

21.20.10. Revenue Share

21.20.11. Executive Bios

21.21. Tianjin Saixiang Technology Co., Ltd.

21.21.1. Company Overview

21.21.2. Company Footprints

21.21.3. Production Locations

21.21.4. Product Portfolio

21.21.5. Competitors & Customers

21.21.6. Subsidiaries & Parent Organization

21.21.7. Recent Developments

21.21.8. Financial Analysis

21.21.9. Profitability

21.21.10. Revenue Share

21.21.11. Executive Bios

21.22. TKH Group NV

21.22.1. Company Overview

21.22.2. Company Footprints

21.22.3. Production Locations

21.22.4. Product Portfolio

21.22.5. Competitors & Customers

21.22.6. Subsidiaries & Parent Organization

21.22.7. Recent Developments

21.22.8. Financial Analysis

21.22.9. Profitability

21.22.10. Revenue Share

21.22.11. Executive Bios

21.23. VMI Holland BV

21.23.1. Company Overview

21.23.2. Company Footprints

21.23.3. Production Locations

21.23.4. Product Portfolio

21.23.5. Competitors & Customers

21.23.6. Subsidiaries & Parent Organization

21.23.7. Recent Developments

21.23.8. Financial Analysis

21.23.9. Profitability

21.23.10. Revenue Share

21.23.11. Executive Bios

21.24. Other Key Players

21.24.1. Company Overview

21.24.2. Company Footprints

21.24.3. Production Locations

21.24.4. Product Portfolio

21.24.5. Competitors & Customers

21.24.6. Subsidiaries & Parent Organization

21.24.7. Recent Developments

21.24.8. Financial Analysis

21.24.9. Profitability

21.24.10. Revenue Share

21.24.11. Executive Bios

List of Tables

Table 1: Global Tire Machinery Market Volume ( Units) Forecast, by Machine Type, 2017-2031

Table 2: Global Tire Machinery Market Value (US$ Bn) Forecast, by Machine Type, 2017-2031

Table 3: Global Tire Machinery Market Volume (Units) Forecast, by Tire Type, 2017-2031

Table 4: Global Tire Machinery Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Table 5: Global Tire Machinery Market Volume (Units) Forecast, by Application, 2017-2031

Table 6: Global Tire Machinery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 7: Global Tire Machinery Market Volume (Units) Forecast, by Region, 2017-2031

Table 8: Global Tire Machinery Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 9: North America Tire Machinery Market Volume ( Units) Forecast, by Machine Type, 2017-2031

Table 10: North America Tire Machinery Market Value (US$ Bn) Forecast, by Machine Type, 2017-2031

Table 11: North America Tire Machinery Market Volume (Units) Forecast, by Tire Type, 2017-2031

Table 12: North America Tire Machinery Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Table 13: North America Tire Machinery Market Volume (Units) Forecast, by Application, 2017-2031

Table 14: North America Tire Machinery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 15: North America Tire Machinery Market Volume (Units) Forecast, by Country, 2017-2031

Table 16: North America Tire Machinery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 17: Europe Tire Machinery Market Volume ( Units) Forecast, by Machine Type, 2017-2031

Table 18: Europe Tire Machinery Market Value (US$ Bn) Forecast, by Machine Type, 2017-2031

Table 19: Europe Tire Machinery Market Volume (Units) Forecast, by Tire Type, 2017-2031

Table 20: Europe Tire Machinery Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Table 21: Europe Tire Machinery Market Volume (Units) Forecast, by Application, 2017-2031

Table 22: Europe Tire Machinery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 23: Europe Tire Machinery Market Volume (Units) Forecast, by Country, 2017-2031

Table 24: Europe Tire Machinery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Asia Pacific Tire Machinery Market Volume ( Units) Forecast, by Machine Type, 2017-2031

Table 26: Asia Pacific Tire Machinery Market Value (US$ Bn) Forecast, by Machine Type, 2017-2031

Table 27: Asia Pacific Tire Machinery Market Volume (Units) Forecast, by Tire Type, 2017-2031

Table 28: Asia Pacific Tire Machinery Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Table 29: Asia Pacific Tire Machinery Market Volume (Units) Forecast, by Application, 2017-2031

Table 30: Asia Pacific Tire Machinery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 31: Asia Pacific Tire Machinery Market Volume (Units) Forecast, by Country, 2017-2031

Table 32: Asia Pacific Tire Machinery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 33: Middle East & Africa Tire Machinery Market Volume ( Units) Forecast, by Machine Type, 2017-2031

Table 34: Middle East & Africa Tire Machinery Market Value (US$ Bn) Forecast, by Machine Type, 2017-2031

Table 35: Middle East & Africa Tire Machinery Market Volume (Units) Forecast, by Tire Type, 2017-2031

Table 36: Middle East & Africa Tire Machinery Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Table 37: Middle East & Africa Tire Machinery Market Volume (Units) Forecast, by Application, 2017-2031

Table 38: Middle East & Africa Tire Machinery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 39: Middle East & Africa Tire Machinery Market Volume (Units) Forecast, by Country, 2017-2031

Table 40: Middle East & Africa Tire Machinery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 41: South America Tire Machinery Market Volume ( Units) Forecast, by Machine Type, 2017-2031

Table 42: South America Tire Machinery Market Value (US$ Bn) Forecast, by Machine Type, 2017-2031

Table 43: South America Tire Machinery Market Volume (Units) Forecast, by Tire Type, 2017-2031

Table 44: South America Tire Machinery Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Table 45: South America Tire Machinery Market Volume (Units) Forecast, by Application, 2017-2031

Table 46: South America Tire Machinery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 47: South America Tire Machinery Market Volume (Units) Forecast, by Country, 2017-2031

Table 48: South America Tire Machinery Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Tire Machinery Market Volume (Units) Forecast, by Machine Type, 2017-2031

Figure 2: Global Tire Machinery Market Value (US$ Bn) Forecast, by Machine Type, 2017-2031

Figure 3: Global Tire Machinery Market, Incremental Opportunity, by Machine Type, Value (US$ Bn), 2023-2031

Figure 4: Global Tire Machinery Market Volume (Units) Forecast, by Tire Type, 2017-2031

Figure 5: Global Tire Machinery Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 6: Global Tire Machinery Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 7: Global Tire Machinery Market Volume (Units) Forecast, by Application, 2017-2031

Figure 8: Global Tire Machinery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 9: Global Tire Machinery Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 10: Global Tire Machinery Market Volume (Units) Forecast, by Region, 2017-2031

Figure 11: Global Tire Machinery Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Tire Machinery Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 13: North America Tire Machinery Market Volume (Units) Forecast, by Machine Type, 2017-2031

Figure 14: North America Tire Machinery Market Value (US$ Bn) Forecast, by Machine Type, 2017-2031

Figure 15: North America Tire Machinery Market, Incremental Opportunity, by Machine Type, Value (US$ Bn), 2023-2031

Figure 16: North America Tire Machinery Market Volume (Units) Forecast, by Tire Type, 2017-2031

Figure 17: North America Tire Machinery Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 18: North America Tire Machinery Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 19: North America Tire Machinery Market Volume (Units) Forecast, by Application, 2017-2031

Figure 20: North America Tire Machinery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 21: North America Tire Machinery Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 22: North America Tire Machinery Market Volume (Units) Forecast, by Country, 2017-2031

Figure 23: North America Tire Machinery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Tire Machinery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 25: Europe Tire Machinery Market Volume (Units) Forecast, by Machine Type, 2017-2031

Figure 26: Europe Tire Machinery Market Value (US$ Bn) Forecast, by Machine Type, 2017-2031

Figure 27: Europe Tire Machinery Market, Incremental Opportunity, by Machine Type, Value (US$ Bn), 2023-2031

Figure 28: Europe Tire Machinery Market Volume (Units) Forecast, by Tire Type, 2017-2031

Figure 29: Europe Tire Machinery Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 30: Europe Tire Machinery Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 31: Europe Tire Machinery Market Volume (Units) Forecast, by Application, 2017-2031

Figure 32: Europe Tire Machinery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 33: Europe Tire Machinery Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 34: Europe Tire Machinery Market Volume (Units) Forecast, by Country, 2017-2031

Figure 35: Europe Tire Machinery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Tire Machinery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Asia Pacific Tire Machinery Market Volume (Units) Forecast, by Machine Type, 2017-2031

Figure 38: Asia Pacific Tire Machinery Market Value (US$ Bn) Forecast, by Machine Type, 2017-2031

Figure 39: Asia Pacific Tire Machinery Market, Incremental Opportunity, by Machine Type, Value (US$ Bn), 2023-2031

Figure 40: Asia Pacific Tire Machinery Market Volume (Units) Forecast, by Tire Type, 2017-2031

Figure 41: Asia Pacific Tire Machinery Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 42: Asia Pacific Tire Machinery Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Tire Machinery Market Volume (Units) Forecast, by Application, 2017-2031

Figure 44: Asia Pacific Tire Machinery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 45: Asia Pacific Tire Machinery Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 46: Asia Pacific Tire Machinery Market Volume (Units) Forecast, by Country, 2017-2031

Figure 47: Asia Pacific Tire Machinery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Tire Machinery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 49: Middle East & Africa Tire Machinery Market Volume (Units) Forecast, by Machine Type, 2017-2031

Figure 50: Middle East & Africa Tire Machinery Market Value (US$ Bn) Forecast, by Machine Type, 2017-2031

Figure 51: Middle East & Africa Tire Machinery Market, Incremental Opportunity, by Machine Type, Value (US$ Bn), 2023-2031

Figure 52: Middle East & Africa Tire Machinery Market Volume (Units) Forecast, by Tire Type, 2017-2031

Figure 53: Middle East & Africa Tire Machinery Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 54: Middle East & Africa Tire Machinery Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 55: Middle East & Africa Tire Machinery Market Volume (Units) Forecast, by Application, 2017-2031

Figure 56: Middle East & Africa Tire Machinery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 57: Middle East & Africa Tire Machinery Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 58: Middle East & Africa Tire Machinery Market Volume (Units) Forecast, by Country, 2017-2031

Figure 59: Middle East & Africa Tire Machinery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Tire Machinery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: South America Tire Machinery Market Volume (Units) Forecast, by Machine Type, 2017-2031

Figure 62: South America Tire Machinery Market Value (US$ Bn) Forecast, by Machine Type, 2017-2031

Figure 63: South America Tire Machinery Market, Incremental Opportunity, by Machine Type, Value (US$ Bn), 2023-2031

Figure 64: South America Tire Machinery Market Volume (Units) Forecast, by Tire Type, 2017-2031

Figure 65: South America Tire Machinery Market Value (US$ Bn) Forecast, by Tire Type, 2017-2031

Figure 66: South America Tire Machinery Market, Incremental Opportunity, by Tire Type, Value (US$ Bn), 2023-2031

Figure 67: South America Tire Machinery Market Volume (Units) Forecast, by Application, 2017-2031

Figure 68: South America Tire Machinery Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 69: South America Tire Machinery Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 70: South America Tire Machinery Market Volume (Units) Forecast, by Country, 2017-2031

Figure 71: South America Tire Machinery Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Tire Machinery Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031