Reports

Reports

As industrial growth becomes the touchstone to gauge a country’s economic vigor, governments of numerous countries divert their focus towards enhancing industrial efficiency. The thermoelectric assembly remains one such attractive proposition for energy scavenging from the heat accumulated by various industrial processes, with almost negligible greenhouse gas emission.

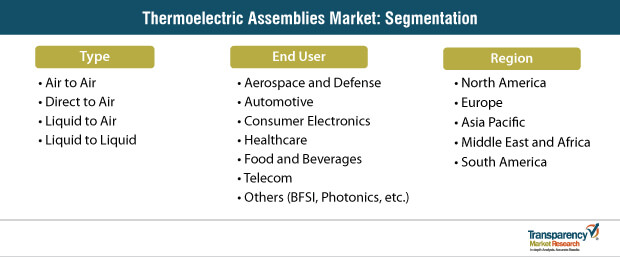

Rapid adoption of thermoelectric assemblies in numerous industries - telecom, automotive, healthcare, consumer electronics, and aerospace and defense – has, in turn, brought about stringent quality filters. For instance, for the adoption of thermoelectric assemblies in the telecommunication industry, they need to conform to Telcordia’s guidelines. This has caused a stir in the manufacturing approach of thermoelectric assemblies, and the trend of smart-sized devices has further offered the required momentum for their high adoption.

Sensing the impressive ROI potential in the thermoelectric assemblies market for stakeholders, Transparency Market Research (TMR), in its recent report, identifies the key trends and measures their impact, in order to help stakeholders devise sustainable business strategies.

Thermoelectric assemblies surfaced as a result of the limitations encountered by industrialists with the employment of conventional compressor-based systems. Existing thermoelectric assemblies exhibit flexibility with their compact size, low weight, and reduced noise and vibration, which makes them viable in industrial applications to cater to the required reliability and performance specifications. On account of their competency, in 2018, the sales of thermoelectric assemblies registered a value of ~ US$ 3.1 Bn, and with technological leaps, the market is likely to grow at a steady pace through to 2027.

As manufacturers scramble towards adopting green technology for the generation of electric power, solar-based thermoelectric solutions are gaining prominence in industries that operate amid scarce availability of electricity. With 'portability' exerting its influence in the adoption of industrial equipment, manufacturers can follow suit for the production of thermoelectric assemblies. However, manufacturers’ capabilities have been put to the test in optimizing their processes to reduce operational costs, as thermoelectric assemblies are cost-prohibitive as compared to conventional cooling and refrigeration systems.

The demand for thermoelectric assemblies in surgical centers and hospitals has been on a surge, as medical devices require strict temperature controls. These devices also offer immunoassay reagent cooling and temperature control for in-vitro diagnostics specimens in the healthcare industry for effective storage and transportation of human organs, insulin, and tissues. On the whole, the healthcare industry is likely to remain a leading revenue generating end-use industry, with a market share of ~ 20%.

The proclivity of consumers for processed food and beverages has been hard pressing manufacturers to employ refrigerating solutions for wine cellars, vending machines, and dispensing businesses. Sensing the high growth opportunities available in the food and beverages industry, manufacturers are stepping up their endeavors towards the development of advanced portable thermoelectric coolers with energy-saving features.

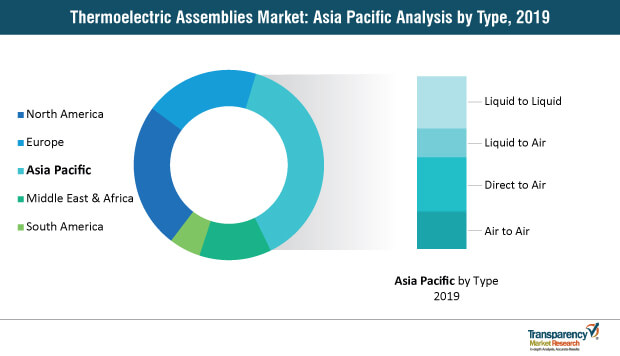

The high growth of the healthcare and food and beverages industries in North America, coupled with the increasing interest of governments in green energy and use of thermoelectric-based devices in numerous industries, has been enhancing the attractiveness of the thermoelectric assemblies market in the region. However, the high manufacturing and consumption of consumer goods in Asia Pacific, along with the growing applications of semiconductors such as laser systems, re-circulating baths, and spot cooling, which demand efficient temperature control devices, is likely to augur well for the sales of thermoelectric assemblies in the long run.

With the latent aim of business expansion, a significant number of market players are found expanding their offerings by loosening their budget strings towards research and development activities for new product development. As thermoelectric assemblies penetrate deeper into industries such as healthcare, food and beverages, consumer electronics, aerospace, and automotive, among others, manufacturers can develop end-user-specific thermoelectric assembly solutions to increase their exposure in the market.

In recent times, as industrial devices and equipment undergo government scrutiny, manufacturers operate under pressure to develop thermoelectric assemblies within the permissible boundaries of environmental sustainability. With the shifting paradigms towards renewable sources, manufacturers can capitalize on this opportunity to broaden their portfolio with solar-based thermoelectric solutions.

As industries increasingly seek space optimization to cut down their operational costs, portability of equipment and devices becomes handy. Manufacturers can increase their investments towards the development of portable thermoelectric assemblies, enriched with advanced features, which will offer them a competitive edge in the market.

The thermoelectric assemblies market evinces a high level of fragmentation. Ferrotec Holdings Corporation, Gentherm, II-VI Marlow Incorporated, Laird Technologies, and Toshiba Materials are leading players in the thermoelectric assemblies market.

Considering the evolutionary nature of the thermoelectric assemblies market, innovation continues to be a key competitive factor for market players, for which, they resort to the adoption of advanced technology. In addition, these players target the niche demand ascending from industries to boost their sales prospects. For instance, in September 2018, Ferrotec Holdings Corporation averred the launch of customized thermoelectric module technology for heating and cooling applications for the automotive sector. This technology aims at enhancing the heating and cooling capabilities of batteries in electric vehicles.

Prominent players, however, rely on developing portable and customized thermoelectric assemblies. For instance, in April 2017, TEC Microsystems GmbH announced the launch of the DX4085 Z-Meter Tester, a portable device for the express analysis of thermoelectric coolers. Manufacturers, in turn, focus on increasing their product manufacturing capacity to accommodate the growing demand.

Analysts’ Take on the Thermoelectric Assemblies Market

Authors of the study maintain a bullish stance regarding the growth of the thermoelectric assemblies market, with the opinion that, the market will grow at a CAGR of ~ 8% during 2019-2027. Industries scrambling towards integrating efficiency in their processes will offer high sales opportunities for manufacturers. The healthcare and food and beverages sectors are likely to remain at the forefront of the demand for thermoelectric assemblies.

Growing concerns regarding environmental sustainability will push the competency of manufacturers towards the development of renewable source-based thermoelectric assemblies. Leading players functioning in the thermoelectric assemblies market are offering customized solutions for businesses to meet their specific needs, which will give them a better shot at increased sales. As the trend of smart-sized devices continues to grow, portability will be the new proposition of thermoelectric assemblies.

Competitive Advantages of Thermoelectric Assemblies over Other Compressor-based Systems

Increasing Usage in Food & Beverages Industry a Key Factor Propelling the Thermoelectric Assemblies Market

Higher Cost than Conventional Cooling and Refrigeration Systems a Major Challenge

Thermoelectric Assemblies Market: Competition Landscape

Thermoelectric Assemblies Market: Key Developments

Key manufacturers operating in the global thermoelectric assemblies market, such as Laird Technologies and II-VI Incorporated, are strengthening their overseas sales structure by increasing their production capacities. Some other key developments in the global thermoelectric assemblies market are as follows:

In the global thermoelectric assemblies market report, we have discussed individual strategies of manufacturers of thermoelectric assemblies, followed by their company profiles. The ‘Competition Landscape’ section is included in the report to provide readers with a dashboard view and company market share analysis of key players operating in the global thermoelectric assemblies market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Thermoelectric Assemblies Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Trends Analysis

4.4. Key Market Indicators

4.5. Component Market Share Analysis

4.5.1. Thermoelectric Modules

4.5.2. CFM Axial Fans

4.5.3. Heat Sinks

4.5.4. Enclosures

4.5.5. Power Supply

4.5.6. Other Parts

4.6. Global Thermoelectric Assemblies Market Analysis and Forecast, 2017–2027

4.6.1. Market Revenue Projection (US$ Mn)

4.7. Porter’s Five Forces Analysis - Global Thermoelectric Assemblies Market

4.8. Value Chain Analysis - Global Thermoelectric Assemblies Market

4.9. Market Outlook

5. Global Thermoelectric Assemblies Market Analysis and Forecast, by Type

5.1. Overview & Definitions

5.2. Global Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

5.2.1. Air to Air

5.2.2. Direct to Air

5.2.3. Liquid to Air

5.2.4. Liquid to Liquid

5.3. Type Comparison Matrix

5.4. Global Thermoelectric Assemblies Market Attractiveness, by Type

6. Global Thermoelectric Assemblies Market Analysis and Forecast, by End-user

6.1. Overview & Definitions

6.2. Global Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

6.2.1. Aerospace & Defense

6.2.2. Automotive

6.2.3. Consumer Electronics

6.2.4. Healthcare

6.2.5. Food & Beverages

6.2.6. Telecom

6.2.7. Others (BFSI, Photonics, etc.)

6.3. End-user Comparison Matrix

6.4. Global Thermoelectric Assemblies Market Attractiveness, by End-user

7. Global Thermoelectric Assemblies Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Regulations and Policies

7.3. Global Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Region, 2017–2027

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East & Africa

7.3.5. South America

7.4. Global Thermoelectric Assemblies Market Attractiveness, by Region

8. North America Thermoelectric Assemblies Market Analysis and Forecast

8.1. Key Findings

8.2. Key Trends

8.3. North America Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

8.3.1. Air to Air

8.3.2. Direct to Air

8.3.3. Liquid to Air

8.3.4. Liquid to Liquid

8.4. North America Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

8.4.1. Aerospace & Defense

8.4.2. Automotive

8.4.3. Consumer Electronics

8.4.4. Healthcare

8.4.5. Food & Beverages

8.4.6. Telecom

8.4.7. Others (BFSI, Photonics, etc.)

8.5. North America Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Country, 2017–2027

8.5.1. U.S.

8.5.2. Canada

8.5.3. Rest of North America

8.6. North America Thermoelectric Assemblies Market Attractiveness Analysis

8.6.1. By Type

8.6.2. By End-user

8.6.3. By Country/Sub-region

9. Europe Thermoelectric Assemblies Market Analysis and Forecast

9.1. Key Findings

9.2. Key Trends

9.3. Europe Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

9.3.1. Air to Air

9.3.2. Direct to Air

9.3.3. Liquid to Air

9.3.4. Liquid to Liquid

9.4. Europe Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

9.4.1. Aerospace & Defense

9.4.2. Automotive

9.4.3. Consumer Electronics

9.4.4. Healthcare

9.4.5. Food & Beverages

9.4.6. Telecom

9.4.7. Others (BFSI, Photonics, etc.)

9.5. Europe Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

9.5.1. Germany

9.5.2. U.K.

9.5.3. France

9.5.4. Italy

9.5.5. Rest of Europe

9.6. Europe Thermoelectric Assemblies Market Attractiveness Analysis

9.6.1. By Type

9.6.2. By End-user

9.6.3. By Country/Sub-region

10. Asia Pacific Thermoelectric Assemblies Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. Asia Pacific Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

10.3.1. Air to Air

10.3.2. Direct to Air

10.3.3. Liquid to Air

10.3.4. Liquid to Liquid

10.4. Asia Pacific Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

10.4.1. Aerospace & Defense

10.4.2. Automotive

10.4.3. Consumer Electronics

10.4.4. Healthcare

10.4.5. Food & Beverages

10.4.6. Telecom

10.4.7. Others (BFSI, Photonics, etc.)

10.5. Asia Pacific Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. Rest of Asia Pacific

10.6. Asia Pacific Thermoelectric Assemblies Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By End-user

10.6.3. By Country/Sub-region

11. Middle East & Africa Thermoelectric Assemblies Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Middle East & Africa Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

11.3.1. Air to Air

11.3.2. Direct to Air

11.3.3. Liquid to Air

11.3.4. Liquid to Liquid

11.4. Middle East & Africa Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

11.4.1. Aerospace & Defense

11.4.2. Automotive

11.4.3. Consumer Electronics

11.4.4. Healthcare

11.4.5. Food & Beverages

11.4.6. Telecom

11.4.7. Others (BFSI, Photonics, etc.)

11.5. Middle East & Africa Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

11.5.1. GCC

11.5.2. South Africa

11.5.3. Rest of Middle East & Africa

11.6. Middle East & Africa Thermoelectric Assemblies Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By End-user

11.6.3. By Country/Sub-region

12. South America Thermoelectric Assemblies Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. South America Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

12.3.1. Air to Air

12.3.2. Direct to Air

12.3.3. Liquid to Air

12.3.4. Liquid to Liquid

12.4. South America Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

12.4.1. Aerospace & Defense

12.4.2. Automotive

12.4.3. Consumer Electronics

12.4.4. Healthcare

12.4.5. Food & Beverages

12.4.6. Telecom

12.4.7. Others (BFSI, Photonics, etc.)

12.5. South America Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

12.5.1. Brazil

12.5.2. Rest of South America

12.6. South America Thermoelectric Assemblies Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By End-user

12.6.3. By Country/Sub-region

13. Competition Landscape

13.1. Market Players – Competition Matrix

13.2. Global Thermoelectric Assemblies Market Share Analysis, by Company (2018)

13.3. Company Profiles (Details – Overview, Financials, SWOT Analysis, Recent Development, Strategy)

13.3.1. Crystal Ltd.

13.3.1.1. Overview,

13.3.1.2. Financials,

13.3.1.3. SWOT Analysis,

13.3.1.4. Recent Development,

13.3.1.5. Strategy

13.3.2. Ferrotec Corporation

13.3.2.1. Overview,

13.3.2.2. Financials,

13.3.2.3. SWOT Analysis,

13.3.2.4. Recent Development,

13.3.2.5. Strategy

13.3.3. II-VI Marlow Incorporated

13.3.3.1. Overview,

13.3.3.2. Financials,

13.3.3.3. SWOT Analysis,

13.3.3.4. Recent Development,

13.3.3.5. Strategy

13.3.4. KRYOTHERM

13.3.4.1. Overview,

13.3.4.2. Financials,

13.3.4.3. SWOT Analysis,

13.3.4.4. Recent Development,

13.3.4.5. Strategy

13.3.5. Laird Technologies

13.3.5.1. Overview,

13.3.5.2. Financials,

13.3.5.3. SWOT Analysis,

13.3.5.4. Recent Development,

13.3.5.5. Strategy

13.3.6. Wakefield-Vette, Inc.

13.3.6.1. Overview,

13.3.6.2. Financials,

13.3.6.3. SWOT Analysis,

13.3.6.4. Recent Development,

13.3.6.5. Strategy

13.3.7. TE Technology, Inc.

13.3.7.1. Overview,

13.3.7.2. Financials,

13.3.7.3. SWOT Analysis,

13.3.7.4. Recent Development,

13.3.7.5. Strategy

13.3.8. TEC Microsystems GmbH

13.3.8.1. Overview,

13.3.8.2. Financials,

13.3.8.3. SWOT Analysis,

13.3.8.4. Recent Development,

13.3.8.5. Strategy

13.3.9. Thermonamic Electronics (Jiangxi) Corp., Ltd

13.3.9.1. Overview,

13.3.9.2. Financials,

13.3.9.3. SWOT Analysis,

13.3.9.4. Recent Development,

13.3.9.5. Strategy

13.3.10. TOSHIBA MATERIALS CO., LTD.

13.3.10.1. Overview,

13.3.10.2. Financials,

13.3.10.3. SWOT Analysis,

13.3.10.4. Recent Development,

13.3.10.5. Strategy

14. Key Takeaways

List of Tables

Table 01: Component Market Share Analysis

Table 02: Global Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

Table 03: Global Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

Table 04: North America Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Type, 2017–2027

Table 05: North America Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

Table 06: North America Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 07: Europe Thermoelectric Assemblies Market Revenue (US$ Mn)Forecast, by Type, 2017–2027

Table 08: Europe Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

Table 09: Europe Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 10: Asia Pacific Thermoelectric Assemblies Market Revenue (US$ Mn)Forecast, by Type, 2017–2027

Table 11: Asia Pacific Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

Table 12: Asia Pacific Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 13: Middle East & Africa Thermoelectric Assemblies Market Revenue (US$ Mn)Forecast, by Type, 2017–2027

Table 14: Middle East & Africa Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

Table 15: Middle East & Africa Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 16: South America Thermoelectric Assemblies Market Revenue (US$ Mn)Forecast, by Type, 2017–2027

Table 17: South America Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by End-user, 2017–2027

Table 18: South America Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 19: Global Thermoelectric Assemblies Market Share Analysis, by Company

List of Figures

Figure 01: Global Thermoelectric Assemblies Market Growth, Historical and Forecast, 2017–2027

Figure 02: Global Thermoelectric Assemblies Market Size, Historical and Forecast, 2017–2027

Figure 03: North America Thermoelectric Assemblies Market CAGR

Figure 04: Europe Thermoelectric Assemblies Market CAGR

Figure 05: Asia Pacific Thermoelectric Assemblies Market CAGR

Figure 06: South America Thermoelectric Assemblies Market CAGR

Figure 07: Middle East & Africa Thermoelectric Assemblies Market CAGR

Figure 08: Global Thermoelectric Assemblies Market Value Share, by Region, 2018

Figure 09: Global Thermoelectric Assemblies Market Revenue Projection and Y-o-Y Growth, 2017–2027 (US$ Mn)

Figure 10: Porter’s Five Forces

Figure 11: Supply Chain Analysis

Figure 12: Global Thermoelectric Assemblies Market Revenue (US$ Mn)

Figure 13: Global Thermoelectric Assemblies Market, by Type (2019)

Figure 14: Global Thermoelectric Assemblies Market, by End-user (2019)

Figure 15: Global Thermoelectric Assemblies Market Value Share Analysis, by Type, 2019 and 2027

Figure 16: Global Thermoelectric Assemblies Market, by Type, Air to Air

Figure 17: Global Thermoelectric Assemblies Market, by Type, Direct to Air

Figure 18: Global Thermoelectric Assemblies Market, by Type, Liquid to Air

Figure 19: Global Thermoelectric Assemblies Market, by Type, Liquid to Liquid

Figure 20: Segment Growth Matrix, 2019–2027 (%) , by Type

Figure 21: Segment Revenue Contribution, 2019–2027 (%) , by Type

Figure 22: Segment Compounded Growth Matrix (CAGR %) , by Type

Figure 23: Global Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by Type

Figure 24: Global Thermoelectric Assemblies Market Value Share Analysis, by End-user, 2019 and 2027

Figure 25: Global Thermoelectric Assemblies Market, by End-user, Aerospace & Defense

Figure 26: Global Thermoelectric Assemblies Market, by End-user, Automotive

Figure 27: Global Thermoelectric Assemblies Market, by End-user, Consumer Electronics

Figure 28: Global Thermoelectric Assemblies Market, by End-user, Healthcare

Figure 29: Global Thermoelectric Assemblies Market, by End-user, Food & Beverages

Figure 30: Global Thermoelectric Assemblies Market, by End-user, Telecom

Figure 31: Global Thermoelectric Assemblies Market, by End-user, Others

Figure 32: Segment Growth Matrix, 2019–2027 (%), by End-user

Figure 33: Segment Revenue Contribution, 2019–2027 (%) , by End-user

Figure 34: Segment Compounded Growth Matrix (CAGR %), by End-user

Figure 35: Global Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by End-user

Figure 36: North America Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 37: North America Thermoelectric Assemblies Market, Y-o-Y Growth Forecast, 2017–2027

Figure 38: North America Thermoelectric Assemblies Market Value Share Analysis, by Type, 2019 and 2027

Figure 39: North America Thermoelectric Assemblies Market Value Share Analysis, End-user, 2019 and 2027

Figure 40: North America Thermoelectric Assemblies Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 41: North America Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by Type

Figure 42: North America Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by End-user

Figure 43: North America Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by Country/Sub-region

Figure 44: Europe Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 45: Europe Thermoelectric Assemblies Market Y-o-Y Growth Forecast, 2017–2027

Figure 46: Europe Thermoelectric Assemblies Market Value Share Analysis, by Type, 2019 and 2027

Figure 47: Europe Thermoelectric Assemblies Market Value Share Analysis, End-user, 2019 and 2027

Figure 48: Europe Thermoelectric Assemblies Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 49: Europe Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by Type

Figure 50: Europe Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by End-user

Figure 51: Europe Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by Country/Sub-region

Figure 52: Asia Pacific Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 53: Asia Pacific Thermoelectric Assemblies Market Y-o-Y Growth Forecast, 2017–2027

Figure 54: Asia Pacific Thermoelectric Assemblies Market Value Share Analysis, by Type, 2019 and 2027

Figure 55: Asia Pacific Thermoelectric Assemblies Market Value Share Analysis, End-user, 2019 and 2027

Figure 56: Asia Pacific Thermoelectric Assemblies Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 57: Asia Pacific Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by Type

Figure 58: Asia Pacific Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by End-user

Figure 59: Asia Pacific Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by Country/Sub-region

Figure 60: Middle East & Africa Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 61: Middle East & Africa Thermoelectric Assemblies Market Y-o-Y Growth Forecast, 2017–2027

Figure 62: Middle East & Africa Thermoelectric Assemblies Market Value Share Analysis, by Type, 2019 and 2027

Figure 63: Middle East & Africa Thermoelectric Assemblies Market Value Share Analysis, End-user, 2019 and 2027

Figure 64: Middle East & Africa Thermoelectric Assemblies Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 65: Middle East & Africa Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by Type

Figure 66: Middle East & Africa Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by End-user

Figure 67: Middle East & Africa Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by Country/Sub-region

Figure 68: South America Thermoelectric Assemblies Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 69: South America Thermoelectric Assemblies Market Y-o-Y Growth Forecast, 2017–2027

Figure 70: South America Thermoelectric Assemblies Market Revenue (US$ Mn)Forecast, by Type, 2017–2027

Figure 71: South America Thermoelectric Assemblies Market Value Share Analysis, End-user, 2019 and 2027

Figure 72: South America Thermoelectric Assemblies Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 73: South America Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by Type

Figure 74: South America Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by End-user

Figure 75: South America Thermoelectric Assemblies Thermoelectric Assemblies Market Attractiveness Analysis, by Country/Sub-region

Figure 76: Thermoelectric Module Market Share Analysis, by Company (2017)

Figure 77: Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018, Ferrotec Holdings Corporation

Figure 78: Net Sales, by Region, (2018), II-VI Incorporated

Figure 79: Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 80: Net Sales, by Region, (2018) , Toshiba Corp

Figure 81: Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018, Toshiba Corp