Reports

Reports

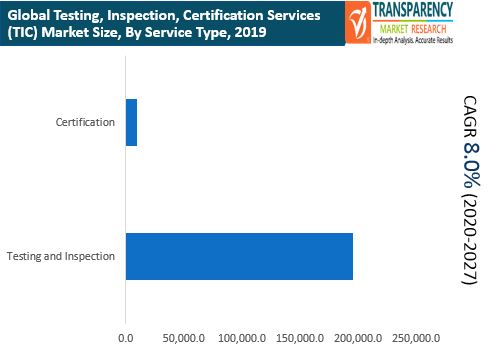

The global testing, inspection, and certification or TIC market is estimated to register growth at a CAGR of 8% during the forecast period, from 2020 to 2027. This market growth can be ascribed to many factors such as increasing awareness on the health safety measures, stringent environmental standards, and technological advancements in the industry.

A study by Transparency Market Research (TMR) delivers in-depth analysis of major factors shaping the growth curve of the global TIC market. Hence, this report covers comprehensive study of expansion opportunities, key regions, competition analysis, growth drivers, challenges, growth restraints, and different strategies used by companies in the market for TIC.

The global TIC market is segmented based on many crucial parameters such as service type, sourcing type, industry, and region. In term of service type, the market is divided into two parts, namely, testing & inspection and certification. Based on sourcing type, the global TIC market is classified into two segments, namely, outsourcing and in-house sourcing.

On the basis of industry, the TIC market is bifurcated into many sections such as transformational & contract manufacturing, infrastructure & construction, agriculture & forest, food & beverages, chemical, information technologies, transportation &logistics, healthcare & pharmaceutical, energy & utilities, travel & tourism, government, water & wastewater management, textile, cosmetics, education, and others.

With growing focus of major government authorities on infrastructure development, there has been a rise in the construction activities across the globe. This factor is estimated to create high demand for TIC, which help in maintaining the quality standards of material and services set by regional governments. This, in turn, is prognosticated to fuel the sales growth in the TIC market.

At the time of trading several crucial items such as processed food and medicines, these products need to pass different stringent regulations imposed by respective government authorities in order to confirm the high quality of these products is maintained. Thus, rise in the trading of such items is creating revenue-generation opportunities in the TIC market. Moreover, TIC tools and services are being increasingly adopted across varied end-use industries such as energy & utilities and infrastructure and construction sectors. This factor is boosting the expansion of the TIC market.

In terms of region, the global TIC market is divided into several parts such as North America, Europe, Asia Pacific, Middle East and Africa, and South America. Of them, Europe is one of the promising regions in the TIC market owing to increased focus of regional government authorities toward performing testing, inspection, and certification of products from several industries such as oil & gas, food & beverages, cosmetics, and infrastructure & construction. Moreover, a rise in awareness on the safety of consumer products is fueling the expansion of the Europe TIC market.

Players in the global TIC market are using organic as well as inorganic strategies in order to stay ahead of the competition. For instance, several companies are seen involved in the mergers and acquisitions to gain major share of the market. Moreover, enterprises are increasing focus on upgradation of their facilities with next-gen laboratory equipment as well as technical expertise. These activities are likely to help in the market expansion in the years to come.

The list of key players operating in the TIC market includes many names such as Bureau Veritas SA, Intertek Group PLC, ASTM International, SGS Group, TUV SUD AG, ALS Ltd., AsureQuality Ltd., DNV GL Group AS, Dekra SE, Underwriters Laboratories Inc, TÜV Rheinland Group, and Lloyd's Register Group Limited.

Companies in the TIC industry are making amendments in their policies in order to sustain in the critical situations owing to the COVID-19 outbreak. They are focused on carrying out their regular activities while following all safety standards imposed by regional government authorities.

The testing, Inspection and certification (TIC) Market is estimated to grow at a CAGR of 8.0% from 2020 to 2027

Factors such as Increase in focus of manufacturing companies to improve customer retention by offering quality products and surge in demand for interoperability testing for connected devices and IoT drives the growth of the testing, Inspection and certification (TIC) market

Top key players in the testing, inspection and certification market are Intertek Group PLC, TÜV Rheinland Group, Dekra SE, AsureQuality Ltd., and Bureau Veritas.

The testing, Inspection and certification (TIC) Market is segmented on the basis of service type, sourcing type, application, end user, and region.

The key growth strategies of testing, Inspection and certification (TIC) market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Testing, Inspection and Certification (TIC) Services Market

4. Market Overviews

4.1. Introduction/Segment Definitions

4.2. Nature of Testing, Inspection, and Certification (TIC) Market

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunity

4.4. Key Trends

4.5. In-house and Outsourced Services Trend Analysis

4.6. Global Video Conferencing Market Analysis and Forecasts, 2017 – 2027

4.6.1. Market Revenue Projections, 2017 – 2027 (US$ Mn)

4.7. Porter’s Five Forces Analysis

4.8. Value Chain Analysis

4.9. Market Outlook

5. Global Testing, Inspection and Certification (TIC) Services Market Analysis and Forecasts, By Service Type

5.1. Introduction & Definition

5.2. Market Size Forecast (US$ Mn) By Service Type, 2017 - 2027

5.2.1. Testing & Inspection

5.2.2. Certification

5.3. Market Attractiveness By Service Type

6. Global Testing, Inspection and Certification (TIC) Services Market Analysis and Forecasts, By Sourcing Type

6.1. Introduction & Definition

6.2. Market Size Forecast (US$ Mn) By Sourcing Type, 2017 - 2027

6.2.1. In-house Sourcing

6.2.2. Outsourcing

6.3. Market Attractiveness By Sourcing Type

7. Global Testing and Inspection Services Market Analysis and Forecasts, By Industry

7.1. Introduction

7.2. Market Size Forecast (US$ Mn) By Industry, 2017 - 2027

7.2.1. Infrastructure & Construction

7.2.2. Transformational & Contract Manufacturing

7.2.3. Food & Beverages

7.2.4. Agriculture & Forest

7.2.5. Information Technologies

7.2.6. Chemical

7.2.7. Healthcare & Pharmaceutical

7.2.8. Transportation &Logistics

7.2.9. Travel & Tourism

7.2.10. Energy & Utilities

7.2.11. Water & Wastewater Management

7.2.12. Government

7.2.13. Education

7.2.14. Textile

7.2.15. Cosmetics

7.2.16. Others

7.3. Market Attractiveness By Industry

8. Global Certification Services Market Analysis and Forecasts, By Industry

8.1. Introduction

8.2. Market Size Forecast (US$ Mn) By Industry, 2017 - 2027

8.2.1. Infrastructure & Construction

8.2.2. Transformational & Contract Manufacturing

8.2.3. Food & Beverages

8.2.4. Agriculture & Forest

8.2.5. Information Technologies

8.2.6. Chemical

8.2.7. Healthcare & Pharmaceutical

8.2.8. Transportation &Logistics

8.2.9. Travel & Tourism

8.2.10. Energy & Utilities

8.2.11. Water & Wastewater Management

8.2.12. Government

8.2.13. Education

8.2.14. Textile

8.2.15. Cosmetics

8.2.16. Others

8.3. Market Attractiveness By Industry

9. Global Testing, Inspection and Certification (TIC) Services Market Analysis and Forecasts, By Region

9.1. Introduction & Definition

9.2. Market Size Forecast (Mn) By Region, 2017 - 2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

10. North America Testing, Inspection and Certification (T.I.C.) Market Analysis

10.1. Key Trends

10.2. Market Size Forecast (US$ Mn) By Service Type, 2017 - 2027

10.2.1. Testing & Inspection

10.2.2. Certification

10.3. Market Size Forecast (US$ Mn) By Sourcing Type, 2017 - 2027

10.3.1. In-house Sourcing

10.3.2. Outsourcing

10.4. Certification Services Market Size Forecast (US$ Mn) By Industry, 2017 - 2027

10.4.1. Infrastructure & Construction

10.4.2. Transformational & Contract Manufacturing

10.4.3. Food & Beverages

10.4.4. Agriculture & Forest

10.4.5. Information Technologies

10.4.6. Chemical

10.4.7. Healthcare & Pharmaceutical

10.4.8. Transportation &Logistics

10.4.9. Travel & Tourism

10.4.10. Energy & Utilities

10.4.11. Water & Wastewater Management

10.4.12. Government

10.4.13. Education

10.4.14. Textile

10.4.15. Cosmetics

10.4.16. Others

10.5. Testing & Inspection Services Market Size Forecast (US$ Mn) By Industry, 2017 - 2027

10.5.1. Infrastructure & Construction

10.5.2. Transformational & Contract Manufacturing

10.5.3. Food & Beverages

10.5.4. Agriculture & Forest

10.5.5. Information Technologies

10.5.6. Chemical

10.5.7. Healthcare & Pharmaceutical

10.5.8. Transportation &Logistics

10.5.9. Travel & Tourism

10.5.10. Energy & Utilities

10.5.11. Water & Wastewater Management

10.5.12. Government

10.5.13. Education

10.5.14. Textile

10.5.15. Cosmetics

10.5.16. Others

10.6. Market Size (US$ Mn) Forecast, By Country, 2017 – 2027

10.6.1. The U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. Market Attractiveness Analysis

10.7.1. By Service Type

10.7.2. By Sourcing Type

10.7.3. By Industry

10.7.4. By Country

11. Europe Testing, Inspection and Certification (T.I.C.) Market Analysis

11.1. Key Trends

11.2. Market Size Forecast (US$ Mn) By Service Type, 2017 - 2027

11.2.1. Testing & Inspection

11.2.2. Certification

11.3. Market Size Forecast (US$ Mn) By Sourcing Type, 2017 - 2027

11.3.1. In-house Sourcing

11.3.2. Outsourcing

11.4. Certification Services Market Size Forecast (US$ Mn) By Industry, 2017 - 2027

11.4.1. Infrastructure & Construction

11.4.2. Transformational & Contract Manufacturing

11.4.3. Food & Beverages

11.4.4. Agriculture & Forest

11.4.5. Information Technologies

11.4.6. Chemical

11.4.7. Healthcare & Pharmaceutical

11.4.8. Transportation &Logistics

11.4.9. Travel & Tourism

11.4.10. Energy & Utilities

11.4.11. Water & Wastewater Management

11.4.12. Government

11.4.13. Education

11.4.14. Textile

11.4.15. Cosmetics

11.4.16. Others

11.5. Testing & Inspection Services Market Size Forecast (US$ Mn) By Industry, 2017 - 2027

11.5.1. Infrastructure & Construction

11.5.2. Transformational & Contract Manufacturing

11.5.3. Food & Beverages

11.5.4. Agriculture & Forest

11.5.5. Information Technologies

11.5.6. Chemical

11.5.7. Healthcare & Pharmaceutical

11.5.8. Transportation &Logistics

11.5.9. Travel & Tourism

11.5.10. Energy & Utilities

11.5.11. Water & Wastewater Management

11.5.12. Government

11.5.13. Education

11.5.14. Textile

11.5.15. Cosmetics

11.5.16. Others

11.6. Market Size (US$ Mn) Forecast, By Country, 2017 – 2027

11.6.1. Spain

11.6.2. Italy

11.6.3. Portugal

11.6.4. Poland

11.6.5. The U.K.

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Service Type

11.7.2. By Sourcing Type

11.7.3. By Industry

11.7.4. By Country

12. Asia Pacific Testing, Inspection and Certification (T.I.C.) Market Analysis

12.1. Key Trends

12.2. Market Size Forecast (US$ Mn) By Service Type, 2017 - 2027

12.2.1. Testing & Inspection

12.2.2. Certification

12.3. Market Size Forecast (US$ Mn) By Sourcing Type, 2017 - 2027

12.3.1. In-house Sourcing

12.3.2. Outsourcing

12.4. Certification Services Market Size Forecast (US$ Mn) By Industry, 2017 - 2027

12.4.1. Infrastructure & Construction

12.4.2. Transformational & Contract Manufacturing

12.4.3. Food & Beverages

12.4.4. Agriculture & Forest

12.4.5. Information Technologies

12.4.6. Chemical

12.4.7. Healthcare & Pharmaceutical

12.4.8. Transportation &Logistics

12.4.9. Travel & Tourism

12.4.10. Energy & Utilities

12.4.11. Water & Wastewater Management

12.4.12. Government

12.4.13. Education

12.4.14. Textile

12.4.15. Cosmetics

12.4.16. Others

12.5. Testing & Inspection Services Market Size Forecast (US$ Mn) By Industry, 2017 - 2027

12.5.1. Infrastructure & Construction

12.5.2. Transformational & Contract Manufacturing

12.5.3. Food & Beverages

12.5.4. Agriculture & Forest

12.5.5. Information Technologies

12.5.6. Chemical

12.5.7. Healthcare & Pharmaceutical

12.5.8. Transportation &Logistics

12.5.9. Travel & Tourism

12.5.10. Energy & Utilities

12.5.11. Water & Wastewater Management

12.5.12. Government

12.5.13. Education

12.5.14. Textile

12.5.15. Cosmetics

12.5.16. Others

12.6. Market Size (US$ Mn) Forecast, By Country, 2017 – 2027

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Service Type

12.7.2. By Sourcing Type

12.7.3. By Industry

12.7.4. By Country

13. Middle East & Africa Testing, Inspection and Certification (T.I.C.) Market Analysis

13.1. Key Trends

13.2. Market Size Forecast (US$ Mn) By Service Type, 2017 - 2027

13.2.1. Testing & Inspection

13.2.2. Certification

13.3. Market Size Forecast (US$ Mn) By Sourcing Type, 2017 - 2027

13.3.1. In-house Sourcing

13.3.2. Outsourcing

13.4. Certification Services Market Size Forecast (US$ Mn) By Industry, 2017 - 2027

13.4.1. Infrastructure & Construction

13.4.2. Transformational & Contract Manufacturing

13.4.3. Food & Beverages

13.4.4. Agriculture & Forest

13.4.5. Information Technologies

13.4.6. Chemical

13.4.7. Healthcare & Pharmaceutical

13.4.8. Transportation &Logistics

13.4.9. Travel & Tourism

13.4.10. Energy & Utilities

13.4.11. Water & Wastewater Management

13.4.12. Government

13.4.13. Education

13.4.14. Textile

13.4.15. Cosmetics

13.4.16. Others

13.5. Testing & Inspection Services Market Size Forecast (US$ Mn) By Industry, 2017 - 2027

13.5.1. Infrastructure & Construction

13.5.2. Transformational & Contract Manufacturing

13.5.3. Food & Beverages

13.5.4. Agriculture & Forest

13.5.5. Information Technologies

13.5.6. Chemical

13.5.7. Healthcare & Pharmaceutical

13.5.8. Transportation &Logistics

13.5.9. Travel & Tourism

13.5.10. Energy & Utilities

13.5.11. Water & Wastewater Management

13.5.12. Government

13.5.13. Education

13.5.14. Textile

13.5.15. Cosmetics

13.5.16. Others

13.6. Market Size (US$ Mn) Forecast, By Country, 2017 – 2027

13.6.1. Algeria

13.6.2. Saudi Arabia

13.6.3. Morocco

13.6.4. Egypt

13.6.5. Rest of MEA

13.7. Market Attractiveness Analysis

13.7.1. By Service Type

13.7.2. By Sourcing Type

13.7.3. By Industry

13.7.4. By Country

14. South America Testing, Inspection and Certification (T.I.C.) Market Analysis

14.1. Key Trends

14.2. Market Size Forecast (US$ Mn) By Service Type, 2017 - 2027

14.2.1. Testing & Inspection

14.2.2. Certification

14.3. Market Size Forecast (US$ Mn) By Sourcing Type, 2017 - 2027

14.3.1. In-house Sourcing

14.3.2. Outsourcing

14.4. Certification Services Market Size Forecast (US$ Mn) By Industry, 2017 - 2027

14.4.1. Infrastructure & Construction

14.4.2. Transformational & Contract Manufacturing

14.4.3. Food & Beverages

14.4.4. Agriculture & Forest

14.4.5. Information Technologies

14.4.6. Chemical

14.4.7. Healthcare & Pharmaceutical

14.4.8. Transportation &Logistics

14.4.9. Travel & Tourism

14.4.10. Energy & Utilities

14.4.11. Water & Wastewater Management

14.4.12. Government

14.4.13. Education

14.4.14. Textile

14.4.15. Cosmetics

14.4.16. Others

14.5. Testing & Inspection Services Market Size Forecast (US$ Mn) By Industry, 2017 - 2027

14.5.1. Infrastructure & Construction

14.5.2. Transformational & Contract Manufacturing

14.5.3. Food & Beverages

14.5.4. Agriculture & Forest

14.5.5. Information Technologies

14.5.6. Chemical

14.5.7. Healthcare & Pharmaceutical

14.5.8. Transportation &Logistics

14.5.9. Travel & Tourism

14.5.10. Energy & Utilities

14.5.11. Water & Wastewater Management

14.5.12. Government

14.5.13. Education

14.5.14. Textile

14.5.15. Cosmetics

14.5.16. Others

14.6. Market Size (US$ Mn) Forecast, By Country, 2017 – 2027

14.6.1. Chile

14.6.2. Brazil

14.6.3. Ecuador

14.6.4. Peru

14.6.5. Colombia

14.6.6. Rest of South America

14.7. Market Attractiveness Analysis

14.7.1. By Service Type

14.7.2. By Sourcing Type

14.7.3. By Industry

14.7.4. By Country

15. Competition Landscape

15.1. Market Player – Competition Matrix

15.2. Market Share Analysis, by Company (2019), OEM

15.3. Company Profiles (Details – Overview, Financials, SWOT, Strategy)

15.3.1. Bureau Veritas SA

15.3.1.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

15.3.1.2. Company Description

15.3.1.3. SWOT Analysis

15.3.1.4. Annual Revenue

15.3.1.5. Strategic Overview

15.3.2. Intertek Group PLC

15.3.2.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

15.3.2.2. Company Description

15.3.2.3. SWOT Analysis

15.3.2.4. Annual Revenue

15.3.2.5. Strategic Overview

15.3.3. SGS Group

15.3.3.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

15.3.3.2. Company Description

15.3.3.3. SWOT Analysis

15.3.3.4. Annual Revenue

15.3.3.5. Strategic Overview

15.3.4. ALS Limited

15.3.4.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

15.3.4.2. Company Description

15.3.4.3. SWOT Analysis

15.3.4.4. Annual Revenue

15.3.4.5. Strategic Overview

15.3.5. ASTM International

15.3.5.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

15.3.5.2. Company Description

15.3.5.3. SWOT Analysis

15.3.5.4. Annual Revenue

15.3.5.5. Strategic Overview

15.3.6. AsureQuality Limited

15.3.6.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

15.3.6.2. Company Description

15.3.6.3. SWOT Analysis

15.3.6.4. Annual Revenue

15.3.6.5. Strategic Overview

15.3.7. Dekra SE

15.3.7.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

15.3.7.2. Company Description

15.3.7.3. SWOT Analysis

15.3.7.4. Annual Revenue

15.3.7.5. Strategic Overview

15.3.8. Underwriters Laboratories Inc.

15.3.8.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

15.3.8.2. Company Description

15.3.8.3. SWOT Analysis

15.3.8.4. Annual Revenue

15.3.8.5. Strategic Overview

15.3.9. Lloyd’s Register Group Limited

15.3.9.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

15.3.9.2. Company Description

15.3.9.3. SWOT Analysis

15.3.9.4. Annual Revenue

15.3.9.5. Strategic Overview

15.3.10. DNV GL Group AS

15.3.10.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

15.3.10.2. Company Description

15.3.10.3. SWOT Analysis

15.3.10.4. Annual Revenue

15.3.10.5. Strategic Overview

15.3.11. TUV Rheinland Group.

15.3.11.1. Company Details (Headquarter, Foundation Year, & Employee Strength)

15.3.11.2. Company Description

15.3.11.3. SWOT Analysis

15.3.11.4. Annual Revenue

15.3.11.5. Strategic Overview

16. Key Takeaways

List of Tables

Table 1: Global Testing, Inspection and Certification Market Revenue (US$ Mn) and CAGR, By Service Type, 2017–2027

Table 2: Global Testing, Inspection and Certification Market Revenue (US$ Mn) and CAGR, By Sourcing Type, 2017–2027

Table 3: Global Testing, Inspection Market Revenue (US$ Mn) and CAGR, By Industry, 2017–2027

Table 4: Global Certification Service Market Revenue (US$ Mn) and CAGR, By Industry, 2017–2027

Table 5: Global Testing, Inspection and Certification Market Revenue (US$ Mn) Forecast and CAGR, By Region, 2017–2027

Table 6: North America Testing, Inspection and Certification Market Revenue (US$ Mn) and CAGR, By Service Type, 2017–2027

Table 7: North America Testing, Inspection and Certification Market Revenue (US$ Mn) and CAGR, By Sourcing Type, 2017–2027

Table 8: North America Testing and Inspection Market Revenue (US$ Mn) Forecast and CAGR, By Industry, 2017–2027

Table 9: North America Certification Market Revenue (US$ Mn) Forecast and CAGR, By Industry, 2017–2027

Table 10: Europe Testing, Inspection and Certification Market Revenue (US$ Mn) and CAGR, By Service Type, 2017–2027

Table 11: Europe Testing, Inspection and Certification Market Revenue (US$ Mn) and CAGR, By Sourcing Type, 2017–2027

Table 12: Europe Testing and Inspection Market Revenue (US$ Mn) Forecast and CAGR, By Industry, 2017–2027

Table 13: Europe Certification Market Revenue (US$ Mn) Forecast and CAGR, By Industry, 2017–2027

Table 14: Asia Pacific Testing, Inspection and Certification Market Revenue (US$ Mn) and CAGR, By Service Type, 2017–2027

Table 15: Asia Pacific Testing, Inspection and Certification Market Revenue (US$ Mn) and CAGR, By Sourcing Type, 2017–2027

Table 16: Asia Pacific Testing and Inspection Market Revenue (US$ Mn) Forecast and CAGR, By Industry, 2017–2027

Table 17: Asia Pacific Certification Market Revenue (US$ Mn) Forecast and CAGR, By Industry, 2017–2027

Table 18: MEA Testing, Inspection and Certification Market Revenue (US$ Mn) and CAGR, By Service Type, 2017–2027

Table 19: MEA Testing, Inspection and Certification Market Revenue (US$ Mn) and CAGR, By Sourcing Type, 2017–2027

Table 20: MEA Testing and Inspection Market Revenue (US$ Mn) Forecast and CAGR, By Industry, 2017–2027

Table 21: MEA Certification Market Revenue (US$ Mn) Forecast and CAGR, By Industry, 2017–2027

Table 22: South America Testing, Inspection and Certification Market Revenue (US$ Mn) and CAGR, By Service Type, 2017–2027

Table 23: South America Testing, Inspection and Certification Market Revenue (US$ Mn) and CAGR, By Sourcing Type, 2017–2027

Table 24: South America Testing and Inspection Market Revenue (US$ Mn) Forecast and CAGR, By Industry, 2017–2027

Table 25: South America Certification Market Revenue (US$ Mn) Forecast and CAGR, By Industry, 2017–2027

List of Figures

Figure 1: Forecast Methodology – Testing, Inspection and Certification Market

Figure 2: Executive Summary

Figure 3: Global Testing, Inspection and Certification Market- Regional Overview

Figure 4: Global Testing, Inspection and Certification Market - Lucrative Market Overview

Figure 5: TIC Revenue Projections, 2017 – 2027 (US$ Mn)

Figure 6: Market Value Share by Service Type (2019)

Figure 7: Market Value Share by Sourcing Type (2019)

Figure 8: Market Value Share by Geography (2019)

Figure 9: Market Value Share by Testing & Inspection by Industry (2019)

Figure 10: Market Value Share by Certification by Industry (2019)

Figure 11: Global Testing, Inspection and Certification Market Value Share Analysis, by Service Type, 2019 and 2027

Figure 12: Testing, Inspection and Certification, By Service Type Comparison Matrix

Figure 13: Testing, Inspection and Certification Market Attractiveness Analysis, by Service Type

Figure 14: Global Testing, Inspection and Certification Market Value Share Analysis, by Sourcing Type, 2019 and 2027

Figure 15: Testing, Inspection and Certification, By Sourcing Type Comparison Matrix

Figure 16: Testing, Inspection and Certification Market Attractiveness Analysis, by Sourcing Type

Figure 17: Global Testing & Inspection Market Value Share Analysis, by Industry, 2019 and 2027

Figure 18: Global Certification Market Value Share Analysis, by Industry, 2019 and 2027

Figure 19: Testing, Inspection Market, By Industry Type Comparison Matrix

Figure 20: Certification Service Market, By Industry Comparison Matrix

Figure 21: Testing, Inspection Market Attractiveness Analysis, by Industry

Figure 22: Certification Market Attractiveness Analysis, by Industry

Figure 23: Global Testing, Inspection and Certification Market Value Share Analysis, by Region 2019 and 2027

Figure 24: Testing, Inspection and Certification Market Attractiveness Analysis, by Region

Figure 25: North America Testing, Inspection and Certification Market Size (US$ Mn) Forecast, 2017–2027

Figure 26: North America Testing, Inspection and Certification Market Size Y-o-Y Growth Projections, 2018–2027

Figure 27: North America Testing, Inspection and Certification Market Revenue Share Analysis, by Service Type, 2019 and 2027

Figure 28: North America Testing, Inspection and Certification Market Revenue Share Analysis, by Sourcing Type, 2019 and 2027

Figure 29: North America Testing, Inspection Market Revenue Share Analysis, by Industry, 2019 and 2027

Figure 30: North America Certification Market Revenue Share Analysis, by Industry, 2019 and 2027

Figure 31: North America Testing, Inspection and Certification Market Attractiveness Analysis, by Sourcing Type

Figure 32: North America Testing, Inspection and Certification Market Attractiveness Analysis, by Service Type

Figure 33: North America Testing, Inspection and Certification Market Attractiveness Analysis, by Country

Figure 34: North America Testing, Inspection Market Attractiveness Analysis, by Industry

Figure 35: North America Certification Market Attractiveness Analysis, by Industry

Figure 36: Europe Testing, Inspection and Certification Market Size (US$ Mn) Forecast, 2017–2027

Figure 37: Europe Testing, Inspection and Certification Market Size Y-o-Y Growth Projections, 2018–2027

Figure 38: Europe Testing, Inspection and Certification Market Revenue Share Analysis, by Service Type, 2019 and 2027

Figure 39: Europe Testing, Inspection and Certification Market Revenue Share Analysis, by Sourcing Type, 2019 and 2027

Figure 40: Europe Testing, Inspection Market Revenue Share Analysis, by Industry, 2019 and 2027

Figure 41: Europe Certification Market Revenue Share Analysis, by Industry, 2019 and 2027

Figure 42: Europe Testing, Inspection and Certification Market Attractiveness Analysis, by Sourcing Type

Figure 43: Europe Testing, Inspection and Certification Market Attractiveness Analysis, by Service Type

Figure 44: Europe Testing, Inspection and Certification Market Attractiveness Analysis, by Country

Figure 45: Europe Testing, Inspection Market Attractiveness Analysis, by Industry

Figure 46: Europe Certification Market Attractiveness Analysis, by Industry

Figure 47: Asia Pacific Testing, Inspection and Certification Market Size (US$ Mn) Forecast, 2017–2027

Figure 48: Asia Pacific Testing, Inspection and Certification Market Size Y-o-Y Growth Projections, 2018–2027

Figure 49: Asia Pacific Testing, Inspection and Certification Market Revenue Share Analysis, by Service Type, 2019 and 2027

Figure 50: Asia Pacific Testing, Inspection and Certification Market Revenue Share Analysis, by Sourcing Type, 2019 and 2027

Figure 51: Asia Pacific Testing, Inspection Market Revenue Share Analysis, by Industry, 2019 and 2027

Figure 52: Asia Pacific Certification Market Revenue Share Analysis, by Industry, 2019 and 2027

Figure 53: Asia Pacific Testing, Inspection and Certification Market Attractiveness Analysis, by Sourcing Type

Figure 54: Asia Pacific Testing, Inspection and Certification Market Attractiveness Analysis, by Service Type

Figure 55: Asia Pacific Testing, Inspection and Certification Market Attractiveness Analysis, by Country

Figure 56: Asia Pacific Testing, Inspection Market Attractiveness Analysis, by Industry

Figure 57: Asia Pacific Certification Market Attractiveness Analysis, by Industry

Figure 58: MEA Testing, Inspection and Certification Market Size (US$ Mn) Forecast, 2017–2027

Figure 59: MEA Testing, Inspection and Certification Market Size Y-o-Y Growth Projections, 2018–2027

Figure 60: MEA Testing, Inspection and Certification Market Revenue Share Analysis, by Service Type, 2019 and 2027

Figure 61: MEA Testing, Inspection and Certification Market Revenue Share Analysis, by Sourcing Type, 2019 and 2027

Figure 62: MEA Testing, Inspection Market Revenue Share Analysis, by Industry, 2019 and 2027

Figure 63: MEA Certification Market Revenue Share Analysis, by Industry, 2019 and 2027

Figure 64: MEA Testing, Inspection and Certification Market Attractiveness Analysis, by Sourcing Type

Figure 65: MEA Testing, Inspection and Certification Market Attractiveness Analysis, by Service Type

Figure 66: MEA Testing, Inspection and Certification Market Attractiveness Analysis, by Country

Figure 67: MEA Testing, Inspection Market Attractiveness Analysis, by Industry

Figure 68: MEA Certification Market Attractiveness Analysis, by Industry

Figure 69: South America Testing, Inspection and Certification Market Size (US$ Mn) Forecast, 2017–2027

Figure 70: South America Testing, Inspection and Certification Market Size Y-o-Y Growth Projections, 2018–2027

Figure 71: South America Testing, Inspection and Certification Market Revenue Share Analysis, by Service Type, 2019 and 2027

Figure 72: South America Testing, Inspection and Certification Market Revenue Share Analysis, by Sourcing Type, 2019 and 2027

Figure 73: South America Testing, Inspection Market Revenue Share Analysis, by Industry, 2019 and 2027

Figure 74: South America Certification Market Revenue Share Analysis, by Industry, 2019 and 2027

Figure 75: South America Testing, Inspection and Certification Market Attractiveness Analysis, by Sourcing Type

Figure 76: South America Testing, Inspection and Certification Market Attractiveness Analysis, by Service Type

Figure 77: South America Testing, Inspection and Certification Market Attractiveness Analysis, by Country

Figure 78: South America Testing, Inspection Market Attractiveness Analysis, by Industry

Figure 79: South America Certification Market Attractiveness Analysis, by Industry