Reports

Reports

Analysts’ Viewpoint

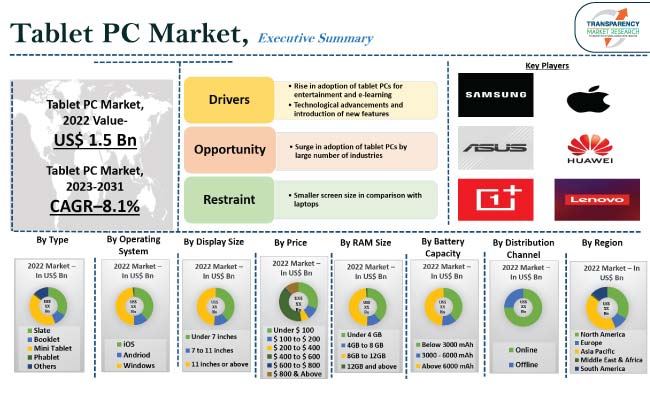

The convenience offered by tablet PCs in terms of portability and mobility is anticipated to significantly aid in the tablet PC market growth. Tablet PCs are highly efficient in performing tasks such as document editing and email management. The hybrid devices, which can be used both as tablets and laptops, are significantly gaining traction among consumers.

After the COVID-19 outbreak, the surge in tablet PC market demand is primarily ascribed to their usage for education, entertainment, and remote working purposes. The tablet PC market trends include the manufacturing of tablet PCs with the latest features such as improved camera quality, increased battery life, and at an affordable price. Leading companies are following the latest market trends to expand their customer base.

A tablet PC, also known as a tablet computer, touchscreen computer, or portable computer, refers to a wireless and portable personal computer that is a hybrid between a personal digital assistant and a notebook PC and comes with a touchscreen interface. A tablet PC is smaller in size than a computer but bigger in size than a smartphone. Earlier, tablets used light pens or styluses as the input device, but currently the tablets come with touchscreen features. Several types of tablet PCs are available in the market, such as convertible tablets, hybrid tablets, rugged tablets, and slate computers. Generally, these tablet PC displays range between 7 and 10 inches.

Some models of tablet PCs run on x86 central processing units, but the majority of them rely on advanced RISC machine processors, which consume less power and leads to extended battery life. Tablet PCs have gained much popularity owing to their user-friendly interface.

The device can be used for numerous tasks such as video conferencing, reading e-books, and watching movies. Tablet PCs run on various operating systems, such as open source OSes built by Google, Android Jelly Bean, and Windows. All tablet PCs offer a variety of utilities; they only differ in the features they offer, such as screen size, processing power, battery life, and storage capacity.

Increase in adoption of tablet PCs for entertainment purposes is projected to lead to growth of the global tablet PC industry. Tablet PCs are used overwhelmingly for gaming, and watching movies & videos. Users are spending more and more time on these tablet devices instead of mobile phones, as they provide a better experience with a bigger screen size. The availability of gaming and social media apps on tablet PCs is significantly contributing to the growth of the global tablet PC industry.

Tablet PCs are also a preferred choice for e-learning for students and remotely working professionals. After the COVID-19 outbreak, the need for online education and remote work has increased the tablet PC market share. The device provides convenience for studies and professional work with a bigger screen and better graphics. Tablet PCs are highly demanded by numerous industries, such as pharmaceuticals and education. These factors offer lucrative opportunities for market expansion.

A tablet PC is capable of doing the same range of tasks as a laptop, except those that require heavy processors. Tablet PCs are being launched with improved functionality and features. Various technological advancements, such as improved battery life, display resolution, increased memory storage, and wireless internet access, have made these tablets a preferred choice for consumers. Technological advancements in the production of personal electronic devices are estimated to enhance the tablet PC market share.

Growth in the e-commerce industry also has a positive impact on the development of the tablet PC market. With expansion in the e-commerce industry, consumers have better access to a variety of options. Increasingly affordable and easily accessible internet services are also factors surging the demand for tablet PCs, thus fueling the tablet PC market size.

The tablet PC market segmentation based on type comprises slate, booklet, mini tablet, phablet, and others (gaming tablet, rugged tablet, etc.). As per the tablet PC market analysis, the slate type segment is projected to hold the major share owing to its usage in a variety of sectors such as education, healthcare, and manufacturing. Slate tablets are also more resistant to harsh climatic conditions such as high humidity and dust heat.

As per the tablet PC market forecast, Asia Pacific is anticipated to account for major share of the global landscape due to a large customer base, advancement of technology, and increasing demand for tablet PCs for educational and professional purposes. Furthermore, the large population in India and China, and rise in disposable income in the developing nations of this region are further market catalysts.

The markets in North America and Europe are also growing at a steady pace owing to the inclination of the population toward the latest technological gadgets. High per capita income is also supporting the growth of the table PC market in these regions.

Detailed profiles of companies in the tablet PC market research report are provided to evaluate their financials, key product offerings, recent developments, and strategies. Product development and product line expansion are the emerging focus of tablet PC manufacturers.

The market is highly competitive, with the presence of various global and regional players. Google, Microsoft, Samsung, Apple, Asus, OnePlus, Amazon, Lenovo, Huawei, Xiaomi, and BlackBerry are the prominent entities profiled in the tablet PC industry.

Each of these players has been profiled in the tablet PC market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 1.5 Bn |

|

Market Forecast Value in 2031 |

US$ 3.1 Bn |

|

Growth Rate (CAGR) |

8.1% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for value and Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 1.5 Bn in 2022

It is projected to reach US$ 3.1 Bn by 2031

Rise in adoption of tablet PCs for entertainment and e-learning, technological advancements, and introduction of new features

The slate type segment accounted for the largest share in 2022

The business is witnessing steady growth in Asia Pacific owing to increase in demand for tablet PCs for education and professional purposes

Google, Microsoft, Samsung, Apple, Asus, OnePlus, Amazon, Lenovo, Huawei, Xiaomi, and BlackBerry

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Global Tablet PC Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projections (US$ Bn)

5.8.2. Market Volume Projections (Thousand Units)

6. Global Tablet PC Market Analysis and Forecast, by Type

6.1. Global Tablet PC Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

6.1.1. Slate

6.1.2. Booklet

6.1.3. Mini Tablet

6.1.4. Phablet

6.1.5. Others (Gaming Tablet, Rugged Tablet etc.)

6.2. Incremental Opportunity, by Type

7. Global Tablet PC Market Analysis and Forecast, by Operating System

7.1. Global Tablet PC Market Size (US$ Bn) (Thousand Units), by Operating System, 2017- 2031

7.1.1. iOS

7.1.2. Android

7.1.3. Windows

7.1.4. Others

7.2. Incremental Opportunity, by Operating System

8. Global Tablet PC Market Analysis and Forecast, by Display Size

8.1. Global Tablet PC Market Size (US$ Bn) (Thousand Units), by Display Size, 2017- 2031

8.1.1. Under 7 inches

8.1.2. 7 to 11 inches

8.1.3. 11 inches or above

8.2. Incremental Opportunity, by Display Size

9. Global Tablet PC Market Analysis and Forecast, by Price

9.1. Global Tablet PC Market Size (US$ Bn) (Thousand Units), by Price, 2017- 2031

9.1.1. Under US$ 100

9.1.2. US$100 to US$200

9.1.3. US$200 to US$400

9.1.4. US$400 to US$600

9.1.5. US$600 to US$800

9.1.6. US$800 & Above

9.2. Incremental Opportunity, by Price

10. Global Tablet PC Market Analysis and Forecast, by Ram Size

10.1. Global Tablet PC Market Size (US$ Bn) (Thousand Units), by Ram Size, 2017- 2031

10.1.1. Under 4 GB

10.1.2. 4GB to 8 GB

10.1.3. 8GB to 12GB

10.1.4. 12GB and above

10.2. Incremental Opportunity, by Ram Size

11. Global Tablet PC Market Analysis and Forecast, by Battery Capacity

11.1. Global Tablet PC Market Size (US$ Bn) (Thousand Units), by Battery Capacity, 2017- 2031

11.1.1. Below 3000 mAh

11.1.2. 3000 - 6000 mAh

11.1.3. Above 6000 mAh

11.2. Incremental Opportunity, by Battery Capacity

12. Global Tablet PC Market Analysis and Forecast, by Distribution Channel

12.1. Global Tablet PC Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

12.1.1. Online

12.1.1.1. E-commerce Websites

12.1.1.2. Company-owned Website

12.1.2. Offline

12.1.2.1. Hypermarkets/Supermarkets

12.1.2.2. Specialty Stores

12.1.2.3. Independent Retailers

12.2. Incremental Opportunity, by Distribution Channel

13. Global Tablet PC Market Analysis and Forecast, by Region

13.1. Global Tablet PC Market Size (US$ Bn) (Thousand Units), by Region, 2017- 2031

13.1.1. North America

13.1.2. Europe

13.1.3. Asia Pacific

13.1.4. Middle East & Africa

13.1.5. South America

13.2. Incremental Opportunity, by Region

14. North America Tablet PC Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Tablet PC Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

14.5.1. Slate

14.5.2. Booklet

14.5.3. Mini Tablet

14.5.4. Phablet

14.5.5. Others (Gaming Tablet, Rugged Tablet etc.)

14.6. Tablet PC Market Size (US$ Bn) (Thousand Units), by Operating System, 2017- 2031

14.6.1. iOS

14.6.2. Android

14.6.3. Windows

14.6.4. Others

14.7. Tablet PC Market Size (US$ Bn) (Thousand Units), by Display Size, 2017- 2031

14.7.1. Under 7 inches

14.7.2. 7 to 11 inches

14.7.3. 11 inches or above

14.8. Tablet PC Market Size (US$ Bn) (Thousand Units), by Price, 2017- 2031

14.8.1. Under US$ 100

14.8.2. US$100 to US$200

14.8.3. US$200 to US$400

14.8.4. US$400 to US$600

14.8.5. US$600 to US$800

14.8.6. US$800 & Above

14.9. Tablet PC Market Size (US$ Bn) (Thousand Units), by Ram Size, 2017- 2031

14.9.1. Under 4 GB

14.9.2. 4GB to 8 GB

14.9.3. 8GB to 12GB

14.9.4. 12GB and above

14.10. Tablet PC Market Size (US$ Bn) (Thousand Units), by Battery Capacity, 2017- 2031

14.10.1. Below 3000 mAh

14.10.2. 3000 - 6000 mAh

14.10.3. Above 6000 mAh

14.11. Tablet PC Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

14.11.1. Online

14.11.1.1. E-commerce Websites

14.11.1.2. Company-owned Website

14.11.2. Offline

14.11.2.1. Hypermarket/Supermarket

14.11.2.2. Specialty Stores

14.11.2.3. Independent Retailers

14.12. Tablet PC Market Size (US$ Bn) (Thousand Units), by Country/Sub-region, 2017- 2031

14.12.1. U.S.

14.12.2. Canada

14.12.3. Rest of North America

14.13. Incremental Opportunity Analysis

15. Europe Tablet PC Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Supply side

15.3.2. Demand Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Tablet PC Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

15.5.1. Slate

15.5.2. Booklet

15.5.3. Mini Tablet

15.5.4. Phablet

15.5.5. Others (Gaming Tablet, Rugged Tablet etc.)

15.6. Tablet PC Market Size (US$ Bn) (Thousand Units), by Operating System, 2017- 2031

15.6.1. iOS

15.6.2. Android

15.6.3. Windows

15.6.4. Others

15.7. Tablet PC Market Size (US$ Bn) (Thousand Units), by Display Size, 2017- 2031

15.7.1. Under 7 inches

15.7.2. 7 to 11 inches

15.7.3. 11 inches or above

15.8. Tablet PC Market Size (US$ Bn) (Thousand Units), by Price, 2017- 2031

15.8.1. Under US$ 100

15.8.2. US$100 to US$200

15.8.3. US$200 to US$400

15.8.4. US$400 to US$600

15.8.5. US$600 to US$800

15.8.6. US$800 & Above

15.9. Tablet PC Market Size (US$ Bn) (Thousand Units), by Ram Size, 2017- 2031

15.9.1. Under 4 GB

15.9.2. 4GB to 8 GB

15.9.3. 8GB to 12GB

15.9.4. 12GB and above

15.10. Tablet PC Market Size (US$ Bn) (Thousand Units), by Battery Capacity, 2017- 2031

15.10.1. Below 3000 mAh

15.10.2. 3000 – 6000 mAh

15.10.3. Above 6000 mAh

15.11. Tablet PC Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

15.11.1. Online

15.11.1.1. E-commerce Websites

15.11.1.2. Company-owned Website

15.11.2. Offline

15.11.2.1. Hypermarket/Supermarket

15.11.2.2. Specialty Stores

15.11.2.3. Independent Retailers

15.12. Tablet PC Market Size (US$ Bn) (Thousand Units), by Country/Sub-region, 2017- 2031

15.12.1. U.K.

15.12.2. Germany

15.12.3. France

15.12.4. Rest of Europe

15.13. Incremental Opportunity Analysis

16. Asia Pacific Tablet PC Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Key Trends Analysis

16.3.1. Supply side

16.3.2. Demand Side

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Tablet PC Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

16.5.1. Slate

16.5.2. Booklet

16.5.3. Mini Tablet

16.5.4. Phablet

16.5.5. Others (Gaming Tablet, Rugged Tablet etc.)

16.6. Tablet PC Market Size (US$ Bn) (Thousand Units), by Operating System, 2017- 2031

16.6.1. iOS

16.6.2. Android

16.6.3. Windows

16.6.4. Others

16.7. Tablet PC Market Size (US$ Bn) (Thousand Units), by Display Size, 2017- 2031

16.7.1. Under 7 inches

16.7.2. 7 to 11 inches

16.7.3. 11 inches or above

16.8. Tablet PC Market Size (US$ Bn) (Thousand Units), by Price, 2017- 2031

16.8.1. Under US$ 100

16.8.2. US$100 to US$200

16.8.3. US$200 to US$400

16.8.4. US$400 to US$600

16.8.5. US$600 to US$800

16.8.6. US$800 & Above

16.9. Tablet PC Market Size (US$ Bn) (Thousand Units), by Ram Size, 2017- 2031

16.9.1. Under 4 GB

16.9.2. 4GB to 8 GB

16.9.3. 8GB to 12GB

16.9.4. 12GB and above

16.10. Tablet PC Market Size (US$ Bn) (Thousand Units), by Battery Capacity, 2017- 2031

16.10.1. Below 3000 mAh

16.10.2. 3000 - 6000 mAh

16.10.3. Above 6000 mAh

16.11. Tablet PC Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

16.11.1. Online

16.11.1.1. E-commerce Websites

16.11.1.2. Company-owned Website

16.11.2. Offline

16.11.2.1. Hypermarket/Supermarket

16.11.2.2. Specialty Stores

16.11.2.3. Independent Retailers

16.12. Tablet PC Market Size (US$ Bn) (Thousand Units), by Country/Sub-region, 2017- 2031

16.12.1. China

16.12.2. India

16.12.3. Japan

16.12.4. Rest of Asia Pacific

16.13. Incremental Opportunity Analysis

17. Middle East & Africa Tablet PC Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Key Supplier Analysis

17.3. Key Trends Analysis

17.3.1. Supply side

17.3.2. Demand Side

17.4. Price Trend Analysis

17.4.1. Weighted Average Selling Price (US$)

17.5. Tablet PC Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

17.5.1. Slate

17.5.2. Booklet

17.5.3. Mini Tablet

17.5.4. Phablet

17.5.5. Others (Gaming Tablet, Rugged Tablet etc.)

17.6. Tablet PC Market Size (US$ Bn) (Thousand Units), by Operating System, 2017- 2031

17.6.1. iOS

17.6.2. Android

17.6.3. Windows

17.6.4. Others

17.7. Tablet PC Market Size (US$ Bn) (Thousand Units), by Display Size, 2017- 2031

17.7.1. Under 7 inches

17.7.2. 7 to 11 inches

17.7.3. 11 inches or above

17.8. Tablet PC Market Size (US$ Bn) (Thousand Units), by Price, 2017- 2031

17.8.1. Under US$ 100

17.8.2. US$100 to US$200

17.8.3. US$200 to US$400

17.8.4. US$400 to US$600

17.8.5. US$600 to US$800

17.8.6. US$800 & Above

17.9. Tablet PC Market Size (US$ Bn) (Thousand Units), by Ram Size, 2017- 2031

17.9.1. Under 4 GB

17.9.2. 4GB to 8 GB

17.9.3. 8GB to 12GB

17.9.4. 12GB and above

17.10. Tablet PC Market Size (US$ Bn) (Thousand Units), by Battery Capacity, 2017- 2031

17.10.1. Below 3000 mAh

17.10.2. 3000 - 6000 mAh

17.10.3. Above 6000 mAh

17.11. Tablet PC Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

17.11.1. Online

17.11.1.1. E-commerce Websites

17.11.1.2. Company-owned Website

17.11.2. Offline

17.11.2.1. Hypermarket/Supermarket

17.11.2.2. Specialty Stores

17.11.2.3. Independent Retailers

17.12. Tablet PC Market Size (US$ Bn) (Thousand Units), by Country/Sub-region, 2017- 2031

17.12.1. GCC

17.12.2. South Africa

17.12.3. Rest of Middle East & Africa

17.13. Incremental Opportunity Analysis

18. South America Tablet PC Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Key Supplier Analysis

18.3. Key Trends Analysis

18.3.1. Supply side

18.3.2. Demand Side

18.4. Price Trend Analysis

18.4.1. Weighted Average Selling Price (US$)

18.5. Tablet PC Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

18.5.1. Slate

18.5.2. Booklet

18.5.3. Mini Tablet

18.5.4. Phablet

18.5.5. Others (Gaming Tablet, Rugged Tablet etc.)

18.6. Tablet PC Market Size (US$ Bn) (Thousand Units), by Operating System, 2017- 2031

18.6.1. iOS

18.6.2. Android

18.6.3. Windows

18.6.4. Others

18.7. Tablet PC Market Size (US$ Bn) (Thousand Units), by Display Size, 2017- 2031

18.7.1. Under 7 inches

18.7.2. 7 to 11 inches

18.7.3. 11 inches or above

18.8. Tablet PC Market Size (US$ Bn) (Thousand Units), by Price, 2017- 2031

18.8.1. Under US$ 100

18.8.2. US$100 to US$200

18.8.3. US$200 to US$400

18.8.4. US$400 to US$600

18.8.5. US$600 to US$800

18.8.6. US$800 & Above

18.9. Tablet PC Market Size (US$ Bn) (Thousand Units), by Ram Size, 2017- 2031

18.9.1. Under 4 GB

18.9.2. 4GB to 8 GB

18.9.3. 8GB to 12GB

18.9.4. 12GB and above

18.10. Tablet PC Market Size (US$ Bn) (Thousand Units), by Battery Capacity, 2017- 2031

18.10.1. Below 3000 mAh

18.10.2. 3000 - 6000 mAh

18.10.3. Above 6000 mAh

18.11. Tablet PC Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

18.11.1. Online

18.11.1.1. E-commerce Websites

18.11.1.2. Company-owned Website

18.11.2. Offline

18.11.2.1. Hypermarket/Supermarket

18.11.2.2. Specialty Stores

18.11.2.3. Independent Retailers

18.12. Tablet PC Market Size (US$ Bn) (Thousand Units), by Country/Sub-region, 2017- 2031

18.12.1. Brazil

18.12.2. Rest of South America

18.13. Incremental Opportunity Analysis

19. Competition Landscape

19.1. Competition Dashboard

19.2. Market Share Analysis % (2022)

19.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

19.3.1. Google

19.3.1.1. Company Overview

19.3.1.2. Product Portfolio

19.3.1.3. Financial Information, (Subject to Data Availability)

19.3.1.4. Business Strategies / Recent Developments

19.3.2. Microsoft

19.3.2.1. Company Overview

19.3.2.2. Product Portfolio

19.3.2.3. Financial Information, (Subject to Data Availability)

19.3.2.4. Business Strategies / Recent Developments

19.3.3. Samsung

19.3.3.1. Company Overview

19.3.3.2. Product Portfolio

19.3.3.3. Financial Information, (Subject to Data Availability)

19.3.3.4. Business Strategies / Recent Developments

19.3.4. Apple

19.3.4.1. Company Overview

19.3.4.2. Product Portfolio

19.3.4.3. Financial Information, (Subject to Data Availability)

19.3.4.4. Business Strategies / Recent Developments

19.3.5. Asus

19.3.5.1. Company Overview

19.3.5.2. Product Portfolio

19.3.5.3. Financial Information, (Subject to Data Availability)

19.3.5.4. Business Strategies / Recent Developments

19.3.6. OnePlus

19.3.6.1. Company Overview

19.3.6.2. Product Portfolio

19.3.6.3. Financial Information, (Subject to Data Availability)

19.3.6.4. Business Strategies / Recent Developments

19.3.7. Amazon

19.3.7.1. Company Overview

19.3.7.2. Product Portfolio

19.3.7.3. Financial Information, (Subject to Data Availability)

19.3.7.4. Business Strategies / Recent Developments

19.3.8. Lenovo

19.3.8.1. Company Overview

19.3.8.2. Product Portfolio

19.3.8.3. Financial Information, (Subject to Data Availability)

19.3.8.4. Business Strategies / Recent Developments

19.3.9. Huawei

19.3.9.1. Company Overview

19.3.9.2. Product Portfolio

19.3.9.3. Financial Information, (Subject to Data Availability)

19.3.9.4. Business Strategies / Recent Developments

19.3.10. Xiaomi

19.3.10.1. Company Overview

19.3.10.2. Product Portfolio

19.3.10.3. Financial Information, (Subject to Data Availability)

19.3.10.4. Business Strategies / Recent Developments

19.3.11. BlackBerry

19.3.11.1. Company Overview

19.3.11.2. Product Portfolio

19.3.11.3. Financial Information, (Subject to Data Availability)

19.3.11.4. Business Strategies / Recent Developments

20. Go to Market Strategy

20.1. Identification of Potential Market Spaces

20.2. Understanding the Buying Process of Customers

20.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Tablet PC Market Value (US$ Bn), By Type, 2017 - 2031

Table 2: Global Tablet PC Market Volume (Thousand Units), By Type, 2017 - 2031

Table 3: Global Tablet PC Market Value (US$ Bn), By Operating System, 2017 - 2031

Table 4: Global Tablet PC Market Volume (Thousand Units), By Operating System, 2017 - 2031

Table 5: Global Tablet PC Market Value (US$ Bn), By Display Size, 2017 - 2031

Table 6: Global Tablet PC Market Volume (Thousand Units), By Display Size, 2017 - 2031

Table 7: Global Tablet PC Market Value (US$ Bn), By Price, 2017 - 2031

Table 8: Global Tablet PC Market Volume (Thousand Units), By Price, 2017 - 2031

Table 9: Global Tablet PC Market Value (US$ Bn), By Ram Size, 2017 - 2031

Table 10: Global Tablet PC Market Volume (Thousand Units), By Ram Size, 2017 - 2031

Table 11: Global Tablet PC Market Value (US$ Bn), By Battery Capacity, 2017 - 2031

Table 12: Global Tablet PC Market Volume (Thousand Units), By Battery Capacity, 2017 - 2031

Table 13: Global Tablet PC Market Value (US$ Bn), By Distribution Channel, 2017 - 2031

Table 14: Global Tablet PC Market Volume (Thousand Units), By Distribution Channel, 2017 - 2031

Table 15: Global Tablet PC Market Value (US$ Bn), By Region, 2017 - 2031

Table 16: Global Tablet PC Market Volume (Thousand Units), By Region, 2017 - 2031

Table 17: North America Tablet PC Market Value (US$ Bn), By Type, 2017 - 2031

Table 18: North America Tablet PC Market Volume (Thousand Units), By Type, 2017 - 2031

Table 19: North America Tablet PC Market Value (US$ Bn), By Operating System, 2017 - 2031

Table 20: North America Tablet PC Market Volume (Thousand Units), By Operating System, 2017 - 2031

Table 21: North America Tablet PC Market Value (US$ Bn), By Display Size, 2017 - 2031

Table 22: North America Tablet PC Market Volume (Thousand Units), By Display Size, 2017 - 2031

Table 23: North America Tablet PC Market Value (US$ Bn), By Price, 2017 - 2031

Table 24: North America Tablet PC Market Volume (Thousand Units), By Price, 2017 - 2031

Table 25: North America Tablet PC Market Value (US$ Bn), By Ram Size, 2017 - 2031

Table 26: North America Tablet PC Market Volume (Thousand Units), By Ram Size, 2017 - 2031

Table 27: North America Tablet PC Market Value (US$ Bn), By Battery Capacity, 2017 - 2031

Table 28: North America Tablet PC Market Volume (Thousand Units), By Battery Capacity, 2017 - 2031

Table 29: North America Tablet PC Market Value (US$ Bn), By Distribution Channel, 2017 - 2031

Table 30: North America Tablet PC Market Volume (Thousand Units), By Distribution Channel, 2017 - 2031

Table 31: North America Tablet PC Market Value (US$ Bn), By Country, 2017 - 2031

Table 32: North America Tablet PC Market Volume (Thousand Units), By Country, 2017 - 2031

Table 33: Europe Tablet PC Market Value (US$ Bn), By Type, 2017 - 2031

Table 34: Europe Tablet PC Market Volume (Thousand Units), By Type, 2017 - 2031

Table 35: Europe Tablet PC Market Value (US$ Bn), By Operating System, 2017 - 2031

Table 36: Europe Tablet PC Market Volume (Thousand Units), By Operating System, 2017 - 2031

Table 37: Europe Tablet PC Market Value (US$ Bn), By Display Size, 2017 - 2031

Table 38: Europe Tablet PC Market Volume (Thousand Units), By Display Size, 2017 - 2031

Table 39: Europe Tablet PC Market Value (US$ Bn), By Price, 2017 - 2031

Table 40: Europe Tablet PC Market Volume (Thousand Units), By Price, 2017 - 2031

Table 41: Europe Tablet PC Market Value (US$ Bn), By Ram Size, 2017 - 2031

Table 42: Europe Tablet PC Market Volume (Thousand Units), By Ram Size, 2017 - 2031

Table 43: Europe Tablet PC Market Value (US$ Bn), By Battery Capacity, 2017 - 2031

Table 44: Europe Tablet PC Market Volume (Thousand Units), By Battery Capacity, 2017 - 2031

Table 45: Europe Tablet PC Market Value (US$ Bn), By Distribution Channel, 2017 - 2031

Table 46: Europe Tablet PC Market Volume (Thousand Units), By Distribution Channel, 2017 - 2031

Table 47: Europe Tablet PC Market Value (US$ Bn), By Country, 2017 - 2031

Table 48: Europe Tablet PC Market Volume (Thousand Units), By Country, 2017 - 2031

Table 49: Asia Pacific Tablet PC Market Value (US$ Bn), By Type, 2017 - 2031

Table 50: Asia Pacific Tablet PC Market Volume (Thousand Units), By Type, 2017 - 2031

Table 51: Asia Pacific Tablet PC Market Value (US$ Bn), By Operating System, 2017 - 2031

Table 52: Asia Pacific Tablet PC Market Volume (Thousand Units), By Operating System, 2017 - 2031

Table 53: Asia Pacific Tablet PC Market Value (US$ Bn), By Display Size, 2017 - 2031

Table 54: Asia Pacific Tablet PC Market Volume (Thousand Units), By Display Size, 2017 - 2031

Table 55: Asia Pacific Tablet PC Market Value (US$ Bn), By Price, 2017 - 2031

Table 56: Asia Pacific Tablet PC Market Volume (Thousand Units), By Price, 2017 - 2031

Table 57: Asia Pacific Tablet PC Market Value (US$ Bn), By Ram Size, 2017 - 2031

Table 58: Asia Pacific Tablet PC Market Volume (Thousand Units), By Ram Size, 2017 - 2031

Table 59: Asia Pacific Tablet PC Market Value (US$ Bn), By Battery Capacity, 2017 - 2031

Table 60: Asia Pacific Tablet PC Market Volume (Thousand Units), By Battery Capacity, 2017 - 2031

Table 61: Asia Pacific Tablet PC Market Value (US$ Bn), By Distribution Channel, 2017 - 2031

Table 62: Asia Pacific Tablet PC Market Volume (Thousand Units), By Distribution Channel, 2017 - 2031

Table 63: Asia Pacific Tablet PC Market Value (US$ Bn), By Country, 2017 - 2031

Table 64: Asia Pacific Tablet PC Market Volume (Thousand Units), By Country, 2017 - 2031

Table 65: Middle East & Africa Tablet PC Market Value (US$ Bn), By Type, 2017 - 2031

Table 66: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Type, 2017 - 2031

Table 67: Middle East & Africa Tablet PC Market Value (US$ Bn), By Operating System, 2017 - 2031

Table 68: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Operating System, 2017 - 2031

Table 69: Middle East & Africa Tablet PC Market Value (US$ Bn), By Display Size, 2017 - 2031

Table 70: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Display Size, 2017 - 2031

Table 71: Middle East & Africa Tablet PC Market Value (US$ Bn), By Price, 2017 - 2031

Table 72: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Price, 2017 - 2031

Table 73: Middle East & Africa Tablet PC Market Value (US$ Bn), By Ram Size, 2017 - 2031

Table 74: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Ram Size, 2017 - 2031

Table 75: Middle East & Africa Tablet PC Market Value (US$ Bn), By Battery Capacity, 2017 - 2031

Table 76: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Battery Capacity, 2017 - 2031

Table 77: Middle East & Africa Tablet PC Market Value (US$ Bn), By Distribution Channel, 2017 - 2031

Table 78: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Distribution Channel, 2017 - 2031

Table 79: Middle East & Africa Tablet PC Market Value (US$ Bn), By Country, 2017 - 2031

Table 80: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Country, 2017 - 2031

Table 81: South America Tablet PC Market Value (US$ Bn), By Type, 2017 - 2031

Table 82: South America Tablet PC Market Volume (Thousand Units), By Type, 2017 - 2031

Table 83: South America Tablet PC Market Value (US$ Bn), By Operating System, 2017 - 2031

Table 84: South America Tablet PC Market Volume (Thousand Units), By Operating System, 2017 - 2031

Table 85: South America Tablet PC Market Value (US$ Bn), By Display Size, 2017 - 2031

Table 86: South America Tablet PC Market Volume (Thousand Units), By Display Size, 2017 - 2031

Table 87: South America Tablet PC Market Value (US$ Bn), By Price, 2017 - 2031

Table 88: South America Tablet PC Market Volume (Thousand Units), By Price, 2017 - 2031

Table 89: South America Tablet PC Market Value (US$ Bn), By Ram Size, 2017 - 2031

Table 90: South America Tablet PC Market Volume (Thousand Units), By Ram Size, 2017 - 2031

Table 91: South America Tablet PC Market Value (US$ Bn), By Battery Capacity, 2017 - 2031

Table 92: South America Tablet PC Market Volume (Thousand Units), By Battery Capacity, 2017 - 2031

Table 93: South America Tablet PC Market Value (US$ Bn), By Distribution Channel, 2017 - 2031

Table 94: South America Tablet PC Market Volume (Thousand Units), By Distribution Channel, 2017 - 2031

Table 95: South America Tablet PC Market Value (US$ Bn), By Country, 2017 - 2031

Table 96: South America Tablet PC Market Volume (Thousand Units), By Country, 2017 - 2031

List of Figures

Figure 1: Global Tablet PC Market Value (US$ Bn), By Type, 2017 - 2031

Figure 2: Global Tablet PC Market Volume (Thousand Units), By Type, 2017 - 2031

Figure 3: Global Tablet PC Market Incremental Opportunity (US$ Bn), By Type, 2017 - 2031

Figure 4: Global Tablet PC Market Value (US$ Bn), By Operating System, 2017 - 2031

Figure 5: Global Tablet PC Market Volume (Thousand Units), By Operating System, 2017 - 2031

Figure 6: Global Tablet PC Market Incremental Opportunity (US$ Bn), By Operating System, 2017 - 2031

Figure 7: Global Tablet PC Market Value (US$ Bn), By Display Size, 2017 - 2031

Figure 8: Global Tablet PC Market Volume (Thousand Units), By Display Size, 2017 - 2031

Figure 9: Global Tablet PC Market Incremental Opportunity (US$ Bn), By Display Size, 2017 - 2031

Figure 10: Global Tablet PC Market Value (US$ Bn), By Price, 2017 - 2031

Figure 11: Global Tablet PC Market Volume (Thousand Units), By Price, 2017 - 2031

Figure 12: Global Tablet PC Market Incremental Opportunity (US$ Bn), By Price, 2017 - 2031

Figure 13: Global Tablet PC Market Value (US$ Bn), By Ram Size, 2017 - 2031

Figure 14: Global Tablet PC Market Volume (Thousand Units), By Ram Size, 2017 - 2031

Figure 15: Global Tablet PC Market Incremental Opportunity (US$ Bn), By Ram Size, 2017 - 2031

Figure 16: Global Tablet PC Market Value (US$ Bn), By Battery Capacity, 2017 - 2031

Figure 17: Global Tablet PC Market Volume (Thousand Units), By Battery Capacity, 2017 - 2031

Figure 18: Global Tablet PC Market Incremental Opportunity (US$ Bn), By Battery Capacity, 2017 - 2031

Figure 19: Global Tablet PC Market Value (US$ Bn), By Distribution Channel, 2017 - 2031

Figure 20: Global Tablet PC Market Volume (Thousand Units), By Distribution Channel, 2017 - 2031

Figure 21: Global Tablet PC Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017 - 2031

Figure 22: Global Tablet PC Market Value (US$ Bn), By Region, 2017 - 2031

Figure 23: Global Tablet PC Market Volume (Thousand Units), By Region, 2017 - 2031

Figure 24: Global Tablet PC Market Incremental Opportunity (US$ Bn), By Region, 2017 - 2031

Figure 25: North America Tablet PC Market Value (US$ Bn), By Type, 2017 - 2031

Figure 26: North America Tablet PC Market Volume (Thousand Units), By Type, 2017 - 2031

Figure 27: North America Tablet PC Market Incremental Opportunity (US$ Bn), By Type, 2017 - 2031

Figure 28: North America Tablet PC Market Value (US$ Bn), By Operating System, 2017 - 2031

Figure 29: North America Tablet PC Market Volume (Thousand Units), By Operating System, 2017 - 2031

Figure 30: North America Tablet PC Market Incremental Opportunity (US$ Bn), By Operating System, 2017 - 2031

Figure 31: North America Tablet PC Market Value (US$ Bn), By Display Size, 2017 - 2031

Figure 32: North America Tablet PC Market Volume (Thousand Units), By Display Size, 2017 - 2031

Figure 33: North America Tablet PC Market Incremental Opportunity (US$ Bn), By Display Size, 2017 - 2031

Figure 34: North America Tablet PC Market Value (US$ Bn), By Price, 2017 - 2031

Figure 35: North America Tablet PC Market Volume (Thousand Units), By Price, 2017 - 2031

Figure 36: North America Tablet PC Market Incremental Opportunity (US$ Bn), By Price, 2017 - 2031

Figure 37: North America Tablet PC Market Value (US$ Bn), By Ram Size, 2017 - 2031

Figure 38: North America Tablet PC Market Volume (Thousand Units), By Ram Size, 2017 - 2031

Figure 39: North America Tablet PC Market Incremental Opportunity (US$ Bn), By Ram Size, 2017 - 2031

Figure 40: North America Tablet PC Market Value (US$ Bn), By Battery Capacity, 2017 - 2031

Figure 41: North America Tablet PC Market Volume (Thousand Units), By Battery Capacity, 2017 - 2031

Figure 42: North America Tablet PC Market Incremental Opportunity (US$ Bn), By Battery Capacity, 2017 - 2031

Figure 43: North America Tablet PC Market Value (US$ Bn), By Distribution Channel, 2017 - 2031

Figure 44: North America Tablet PC Market Volume (Thousand Units), By Distribution Channel, 2017 - 2031

Figure 45: North America Tablet PC Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017 - 2031

Figure 46: North America Tablet PC Market Value (US$ Bn), By Country, 2017 - 2031

Figure 47: North America Tablet PC Market Volume (Thousand Units), By Country, 2017 - 2031

Figure 48: North America Tablet PC Market Incremental Opportunity (US$ Bn), By Country, 2017 - 2031

Figure 49: Europe Tablet PC Market Value (US$ Bn), By Type, 2017 - 2031

Figure 50: Europe Tablet PC Market Volume (Thousand Units), By Type, 2017 - 2031

Figure 51: Europe Tablet PC Market Incremental Opportunity (US$ Bn), By Type, 2017 - 2031

Figure 52: Europe Tablet PC Market Value (US$ Bn), By Operating System, 2017 - 2031

Figure 53: Europe Tablet PC Market Volume (Thousand Units), By Operating System, 2017 - 2031

Figure 54: Europe Tablet PC Market Incremental Opportunity (US$ Bn), By Operating System, 2017 - 2031

Figure 55: Europe Tablet PC Market Value (US$ Bn), By Display Size, 2017 - 2031

Figure 56: Europe Tablet PC Market Volume (Thousand Units), By Display Size, 2017 - 2031

Figure 57: Europe Tablet PC Market Incremental Opportunity (US$ Bn), By Display Size, 2017 - 2031

Figure 58: Europe Tablet PC Market Value (US$ Bn), By Price, 2017 - 2031

Figure 59: Europe Tablet PC Market Volume (Thousand Units), By Price, 2017 - 2031

Figure 60: Europe Tablet PC Market Incremental Opportunity (US$ Bn), By Price, 2017 - 2031

Figure 61: Europe Tablet PC Market Value (US$ Bn), By Ram Size, 2017 - 2031

Figure 62: Europe Tablet PC Market Volume (Thousand Units), By Ram Size, 2017 - 2031

Figure 63: Europe Tablet PC Market Incremental Opportunity (US$ Bn), By Ram Size, 2017 - 2031

Figure 64: Europe Tablet PC Market Value (US$ Bn), By Battery Capacity, 2017 - 2031

Figure 65: Europe Tablet PC Market Volume (Thousand Units), By Battery Capacity, 2017 - 2031

Figure 66: Europe Tablet PC Market Incremental Opportunity (US$ Bn), By Battery Capacity, 2017 - 2031

Figure 67: Europe Tablet PC Market Value (US$ Bn), By Distribution Channel, 2017 - 2031

Figure 68: Europe Tablet PC Market Volume (Thousand Units), By Distribution Channel, 2017 - 2031

Figure 69: Europe Tablet PC Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017 - 2031

Figure 70: Europe Tablet PC Market Value (US$ Bn), By Country, 2017 - 2031

Figure 71: Europe Tablet PC Market Volume (Thousand Units), By Country, 2017 - 2031

Figure 72: Europe Tablet PC Market Incremental Opportunity (US$ Bn), By Country, 2017 - 2031

Figure 73: Asia Pacific Tablet PC Market Value (US$ Bn), By Type, 2017 - 2031

Figure 74: Asia Pacific Tablet PC Market Volume (Thousand Units), By Type, 2017 - 2031

Figure 75: Asia Pacific Tablet PC Market Incremental Opportunity (US$ Bn), By Type, 2017 - 2031

Figure 76: Asia Pacific Tablet PC Market Value (US$ Bn), By Operating System, 2017 - 2031

Figure 77: Asia Pacific Tablet PC Market Volume (Thousand Units), By Operating System, 2017 - 2031

Figure 78: Asia Pacific Tablet PC Market Incremental Opportunity (US$ Bn), By Operating System, 2017 - 2031

Figure 79: Asia Pacific Tablet PC Market Value (US$ Bn), By Display Size, 2017 - 2031

Figure 80: Asia Pacific Tablet PC Market Volume (Thousand Units), By Display Size, 2017 - 2031

Figure 81: Asia Pacific Tablet PC Market Incremental Opportunity (US$ Bn), By Display Size, 2017 - 2031

Figure 82: Asia Pacific Tablet PC Market Value (US$ Bn), By Price, 2017 - 2031

Figure 83: Asia Pacific Tablet PC Market Volume (Thousand Units), By Price, 2017 - 2031

Figure 84: Asia Pacific Tablet PC Market Incremental Opportunity (US$ Bn), By Price, 2017 - 2031

Figure 85: Asia Pacific Tablet PC Market Value (US$ Bn), By Ram Size, 2017 - 2031

Figure 86: Asia Pacific Tablet PC Market Volume (Thousand Units), By Ram Size, 2017 - 2031

Figure 87: Asia Pacific Tablet PC Market Incremental Opportunity (US$ Bn), By Ram Size, 2017 - 2031

Figure 88: Asia Pacific Tablet PC Market Value (US$ Bn), By Battery Capacity, 2017 - 2031

Figure 89: Asia Pacific Tablet PC Market Volume (Thousand Units), By Battery Capacity, 2017 - 2031

Figure 90: Asia Pacific Tablet PC Market Incremental Opportunity (US$ Bn), By Battery Capacity, 2017 - 2031

Figure 91: Asia Pacific Tablet PC Market Value (US$ Bn), By Distribution Channel, 2017 - 2031

Figure 92: Asia Pacific Tablet PC Market Volume (Thousand Units), By Distribution Channel, 2017 - 2031

Figure 93: Asia Pacific Tablet PC Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017 - 2031

Figure 94: Asia Pacific Tablet PC Market Value (US$ Bn), By Country, 2017 - 2031

Figure 95: Asia Pacific Tablet PC Market Volume (Thousand Units), By Country, 2017 - 2031

Figure 96: Asia Pacific Tablet PC Market Incremental Opportunity (US$ Bn), By Country, 2017 - 2031

Figure 97: Middle East & Africa Tablet PC Market Value (US$ Bn), By Type, 2017 - 2031

Figure 98: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Type, 2017 - 2031

Figure 99: Middle East & Africa Tablet PC Market Incremental Opportunity (US$ Bn), By Type, 2017 - 2031

Figure 100: Middle East & Africa Tablet PC Market Value (US$ Bn), By Operating System, 2017 - 2031

Figure 101: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Operating System, 2017 - 2031

Figure 102: Middle East & Africa Tablet PC Market Incremental Opportunity (US$ Bn), By Operating System, 2017 - 2031

Figure 103: Middle East & Africa Tablet PC Market Value (US$ Bn), By Display Size, 2017 - 2031

Figure 104: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Display Size, 2017 - 2031

Figure 105: Middle East & Africa Tablet PC Market Incremental Opportunity (US$ Bn), By Display Size, 2017 - 2031

Figure 106: Middle East & Africa Tablet PC Market Value (US$ Bn), By Price, 2017 - 2031

Figure 107: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Price, 2017 - 2031

Figure 108: Middle East & Africa Tablet PC Market Incremental Opportunity (US$ Bn), By Price, 2017 - 2031

Figure 109: Middle East & Africa Tablet PC Market Value (US$ Bn), By Ram Size, 2017 - 2031

Figure 110: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Ram Size, 2017 - 2031

Figure 111: Middle East & Africa Tablet PC Market Incremental Opportunity (US$ Bn), By Ram Size, 2017 - 2031

Figure 112: Middle East & Africa Tablet PC Market Value (US$ Bn), By Battery Capacity, 2017 - 2031

Figure 113: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Battery Capacity, 2017 - 2031

Figure 114: Middle East & Africa Tablet PC Market Incremental Opportunity (US$ Bn), By Battery Capacity, 2017 - 2031

Figure 115: Middle East & Africa Tablet PC Market Value (US$ Bn), By Distribution Channel, 2017 - 2031

Figure 116: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Distribution Channel, 2017 - 2031

Figure 117: Middle East & Africa Tablet PC Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017 - 2031

Figure 118: Middle East & Africa Tablet PC Market Value (US$ Bn), By Country, 2017 - 2031

Figure 119: Middle East & Africa Tablet PC Market Volume (Thousand Units), By Country, 2017 - 2031

Figure 120: Middle East & Africa Tablet PC Market Incremental Opportunity (US$ Bn), By Country, 2017 - 2031

Figure 121: South America Tablet PC Market Value (US$ Bn), By Type, 2017 - 2031

Figure 122: South America Tablet PC Market Volume (Thousand Units), By Type, 2017 - 2031

Figure 123: South America Tablet PC Market Incremental Opportunity (US$ Bn), By Type, 2017 - 2031

Figure 124: South America Tablet PC Market Value (US$ Bn), By Operating System, 2017 - 2031

Figure 125: South America Tablet PC Market Volume (Thousand Units), By Operating System, 2017 - 2031

Figure 126: South America Tablet PC Market Incremental Opportunity (US$ Bn), By Operating System, 2017 - 2031

Figure 127: South America Tablet PC Market Value (US$ Bn), By Display Size, 2017 - 2031

Figure 128: South America Tablet PC Market Volume (Thousand Units), By Display Size, 2017 - 2031

Figure 129: South America Tablet PC Market Incremental Opportunity (US$ Bn), By Display Size, 2017 - 2031

Figure 130: South America Tablet PC Market Value (US$ Bn), By Price, 2017 - 2031

Figure 131: South America Tablet PC Market Volume (Thousand Units), By Price, 2017 - 2031

Figure 132: South America Tablet PC Market Incremental Opportunity (US$ Bn), By Price, 2017 - 2031

Figure 133: South America Tablet PC Market Value (US$ Bn), By Ram Size, 2017 - 2031

Figure 134: South America Tablet PC Market Volume (Thousand Units), By Ram Size, 2017 - 2031

Figure 135: South America Tablet PC Market Incremental Opportunity (US$ Bn), By Ram Size, 2017 - 2031

Figure 136: South America Tablet PC Market Value (US$ Bn), By Battery Capacity, 2017 - 2031

Figure 137: South America Tablet PC Market Volume (Thousand Units), By Battery Capacity, 2017 - 2031

Figure 138: South America Tablet PC Market Incremental Opportunity (US$ Bn), By Battery Capacity, 2017 - 2031

Figure 139: South America Tablet PC Market Value (US$ Bn), By Distribution Channel, 2017 - 2031

Figure 140: South America Tablet PC Market Volume (Thousand Units), By Distribution Channel, 2017 - 2031

Figure 141: South America Tablet PC Market Incremental Opportunity (US$ Bn), By Distribution Channel, 2017 - 2031

Figure 142: South America Tablet PC Market Value (US$ Bn), By Country, 2017 - 2031

Figure 143: South America Tablet PC Market Volume (Thousand Units), By Country, 2017 - 2031

Figure 144: South America Tablet PC Market Incremental Opportunity (US$ Bn), By Country, 2017 - 2031