Reports

Reports

The synthetic biology market is growing considerably as a result of adoption of advanced technologies in genetic engineering, bioinformatics, and bio manufacturing. New technologies such as CRISPR-Cas9, gene synthesis platforms, and cell-free systems have enabled biologists to design and program biological systems with unprecedented specificity.

This growth is coming from a variety of players in the industry-a deep-tech startup or huge biopharma company, or a specialized tool provider. Some examples include an automated DNA synthesis machine that offers GM constructs quicker, cheaper, and more reliably, with expedited development times for the biotechnology firms looking to use synthetic biology to yield more therapeutics, diagnostics, or sustainable chemicals.

.webp)

The introduction of significant new resources collected from, for example, collaborative efforts between academia and commercial entities are assisting significant and sometimes needed advances into the initiatives and ecosystem of synthetic biology.

Coupling increased investment from venture capital and governmental funding (and granting funding) in synthetic biology initiatives, particularly the biosafety or environmentally-sensitive biosensing, it makes sense that the entire space is scaling strongly. For all the synthetic biology players all over the value chain-from gene editing services to bio-design software-all of them will expand, invest, and/or partner, and therefore eclectically boost momentum in the space.

The growth of the synthetic biology industry has been remarkable in recent years with metrics clearly demonstrating that it is on an upward trajectory. Venture capital financing has more than doubled over the past five years, and it is seen now as funding moves into many new applications such as precision fermentation, bio-based materials, cell therapeutics, and agricultural biotech.

The number of synthetic biology companies has increased globally more than any other biotech subsector. New company formations are increasing faster than any other subsector. Patent applications across synthetic gene circuits, chassis microorganisms, and metabolic engineering are increasing by 15-20% each year, which is a clear indicator of the level of innovation activity in this space.

Additionally, the number of GMP facilities that can produce biologics derived from synthetic biology has increased by more than 30% in the last three years - indicating that the underlying manufacturing infrastructure is maturing. Collaborations with synthetic biology experts and the major industries including consumer goods, agrochemicals and pharma of scale have increased threefold, indicating broadening interest.

Finally, publications in leading journals on scalable bio-production and synthetic genome assembly have also increased by approximately 25% annually, which shows strong academic/studies momentum. Collectively, this all demonstrates a market that is growing not just in financial terms but also in innovation, infrastructure, and industry integration.

| Attribute | Detail |

|---|---|

| Synthetic Biology Market Drivers |

|

One of the biggest factors behind the synthetic biology market's growth is the drastic reduction in the costs associated with biomanufacturing. Companies are producing chemicals, enzymes, and therapeutic proteins (biologics) at cheaper prices. Through breakthroughs in strain engineering and fermentation optimization; companies are investing in better strains, optimizing synthetic pathways, and improved bioreactor designs.

Centralized collaborators or strategic partnerships with firms will receive investment by both - early stage start and matured companies looking to be able to scale up products and improve yields that will ultimately reduce process costs. Biomanufacturers are interested in cell line engineering, which allows for development timelines to be decreased for scale and increases yield in the biomanufacturing process, creating a pathway to lower costs in biomanufacturing.

DNA synthesis prices have come down significantly. DNA that once cost tens of dollars per gene is now a few cents per base pair. Companies that offer drop-in replacements for petrochemical-derived compounds (cosmetics, food ingredients, and industrial monomers) claim to be able to match petroleum-derived products and sometimes beat petroleum pricing through synthetic biology.

These economic factors are motivating pharmaceutical incumbents to partner with synthetic biology firms, and additional companies are stepping into the market. The market has developed a trajectory towards acceleration; costs are being reduced, product development and process costs are driving manufacturing forward through extended applications, and labs are moving to reallocate resources towards experimentation and innovation at the same time as costs are being brought down.

The major driver of growth is the availability of customizable design tools (software platforms, automated lab systems and modular genetic parts) that facilitate biological engineering. Design-build-test-learn (DBTL) platforms support streamlined workflows and less trial-and-error with broad access to synthetic biology. For example, cloud-based design tools that allows one to design genetic circuits or metabolic pathways, simulate their putative performance, and connected directly to DNA synthesis services eliminates traditional bottlenecks in workflows. Researchers first design in silico, decide to use DAC, and then print DNA to physically prototype their designs.

Lab automation platforms that have robotics for liquid handling and automated high-throughput screening enable faster cycles of experimentation. For example, teams can run dozens of enzyme variants in parallel, with each enzyme tested under different conditions, to rapidly narrow down selection of good candidates.

With standardized modular toolkit components (standardized promoters, ribosome-binding sites, scaffolds, and chassis organisms), users can mix and match these parts to develop bespoke applications without needing deep biological engineering expertise. This has already enabled businesses to clear a `proof-of-concept` product from bio-based pigments to environmental sensors in a short period, reducing both - time-to-market and risk. While reducing technical barriers and providing flexible, precise control over biological constructs, this approach also indirectly encourages wider adoption and growth markets.

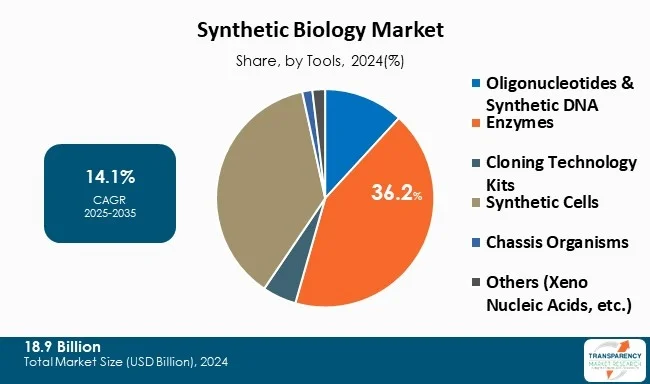

Oligonucleotides and synthetic DNA comprise the largest part of the global synthetic biology marketplace as they serve as a basis for genetic engineering obtaining genetic material necessary for use in life sciences fields such as diagnostics and therapeutics. Oligonucleotides, which are short sequences of DNA or RNA, are needed for gene synthesis, CRISPR-based genome editing, or design of synthetic gene circuits.

Oligonucleotide synthesis offers high precision, replicability across size scales, and lowering synthesis costs, which enables growing acceptance across many sectors including biotechnology, pharmaceutical, and agriculture. With increasing use of personalized medicines, mRNA-based vaccines, cell and gene therapies, the demand for well characterized, affordable and flexible manufacturing capacity presents a fast growing opportunity for investment into the technologies that facilitate oligonucleotide production.

The use of oligonucleotides for rapid prototyping biological systems as a growth area, for example, engineered microbes for bio-manufacturing or engineered crops for sustainable agriculture, is becoming clearer every day. Capability in oligonucleotide production continues to improve with the advancement of DNA synthesis manufacturer platforms, the introduction automated synthesis units, and development of high fidelity error correction tools in most synthesis platforms.

Increased government investment, large private sector funding, and the rise in startup interest within the space of synthetic biology are also providing a boost to this area in the microcosm of synthetic biology.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America is at the forefront of innovation and commercialization of synthetic biology supported by strong institutional support, investment from venture capital, and sound infrastructure. The U.S. participates with over 60% of the total synthetic biology venture capital financing and has approximately 70% of the global synthetic biology start-ups.

Many of the U.S.-headquartered companies are emerging as leaders in computational biology platforms and cell programming tools, including many in biotech city regions of Boston, San Francisco, and San Diego. Federal efforts increasing public agency funding to the bioeconomy have been another way to further strengthen its position to lead.

The U.S. also has a broad network of contract development and manufacturing organizations (CDMOs) that can push synthetic constructs into clinical and commercial volumes. For example, one midwestern U.S.-based CDMO recently tripled the number of patient iterations in a manufacturing run by producing synthetic RNA therapeutics at GMP scale, which would be impossible for a small startup.

Partnership activity is also strong, with large American consumer goods and agrochemical firms regularly collaborating with synthetic biology companies to incorporate bio-based ingredients in their products. Moreover, there are several state-level programs (for example: California and Massachusetts) that provide grants and infrastructure to synthetic biology start-ups to support their development and entrench their regional dominance in synthetic biology.

Key players operating in the synthetic biology industry are investing through innovation, technological advancements, and strategic partnerships. They focus on enhancing imaging clarity, and expanding product portfolios, ensuring sustained growth and leadership in the evolving healthcare landscape.

Ginkgo Bioworks, Bolt Threads, Mammoth Biosciences, LanzaTech, Motif FoodWorks, Joyn Bio, Kiverdi, Perfect Day, Viridos, Upside Foods, Asimov, Apeel, & Twist Bioscience are the key players in synthetic biology market.

Each of these players has been profiled in the synthetic biology market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 18.9 Bn |

| Forecast Value in 2035 | US$ 84.7 Bn |

| CAGR | 14.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Synthetic Biology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The synthetic biology market was valued at US$ 18.9 Bn in 2024.

The synthetic biology market is projected to cross US$ 84.7 Bn by the end of 2035.

Reduction in the cost of bio manufacturing and growth in customizable Bio-Design Tools.

The CAGR is anticipated to be 14.1% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Ginkgo Bioworks, Bolt Threads, Mammoth Biosciences, LanzaTech, Motif FoodWorks, Joyn Bio, Kiverdi, Perfect Day, Viridos, Upside Foods, Asimov, Apeel, & Twist Bioscience, and others

List of Tables

Table 01: Global Synthetic Biology Market Value (US$ Bn) Forecast, by Tools, 2020 to 2035

Table 02: Global Synthetic Biology Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 03: Global Synthetic Biology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Synthetic Biology Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 05: Global Synthetic Biology Market Value (US$ Bn) Forecast, by Healthcare, 2020 to 2035

Table 06: Global Synthetic Biology Market Value (US$ Bn) Forecast, by Industry, 2020 to 2035

Table 07: Global Synthetic Biology Market Value (US$ Bn) Forecast, by Environment, 2020 to 2035

Table 08: Global Synthetic Biology Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 09: North America Synthetic Biology Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 10: North America Synthetic Biology Market Value (US$ Bn) Forecast, by Tools, 2020 to 2035

Table 11: North America Synthetic Biology Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 12: North America Synthetic Biology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 13: North America Synthetic Biology Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 14: North America Synthetic Biology Market Value (US$ Bn) Forecast, by Healthcare, 2020 to 2035

Table 15: North America Synthetic Biology Market Value (US$ Bn) Forecast, by Industry, 2020 to 2035

Table 16: North America Synthetic Biology Market Value (US$ Bn) Forecast, by Environment, 2020 to 2035

Table 17: Europe Synthetic Biology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 18: Europe Synthetic Biology Market Value (US$ Bn) Forecast, by Tools, 2020 to 2035

Table 19: Europe Synthetic Biology Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 20: Europe Synthetic Biology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 21: Europe Synthetic Biology Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 22: Europe Synthetic Biology Market Value (US$ Bn) Forecast, by Healthcare, 2020 to 2035

Table 23: Europe Synthetic Biology Market Value (US$ Bn) Forecast, by Industry, 2020 to 2035

Table 24: Europe Synthetic Biology Market Value (US$ Bn) Forecast, by Environment, 2020 to 2035

Table 25: Asia Pacific Synthetic Biology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 26: Asia Pacific Synthetic Biology Market Value (US$ Bn) Forecast, by Tools, 2020 to 2035

Table 27: Asia Pacific Synthetic Biology Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 28: Asia Pacific Synthetic Biology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 29: Asia Pacific Synthetic Biology Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 30: Asia Pacific Synthetic Biology Market Value (US$ Bn) Forecast, by Healthcare, 2020 to 2035

Table 31: Asia Pacific Synthetic Biology Market Value (US$ Bn) Forecast, by Industry, 2020 to 2035

Table 32: Asia Pacific Synthetic Biology Market Value (US$ Bn) Forecast, by Environment, 2020 to 2035

Table 33: Latin America Synthetic Biology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 34: Latin America Synthetic Biology Market Value (US$ Bn) Forecast, by Tools, 2020 to 2035

Table 35: Latin America Synthetic Biology Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 36: Latin America Synthetic Biology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 37: Latin America Synthetic Biology Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 38: Latin America Synthetic Biology Market Value (US$ Bn) Forecast, by Healthcare, 2020 to 2035

Table 39: Latin America Synthetic Biology Market Value (US$ Bn) Forecast, by Industry, 2020 to 2035

Table 40: Latin America Synthetic Biology Market Value (US$ Bn) Forecast, by Environment, 2020 to 2035

Table 41: Middle East & Africa Synthetic Biology Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 42: Middle East and Africa Synthetic Biology Market Value (US$ Bn) Forecast, by Tools, 2020 to 2035

Table 43: Middle East and Africa Synthetic Biology Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 44: Middle East and Africa Synthetic Biology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 45: Middle East and Africa Synthetic Biology Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 46: Middle East and Africa Synthetic Biology Market Value (US$ Bn) Forecast, by Healthcare, 2020 to 2035

Table 47: Middle East and Africa Synthetic Biology Market Value (US$ Bn) Forecast, by Industry, 2020 to 2035

Table 48: Middle East and Africa Synthetic Biology Market Value (US$ Bn) Forecast, by Environment, 2020 to 2035

List of Figures

Figure 01: Global Synthetic Biology Market Value Share Analysis, by Tools, 2024 and 2035

Figure 02: Global Synthetic Biology Market Attractiveness Analysis, by Tools, 2025 to 2035

Figure 03: Global Synthetic Biology Market Revenue (US$ Mn), by Oligonucleotides & Synthetic DNA, 2020 to 2035

Figure 04: Global Synthetic Biology Market Revenue (US$ Mn), by Enzymes, 2020 to 2035

Figure 05: Global Synthetic Biology Market Revenue (US$ Mn), by Cloning Technology Kits, 2020 to 2035

Figure 06: Global Synthetic Biology Market Revenue (US$ Mn), by Synthetic Cells, 2020 to 2035

Figure 07: Global Synthetic Biology Market Revenue (US$ Mn), by Chassis Organisms, 2020 to 2035

Figure 08: Global Synthetic Biology Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 09: Global Synthetic Biology Market Value Share Analysis, by Technology, 2024 and 2035

Figure 10: Global Synthetic Biology Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 11: Global Synthetic Biology Market Revenue (US$ Mn), by Gene Synthesis, 2020 to 2035

Figure 12: Global Synthetic Biology Market Revenue (US$ Mn), by Genome Engineering, 2020 to 2035

Figure 13: Global Synthetic Biology Market Revenue (US$ Mn), by Sequencing, 2020 to 2035

Figure 14: Global Synthetic Biology Market Revenue (US$ Mn), by Bioinformatics, 2020 to 2035

Figure 15: Global Synthetic Biology Market Revenue (US$ Mn), by Cloning, 2020 to 2035

Figure 16: Global Synthetic Biology Market Revenue (US$ Mn), by Site-Directed Mutagenesis, 2020 to 2035

Figure 17: Global Synthetic Biology Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 18: Global Synthetic Biology Market Value Share Analysis, by Application, 2024 and 2035

Figure 19: Global Synthetic Biology Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 20: Global Synthetic Biology Market Revenue (US$ Mn), by Biosensors, 2020 to 2035

Figure 21: Global Synthetic Biology Market Revenue (US$ Mn), by Biological Computers, 2020 to 2035

Figure 22: Global Synthetic Biology Market Revenue (US$ Mn), by Cell Transformation, 2020 to 2035

Figure 23: Global Synthetic Biology Market Revenue (US$ Mn), by Proteins Designing, 2020 to 2035

Figure 24: Global Synthetic Biology Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 25: Global Synthetic Biology Market Value Share Analysis, by End-user, 2024 and 2035

Figure 26: Global Synthetic Biology Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 27: Global Synthetic Biology Market Revenue (US$ Mn), by Healthcare, 2020 to 2035

Figure 28: Global Synthetic Biology Market Revenue (US$ Mn), by Industry, 2020 to 2035

Figure 29: Global Synthetic Biology Market Revenue (US$ Mn), by Environment, 2020 to 2035

Figure 30: Global Synthetic Biology Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 31: Global Synthetic Biology Market Value Share Analysis, By Region, 2024 and 2035

Figure 32: Global Synthetic Biology Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 33: North America Synthetic Biology Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 34: North America Synthetic Biology Market Value Share Analysis, by Country, 2024 and 2035

Figure 35: North America Synthetic Biology Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 36: North America Synthetic Biology Market Value Share Analysis, by Tools, 2024 and 2035

Figure 37: North America Synthetic Biology Market Attractiveness Analysis, by Tools, 2025 to 2035

Figure 38: North America Synthetic Biology Market Value Share Analysis, by Technology, 2025 to 2035

Figure 39: North America Synthetic Biology Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 40: North America Synthetic Biology Market Value Share Analysis, by Application, 2024 and 2035

Figure 41: North America Synthetic Biology Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 42: North America Synthetic Biology Market Value Share Analysis, by End-user, 2024 and 2035

Figure 43: North America Synthetic Biology Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 44: Europe Synthetic Biology Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 45: Europe Synthetic Biology Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 46: Europe Synthetic Biology Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 47: Europe Synthetic Biology Market Value Share Analysis, by Tools, 2024 and 2035

Figure 48: Europe Synthetic Biology Market Attractiveness Analysis, by Tools, 2025 to 2035

Figure 49: Europe Synthetic Biology Market Value Share Analysis, by Technology, 2024 and 2035

Figure 50: Europe Synthetic Biology Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 51: Europe Synthetic Biology Market Value Share Analysis, By Application, 2024 and 2035

Figure 52: Europe Synthetic Biology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 53: Europe Synthetic Biology Market Value Share Analysis, by End-user, 2024 and 2035

Figure 54: Europe Synthetic Biology Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 55: Asia Pacific Synthetic Biology Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 56: Asia Pacific Synthetic Biology Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 57: Asia Pacific Synthetic Biology Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 58: Asia Pacific Synthetic Biology Market Value Share Analysis, by Tools, 2024 and 2035

Figure 59: Asia Pacific Synthetic Biology Market Attractiveness Analysis, by Tools, 2025 to 2035

Figure 60: Asia Pacific Synthetic Biology Market Value Share Analysis, by Technology, 2024 and 2035

Figure 61: Asia Pacific Synthetic Biology Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 62: Asia Pacific Synthetic Biology Market Value Share Analysis, By Application, 2024 and 2035

Figure 63: Asia Pacific Synthetic Biology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 64: Asia Pacific Synthetic Biology Market Value Share Analysis, by End-user, 2024 and 2035

Figure 65: Asia Pacific Synthetic Biology Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 66: Latin America Synthetic Biology Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 67: Latin America Synthetic Biology Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 68: Latin America Synthetic Biology Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 69: Latin America Synthetic Biology Market Value Share Analysis, by Tools, 2024 and 2035

Figure 70: Latin America Synthetic Biology Market Attractiveness Analysis, by Tools, 2025 to 2035

Figure 71: Latin America Synthetic Biology Market Value Share Analysis, by Technology, 2024 and 2035

Figure 72: Latin America Synthetic Biology Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 73: Latin America Synthetic Biology Market Value Share Analysis, By Application, 2024 and 2035

Figure 74: Latin America Synthetic Biology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 75: Latin America Synthetic Biology Market Value Share Analysis, by End-user, 2024 and 2035

Figure 76: Latin America Synthetic Biology Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 77: Middle East & Africa Synthetic Biology Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 78: Middle East & Africa Synthetic Biology Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 79: Middle East & Africa Synthetic Biology Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 80: Middle East and Africa Synthetic Biology Market Value Share Analysis, by Tools, 2024 and 2035

Figure 81: Middle East and Africa Synthetic Biology Market Attractiveness Analysis, by Tools, 2025 to 2035

Figure 82: Middle East and Africa Synthetic Biology Market Value Share Analysis, by Technology, 2024 and 2035

Figure 83: Middle East and Africa Synthetic Biology Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 84: Middle East and Africa Synthetic Biology Market Value Share Analysis, by Application, 2024 and 2035

Figure 85: Middle East and Africa Synthetic Biology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 86: Middle East and Africa Synthetic Biology Market Value Share Analysis, by End-user, 2024 and 2035

Figure 87: Middle East and Africa Synthetic Biology Market Attractiveness Analysis, by End-user, 2025 to 2035