Reports

Reports

Analyst Viewpoint

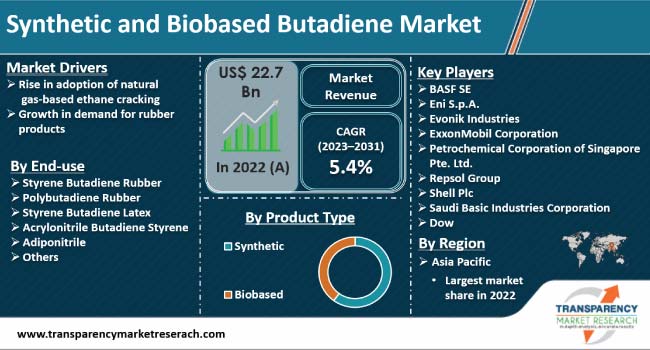

Rise in adoption of natural gas-based ethane cracking and growth in demand for rubber products are projected to augment the synthetic and biobased butadiene market size during the forecast period. On-site butadiene manufacturing from conventional and renewable feedstock is gaining traction owing to increase in investment in natural gas-based ethane cracking.

End-users are relying on biobased butadiene and silica for various applications due to surge in focus on sustainability. Bio-derived butadiene is largely considered an internal substitute for synthetic butadiene. Vendors are investing in the R&D of new products to maintain a competitive edge over other companies.

Butadiene, also known as 1, 3-butadiene, is a colorless, non-corrosive gas with the potential to condense at -4.5°C. Synthetic butadiene has a mildly fragrant odor and is commercially produced using the crude butylene concentration (C4) stream refining technology.

Automobile and rubber industries consume more than 75% of all synthetic and biobased butadiene made globally. Rubber compound materials are created using a combination of synthetic and biobased butadiene, various processing oils, and natural and synthetic elastomers. This mixture is subsequently heated to produce PBR, SBR, ABS, SB latex, and adiponitrile.

Applications of synthetic and biobased butadiene include the production of SBR, PBR, polymers, plastics, and latex. Synthetic and biobased butadiene are largely employed as rubber-reinforcing agents in the tire manufacturing business owing to their capacity to provide greater reinforcement and increased resilience, tear strength, conductivity, and other physical qualities.

Green butadiene is an alternative to artificial butadiene. Prices of raw materials (such as C4 mixed and oil butadiene feedstock) are volatile, affecting the synthetic and biobased market dynamics. The release of toxic chemicals into the atmosphere during the manufacturing process is a major issue limiting the demand for synthetic butadiene.

Ethylene is a major byproduct of natural gas-based ethane cracking. It is major precursor for the production of butadiene. Thus, increase in ethylene production from ethane cracking is expected to contribute to market growth in the near future. In the U.S., high crude oil costs and low natural gas prices have forced petrochemical businesses to change their focus from oil-based naphtha cracking to natural gas-based ethane cracking.

Synthetic and biobased butadiene are frequently used as rubber-reinforcing agents. Synthetic and biobased butadiene offer enhanced reinforcement and high resilience, conductivity, and tear strength. Green tires are gaining traction among automakers. Vendors in the market are exploring various approaches to make the production of butadiene more sustainable. They are developing biobased sources of butadiene to achieve this goal.

Sidewalls, inner liners, and treads of tires are made of SBR and PBR. Synthetic and biobased butadiene are also utilized in non-tire applications in the form of mechanical rubber goods (MRG) such as membrane roofing and automotive rubber parts (hoses, anti-vibration pieces, and sealing systems). They are widely employed in ordinary rubber goods such as belts, hoses, seals, and gaskets. The demand for SB latex is high for the manufacturing of paints & coatings. ABS can be utilized in the manufacturing of lightweight automobiles.

According to the latest synthetic and biobased butadiene market forecast, Asia Pacific is expected to hold largest share from 2023 to 2031. Expansion in tire manufacturing and paints & coatings sectors is fueling the market dynamics in the region. China is a major producer of synthetic and biobased butadiene.

Availability of crude oil and raw materials for butadiene manufacturing is boosting the synthetic and biobased butadiene industry statistics in Middle East & Africa. Expansion in the automotive sector is also driving demand for synthetic and biobased butadiene in the region. The industry in North America, Europe, and Latin America is expected to grow at a steady pace during the forecast period.

The global industry is consolidated, with the presence of several large synthetic and biobased butadiene manufacturers. Vendors are investing in on-site butadiene manufacturing using renewable feedstock. They are also investing in R&D activities to increase their synthetic and biobased butadiene market share.

BASF SE, Eni S.p.A., Evonik Industries, ExxonMobil Corporation, Petrochemical Corporation of Singapore Pte Ltd., Repsol Group, Shell Plc, Saudi Basic Industries Corporation, Dow, TPC Group, Yeochun NCC Co., Ltd., INEOS Group AG, LyondellBasell Industries N.V., and Nizhnekamskneftekhim are prominent companies operating in this market.

Each of these players has been profiled in the synthetic and biobased butadiene market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 22.7 Bn |

| Market Forecast Value in 2031 | US$ 36.5 Bn |

| Growth Rate (CAGR) | 5.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020-2022 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Prominent Players - Competition Dashboard and Revenue Share Analysis, 2023 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 22.7 Bn in 2022

It is projected to grow at a CAGR of 5.4% from 2023 to 2031

Rise in adoption of natural gas-based ethane cracking and growth in demand for rubber products

The synthetic product type segment held the largest share in 2022

Asia Pacific was the leading region in 2022

BASF SE, Eni S.p.A., Evonik Industries, ExxonMobil Corporation, Petrochemical Corporation of Singapore Pte Ltd., Repsol Group, Shell Plc, Saudi Basic Industries Corporation, Dow, TPC Group, Yeochun NCC Co., Ltd., INEOS Group AG, LyondellBasell Industries N.V., and Nizhnekamskneftekhim

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Synthetic and Biobased Butadiene Market Analysis and Forecast, 2023-2031

2.6.1. Global Synthetic and Biobased Butadiene Market Volume (Kilo Tons)

2.6.2. Global Synthetic and Biobased Butadiene Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Synthetic and Biobased Butadiene

3.2. Impact on Demand for Synthetic and Biobased Butadiene- Pre & Post Crisis

4. Production Output Analysis (Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis by Product Type

6.2. Price Trend Analysis by Region

7. Global Synthetic and Biobased Butadiene Market Analysis and Forecast, by Product Type, 2023-2031

7.1. Introduction and Definitions

7.2. Global Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

7.2.1. Synthetic

7.2.2. Biobased

7.3. Global Synthetic and Biobased Butadiene Market Attractiveness, by Product Type

8. Global Synthetic and Biobased Butadiene Market Analysis and Forecast, by End-use, 2023-2031

8.1. Introduction and Definitions

8.2. Global Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

8.2.1. Styrene Butadiene Rubber

8.2.2. Poly Butadiene Rubber

8.2.3. Styrene Butadiene Latex

8.2.4. Acrylonitrile Butadiene Styrene

8.2.5. Adiponitrile

8.2.6. Others

8.3. Global Synthetic and Biobased Butadiene Market Attractiveness, by End-use

9. Global Synthetic and Biobased Butadiene Market Analysis and Forecast, by Region, 2023-2031

9.1. Key Findings

9.2. Global Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2023-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Synthetic and Biobased Butadiene Market Attractiveness, by Region

10. North America Synthetic and Biobased Butadiene Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. North America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

10.3. North America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

10.4. North America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2023-2031

10.4.1. U.S. Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

10.4.2. U.S. Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

10.4.3. Canada Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

10.4.4. Canada Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

10.5. North America Synthetic and Biobased Butadiene Market Attractiveness Analysis

11. Europe Synthetic and Biobased Butadiene Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Europe Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

11.3. Europe Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.4. Europe Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

11.4.1. Germany Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

11.4.2. Germany. Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.4.3. France Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

11.4.4. France. Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.4.5. U.K. Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

11.4.6. U.K. Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.4.7. Italy Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

11.4.8. Italy Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.4.9. Russia & CIS Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

11.4.10. Russia & CIS Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.4.11. Rest of Europe Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

11.4.12. Rest of Europe Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

11.5. Europe Synthetic and Biobased Butadiene Market Attractiveness Analysis

12. Asia Pacific Synthetic and Biobased Butadiene Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Asia Pacific Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type

12.3. Asia Pacific Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.4. Asia Pacific Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

12.4.1. China Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

12.4.2. China Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.4.3. Japan Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

12.4.4. Japan Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.4.5. India Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

12.4.6. India Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.4.7. ASEAN Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

12.4.8. ASEAN Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.4.9. Rest of Asia Pacific Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

12.4.10. Rest of Asia Pacific Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

12.5. Asia Pacific Synthetic and Biobased Butadiene Market Attractiveness Analysis

13. Latin America Synthetic and Biobased Butadiene Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Latin America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

13.3. Latin America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.4. Latin America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

13.4.1. Brazil Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

13.4.2. Brazil Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.4.3. Mexico Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

13.4.4. Mexico Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.4.5. Rest of Latin America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

13.4.6. Rest of Latin America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

13.5. Latin America Synthetic and Biobased Butadiene Market Attractiveness Analysis

14. Middle East & Africa Synthetic and Biobased Butadiene Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Middle East & Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

14.3. Middle East & Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.4. Middle East & Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

14.4.1. GCC Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

14.4.2. GCC Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.4.3. South Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

14.4.4. South Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.4.5. Rest of Middle East & Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Product Type, 2023-2031

14.4.6. Rest of Middle East & Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by End-use, 2023-2031

14.5. Middle East & Africa Synthetic and Biobased Butadiene Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Synthetic and Biobased Butadiene Market Company Share Analysis, 2022

15.2. Company Profiles (Details - Overview, Financials, Recent Developments, and Strategy)

15.2.1. BASF SE

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.2. Eni S.P.A

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.3. Evonik Industries

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.4. ExxonMobil Corporation

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.5. Petrochemical Corporation of Singapore Pte. Ltd.

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.6. Repsol Group

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.7. Shell Plc

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.8. Saudi Basic Industries Corporation

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.9. Dow

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.10. TPC Group

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.11. Yeochun NCC Co., Ltd.

15.2.11.1. Company Revenue

15.2.11.2. Business Overview

15.2.11.3. Product Segments

15.2.11.4. Geographic Footprint

15.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.12. INEOS Group AG

15.2.12.1. Company Revenue

15.2.12.2. Business Overview

15.2.12.3. Product Segments

15.2.12.4. Geographic Footprint

15.2.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.13. LyondellBasell Industries N.V.

15.2.13.1. Company Revenue

15.2.13.2. Business Overview

15.2.13.3. Product Segments

15.2.13.4. Geographic Footprint

15.2.13.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.13.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.14. Nizhnekamskneftekhim

15.2.14.1. Company Revenue

15.2.14.2. Business Overview

15.2.14.3. Product Segments

15.2.14.4. Geographic Footprint

15.2.14.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.14.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 01: Global Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 02: Global Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 03: Global Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 04: Global Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 05: Global Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Region, 2023-2031

Table 06: Global Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Region, 2023-2031

Table 07: North America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 08: North America Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 09: North America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 10: North America Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 11: North America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Country, 2023-2031

Table 12: North America Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Country, 2023-2031

Table 13: U.S. Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 14: U.S. Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 15: U.S. Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 16: U.S. Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 17: Canada Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 18: Canada Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 19: Canada Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 20: Canada Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 21: Europe Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 22: Europe Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 23: Europe Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 24: Europe Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 25: Europe Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 26: Europe Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 27: Germany Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 28: Germany Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 29: Germany Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 30: Germany Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 31: France Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 32: France Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 33: France Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 34: France Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 35: U.K. Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 36: U.K. Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 37: U.K. Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 38: U.K. Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 39: Italy Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 40: Italy Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 41: Italy Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 42: Italy Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 43: Spain Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 44: Spain Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 45: Spain Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 46: Spain Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 47: Russia & CIS Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 48: Russia & CIS Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 49: Russia & CIS Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 50: Russia & CIS Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 51: Rest of Europe Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 52: Rest of Europe Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 53: Rest of Europe Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 54: Rest of Europe Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 55: Asia Pacific Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 56: Asia Pacific Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 57: Asia Pacific Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 58: Asia Pacific Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 59: Asia Pacific Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 60: Asia Pacific Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 61: China Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 62: China Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type 2023-2031

Table 63: China Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 64: China Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 65: Japan Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 66: Japan Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 67: Japan Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 68: Japan Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 69: India Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 70: India Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 71: India Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 72: India Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 73: ASEAN Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 74: ASEAN Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 75: ASEAN Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 76: ASEAN Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 77: Rest of Asia Pacific Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 78: Rest of Asia Pacific Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 79: Rest of Asia Pacific Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 80: Rest of Asia Pacific Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 81: Latin America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 82: Latin America Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 83: Latin America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 84: Latin America Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 85: Latin America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 86: Latin America Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 87: Brazil Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 88: Brazil Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 89: Brazil Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 90: Brazil Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 91: Mexico Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 92: Mexico Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 93: Mexico Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 94: Mexico Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 95: Rest of Latin America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 96: Rest of Latin America Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 97: Rest of Latin America Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 98: Rest of Latin America Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 99: Middle East & Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 100: Middle East & Africa Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 101: Middle East & Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 102: Middle East & Africa Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 103: Middle East & Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023-2031

Table 104: Middle East & Africa Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

Table 105: GCC Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 106: GCC Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 107: GCC Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 108: GCC Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 109: South Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 110: South Africa Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 111: South Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 112: South Africa Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

Table 113: Rest of Middle East & Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by Product Type, 2023-2031

Table 114: Rest of Middle East & Africa Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by Product Type, 2023-2031

Table 115: Rest of Middle East & Africa Synthetic and Biobased Butadiene Market Volume (Kilo Tons) Forecast, by End-use, 2023-2031

Table 116: Rest of Middle East & Africa Synthetic and Biobased Butadiene Market Value (US$ Bn) Forecast, by End-use, 2023-2031

List of Figures

Figure 01: Global Synthetic and Biobased Butadiene Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 02: Global Synthetic and Biobased Butadiene Market Attractiveness, by Product Type

Figure 03: Global Synthetic and Biobased Butadiene Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 04: Global Synthetic and Biobased Butadiene Market Attractiveness, by End-use

Figure 05: Global Synthetic and Biobased Butadiene Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 06: Global Synthetic and Biobased Butadiene Market Attractiveness, by Region

Figure 07: North America Synthetic and Biobased Butadiene Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 08: North America Synthetic and Biobased Butadiene Market Attractiveness, by Product Type

Figure 09: North America Synthetic and Biobased Butadiene Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 10: North America Synthetic and Biobased Butadiene Market Attractiveness, by End-use

Figure 11: North America Synthetic and Biobased Butadiene Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 12: North America Synthetic and Biobased Butadiene Market Attractiveness, by Country

Figure 13: Europe Synthetic and Biobased Butadiene Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 14: Europe Synthetic and Biobased Butadiene Market Attractiveness, by Product Type

Figure 15: Europe Synthetic and Biobased Butadiene Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 16: Europe Synthetic and Biobased Butadiene Market Attractiveness, by End-use

Figure 17: Europe Synthetic and Biobased Butadiene Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 18: Europe Synthetic and Biobased Butadiene Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Synthetic and Biobased Butadiene Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 20: Asia Pacific Synthetic and Biobased Butadiene Market Attractiveness, by Product Type

Figure 21: Asia Pacific Synthetic and Biobased Butadiene Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 22: Asia Pacific Synthetic and Biobased Butadiene Market Attractiveness, by End-use

Figure 23: Asia Pacific Synthetic and Biobased Butadiene Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Synthetic and Biobased Butadiene Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Synthetic and Biobased Butadiene Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 26: Latin America Synthetic and Biobased Butadiene Market Attractiveness, by Product Type

Figure 27: Latin America Synthetic and Biobased Butadiene Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 28: Latin America Synthetic and Biobased Butadiene Market Attractiveness, by End-use

Figure 29: Latin America Synthetic and Biobased Butadiene Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Synthetic and Biobased Butadiene Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Synthetic and Biobased Butadiene Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 32: Middle East & Africa Synthetic and Biobased Butadiene Market Attractiveness, by Product Type

Figure 33: Middle East & Africa Synthetic and Biobased Butadiene Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 34: Middle East & Africa Synthetic and Biobased Butadiene Market Attractiveness, by End-use

Figure 35: Middle East & Africa Synthetic and Biobased Butadiene Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Synthetic and Biobased Butadiene Market Attractiveness, by Country and Sub-region