Reports

Reports

Analysts’ Viewpoint on Street Washer Machine Market Scenario

Street washer machines play an important role in the municipal street cleaning system. They not only help keep the roads and streets clean, but are also used to sanitize roads, especially during the COVID-19 pandemic. The street/road washing and highway washing segments hold prominent share of the street washing machine market, as authorities frequently use street washing machines to clean streets and highways. Manufacturers are expanding their third-party distribution channels to maintain their position in the market. This is expected to boost the indirect distribution channel segment of the market during the forecast period. Demand sentiment is improving post the peak of the COVID-19, as infection cases have reduced drastically in the past few months.

Street washer or road washing machine is a municipal vehicle that is used to clean roads, usually in urban and industrial areas, with a high-pressure water pump and water tank. It is used to deep clean the streets. It is a mechanical road cleaner machine; hence, it takes less time and effort to clean the road.

Street washing machines or road washing machines ensure that sedimentations and debris are washed from the road, which makes driving on the road more comfortable. In industrial areas, street pressure washers are employed to remove emissions such as oil residues or chemicals from the streets. In construction areas, street power washers are extensively employed to remove cement and other residues. Street washing equipment is also used to disinfect or sanitize streets. Authorities in several countries such as Italy and Germany are increasingly using street washers to sanitize streets near bus stops, highways, and parking lots during the COVID-19 pandemic.

Demand for street washers is increasing in Europe due to the rise in infrastructure projects. For instance, five airport infrastructure construction projects commenced in Europe during the third quarter of 2021. Increase in number of road development projects is also creating new opportunities for key players operating in the street washer machine market in Europe. Recently, Germany invested in a few new roadways projects that are expected to be completed in the next five to seven years. Similarly, several new tunnels, roads, and bridge development projects are underway in Italy. This is driving the demand for street washers in order to keep the construction area clean. Construction of roads and bridges is likely to increase at a moderate pace in Italy in the next decade. This is estimated to boost the road washing segment of the market during the forecast period. Thus, road development provides lucrative opportunities for street washer machine manufacturers in terms of revenue growth.

Manual washing of streets takes several hours and entails considerable labor force. The cost of labor is increasing in Europe considering the rise in the cost of living. According to Eurostat, the statistical office of the European Union, hourly labor costs rose by 2.5% in the Euro area and by 2.9% in the EU in the third quarter of 2021 compared to that in the same quarter of 2020.

There has been a rise in labor strikes in Europe due to reasons such as disputes between employees and employers, increase in working hours, untimely payment of wages, and reduction of salary/wages. This has also led to discontinuity in work. Therefore, authorities are shifting toward mechanical solutions. This is expected to drive the street washer machine market in Europe during the forecast period.

Based on propulsion type, the diesel/petrol segment held relatively large share of the street washer machine market in 2021. Customers prefer to buy the diesel/petrol model, as it is cheaper. Furthermore, diesel engines work on the compression cycle, which enables them to generate more power and torque output. However, the running cost of diesel/petrol driven street washers is quite high. These vehicles also emit significant amount of CO2 and other pollutants into the environment. Therefore, customers are increasingly shifting toward a clean fuel alternative such as electric municipal vehicles.

Countries in Europe are taking several initiatives to encourage contractors and municipalities to use electric municipal vehicles. For instance, one out of five cars in Germany's municipal vehicle fleets is electric. According to a government survey, the country is expected to purchase just electric municipal vehicles from 2025.

Christian Hochfeld, Director of Agora Verkehrswende, a Germany-based company, shared his view on the municipal vehicle fleet arrangement: “German Municipalities can further expand their pioneering role in the switch to electromobility. A good goal would be to only procure electric vehicles 2025 onward. If city administrations commit to this goal and align their planning and processes accordingly, they can send a clear signal for electromobility and climate protection. However, they also need the support of the federal and state governments, especially in terms of financing, expanding the charging infrastructure, and providing reliable framework conditions.” Road sweeping machine manufacturers are capitalizing on this opportunity to increase R&D to carry out innovations in electrical municipal vehicles.

In terms of application, the road/street washing segment accounted for notable share of the street washer machine market in Europe in 2021. Authorities and contractors in the region mostly use vehicles for washing streets and highways. They use these vehicles to keep the streets clean from dust and debris as well as disinfect the streets, especially at bus stops, taxi stands, etc. Highway washing also held large share of the market in 2021. Countries in Europe are investing in several infrastructure and road development projects. This is expected to augment the road/street washing segment.

Germany held around 25% share of the Europe street washer machine market in 2021. The country is taking various initiatives to develop its municipal fleets. Furthermore, Germany is investing in several new projects, wherein street washers would be used. Followed by Germany, Italy also accounted for significant share of the market in 2021. Most of the street washer manufacturers are based in Italy. The use of street washers in Italy is expected to increase due to the growth in road development projects being undertaken in the country.

Customers in the market are currently demanding electric and other green fuel-driven street washers such as CNG due to the rise in concerns about the environment. Thus, electric propulsion is one of the fastest growing segments of the street washer machine market in Europe.

The street washer machine market in Europe is consolidated, with the presence of a few players in the market. Most of the firms are investing significantly in comprehensive research & development activities, especially in the manufacture of electric street washers. Companies are increasing the manufacture of road pressure washers, street cleaning machines, and street washer equipment. Diversification of product portfolios and mergers & acquisitions are important strategies adopted by key players. Manufacturers in the region prefer to promote and launch their street washers in exhibitions and trade fairs. Aebi Schmidt Holding AG, Dulevo S.p.A., Dynaset Oy, MultiOne, TENAX INTERNATIONAL s.r.l., Yantai Haide Special Vehicle Co., Ltd, TRILETY, Mulag, Piquersa Machinery, SA, and Boschung are the prominent entities operating in the market.

Each of these players has been profiled in the street washer machine market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 978.5 Mn |

|

Market Forecast Value in 2031 |

US$ 1,570.8 Mn |

|

Growth Rate (CAGR) |

5.1% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Mn for Value Thousand Units for Volume |

|

Market Analysis |

The global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, key market indicators, regulatory framework, COVID-19 impact analysis, and SWOT analysis. |

|

Competition Landscape |

Market Player – Competition Dashboard and Revenue Share Analysis 2021 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, COVID-19 Response, Strategy & Business Overview) |

|

Format |

PDF + Excel |

|

Market Segmentation |

|

|

Regions Covered |

Europe |

|

Countries Covered |

U.K., Germany, France, Italy, Rest of Europe |

|

Companies Profiled |

Aebi Schmidt Holding AG, Dulevo S.p.A., Dynaset Oy, MultiOne, TENAX INTERNATIONAL s.r.l., Yantai Haide Special Vehicle Co., Ltd, TRILETY, Mulag, Piquersa Machinery, SA, and Boschung |

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Reques |

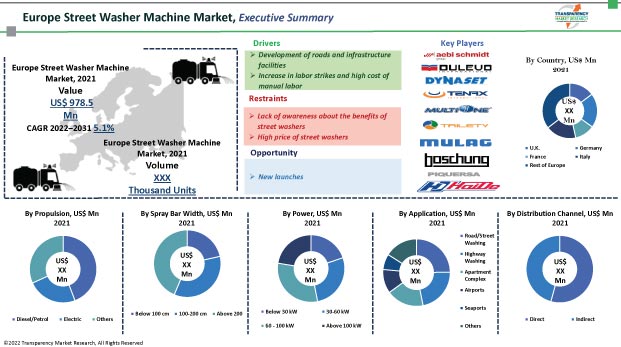

The market stood at US$ 978.5 Mn in 2021

The market is estimated to expand at a CAGR of 5.1% during 2022-2031

The market is expected to reach US$ 1,570.8 Mn in 2031

Development of roads and infrastructure facilities; increase in labor strike; and high cost of manual labor

The diesel/petrol segment accounted for ~44% share of the market in 2021

Key players operating in the market include Aebi Schmidt Holding AG, Dulevo S.p.A., Dynaset Oy, MultiOne, TENAX INTERNATIONAL s.r.l., Yantai Haide Special Vehicle Co., Ltd, TRILETY, Mulag, Piquersa Machinery, SA, and Boschung

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.2.1. Europe Overall Municipal Vehicle Market Size and Analysis

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Powertrain Developments

5.8. COVID-19 Impact Analysis

5.9. Europe Street Washer Machine Market Analysis and Forecast, 2017‒2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. Europe Street Washer Machine Market Analysis and Forecast

6.1. Regional Snapshot

6.2. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Propulsion, 2017‒2031

6.2.1. Diesel/Petrol

6.2.2. Electric

6.2.3. Others (CNG, LPG, etc.)

6.3. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Spray Bar Width, 2017‒2031

6.3.1. Below 100 cm

6.3.2. 100-200 cm

6.3.3. Above 200 cm

6.4. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Power, 2017‒2031

6.4.1. Below 30 kW

6.4.2. 30-60 kW

6.4.3. 60 - 100 kW

6.4.4. Above 100 kW

6.5. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Application, 2017‒2031

6.5.1. Road/Street Sweeping

6.5.2. Highway Sweeping

6.5.3. Apartment Complex

6.5.4. Airports

6.5.5. Seaports

6.5.6. Others (Car Parks, Railway Station, etc.)

6.6. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Sales Channel, 2017‒2031

6.6.1. Direct Sales

6.6.2. Indirect Sales

6.7. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Country and Sub-region, 2017‒2031

6.7.1. UK

6.7.2. Germany

6.7.3. France

6.7.4. Italy

6.7.5. Rest of Europe

6.8. Incremental Opportunity, by Country

7. U.K. Street Washer Machine Market Analysis and Forecast

7.1. Country Snapshot

7.2. Key Supplier Analysis

7.3. COVID-19 Impact Analysis

7.4. Key Trends Analysis

7.4.1. Supply side

7.4.2. Demand Side

7.5. Price Trend Analysis

7.5.1. Weighted Average Selling Price (US$)

7.6. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Propulsion, 2017‒2031

7.6.1. Diesel/Petrol

7.6.2. Electric

7.6.3. Others (CNG, LPG, etc.)

7.7. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Spray Bar Width, 2017‒2031

7.7.1. Below 100 cm

7.7.2. 100-200 cm

7.7.3. Above 200 cm

7.8. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Power, 2017‒2031

7.8.1. Below 30 kW

7.8.2. 30-60 kW

7.8.3. 60 - 100 kW

7.8.4. Above 100 kW

7.9. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Application, 2017‒2031

7.9.1. Road/Street Sweeping

7.9.2. Highway Sweeping

7.9.3. Apartment Complex

7.9.4. Airports

7.9.5. Seaports

7.9.6. Others (Car Parks, Railway Station, etc.)

7.10. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Sales Channel, 2017‒2031

7.10.1. Direct Sales

7.10.2. Indirect Sales

7.11. Incremental Opportunity Analysis

8. Germany Street Washer Machine Market Analysis and Forecast

8.1. Country Snapshot

8.2. Key Supplier Analysis

8.3. COVID-19 Impact Analysis

8.4. Key Trends Analysis

8.4.1. Supply side

8.4.2. Demand Side

8.5. Price Trend Analysis

8.5.1. Weighted Average Selling Price (US$)

8.6. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Propulsion, 2017‒2031

8.6.1. Diesel/Petrol

8.6.2. Electric

8.6.3. Others (CNG, LPG, etc.)

8.7. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Spray Bar Width, 2017‒2031

8.7.1. Below 100 cm

8.7.2. 100-200 cm

8.7.3. Above 200 cm

8.8. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Power, 2017‒2031

8.8.1. Below 30 kW

8.8.2. 30-60 kW

8.8.3. 60 - 100 kW

8.8.4. Above 100 kW

8.9. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Application, 2017‒2031

8.9.1. Road/Street Sweeping

8.9.2. Highway Sweeping

8.9.3. Apartment Complex

8.9.4. Airports

8.9.5. Seaports

8.9.6. Others (Car Parks, Railway Station, etc.)

8.10. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Sales Channel, 2017‒2031

8.10.1. Direct Sales

8.10.2. Indirect Sales

8.11. Incremental Opportunity Analysis

9. France Street Washer Machine Market Analysis and Forecast

9.1. Country Snapshot

9.2. Key Supplier Analysis

9.3. COVID-19 Impact Analysis

9.4. Key Trends Analysis

9.4.1. Supply side

9.4.2. Demand Side

9.5. Price Trend Analysis

9.5.1. Weighted Average Selling Price (US$)

9.6. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Propulsion, 2017‒2031

9.6.1. Diesel/Petrol

9.6.2. Electric

9.6.3. Others (CNG, LPG, etc.)

9.7. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Spray Bar Width, 2017‒2031

9.7.1. Below 100 cm

9.7.2. 100-200 cm

9.7.3. Above 200 cm

9.8. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Power, 2017‒2031

9.8.1. Below 30 kW

9.8.2. 30-60 kW

9.8.3. 60 - 100 kW

9.8.4. Above 100 kW

9.9. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Application, 2017‒2031

9.9.1. Road/Street Sweeping

9.9.2. Highway Sweeping

9.9.3. Apartment Complex

9.9.4. Airports

9.9.5. Seaports

9.9.6. Others (Car Parks, Railway Station, etc.)

9.10. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Sales Channel, 2017‒2031

9.10.1. Direct Sales

9.10.2. Indirect Sales

9.11. Incremental Opportunity Analysis

10. Italy Street Washer Machine Market Analysis and Forecast

10.1. Country Snapshot

10.2. Key Supplier Analysis

10.3. COVID-19 Impact Analysis

10.4. Key Trends Analysis

10.4.1. Supply side

10.4.2. Demand Side

10.5. Price Trend Analysis

10.5.1. Weighted Average Selling Price (US$)

10.6. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Propulsion, 2017‒2031

10.6.1. Diesel/Petrol

10.6.2. Electric

10.6.3. Others (CNG, LPG, etc.)

10.7. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Spray Bar Width, 2017‒2031

10.7.1. Below 100 cm

10.7.2. 100-200 cm

10.7.3. Above 200 cm

10.8. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Power, 2017‒2031

10.8.1. Below 30 kW

10.8.2. 30-60 kW

10.8.3. 60 - 100 kW

10.8.4. Above 100 kW

10.9. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Application, 2017‒2031

10.9.1. Road/Street Sweeping

10.9.2. Highway Sweeping

10.9.3. Apartment Complex

10.9.4. Airports

10.9.5. Seaports

10.9.6. Others (Car Parks, Railway Station, etc.)

10.10. Street Washer Machine Market Size (US$ Mn) (Thousand Units), by Sales Channel, 2017‒2031

10.10.1. Direct Sales

10.10.2. Indirect Sales

10.11. Incremental Opportunity Analysis

11. Competition Landscape

11.1. Competition Dashboard

11.2. Market Share Analysis % (2021)

11.3. Company Profiles

11.3.1. Aebi Schmidt Holding AG.

11.3.2. Boschung Group

11.3.3. Dulevo S.p.A.

11.3.4. Dynaset Oy

11.3.5. TRILETY

11.3.6. Mulag

11.3.7. MultiOne

11.3.8. Piquersa Machinery, SA

11.3.9. TENAX INTERNATIONAL s.r.l.

11.3.10. Yantai Haide Special Vehicle Co., Ltd

12. Key Takeaways

12.1. Identification of Potential Market Spaces

12.1.1. Propulsion

12.1.2. Spray Bar Width

12.1.3. Power

12.1.4. Application

12.1.5. Sales Channel

12.1.6. Country

12.2. Understanding the Procurement Process of the End Users

12.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Europe Street Washer Machine Market, by Propulsion, Thousand Units, 2017‒2031

Table 2: Europe Street Washer Machine Market, by Propulsion, US$ Mn, 2017‒2031

Table 3: Europe Street Washer Machine Market, by Spray Bar Width, Thousand Units, 2017‒2031

Table 4: Europe Street Washer Machine Market, by Spray Bar Width, US$ Mn, 2017‒2031

Table 5: Europe Street Washer Machine Market, by Power, Thousand Units, 2017‒2031

Table 6: Europe Street Washer Machine Market, by Power, US$ Mn, 2017‒2031

Table 7: Europe Street Washer Machine Market, by Application, Thousand Units, 2017‒2031

Table 8: Europe Street Washer Machine Market, by Application, US$ Mn, 2017‒2031

Table 9: Europe Street Washer Machine Market, by Distribution Channel, Thousand Units, 2017‒2031

Table 10: Europe Street Washer Machine Market, by Distribution Channel, US$ Mn, 2017‒2031

Table 11: Europe Street Washer Machine Market, by Country and Sub-region, Thousand Units, 2017‒2031

Table 12: Europe Street Washer Machine Market, by Country and Sub-region, US$ Mn, 2017‒2031

Table 13: U.K. Street Washer Machine Market, by Propulsion, Thousand Units, 2017‒2031

Table 14: U.K. Street Washer Machine Market, by Propulsion, US$ Mn, 2017‒2031

Table 15: U.K. Street Washer Machine Market, by Spray Bar Width, Thousand Units, 2017‒2031

Table 16: U.K. Street Washer Machine Market, by Spray Bar Width, US$ Mn, 2017‒2031

Table 17: U.K. Street Washer Machine Market, by Power, Thousand Units, 2017‒2031

Table 18: U.K. Street Washer Machine Market, by Power, US$ Mn, 2017‒2031

Table 19: U.K. Street Washer Machine Market, by Application, Thousand Units, 2017‒2031

Table 20: U.K. Street Washer Machine Market, by Application, US$ Mn, 2017‒2031

Table 21: U.K. Street Washer Machine Market, by Distribution Channel, Thousand Units, 2017‒2031

Table 22: U.K. Street Washer Machine Market, by Distribution Channel, US$ Mn, 2017‒2031

Table 23: Germany Street Washer Machine Market, by Propulsion, Thousand Units, 2017‒2031

Table 24: Germany Street Washer Machine Market, by Propulsion, US$ Mn, 2017‒2031

Table 25: Germany Street Washer Machine Market, by Spray Bar Width, Thousand Units, 2017‒2031

Table 26: Germany Street Washer Machine Market, by Spray Bar Width, US$ Mn, 2017‒2031

Table 27: Germany Street Washer Machine Market, by Power, Thousand Units, 2017‒2031

Table 28: Germany Street Washer Machine Market, by Power, US$ Mn, 2017‒2031

Table 29: Germany Street Washer Machine Market, by Application, Thousand Units, 2017‒2031

Table 30: Germany Street Washer Machine Market, by Application, US$ Mn, 2017‒2031

Table 31: Germany Street Washer Machine Market, by Distribution Channel, Thousand Units, 2017‒2031

Table 32: Germany Street Washer Machine Market, by Distribution Channel, US$ Mn, 2017‒2031

Table 33: France Street Washer Machine Market, by Propulsion, Thousand Units, 2017‒2031

Table 34: France Street Washer Machine Market, by Propulsion, US$ Mn, 2017‒2031

Table 35: France Street Washer Machine Market, by Spray Bar Width, Thousand Units, 2017‒2031

Table 36: France Street Washer Machine Market, by Spray Bar Width, US$ Mn, 2017‒2031

Table 37: France Street Washer Machine Market, by Power, Thousand Units, 2017‒2031

Table 38: France Street Washer Machine Market, by Power, US$ Mn, 2017‒2031

Table 39: France Street Washer Machine Market, by Application, Thousand Units, 2017‒2031

Table 40: France Street Washer Machine Market, by Application, US$ Mn, 2017‒2031

Table 41: France Street Washer Machine Market, by Distribution Channel, Thousand Units, 2017‒2031

Table 42: France Street Washer Machine Market, by Distribution Channel, US$ Mn, 2017‒2031

Table 43: Italy Street Washer Machine Market, by Propulsion, Thousand Units, 2017‒2031

Table 44: Italy Street Washer Machine Market, by Propulsion, US$ Mn, 2017‒2031

Table 45: Italy Street Washer Machine Market, by Spray Bar Width, Thousand Units, 2017‒2031

Table 46: Italy Street Washer Machine Market, by Spray Bar Width, US$ Mn, 2017‒2031

Table 47: Italy Street Washer Machine Market, by Power, Thousand Units, 2017‒2031

Table 48: Italy Street Washer Machine Market, by Power, US$ Mn, 2017‒2031

Table 49: Italy Street Washer Machine Market, by Application, Thousand Units, 2017‒2031

Table 50: Italy Street Washer Machine Market, by Application, US$ Mn, 2017‒2031

Table 51: Italy Street Washer Machine Market, by Distribution Channel, Thousand Units, 2017‒2031

Table 52: Italy Street Washer Machine Market, by Distribution Channel, US$ Mn, 2017‒2031

List of Figures

Figure 1: Europe Street Washer Machine Market, by Propulsion, Thousand Units, 2017‒2031

Figure 2: Europe Street Washer Machine Market, by Propulsion, US$ Mn, 2017‒2031

Figure 3: Europe Street Washer Machine Market, by Propulsion, Incremental Opportunity, 2017‒2031

Figure 4: Europe Street Washer Machine Market, by Spray Bar Width, Thousand Units, 2017‒2031

Figure 5: Europe Street Washer Machine Market, by Spray Bar Width, US$ Mn, 2017‒2031

Figure 6: Europe Street Washer Machine Market, by Power, Thousand Units, 2017‒2031

Figure 7: Europe Street Washer Machine Market, by Power, US$ Mn, 2017‒2031

Figure 8: Europe Street Washer Machine Market, by Application, Thousand Units, 2017‒2031

Figure 9: Europe Street Washer Machine Market, by Application, US$ Mn, 2017‒2031

Figure 10: Europe Street Washer Machine Market, by Distribution Channel, Thousand Units, 2017‒2031

Figure 11: Europe Street Washer Machine Market, by Distribution Channel, US$ Mn, 2017‒2031

Figure 12: Europe Street Washer Machine Market, by Country and Sub-region, Thousand Units, 2017‒2031

Figure 13: Europe Street Washer Machine Market, by Country and Sub-region, US$ Mn, 2017‒2031

Figure 14: U.K. Street Washer Machine Market, by Propulsion, Thousand Units, 2017‒2031

Figure 15: U.K. Street Washer Machine Market, by Propulsion, US$ Mn, 2017‒2031

Figure 16: U.K. Street Washer Machine Market, by Propulsion, Incremental Opportunity, 2017‒2031

Figure 17: U.K. Street Washer Machine Market, by Spray Bar Width, Thousand Units, 2017‒2031

Figure 18: U.K. Street Washer Machine Market, by Spray Bar Width, US$ Mn, 2017‒2031

Figure 19: U.K. Street Washer Machine Market, by Power, Thousand Units, 2017‒2031

Figure 20: U.K. Street Washer Machine Market, by Power, US$ Mn, 2017‒2031

Figure 21: U.K. Street Washer Machine Market, by Application, Thousand Units, 2017‒2031

Figure 22: U.K. Street Washer Machine Market, by Application, US$ Mn, 2017‒2031

Figure 23: U.K. Street Washer Machine Market, by Distribution Channel, Thousand Units, 2017‒2031

Figure 24: U.K. Street Washer Machine Market, by Distribution Channel, US$ Mn, 2017‒2031

Figure 25: Germany Street Washer Machine Market, by Propulsion, Thousand Units, 2017‒2031

Figure 26: Germany Street Washer Machine Market, by Propulsion, US$ Mn, 2017‒2031

Figure 27: Germany Street Washer Machine Market, by Propulsion, Incremental Opportunity, 2017‒2031

Figure 28: Germany Street Washer Machine Market, by Spray Bar Width, Thousand Units, 2017‒2031

Figure 29: Germany Street Washer Machine Market, by Spray Bar Width, US$ Mn, 2017‒2031

Figure 30: Germany Street Washer Machine Market, by Power, Thousand Units, 2017‒2031

Figure 31: Germany Street Washer Machine Market, by Power, US$ Mn, 2017‒2031

Figure 32: Germany Street Washer Machine Market, by Application, Thousand Units, 2017‒2031

Figure 33: Germany Street Washer Machine Market, by Application, US$ Mn, 2017‒2031

Figure 34: Germany Street Washer Machine Market, by Distribution Channel, Thousand Units, 2017‒2031

Figure 35: Germany Street Washer Machine Market, by Distribution Channel, US$ Mn, 2017‒2031

Figure 36: France Street Washer Machine Market, by Propulsion, Thousand Units, 2017‒2031

Figure 37: France Street Washer Machine Market, by Propulsion, US$ Mn, 2017‒2031

Figure 38: France Street Washer Machine Market, by Propulsion, Incremental Opportunity, 2017‒2031

Figure 39: France Street Washer Machine Market, by Spray Bar Width, Thousand Units, 2017‒2031

Figure 40: France Street Washer Machine Market, by Spray Bar Width, US$ Mn, 2017‒2031

Figure 41: France Street Washer Machine Market, by Power, Thousand Units, 2017‒2031

Figure 42: France Street Washer Machine Market, by Power, US$ Mn, 2017‒2031

Figure 43: France Street Washer Machine Market, by Application, Thousand Units, 2017‒2031

Figure 44: France Street Washer Machine Market, by Application, US$ Mn, 2017‒2031

Figure 45: France Street Washer Machine Market, by Distribution Channel, Thousand Units, 2017‒2031

Figure 46: France Street Washer Machine Market, by Distribution Channel, US$ Mn, 2017‒2031

Figure 47: Italy Street Washer Machine Market, by Propulsion, Thousand Units, 2017‒2031

Figure 48: Italy Street Washer Machine Market, by Propulsion, US$ Mn, 2017‒2031

Figure 49: Italy Street Washer Machine Market, by Propulsion, Incremental Opportunity, 2017‒2031

Figure 50: Italy Street Washer Machine Market, by Spray Bar Width, Thousand Units, 2017‒2031

Figure 51: Italy Street Washer Machine Market, by Spray Bar Width, US$ Mn, 2017‒2031

Figure 52: Italy Street Washer Machine Market, by Power, Thousand Units, 2017‒2031

Figure 53: Italy Street Washer Machine Market, by Power, US$ Mn, 2017‒2031

Figure 54: Italy Street Washer Machine Market, by Application, Thousand Units, 2017‒2031

Figure 55: Italy Street Washer Machine Market, by Application, US$ Mn, 2017‒2031

Figure 56: Italy Street Washer Machine Market, by Distribution Channel, Thousand Units, 2017‒2031

Figure 57: Italy Street Washer Machine Market, by Distribution Channel, US$ Mn, 2017‒2031