Reports

Reports

Analyst Viewpoint

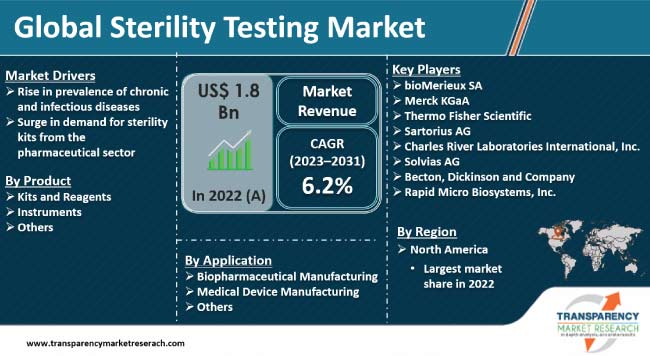

Rise in prevalence of chronic and infectious diseases among people and increase in demand for sterility kits from the pharmaceutical sector are augmenting the sterility testing market size. Sterility kits can precisely detect the presence of microorganisms on various medical equipment to avoid the spread of infectious diseases. Growth in adoption of rapid sterility testing to provide quick treatments to patients is augmenting the sterility testing industry value.

Leading companies in the market are forming partnerships with companies operating in the pharmaceutical sector and undertaking acquisitions. This strategy allows companies to develop sterility kits according to their requirements and ensure high performance and result accuracy. Furthermore, manufacturers are investing heavily in research and development activities to adopt advanced technologies and launch new testing kits.

Sterility testing refers to a set of activities performed to confirm that products are free from microorganisms. The sterility testing method involves passing a quantity of drug product through filters designed to retain microorganisms. It is followed by a rinse to ensure that no drug product remains on the filter, which can inhibit the growth of microorganisms. These testing methods are extensively employed in the pharmaceutical sector to limit the spread of viruses.

Membrane filtration and direct inoculation are two major types of sterility testing. Membrane filtration sterility testing is the regulatory method of choice for filterable pharmaceutical products, whereas in direct inoculation, a small volume of sample is removed aseptically from the sample unit and inoculated directly into a suitable volume of growth medium before incubation. Accurate determination of purity, hygiene maintenance, disinfecting medical devices, and safety of drugs are key advantages of sterility testing.

Poor sanitation, lack of vaccination, or exposure to infected individuals are causing infectious diseases such as flu, tuberculosis, and human immunodeficiency virus. Changes in lifestyles, eating habits, and lack of physical activities are causing chronic diseases among the geriatric population. Sterility testing is a crucial step to prevent the spread of these diseases by ensuring absence of viable microorganisms in drugs, medical equipment, and other medical devices required during treatments. Thus, rise in prevalence of infectious and chronic diseases is augmenting the sterility testing market revenue.

Increase in demand for rapid sterility testing in the pharmaceutical sector is offering lucrative opportunities for market expansion. Rapid sterility testing has shortened incubation times and reduced subjectivity in result analysis. Growth in popularity of rapid drug testing to ensure quick treatments is creating high demand for sterility testing tools.

Sterility kits are widely utilized in the pharmaceutical sector to assess the purity of drugs, diagnosis kits, and ensure sanitization. The World Health Organization (WHO) sterility testing guidelines are applicable across a wide range of biological medicinal products, such as biotechnology products, vaccines, cell & tissue products, and blood products. Hence, increase in demand for sterility testing kits in the pharmaceutical sector to ensure purity of various products is bolstering the sterility testing market growth.

Increase in adoption of sterile product testing in biopharmaceuticals is driving the demand for sterility testing kits. Adenosine Triphosphate (ATP) bioluminescence is one of the common rapid sterility testing methods for pharmaceuticals that provides accurate results in a short period of time. Furthermore, increase in investments in drug development and clinical trials by pharmaceutical companies is increasing the use of sterility testing tools.

As per the latest regional sterility testing market analysis, North America dominated the global landscape in 2022. Early adoption of advanced technologies and establishment of new biopharmaceutical companies in the region are likely to propel the market share in the next few years. Increase in investments in research and development activities in medical technology and life sciences is fueling the sterility testing industry revenue.

Leading companies in the region are introducing new drugs for prevention of infectious diseases. For instance, in March 2022, VBI Vaccines Inc. launched PreHevbrioin in the United States for the prevention of infection caused by all known subtypes of Hepatitis B Virus (HBV) in adults.

Leading companies in the market are implementing advanced business strategies, such as acquisitions and partnerships to increase their presence in global markets. Manufacturers are adopting the latest sterility testing market trends to launch new testing kits with advanced technologies. They are investing in research and development activities to launch new products with high accuracy and provide results in minimum time.

Some of the leading players in the industry include bioMerieux SA, Merck KGaA, Thermo Fisher Scientific, Sartorius AG, Charles River Laboratories International, Inc., Solvias AG, Becton, Dickinson and Company, and Rapid Micro Biosystems, Inc.

These companies are profiled in the sterility testing market report based on various parameters including company overview, business segments, product portfolio, recent developments, business strategies, and financial overview.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 1.8 Bn |

| Market Forecast (Value) in 2031 | US$ 3.1 Bn |

| Growth Rate (CAGR) | 6.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.8 Bn in 2022

It is projected to register a CAGR of 6.2% from 2023 to 2031

Rise in prevalence of chronic and infectious diseases and rise in demand for sterility kits from the pharmaceutical sector

North America was the most lucrative region in 2022

bioMerieux SA, Merck KGaA, Thermo Fisher Scientific, Sartorius AG, Charles River Laboratories International, Inc., Solvias AG, Becton, Dickinson and Company, and Rapid Micro Biosystems, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Sterility Testing Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Sterility Testing Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Sterility Testing Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Kits and Reagents

6.3.2. Instruments

6.3.3. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Sterility Testing Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Biopharmaceutical Manufacturing

7.3.2. Medical Device Manufacturing

7.3.3. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Sterility Testing Market Analysis and Forecast, by Test Type

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Test Type, 2017–2031

8.3.1. Traditional Sterility Tests

8.3.1.1. Membrane Filtration

8.3.1.2. Immersion Test

8.3.2. Rapid Sterility Tests

8.3.2.1. Solid Phase Cytometry

8.3.2.2. Flow Cytometry

8.3.2.3. Bioluminescence

8.3.2.4. Nucleic Acid Amplification

8.3.2.5. Immunological Methods

8.3.2.6. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Sterility Testing Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Sterility Testing Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Product, 2017–2031

10.3.1. Kits and Reagents

10.3.2. Instruments

10.3.3. Others

10.4. Market Value Forecast, by Application, 2017–2031

10.4.1. Biopharmaceutical Manufacturing

10.4.2. Medical Device Manufacturing

10.4.3. Others

10.5. Market Value Forecast, by Test Type, 2017–2031

10.5.1. Traditional Sterility Tests

10.5.1.1. Membrane Filtration

10.5.1.2. Immersion Test

10.5.2. Rapid Sterility Tests

10.5.2.1. Solid Phase Cytometry

10.5.2.2. Flow Cytometry

10.5.2.3. Bioluminescence

10.5.2.4. Nucleic Acid Amplification

10.5.2.5. Immunological Methods

10.5.2.6. Others

10.6. Market Value Forecast, by Country, 2017–2031

10.6.1. U.S.

10.6.2. Canada

10.7. Market Attractiveness Analysis

10.7.1. By Product

10.7.2. By Application

10.7.3. By Test Type

10.7.4. By Country

11. Europe Sterility Testing Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Product, 2017–2031

11.3.1. Kits and Reagents

11.3.2. Instruments

11.3.3. Others

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Biopharmaceutical Manufacturing

11.4.2. Medical Device Manufacturing

11.4.3. Others

11.5. Market Value Forecast, by Test Type, 2017–2031

11.5.1. Traditional Sterility Tests

11.5.1.1. Membrane Filtration

11.5.1.2. Immersion Test

11.5.2. Rapid Sterility Tests

11.5.2.1. Solid Phase Cytometry

11.5.2.2. Flow Cytometry

11.5.2.3. Bioluminescence

11.5.2.4. Nucleic Acid Amplification

11.5.2.5. Immunological Methods

11.5.2.6. Others

11.6. Market Value Forecast, by Country/Sub-region, 2017–2031

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Application

11.7.3. By Test Type

11.7.4. By Country/Sub-region

12. Asia Pacific Sterility Testing Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Product, 2017–2031

12.3.1. Kits and Reagents

12.3.2. Instruments

12.3.3. Others

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Biopharmaceutical Manufacturing

12.4.2. Medical Device Manufacturing

12.4.3. Others

12.5. Market Value Forecast, by Test Type, 2017–2031

12.5.1. Traditional Sterility Tests

12.5.1.1. Membrane Filtration

12.5.1.2. Immersion Test

12.5.2. Rapid Sterility Tests

12.5.2.1. Solid Phase Cytometry

12.5.2.2. Flow Cytometry

12.5.2.3. Bioluminescence

12.5.2.4. Nucleic Acid Amplification

12.5.2.5. Immunological Methods

12.5.2.6. Others

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Australia & New Zealand

12.6.5. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Application

12.7.3. By Test Type

12.7.4. By Country/Sub-region

13. Latin America Sterility Testing Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Product, 2017–2031

13.3.1. Kits and Reagents

13.3.2. Instruments

13.3.3. Others

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Biopharmaceutical Manufacturing

13.4.2. Medical Device Manufacturing

13.4.3. Others

13.5. Market Value Forecast, by Test Type, 2017–2031

13.5.1. Traditional Sterility Tests

13.5.1.1. Membrane Filtration

13.5.1.2. Immersion Test

13.5.2. Rapid Sterility Tests

13.5.2.1. Solid Phase Cytometry

13.5.2.2. Flow Cytometry

13.5.2.3. Bioluminescence

13.5.2.4. Nucleic Acid Amplification

13.5.2.5. Immunological Methods

13.5.2.6. Others

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Application

13.7.3. By Test Type

13.7.4. By Country/Sub-region

14. Middle East & Africa Sterility Testing Market Analysis and Forecast

14.1. Introduction

14.2. Key Findings

14.3. Market Value Forecast, by Product, 2017–2031

14.3.1. Kits and Reagents

14.3.2. Instruments

14.3.3. Others

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Biopharmaceutical Manufacturing

14.4.2. Medical Device Manufacturing

14.4.3. Others

14.5. Market Value Forecast, by Test Type, 2017–2031

14.5.1. Traditional Sterility Tests

14.5.1.1. Membrane Filtration

14.5.1.2. Immersion Test

14.5.2. Rapid Sterility Tests

14.5.2.1. Solid Phase Cytometry

14.5.2.2. Flow Cytometry

14.5.2.3. Bioluminescence

14.5.2.4. Nucleic Acid Amplification

14.5.2.5. Immunological Methods

14.5.2.6. Others

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. GCC Countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Application

14.7.3. By Test Type

14.7.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. bioMerieux SA

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Merck KGaA

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Thermo Fisher Scientific

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Sartorius AG

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Charles River Laboratories International, Inc.

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Solvias AG

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Becton, Dickinson and Company

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Rapid Micro Biosystems, Inc.

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

List of Tables

Table 01: Global Sterility Testing Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Sterility Testing Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Sterility Testing Market Size (US$ Mn) Forecast, by Test Type, 2017–2031

Table 04: Global Sterility Testing Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Sterility Testing Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Sterility Testing Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 07: North America Sterility Testing Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America Sterility Testing Market Size (US$ Mn) Forecast, by Test Type, 2017–2031

Table 09: Europe Sterility Testing Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Sterility Testing Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 11: Europe Sterility Testing Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Europe Sterility Testing Market Size (US$ Mn) Forecast, by Test Type, 2017–2031

Table 13: Asia Pacific Sterility Testing Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Sterility Testing Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Asia Pacific Sterility Testing Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Asia Pacific Sterility Testing Market Size (US$ Mn) Forecast, by Test Type, 2017–2031

Table 17: Latin America Sterility Testing Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Sterility Testing Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 19: Latin America Sterility Testing Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Latin America Sterility Testing Market Size (US$ Mn) Forecast, by Test Type, 2017–2031

Table 21: Middle East & Africa Sterility Testing Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Sterility Testing Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Middle East & Africa Sterility Testing Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Middle East & Africa Sterility Testing Market Size (US$ Mn) Forecast, by Test Type, 2017–2031

List of Figures

Figure 01: Global Sterility Testing Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Sterility Testing Market Revenue (US$ Mn), by Product, 2022

Figure 03: Global Sterility Testing Market Value Share, by Product, 2022

Figure 04: Global Sterility Testing Market Revenue (US$ Mn), by Application, 2022

Figure 05: Global Sterility Testing Market Value Share, by Application, 2022

Figure 06: Global Sterility Testing Market Revenue (US$ Mn), by Test Type, 2022

Figure 07: Global Sterility Testing Market Value Share, by Test Type, 2022

Figure 08: Global Sterility Testing Market Value Share, by Region, 2022

Figure 09: Global Sterility Testing Market Value (US$ Mn) Forecast, 2017–2031

Figure 10: Global Sterility Testing Market Value Share Analysis, by Product, 2022 and 2031

Figure 11: Global Sterility Testing Market Attractiveness Analysis, by Product, 2023-2031

Figure 12: Global Sterility Testing Market Value Share Analysis, by Application, 2022 and 2031

Figure 13: Global Sterility Testing Market Attractiveness Analysis, by Application, 2023-2031

Figure 14: Global Sterility Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 15: Global Sterility Testing Market Attractiveness Analysis, by Test Type, 2023-2031

Figure 16: Global Sterility Testing Market Value Share Analysis, by Region, 2022 and 2031

Figure 17: Global Sterility Testing Market Attractiveness Analysis, by Region, 2023-2031

Figure 18: North America Sterility Testing Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 19: North America Sterility Testing Market Attractiveness Analysis, by Country, 2023–2031

Figure 20: North America Sterility Testing Market Value Share Analysis, by Country, 2022 and 2031

Figure 21: North America Sterility Testing Market Value Share Analysis, by Product, 2022 and 2031

Figure 22: North America Sterility Testing Market Value Share Analysis, by Application, 2022 and 2031

Figure 23: North America Sterility Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 24: North America Sterility Testing Market Attractiveness Analysis, by Product, 2023–2031

Figure 25: North America Sterility Testing Market Attractiveness Analysis, by Application, 2023–2031

Figure 26:North America Sterility Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 27: Europe Sterility Testing Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 28: Europe Sterility Testing Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Europe Sterility Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 30: Europe Sterility Testing Market Value Share Analysis, by Product, 2022 and 2031

Figure 31: Europe Sterility Testing Market Value Share Analysis, by Application, 2022 and 2031

Figure 32: Europe Sterility Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 33: Europe Sterility Testing Market Attractiveness Analysis, by Product, 2023–2031

Figure 34: Europe Sterility Testing Market Attractiveness Analysis, by Application, 2023–2031

Figure 35: Europe Sterility Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 36: Asia Pacific Sterility Testing Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 37: Asia Pacific Sterility Testing Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Asia Pacific Sterility Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 39: Asia Pacific Sterility Testing Market Value Share Analysis, by Product, 2022 and 2031

Figure 40: Asia Pacific Sterility Testing Market Value Share Analysis, by Application, 2022 and 2031

Figure 41: Asia Pacific Sterility Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 42: Asia Pacific Sterility Testing Market Attractiveness Analysis, by Product, 2023–2031

Figure 43: Asia Pacific Sterility Testing Market Attractiveness Analysis, by Application, 2023–2031

Figure 44: Asia Pacific Sterility Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 45: Latin America Sterility Testing Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Latin America Sterility Testing Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 47: Latin America Sterility Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Latin America Sterility Testing Market Value Share Analysis, by Product, 2022 and 2031

Figure 49: Latin America Sterility Testing Market Value Share Analysis, by Application, 2022 and 2031

Figure 50: Latin America Sterility Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 51: Latin America Sterility Testing Market Attractiveness Analysis, by Product, 2023–2031

Figure 52: Latin America Sterility Testing Market Attractiveness Analysis, by Application, 2023–2031

Figure 53: Latin America Sterility Testing Market Attractiveness Analysis, by Test Type, 2023–2031

Figure 54: Middle East & Africa Sterility Testing Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 55: Middle East & Africa Sterility Testing Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 56: Middle East & Africa Sterility Testing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 57: Middle East & Africa Sterility Testing Market Value Share Analysis, by Product, 2022 and 2031

Figure 58: Middle East & Africa Sterility Testing Market Value Share Analysis, by Application, 2022 and 2031

Figure 59: Middle East & Africa Sterility Testing Market Value Share Analysis, by Test Type, 2022 and 2031

Figure 60: Middle East & Africa Sterility Testing Market Attractiveness Analysis, by Product, 2023–2031

Figure 61: Middle East & Africa Sterility Testing Market Attractiveness Analysis, by Application, 2023–2031

Figure 62: Middle East & Africa Sterility Testing Market Attractiveness Analysis, by Test Type, 2023–2031