Reports

Reports

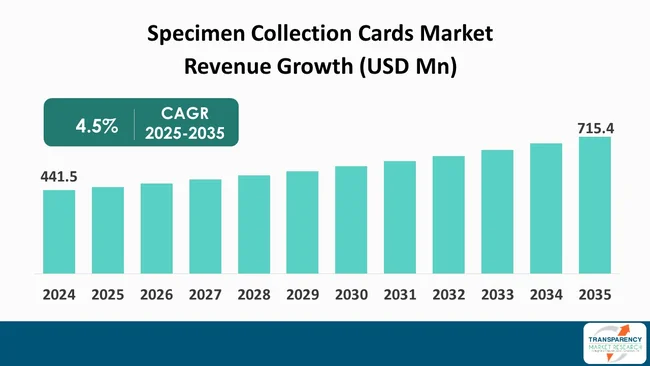

The global specimen collection cards market size was valued at US $ 441.5 million in 2024 and is projected to reach US $ 715.4 million by 2035, expanding at a CAGR of 4.5 % from 2025 to 2035. The primary factors that are fueling this growth include the personalized medicine and newborn screening initiatives.

The global specimen collection cards market functions as a continuously expanding division of the diagnostic and clinical testing industry. The growing requirement exists as medical, forensic, and research applications need sample collection systems that provide both - efficiency and reliability.

Cosmetic experts emphasize that the progress in card technology, which includes features such as better sample preservation, greater sensitivity, and the ability to work with different testing platforms, is one of the major factor for the market expansion. Moreover, the increasing occurrence of chronic diseases along with the growing newborn screening programs and the transition to decentralized and remote healthcare solutions are recognized as the major opportunities.

Companies that concentrate their efforts on strategic alliances, extending their operations to new regions and utilizing technology are likely to be ahead of the competition. Healthcare providers who understand specimen collection cards benefits will lead to wider adoption of these cards in emerging markets. The market will experience steady growth as innovation, and strategic collaborations serve as the main drivers for its future development.

The healthcare and diagnostic industry depends on the specimen collection cards market as a fundamental sector that provides safe and easy solutions for biological sample collection, storage, and transportation needs. One of the major areas where these cards find wide application is clinical diagnostics, alongside newborn screening, epidemiological studies, and forensic investigations, as they facilitate sample integrity maintenance, and simplify the entire logistics process.

The market shows steadiness due to technological progress in card systems, expanding decentralized healthcare services, and improved sample management awareness. Moreover, aspects such as the increasing incidences of chronic diseases, extension of screening programs, and a growing demand in emerging markets are energizing the market development.

The specimen collection cards will become essential tools for medical testing accuracy, efficiency, and accessibility due to ongoing development and their incorporation into modern diagnostic workflows. For instance, quality standards are established for laboratory testing by the Centers for Medicare and Medicaid Services (CMS) through the Clinical Laboratory Improvement Amendments (CLIA). These standards, which cover the whole chain from the testing of the specimen to the specimen collection, indirectly affect the quality and standards of specimen collection methods such as collection cards.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The expanding focus on individualized healthcare through genetic analysis has created a major need for trustworthy specimen collection systems, including specimen collection cards. These cards provide a simple non-invasive method for biological sample collection, storage, and transportation, which preserve the integrity and accuracy needed for advanced genetic and molecular analyses.

As the healthcare system shifts to tailored treatment plans and accurate diagnostics, a growing need for uniform, user-friendly collection tools is emerging. Specimen collection cards allow patients and healthcare providers to join decentralized testing programs and support large-scale genomic research, and improve laboratory operational processes, which makes them vital elements of modern personalized healthcare delivery.

The adoption of these cards leads to lower error rates in traditional sample collection and handling, which results in improved diagnostic reliability. The devices operate in remote areas with limited resources to expand genetic testing availability for personalized medical treatment. For instance, CLIA (Clinical Laboratory Improvement Amendments) permits CMS (the Centers for Medicare & Medicaid Services) to set the quality standards for laboratory testing. Therefore, apart from the direct influence on the quality and standards of specimen collection methods such as collection cards, CMS still maintains a substantial, albeit indirect, impact over these methods.

One of the main factors that have led to the specimen collection cards market is the introduction of healthcare and government programs that actively support newborn screening. In these programs, dried blood spot (DBS) cards have become essential since they allow the on-demand, quick, and low invasive collection of blood samples from infants.

In the U.S., approximately 98% of women give birth in hospitals. An increase in the capacity of hospitals and clinics is anticipated to boost the demand for specimen collection cards. In addition, the government of Australia has announced that they have planned to increase the healthcare budget to USD 122.8 Mn for 2027-28 from USD 112.7 Mn for the year 2024-2025.

Early, these cards uncover a broad range of metabolism, hereditary, and hormonal diseases, and corresponding timely interventions can greatly improve the health outcomes.

Government backing continues alongside technological progress in collection card materials, and testing capabilities, which makes these cards essential tools for public health strategies that protect newborns. For instance, in Washington State, testing newborns is a standard procedure and many diseases are screened via DBS specimens. After blood spots are kept for a period of 18 months, they are permanently deleted, nevertheless, parents are authorized to get their child's dried blood collection card for their own use.

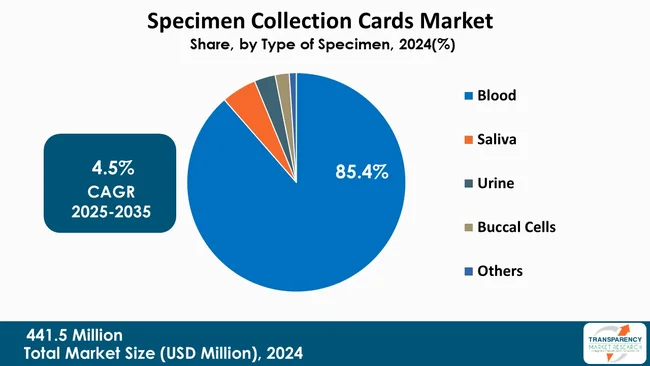

Based on type of specimen, blood-based specimen collection cards are the leading type of consumables in the specimen collection cards market with 85.4% market share, as they are the most common in clinical diagnostics, disease screening, and research applications. Biomarkers such as DNA, RNA, and proteins, which are the fundamental units that constitute life, are all present in blood samples, thus, making them the most accurate for medical and forensic analysis,

One of the factors that make dried blood spot (DBS) popular is their ease and reliability of collection, which then makes them easily transportable, storable for a long time, and with a minimal biohazard risk. In addition, the trend toward decentralized testing, e.g., newborn screening and infectious disease monitoring, is a major driver that keeps blood specimen collection cards as the leading products in the worldwide market.

Besides that, improvements in micro-sampling technologies have made the process of collecting blood specimens from cards more efficient and precise, thus they can be used for testing both in labs and in the field. At the same time, these devices that are automatized and analytical by nature, also facilitate the flow of work that is of high-throughput in clinics and research places.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America leads the global specimen collection cards market with 37.5% market share, as it has strong healthcare systems, advanced diagnostic centers, and extensive newborn screening programs. The region receives support from government programs that focus on early disease detection, and personalized medicine, alongside healthcare providers and patients who understand the value of effective sample collection techniques.

Moreover, continuous research and development activities with respect to materials for specimen collection cards, as well as the rising number of chronic and genetic diseases, are contributing factors to the dominance of the North American region in the market. Regulatory backing combined with smart plays by the major players in the market and strong healthcare financing makes this region the center of growth and innovation for the specimen collection cards industry.

For instance, the California Department of Public Health (CDPH) stores blood spot cards in the state's biobank after newborn screening. The specimen release for special testing requires signed consent from parents who need to submit a request for their child's healthcare evaluation.

QIAGEN, PerkinElmer, Hemaxis, Danaher Corporation, Eastern Business Forms, Inc, Thermo Fisher Scientific Inc., GenTegra LLC., CENTOGENE GmbH, ARCHIMEDlife GmbH, FortiusBio, Ahlstrom, genetechinnovations, EUROIMMUN Medizinische Labordiagnostika AG, F. Hoffmann-La Roche AG, Capitainer, and others are some of the leading manufacturers operating in the global Specimen Collection Cards Market.

Each of these companies has been profiled in the specimen collection cards market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 441.5 Mn |

| Forecast Value in 2035 | More than US$ 715.4 Mn |

| CAGR | 4.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Type of Specimen

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global specimen collection cards market was valued at US$ 441.5 Mn in 2024

The global specimen collection cards industry is projected to reach more than US$ 715.4 Mn by the end of 2035

Personalized medicine and genetic testing and newborn screening initiatives are some of the factors driving the expansion of specimen collection cards market.

The CAGR is anticipated to be 4.5 % from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

QIAGEN, PerkinElmer, Hemaxis, Danaher Corporation, Eastern Business Forms, Inc, Thermo Fisher Scientific Inc., GenTegra LLC., CENTOGENE GmbH, ARCHIMEDlife GmbH, FortiusBio, Ahlstrom, genetechinnovations, EUROIMMUN Medizinische Labordiagnostika AG, F. Hoffmann-La Roche AG, Capitainer, and other prominent players.

Table 01: Global Specimen Collection Cards Market Value (US$ Mn) Forecast, by Type of Specimen, 2020-2035

Table 02: Global Specimen Collection Cards Market Value (US$ Mn) Forecast, By Material, 2020-2035

Table 03: Global Specimen Collection Cards Market Value (US$ Mn) Forecast, By Application, 2020-2035

Table 04: Global Specimen Collection Cards Market Value (US$ Mn) Forecast, By End-user, 2020-2035

Table 05: Global Specimen Collection Cards Market Value (US$ Mn) Forecast, By Region, 2020-2035

Table 06: North America Specimen Collection Cards Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 07: North America Specimen Collection Cards Market Value (US$ Mn) Forecast, by Type of Specimen, 2020-2035

Table 08: North America Specimen Collection Cards Market Value (US$ Mn) Forecast, by Material, 2020-2035

Table 09: North America Specimen Collection Cards Market Value (US$ Mn) Forecast, by Application, 2020-2035

Table 10: North America Specimen Collection Cards Market Value (US$ Mn) Forecast, by End-user, 2020-2035

Table 11: Europe Specimen Collection Cards Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 12: Europe Specimen Collection Cards Market Value (US$ Mn) Forecast, by Type of Specimen, 2020-2035

Table 13: Europe Specimen Collection Cards Market Value (US$ Mn) Forecast, by Material, 2020-2035

Table 14: Europe Specimen Collection Cards Market Value (US$ Mn) Forecast, by Application, 2020-2035

Table 15: Europe Specimen Collection Cards Market Value (US$ Mn) Forecast, by End-user, 2020-2035

Table 16: Asia Pacific Specimen Collection Cards Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 17: Asia Pacific Specimen Collection Cards Market Value (US$ Mn) Forecast, by Type of Specimen, 2020-2035

Table 18: Asia Pacific Specimen Collection Cards Market Value (US$ Mn) Forecast, by Material, 2020-2035

Table 19: Asia Pacific Specimen Collection Cards Market Value (US$ Mn) Forecast, by Application, 2020-2035

Table 20: Asia Pacific Specimen Collection Cards Market Value (US$ Mn) Forecast, by End-user, 2020-2035

Table 21: Latin America Specimen Collection Cards Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 22: Latin America Specimen Collection Cards Market Value (US$ Mn) Forecast, by Type of Specimen, 2020-2035

Table 23: Latin America Specimen Collection Cards Market Value (US$ Mn) Forecast, by Material, 2020-2035

Table 24: Latin America Specimen Collection Cards Market Value (US$ Mn) Forecast, by Application, 2020-2035

Table 25: Latin America Specimen Collection Cards Market Value (US$ Mn) Forecast, by End-user, 2020-2035

Table 26: Middle East and Africa Specimen Collection Cards Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 27: Middle East and Africa Specimen Collection Cards Market Value (US$ Mn) Forecast, by Type of Specimen, 2020-2035

Table 28: Middle East and Africa Specimen Collection Cards Market Value (US$ Mn) Forecast, by Material, 2020-2035

Table 29: Middle East and Africa Specimen Collection Cards Market Value (US$ Mn) Forecast, by Application, 2020-2035

Table 30: Middle East and Africa Specimen Collection Cards Market Value (US$ Mn) Forecast, by End-user, 2020-2035

Figure 01: Global Specimen Collection Cards Market Value Share Analysis, by Type of Specimen, 2024 and 2035

Figure 02: Global Specimen Collection Cards Market Attractiveness Analysis, by Type of Specimen, 2025 to 2035

Figure 03: Global Specimen Collection Cards Market Revenue (US$ Mn), by Blood, 2020-2035

Figure 04: Global Specimen Collection Cards Market Revenue (US$ Mn), by Saliva, 2020-2035

Figure 05: Global Specimen Collection Cards Market Value Share Analysis, by Urine, 2024 and 2035

Figure 06: Global Specimen Collection Cards Market Value Share Analysis, by Buccal Cells, 2024 and 2035

Figure 07: Global Specimen Collection Cards Market Value Share Analysis, by Others, 2024 and 2035

Figure 08: Global Specimen Collection Cards Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 09: Global Specimen Collection Cards Market Revenue (US$ Mn), by Cotton & Cellulose-based, 2020-2035

Figure 10: Global Specimen Collection Cards Market Revenue (US$ Mn), by Fiber-based, 2020-2035

Figure 11: Global Specimen Collection Cards Market Revenue (US$ Mn), by Others, 2020-2035

Figure 12: Global Specimen Collection Cards Market Value Share Analysis, by Application, 2024 and 2035

Figure 13: Global Specimen Collection Cards Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 14: Global Specimen Collection Cards Market Revenue (US$ Mn), by New Born Screening (NBS), 2020-2035

Figure 15: Global Specimen Collection Cards Market Revenue (US$ Mn), by Infectious Diseases Testing, 2020-2035

Figure 16: Global Specimen Collection Cards Market Revenue (US$ Mn), by Therapeutic Drug Monitoring, 2020-2035

Figure 17: Global Specimen Collection Cards Market Revenue (US$ Mn), by Forensics, 2020-2035

Figure 18: Global Specimen Collection Cards Market Revenue (US$ Mn), by Others, 2020-2035

Figure 19: Global Specimen Collection Cards Market Value Share Analysis, by End-user, 2024 and 2035

Figure 20: Global Specimen Collection Cards Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 21: Global Specimen Collection Cards Market Revenue (US$ Mn), by Healthcare/Clinical Diagnostics, 2025 to 2035

Figure 22: Global Specimen Collection Cards Market Revenue (US$ Mn), by Forensic Science, 2020-2035

Figure 23: Global Specimen Collection Cards Market Revenue (US$ Mn), by Pharmaceutical and Biotechnology Companies, 2020-2035

Figure 24: Global Specimen Collection Cards Market Revenue (US$ Mn), by Others, 2020-2035

Figure 25: Global Specimen Collection Cards Market Value Share Analysis, By Region, 2024 and 2035

Figure 26: Global Specimen Collection Cards Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 27: North America Specimen Collection Cards Market Value (US$ Mn) Forecast, 2020-2035

Figure 28: North America Specimen Collection Cards Market Value Share Analysis, by Country, 2024 and 2035

Figure 29: North America Specimen Collection Cards Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 30: North America Specimen Collection Cards Market Value Share Analysis, by Type of Specimen, 2024 and 2035

Figure 31: North America Specimen Collection Cards Market Attractiveness Analysis, by Type of Specimen, 2025 to 2035

Figure 32: North America Specimen Collection Cards Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 33: North America Specimen Collection Cards Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 34: North America Specimen Collection Cards Market Value Share Analysis, by Application, 2024 and 2035

Figure 35: North America Specimen Collection Cards Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 36: North America Specimen Collection Cards Market Value Share Analysis, by End-user, 2024 and 2035

Figure 37: North America Specimen Collection Cards Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 38: Europe Specimen Collection Cards Market Value (US$ Mn) Forecast, 2020-2035

Figure 39: Europe Specimen Collection Cards Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 40: Europe Specimen Collection Cards Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 41: Europe Specimen Collection Cards Market Value Share Analysis, by Type of Specimen, 2024 and 2035

Figure 42: Europe Specimen Collection Cards Market Attractiveness Analysis, by Type of Specimen, 2025 to 2035

Figure 43: Europe Specimen Collection Cards Market Value Share Analysis, by Material, 2024 and 2035

Figure 44: Europe Specimen Collection Cards Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 45: Europe Specimen Collection Cards Market Value Share Analysis, By Application, 2024 and 2035

Figure 46: Europe Specimen Collection Cards Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 47: Europe Specimen Collection Cards Market Value Share Analysis, by End-user, 2024 and 2035

Figure 48: Europe Specimen Collection Cards Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 49: Asia Pacific Specimen Collection Cards Market Value (US$ Mn) Forecast, 2020-2035

Figure 50: Asia Pacific Specimen Collection Cards Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 51: Asia Pacific Specimen Collection Cards Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 52: Asia Pacific Specimen Collection Cards Market Value Share Analysis, by Type of Specimen, 2024 and 2035

Figure 53: Asia Pacific Specimen Collection Cards Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 54: Asia Pacific Specimen Collection Cards Market Value Share Analysis, by Material, 2024 and 2035

Figure 55: Asia Pacific Specimen Collection Cards Market Attractiveness Analysis, by Type of Specimen, 2025 to 2035

Figure 56: Asia Pacific Specimen Collection Cards Market Value Share Analysis, By Application, 2024 and 2035

Figure 57: Asia Pacific Specimen Collection Cards Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 58: Asia Pacific Specimen Collection Cards Market Value Share Analysis, by End-user, 2024 and 2035

Figure 59: Asia Pacific Specimen Collection Cards Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 60: Latin America Specimen Collection Cards Market Value (US$ Mn) Forecast, 2020-2035

Figure 61: Latin America Specimen Collection Cards Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 62: Latin America Specimen Collection Cards Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 63: Latin America Specimen Collection Cards Market Value Share Analysis, by Type of Specimen, 2024 and 2035

Figure 64: Latin America Specimen Collection Cards Market Attractiveness Analysis, by Type of Specimen, 2025 to 2035

Figure 65: Latin America Specimen Collection Cards Market Value Share Analysis, by Material, 2024 and 2035

Figure 66: Latin America Specimen Collection Cards Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 67: Latin America Specimen Collection Cards Market Value Share Analysis, By Application, 2024 and 2035

Figure 68: Latin America Specimen Collection Cards Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 69: Latin America Specimen Collection Cards Market Value Share Analysis, by End-user, 2024 and 2035

Figure 70: Latin America Specimen Collection Cards Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 71: Middle East & Africa Specimen Collection Cards Market Value (US$ Mn) Forecast, 2020-2035

Figure 72: Middle East & Africa Specimen Collection Cards Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 73: Middle East & Africa Specimen Collection Cards Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 74: Middle East and Africa Specimen Collection Cards Market Value Share Analysis, by Type of Specimen, 2024 and 2035

Figure 75: Middle East and Africa Specimen Collection Cards Market Attractiveness Analysis, by Type of Specimen, 2025 to 2035

Figure 76: Middle East and Africa Specimen Collection Cards Market Value Share Analysis, by Material, 2024 and 2035

Figure 77: Middle East and Africa Specimen Collection Cards Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 78: Middle East and Africa Specimen Collection Cards Market Value Share Analysis, by Application, 2024 and 2035

Figure 79: Middle East and Africa Specimen Collection Cards Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 80: Middle East and Africa Specimen Collection Cards Market Value Share Analysis, by End-user, 2024 and 2035

Figure 81: Middle East and Africa Specimen Collection Cards Market Attractiveness Analysis, by End-user, 2025 to 2035