Reports

Reports

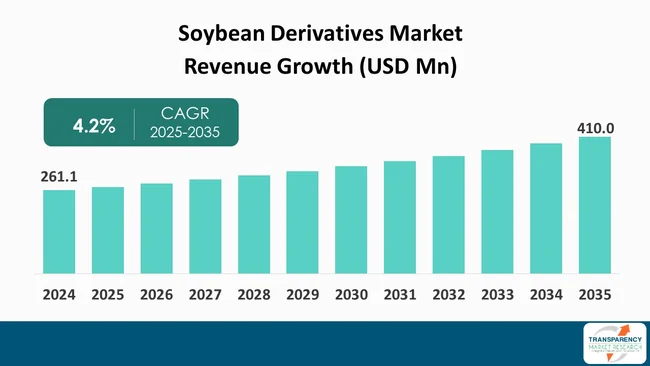

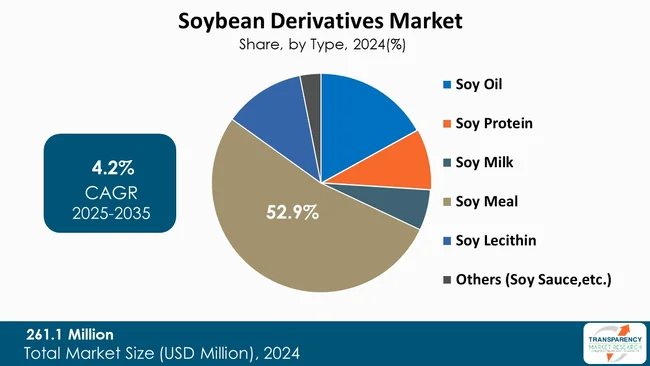

The global soybean derivatives market size was valued at US$ 261.1 Mn in 2024 and is projected to reach US$ 410.0 Mn by 2035, expanding at a CAGR of 4.2% from 2025 to 2035. The market growth is driven by rising demand for high-protein animal feed and rising health awareness among consumers.

The global soybean derivatives market is a dynamic and strategically important segment of the agricultural and industrial sectors. It encompasses a wide range of products, including soybean meal, soybean oil, soy protein ingredients, lecithin, and soy-derived isolates and concentrates, which are utilized across food, feed, and industrial applications. Soy meal remains the dominant segment, reflecting its central role in livestock and aquaculture nutrition and its position as the primary output of soybean processing. Asia-Pacific leads the market, accounting for a significant share, due to its large consumption base, established livestock and aquaculture industries, and high demand for soy-based foods and industrial products. Technological advancements in processing, the expansion of product portfolios, and the integration of soy derivatives into industrial applications such as bioplastics, inks, and adhesives enhance the market’s value and versatility. Overall, the soybean derivatives market continues to show resilience and growth potential, supported by broad applications, regional dominance, and the increasing adoption of soy-based products in both traditional and industrial uses.

Soybean derivatives market covers a broad selection of value-added products that have been acquired by the processing of whole soybeans like soybean meal, soybean oil, soy protein ingredients, soy lecithin, and soy-derived isolates and concentrates. These derivatives can be used in various industries as a key ingredient since it is a nutritionally balanced, functioning as well as economically viable.

The increasing demand of high protein for feeding animals is the main driver to the market as soybean meal has been one of the most common protein sources in the feeding of chicken, fish, and livelihoods. Moreover, soybean oil is currently a sought-after edible oil in the world with a major portion of the demand being facilitated by its use in food processing, packaged foods, and also in biofuel production.

The increasing use of plant-based proteins also contributes to the growth of the demand for soy protein concentrates, isolates, and textured soy protein in bakery, meat alternatives, dairy substitutes, sport nutrition. Non-food uses (soy based ink, lubricants, adhesives and bioplastics) are also contributing to market expansion driven by sustainability trends and the move toward bio-based materials.

Comprehensively, the soybean derivatives market is informed by the agricultural production, the international trade patterns, the technological innovation in the soybean processing, and the increasing demand of the affordable, diverse, and sustainable plant-based products in the industries.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

One of the most dominant forces of the soybean derivatives market is the increased need for high-protein feed of the animal feed and soybean-meal in the United States. The U.S. Soybean Export Council, in its 2025 SoyStats report, recorded that soybean meal is still predominantly used in the poultry industry with the latter consuming approximately 62.1% of total U.S. soybean-meal use in 2023/24. This is an indication of the booming production of poultry due to the growing global demand for chicken meat and eggs.

According to the same report, 16.8 % of usage of soybean-meal was in swine feeds and 15.2% in dairy cattle, showing the significance of soybean meal in various livestock groups. The diets of poultry and swine are highly sensitive to a high level of digestible protein and essential amino acids that promote rapid growth, favorable feed to weight ratio, and high production. Therefore, soybean meal is the cheapest and most nutritionally assured option, the protein content of which generally exceeds 44 %.

The demand for protein enriched feed materials also increases in line with the requirement of livestock producers to scale their output to satisfy the increasing domestic and export demand of animal protein. Such structural reliance of soybean meal in several animal industries has a direct stimulating effect on soybean processing volumes, and, in fact, the general development of the soybean derivatives market.

The steady production of feeds used in poultry, pork and dairy industries can further affirm the importance of soybean meal as an essential feed input where the demand is still steadfast despite the crop production variation or price trend.

The shift toward sustainable packaging is increasingly influencing the soybean derivatives market as manufacturers and end-users look to align with environmental goals and regulatory standards. Soy-derived products, particularly soy oil and soy-based additives, are now being leveraged in bio-based inks, coatings, adhesives, and bioplastics, which serve as eco-friendly alternatives to conventional petroleum-based materials. This trend is driven by rising awareness of the environmental impact of single-use plastics and mixed-material packaging, as well as global initiatives promoting circular economy practices.

Governments worldwide are introducing stricter regulations and waste minimization targets, encouraging companies to adopt recyclable, biodegradable, or plant-based packaging solutions. For example, packaging materials incorporating soy-based inks or adhesives can reduce carbon footprint and improve recyclability, while soy-based bioplastics are increasingly used in bottles, containers, and flexible packaging, offering functional performance comparable to traditional plastics.

Additionally, consumer preferences are shifting toward products with sustainable and responsibly sourced packaging, creating market incentives for manufacturers to integrate soy derivatives into their packaging solutions. This convergence of regulatory pressure, corporate sustainability commitments, and evolving consumer expectations is expanding the applications of soy-derived ingredients in packaging.

Consequently, the soybean derivatives market benefits not only from traditional food and feed applications but also from emerging industrial uses, particularly in sustainable packaging, making it a strategically important driver for future growth and innovation in the sector.

The largest portion of the category of soybean derivatives is represented by the soy meal with 52.9% market share due to the large scale of its production volume, as well as due to the necessity in the global feed mechanism. According to the United States Department of Agriculture (USDA), global soybean-meal production for 2024/25 is estimated at 278.11 million metric tons, which is more than four times the volume of global soybean-oil production, recorded at 68.57 million metric tons. This substantial difference highlights that the soybean-crushing industry is primarily geared toward producing meal rather than oil or other derivatives. Soy meal’s dominance is further reinforced by its critical application as a high-protein feed ingredient for poultry, livestock, and aquaculture. In the United States one of the world’s largest producers and consumers of soybean derivatives USDA data shows that around 74% of total domestic soybean-meal production is consumed within the country itself.

This consistently high consumption indicates that soy meal remains the core output from the crushing process, even when export demand fluctuates. Since the global agricultural sector depends heavily on soy meal to meet protein requirements for animal nutrition, its demand far outweighs that of other derivatives such as soy protein isolates, soy milk, lecithin, and soy sauce. Thus, both the overwhelming production share and indispensable end-use profile make soymeal the most dominant and influential segment in the soybean derivatives market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia-Pacific, accounting for 41.2% of the global soybean derivatives market, is the dominating region due to its massive consumption base, strong livestock and aquaculture sectors, and expanding food, beverage, and industrial applications. The region includes some of the world’s largest consumers and importers of soybeans and soymeal, such as China, India, Japan, South Korea, Vietnam, Indonesia, and Thailand. China alone accounts for a substantial share of global soybean imports and soy meal usage, driven by its extensive poultry, swine, and aquaculture industries, which rely heavily on soybean meal as the primary protein source in feed formulations.

In addition to feed, Asia-Pacific has a deeply rooted consumer market for soy-based foods, including tofu, soy milk, soy sauce, textured soy protein, and traditional fermented products, contributing to high demand for soy derivatives beyond meal. India, emerging as both a major producer and consumer, also strengthens the region’s scale through growing domestic use of soy oil and protein products.

Furthermore, rapid urbanization, rising incomes, and evolving dietary patterns in Southeast Asian markets have increased the adoption of plant-based foods, expanding the presence of soy proteins and soy beverages. Industrial utilization of soybean oil in biodiesel and food processing also contributes to robust demand. Together, these factors position Asia-Pacific as the dominant force in the global soybean derivatives market.

Manufacturers in the soybean derivatives market are expanding their portfolios through cleaner ingredient formulations, advanced processing technologies, and sustainable sourcing, thereby facilitating improved product functionality, improved nutritional value, and wider applications across food, feed, and industrial sectors.

Key players in the soybean derivatives market include ADM, Bunge, Cargill, Incorporated, Wilmar International Ltd, CHS Inc., International Flavors & Fragrances Inc., Patanjali Foods Ltd, Noble Foods, Ingredion, Solbar Ningbo Protein Technology Co., Ltd., SunOpta, FUJI OIL CO., LTD., AGROPECUARIA MAGGI LTDA, and Vitasoy International Holdings Ltd. are some of the leading companies operating in the global soybean derivatives market.

Each of these companies has been profiled in the soybean derivatives market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 (Base Year) | US$ 261.1 Mn |

| Market Forecast Value in 2035 | US$ 410.0 Mn |

| Growth Rate (CAGR 2025 to 2035) | 4.2% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value and Tons for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The soybean derivatives market was valued at US$ 261.1 Mn in 2024

The soybean derivatives industry is projected to reach US$ 410.0 Mn by the end of 2035

Rising demand for high-protein animal feed and rising health awareness are some of the factors driving the expansion of soybean derivatives market.

The CAGR is anticipated to be 4.2% from 2025 to 2035

ADM, Bunge, Cargill, Incorporated, Wilmar International Ltd, CHS Inc., International Flavors & Fragrances Inc., Patanjali Foods Ltd, Noble Foods, Ingredion, Solbar Ningbo Protein Technology Co., Ltd., SunOpta, FUJI OIL CO., LTD., AGROPECUARIA MAGGI LTDA, Vitasoy International Holdings Ltd and others.

Table 01: Global Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 02: Global Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 03: Global Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 04: Global Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 05: Global Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 06: Global Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 07: Global Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 08: Global Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 09: Global Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 10: Global Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 11: Global Soybean Derivatives Market Value (US$ Mn) Projection, By Region 2020 to 2035

Table 12: Global Soybean Derivatives Market Volume (Tons) Projection, By Region 2020 to 2035

Table 13: North America Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 14: North America Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 15: North America Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 16: North America Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 17: North America Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 18: North America Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 19: North America Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 20: North America Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 21: North America Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 22: North America Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 23: North America Soybean Derivatives Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 24: North America Soybean Derivatives Market Volume (Tons) Projection, By Country 2020 to 2035

Table 25: U.S. Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 26: U.S. Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 27: U.S. Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 28: U.S. Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 29: U.S. Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 30: U.S. Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 31: U.S. Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 32: U.S. Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 33: U.S. Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 34: U.S. Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 35: Canada Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 36: Canada Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 37: Canada Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 38: Canada Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 39: Canada Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 40: Canada Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 41: Canada Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 42: Canada Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 43: Canada Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 44: Canada Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 45: Europe Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 46: Europe Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 47: Europe Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 48: Europe Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 49: Europe Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 50: Europe Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 51: Europe Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 52: Europe Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 53: Europe Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 54: Europe Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 55: Europe Soybean Derivatives Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 56: Europe Soybean Derivatives Market Volume (Tons) Projection, By Country 2020 to 2035

Table 57: U.K. Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 58: U.K. Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 59: U.K. Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 60: U.K. Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 61: U.K. Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 62: U.K. Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 63: U.K. Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 64: U.K. Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 65: U.K. Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 66: U.K. Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 67: Germany Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 68: Germany Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 69: Germany Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 70: Germany Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 71: Germany Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 72: Germany Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 73: Germany Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 74: Germany Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 75: Germany Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 76: Germany Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 77: France Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 78: France Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 79: France Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 80: France Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 81: France Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 82: France Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 83: France Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 84: France Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 85: France Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 86: France Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 87: Italy Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 88: Italy Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 89: Italy Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 90: Italy Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 91: Italy Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 92: Italy Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 93: Italy Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 94: Italy Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 95: Italy Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 96: Italy Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 97: Spain Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 98: Spain Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 99: Spain Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 100: Spain Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 101: Spain Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 102: Spain Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 103: Spain Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 104: Spain Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 105: Spain Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 106: Spain Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 107: The Netherlands Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 108: The Netherlands Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 109: The Netherlands Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 110: The Netherlands Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 111: The Netherlands Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 112: The Netherlands Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 113: The Netherlands Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 114: The Netherlands Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 115: The Netherlands Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 116: The Netherlands Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 117: Asia Pacific Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 118: Asia Pacific Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 119: Asia Pacific Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 120: Asia Pacific Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 121: Asia Pacific Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 122: Asia Pacific Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 123: Asia Pacific Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 124: Asia Pacific Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 125: Asia Pacific Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 126: Asia Pacific Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 127: Asia Pacific Soybean Derivatives Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 128: Asia Pacific Soybean Derivatives Market Volume (Tons) Projection, By Country 2020 to 2035

Table 129: China Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 130: China Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 131: China Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 132: China Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 133: China Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 134: China Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 135: China Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 136: China Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 137: China Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 138: China Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 139: India Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 140: India Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 141: India Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 142: India Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 143: India Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 144: India Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 145: India Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 146: India Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 147: India Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 148: India Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 149: Japan Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 150: Japan Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 151: Japan Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 152: Japan Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 153: Japan Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 154: Japan Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 155: Japan Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 156: Japan Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 157: Japan Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 158: Japan Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 159: Australia Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 160: Australia Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 161: Australia Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 162: Australia Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 163: Australia Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 164: Australia Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 165: Australia Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 166: Australia Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 167: Australia Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 168: Australia Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 169: South Korea Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 170: South Korea Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 171: South Korea Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 172: South Korea Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 173: South Korea Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 174: South Korea Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 175: South Korea Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 176: South Korea Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 177: South Korea Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 178: South Korea Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 179: ASEAN Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 180: ASEAN Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 181: ASEAN Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 182: ASEAN Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 183: ASEAN Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 184: ASEAN Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 185: ASEAN Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 186: ASEAN Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 187: ASEAN Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 188: ASEAN Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 189: Middle East & Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 190: Middle East & Africa Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 191: Middle East & Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 192: Middle East & Africa Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 193: Middle East & Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 194: Middle East & Africa Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 195: Middle East & Africa Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 196: Middle East & Africa Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 197: Middle East & Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 198: Middle East & Africa Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 199: Middle East & Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 200: Middle East & Africa Soybean Derivatives Market Volume (Tons) Projection, By Country 2020 to 2035

Table 201: GCC Countries Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 202: GCC Countries Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 203: GCC Countries Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 204: GCC Countries Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 205: GCC Countries Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 206: GCC Countries Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 207: GCC Countries Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 208: GCC Countries Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 209: GCC Countries Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 210: GCC Countries Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 211: South Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 212: South Africa Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 213: South Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 214: South Africa Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 215: South Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 216: South Africa Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 217: South Africa Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 218: South Africa Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 219: South Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 220: South Africa Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 221: Latin America Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 222: Latin America Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 223: Latin America Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 224: Latin America Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 225: Latin America Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 226: Latin America Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 227: Latin America Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 228: Latin America Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 229: Latin America Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 230: Latin America Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 231: Latin America Soybean Derivatives Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 232: Latin America Soybean Derivatives Market Volume (Tons) Projection, By Country 2020 to 2035

Table 233: Brazil Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 234: Brazil Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 235: Brazil Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 236: Brazil Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 237: Brazil Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 238: Brazil Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 239: Brazil Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 240: Brazil Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 241: Brazil Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 242: Brazil Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 243: Mexico Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 244: Mexico Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 245: Mexico Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 246: Mexico Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 247: Mexico Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 248: Mexico Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 249: Mexico Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 250: Mexico Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 251: Mexico Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 252: Mexico Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 253: Argentina Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Table 254: Argentina Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Table 255: Argentina Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 256: Argentina Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Table 257: Argentina Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Table 258: Argentina Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Table 259: Argentina Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 260: Argentina Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 261: Argentina Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 262: Argentina Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 01: Global Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 02: Global Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 03: Global Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 04: Global Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 05: Global Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 06: Global Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 07: Global Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 08: Global Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 09: Global Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 10: Global Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 11: Global Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 12: Global Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 13: Global Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 14: Global Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 15: Global Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 16: Global Soybean Derivatives Market Value (US$ Mn) Projection, By Region 2020 to 2035

Figure 17: Global Soybean Derivatives Market Volume (Tons) Projection, By Region 2020 to 2035

Figure 18: Global Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Region 2025 to 2035

Figure 19: North America Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 20: North America Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 21: North America Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 22: North America Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 23: North America Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 24: North America Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 25: North America Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 26: North America Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 27: North America Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 28: North America Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 29: North America Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 30: North America Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 31: North America Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 32: North America Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 33: North America Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 34: North America Soybean Derivatives Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 35: North America Soybean Derivatives Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 36: North America Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 37: U.S. Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 38: U.S. Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 39: U.S. Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 40: U.S. Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 41: U.S. Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 42: U.S. Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 43: U.S. Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 44: U.S. Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 45: U.S. Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 46: U.S. Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 47: U.S. Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 48: U.S. Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 49: U.S. Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 50: U.S. Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 51: U.S. Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 52: Canada Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 53: Canada Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 54: Canada Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 55: Canada Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 56: Canada Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 57: Canada Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 58: Canada Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 59: Canada Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 60: Canada Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 61: Canada Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 62: Canada Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 63: Canada Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 64: Canada Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Canada Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 66: Canada Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 67: Europe Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 68: Europe Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 69: Europe Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 70: Europe Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 71: Europe Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 72: Europe Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 73: Europe Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 74: Europe Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 75: Europe Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 76: Europe Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 77: Europe Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 78: Europe Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 79: Europe Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 80: Europe Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 81: Europe Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 82: Europe Soybean Derivatives Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 83: Europe Soybean Derivatives Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 84: Europe Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 85: U.K. Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 86: U.K. Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 87: U.K. Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 88: U.K. Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 89: U.K. Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 90: U.K. Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 91: U.K. Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 92: U.K. Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 93: U.K. Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 94: U.K. Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 95: U.K. Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 96: U.K. Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 97: U.K. Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 98: U.K. Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 99: U.K. Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 100: Germany Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 101: Germany Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 102: Germany Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 103: Germany Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 104: Germany Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 105: Germany Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 106: Germany Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 107: Germany Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 108: Germany Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 109: Germany Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 110: Germany Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 111: Germany Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 112: Germany Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 113: Germany Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 114: Germany Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 115: France Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 116: France Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 117: France Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 118: France Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 119: France Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 120: France Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 121: France Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 122: France Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 123: France Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 124: France Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 125: France Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 126: France Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 127: France Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 128: France Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 129: France Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 130: Italy Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 131: Italy Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 132: Italy Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 133: Italy Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 134: Italy Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 135: Italy Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 136: Italy Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 137: Italy Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 138: Italy Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 139: Italy Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 140: Italy Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 141: Italy Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 142: Italy Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 143: Italy Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 144: Italy Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 145: Spain Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 146: Spain Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 147: Spain Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 148: Spain Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 149: Spain Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 150: Spain Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 151: Spain Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 152: Spain Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 153: Spain Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 154: Spain Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 155: Spain Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 156: Spain Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 157: Spain Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 158: Spain Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 159: Spain Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 160: The Netherlands Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 161: The Netherlands Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 162: The Netherlands Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 163: The Netherlands Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 164: The Netherlands Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 165: The Netherlands Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 166: The Netherlands Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 167: The Netherlands Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 168: The Netherlands Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 169: The Netherlands Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 170: The Netherlands Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 171: The Netherlands Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 172: The Netherlands Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 173: The Netherlands Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 174: The Netherlands Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 175: Asia Pacific Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 176: Asia Pacific Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 177: Asia Pacific Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 178: Asia Pacific Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 179: Asia Pacific Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 180: Asia Pacific Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 181: Asia Pacific Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 182: Asia Pacific Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 183: Asia Pacific Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 184: Asia Pacific Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 185: Asia Pacific Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 186: Asia Pacific Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 187: Asia Pacific Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 188: Asia Pacific Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 189: Asia Pacific Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 190: Asia Pacific Soybean Derivatives Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 191: Asia Pacific Soybean Derivatives Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 192: Asia Pacific Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 193: China Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 194: China Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 195: China Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 196: China Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 197: China Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 198: China Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 199: China Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 200: China Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 201: China Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 202: China Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 203: China Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 204: China Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 205: China Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 206: China Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 207: China Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 208: India Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 209: India Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 210: India Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 211: India Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 212: India Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 213: India Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 214: India Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 215: India Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 216: India Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 217: India Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 218: India Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 219: India Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 220: India Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 221: India Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 222: India Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 223: Japan Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 224: Japan Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 225: Japan Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 226: Japan Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 227: Japan Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 228: Japan Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 229: Japan Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 230: Japan Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 231: Japan Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 232: Japan Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 233: Japan Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 234: Japan Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 235: Japan Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 236: Japan Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 237: Japan Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 238: Australia Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 239: Australia Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 240: Australia Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 241: Australia Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 242: Australia Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 243: Australia Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 244: Australia Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 245: Australia Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 246: Australia Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 247: Australia Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 248: Australia Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 249: Australia Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 250: Australia Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 251: Australia Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 252: Australia Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 253: South Korea Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 254: South Korea Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 255: South Korea Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 256: South Korea Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 257: South Korea Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 258: South Korea Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 259: South Korea Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 260: South Korea Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 261: South Korea Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 262: South Korea Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 263: South Korea Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 264: South Korea Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 265: South Korea Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Korea Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Korea Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 268: ASEAN Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 269: ASEAN Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 270: ASEAN Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 271: ASEAN Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 272: ASEAN Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 273: ASEAN Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 274: ASEAN Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 275: ASEAN Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 276: ASEAN Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 277: ASEAN Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 278: ASEAN Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 279: ASEAN Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 280: ASEAN Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 281: ASEAN Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 282: ASEAN Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 283: Middle East & Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 284: Middle East & Africa Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 285: Middle East & Africa Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 286: Middle East & Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 287: Middle East & Africa Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 288: Middle East & Africa Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 289: Middle East & Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 290: Middle East & Africa Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 291: Middle East & Africa Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 292: Middle East & Africa Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 293: Middle East & Africa Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 294: Middle East & Africa Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 295: Middle East & Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 296: Middle East & Africa Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 297: Middle East & Africa Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 298: Middle East & Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 299: Middle East & Africa Soybean Derivatives Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 300: Middle East & Africa Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 301: GCC Countries Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 302: GCC Countries Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 303: GCC Countries Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 304: GCC Countries Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 305: GCC Countries Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 306: GCC Countries Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 307: GCC Countries Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 308: GCC Countries Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 309: GCC Countries Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 310: GCC Countries Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 311: GCC Countries Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 312: GCC Countries Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 313: GCC Countries Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 314: GCC Countries Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 315: GCC Countries Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 316: South Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 317: South Africa Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 318: South Africa Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 319: South Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 320: South Africa Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 321: South Africa Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 322: South Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 323: South Africa Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 324: South Africa Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 325: South Africa Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 326: South Africa Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 327: South Africa Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 328: South Africa Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 329: South Africa Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 330: South Africa Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 331: Latin America Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 332: Latin America Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 333: Latin America Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 334: Latin America Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 335: Latin America Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 336: Latin America Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 337: Latin America Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 338: Latin America Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 339: Latin America Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 340: Latin America Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 341: Latin America Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 342: Latin America Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 343: Latin America Soybean Derivatives Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 344: Latin America Soybean Derivatives Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 345: Latin America Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 346: Latin America Soybean Derivatives Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 347: Latin America Soybean Derivatives Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 348: Latin America Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 349: Brazil Soybean Derivatives Market Value (US$ Mn) Projection, By Type 2020 to 2035

Figure 350: Brazil Soybean Derivatives Market Volume (Tons) Projection, By Type 2020 to 2035

Figure 351: Brazil Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Type 2025 to 2035

Figure 352: Brazil Soybean Derivatives Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 353: Brazil Soybean Derivatives Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 354: Brazil Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 355: Brazil Soybean Derivatives Market Value (US$ Mn) Projection, By Form 2020 to 2035

Figure 356: Brazil Soybean Derivatives Market Volume (Tons) Projection, By Form 2020 to 2035

Figure 357: Brazil Soybean Derivatives Market Incremental Opportunities (US$ Mn) Forecast, By Form 2025 to 2035

Figure 358: Brazil Soybean Derivatives Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 359: Brazil Soybean Derivatives Market Volume (Tons) Projection, By End-use 2020 to 2035