Reports

Reports

Analysts’ Viewpoint

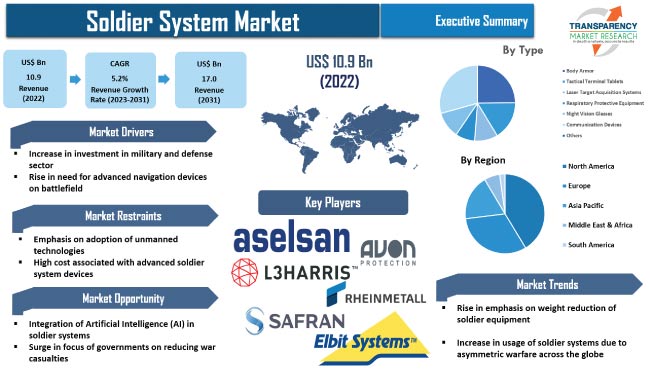

The global soldier system industry is expected to grow at a steady pace in the near future due to the increase in defense investment and need for more advanced technologies to improve the effectiveness and safety of soldiers in the field. The soldier system market involves advanced technologies and equipment designed to enhance the capabilities of soldiers in the field. These systems include a range of technologies such as advanced communication systems, sensors, body armor, and navigation systems.

Rise in need for improved situational awareness, communication, and data sharing on the battlefield is also likely to boost the demand for soldier systems in the near future. Advancements in materials science and technology have led to the development of lighter and more effective body armor and other protective equipment. This is further driving market expansion.

Soldier system is designed to enhance the warfighting capabilities of individual soldiers with the use of doctrine, training, and equipment, enabling them to effectively counter threats on the battlefield. It plays a vital role in enhancing soldiers' capabilities in various terrains and environments.

Soldier systems include a diverse array of equipment, ranging from small scopes to large, portable devices such as jammers and radars. These systems also involve equipment such as portable oxygen concentrators, which soldiers use at high altitudes.

Soldier systems are equipped with C4ISTAR sensors, communication, self-protection equipment, and autonomous systems to provide a comprehensive operational picture in order to support decision-making and intervention at all levels of command. These systems improve combat performance by offering stable connectivity, real-time situational awareness, and reducing weight and equipment complexity.

Governments of countries across the globe are investing significantly in the military and defense sector to boost their defense capabilities. These investments enable the adoption of new technologies to enhance soldiers' warfighting capabilities.

In the recent past, several developing countries, including China, India, and Japan, have raised their defense budgets to historic highs and are on the list of countries spending the most on their defense forces. China and India rank second and fourth, respectively, in terms of their defense spending. In February 2023, the Government of India announced its defense budget, which was 13% more than the previous year.

Such rise in investment is directed toward the acquisition of new technologies and upgrade of current soldier systems such as body armor, communication devices, respiratory protective equipment, night vision glasses, and laser target acquisition systems. Thus, surge in investment in the military and defense sector is projected to positively impact the soldier system market growth in the near future.

Growth in risk of peer-to-peer conflict is prompting digitization in the military and defense sector. Armed forces around the globe are investing significantly in advanced soldier systems to enhance soldier capabilities. They are integrating AI capabilities into soldier systems to allow rapid processing of tactical and strategic data. AI also provides troops and commanders with reliable intelligence to improve reaction times and coordination during large-scale operations. Hence, integration of AI in soldier systems is expected to drive the soldier system market progress in the next few years.

The varying terrain in different regions can pose challenges for troops, thus hindering their ability to detect threats and slowing their movement. This increases the likelihood of casualties. GPS devices can play a critical role in addressing these challenges and reducing the risk of harm. By integrating with surveillance equipment, GPS technology can track potential threats and provide soldiers with safe passage. Additionally, GPS can assist with the evacuation of injured soldiers in situations where medical assistance may not be immediately available. Thus, increase in need for advanced navigation devices on the battlefield is boosting the market revenue.

GPS devices have a wide range of applications and can be integrated with various types of equipment, including radars, tactical terminal tablets, and missile defense systems. Major countries are prioritizing the development of their navigation systems due to the crucial role they play in detecting enemy positions. In 2018, India successfully developed the NavIC satellite system, which provides critical information to soldiers in wartime situations.

Vendors in the industry are launching new navigation systems to increase their soldier system market share. In November 2022, Thales Visionix, a subsidiary of Thales Defense & Security Inc., launched its new PLI navigation system, which is designed to operate in environments where global positioning systems are denied. The system comprises a combined visual-inertial sensor, which collects inertial data and video transmitted to a wearable computer.

According to the latest soldier system market trends, the body armor type segment held major share in 2022. Body armor is the most important and traditional means of personal protection for soldiers.

Over time, personal protective equipment has undergone several upgrades and is now classified as either hard armor or soft armor. Hard body armor includes ballistic plates designed to protect against rifle threats. Soft body armor consists of flexible panels made from ballistic material and is intended to offer protection against assaults involving handguns.

Soldier system manufacturers are prioritizing the development of body armor that can withstand maximum ballistic impact. They are creating materials capable of absorbing the most powerful shot impacts. In February 2021, Russia revealed its next-generation Sotnik soldier battle armor, which is expected to replace the Ratnik series of body armor by 2025. The Sotnik armor would be the lightest bulletproof body armor in the world. It would be able to withstand gunshots that can damage light armored vehicles.

According to the latest soldier system market analysis, the homeland security end-user segment dominated the global landscape in 2022. Growth of the segment can be ascribed to increase in border tensions between several countries around the globe, rise in influence of extremist and terror groups, and need for strong internal security.

Homeland security refers to national security, especially with regard to the threat of terrorism within a country. Homeland security is tasked to protect borders and efficiently manage the flow of people and products into and out of a country.

North America is expected to hold prominent share during the forecast period. The region accounted for 41.3% share in 2022. Presence of major vendors and rise in investment in the military and defense sector are driving market dynamics of the region.

Many countries around the world depend substantially on military equipment manufacturers based in North America. These companies produce devices and equipment that comply with various government regulations, resulting in a large customer base. Additionally, the U.S. Government is actively supporting its defense manufacturers through various initiatives. In September 2022, the U.S. Department of Defense approved a US$ 30 Mn budget for defense manufacturers as part of the Defense Manufacturing Community Support Program.

Vendors in North America are also benefitting from U.S. funding for the Ukraine forces. Since January 2021, the U.S. has invested more than US$ 32.4 Bn in security assistance for training and equipment to help Ukraine preserve its territorial integrity.

The industry in Europe is projected to grow at a significant CAGR of 4.9% during the forecast period. Increase in investment in the military and defense sector is boosting market statistics in the region. Most countries in Europe are NATO members that face threats from Russia and its expansionist policies, leading to surge in defense budgets. In February 2023, Germany announced its plan to increase its defense budget to 2.0% of its GDP to comply with NATO's 2.0% guideline.

The global business is consolidated, with a small number of large-medium scale vendors controlling majority of the market share. ASELSAN A.Ş., Avon Protection plc, Banc 3, Inc., Elbit Systems Ltd., Inmarsat Global Limited, L3Harris Technologies, Inc., Metravib Defence, Rheinmetall AG, Safran Vectronix AG, Teldat Group, Textron Systems, and Thales Group are key entities operating in this market.

Each of these players has been profiled in the soldier system market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Manufacturers are investing significantly in R&D to create innovative technologies and equipment that provide soldiers with improved capabilities and safety. They are also entering into strategic partnerships with other companies to share technology and expertise, reduce costs, and improve product offerings.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 10.9 Bn |

|

Market Forecast Value in 2031 |

US$ 17.0 Bn |

|

Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 10.9 Bn in 2022.

It is expected to be 5.2% from 2023 to 2031.

Increase in investment in military and defense sector and rise in need for advanced navigation devices on battlefield.

The body armor segment accounted for major share of 27.5% in 2022.

North America is a more attractive region for vendors.

ASELSAN A.Ş., Avon Protection plc, Banc 3, Inc., Elbit Systems Ltd., Inmarsat Global Limited, L3Harris Technologies, Inc., Metravib Defence, Rheinmetall AG, Safran Vectronix AG, Teldat Group, Textron Systems, and Thales Group.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Soldier System Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global C4ISR Application Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap

4.4. Industry SWOT Analysis

4.5. Porter’s Five Forces Analysis

4.6. COVID-19 Impact and Recovery Analysis

5. Global Soldier System Market Analysis, By Type

5.1. Soldier System Market Size (US$ Bn) Analysis & Forecast, By Type, 2017–2031

5.1.1. Body Armor

5.1.2. Tactical Terminal Tablets

5.1.3. Laser Target Acquisition Systems

5.1.4. Respiratory Protective Equipment

5.1.5. Night Vision Glasses

5.1.6. Communication Devices

5.1.7. Others (Navigation Devices, Training & Simulation)

5.2. Market Attractiveness Analysis, By Type

6. Global Soldier System Market Analysis, By End-user

6.1. Soldier System Market Size (US$ Bn) Analysis & Forecast, By End-user, 2017–2031

6.1.1. Defense

6.1.2. Homeland Security

6.2. Market Attractiveness Analysis, By End-user

7. Global Soldier System Market Analysis and Forecast, By Region

7.1. Soldier System Market Size (US$ Bn) Analysis & Forecast, By Region, 2017–2031

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East & Africa

7.1.5. South America

7.2. Market Attractiveness Analysis, By Region

8. North America Soldier System Market Analysis and Forecast

8.1. Market Snapshot

8.2. Drivers and Restraints: Impact Analysis

8.3. Soldier System Market Size (US$ Bn) Analysis & Forecast, By Type, 2017–2031

8.3.1. Body Armor

8.3.2. Tactical Terminal Tablets

8.3.3. Laser Target Acquisition Systems

8.3.4. Respiratory Protective Equipment

8.3.5. Night Vision Glasses

8.3.6. Communication Devices

8.3.7. Others (Navigation Devices, Training & Simulation)

8.4. Soldier System Market Size (US$ Bn) Analysis & Forecast, By End-user, 2017–2031

8.4.1. Defense

8.4.2. Homeland Security

8.5. Soldier System Market Size (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017–2031

8.5.1. U.S.

8.5.2. Canada

8.5.3. Rest of North America

8.6. Market Attractiveness Analysis

8.6.1. By Type

8.6.2. By End-user

8.6.3. By Country/Sub-region

9. Europe Soldier System Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Soldier System Market Size (US$ Bn) Analysis & Forecast, By Type, 2017–2031

9.3.1. Body Armor

9.3.2. Tactical Terminal Tablets

9.3.3. Laser Target Acquisition Systems

9.3.4. Respiratory Protective Equipment

9.3.5. Night Vision Glasses

9.3.6. Communication Devices

9.3.7. Others (Navigation Devices, Training & Simulation)

9.4. Soldier System Market Size (US$ Bn) Analysis & Forecast, By End-user, 2017–2031

9.4.1. Defense

9.4.2. Homeland Security

9.5. Soldier System Market Size (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017–2031

9.5.1. U.K.

9.5.2. Germany

9.5.3. France

9.5.4. Rest of Europe

9.6. Market Attractiveness Analysis

9.6.1. By Type

9.6.2. By End-user

9.6.3. By Country/Sub-region

10. Asia Pacific Soldier System Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Soldier System Market Size (US$ Bn) Analysis & Forecast, By Type, 2017–2031

10.3.1. Body Armor

10.3.2. Tactical Terminal Tablets

10.3.3. Laser Target Acquisition Systems

10.3.4. Respiratory Protective Equipment

10.3.5. Night Vision Glasses

10.3.6. Communication Devices

10.3.7. Others (Navigation Devices, Training & Simulation)

10.4. Soldier System Market Size (US$ Bn) Analysis & Forecast, By End-user, 2017–2031

10.4.1. Defense

10.4.2. Homeland Security

10.5. Soldier System Market Size (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. South Korea

10.5.5. ASEAN

10.5.6. Rest of Asia Pacific

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By End-user

10.6.3. By Country/Sub-region

11. Middle East & Africa Soldier System Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Soldier System Market Size (US$ Bn) Analysis & Forecast, By Type, 2017–2031

11.3.1. Body Armor

11.3.2. Tactical Terminal Tablets

11.3.3. Laser Target Acquisition Systems

11.3.4. Respiratory Protective Equipment

11.3.5. Night Vision Glasses

11.3.6. Communication Devices

11.3.7. Others (Navigation Devices, Training & Simulation)

11.4. Soldier System Market Size (US$ Bn) Analysis & Forecast, By End-user, 2017–2031

11.4.1. Defense

11.4.2. Homeland Security

11.5. Soldier System Market Size (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.5.1. GCC

11.5.2. Africa

11.5.3. Rest of Middle East & Africa

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By End-user

11.6.3. By Country/Sub-region

12. South America Soldier System Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Soldier System Market Size (US$ Bn) Analysis & Forecast, By Type, 2017–2031

12.3.1. Body Armor

12.3.2. Tactical Terminal Tablets

12.3.3. Laser Target Acquisition Systems

12.3.4. Respiratory Protective Equipment

12.3.5. Night Vision Glasses

12.3.6. Communication Devices

12.3.7. Others (Navigation Devices, Training & Simulation)

12.4. Soldier System Market Size (US$ Bn) Analysis & Forecast, By End-user, 2017–2031

12.4.1. Defense

12.4.2. Homeland Security

12.5. Soldier System Market Size (US$ Bn) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.5.1. Brazil

12.5.2. Rest of South America

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By End-user

12.6.3. By Country/Sub-region

13. Competition Assessment

13.1. Global Soldier System Market Competition Matrix - a Dashboard View

13.1.1. Global Soldier System Market Company Share Analysis, by Value (2022)

13.1.2. Technological Differentiator

14. Company Profiles (Global Manufacturers/Suppliers)

14.1. ASELSAN A.Ş.

14.1.1. Overview

14.1.2. Product Portfolio

14.1.3. Sales Footprint

14.1.4. Key Subsidiaries or Distributors

14.1.5. Strategy and Recent Developments

14.1.6. Key Financials

14.2. Avon Protection plc

14.2.1. Overview

14.2.2. Product Portfolio

14.2.3. Sales Footprint

14.2.4. Key Subsidiaries or Distributors

14.2.5. Strategy and Recent Developments

14.2.6. Key Financials

14.3. Banc 3, Inc.

14.3.1. Overview

14.3.2. Product Portfolio

14.3.3. Sales Footprint

14.3.4. Key Subsidiaries or Distributors

14.3.5. Strategy and Recent Developments

14.3.6. Key Financials

14.4. Elbit Systems Ltd.

14.4.1. Overview

14.4.2. Product Portfolio

14.4.3. Sales Footprint

14.4.4. Key Subsidiaries or Distributors

14.4.5. Strategy and Recent Developments

14.4.6. Key Financials

14.5. Inmarsat Global Limited

14.5.1. Overview

14.5.2. Product Portfolio

14.5.3. Sales Footprint

14.5.4. Key Subsidiaries or Distributors

14.5.5. Strategy and Recent Developments

14.5.6. Key Financials

14.6. L3Harris Technologies, Inc.

14.6.1. Overview

14.6.2. Product Portfolio

14.6.3. Sales Footprint

14.6.4. Key Subsidiaries or Distributors

14.6.5. Strategy and Recent Developments

14.6.6. Key Financials

14.7. Metravib Defence

14.7.1. Overview

14.7.2. Product Portfolio

14.7.3. Sales Footprint

14.7.4. Key Subsidiaries or Distributors

14.7.5. Strategy and Recent Developments

14.7.6. Key Financials

14.8. Rheinmetall AG

14.8.1. Overview

14.8.2. Product Portfolio

14.8.3. Sales Footprint

14.8.4. Key Subsidiaries or Distributors

14.8.5. Strategy and Recent Developments

14.8.6. Key Financials

14.9. Safran Vectronix AG

14.9.1. Overview

14.9.2. Product Portfolio

14.9.3. Sales Footprint

14.9.4. Key Subsidiaries or Distributors

14.9.5. Strategy and Recent Developments

14.9.6. Key Financials

14.10. Teldat Group

14.10.1. Overview

14.10.2. Product Portfolio

14.10.3. Sales Footprint

14.10.4. Key Subsidiaries or Distributors

14.10.5. Strategy and Recent Developments

14.10.6. Key Financials

14.11. Textron Systems

14.11.1. Overview

14.11.2. Product Portfolio

14.11.3. Sales Footprint

14.11.4. Key Subsidiaries or Distributors

14.11.5. Strategy and Recent Developments

14.11.6. Key Financials

14.12. Thales Group

14.12.1. Overview

14.12.2. Product Portfolio

14.12.3. Sales Footprint

14.12.4. Key Subsidiaries or Distributors

14.12.5. Strategy and Recent Developments

14.12.6. Key Financials

15. Recommendation

15.1. Opportunity Assessment

15.1.1. By Type

15.1.2. By End-user

15.1.3. By Country/Sub-region

List of Tables

Table 1: Global Soldier System Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 2: Global Soldier System Market Value (US$ Bn) & Forecast, by End-user, 2017‒2031

Table 3: Global Soldier System Market Value (US$ Bn) & Forecast, by Region, 2017‒2031

Table 4: North America Soldier System Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 5: North America Soldier System Market Value (US$ Bn) & Forecast, by End-user, 2017‒2031

Table 6: North America Soldier System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 7: Europe Soldier System Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 8: Europe Soldier System Market Value (US$ Bn) & Forecast, by End-user, 2017‒2031

Table 9: Europe Soldier System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 10: Asia Pacific Soldier System Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 11: Asia Pacific Soldier System Market Value (US$ Bn) & Forecast, by End-user, 2017‒2031

Table 12: Asia Pacific Soldier System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 13: Middle East & Africa Soldier System Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 14: Middle East & Africa Soldier System Market Value (US$ Bn) & Forecast, by End-user, 2017‒2031

Table 15: Middle East & Africa Soldier System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 16: South America Soldier System Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 17: South America Soldier System Market Value (US$ Bn) & Forecast, by End-user, 2017‒2031

Table 18: South America Soldier System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 1: Global Soldier System Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 2: Global Soldier System Market Value (US$ Bn) & Forecast, by End-user, 2017‒2031

Table 3: Global Soldier System Market Value (US$ Bn) & Forecast, by Region, 2017‒2031

Table 4: North America Soldier System Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 5: North America Soldier System Market Value (US$ Bn) & Forecast, by End-user, 2017‒2031

Table 6: North America Soldier System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 7: Europe Soldier System Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 8: Europe Soldier System Market Value (US$ Bn) & Forecast, by End-user, 2017‒2031

Table 9: Europe Soldier System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 10: Asia Pacific Soldier System Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 11: Asia Pacific Soldier System Market Value (US$ Bn) & Forecast, by End-user, 2017‒2031

Table 12: Asia Pacific Soldier System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 13: Middle East & Africa Soldier System Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 14: Middle East & Africa Soldier System Market Value (US$ Bn) & Forecast, by End-user, 2017‒2031

Table 15: Middle East & Africa Soldier System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 16: South America Soldier System Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 17: South America Soldier System Market Value (US$ Bn) & Forecast, by End-user, 2017‒2031

Table 18: South America Soldier System Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Soldier System

Figure 02: Porter Five Forces Analysis - Global Soldier System

Figure 03: Technology Road Map - Global Soldier System

Figure 04: Global Soldier System Market, Value (US$ Bn), 2017-2031

Figure 05: Global Soldier System Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017‒2031

Figure 06: Global Soldier System Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 07: Global Soldier System Market, Incremental Opportunity, by Type, 2023‒2031

Figure 08: Global Soldier System Market Share Analysis, by Type, 2023 and 2031

Figure 09: Global Soldier System Market Projections by End-user, Value (US$ Bn), 2017‒2031

Figure 10: Global Soldier System Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 11: Global Soldier System Market Share Analysis, by End-user, 2023 and 2031

Figure 12: Global Soldier System Market Projections by Region, Value (US$ Bn), 2017‒2031

Figure 13: Global Soldier System Market, Incremental Opportunity, by Region, 2023‒2031

Figure 14: Global Soldier System Market Share Analysis, by Region, 2023 and 2031

Figure 15: North America Soldier System Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 16: North America Soldier System Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017‒2031

Figure 17: North America Soldier System Market Projections by Type Value (US$ Bn), 2017‒2031

Figure 18: North America Soldier System Market, Incremental Opportunity, by Type, 2023‒2031

Figure 19: North America Soldier System Market Share Analysis, by Type, 2023 and 2031

Figure 20: North America Soldier System Market Projections by End-user Value (US$ Bn), 2017‒2031

Figure 21: North America Soldier System Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 22: North America Soldier System Market Share Analysis, by End-user, 2023 and 2031

Figure 23: North America Soldier System Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 24: North America Soldier System Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 25: North America Soldier System Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 26: Europe Soldier System Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 27: Europe Soldier System Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017‒2031

Figure 28: Europe Soldier System Market Projections by Type Value (US$ Bn), 2017‒2031

Figure 29: Europe Soldier System Market, Incremental Opportunity, by Type, 2023‒2031

Figure 30: Europe Soldier System Market Share Analysis, by Type, 2023 and 2031

Figure 31: Europe Soldier System Market Projections by End-user Value (US$ Bn), 2017‒2031

Figure 32: Europe Soldier System Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 33: Europe Soldier System Market Share Analysis, by End-user, 2023 and 2031

Figure 34: Europe Soldier System Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 35: Europe Soldier System Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 36: Europe Soldier System Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 37: Asia Pacific Soldier System Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 38: Asia Pacific Soldier System Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017‒2031

Figure 39: Asia Pacific Soldier System Market Projections by Type Value (US$ Bn), 2017‒2031

Figure 40: Asia Pacific Soldier System Market, Incremental Opportunity, by Type, 2023‒2031

Figure 41: Asia Pacific Soldier System Market Share Analysis, by Type, 2023 and 2031

Figure 42: Asia Pacific Soldier System Market Projections by End-user Value (US$ Bn), 2017‒2031

Figure 43: Asia Pacific Soldier System Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 44: Asia Pacific Soldier System Market Share Analysis, by End-user, 2023 and 2031

Figure 45: Asia Pacific Soldier System Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 46: Asia Pacific Soldier System Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 47: Asia Pacific Soldier System Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 48: Middle East & Africa Soldier System Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 49: Middle East & Africa Soldier System Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017‒2031

Figure 50: Middle East & Africa Soldier System Market Projections by Type Value (US$ Bn), 2017‒2031

Figure 51: Middle East & Africa Soldier System Market, Incremental Opportunity, by Type, 2023‒2031

Figure 52: Middle East & Africa Soldier System Market Share Analysis, by Type, 2023 and 2031

Figure 53: Middle East & Africa Soldier System Market Projections by End-user Value (US$ Bn), 2017‒2031

Figure 54: Middle East & Africa Soldier System Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 55: Middle East & Africa Soldier System Market Share Analysis, by End-user, 2023 and 2031

Figure 56: Middle East & Africa Soldier System Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 57: Middle East & Africa Soldier System Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 58: Middle East & Africa Soldier System Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 59: South America Soldier System Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 60: South America Soldier System Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017‒2031

Figure 61: South America Soldier System Market Projections by Type Value (US$ Bn), 2017‒2031

Figure 62: South America Soldier System Market, Incremental Opportunity, by Type, 2023‒2031

Figure 63: South America Soldier System Market Share Analysis, by Type, 2023 and 2031

Figure 64: South America Soldier System Market Projections by End-user Value (US$ Bn), 2017‒2031

Figure 65: South America Soldier System Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 66: South America Soldier System Market Share Analysis, by End-user, 2023 and 2031

Figure 67: South America Soldier System Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 68: South America Soldier System Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 69: South America Soldier System Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 70: Global Soldier System Market Competition

Figure 71: Global Soldier System Market Company Share Analysis