Reports

Reports

Analyst Viewpoint

Rise in number of individuals, businesses, and governments adopting solar energy is driving the installation of high-quality efficient solar panels, which in turn is boosting the solar panel coatings market growth. Solar panel coatings offer exceptional anti-reflective properties, thereby maximizing capture of sunlight and conversion into clean energy. Therefore, rise in installation of solar panels is likely to propel the growth of the solar panel coatings industry in the next few years.

Increase in awareness about solar energy and government initiatives promoting the adoption of renewable sources of energy are expected to offer significant solar panel coatings market opportunities for manufacturers across the globe. Furthermore, growing focus on solar plants by governments worldwide is also fueling the demand for solar cell coating solutions.

Solar panel coatings are designed to enhance solar energy absorption by reducing reflection, reduce energy losses, and improve light trapping, which increases energy conversion efficiency. Self-cleaning coatings help prevent dust and dirt buildup on the surface, ensuring optimal performance. Furthermore, growing concerns about climate change and implementation of favorable policies are propelling the demand for efficient and cost-effective solar panels and consequently, driving the solar panel coatings market demand.

Advancements in coating technologies have led to the design of anti-reflective coatings, which reduce the amount of sunlight reflected from the surface of solar panels, thereby enabling them to absorb a higher percentage of sunlight. Furthermore, hydrophilic coating materials have been developed, which repel and prevent the build-up of dust on the panels.

High initial investment required for installation of solar panels and lack of awareness about the benefits of solar panel coatings among consumers could negatively impact the solar panel coatings market outlook in the next few years.

Renewable and green energy technologies have been gaining traction for the last few years owing to growing concerns about the detrimental effect of conventional resources of energy on the Earth's atmosphere. Moreover, significant research is being carried out to improve the efficiency of solar panels, as power generation from the Sun is beneficial in regions that experience year-round sunshine and water is scarce. Moreover, multifunctional thin films or coatings are being developed to impart self-cleaning, anti-reflection, and energy transmittance properties to the surface of solar panels.

Increasing adoption of solar energy has also prompted leading manufacturers to develop coatings that enhance the efficiency of solar panels. Accordingly, SunDensity developed a nano-optical coating for solar panels that boosts the energy yield by 20%. Therefore, increase in concerns about the environment and rise in awareness about the advantages of solar power generation are anticipated to propel the solar panel coatings market growth in the next few years.

Rise in global population coupled with rapid industrialization and surge in disposable income of individuals has driven the demand for energy across the globe. This increase in demand has meant that solar energy has emerged as a reliable and sustainable source of energy. Moreover, growing preference for sustainable practices has prompted business and industries to adopt solar power on a large scale to meet their energy demands and reduce their carbon footprint. Furthermore, numerous government incentives in several countries are helping reduce the installation cost of solar units, making them affordable for commercial and residential applications.

Growing number of eco-conscious homeowners seeking cost-effective and sustainable energy solutions are driving the installation of solar panels in the residential sector. Increase in number of families worldwide employing solar energy solutions to reduce their energy costs and adopting greener practices is projected to propel the solar power coatings market development in the near future.

According to the latest solar panel coatings industry analysis, Asia Pacific accounted for the largest solar panel coatings market share in 2022 owing to the rising demand for sustainable energy solutions from a rapidly expanding population in the region. China is the largest producer and consumer of solar energy globally. It is also home to the largest solar park, in terms of land area, in the world. The country has installed more than 30.88 GW of solar PV systems in the first half of 2022. India is planning to issue 40 GW tenders for solar and hybrid projects in 2023-2024. It has already established 42 solar parks to make land available for installation of solar panel systems. Rising emphasis on adoption of solar energy in China and India is estimated to significantly boost the photovoltaic coatings market in the near future.

As per National Geographic, India has created close to 42 parks for providing land to the ones promoting solar plants. It further states that as of August 2021, the country had generated solar capacity of close to 44.3 GW.

North America holds a significant market share due to rising demand for eco-friendly and sustainable goods such as panel coatings and solar panels in the wake of growing awareness regarding ill-effects of conventional energy sources. Furthermore, the solar panel coatings market size in North America is expected to increase considerably due to government incentives driving the adoption of renewable energy sources in the region.

The global solar panel coatings business is highly consolidated owing to the presence of several prominent players operating across the globe. Leading vendors in solar panel coatings are following the latest market trends and engaging in new product launches and mergers & acquisitions to consolidate their position in the global market. Arkema Group, Fenzi SpA, NanoTech Types Pty. Ltd., Koninklijke DSM N.V., 3M, PPG Industries Inc., Nano Shell Ltd., Unelko Corporation, Optitune Oy, and Diamon-Fusion International Inc. are a few prominent entities operating in the global solar panel coatings market.

Key players in the solar panel coatings market report have been profiled based on various parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 3.2 Bn |

| Forecast (Value) in 2031 | US$ 26.7 Bn |

| Growth Rate (CAGR) | 26.7% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Bn for Value and Liters for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available Upon Request |

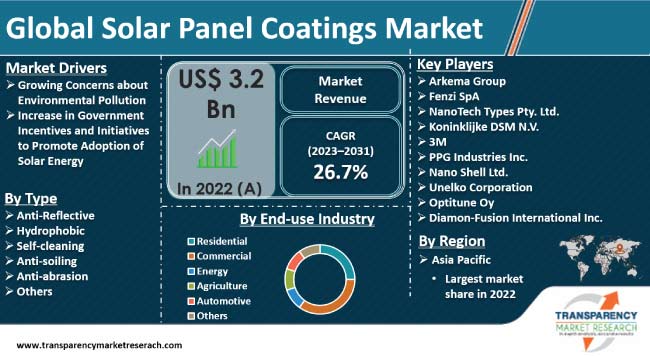

The global market was valued at US$ 3.2 Bn in 2022

It is projected to advance at a CAGR of 26.7% from 2023 to 2031

Growing concerns about environmental pollution and increase in government incentives and initiatives to promote adoption of solar energy

In terms of end-use industry, the commercial segment held largest share in 2022

Asia Pacific is estimated to dominate in the next few years

Arkema Group, Fenzi SpA, NanoTech Types Pty. Ltd., Koninklijke DSM N.V., 3M, PPG Industries Inc., Nano Shell Ltd., Unelko Corporation, Optitune Oy, and Diamon-Fusion International Inc.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Solar Panel Coatings Market Analysis and Forecasts, 2022-2031

2.6.1. Global Solar Panel Coatings Market Volume (Liters)

2.6.2. Global Solar Panel Coatings Market Value (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Solar Panel Coatings

3.2. Impact on the Demand of Solar Panel Coatings– Pre & Post Crisis

4. Production Output Analysis (Tons), 2021

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East and Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2022-2031

6.1. Price Trend Analysis by Type

6.2. Price Trend Analysis by Region

7. Solar Panel Coatings Market Analysis and Forecast, by Type, 2022–2031

7.1. Introduction and Definitions

7.2. Global Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

7.2.1. Anti-reflective

7.2.2. Hydrophobic

7.2.3. Self-cleaning

7.2.4. Anti-soiling

7.2.5. Anti-abrasion

7.2.6. Others

7.3. Global Solar Panel Coatings Market Attractiveness, by Type

8. Global Solar Panel Coatings Market Analysis and Forecast, End-use Industry, 2022–2031

8.1. Introduction and Definitions

8.2. Global Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by End-use Industry, 2022–2031

8.2.1. Residential

8.2.2. Commercial

8.2.3. Energy

8.2.4. Agriculture

8.2.5. Automotive

8.2.6. Others

8.3. Global Solar Panel Coatings Market Attractiveness, by End-use Industry

9. Global Solar Panel Coatings Market Analysis and Forecast, by Region, 2022–2031

9.1. Key Findings

9.2. Global Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Region, 2022–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Solar Panel Coatings Market Attractiveness, by Region

10. North America Solar Panel Coatings Market Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. North America Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

10.3. North America Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by End-use Industry, 2022–2031

10.4. North America Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Country, 2022–2031

10.4.1. U.S. Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

10.4.2. U.S. Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

10.4.3. Canada Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

10.4.4. Canada Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

10.5. North America Solar Panel Coatings Market Attractiveness Analysis

11. Europe Solar Panel Coatings Market Analysis and Forecast, 2022–2031

11.1. Key Findings

11.2. Europe Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

11.3. Europe Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by End-use Industry, 2022–2031

11.4. Europe Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

11.4.1. Germany Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

11.4.2. Germany. Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

11.4.3. France Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

11.4.4. France. Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

11.4.5. U.K. Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

11.4.6. U.K. Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

11.4.7. Italy Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

11.4.8. Italy Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

11.4.9. Russia & CIS Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

11.4.10. Russia & CIS Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

11.4.11. Rest of Europe Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

11.4.12. Rest of Europe Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

11.5. Europe Solar Panel Coatings Market Attractiveness Analysis

12. Asia Pacific Solar Panel Coatings Market Analysis and Forecast, 2022–2031

12.1. Key Findings

12.2. Asia Pacific Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type

12.3. Asia Pacific Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by End-use Industry, 2022–2031

12.4. Asia Pacific Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

12.4.1. China Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

12.4.2. China Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

12.4.3. Japan Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

12.4.4. Japan Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

12.4.5. India Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

12.4.6. India Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

12.4.7. ASEAN Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

12.4.8. ASEAN Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

12.4.9. Rest of Asia Pacific Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

12.4.10. Rest of Asia Pacific Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

12.5. Asia Pacific Solar Panel Coatings Market Attractiveness Analysis

13. Latin America Solar Panel Coatings Market Analysis and Forecast, 2022–2031

13.1. Key Findings

13.2. Latin America Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

13.3. Latin America Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by End-use Industry, 2022–2031

13.4. Latin America Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

13.4.1. Brazil Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

13.4.2. Brazil Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

13.4.3. Mexico Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

13.4.4. Mexico Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

13.4.5. Rest of Latin America Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

13.4.6. Rest of Latin America Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

13.5. Latin America Solar Panel Coatings Market Attractiveness Analysis

14. Middle East & Africa Solar Panel Coatings Market Analysis and Forecast, 2022–2031

14.1. Key Findings

14.2. Middle East & Africa Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

14.3. Middle East & Africa Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by End-use Industry, 2022–2031

14.4. Middle East & Africa Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

14.4.1. GCC Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

14.4.2. GCC Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

14.4.3. South Africa Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

14.4.4. South Africa Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

14.4.5. Rest of Middle East & Africa Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, by Type, 2022–2031

14.4.6. Rest of Middle East & Africa Solar Panel Coatings Market Volume (Liters) and Value (US$ Mn) Forecast, End-use Industry, 2022–2031

14.5. Middle East & Africa Solar Panel Coatings Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Solar Panel Coatings Company Market Share Analysis, 2021

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Arkema Group

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.2. Fenzi SpA

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.3. NanoTech Types Pty Ltd.

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.4. Koninklijke DSM N.V.

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.5. 3M

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.6. PPG Industries Inc.

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.7. Nano Shell Ltd.

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.8. Unelko Corporation

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.9. Opitune Oy

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.10. Diamon-Fusion International Inc. (DFI)

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 2: Global Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 3: Global Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 4: Global Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry, 2022–2031

Table 5: Global Solar Panel Coatings Market Volume (Liters) Forecast, by Region, 2022–2031

Table 6: Global Solar Panel Coatings Market Value (US$ Mn) Forecast, by Region, 2022–2031

Table 7: North America Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 8: North America Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 9: North America Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 10: North America Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry, 2022–2031

Table 11: North America Solar Panel Coatings Market Volume (Liters) Forecast, by Country, 2022–2031

Table 12: North America Solar Panel Coatings Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 13: U.S. Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 14: U.S. Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 15: U.S. Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 16: U.S. Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry, 2022–2031

Table 17: Canada Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 18: Canada Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 19: Canada Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 20: Canada Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 21: Europe Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 22: Europe Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 23: Europe Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 24: Europe Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 25: Europe Solar Panel Coatings Market Volume (Liters) Forecast, by Country and Sub-region, 2022–2031

Table 26: Europe Solar Panel Coatings Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 27: Germany Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 28: Germany Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 29: Germany Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 30: Germany Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 31: France Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 32: France Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 33: France Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 34: France Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 35: U.K. Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 36: U.K. Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 37: U.K. Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 38: U.K. Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 39: Italy Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 40: Italy Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 41: Italy Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 42: Italy Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 43: Spain Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 44: Spain Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 45: Spain Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 46: Spain Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 47: Russia & CIS Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 48: Russia & CIS Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 49: Russia & CIS Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 50: Russia & CIS Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 51: Rest of Europe Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 52: Rest of Europe Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 53: Rest of Europe Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 54: Rest of Europe Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 55: Asia Pacific Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 56: Asia Pacific Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 57: Asia Pacific Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 58: Asia Pacific Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 59: Asia Pacific Solar Panel Coatings Market Volume (Liters) Forecast, by Country and Sub-region, 2022–2031

Table 60: Asia Pacific Solar Panel Coatings Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 61: China Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 62: China Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type 2022–2031

Table 63: China Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 64: China Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 65: Japan Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 66: Japan Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 67: Japan Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 68: Japan Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 69: India Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 70: India Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 71: India Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 72: India Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 73: ASEAN Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 74: ASEAN Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 75: ASEAN Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 76: ASEAN Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 77: Rest of Asia Pacific Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 78: Rest of Asia Pacific Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 79: Rest of Asia Pacific Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 80: Rest of Asia Pacific Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 81: Latin America Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 82: Latin America Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 83: Latin America Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 84: Latin America Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 85: Latin America Solar Panel Coatings Market Volume (Liters) Forecast, by Country and Sub-region, 2022–2031

Table 86: Latin America Solar Panel Coatings Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 87: Brazil Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 88: Brazil Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 89: Brazil Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 90: Brazil Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 91: Mexico Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 92: Mexico Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 93: Mexico Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 94: Mexico Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 95: Rest of Latin America Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 96: Rest of Latin America Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 97: Rest of Latin America Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 98: Rest of Latin America Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 99: Middle East & Africa Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 100: Middle East & Africa Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 101: v Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 102: Middle East & Africa Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 103: Middle East & Africa Solar Panel Coatings Market Volume (Liters) Forecast, by Country and Sub-region, 2022–2031

Table 104: Middle East & Africa Solar Panel Coatings Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 105: GCC Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 106: GCC Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 107: GCC Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 108: GCC Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 109: South Africa Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 110: South Africa Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 111: South Africa Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 112: South Africa Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

Table 113: Rest of Middle East & Africa Solar Panel Coatings Market Volume (Liters) Forecast, by Type, 2022–2031

Table 114: Rest of Middle East & Africa Solar Panel Coatings Market Value (US$ Mn) Forecast, by Type, 2022–2031

Table 115: Rest of Middle East & Africa Solar Panel Coatings Market Volume (Liters) Forecast, by End-use Industry, 2022–2031

Table 116: Rest of Middle East & Africa Solar Panel Coatings Market Value (US$ Mn) Forecast, by End-use Industry 2022–2031

List of Figures

Figure 1: Global Solar Panel Coatings Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 2: Global Solar Panel Coatings Market Attractiveness, by Type

Figure 3: Global Solar Panel Coatings Market Volume Share Analysis, by End-use Industry, 2021, 2027, and 2031

Figure 4: Global Solar Panel Coatings Market Attractiveness, by End-use Industry

Figure 5: Global Solar Panel Coatings Market Volume Share Analysis, by Region, 2021, 2027, and 2031

Figure 6: Global Solar Panel Coatings Market Attractiveness, by Region

Figure 7: North America Solar Panel Coatings Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 8: North America Solar Panel Coatings Market Attractiveness, by Type

Figure 9: North America Solar Panel Coatings Market Attractiveness, by Type

Figure 10: North America Solar Panel Coatings Market Volume Share Analysis, by End-use Industry, 2021, 2027, and 2031

Figure 11: North America Solar Panel Coatings Market Attractiveness, by End-use Industry

Figure 12: North America Solar Panel Coatings Market Attractiveness, by Country and Sub-region

Figure 13: Europe Solar Panel Coatings Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 14: Europe Solar Panel Coatings Market Attractiveness, by Type

Figure 15: Europe Solar Panel Coatings Market Volume Share Analysis, by End-use Industry, 2021, 2027, and 2031

Figure 16: Europe Solar Panel Coatings Market Attractiveness, by End-use Industry

Figure 17: Europe Solar Panel Coatings Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 18: Europe Solar Panel Coatings Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Solar Panel Coatings Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 20: Asia Pacific Solar Panel Coatings Market Attractiveness, by Type

Figure 21: Asia Pacific Solar Panel Coatings Market Volume Share Analysis, by End-use Industry, 2021, 2027, and 2031

Figure 22: Asia Pacific Solar Panel Coatings Market Attractiveness, by End-use Industry

Figure 23: Asia Pacific Solar Panel Coatings Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 24: Asia Pacific Solar Panel Coatings Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Solar Panel Coatings Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 26: Latin America Solar Panel Coatings Market Attractiveness, by Type

Figure 27: Latin America Solar Panel Coatings Market Volume Share Analysis, by End-use Industry, 2021, 2027, and 2031

Figure 28: Latin America Solar Panel Coatings Market Attractiveness, by End-use Industry

Figure 29: Latin America Solar Panel Coatings Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 30: Latin America Solar Panel Coatings Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Solar Panel Coatings Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 32: Middle East & Africa Solar Panel Coatings Market Attractiveness, by Type

Figure 33: Middle East & Africa Solar Panel Coatings Market Volume Share Analysis, by End-use Industry, 2021, 2027, and 2031

Figure 34: Middle East & Africa Solar Panel Coatings Market Attractiveness, by End-use Industry

Figure 35: Middle East & Africa Solar Panel Coatings Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 36: Middle East & Africa Solar Panel Coatings Market Attractiveness, by Country and Sub-region