Reports

Reports

The use of organic acids as food additives gained significant importance after the ban on antibiotic growth promoters (AGPs) in Europe in 2006, which addressed the problem of non-essential use of antibiotics. There is an increasing preference for organic and safe feed additives, globally, which has had a significant impact on the sodium formate market, due to its application as an effective organic feed additive.

Various regulations have given rise to the demand for organic acids in the animal nutrition sector, and with the growing awareness about their positive effects on feed quality, and subsequently animal performance, the sales of sodium formate are likely to soar in this sector in the coming years. A recently published rule by The Food and Drug Administration (FDA) (Document citation: 81 FR 67153), amended the regulations for the safe use of sodium formate as a food additive. Further, the European Food Safety Authority (EFSA) also confirmed the safety of the use of sodium formate in the production of animal feed additives.

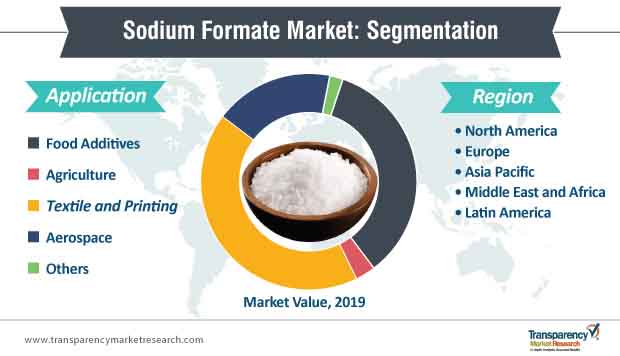

Food additives accounted for almost a third of the global sodium formate market share in 2018, which is likely to remain the same during the forecast period of 2019-2027. The efficacy and safety of sodium formate as an animal feed additive will continue to make it a popular application for sodium formate, positively impacting the growth of the market.

The sodium formate industry’s reliance on textile and printing is expected to continue to prevail during the forecast period of 2019–2027. In 2018, the textile and printing industry held almost 40% share of the global sodium formate market revenue, and this share is projected to increase over the forecast period.

A steady rise in printing activity and advancements of printing techniques that involve the use of sodium formate are also expected to cause a boost in the growth of the sodium formate market. The expansion of the digital printing market, along with innovation in fabric dyeing and printing processes for effective alkali neutralization and pH control, coupled with the environment-friendly attributes of sodium formate, is expected to contribute to the evolution of the market.

Furthermore, sodium formate is being increasingly used in the leather tanning industry, and it is also considered to be very efficient when it comes to chrome penetration into the entire thickness of the hide. The reliability and consistency of acid concentrations, and the purity of sodium formate, are likely to advocate for the use of it in tanning. The flurry of activity in the printing and textile industry can mean a steady demand for sodium formate in the foreseeable future.

The aerospace industry, due to increasing concerns about the environmental impact of deicing chemicals such as urea and acetates, is gradually making a shift to formate-based deicers. As such, the preference for sodium formate-based deicers has been growing steadily, with demand from the aerospace industry accounting for ~20% of the global sodium formate market share.

The growing focus on environment conservation has opened up opportunities for manufacturers in the sodium formate industry. For instance: Perstorp Holdings, a leading specialty chemicals innovator, in May 2019, announced the construction of a plant in Sweden to granulate solid sodium formate, increasing the availability of the same for its product PERGRIP RUN NF.

However, the hygroscopic nature of sodium formate continues to be a cause for concern for manufacturers within the market. This property of sodium formate translates to other additives having to be added before use and special requirements when it comes to handling and storage. This, coupled with its tendency to cake when stored, is likely to have a restraining effect on the sodium formate market.

Accounting for a whopping ~43% of the value share, as of 2018, Asia Pacific dominates the sodium formate market, a trend that is unlikely to change during the forecast period. This is likely to be being driven by the expansion of the already strong textile market in the region, and the availability of newer materials and printing processes as well.

The sodium formate market in Europe held ~one-fourth of the global market share in 2018. Increasing stringency of environmental laws in Europe, coupled with the push for ecologically-sound solutions in both, the aerospace and additives industry, are likely to drive the demand for sodium formate across a variety of applications, in the region. Major stakeholders in the industry are looking at expanding their geographical presence to include Europe, so as to meet the potential high demand from the region.

Analysis of the Competitive Landscape

The sodium formate market is very fragmented, with a plethora of small and medium material companies crowding the scene, alongside larger global players. Frontrunners in the industry, such as Perstorp Holdings and ADDCON, account for ~20% of the revenue share of the global sodium formate market. Considering the nature of the product, a number of regional players operate to meet the domestic demand in their respective regions.

Key players in the market are focusing on expanding their business in the aerospace industry by penetrating into other regional markets. For instance: Jost Chemical, a global leader in high purity chemicals, in October 2018, announced the construction of a new manufacturing plant in Poland, a facility set to be a part of the company’s integrated global network. This move allows Jost Chemical to expand into the region, positioned to meet the future demand from the region.

Analysts’ POV

Authors of this TMR report on the sodium formate market predict that, the revenue of the market will grow at a rate of 4.5% during the forecast period, and have a positive outlook on the evolution of the market. One of key trends that has had a massive impact on many industries, including textiles, printing, animal nutrition, aerospace, and others, is sustainability, which is expected to influence the manufacturing strategies of stakeholders in the sodium formate market.

As a winning strategy, manufacturers looking to consolidate their presence in the sodium formate market should look at collaboration and product innovation to stay ahead of the competition. Though sodium formate’s hygroscopic nature can act as a hindrance, manufacturers can look at capitalizing its low-carbon footprint property to improve their sales.

Sodium Formate Market: Description

Key Growth Drivers of the Sodium Formate Market

Major Challenges for the Sodium Formate Market

Lucrative Opportunities for the Global Sodium Formate Market

Asia Pacific a Large Sodium Formate Market

Textile & Printing to Account for Prominent Share

Leading Players Engage in Joint Ventures and R&D Activities

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Sodium Formate Market

4. Market Overview

4.1. Introduction

4.2. Key Market Indicators/Definitions

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Sodium Formate Market Analysis and Forecast, 2019–2027

4.4.1. Global Sodium Formate Market Volume (Kilo Tons)

4.4.2. Global Sodium Formate Market Value (US$ Mn)

4.5. Porters Five Forces Analysis

4.6. Technology Landscape

4.6.1. Comparative Analysis- Sodium Formate Manufacturing Technology

4.7. Regulatory Landscape

4.8. Value Chain Analysis

5. Pricing Analysis, 2018 (Benchmarking)

5.1. Price Comparison Analysis, by Region

6. Production Outlook, 2018

6.1. Production Outlook, by Region

7. Global Sodium Formate Market Analysis and Forecast, by Application

7.1. Introduction & Key Findings

7.2. Global Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

7.2.1. Food & Feed Additives

7.2.2. Agriculture

7.2.3. Textile & Printing

7.2.4. Aerospace

7.2.5. Others

7.3. Global Sodium Formate Market Attractiveness, by Application

8. Global Sodium Formate Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Global Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2018–2027

8.2.1. North America

8.2.1.1. U.S.

8.2.1.2. Canada

8.2.2. Europe

8.2.2.1. Germany

8.2.2.2. U.K.

8.2.2.3. Italy

8.2.2.4. France

8.2.2.5. Spain

8.2.2.6. Russia & CIS

8.2.2.7. Rest of Europe

8.2.3. Asia Pacific

8.2.3.1. China

8.2.3.2. India

8.2.3.3. Japan

8.2.3.4. ASEAN

8.2.3.5. Rest of Asia Pacific

8.2.4. Latin America

8.2.4.1. Brazil

8.2.4.2. Mexico

8.2.4.3. Rest of Latin America

8.2.5. Middle East & Africa

8.2.5.1. South Africa

8.2.5.2. GCC

8.2.5.3. Rest of Middle East & Africa

8.3. Global Sodium Formate Market Attractiveness, by Region

9. North America Sodium Formate Market Analysis and Forecast

9.1. Key Findings

9.2. North America Sodium Formate Market Forecast, by Application, 2019–2027

9.3. North America Sodium Formate Market Forecast, by Country, 2019–2027

9.3.1.1. 9.3.2. U.S. Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

9.3.1.2. 9.3.4. Canada Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

9.4. North America Sodium Formate Market Attractiveness Analysis

10. Europe Sodium Formate Market Analysis and Forecast

10.1. Key Findings

10.2. Europe Sodium Formate Market Forecast, by Application, 2019–2027

10.3. Europe Sodium Formate Market Forecast, by Country and Sub-region, 2019–2027

10.3.1. Germany Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

10.3.2. U.K. Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

10.3.3. France Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

10.3.4. Italy Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

10.3.5. Spain Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

10.3.6. Russia & CIS Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

10.3.7. Rest of Europe Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

10.4. Europe Sodium Formate Market Attractiveness Analysis

11. Asia Pacific Sodium Formate Market Analysis and Forecast

11.1. Key Findings

11.2. Asia Pacific Sodium Formate Market Forecast, by Application, 2019–2027

11.3. Asia Pacific Sodium Formate Market Forecast, by Country and Sub-region, 2019–2027

11.3.1. China Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

11.3.2. Japan Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

11.3.3. India Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

11.3.4. ASEAN Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

11.3.5. Rest of Asia Pacific Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

11.4. Asia Pacific Sodium Formate Market Attractiveness Analysis

12. Latin America Sodium Formate Market Analysis and Forecast

12.1. Key Findings

12.2. Latin America Sodium Formate Market Forecast, by Application, 2019–2027

12.3. Latin America Sodium Formate Market Forecast, by Country and Sub-region, 2019–2027

12.3.1. Brazil Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

12.3.2. Mexico Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

12.3.3. Rest of Latin America Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

12.4. Latin America Sodium Formate Market Attractiveness Analysis

13. Middle East & Africa Sodium Formate Market Analysis and Forecast

13.1. Key Findings

13.2. Middle East & Africa Sodium Formate Market Forecast, by Application, 2019–2027

13.3. Middle East & Africa Sodium Formate Market Forecast, by Country and Sub-region, 2019–2027

13.3.1. South Africa Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

13.3.2. GCC Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

13.3.3. Rest of Middle East & Africa Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

13.4. Middle East & Africa Sodium Formate Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Sodium Formate Market Share Analysis, by Company, 2018

14.2. Competition Matrix

14.2.1. Perstorp Holdings

14.2.2. ADDCON

14.3. Company Profiles

14.3.1. Perstorp Holdings

14.3.1.1. Company Description

14.3.1.2. Business Overview

14.3.1.3. Financial Details

14.3.1.4. Key Developments

14.3.2. ADDCON

14.3.2.1. Company Description

14.3.2.2. Business Overview

14.3.2.3. Financial Details

14.3.2.4. Key Developments

14.3.3. Honeywell International Inc.

14.3.3.1. Company Description

14.3.3.2. Business Overview

14.3.3.3. Financial Details

14.3.3.4. Key Developments

14.3.4. Metafrax

14.3.4.1. Company Description

14.3.4.2. Business Overview

14.3.4.3. Financial Details

14.3.4.4. Key Developments

14.3.5. Kanoria Chemicals & Industries Ltd.

14.3.5.1. Company Description

14.3.5.2. Business Overview

14.3.5.3. Financial Details

14.3.5.4. Key Developments

14.3.6. MKS Marmara

14.3.6.1. Company Description

14.3.6.2. Business Overview

14.3.7. Luxi Chemical Group Co., Ltd.

14.3.7.1. Company Description

14.3.7.2. Business Overview

14.3.8. Hubei Yihua Chemical Co., Ltd.

14.3.8.1. Company Description

14.3.8.2. Business Overview

14.3.9. Shandong Kailong Chemical Technology Development Co., Ltd.

14.3.9.1. Company Description

14.3.9.2. Business Overview

14.3.10. Zibo Ruibao Chemical Co., Ltd.

14.3.10.1. Company Description

14.3.10.2. Business Overview

14.3.11. Yuanping Chemicals Co., Ltd.

14.3.11.1. Company Description

14.3.11.2. Business Overview

14.3.12. ZIBO AIHENG NEW MATERIAL CO.,LTD

14.3.12.1. Company Description

14.3.12.2. Business Overview

14.3.13. Tokyo Chemical Industry Co., Ltd.

14.3.13.1. Company Description

14.3.13.2. Business Overview

14.3.14. Alder S.p.A

14.3.14.1. Company Description

14.3.14.2. Business Overview

14.3.15. Zouping Fenlian Biotech Co.,Ltd.

14.3.15.1. Company Description

14.3.15.2. Business Overview

14.3.16. Haihang Industry Co., Ltd.

14.3.16.1. Company Description

14.3.16.2. Business Overview

14.3.17. Chongqing Chuandong Chemical (Group)Co., Ltd

14.3.17.1. Company Description

14.3.17.2. Business Overview

14.3.18. American Elements

14.3.18.1. Company Description

14.3.18.2. Business Overview

14.3.19. Rock Chemie Co.

14.3.19.1. Company Description

14.3.19.2. Business Overview

14.3.20. Jost Chemical Co

14.3.20.1. Company Description

14.3.20.2. Business Overview

List of Tables

Table 1: Global Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 2: Global Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 3: Global Sodium Formate Market Volume (Kilo Tons) Forecast, by Region, 2019–2027

Table 4: Global Sodium Formate Market Value (US$ Mn) Forecast, by Region, 2019–2027

Table 5: North America Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 6: North America Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 7: North America Sodium Formate Market Volume (Kilo Tons) Forecast, by Country, 2019–2027

Table 8: North America Sodium Formate Market Value (US$ Mn) Forecast, by Country, 2019–2027

Table 9: U.S. Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 10: U.S. Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 11: Canada Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 12: Canada Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 13: Europe Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 14: Europe Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 15: Europe Sodium Formate Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2019–2027

Table 16: Europe Sodium Formate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2027

Table 17: Germany Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 18: Germany Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 19: U.K. Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 20: U.K. Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 21: France Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 22: France Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 23: Spain Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 24: Spain Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 25: Italy Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 26: Italy Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 27: Russia & CIS Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 28: Russia & CIS Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 29: Rest of Europe Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 30: Rest of Europe Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 31: Asia Pacific Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 32: Asia Pacific Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 33: Asia Pacific Sodium Formate Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2019–2027

Table 34: Asia Pacific Sodium Formate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2027

Table 35: China Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 36: China Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 37: Japan Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 38: Japan Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 39: India Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 40: India Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 41: ASEAN Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 42: ASEAN Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 43: Rest of Asia Pacific Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 44: Rest of Asia Pacific Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 45: Latin America Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 46: Latin America Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 47: Latin America Sodium Formate Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2019–2027

Table 48: Latin America Sodium Formate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2027

Table 49: Brazil Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 50: Brazil Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 51: Mexico Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 52: Mexico Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 53: Rest of Latin America Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 54: Rest of Latin America Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 55: Middle East & Africa Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 56: Middle East & Africa Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 57: Middle East & Africa Sodium Formate Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2019–2027

Table 58: Middle East & Africa Sodium Formate Market Value (US$ Mn) Forecast, by Country and Sub-region, 2019–2027

Table 59: GCC Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 60: GCC Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 61: South Africa Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 62: South Africa Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

Table 63: Rest of Middle East & Africa Sodium Formate Market Volume (Kilo Tons) Forecast, by Application, 2019–2027

Table 64: Rest of Middle East & Africa Sodium Formate Market Value (US$ Mn) Forecast, by Application, 2019–2027

List of Figures

Figure 1: Global Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 2: Global Sodium Formate Market Value Share, by Application, 2018 and 2027

Figure 3: Global Sodium Formate Market Attractiveness, by Application

Figure 4: Global Sodium Formate Market Value Share, by Region, 2018 and 2027

Figure 5: Global Sodium Formate Market Attractiveness, by Region

Figure 6: North America Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 7: North America Sodium Formate Market Attractiveness, by Country

Figure 8: North America Sodium Formate Market Value Share, by Application, 2018 and 2027

Figure 9: North America Sodium Formate Market Value Share, by Country, 2018 and 2027

Figure 10: North America Sodium Formate Market Attractiveness, by Application

Figure 11: Europe Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 12: Europe Sodium Formate Market Attractiveness, by Country and Sub-region

Figure 13: Europe Sodium Formate Market Value Share, by Application, 2018 and 2027

Figure 14: Europe Sodium Formate Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 15: Europe Sodium Formate Market Attractiveness, by Application

Figure 16: Asia Pacific Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 17: Asia Pacific Sodium Formate Market Attractiveness, by Country and Sub-region

Figure 18: Asia Pacific Sodium Formate Market Value Share, by Application, 2018 and 2027

Figure 19: Asia Pacific Sodium Formate Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 20: Asia Pacific Sodium Formate Market Attractiveness, by Application

Figure 21: Latin America Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 22: Latin America Sodium Formate Market Attractiveness, by Country and Sub-region

Figure 23: Latin America Sodium Formate Market Value Share, by Application, 2018 and 2027

Figure 24: Latin America Sodium Formate Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 25: Latin America Sodium Formate Market Attractiveness, by Application

Figure 26: Middle East & Africa Sodium Formate Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, 2019–2027

Figure 27: Middle East & Africa Sodium Formate Market Attractiveness, by Country and Sub-region

Figure 28: Middle East & Africa Sodium Formate Market Value Share, by Application, 2018 and 2027

Figure 29: Middle East & Africa Sodium Formate Market Value Share, by Country and Sub-region, 2018 and 2027

Figure 30: Middle East & Africa Sodium Formate Market Attractiveness, by Application

Figure 31: Global Sodium Formate Market Share, by Company, 2018