Reports

Reports

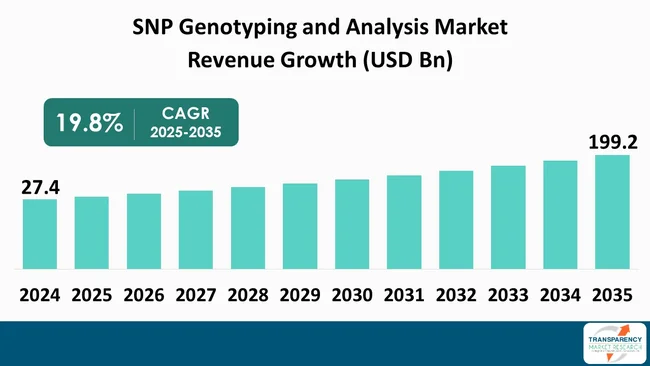

The global SNP genotyping and analysis market size was valued at US$ 27.4 Bn in 2024 and is projected to reach US$ 199.2 Bn by 2035, expanding at a CAGR of 19.8% from 2025 to 2035. The market growth is driven by increasing demand for personalized medicine and enhanced bioinformatics tools and data management.

The SNP genotyping and analysis market has escalated in volume over the past few years, in step with the rise of genomic technologies and the spreading of the concept of personalized medicine. SNPs refer to single nucleotide polymorphisms, which make them the most common type of genetic variation among individuals. The increase of genomic research initiatives and the use of SNP analysis in clinical settings have been the main factors to contribute to the market expansion.

It is worth noting that companies operating in this market are investing a large portion of their capital in the development of new technologies such as next-generation sequencing (NGS) and high-throughput genotyping platforms for the goals of improving precision and lowering costs.

However, barriers do exist. For instance, data management issues and ethical considerations regarding genetic data privacy. The overall situation of the SNP genotyping and analysis market is such that it will continue to grow in the future, this being mostly attributable to innovations in the field and the growing application of precision medicine, which is a treatment approach based on individual genetic profiles.

SNP genotyping and analysis capitulate to the identification of single nucleotide polymorphisms (SNPs) and their subsequent examination, which entails the changes of one single nucleotide in a specific position in the DNA regulate. These genomic changes are the keys to the comprehension of genetic variations and their utilization for the betterment of human health, agriculture, and animal breeding. Also, SNPs are plentiful in the human genome and can cause the variations of the traits that will make the person more susceptible to diseases, their drug metabolism, and also the general health of that person.

Any SNP genotyping is done using one or several of a number of different procedures, such as polymerase chain reaction (PCR), microarray analysis, and next-generation sequencing (NGS) techniques. These technologies are indeed very fast and thus it is possible to analyze thousands of SNPs simultaneously. The information obtained through SNP analysis is instrumental in a plethora of applications such as disease association studies, and the implementation of personalized medicine strategies.

Bioinformatics tools' deployment as a data management and interpretation strategy for SNP genotyping large datasets has been a game-changer recently. As a matter of fact, as scientists keep on unraveling the human genome's intricacies, SNP analysis will be of greater significance, providing the leading-edge concepts that will finally be consummated not only as improved health outcomes but also as developments in different sectors such as genomics, pharmacogenomics, and evolutionary biology.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The SNP genotyping and analysis market is majorly influenced by the increasing demand for personalized medicine. The primary objective of personalized medicine is to provide medical treatment, which is beneficial and least harmful, based on individual characteristics, mainly genetic makeup. As the healthcare system moves from the traditional way of treatment to customized solutions, SNP genotyping is crucial in locating the genetic variations that determine the patient’s response to the drugs and their susceptibility to diseases.

The shift toward personalized medicine is mainly due to technological advancements in genomics and the reduced prices of genetic testing. In addition, as patients become more knowledgeable and actively participate in healthcare decisions, the demand for genetic testing that can reveal their genetic profiles is increasing.

Moreover, pharmaceutical companies are partnering with SNP genotyping to create targeted therapies and companion diagnostics. Thus, drug development is in line with genetic profiles. This trend not only supports the market’s expansion but also accelerates the innovation process in drug discovery and development, which is ultimately beneficial to the patients as they gain access to more effective and personalized treatment options.

The SNP genotyping and analysis market is largely influenced by enhanced bioinformatics instruments and data management solutions. Besides, they make it easy to identify significant genetic markers, associations with diseases, and predictive modeling of treatment responses. What's more, these tools open up collaboration opportunities for researchers by offering cloud-based platforms for data sharing and computational analysis, thereby accelerating genomic research innovation.

As bioinformatics tools become the go-to option for researchers and healthcare providers in SNP analysis, the market is bound to experience an explosive rise, thus opening up various opportunities for the efficient handling of data and insightful interpretation of genetics in personalized medicine and other fields.

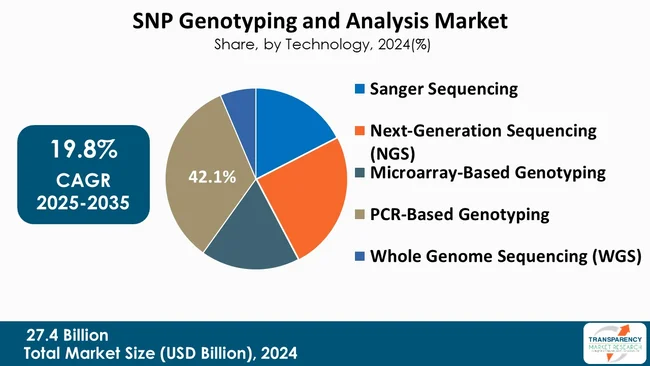

The PCR-based genotyping technology segment is one of the major factors that contributes to the growth of the SNP genotyping and analysis market owing to its features like high specificity, sensitivity, and being cost-effective. Polymerase chain reaction (PCR) methods are capable of amplification of the exact DNA segments, thus allowing for detecting SNPs even if only a tiny amount of genetic material is available.

Methods based on PCR, for example, quantitative PCR (qPCR) and multiplex PCR, make it possible to analyze several SNPs at the same time, thus increasing the efficiency and throughput. The ability to perform such a high-throughput is important for large-scale genomic studies, where the knowledge of genetic variation in diverse cohorts is vital. Besides, improvements in PCR technology such as digital PCR also improve the accuracy and capability of precise quantification of genetic variants.

The factors such as ease and availability of PCR-based genotyping also lead to the popularity of this method. Most laboratories already have PCR technology, and thus there is no need for a large investment in new equipment. As doctors and researchers become more dependent on methods that are fast, reliable, and cost-effective for SNP analysis, the PCR-based genotyping segment will be the one that keeps on leading the overall market growth in the SNP genotyping and analysis market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

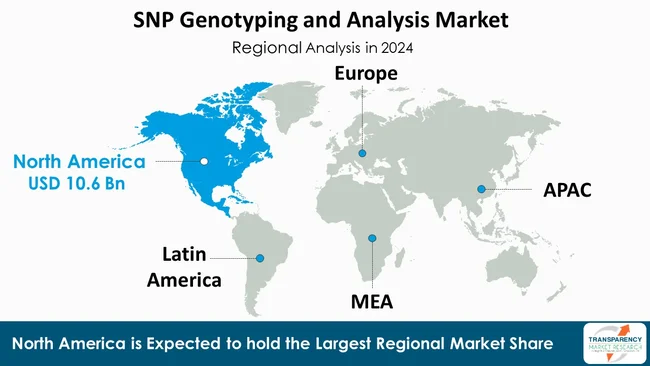

North America holds the largest revenue share of 38.7%, due to its sizable investments in genomics, well-established research infrastructure, and a strong focus on personalized medicine. Several top-tier research institutions and biotech companies, engaged in cutting-edge innovation and genomic research, are located in the region.

Besides, the rising incidences of genetic disorders and chronic diseases in North America have created a strong need for accurate diagnostic tools and personalized treatment options.

The leadership in the market of the region is also supported by government initiatives and funding programs like the National Institutes of Health (NIH) and the National Human Genome Research Institute (NHGRI) that fuel genomic research and the creation of new technologies.

Danaher Corporation, LGC, Invitae, Illumina, PerkinElmer, QIAGEN, BioRad Laboratories, Agilent Technologies, Thermo Fisher Scientific, Roche Diagnostics, Eurofins Scientific, Myriad Genetics, Luminex Corporation are the key players governing the global SNP genotyping and analysis market.

Each of these players has been profiled in the SNP genotyping and analysis market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 27.4 Bn |

| Forecast Value in 2035 | More than US$ 199.2 Bn |

| CAGR | 19.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Sample Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 27.4 Bn in 2024

It is projected to cross US$ 199.2 Bn by the end of 2035

Increasing demand for personalized medicine and enhanced bioinformatics tools and data management

It is anticipated to grow at a CAGR of 19.8% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Danaher Corporation, LGC, Invitae, Illumina, PerkinElmer, QIAGEN, BioRad Laboratories, Agilent Technologies, Thermo Fisher Scientific, Roche Diagnostics, Eurofins Scientific, Myriad Genetics, Luminex Corporation and, others

Table 01: Global SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Sample Type, 2020 to 2035

Table 02: Global SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 03: Global SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 04: Global SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 05: Global SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 06: North America SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Sample Type, 2020 to 2035

Table 07: North America SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 08: North America SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 09: North America SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 10: North America SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 11: Europe SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Sample Type, 2020 to 2035

Table 12: Europe SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 13: Europe SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 14: Europe SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 15: Europe SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 16: Asia Pacific SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Sample Type, 2020 to 2035

Table 17: Asia Pacific SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 18: Asia Pacific SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 19: Asia Pacific SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 20: Asia Pacific SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 21: Latin America SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Sample Type, 2020 to 2035

Table 22: Latin America SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 23: Latin America SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 24: Latin America SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 25: Latin America SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 26: Middle East and Africa SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Sample Type, 2020 to 2035

Table 27: Middle East and Africa SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 28: Middle East and Africa SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 29: Middle East and Africa SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 30: Middle East and Africa SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Figure 01: Global SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global SNP Genotyping and Analysis Market Value Share Analysis, by Sample Type, 2024 and 2035

Figure 03: Global SNP Genotyping and Analysis Market Attractiveness Analysis, by Sample Type, 2025 to 2035

Figure 04: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Genomic DNA, 2020 to 2035

Figure 05: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by RNA, 2020 to 2035

Figure 06: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Cell-free DNA (cfDNA), 2020 to 2035

Figure 07: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Plasma Samples, 2020 to 2035

Figure 08: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Whole Blood, 2020 to 2035

Figure 09: Global SNP Genotyping and Analysis Market Value Share Analysis, by Technology, 2024 and 2035

Figure 10: Global SNP Genotyping and Analysis Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 11: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Sanger Sequencing, 2020 to 2035

Figure 12: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Next-Generation Sequencing (NGS), 2020 to 2035

Figure 13: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Microarray-Based Genotyping, 2020 to 2035

Figure 14: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by PCR-Based Genotyping, 2020 to 2035

Figure 15: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Whole Genome Sequencing (WGS), 2020 to 2035

Figure 16: Global SNP Genotyping and Analysis Market Value Share Analysis, by Application, 2024 and 2035

Figure 17: Global SNP Genotyping and Analysis Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 18: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Disease Diagnostics, 2020 to 2035

Figure 19: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Pharmacogenomics, 2020 to 2035

Figure 20: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Precision Medicine, 2020 to 2035

Figure 21: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Forensic Science, 2020 to 2035

Figure 22: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Agriculture and Livestock, 2020 to 2035

Figure 23: Global SNP Genotyping and Analysis Market Value Share Analysis, by End-user, 2024 and 2035

Figure 24: Global SNP Genotyping and Analysis Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 25: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Hospitals and Clinics, 2020 to 2035

Figure 26: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Research Laboratories, 2020 to 2035

Figure 27: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Pharmaceutical and Biotechnological Companies, 2020 to 2035

Figure 28: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Diagnostic Laboratories, 2020 to 2035

Figure 29: Global SNP Genotyping and Analysis Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 30: Global SNP Genotyping and Analysis Market Value Share Analysis, by Region, 2024 and 2035

Figure 31: Global SNP Genotyping and Analysis Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 32: North America SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 33: North America SNP Genotyping and Analysis Market Value Share Analysis, by Sample Type, 2024 and 2035

Figure 34: North America SNP Genotyping and Analysis Market Attractiveness Analysis, by Sample Type, 2025 to 2035

Figure 35: North America SNP Genotyping and Analysis Market Value Share Analysis, by Technology, 2024 and 2035

Figure 36: North America SNP Genotyping and Analysis Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 37: North America SNP Genotyping and Analysis Market Value Share Analysis, by Application, 2024 and 2035

Figure 38: North America SNP Genotyping and Analysis Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 39: North America SNP Genotyping and Analysis Market Value Share Analysis, by End-user, 2024 and 2035

Figure 40: North America SNP Genotyping and Analysis Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 41: North America SNP Genotyping and Analysis Market Value Share Analysis, by Region, 2024 and 2035

Figure 42: North America SNP Genotyping and Analysis Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 43: Europe SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: Europe SNP Genotyping and Analysis Market Value Share Analysis, by Sample Type, 2024 and 2035

Figure 45: Europe SNP Genotyping and Analysis Market Attractiveness Analysis, by Sample Type, 2025 to 2035

Figure 46: Europe SNP Genotyping and Analysis Market Value Share Analysis, by Technology, 2024 and 2035

Figure 47: Europe SNP Genotyping and Analysis Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 48: Europe SNP Genotyping and Analysis Market Value Share Analysis, by Application, 2024 and 2035

Figure 49: Europe SNP Genotyping and Analysis Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 50: Europe SNP Genotyping and Analysis Market Value Share Analysis, by End-user, 2024 and 2035

Figure 51: Europe SNP Genotyping and Analysis Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 52: Europe SNP Genotyping and Analysis Market Value Share Analysis, by Region, 2024 and 2035

Figure 53: Europe SNP Genotyping and Analysis Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 54: Asia Pacific SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 55: Asia Pacific SNP Genotyping and Analysis Market Value Share Analysis, by Sample Type, 2024 and 2035

Figure 56: Asia Pacific SNP Genotyping and Analysis Market Attractiveness Analysis, by Sample Type, 2025 to 2035

Figure 57: Asia Pacific SNP Genotyping and Analysis Market Value Share Analysis, by Technology, 2024 and 2035

Figure 58: Asia Pacific SNP Genotyping and Analysis Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 59: Asia Pacific SNP Genotyping and Analysis Market Value Share Analysis, by Application, 2024 and 2035

Figure 60: Asia Pacific SNP Genotyping and Analysis Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 61: Asia Pacific SNP Genotyping and Analysis Market Value Share Analysis, by End-user, 2024 and 2035

Figure 62: Asia Pacific SNP Genotyping and Analysis Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 63: Asia Pacific SNP Genotyping and Analysis Market Value Share Analysis, by Region, 2024 and 2035

Figure 64: Asia Pacific SNP Genotyping and Analysis Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 65: Latin America SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 66: Latin America SNP Genotyping and Analysis Market Value Share Analysis, by Sample Type, 2024 and 2035

Figure 67: Latin America SNP Genotyping and Analysis Market Attractiveness Analysis, by Sample Type, 2025 to 2035

Figure 68: Latin America SNP Genotyping and Analysis Market Value Share Analysis, by Technology, 2024 and 2035

Figure 69: Latin America SNP Genotyping and Analysis Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 70: Latin America SNP Genotyping and Analysis Market Value Share Analysis, by Application, 2024 and 2035

Figure 71: Latin America SNP Genotyping and Analysis Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 72: Latin America SNP Genotyping and Analysis Market Value Share Analysis, by End-user, 2024 and 2035

Figure 73: Latin America SNP Genotyping and Analysis Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 74: Latin America SNP Genotyping and Analysis Market Value Share Analysis, by Region, 2024 and 2035

Figure 75: Latin America SNP Genotyping and Analysis Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 76: Middle East and Africa SNP Genotyping and Analysis Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 77: Middle East and Africa SNP Genotyping and Analysis Market Value Share Analysis, by Sample Type, 2024 and 2035

Figure 78: Middle East and Africa SNP Genotyping and Analysis Market Attractiveness Analysis, by Sample Type, 2025 to 2035

Figure 79: Middle East and Africa SNP Genotyping and Analysis Market Value Share Analysis, by Technology, 2024 and 2035

Figure 80: Middle East and Africa SNP Genotyping and Analysis Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 81: Middle East and Africa SNP Genotyping and Analysis Market Value Share Analysis, by Application, 2024 and 2035

Figure 82: Middle East and Africa SNP Genotyping and Analysis Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 83: Middle East and Africa SNP Genotyping and Analysis Market Value Share Analysis, by End-user, 2024 and 2035

Figure 84: Middle East and Africa SNP Genotyping and Analysis Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 85: Middle East and Africa SNP Genotyping and Analysis Market Value Share Analysis, by Region, 2024 and 2035

Figure 86: Middle East and Africa SNP Genotyping and Analysis Market Attractiveness Analysis, by Region, 2025 to 2035