Reports

Reports

Analysts’ Viewpoint on Market Scenario

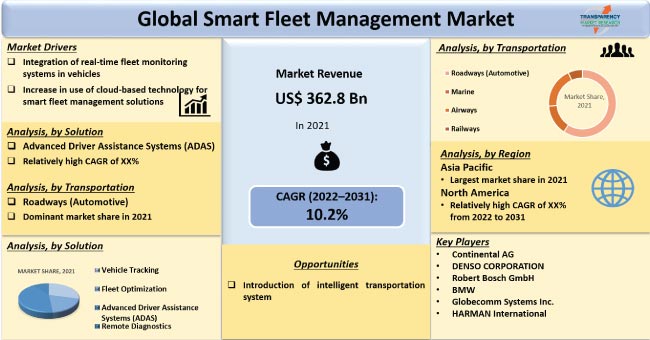

Increased use of cloud-based technology for smart fleet management solutions, integration of real-time fleet monitoring systems in vehicles, and improved vehicle monitoring and fuel management are anticipated to boost the growth of the smart fleet management business across the globe during the forecast period.

However, the growth is anticipated to be constrained by price concerns and worries about cyber security among fleet owners. Additionally, development of intelligent transportation systems, increased business decision-making for fleet owners, improved driver and vehicle safety, and rising demand in developed nations, are all expected to offer significant opportunities for market development in the near future.

Smart fleet management integrates several fleet management technologies in order to manage, maintain, and achieve the most effective operations for the fleet. In addition to driver safety, telematics, tracking, and intelligent surveillance, it offers digital technology applications for maintenance and fuel management.

The fleet management system is utilized to keep an eye on all moving assets in real-time with the help of GPS tracking system. Additionally, it has the capacity to store and control various vehicles, such as corporate cars, vans, trucks, and lorries.

These systems encourage safer driving practices and continuously offer feedback and alerts on driving habits. Businesses across the globe are integrating fleet management systems, as they save fuel, lower maintenance costs, and offer peace of mind to fleet or vehicle owners regarding the management of their vehicles and users.

Fleet managers can monitor if drivers are taking the suggested route or if there are deviations, thanks to real-time vehicle tracking. Cloud-based tools, such as artificial intelligence (AI), internet of things (IoT), and big data, are used to gather the initial fleet management data. Majority of OEMs employ integrated automobile sensors to track expensive products, as these sensors can connect to the cloud and transmit real-time data.

Smart fleet management also includes additional activities such as tracking cars and drivers, managing assets, keeping two-way communication open, controlling driver safety & time, and rescheduling the delivery assignment. Demand for these services is estimated to increase in the near future, which in turn, is likely to propel the demand for smart fleet management during the forecast period.

Developed countries such as U. S. have become major markets for shared mobility services, which includes vehicle leasing, rental, ride sharing, and vehicle subscription. Rise in awareness among consumers about lower cost of shared vehicles, as compared to owned vehicles, is fueling the demand for shared mobility services across the globe.

Surge in demand for shared mobility services is prompting service providers to increase their vehicle fleet, which in turn is estimated to fuel the demand for fleet management systems in the near future.

Moreover, several shared mobility service providers are replacing their old fleet with new energy vehicles. Numerous providers are incorporating connected and automated vehicles owing to an increase in the demand for electric, connected, and automated vehicles from consumers. This is likely to further boost the smart fleet management market size in the near future.

In terms of solution, the global smart fleet management market segmentation comprises vehicle tracking, fleet optimization, advanced driver assistance systems (ADAS), and remote diagnostics. In 2021, the advanced driver assistance system (ADAS) segment accounted for a sizeable 41.14% share of the overall market. The segment has estimated to maintain its leading position and expand at a CAGR of more than 11.4% during the forecast period.

The advanced driver assistance system (ADAS) is designed to support drivers while they are on the roads. Several cutting-edge driver assistance systems are available for specific functions such as lane departure warnings, collision avoidance, etc.

Smart fleet management collects data from the ADAS system to monitor in-vehicle performance and control the traffic environment outside the vehicle, which includes other vehicles, pedestrians, objects, traffic signals, lane markings, and speed limit signs.

The car camera also scans the surrounding area and keeps an eye out for potential hazards. ADAS is crucial to fleet management, as it offers the maximum level of operational effectiveness while assuring the safety of the driver and the asset. These factors are likely to boost the smart fleet management market demand in the upcoming years.

In terms of connectivity, the short-range segment held 58.17% market share. The segment is estimate to maintain its position and expand at a CAGR of more than 10.24% during the forecast period. Examples of short-range connection devices include cameras, ultrasonic sensors, and short-range RADAR. Rapid increase in adoption of the Internet of Things (IoT) is drastically altering the global transportation ecology.

OEMs may trace their installed base globally with help from companies such as Globecomm Systems Inc. They can improve the quality and effectiveness of their service by repairing mistakes more rapidly, cutting down on production halts, and optimizing machine performance close to where they are located. A connected infrastructure includes parking lots, tollgates, intelligent traffic lights, and tollbooths. All these factors are likely to boost the demand for short range fleet management systems during the forecast period.

Analysis of the global market trends reveal that Asia Pacific accounts for a dominant share of the global smart fleet management industry in 2021. This is due to the increase in population; requirement for huge fleet management, rapid urbanization, a strong rail infrastructure; rise in major international trade; and encouraging government initiatives in countries such as China, India, and Indonesia.

Moreover, concerns about driver and vehicle safety and the adoption of stringent government regulations for vehicle maintenance and tracking are some of the key factors aiding market progress in the region.

Europe also holds a significant share of the global industry, followed by North America. Market expansion in the region is anticipated to be aided by population growth and increased telematics and GNSS implementation in fleet management services. Top manufacturers are also releasing brand-new autonomous, connected vehicles for a better driving experience.

The global smart fleet management market has consolidated with a few number of system integrators controlling the market share and major companies possessing the potential to increase the pace of growth by the way of adoption of newer technologies. Notable business strategies adopted by key market players include acquisitions, mergers, and expansion of product portfolios. Some of the key players operating across the globe include BMW, CalAmp, CHAINWAYTSP CO., Ltd., Cisco, Continental AG, DENSO CORPORATION, Globecomm Systems Inc., HARMAN International, IBM Corporation, Otto Marine Limited., Robert Bosch GmbH, Siemens AG, and TomTom International BV.

Key players in the market research report have been profiled based on financial overview, product portfolio, business strategies, business segments, company overview, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 362.8 Bn |

|

Market Forecast Value in 2031 |

US$ 962.6 Bn |

|

Growth Rate (CAGR) |

10.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

Thousand Units for Volume and US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market is valued at US$ 362.8 Bn in 2021

The market has expected to advance at a CAGR of 10.2% by 2031

It is expected to be valued at US$ 962.6 Bn in 2031

Integration of real-time fleet monitoring systems in vehicles and rise in use of cloud-based technology for smart fleet management solutions.

The advanced driver assistance system (ADAS) segment accounts for 41.14% share in 2021

Asia Pacific is a highly lucrative region of the global market.

BMW, CalAmp, CHAINWAYTSP CO., Ltd., Cisco, Continental AG, DENSO CORPORATION, Globecomm Systems Inc., HARMAN International, IBM Corporation, Otto Marine Limited., Robert Bosch GmbH, Siemens AG, and TomTom International BV.

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Thousand Units, US$ Bn, 2017-2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Macro-Economic Factors

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Regulatory Scenario

3.5. Key Trend Analysis

3.6. Value Chain Analysis

3.7. Cost Structure Analysis

3.8. Profit Margin Analysis

4. COVID-19 Impact Analysis – Smart Fleet Management Market

5. Global Smart Fleet Management Market, By Solution

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Solution

5.2.1. Hardware

5.2.1.1. Vehicle Tracking

5.2.1.2. Fleet Optimization

5.2.1.3. Advanced Driver Assistance Systems (ADAS)

5.2.1.4. Remote Diagnostics

6. Global Smart Fleet Management Market, By Connectivity

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Connectivity

6.2.1. Short Range

6.2.2. Long Range

6.2.3. Cloud

7. Global Smart Fleet Management Market, By Transportation

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Transportation

7.2.1. Roadways (Automotive)

7.2.2. Marine

7.2.3. Airways

7.2.4. Railways

8. Global Smart Fleet Management Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Smart Fleet Management Market

9.1. Market Snapshot

9.2. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Solution

9.2.1. Hardware

9.2.1.1. Vehicle Tracking

9.2.1.2. Fleet Optimization

9.2.1.3. Advanced Driver Assistance Systems (ADAS)

9.2.1.4. Remote Diagnostics

9.3. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Connectivity

9.3.1. Short Range

9.3.2. Long Range

9.3.3. Cloud

9.4. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Transportation

9.4.1. Roadways (Automotive)

9.4.2. Marine

9.4.3. Airways

9.4.4. Railways

9.5. Key Country Analysis – North America Smart Fleet Management Market Size Analysis & Forecast, 2017-2031

9.5.1. U.S.

9.5.2. Canada

9.5.3. Mexico

10. Europe Smart Fleet Management Market

10.1. Market Snapshot

10.2. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Solution

10.2.1. Hardware

10.2.1.1. Vehicle Tracking

10.2.1.2. Fleet Optimization

10.2.1.3. Advanced Driver Assistance Systems (ADAS)

10.2.1.4. Remote Diagnostics

10.3. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Connectivity

10.3.1. Short Range

10.3.2. Long Range

10.3.3. Cloud

10.4. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Transportation

10.4.1. Roadways (Automotive)

10.4.2. Marine

10.4.3. Airways

10.4.4. Railways

10.5. Key Country Analysis – Europe Smart Fleet Management Market Size Analysis & Forecast, 2017-2031

10.5.1. Germany

10.5.2. U. K.

10.5.3. France

10.5.4. Italy

10.5.5. Spain

10.5.6. Nordic Countries

10.5.7. Russia & CIS

10.5.8. Rest of Europe

11. Asia Pacific Smart Fleet Management Market

11.1. Market Snapshot

11.2. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Solution

11.2.1. Hardware

11.2.1.1. Vehicle Tracking

11.2.1.2. Fleet Optimization

11.2.1.3. Advanced Driver Assistance Systems (ADAS)

11.2.1.4. Remote Diagnostics

11.3. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Connectivity

11.3.1. Short Range

11.3.2. Long Range

11.3.3. Cloud

11.4. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Transportation

11.4.1. Roadways (Automotive)

11.4.2. Marine

11.4.3. Airways

11.4.4. Railways

11.5. Key Country Analysis – Asia Pacific Smart Fleet Management Market Size Analysis & Forecast, 2017-2031

11.5.1. China

11.5.2. India

11.5.3. Japan

11.5.4. ASEAN Countries

11.5.5. South Korea

11.5.6. ANZ

11.5.7. Rest of Asia Pacific

12. Middle East & Africa Smart Fleet Management Market

12.1. Market Snapshot

12.2. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Solution

12.2.1. Hardware

12.2.1.1. Vehicle Tracking

12.2.1.2. Fleet Optimization

12.2.1.3. Advanced Driver Assistance Systems (ADAS)

12.2.1.4. Remote Diagnostics

12.3. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Connectivity

12.3.1. Short Range

12.3.2. Long Range

12.3.3. Cloud

12.4. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Transportation

12.4.1. Roadways (Automotive)

12.4.2. Marine

12.4.3. Airways

12.4.4. Railways

12.5. Key Country Analysis – Middle East & Africa Smart Fleet Management Market Size Analysis & Forecast, 2017-2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Turkey

12.5.4. Rest of Middle East & Africa

13. South America Smart Fleet Management Market

13.1. Market Snapshot

13.2. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Solution

13.2.1. Hardware

13.2.1.1. Vehicle Tracking

13.2.1.2. Fleet Optimization

13.2.1.3. Advanced Driver Assistance Systems (ADAS)

13.2.1.4. Remote Diagnostics

13.3. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Connectivity

13.3.1. Short Range

13.3.2. Long Range

13.3.3. Cloud

13.4. Smart Fleet Management Market Size Analysis & Forecast, 2017-2031, By Transportation

13.4.1. Roadways (Automotive)

13.4.2. Marine

13.4.3. Airways

13.4.4. Railways

13.5. Key Country Analysis – South America Smart Fleet Management Market Size Analysis & Forecast, 2017-2031

13.5.1. Brazil

13.5.2. Argentina

13.5.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2021

14.2. Pricing comparison among key players

14.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profile/ Key Players

15.1. BMW

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. CalAmp

15.2.1. Company Footprints

15.2.2. Production Locations

15.2.3. Product Portfolio

15.2.4. Competitors & Customers

15.2.5. Subsidiaries & Parent Organization

15.2.6. Recent Developments

15.2.7. Financial Analysis

15.2.8. Profitability

15.2.9. Revenue Share

15.3. CHAINWAYTSP CO., Ltd.

15.3.1. Company Footprints

15.3.2. Production Locations

15.3.3. Product Portfolio

15.3.4. Competitors & Customers

15.3.5. Subsidiaries & Parent Organization

15.3.6. Recent Developments

15.3.7. Financial Analysis

15.3.8. Profitability

15.3.9. Revenue Share

15.4. Cisco

15.4.1. Company Footprints

15.4.2. Production Locations

15.4.3. Product Portfolio

15.4.4. Competitors & Customers

15.4.5. Subsidiaries & Parent Organization

15.4.6. Recent Developments

15.4.7. Financial Analysis

15.4.8. Profitability

15.4.9. Revenue Share

15.5. Continental AG

15.5.1. Company Footprints

15.5.2. Production Locations

15.5.3. Product Portfolio

15.5.4. Competitors & Customers

15.5.5. Subsidiaries & Parent Organization

15.5.6. Recent Developments

15.5.7. Financial Analysis

15.5.8. Profitability

15.5.9. Revenue Share

15.6. DENSO CORPORATION

15.6.1. Company Footprints

15.6.2. Production Locations

15.6.3. Product Portfolio

15.6.4. Competitors & Customers

15.6.5. Subsidiaries & Parent Organization

15.6.6. Recent Developments

15.6.7. Financial Analysis

15.6.8. Profitability

15.6.9. Revenue Share

15.7. Globecomm Systems Inc.

15.7.1. Company Footprints

15.7.2. Production Locations

15.7.3. Product Portfolio

15.7.4. Competitors & Customers

15.7.5. Subsidiaries & Parent Organization

15.7.6. Recent Developments

15.7.7. Financial Analysis

15.7.8. Profitability

15.7.9. Revenue Share

15.8. HARMAN International

15.8.1. Company Footprints

15.8.2. Production Locations

15.8.3. Product Portfolio

15.8.4. Competitors & Customers

15.8.5. Subsidiaries & Parent Organization

15.8.6. Recent Developments

15.8.7. Financial Analysis

15.8.8. Profitability

15.8.9. Revenue Share

15.9. IBM Corporation

15.9.1. Company Footprints

15.9.2. Production Locations

15.9.3. Product Portfolio

15.9.4. Competitors & Customers

15.9.5. Subsidiaries & Parent Organization

15.9.6. Recent Developments

15.9.7. Financial Analysis

15.9.8. Profitability

15.9.9. Revenue Share

15.10. JUTHA MARITIME

15.10.1. Company Footprints

15.10.2. Production Locations

15.10.3. Product Portfolio

15.10.4. Competitors & Customers

15.10.5. Subsidiaries & Parent Organization

15.10.6. Recent Developments

15.10.7. Financial Analysis

15.10.8. Profitability

15.10.9. Revenue Share

15.11. ORBCOMM

15.11.1. Company Footprints

15.11.2. Production Locations

15.11.3. Product Portfolio

15.11.4. Competitors & Customers

15.11.5. Subsidiaries & Parent Organization

15.11.6. Recent Developments

15.11.7. Financial Analysis

15.11.8. Profitability

15.11.9. Revenue Share

15.12. Otto Marine Limited.

15.12.1. Company Footprints

15.12.2. Production Locations

15.12.3. Product Portfolio

15.12.4. Competitors & Customers

15.12.5. Subsidiaries & Parent Organization

15.12.6. Recent Developments

15.12.7. Financial Analysis

15.12.8. Profitability

15.12.9. Revenue Share

15.13. Precious Shipping Public Company Limited

15.13.1. Company Footprints

15.13.2. Production Locations

15.13.3. Product Portfolio

15.13.4. Competitors & Customers

15.13.5. Subsidiaries & Parent Organization

15.13.6. Recent Developments

15.13.7. Financial Analysis

15.13.8. Profitability

15.13.9. Revenue Share

15.14. Robert Bosch GmbH

15.14.1. Company Footprints

15.14.2. Production Locations

15.14.3. Product Portfolio

15.14.4. Competitors & Customers

15.14.5. Subsidiaries & Parent Organization

15.14.6. Recent Developments

15.14.7. Financial Analysis

15.14.8. Profitability

15.14.9. Revenue Share

15.15. Siemens AG

15.15.1. Company Footprints

15.15.2. Production Locations

15.15.3. Product Portfolio

15.15.4. Competitors & Customers

15.15.5. Subsidiaries & Parent Organization

15.15.6. Recent Developments

15.15.7. Financial Analysis

15.15.8. Profitability

15.15.9. Revenue Share

15.16. Sierra Wireless

15.16.1. Company Footprints

15.16.2. Production Locations

15.16.3. Product Portfolio

15.16.4. Competitors & Customers

15.16.5. Subsidiaries & Parent Organization

15.16.6. Recent Developments

15.16.7. Financial Analysis

15.16.8. Profitability

15.16.9. Revenue Share

15.17. TomTom International BV.

15.17.1. Company Footprints

15.17.2. Production Locations

15.17.3. Product Portfolio

15.17.4. Competitors & Customers

15.17.5. Subsidiaries & Parent Organization

15.17.6. Recent Developments

15.17.7. Financial Analysis

15.17.8. Profitability

15.17.9. Revenue Share

15.18. Zonar Systems

15.18.1. Company Footprints

15.18.2. Production Locations

15.18.3. Product Portfolio

15.18.4. Competitors & Customers

15.18.5. Subsidiaries & Parent Organization

15.18.6. Recent Developments

15.18.7. Financial Analysis

15.18.8. Profitability

15.18.9. Revenue Share

15.19. Other Key Players

List of Tables

Table 1: Global Smart Fleet Management Market Volume (Thousand Units) Forecast, by Solution, 2017-2031

Table 2: Global Smart Fleet Management Market Value (US$ Bn) Forecast, by Solution, 2017‒2031

Table 3: Global Smart Fleet Management Market Volume (Thousand Units) Forecast, by Connectivity, 2017-2031

Table 4: Global Smart Fleet Management Market Value (US$ Bn) Forecast, by Connectivity, 2017‒2031

Table 5: Global Smart Fleet Management Market Volume (Thousand Units) Forecast, by Transportation, 2017-2031

Table 6: Global Smart Fleet Management Market Value (US$ Bn) Forecast, by Transportation, 2017‒2031

Table 7: Global Smart Fleet Management Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 8: Global Smart Fleet Management Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 9: North America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Solution, 2017-2031

Table 10: North America Smart Fleet Management Market Value (US$ Bn) Forecast, by Solution, 2017‒2031

Table 11: North America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Connectivity, 2017-2031

Table 12: North America Smart Fleet Management Market Value (US$ Bn) Forecast, by Connectivity, 2017‒2031

Table 13: North America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Transportation, 2017-2031

Table 14: North America Smart Fleet Management Market Value (US$ Bn) Forecast, by Transportation, 2017‒2031

Table 15: North America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 16: North America Smart Fleet Management Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 17: Europe Smart Fleet Management Market Volume (Thousand Units) Forecast, by Solution, 2017-2031

Table 18: Europe Smart Fleet Management Market Value (US$ Bn) Forecast, by Solution, 2017‒2031

Table 19: Europe Smart Fleet Management Market Volume (Thousand Units) Forecast, by Connectivity, 2017-2031

Table 20: Europe Smart Fleet Management Market Value (US$ Bn) Forecast, by Connectivity, 2017‒2031

Table 21: Europe Smart Fleet Management Market Volume (Thousand Units) Forecast, by Transportation, 2017-2031

Table 22: Europe Smart Fleet Management Market Value (US$ Bn) Forecast, by Transportation, 2017‒2031

Table 23: Europe Smart Fleet Management Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 24: Europe Smart Fleet Management Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Asia Pacific Smart Fleet Management Market Volume (Thousand Units) Forecast, by Solution, 2017-2031

Table 26: Asia Pacific Smart Fleet Management Market Value (US$ Bn) Forecast, by Solution, 2017‒2031

Table 27: Asia Pacific Smart Fleet Management Market Volume (Thousand Units) Forecast, by Connectivity, 2017-2031

Table 28: Asia Pacific Smart Fleet Management Market Value (US$ Bn) Forecast, by Connectivity, 2017‒2031

Table 29: Asia Pacific Smart Fleet Management Market Volume (Thousand Units) Forecast, by Transportation, 2017-2031

Table 30: Asia Pacific Smart Fleet Management Market Value (US$ Bn) Forecast, by Transportation, 2017‒2031

Table 31: Asia Pacific Smart Fleet Management Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 32: Asia Pacific Smart Fleet Management Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 33: Middle East & Africa Smart Fleet Management Market Volume (Thousand Units) Forecast, by Solution, 2017-2031

Table 34: Middle East & Africa Smart Fleet Management Market Value (US$ Bn) Forecast, by Solution, 2017‒2031

Table 35: Middle East & Africa Smart Fleet Management Market Volume (Thousand Units) Forecast, by Connectivity, 2017-2031

Table 36: Middle East & Africa Smart Fleet Management Market Value (US$ Bn) Forecast, by Connectivity, 2017‒2031

Table 37: Middle East & Africa Smart Fleet Management Market Volume (Thousand Units) Forecast, by Transportation, 2017-2031

Table 38: Middle East & Africa Smart Fleet Management Market Value (US$ Bn) Forecast, by Transportation, 2017‒2031

Table 39: Middle East & Africa Smart Fleet Management Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 40: Middle East & Africa Smart Fleet Management Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 41: South America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Solution, 2017-2031

Table 42: South America Smart Fleet Management Market Value (US$ Bn) Forecast, by Solution, 2017‒2031

Table 43: South America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Connectivity, 2017-2031

Table 44: South America Smart Fleet Management Market Value (US$ Bn) Forecast, by Connectivity, 2017‒2031

Table 45: South America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Transportation, 2017-2031

Table 46: South America Smart Fleet Management Market Value (US$ Bn) Forecast, by Transportation, 2017‒2031

Table 47: South America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: South America Smart Fleet Management Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Smart Fleet Management Market Volume (Thousand Units) Forecast, by Solution, 2017-2031

Figure 2: Global Smart Fleet Management Market Value (US$ Bn) Forecast, by Solution, 2017-2031

Figure 3: Global Smart Fleet Management Market, Incremental Opportunity, by Solution, Value (US$ Bn), 2022-2031

Figure 4: Global Smart Fleet Management Market Volume (Thousand Units) Forecast, by Connectivity, 2017-2031

Figure 5: Global Smart Fleet Management Market Value (US$ Bn) Forecast, by Connectivity, 2017-2031

Figure 6: Global Smart Fleet Management Market, Incremental Opportunity, by Connectivity, Value (US$ Bn), 2022-2031

Figure 7: Global Smart Fleet Management Market Volume (Thousand Units) Forecast, by Transportation, 2017-2031

Figure 8: Global Smart Fleet Management Market Value (US$ Bn) Forecast, by Transportation, 2017-2031

Figure 9: Global Smart Fleet Management Market, Incremental Opportunity, by Transportation, Value (US$ Bn), 2022-2031

Figure 10: Global Smart Fleet Management Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 11: Global Smart Fleet Management Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 12: Global Smart Fleet Management Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 13: North America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Solution, 2017-2031

Figure 14: North America Smart Fleet Management Market Value (US$ Bn) Forecast, by Solution, 2017-2031

Figure 15: North America Smart Fleet Management Market, Incremental Opportunity, by Solution, Value (US$ Bn), 2022-2031

Figure 16: North America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Connectivity, 2017-2031

Figure 17: North America Smart Fleet Management Market Value (US$ Bn) Forecast, by Connectivity, 2017-2031

Figure 18: North America Smart Fleet Management Market, Incremental Opportunity, by Connectivity, Value (US$ Bn), 2022-2031

Figure 19: North America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Transportation, 2017-2031

Figure 20: North America Smart Fleet Management Market Value (US$ Bn) Forecast, by Transportation, 2017-2031

Figure 21: North America Smart Fleet Management Market, Incremental Opportunity, by Transportation, Value (US$ Bn), 2022-2031

Figure 22: North America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 23: North America Smart Fleet Management Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 24: North America Smart Fleet Management Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 25: Europe Smart Fleet Management Market Volume (Thousand Units) Forecast, by Solution, 2017-2031

Figure 26: Europe Smart Fleet Management Market Value (US$ Bn) Forecast, by Solution, 2017-2031

Figure 27: Europe Smart Fleet Management Market, Incremental Opportunity, by Solution, Value (US$ Bn), 2022-2031

Figure 28: Europe Smart Fleet Management Market Volume (Thousand Units) Forecast, by Connectivity, 2017-2031

Figure 29: Europe Smart Fleet Management Market Value (US$ Bn) Forecast, by Connectivity, 2017-2031

Figure 30: Europe Smart Fleet Management Market, Incremental Opportunity, by Connectivity, Value (US$ Bn), 2022-2031

Figure 31: Europe Smart Fleet Management Market Volume (Thousand Units) Forecast, by Transportation, 2017-2031

Figure 32: Europe Smart Fleet Management Market Value (US$ Bn) Forecast, by Transportation, 2017-2031

Figure 33: Europe Smart Fleet Management Market, Incremental Opportunity, by Transportation, Value (US$ Bn), 2022-2031

Figure 34: Europe Smart Fleet Management Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: Europe Smart Fleet Management Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: Europe Smart Fleet Management Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Asia Pacific Smart Fleet Management Market Volume (Thousand Units) Forecast, by Solution, 2017-2031

Figure 38: Asia Pacific Smart Fleet Management Market Value (US$ Bn) Forecast, by Solution, 2017-2031

Figure 39: Asia Pacific Smart Fleet Management Market, Incremental Opportunity, by Solution, Value (US$ Bn), 2022-2031

Figure 40: Asia Pacific Smart Fleet Management Market Volume (Thousand Units) Forecast, by Connectivity, 2017-2031

Figure 41: Asia Pacific Smart Fleet Management Market Value (US$ Bn) Forecast, by Connectivity, 2017-2031

Figure 42: Asia Pacific Smart Fleet Management Market, Incremental Opportunity, by Connectivity, Value (US$ Bn), 2022-2031

Figure 43: Asia Pacific Smart Fleet Management Market Volume (Thousand Units) Forecast, by Transportation, 2017-2031

Figure 44: Asia Pacific Smart Fleet Management Market Value (US$ Bn) Forecast, by Transportation, 2017-2031

Figure 45: Asia Pacific Smart Fleet Management Market, Incremental Opportunity, by Transportation, Value (US$ Bn), 2022-2031

Figure 46: Asia Pacific Smart Fleet Management Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 47: Asia Pacific Smart Fleet Management Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 48: Asia Pacific Smart Fleet Management Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 49: Middle East & Africa Smart Fleet Management Market Volume (Thousand Units) Forecast, by Solution, 2017-2031

Figure 50: Middle East & Africa Smart Fleet Management Market Value (US$ Bn) Forecast, by Solution, 2017-2031

Figure 51: Middle East & Africa Smart Fleet Management Market, Incremental Opportunity, by Solution, Value (US$ Bn), 2022-2031

Figure 52: Middle East & Africa Smart Fleet Management Market Volume (Thousand Units) Forecast, by Connectivity, 2017-2031

Figure 53: Middle East & Africa Smart Fleet Management Market Value (US$ Bn) Forecast, by Connectivity, 2017-2031

Figure 54: Middle East & Africa Smart Fleet Management Market, Incremental Opportunity, by Connectivity, Value (US$ Bn), 2022-2031

Figure 55: Middle East & Africa Smart Fleet Management Market Volume (Thousand Units) Forecast, by Transportation, 2017-2031

Figure 56: Middle East & Africa Smart Fleet Management Market Value (US$ Bn) Forecast, by Transportation, 2017-2031

Figure 57: Middle East & Africa Smart Fleet Management Market, Incremental Opportunity, by Transportation, Value (US$ Bn), 2022-2031

Figure 58: Middle East & Africa Smart Fleet Management Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 59: Middle East & Africa Smart Fleet Management Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Middle East & Africa Smart Fleet Management Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 61: South America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Solution, 2017-2031

Figure 62: South America Smart Fleet Management Market Value (US$ Bn) Forecast, by Solution, 2017-2031

Figure 63: South America Smart Fleet Management Market, Incremental Opportunity, by Solution, Value (US$ Bn), 2022-2031

Figure 64: South America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Connectivity, 2017-2031

Figure 65: South America Smart Fleet Management Market Value (US$ Bn) Forecast, by Connectivity, 2017-2031

Figure 66: South America Smart Fleet Management Market, Incremental Opportunity, by Connectivity, Value (US$ Bn), 2022-2031

Figure 67: South America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Transportation, 2017-2031

Figure 68: South America Smart Fleet Management Market Value (US$ Bn) Forecast, by Transportation, 2017-2031

Figure 69: South America Smart Fleet Management Market, Incremental Opportunity, by Transportation, Value (US$ Bn), 2022-2031

Figure 70: South America Smart Fleet Management Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: South America Smart Fleet Management Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: South America Smart Fleet Management Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031