Reports

Reports

Analysts’ Viewpoint

Smart enterprise technologies help manufacturers to reduce cost by improving efficiency, reducing waste, and increasing productivity. This is boosting market progress.

Customers are increasingly demanding products that are tailored to their individual needs. Manufacturers are under immense pressure to reduce costs. Hence, they are progressively adopting smart enterprise solutions that help them produce products on demand and in smaller batches.

Robotic process automation (RPA), collaborative robots (cobots), and autonomous mobile robots (AMRs) are transforming traditional manufacturing processes. These technologies increase productivity, reduce errors, and improve worker safety, leading to cost savings and improved overall output. The adoption of smart enterprise solutions incorporated with these advanced robotics and automation technologies is expected to increase significantly in the next few years.

Smart enterprise refers to the use of information technology (IT) and operational technology (OT) to connect and integrate manufacturing processes, assets, and people. The connectivity enables manufacturers to collect and analyze data in real time, which can be used to improve efficiency, reduce costs, and increase productivity.

In a smart enterprise, advanced technologies and data analytics are used to enhance and automate manufacturing processes. It involves the integration of various technologies, such as Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), big data analytics, and cloud computing, to create a connected and intelligent manufacturing ecosystem.

Smart enterprise processes improve operational efficiency, productivity, flexibility, and quality within the manufacturing industry. It enables manufacturers to streamline their operations, optimize resource utilization, and respond quickly to market demands. Smart enterprise facilitates data-driven decision making, process optimization, and continuous improvements by leveraging real-time data, predictive analytics, and automation.

Surge in digital transformation through the adoption of smart enterprise technologies revolutionized the manufacturing industry. Manufacturers are increasingly implementing advanced technologies, such as AI, IoT, data analytics, and automation, to optimize their operations, enhance productivity, and stay competitive in an increasingly digital and interconnected world.

Digital transformation enables the integration and connectivity of various systems and devices in the manufacturing environment. The connectivity provides seamless communication and data exchange between machines, processes, and systems. As a result, manufacturers collect and analyze a large amount of data in real-time, gaining valuable insights into their operations and identifying areas for optimization and improvement.

Advanced analytics and AI capabilities enable the analysis of large datasets to uncover patterns, trends, and correlations that were previously difficult to identify. Manufacturers leverage AI algorithms to optimize production schedules, predict maintenance needs, and detect anomalies or quality issues, which result in improved operational efficiency and reduced downtime.

Advanced robotics and cobots (collaborative robots) perform repetitive tasks with precision, speed, and consistency, which reduces human error and increases overall productivity. The integration of automation with AI and ML capabilities enable intelligent decision making and adaptive manufacturing processes, allowing manufacturers to quickly respond to changing market demands.

Digital transformation modified the supply chain ecosystem, which facilitates the adoption of smart enterprise solutions. Manufacturers leverage technologies such as blockchain, cloud computing, and predictive analytics to improve supply chain visibility, traceability, and efficiency.

Real-time data sharing among suppliers, manufacturers, and customers enables better coordination, demand forecasting, and inventory management, resulting in reduced lead times and improved customer satisfaction.

Digital twin technology involves creating a virtual replica or digital representation of a physical product, process, or system. It enables manufacturers to monitor, analyze, and optimize various aspects of their operations, leading to improved efficiency, productivity, and decision making.

The integration of digital twin technology enables manufacturers to achieve high level of efficiency, productivity, and competitiveness. It also enables predictive maintenance, enhanced product development, supply chain optimization, remote monitoring and control, and data-driven decision making, which is estimated to boost the smart enterprise market size.

The integration of digital twins across the supply chain enables manufacturers to gain real-time visibility into inventory levels, production progress, and logistics operations. The visibility provides better coordination and synchronization among suppliers, manufacturers, and distributors, which results in improved supply chain efficiency. Manufacturers optimize production schedules, reduce inventory holding costs, and respond rapidly to changing demand patterns, resulting in enhanced customer satisfaction and competitiveness.

Digital twins enable remote monitoring and control of manufacturing assets and processes. Manufacturers access real-time data and insights from their digital twins, regardless of their physical location. The remote monitoring and control capability enables remote troubleshooting, adjustment of process parameters, and proactive decision making. It increases operational flexibility, reduces the need for on-site personnel, and enables centralized management of distributed manufacturing facilities. All these factors enhance smart enterprise market value.

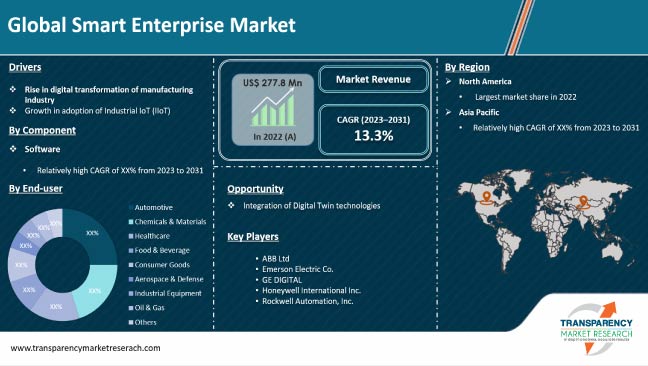

According to the latest smart enterprise industry research report, North America is anticipated to hold dominant share of the global industry during the forecast period due to the presence of leading technology companies and the implementation of various government initiatives to increase the adoption of advanced manufacturing technologies and digital transformation.

Smart enterprise industry growth in Asia Pacific is expected to rise at the highest CAGR during the forecast period. Economies such as China, Thailand, Taiwan, and Indonesia have well-established manufacturing industries. Rise in labor cost in the region is accelerating market expansion.

The smart enterprise market research report profiles major service providers based on parameters such as financials, key product offerings, recent developments, and strategies.

ABB Ltd, Emerson Electric Co., GE DIGITAL, Honeywell International Inc., Robert Bosch GmbH, Yokogawa Electric Corporation, Siemens AG, Schneider Electric SE, Rockwell Automation, Inc., SAP SE, Mitsubishi Electric Corporation, and Oracle Corporation Incorporated are the key smart enterprise providers.

Prominent providers are investing in R&D activities to introduce smart enterprise technologies that can meet the growing smart enterprise market demand. These service providers are tapping into the latest smart enterprise market trends to gain new opportunities and stay ahead of the competitive curve.

Key players have been profiled in the smart enterprise market forecast report based on parameters such as product portfolio, recent developments, business strategies, financial overview, company overview, and business segments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 277.8 Mn |

|

Market Forecast Value in 2031 |

US$ 846.4 Mn |

|

Growth Rate (CAGR) |

13.3% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 277.8 Mn in 2022

It is anticipated to reach US$ 846.4 Mn by the end of 2031

It is projected to expand at a CAGR of 13.3% from 2023 to 2031

Rise in digital transformation of the manufacturing industry and growth in adoption of industrial IoT (IIoT)

North America accounted for leading share in 2022

ABB Ltd, Emerson Electric Co., GE Digital, Honeywell International Inc., Robert Bosch GmbH, Yokogawa Electric Corporation, Siemens AG, Schneider Electric SE, Rockwell Automation, Inc., SAP SE, Mitsubishi Electric Corporation, and Oracle Corporation

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global Smart Enterprise Market

4. Market Overview

4.1. Market Definition

4.2. Technology/Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Smart Enterprise Market

4.5. Porter’s Five Forces Analysis

4.6. PEST Analysis

4.7. Market Opportunity Assessment - by Region (North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.7.1. By Component

4.7.2. By Technology

4.7.3. By Deployment

4.7.4. By Enterprise Size

4.7.5. By End-user

5. Global Smart Enterprise Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Mn), 2017-2031

5.1.1. Historic Growth Trends, 2017-2022

5.1.2. Forecast Trends, 2023-2031

6. Global Smart Enterprise Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Smart Enterprise Market Size (US$ Mn) Forecast, by Component, 2018 - 2031

6.3.1. Hardware

6.3.2. Software

6.3.3. Services

7. Global Smart Enterprise Market Analysis, by Technology

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Smart Enterprise Market Size (US$ Mn) Forecast, by Technology, 2018 - 2031

7.3.1. MES

7.3.2. PLC

7.3.3. ERP

7.3.4. SCADA

7.3.5. HMI

7.3.6. Others

8. Global Smart Enterprise Market Analysis, by Deployment

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. Smart Enterprise Market Size (US$ Mn) Forecast, by Deployment, 2018 - 2031

8.3.1. Cloud

8.3.2. On-premise

9. Global Smart Enterprise Market Analysis, by Enterprise Size

9.1. Overview and Definitions

9.2. Key Segment Analysis

9.3. Smart Enterprise Market Size (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

9.3.1. SMEs

9.3.2. Large Enterprises

10. Global Smart Enterprise Market Analysis, by End-user

10.1. Key Segment Analysis

10.2. Smart Enterprise Market Size (US$ Mn) Forecast, by End-user, 2018 - 2031

10.2.1. Automotive

10.2.2. Chemicals & Materials

10.2.3. Healthcare

10.2.4. Food & Beverage

10.2.5. Consumer Goods

10.2.6. Aerospace & Defense

10.2.7. Industrial Equipment

10.2.8. Oil & Gas

10.2.9. Others

11. Global Smart Enterprise Market Analysis and Forecasts, by Region

11.1. Key Findings

11.2. Market Size (US$ Mn) Forecast by Region, 2018-2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America Smart Enterprise Market Analysis and Forecast

12.1. Regional Outlook

12.2. Smart Enterprise Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

12.2.1. By Component

12.2.2. By Technology

12.2.3. By Deployment

12.2.4. By Enterprise Size

12.2.5. By End-user

12.3. Smart Enterprise Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

12.3.1. U.S.

12.3.2. Canada

12.3.3. Mexico

13. Europe Smart Enterprise Market Analysis and Forecast

13.1. Regional Outlook

13.2. Smart Enterprise Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

13.2.1. By Component

13.2.2. By Technology

13.2.3. By Deployment

13.2.4. By Enterprise Size

13.2.5. By End-user

13.3. Smart Enterprise Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

13.3.1. Germany

13.3.2. U.K.

13.3.3. France

13.3.4. Italy

13.3.5. Spain

13.3.6. Rest of Europe

14. Asia Pacific Smart Enterprise Market Analysis and Forecast

14.1. Regional Outlook

14.2. Smart Enterprise Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

14.2.1. By Component

14.2.2. By Technology

14.2.3. By Deployment

14.2.4. By Enterprise Size

14.2.5. By End-user

14.3. Smart Enterprise Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

14.3.1. China

14.3.2. India

14.3.3. Japan

14.3.4. ASEAN

14.3.5. Rest of Asia Pacific

15. Middle East & Africa Smart Enterprise Market Analysis and Forecast

15.1. Regional Outlook

15.2. Smart Enterprise Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

15.2.1. By Component

15.2.2. By Technology

15.2.3. By Deployment

15.2.4. By Enterprise Size

15.2.5. By End-user

15.3. Smart Enterprise Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

15.3.1. Saudi Arabia

15.3.2. U.A.E.

15.3.3. South Africa

15.3.4. Rest of Middle East & Africa

16. South America Smart Enterprise Market Analysis and Forecast

16.1. Regional Outlook

16.2. Smart Enterprise Market Size (US$ Mn) Analysis and Forecast, 2018 - 2031

16.2.1. By Component

16.2.2. By Technology

16.2.3. By Deployment

16.2.4. By Enterprise Size

16.2.5. By End-user

16.3. Smart Enterprise Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

16.3.1. Brazil

16.3.2. Argentina

16.3.3. Rest of South America

17. Competition Landscape

17.1. Market Competition Matrix, by Leading Players

17.2. Competitive Landscape by Tier Structure of Companies

17.3. Scale of Competition, 2022

17.4. Scale of Competition at Regional Level, 2022

17.5. Market Revenue Share Analysis/Ranking, by Leading Players (2022)

17.6. List of Startups

17.7. Competition Evolution

17.8. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

18. Company Profiles

18.1. ABB Ltd

18.1.1. Business Overview

18.1.2. Company Revenue

18.1.3. Product Portfolio

18.1.4. Geographic Footprint

18.1.5. Recent Developments

18.1.6. Impact of COVID-19

18.1.7. TMR View

18.1.8. Competitive Threats and Weakness

18.2. Emerson Electric Co.

18.2.1. Business Overview

18.2.2. Company Revenue

18.2.3. Product Portfolio

18.2.4. Geographic Footprint

18.2.5. Recent Developments

18.2.6. Impact of COVID-19

18.2.7. TMR View

18.2.8. Competitive Threats and Weakness

18.3. GE DIGITAL

18.3.1. Business Overview

18.3.2. Company Revenue

18.3.3. Product Portfolio

18.3.4. Geographic Footprint

18.3.5. Recent Developments

18.3.6. Impact of COVID-19

18.3.7. TMR View

18.3.8. Competitive Threats and Weakness

18.4. Honeywell International Inc.

18.4.1. Business Overview

18.4.2. Company Revenue

18.4.3. Product Portfolio

18.4.4. Geographic Footprint

18.4.5. Recent Developments

18.4.6. Impact of COVID-19

18.4.7. TMR View

18.4.8. Competitive Threats and Weakness

18.5. Robert Bosch GmbH

18.5.1. Business Overview

18.5.2. Company Revenue

18.5.3. Product Portfolio

18.5.4. Geographic Footprint

18.5.5. Recent Developments

18.5.6. Impact of COVID-19

18.5.7. TMR View

18.5.8. Competitive Threats and Weakness

18.6. Yokogawa Electric Corporation

18.6.1. Business Overview

18.6.2. Company Revenue

18.6.3. Product Portfolio

18.6.4. Geographic Footprint

18.6.5. Recent Developments

18.6.6. Impact of COVID-19

18.6.7. TMR View

18.6.8. Competitive Threats and Weakness

18.7. Siemens AG

18.7.1. Business Overview

18.7.2. Company Revenue

18.7.3. Product Portfolio

18.7.4. Geographic Footprint

18.7.5. Recent Developments

18.7.6. Impact of COVID-19

18.7.7. TMR View

18.7.8. Competitive Threats and Weakness

18.8. Schneider Electric SE

18.8.1. Business Overview

18.8.2. Company Revenue

18.8.3. Product Portfolio

18.8.4. Geographic Footprint

18.8.5. Recent Developments

18.8.6. Impact of COVID-19

18.8.7. TMR View

18.8.8. Competitive Threats and Weakness

18.9. Rockwell Automation, Inc.

18.9.1. Business Overview

18.9.2. Company Revenue

18.9.3. Product Portfolio

18.9.4. Geographic Footprint

18.9.5. Recent Developments

18.9.6. Impact of COVID-19

18.9.7. TMR View

18.9.8. Competitive Threats and Weakness

18.10. SAP SE

18.10.1. Business Overview

18.10.2. Company Revenue

18.10.3. Product Portfolio

18.10.4. Geographic Footprint

18.10.5. Recent Developments

18.10.6. Impact of COVID-19

18.10.7. TMR View

18.10.8. Competitive Threats and Weakness

18.11. Mitsubishi Electric Corporation

18.11.1. Business Overview

18.11.2. Company Revenue

18.11.3. Product Portfolio

18.11.4. Geographic Footprint

18.11.5. Recent Developments

18.11.6. Impact of COVID-19

18.11.7. TMR View

18.11.8. Competitive Threats and Weakness

18.12. Oracle Corporation

18.12.1. Business Overview

18.12.2. Company Revenue

18.12.3. Product Portfolio

18.12.4. Geographic Footprint

18.12.5. Recent Developments

18.12.6. Impact of COVID-19

18.12.7. TMR View

18.12.8. Competitive Threats and Weakness

18.13. Others

18.13.1. Business Overview

18.13.2. Company Revenue

18.13.3. Product Portfolio

18.13.4. Geographic Footprint

18.13.5. Recent Developments

18.13.6. Impact of COVID-19

18.13.7. TMR View

18.13.8. Competitive Threats and Weakness

19. Key Takeaways

List of Tables

Table 1: Acronyms Used in Smart Enterprise Market

Table 2: North America Smart Enterprise Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 3: Europe Smart Enterprise Market Revenue Analysis, by Country/Sub-region, 2023 - 2031 (US$ Mn)

Table 4: Asia Pacific Smart Enterprise Market Revenue Analysis, by Country/Sub-region, 2023 - 2031 (US$ Mn)

Table 5: Middle East & Africa Smart Enterprise Market Revenue Analysis, by Country/Sub-region, 2023 and 2031 (US$ Mn)

Table 6: South America Smart Enterprise Market Revenue Analysis, by Country/Sub-region, 2023 - 2031 (US$ Mn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: Global Smart Enterprise Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 11: Global Smart Enterprise Market Value (US$ Mn) Forecast, by Technology, 2018 - 2031

Table 12: Global Smart Enterprise Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2031

Table 13: Global Smart Enterprise Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 14: Global Smart Enterprise Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 15: Global Smart Enterprise Market Volume (US$ Mn) Forecast, by Region, 2018 - 2031

Table 16: North America Smart Enterprise Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 17: North America Smart Enterprise Market Value (US$ Mn) Forecast, by Technology, 2018 - 2031

Table 18: North America Smart Enterprise Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2031

Table 19: North America Smart Enterprise Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 20: North America Smart Enterprise Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 21: North America Smart Enterprise Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 22: U.S. Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 23: Canada Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 24: Mexico Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: Europe Smart Enterprise Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 26: Europe Smart Enterprise Market Value (US$ Mn) Forecast, by Technology, 2018 - 2031

Table 27: Europe Smart Enterprise Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2031

Table 28: Europe Smart Enterprise Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 29: Europe Smart Enterprise Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 30: Europe Smart Enterprise Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

Table 31: Germany Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 32: U.K. Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: France Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: Italy Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: Spain Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: Asia Pacific Smart Enterprise Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 37: Asia Pacific Smart Enterprise Market Value (US$ Mn) Forecast, by Technology, 2018 - 2031

Table 38: Asia Pacific Smart Enterprise Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2031

Table 39: Asia Pacific Smart Enterprise Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 40: Asia Pacific Smart Enterprise Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 41: Asia Pacific Smart Enterprise Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

Table 42: China Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: India Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 44: Japan Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 45: ASEAN Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 46: Middle East & Africa Smart Enterprise Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 47: Middle East & Africa Smart Enterprise Market Value (US$ Mn) Forecast, by Technology, 2018 - 2031

Table 48: Middle East & Africa Smart Enterprise Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2031

Table 49: Middle East & Africa Smart Enterprise Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 50: Middle East & Africa Smart Enterprise Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 51: Middle East & Africa Smart Enterprise Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

Table 52: Saudi Arabia Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 53: U.A.E. Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 54: South Africa Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 55: South America Smart Enterprise Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 56: South America Smart Enterprise Market Value (US$ Mn) Forecast, by Technology, 2018 - 2031

Table 57: South America Smart Enterprise Market Value (US$ Mn) Forecast, by Deployment, 2018 - 2031

Table 58: South America Smart Enterprise Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 59: South America Smart Enterprise Market Value (US$ Mn) Forecast, by End-user, 2018 - 2031

Table 60: South America Smart Enterprise Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

Table 61: Brazil Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 62: Argentina Smart Enterprise Market Revenue CAGR Breakdown (%), by Growth Term

Table 63: Mergers & Acquisitions, Partnerships (1/2)

Table 64: Mergers & Acquisitions, Partnerships (2/2)

List of Figures

Figure 1: Global Smart Enterprise Market Size (US$ Mn) Forecast, 2018-2031

Figure 2: Global Smart Enterprise Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2023E

Figure 3: Top Segment Analysis of Smart Enterprise Market

Figure 4: Global Smart Enterprise Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Smart Enterprise Market Attractiveness Assessment, by Component

Figure 6: Global Smart Enterprise Market Attractiveness Assessment, by Technology

Figure 7: Global Smart Enterprise Market Attractiveness Assessment, by Deployment

Figure 8: Global Smart Enterprise Market Attractiveness Assessment, by Enterprise Size

Figure 9: Global Smart Enterprise Market Attractiveness Assessment, by End-user

Figure 10: Global Smart Enterprise Market Attractiveness Assessment, by Region

Figure 11: Global Smart Enterprise Market Revenue (US$ Mn) Historic Trends, 2017 - 2022

Figure 12: Global Smart Enterprise Market Revenue Opportunity (US$ Mn) Historic Trends, 2017 - 2022

Figure 13: Global Smart Enterprise Market Value Share Analysis, by Component, 2023

Figure 14: Global Smart Enterprise Market Value Share Analysis, by Component, 2031

Figure 15: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Hardware, 2023 - 2031

Figure 16: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 17: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 18: Global Smart Enterprise Market Value Share Analysis, by Technology, 2023

Figure 19: Global Smart Enterprise Market Value Share Analysis, by Technology, 2031

Figure 20: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by MES, 2023 - 2031

Figure 21: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by PLC, 2023 - 2031

Figure 22: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by ERP, 2023 - 2031

Figure 23: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by SCADA, 2023 - 2031

Figure 24: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by HMI, 2023 - 2031

Figure 25: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 26: Global Smart Enterprise Market Value Share Analysis, by Deployment, 2023

Figure 27: Global Smart Enterprise Market Value Share Analysis, by Deployment, 2031

Figure 28: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Cloud, 2023 - 2031

Figure 29: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by On-premise, 2023 - 2031

Figure 30: Global Smart Enterprise Market Value Share Analysis, by Enterprise Size, 2023

Figure 31: Global Smart Enterprise Market Value Share Analysis, by Enterprise Size, 2031

Figure 32: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 33: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 34: Global Smart Enterprise Market Value Share Analysis, by End-user, 2023

Figure 35: Global Smart Enterprise Market Value Share Analysis, by End-user, 2031

Figure 36: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 37: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Chemicals & Materials, 2023 - 2031

Figure 38: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 39: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Food & Beverage, 2023 - 2031

Figure 40: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Consumer Goods, 2023 - 2031

Figure 41: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Aerospace & Defense, 2023 - 2031

Figure 42: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Industrial Equipment, 2023 - 2031

Figure 43: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 44: Global Smart Enterprise Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 45: Global Smart Enterprise Market Opportunity (US$ Mn), by Region

Figure 46: Global Smart Enterprise Market Opportunity Share (%), by Region, 2023-2031

Figure 47: Global Smart Enterprise Market Size (US$ Mn), by Region, 2023 & 2031

Figure 48: Global Smart Enterprise Market Value Share Analysis, by Region, 2023

Figure 49: Global Smart Enterprise Market Value Share Analysis, by Region, 2031

Figure 50: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 51: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 52: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 53: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 54: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 55: North America Smart Enterprise Market Revenue Opportunity Share, by Component

Figure 56: North America Smart Enterprise Market Revenue Opportunity Share, by Technology

Figure 57: North America Smart Enterprise Market Revenue Opportunity Share, by Deployment

Figure 58: North America Smart Enterprise Market Revenue Opportunity Share, by Enterprise Size

Figure 59: North America Smart Enterprise Market Revenue Opportunity Share, by End-user

Figure 60: North America Smart Enterprise Market Revenue Opportunity Share, by Country

Figure 61: North America Smart Enterprise Market Value Share Analysis, by Component, 2023

Figure 62: North America Smart Enterprise Market Value Share Analysis, by Component, 2031

Figure 63: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Hardware, 2023 - 2031

Figure 64: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 65: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 66: North America Smart Enterprise Market Value Share Analysis, by Technology, 2023

Figure 67: North America Smart Enterprise Market Value Share Analysis, by Technology, 2031

Figure 68: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by MES, 2023 - 2031

Figure 69: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by PLC, 2023 - 2031

Figure 70: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by ERP, 2023 - 2031

Figure 71: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by SCADA, 2023 - 2031

Figure 72: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by HMI, 2023 - 2031

Figure 73: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 74: North America Smart Enterprise Market Value Share Analysis, by Deployment, 2023

Figure 75: North America Smart Enterprise Market Value Share Analysis, by Deployment, 2031

Figure 76: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Cloud, 2023 - 2031

Figure 77: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by On-premise, 2023 - 2031

Figure 78: North America Smart Enterprise Market Value Share Analysis, by Enterprise Size, 2023

Figure 79: North America Smart Enterprise Market Value Share Analysis, by Enterprise Size, 2031

Figure 80: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 81: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 82: North America Smart Enterprise Market Value Share Analysis, by End-user, 2023

Figure 83: North America Smart Enterprise Market Value Share Analysis, by End-user, 2031

Figure 84: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 85: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Chemicals & Materials, 2023 - 2031

Figure 86: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 87: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Food & Beverage, 2023 - 2031

Figure 88: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Consumer Goods, 2023 - 2031

Figure 89: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Aerospace & Defense, 2023 - 2031

Figure 90: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Industrial Equipment, 2023 - 2031

Figure 91: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 92: North America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 93: North America Smart Enterprise Market Value Share Analysis, by Country, 2023

Figure 94: North America Smart Enterprise Market Value Share Analysis, by Country, 2031

Figure 95: U.S. Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 96: Canada Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 97: Mexico Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 98: Europe Smart Enterprise Market Revenue Opportunity Share, by Component

Figure 99: Europe Smart Enterprise Market Revenue Opportunity Share, by Technology

Figure 100: Europe Smart Enterprise Market Revenue Opportunity Share, by Deployment

Figure 101: Europe Smart Enterprise Market Revenue Opportunity Share, by Enterprise Size

Figure 102: Europe Smart Enterprise Market Revenue Opportunity Share, by End-user

Figure 103: Europe Smart Enterprise Market Revenue Opportunity Share, by Country/Sub-region

Figure 104: Europe Smart Enterprise Market Value Share Analysis, by Component, 2023

Figure 105: Europe Smart Enterprise Market Value Share Analysis, by Component, 2031

Figure 106: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Hardware, 2023 - 2031

Figure 107: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 108: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 109: Europe Smart Enterprise Market Value Share Analysis, by Technology, 2023

Figure 110: Europe Smart Enterprise Market Value Share Analysis, by Technology, 2031

Figure 111: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by MES, 2023 - 2031

Figure 112: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by PLC, 2023 - 2031

Figure 113: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by ERP, 2023 - 2031

Figure 114: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by SCADA, 2023 - 2031

Figure 115: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by HMI, 2023 - 2031

Figure 116: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 117: Europe Smart Enterprise Market Value Share Analysis, by Deployment, 2023

Figure 118: Europe Smart Enterprise Market Value Share Analysis, by Deployment, 2031

Figure 119: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Cloud, 2023 - 2031

Figure 120: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by On-premise, 2023 - 2031

Figure 121: Europe Smart Enterprise Market Value Share Analysis, by Enterprise Size, 2023

Figure 122: Europe Smart Enterprise Market Value Share Analysis, by Enterprise Size, 2031

Figure 123: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 124: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 125: Europe Smart Enterprise Market Value Share Analysis, by End-user, 2023

Figure 126: Europe Smart Enterprise Market Value Share Analysis, by End-user, 2031

Figure 127: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 128: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Chemicals & Materials, 2023 - 2031

Figure 129: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 130: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Food & Beverage, 2023 - 2031

Figure 131: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Consumer Goods, 2023 - 2031

Figure 132: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Aerospace & Defense, 2023 - 2031

Figure 133: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Industrial Equipment, 2023 - 2031

Figure 134: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 135: Europe Smart Enterprise Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 136: Europe Smart Enterprise Market Value Share Analysis, by Country/Sub-region, 2023

Figure 137: Europe Smart Enterprise Market Value Share Analysis, by Country/Sub-region, 2031

Figure 138: Germany Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 139: U.K. Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 140: France Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 141: Italy Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 142: Spain Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 143: Asia Pacific Smart Enterprise Market Revenue Opportunity Share, by Component

Figure 144: Asia Pacific Smart Enterprise Market Revenue Opportunity Share, by Technology

Figure 145: Asia Pacific Smart Enterprise Market Revenue Opportunity Share, by Deployment

Figure 146: Asia Pacific Smart Enterprise Market Revenue Opportunity Share, by Enterprise Size

Figure 147: Asia Pacific Smart Enterprise Market Revenue Opportunity Share, by End-user

Figure 148: Asia Pacific Smart Enterprise Market Revenue Opportunity Share, by Country/Sub-region

Figure 149: Asia Pacific Smart Enterprise Market Value Share Analysis, by Component, 2023

Figure 150: Asia Pacific Smart Enterprise Market Value Share Analysis, by Component, 2031

Figure 151: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Hardware, 2023 - 2031

Figure 152: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 153: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 154: Asia Pacific Smart Enterprise Market Value Share Analysis, by Technology, 2023

Figure 155: Asia Pacific Smart Enterprise Market Value Share Analysis, by Technology, 2031

Figure 156: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by MES, 2023 - 2031

Figure 157: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by PLC, 2023 - 2031

Figure 158: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by ERP, 2023 - 2031

Figure 159: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by SCADA, 2023 - 2031

Figure 160: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by HMI, 2023 - 2031

Figure 161: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 162: Asia Pacific Smart Enterprise Market Value Share Analysis, by Deployment, 2023

Figure 163: Asia Pacific Smart Enterprise Market Value Share Analysis, by Deployment, 2031

Figure 164: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Cloud, 2023 - 2031

Figure 165: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by On-premise, 2023 - 2031

Figure 166: Asia Pacific Smart Enterprise Market Value Share Analysis, by Enterprise Size, 2023

Figure 167: Asia Pacific Smart Enterprise Market Value Share Analysis, by Enterprise Size, 2031

Figure 168: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 169: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 170: Asia Pacific Smart Enterprise Market Value Share Analysis, by End-user, 2023

Figure 171: Asia Pacific Smart Enterprise Market Value Share Analysis, by End-user, 2031

Figure 172: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 173: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Chemicals & Materials, 2023 - 2031

Figure 174: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 175: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Food & Beverage, 2023 - 2031

Figure 176: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Consumer Goods, 2023 - 2031

Figure 177: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Aerospace & Defense, 2023 - 2031

Figure 178: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Industrial Equipment, 2023 - 2031

Figure 179: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 180: Asia Pacific Smart Enterprise Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 181: Asia Pacific Smart Enterprise Market Value Share Analysis, by Country/Sub-region, 2023

Figure 182: Asia Pacific Smart Enterprise Market Value Share Analysis, by Country/Sub-region, 2031

Figure 183: China Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 184: India Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 185: Japan Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 186: ASEAN Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 187: Middle East & Africa Smart Enterprise Market Revenue Opportunity Share, by Component

Figure 188: Middle East & Africa Smart Enterprise Market Revenue Opportunity Share, by Technology

Figure 189: Middle East & Africa Smart Enterprise Market Revenue Opportunity Share, by Deployment

Figure 190: Middle East & Africa Smart Enterprise Market Revenue Opportunity Share, by Enterprise Size

Figure 191: Middle East & Africa Smart Enterprise Market Revenue Opportunity Share, by End-user

Figure 192: Middle East & Africa Smart Enterprise Market Revenue Opportunity Share, by Country/Sub-region

Figure 193: Middle East & Africa Smart Enterprise Market Value Share Analysis, by Component, 2023

Figure 194: Middle East & Africa Smart Enterprise Market Value Share Analysis, by Component, 2031

Figure 195: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Hardware, 2023 - 2031

Figure 196: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 197: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 198: Middle East & Africa Smart Enterprise Market Value Share Analysis, by Technology, 2023

Figure 199: Middle East & Africa Smart Enterprise Market Value Share Analysis, by Technology, 2031

Figure 200: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by MES, 2023 - 2031

Figure 201: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by PLC, 2023 - 2031

Figure 202: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by ERP, 2023 - 2031

Figure 203: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by SCADA, 2023 - 2031

Figure 204: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by HMI, 2023 - 2031

Figure 205: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 206: Middle East & Africa Smart Enterprise Market Value Share Analysis, by Deployment, 2023

Figure 207: Middle East & Africa Smart Enterprise Market Value Share Analysis, by Deployment, 2031

Figure 208: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Cloud, 2023 - 2031

Figure 209: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by On-premise, 2023 - 2031

Figure 210: Middle East & Africa Smart Enterprise Market Value Share Analysis, by Enterprise Size, 2023

Figure 211: Middle East & Africa Smart Enterprise Market Value Share Analysis, by Enterprise Size, 2031

Figure 212: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 213: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 214: Middle East & Africa Smart Enterprise Market Value Share Analysis, by End-user, 2023

Figure 215: Middle East & Africa Smart Enterprise Market Value Share Analysis, by End-user, 2031

Figure 216: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 217: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Chemicals & Materials, 2023 - 2031

Figure 218: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 219: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Food & Beverage, 2023 - 2031

Figure 220: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Consumer Goods, 2023 - 2031

Figure 221: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Aerospace & Defense, 2023 - 2031

Figure 222: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Industrial Equipment, 2023 - 2031

Figure 223: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 224: Middle East & Africa Smart Enterprise Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 225: Middle East & Africa East & Africa East & Africa Smart Enterprise Market Value Share Analysis, by Country/Sub-region, 2023

Figure 226: Middle East & Africa Smart Enterprise Market Value Share Analysis, by Country/Sub-region, 2031

Figure 227: Saudi Arabia Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 228: U.A.E. Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 229: South Africa Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 230: South America Smart Enterprise Market Revenue Opportunity Share, by Component

Figure 231: South America Smart Enterprise Market Revenue Opportunity Share, by Technology

Figure 232: South America Smart Enterprise Market Revenue Opportunity Share, by Deployment

Figure 233: South America Smart Enterprise Market Revenue Opportunity Share, by Enterprise Size

Figure 234: South America Smart Enterprise Market Revenue Opportunity Share, by End-user

Figure 235: South America Smart Enterprise Market Revenue Opportunity Share, by Country/Sub-region

Figure 236: South America Smart Enterprise Market Value Share Analysis, by Component, 2023

Figure 237: South America Smart Enterprise Market Value Share Analysis, by Component, 2031

Figure 238: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Hardware, 2023 - 2031

Figure 239: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Software, 2023 - 2031

Figure 240: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 241: South America Smart Enterprise Market Value Share Analysis, by Technology, 2023

Figure 242: South America Smart Enterprise Market Value Share Analysis, by Technology, 2031

Figure 243: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by MES, 2023 - 2031

Figure 244: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by PLC, 2023 - 2031

Figure 245: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by ERP, 2023 - 2031

Figure 246: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by SCADA, 2023 - 2031

Figure 247: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by HMI, 2023 - 2031

Figure 248: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 249: South America Smart Enterprise Market Value Share Analysis, by Deployment, 2023

Figure 250: South America Smart Enterprise Market Value Share Analysis, by Deployment, 2031

Figure 251: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Cloud, 2023 - 2031

Figure 252: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by On-premise, 2023 - 2031

Figure 253: South America Smart Enterprise Market Value Share Analysis, by Enterprise Size, 2023

Figure 254: South America Smart Enterprise Market Value Share Analysis, by Enterprise Size, 2031

Figure 255: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 256: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 257: South America Smart Enterprise Market Value Share Analysis, by End-user, 2023

Figure 258: South America Smart Enterprise Market Value Share Analysis, by End-user, 2031

Figure 259: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 260: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Chemicals & Materials, 2023 - 2031

Figure 261: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 262: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Food & Beverage, 2023 - 2031

Figure 263: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Consumer Goods, 2023 - 2031

Figure 264: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Aerospace & Defense, 2023 - 2031

Figure 265: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Industrial Equipment, 2023 - 2031

Figure 266: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Oil & Gas, 2023 - 2031

Figure 267: South America Smart Enterprise Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 268: South America Smart Enterprise Market Value Share Analysis, by Country/Sub-region, 2023

Figure 269: South America Smart Enterprise Market Value Share Analysis, by Country/Sub-region, 2031

Figure 270: Brazil Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 271: Argentina Smart Enterprise Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031