Reports

Reports

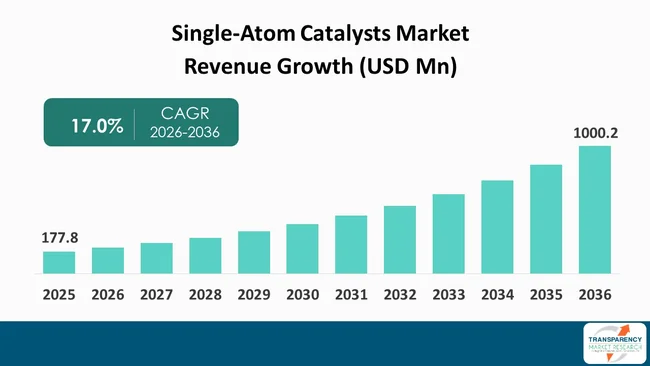

The global single-atom catalysts market size was valued at US$ 177.8 Million in 2025 and is projected to reach US$ 1000.2 Million by 2036, expanding at a CAGR of 17.0% from 2026 to 2036. The market growth is driven by faster adoption of green hydrogen and fuel-cell systems, and industrial emissions control and electrification-driven chemical manufacturing.

The single-atom catalyst market (SACs) is shifting from a research-oriented area to the early stages of commercialization on the back of compelling economic and regulatory imperatives. A prominent push is emerging within the green hydrogen, fuel cell, and emissions mitigation areas, which are all driven by the cost of the catalyst, the availability of precious metals, and efficiency considerations. Verifiable benefits of up to a 50-70% reduction in precious metal loading, along with a current mass activity enhancement of 2-5 times that of existing alternatives, make the single-atom technology indispensable for overall large-scale applications above the 100 MW mark.

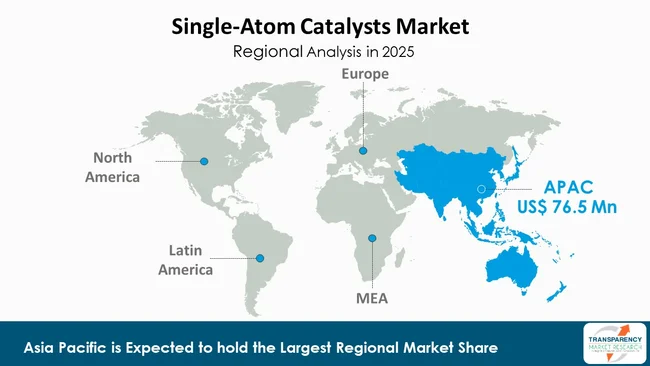

The pre-eminence of the Asia Pacific market can be attributed to the sheer scale of the chemical processing enterprises within the region, as well as public investment in hydrogen research initiatives in the past. North America and Europe are building a foundation in terms of innovation, verification, and the support of regulations.

On the vendor front, the prominent manufacturers are targeting the establishment of supportive infrastructure for pilot plants and atom-efficient catalyst technology kits. On the research front, the specialty suppliers are rapidly increasing the research access channel through their single-atom catalyst products.

Single-atom catalysts (SACs) are emerging as the next generation of catalysts, wherein metal atoms are dispersed atomically on appropriate support materials like carbon, metal oxides, or nitrides are used for stabilizing these metal atoms. Since SACs feature metal active sites dispersed atomically, these maximize metal atom utilization efficiency with high precision for controlling catalysis, selectivity, and reaction pathways. Such precision in designing SACs further assists manufacturers in using less precious or costly metal for their catalysis reactions significantly.

For industries, the advantages offered by SACs are obvious regarding their efficacy, sustainability, and greater process efficiencies. Single-atom catalysts, with their distinct active sites, enhance reaction selectivity, thus further contributing to less formation of by-products, reduced need for downstream purification, as well as lower energy consumption for overall reactions.

Moreover, as advanced research has continuously aided developments for better thermal robustness for single-atom catalysts regarding former apprehensions regarding atom migration as well as agglomeration during their operational activities, these single-atom catalysts are being assessed for greater application potentialities within energy conversion reactions, emission reactions, as well as chemical reactions with unbridled needs for their performance optimization as well as related cost efficacies.

| Attribute | Detail |

|---|---|

| Single-atom catalysts Market Drivers |

|

The rapid emergence of green hydrogen and fuel cell technologies is driving the single-atom catalysts (SACs) market, as catalysis costs and efficiencies are extremely influential to system costs. Even in proton exchange membrane (PEM) fuel cell and electrolyzer technologies, where platinum and iridium are used, these precious metals could potentially contribute to 20-30% of stack costs, thereby necessitating greater efficiency in their use. For this purpose, single-atom catalysts come into play and help to achieve near 100% utilization of active metal atoms, as opposed to 30-40% effective catalysis efficiency in nanoparticle catalysts.

Research states that single-atom catalysts performed up to 2-5 times better than their nanoparticle catalysts in terms of gram platinum-specific current, and this could potentially lead to 50-70% reduction in precious-metal use without compromising system efficiencies. Even for large-scale electrolyzer electricity production, which usually requires energy above 100 MW, such advancements could save millions of dollars in system costs, which are less susceptible to market price variabilities for precious metals.

Even now, with governments and companies investing billions of dollars into hydrogen hubs, FCVs, and energy production, there is a growing interest in system catalysts where efficiencies, long-term system stability, and costs are complemented, where single-atom catalysts come into prominence.

Stringent emission standards and transition to electrified, low carbon chemical production catalyze the development and deployment of single-atom catalysts (SACs). In industrial emissions control, small catalytic efficiency enhancements can provide significant emissions reductions and cost savings. For instance, in NOx and CO removal applications in the power industry and industrial furnaces, SAC enhancements in catalytic efficiency can directly translate to reduced fuel penalties and unscheduled downtime, thereby offsetting operating costs.

In case of chemical production, SACs can facilitate the transition to electrified chemical production by virtue of selectively reacting at lower temperatures. Reducing reaction temperatures by 20 to 40 degrees Celsius can provide 5 to 10% energy reductions in continuously operated, commercially-sized processes, offering attractive returns in the context of increased power costs.

In addition, SAC-catalyzed processes can provide significant selectivity enhancements, often increasing catalytic process yield by 5 to 20 percentage points, thereby lowering the generation of by-products, hence processing and disposal costs. As producers must contend with increasing carbon intensity expectations and expectations to purse decarbonized core processes, SACs can provide technology to improve efficiency, reduce emissions, and align catalytic processes to the new, low emissions, and therefore electricity-intensive manufacturing paradigm.

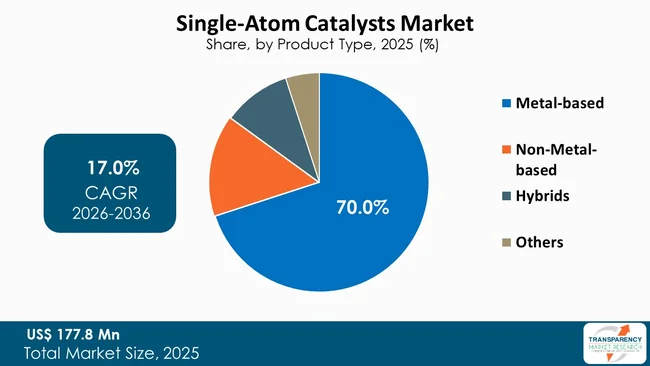

Metal-based SACs are currently the most visible products in the single-atom catalyst market due to their enhanced catalytic properties. These SACs are primarily made up of isolated metal atoms like platinum, iron, cobalt, nickel, or iridium supported on carbon or oxides. These materials thus enable the optimal use of metal atoms.

Metal-based SACs, as compared to nanoparticle-based catalysts, are more active since they offer 2-5 times greater mass activity. This enables the reduction of precious metal loadings by 50-70% without affecting their activity. The efficiency of these metal-based SACs helps in directly offsetting the costs related to fluctuating prices of precious metals.

On the application side, platinum SACs in fuel cells and electrolyzers cut down the overall cost of catalysts by 20-30% per unit. Alternatively, transition-metal SACs enhance the reaction selectivity in chemical synthesis and pollutant emission control by as much as 5-15 percentage points. This enables the reduction of feedstock losses as well as overall separation costs related to separation techniques. As various industries focus on developing more sustainable technologies in terms of cost efficiency, optimization, and sustainability, it is clear that metal-based SACs are leading in the overall adoption rate in various energy-related applications.

| Attribute | Detail |

|---|---|

| Key Opportunity |

|

The commercialization of SACs in green hydrogen and CO₂ conversion represents an exceptionally high value, as these technologies transition from pilot to industrial scale. In water electrolysis, for example, precious metals like iridium and platinum comprise 20-30% of the total stack costs. SACs can enable near-100% metal utilization and have already demonstrated the potential of reducing iridium or platinum loadings by 50-70%, translating into multi-million-dollar savings for 100-500 MW electrolyzer projects.

To developers now facing intense volatility in the prices of these precious metals, this reduction materially enhances project bankability and return on investment. In CO₂ conversion applications, including CO₂-to-CO and CO₂-to-methanol paths, SACs provide better selectivity and energy efficiency. Studies show selectivity enhancements of 10-20 percentage points as compared with conventional catalysts, which lowers by-product formation and downstream separation costs. In addition, higher current densities-enabling greater throughput per reactor unit-are also often improved by 30-50%.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia Pacific’s market for SACs leads due to significant government-supported investments in clean energy, advanced materials, and chemical industries. The cumulative R&D expenditure of China, Japan, and South Korea represents a substantial market share for catalyst R&D, with individual Chinese programs exceeding US$ 50 Bn per year for hydrogen, carbon utilization, and advanced materials.

The installation of mega electrolyzers, over 100 MW capacity per installation, as well as rapid scaling up of refining capacity, draws intense interest for cost-effective, advanced SAC catalysts, making the Asia Pacific market leader with an estimated market share of 43%. The North America’s market comes next with significant support from a strong innovation ecosystem and commercialization ecosystem.

The United States government has allocated US$ 8-10 Bn for regional hydrogen hubs, catalyzing the interest for SACs with the ability to cut precious metal-loading by 50-70% for FCs and electrolyzers. The European market comes next, with significant push support for emissions control regulations. European industries seek SACs with 10-15% selectivity enhancement for carbon emissions reduction, particularly in emissions control and electrified chemical conversion.

Sinopec Catalyst Co., Ltd. is a key player in the single-atom catalyst market based on its refinery catalysts business and petrochemicals business. Worth mentioning is that Sinopec possesses a considerable amount of R&D resources; therefore, Sinopec Catalyst is in a very optimal position to apply the novel idea of single-atom catalysts in the field of hydrogen production, emission reduction, and the chemical industry. This broad market in China facilitates Sinopec Catalyst in accelerating the validation of innovation in the field of single-atom catalysts.

Johnson Matthey is an important player in the single-atom catalysts market, capitalizing on its vast knowledge base in precious metal chemistry and its innovative capability in designing better catalysts. The criterion of the company to efficiently utilize the precious metal can be best met by single-atom catalyst technology, especially in fuel cells, electrolyzers, and emissions management systems.

The skills possessed by the company in preparing, optimizing, and scaling up the catalysts also allow it to meet the challenges of cost and performance in the area of single-atom catalyst technology.

MSE Supplies, Evonik Industries AG, Clariant AG, Topsoe, Angstrom Advanced Inc, BASF SE, Umicore N.V., Shanghai Richem International Co., Ltd, Nanjing Catalyst New Material Co., Ltd, and W.R. Grace & Co are some other major companies operating in the market.

Each of these players has been profiled in the single-atom catalysts industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 | US$ 177.8 Million |

| Market Forecast Value in 2036 | US$ 1000.2 Million |

| Growth Rate (CAGR) | 17.0% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2021-2025 |

| Quantitative Units | US$ Million for Value & Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Single-atom catalysts market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The single-atom catalysts market was valued at US$ 177.8 Million in 2025

The single-atom catalysts industry is expected to grow at a CAGR of 17.0% from 2026 to 2036

Faster adoption of green hydrogen and fuel-cell systems, and industrial emissions control and electrification-driven chemical manufacturing

Metal based was the largest product type segment in the single-atom catalysts market.

Asia Pacific was the most lucrative region in 2025

MSE Supplies, Johnson Matthey, Sinopec Catalyst Co., Ltd, Evonik Industries AG, Clariant AG, Topsoe, Angstrom Advanced Inc, BASF SE, Umicore N.V., and W.R. Grace & Co are the major companies in the global single-atom catalysts market.

Table 1 Global Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 2 Global Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 3 Global Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material 2026 to 2036

Table 4 Global Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material 2026 to 2036

Table 5 Global Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 6 Global Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 7 Global Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 8 Global Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use, 2026 to 2036

Table 9 Global Single-Atom Catalysts Market Volume (Tons) Forecast, by Region, 2026 to 2036

Table 10 Global Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Region, 2026 to 2036

Table 11 North America Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 12 North America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 13 North America Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material 2026 to 2036

Table 14 North America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material 2026 to 2036

Table 15 North America Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 16 North America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 17 North America Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 18 North America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use, 2026 to 2036

Table 19 North America Single-Atom Catalysts Market Volume (Tons) Forecast, by Country, 2026 to 2036

Table 20 North America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Country, 2026 to 2036

Table 21 U.S. Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 22 U.S. Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 23 U.S. Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material 2026 to 2036

Table 24 U.S. Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 25 U.S. Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 26 U.S. Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 27 U.S. Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 28 U.S. Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use, 2026 to 2036

Table 29 Canada Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 30 Canada Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 31 Canada Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 32 Canada Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 33 Canada Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 34 Canada Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 35 Canada Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 36 Canada Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 37 Europe Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 38 Europe Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 39 Europe Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material 2026 to 2036

Table 40 Europe Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 41 Europe Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 42 Europe Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 43 Europe Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 44 Europe Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 45 Europe Single-Atom Catalysts Market Volume (Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 46 Europe Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Country and Sub-region, 2026 to 2036

Table 47 Germany Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 48 Germany Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 49 Germany Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 50 Germany Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 51 Germany Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 52 Germany Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 53 Germany Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 54 Germany Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 55 France Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 56 France Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 57 France Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 58 France Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 59 France Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 60 France Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 61 France Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 62 France Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 63 U.K. Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 64 U.K. Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 65 U.K. Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 66 U.K. Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 67 U.K. Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 68 U.K. Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 69 U.K. Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 70 U.K. Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 71 Italy Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 72 Italy Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 73 Italy Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 74 Italy Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 75 Italy Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 76 Italy Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 77 Italy Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 78 Italy Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 79 Spain Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 80 Spain Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 81 Spain Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 82 Spain Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 83 Spain Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 84 Spain Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 85 Spain Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 86 Spain Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 87 Russia & CIS Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 88 Russia & CIS Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 89 Russia & CIS Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 90 Russia & CIS Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 91 Russia & CIS Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 92 Russia & CIS Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 93 Russia & CIS Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 94 Russia & CIS Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 95 Rest of Europe Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 96 Rest of Europe Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 97 Rest of Europe Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 98 Rest of Europe Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 99 Rest of Europe Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 100 Rest of Europe Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 101 Rest of Europe Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 102 Rest of Europe Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 103 Asia Pacific Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 104 Asia Pacific Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 105 Asia Pacific Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 106 Asia Pacific Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 107 Asia Pacific Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 108 Asia Pacific Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 109 Asia Pacific Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 110 Asia Pacific Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 111 Asia Pacific Single-Atom Catalysts Market Volume (Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 112 Asia Pacific Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Country and Sub-region, 2026 to 2036

Table 113 China Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 114 China Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type 2026 to 2036

Table 115 China Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 116 China Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 117 China Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 118 China Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 119 China Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 120 China Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 121 Japan Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 122 Japan Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 123 Japan Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 124 Japan Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 125 Japan Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 126 Japan Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 127 Japan Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 128 Japan Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 129 India Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 130 India Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 131 India Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 132 India Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 133 India Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 134 India Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 135 India Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 136 India Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 137 ASEAN Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 138 ASEAN Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 139 ASEAN Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 140 ASEAN Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 141 ASEAN Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 142 ASEAN Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 143 ASEAN Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 144 ASEAN Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 145 Rest of Asia Pacific Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 146 Rest of Asia Pacific Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 147 Rest of Asia Pacific Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 148 Rest of Asia Pacific Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 149 Rest of Asia Pacific Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 150 Rest of Asia Pacific Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 151 Rest of Asia Pacific Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 152 Rest of Asia Pacific Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 153 Latin America Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 154 Latin America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 155 Latin America Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 156 Latin America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 157 Latin America Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 158 Latin America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 159 Latin America Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 160 Latin America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 161 Latin America Single-Atom Catalysts Market Volume (Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 162 Latin America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Country and Sub-region, 2026 to 2036

Table 163 Brazil Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 164 Brazil Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 165 Brazil Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 166 Brazil Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 167 Brazil Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 168 Brazil Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 169 Brazil Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 170 Brazil Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 171 Mexico Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 172 Mexico Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 173 Mexico Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 174 Mexico Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 175 Mexico Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 176 Mexico Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 177 Mexico Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 178 Mexico Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 179 Rest of Latin America Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 180 Rest of Latin America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 181 Rest of Latin America Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 182 Rest of Latin America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 183 Rest of Latin America Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 184 Rest of Latin America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 185 Rest of Latin America Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 186 Rest of Latin America Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 187 Middle East & Africa Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 188 Middle East & Africa Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 189 Middle East & Africa Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 190 Middle East & Africa Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 191 Middle East & Africa Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 192 Middle East & Africa Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 193 Middle East & Africa Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 194 Middle East & Africa Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 195 Middle East & Africa Single-Atom Catalysts Market Volume (Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 196 Middle East & Africa Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Country and Sub-region, 2026 to 2036

Table 197 GCC Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 198 GCC Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 199 GCC Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 200 GCC Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 201 GCC Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 202 GCC Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 203 GCC Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 204 GCC Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 205 South Africa Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 206 South Africa Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 207 South Africa Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 208 South Africa Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 209 South Africa Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 210 South Africa Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 211 South Africa Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 212 South Africa Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Table 213 Rest of Middle East & Africa Single-Atom Catalysts Market Volume (Tons) Forecast, by Product Type, 2026 to 2036

Table 214 Rest of Middle East & Africa Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Product Type, 2026 to 2036

Table 215 Rest of Middle East & Africa Single-Atom Catalysts Market Volume (Tons) Forecast, by Support Material, 2026 to 2036

Table 216 Rest of Middle East & Africa Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Support Material, 2026 to 2036

Table 217 Rest of Middle East & Africa Single-Atom Catalysts Market Volume (Tons) Forecast, by Application, 2026 to 2036

Table 218 Rest of Middle East & Africa Single-Atom Catalysts Market Value (US$ Mn) Forecast, by Application, 2026 to 2036

Table 219 Rest of Middle East & Africa Single-Atom Catalysts Market Volume (Tons) Forecast, by End-use, 2026 to 2036

Table 220 Rest of Middle East & Africa Single-Atom Catalysts Market Value (US$ Mn) Forecast, by End-use 2026 to 2036

Figure 1 Global Single-Atom Catalysts Market Volume Share Analysis, by Product Type, 2025, 2029, and 2036

Figure 2 Global Single-Atom Catalysts Market Attractiveness, by Product Type

Figure 3 Global Single-Atom Catalysts Market Volume Share Analysis, by Support Material, 2025, 2029, and 2036

Figure 4 Global Single-Atom Catalysts Market Attractiveness, by Support Material

Figure 5 Global Single-Atom Catalysts Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 6 Global Single-Atom Catalysts Market Attractiveness, by Application

Figure 7 Global Single-Atom Catalysts Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 8 Global Single-Atom Catalysts Market Attractiveness, by End-use

Figure 9 Global Single-Atom Catalysts Market Volume Share Analysis, by Region, 2025, 2029, and 2036

Figure 10 Global Single-Atom Catalysts Market Attractiveness, by Region

Figure 11 North America Single-Atom Catalysts Market Volume Share Analysis, by Product Type, 2025, 2029, and 2036

Figure 12 North America Single-Atom Catalysts Market Attractiveness, by Product Type

Figure 13 North America Single-Atom Catalysts Market Volume Share Analysis, by Support Material, 2025, 2029, and 2036

Figure 14 North America Single-Atom Catalysts Market Attractiveness, by Support Material

Figure 15 North America Single-Atom Catalysts Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 16 North America Single-Atom Catalysts Market Attractiveness, by Application

Figure 17 North America Single-Atom Catalysts Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 18 North America Single-Atom Catalysts Market Attractiveness, by End-use

Figure 19 North America Single-Atom Catalysts Market Attractiveness, by Country and Sub-region

Figure 20 Europe Single-Atom Catalysts Market Volume Share Analysis, by Product Type, 2025, 2029, and 2036

Figure 21 Europe Single-Atom Catalysts Market Attractiveness, by Product Type

Figure 22 Europe Single-Atom Catalysts Market Volume Share Analysis, by Support Material, 2025, 2029, and 2036

Figure 23 Europe Single-Atom Catalysts Market Attractiveness, by Support Material

Figure 24 Europe Single-Atom Catalysts Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 25 Europe Single-Atom Catalysts Market Attractiveness, by Application

Figure 26 Europe Single-Atom Catalysts Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 27 Europe Single-Atom Catalysts Market Attractiveness, by End-use

Figure 28 Europe Single-Atom Catalysts Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 29 Europe Single-Atom Catalysts Market Attractiveness, by Country and Sub-region

Figure 30 Asia Pacific Single-Atom Catalysts Market Volume Share Analysis, by Product Type, 2025, 2029, and 2036

Figure 31 Asia Pacific Single-Atom Catalysts Market Attractiveness, by Product Type

Figure 32 Asia Pacific Single-Atom Catalysts Market Volume Share Analysis, by Support Material, 2025, 2029, and 2036

Figure 33 Asia Pacific Single-Atom Catalysts Market Attractiveness, by Support Material

Figure 34 Asia Pacific Single-Atom Catalysts Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 35 Asia Pacific Single-Atom Catalysts Market Attractiveness, by Application

Figure 36 Asia Pacific Single-Atom Catalysts Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 37 Asia Pacific Single-Atom Catalysts Market Attractiveness, by End-use

Figure 38 Asia Pacific Single-Atom Catalysts Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 39 Asia Pacific Single-Atom Catalysts Market Attractiveness, by Country and Sub-region

Figure 40 Latin America Single-Atom Catalysts Market Volume Share Analysis, by Product Type, 2025, 2029, and 2036

Figure 41 Latin America Single-Atom Catalysts Market Attractiveness, by Product Type

Figure 42 Latin America Single-Atom Catalysts Market Volume Share Analysis, by Support Material, 2025, 2029, and 2036

Figure 43 Latin America Single-Atom Catalysts Market Attractiveness, by Support Material

Figure 44 Latin America Single-Atom Catalysts Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 45 Latin America Single-Atom Catalysts Market Attractiveness, by Application

Figure 46 Latin America Single-Atom Catalysts Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 47 Latin America Single-Atom Catalysts Market Attractiveness, by End-use

Figure 48 Latin America Single-Atom Catalysts Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 49 Latin America Single-Atom Catalysts Market Attractiveness, by Country and Sub-region

Figure 50 Middle East & Africa Single-Atom Catalysts Market Volume Share Analysis, by Product Type, 2025, 2029, and 2036

Figure 51 Middle East & Africa Single-Atom Catalysts Market Attractiveness, by Product Type

Figure 52 Middle East & Africa Single-Atom Catalysts Market Volume Share Analysis, by Support Material, 2025, 2029, and 2036

Figure 53 Middle East & Africa Single-Atom Catalysts Market Attractiveness, by Support Material

Figure 54 Middle East & Africa Single-Atom Catalysts Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 55 Middle East & Africa Single-Atom Catalysts Market Attractiveness, by Application

Figure 56 Middle East & Africa Single-Atom Catalysts Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 57 Middle East & Africa Single-Atom Catalysts Market Attractiveness, by End-use

Figure 58 Middle East & Africa Single-Atom Catalysts Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 59 Middle East & Africa Single-Atom Catalysts Market Attractiveness, by Country and Sub-region