Reports

Reports

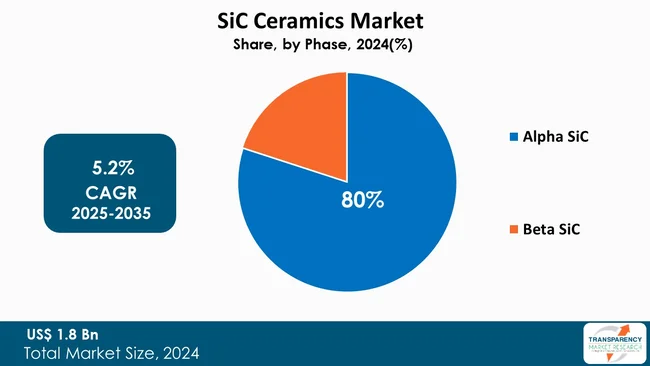

The global SiC ceramics market size was valued at US$ 1.8 Billion in 2024 and is projected to reach US$ 3.1 Billion by 2035, expanding at a CAGR of 5.2% from 2025 to 2035. The market growth is driven by rapid expansion of electric vehicles and power electronics sectors, and rising adoption in high-temperature industrial applications.

The worldwide silicon carbide (SiC) ceramics market is set to experience impressive growth over the next few years. This growth is largely due to expansion of the electric vehicle (EV) and power electronics sectors in addition to the extension of high-temperature industrial applications. Silicon carbide (SiC) ceramics remain the most feasible materials in the above-mentioned areas, which is the reason why they make the most of the demand in the several segments of the market.

Continued energy saving and durability, even in extreme operating conditions, are examples of SiC ceramics advantages that attract the use of these materials in diverse applications such as semiconductors, automotive power modules, chemical processing, and aerospace. Nearly half of the global demand is met by the Asia Pacific region, which is driven by rapid industrialization and an expanded EV manufacturing in China, Japan, and South Korea, while Europe and North America are still holding good positions through the applications of the aerospace, semiconductor, and defense sectors.

The big players on the market, for example, Saint-Gobain, NGK Insulators, and Kyocera are strategically multiplexing their resources in a heavy drive to meet the quality requirements and the ever-rising demand through capacity expansions and advanced production technologies. New technology in sintering, CVD processes, and material purity are some of the advancements that more companies have embraced to open the market for wider adoption and secure the use of SiC ceramics in the future as strategic materials that will facilitate sustainable and high-performing industrial growth.

Silicon carbide (SiC) ceramics are amongst the most progressive categories of technical ceramics. They are highly sought-after due to their long-lasting mechanical strength, resistance to very high temperatures, and to corrosive agents. Sintered, reaction-bonded, or CVD-based SiC ceramics are able to maintain their function at high temperatures, in the presence of wear, and in industrial environments under corrosive attack. Moreover, the combination of low density, high hardness, and good thermal conductivity is what made them so extremely necessary in very challenging fields of application.

A few of the most significant end-use sectors are the following: automotive; oil and gas; chemical processing; power generation; semiconductor manufacturing; aerospace; and systems of industrial furnace. In electric vehicles and power electronics, SiC ceramics contribute to higher energy efficiency and heat dissipation, thus, being their strategic importance even more strengthened.

On the other hand, companies in metallurgy, refractory industries, and process engineering that use SiC to manufacture kiln furniture, seals, bearings, nozzles, and protective components that increase operational reliability and lifecycle performance, are the ones that benefit the most from this material.

Worldwide demand does not slow down and is still very high as material producers opt for lighter, tougher, and energy-saving materials. The Asia Pacific region is the main producer and consumer of these materials, whereas North America and Europe are still large centers for high-performance and value-added SiC ceramic solutions. A great deal of progress in sintering technologies and semiconductor-grade SiC components keeps the pace very fast for new market users.

| Attribute | Detail |

|---|---|

| SiC Ceramics Market Drivers |

|

During 2024, worldwide electric vehicle (EV) sales exceeded 14 million units, which has led to an exceptional demand for high-performance silicon carbide (SiC)-based components utilized in inverters, onboard chargers, and thermal management systems. SiC ceramics offer power efficiency in EV powertrains that is 10-15% higher as compared to their silicon-based counterparts, thus directly increasing the vehicle range and reducing heat losses. The top-tier manufacturers are quickly following the lead: Tesla, BYD, and Hyundai are incorporating SiC power modules in their new-generation platforms, whereas large-scale suppliers like STMicroelectronics and Wolfspeed are increasing the production of SiC devices by more than 45% from 2023 to 2025.The expansion of power electronics is a major factor in the escalation of demand.

The worldwide number of installations of fast-charging stations has gone beyond 2.7 million units in 2024, thus calling for SiC ceramic substrates and heat-resistant parts to deliver the required reliability. Besides, the renewable energy industry is progressively using SiC-based parts in solar inverters and high-voltage converters as utility-scale solar installations are going beyond 400 GW globally in 2024.

The combined growth of EVs and power electronics continues to be a major driver behind the rising demand for SiC ceramics due to their unbeatable efficiency, excellent thermal properties, and long service life in the case of high-voltage, high-temperature operations.

The worldwide market for SiC ceramics is largely influenced by the increasing use of SiC ceramics in high-temperature industrial applications. This is further supported by the expansion of heavy industries such as steel, chemicals, glass, and power generation. SiC ceramics can withstand temperatures of over 1,600°C, provide a service life that is 5-10 times longer than that of alumina in harsh environments, and have outstanding thermal shock and corrosion resistance. Hence, they are the most suitable components for kiln furniture, burner nozzles, mechanical seals, and heat exchangers.

The steel industry which, in 2024, had a total crude steel production of more than 1.88 billion tons, is one of the most significant users of SiC-based refractories for continuous casting, ladle linings, and furnace components. In the same way, the worldwide glass manufacturing sector—with an annual output of over 92 million tons—relies heavily on SiC kiln furniture to achieve energy savings of 10-15% due to the high thermal conductivity of the material.

In the chemical processing industry, the adoption of SiC heat exchangers is on the rise, with the demand increasing at a rate of 8-10% per year as more companies search for corrosion-resistant solutions for acid and high-temperature media. The large-scale industrial transition to higher durability and energy efficiency is still going on, thus, SiC ceramics are becoming more and more acknowledged as a key material for the most extreme operating conditions.

Alpha silicon carbide (α-SiC) remains the major worldwide SiC ceramics market phase as a result of its superior crystallographic stability and its capability to maintain the mechanical strength at very high temperatures. Approximately 80% of all SiC ceramics consumed globally are based on α-SiC which is the core of high-performance components that require resistance to thermal shock, oxidation, and abrasive wear for a long time. Its hexagonal structure provides higher elastic modulus and better creep resistance than β-SiC, thus, it is a must for advanced structural applications.

The α-SiC is progressively being used in pump and valve industry for precision-engineered components, with the demand increasing at 7-9% per year because of the material’s stability in corrosive, high-pressure conditions. Parts of process chamber in semiconductor fabrication equipment also use α-SiC where its dimensional stability is the main reason for more than 20% longer equipment uptime.

Furthermore, the introduction of α-SiC composites in aerospace applications (e.g. thermal protection systems and high-speed turbine components) is helping the industry to carry out weight reductions of 15-20% while the thermal integrity is still kept.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific continues to be the major region in the global SiC ceramics market with contribution of approximately 47% to the total global demand. China, Japan, and South Korea are leading this change where the large-scale manufacturing of semiconductors, automotive, and industrial processing is the main source of the rapid adoption. For instance, China’s advanced ceramics industry contributed to the market by growing over 9% in 2024 and this growth was supported by the production of EVs that went beyond 8 million units, resulting in a significant increase in use of SiC-based components.

Europe is the second-largest market with 22% share that is mainly supported by Germany, France, and the U.K. The presence of a strong aerospace and high-performance industrial sectors in the region is the core reason for the continuous demand of sintered SiC applications. Strict efficiency and emission regulations have been the main reason why the consumption of SiC ceramics in the European turbine and furnace component industries has increased by 6-8% annually.

North America holds about 19% of the global market share. It is mainly the advanced semiconductor fabrication and defense applications that drive the market. The U.S. investments in SiC-related manufacturing were more than US$ 2 Bn in 2024, and as a result, there has been a strong involvement in aerospace thermal systems and power electronics leading to increased regional demand.

Through its flagship Hexoloy product line, Saint-Gobain is one of the worldwide leaders in SiC ceramics. Hexoloy is a brand of high-purity silicon carbide widely used in extreme temperature, abrasive, and aggressive industrial environments. The supplier offers sintered, reaction-bonded, and advanced SiC components to the industrial sector for the chemical processing, power generation, semiconductor tools, and industrial furnace industries. In addition to a comprehensive manufacturing presence across the continent of North America, Europe and Asia, Saint-Gobain is combining excellent R&D and large-scale production to keep its global leadership position in the SiC ceramics market.

NGK Insulators is a leading player in the SiC ceramics market and offers specialty products such as porous SiC filters, membranes, kiln furniture, and high-temperature industrial components. The SiC ceramics of the company are broadly implemented in automotive emission systems, industrial furnaces, gas purification, and energy systems. Besides, highly skilled production of precision porous ceramics and the capacity of large volume production at its factories in Japan and other countries, NGK is among the top suppliers who have the most significant impact on the market. Continuous entry of new products in the energy and process industries as well as in the environment sector is reinforcing the global SiC ceramics portfolio of NGK.

Morgan Advanced Materials, Vesuvius, Mersen, Kyocera, Tokai Carbon, Coors Tek, Silcarb, Asuzac Ceramics, Schunk Group, and Excelsior Ceramic Industries are some other companies in the global market.

Each of these players has been profiled in the SiC ceramics market research report based on parameters such as financial overview, company overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 1.8 Billion |

| Market Forecast Value in 2035 | US$ 3.1 Billion |

| Growth Rate (CAGR) | 5.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Billion for Value & Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, SiC Ceramics market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Material Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The SiC ceramics market was valued at US$ 1.8 Billion in 2024

The SiC ceramics industry is expected to grow at a CAGR of 5.2% from 2025 to 2035

Rapid expansion of electric vehicles and power electronics sectors, and rising adoption in high-temperature industrial applications.

Alpha SiC was the largest phase segment in the global SiC ceramics market.

Asia Pacific was the most lucrative region in 2024

Morgan Advanced Materials, Vesuvius, Mersen, Saint Gobain, NGK Insulators, Kyocera, Tokai Carbon, Coors Tek, Silcarb, Asuzac Ceramics, Schunk Group, and Excelsior Ceramic Industries are the major companies in the global SiC ceramics market.

Table 1 Global SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 2 Global SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 3 Global SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 4 Global SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 5 Global SiC Ceramics Market Volume (Tons) Forecast, by Product Form 2020 to 2035

Table 6 Global SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form 2020 to 2035

Table 7 Global SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 8 Global SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 9 Global SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 10 Global SiC Ceramics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 11 Global SiC Ceramics Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 12 Global SiC Ceramics Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 13 North America SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 14 North America SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 15 North America SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 16 North America SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 17 North America SiC Ceramics Market Volume (Tons) Forecast, by Product Form 2020 to 2035

Table 18 North America SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form 2020 to 2035

Table 19 North America SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 20 North America SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21 North America SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 22 North America SiC Ceramics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 23 North America SiC Ceramics Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 24 North America SiC Ceramics Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 25 U.S. SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 26 U.S. SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 27 U.S. SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 28 U.S. SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 29 U.S. SiC Ceramics Market Volume (Tons) Forecast, by Product Form 2020 to 2035

Table 30 U.S. SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 31 U.S. SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 32 U.S. SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 33 U.S. SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 34 U.S. SiC Ceramics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 35 Canada SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 36 Canada SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 37 Canada SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 38 Canada SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 39 Canada SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 40 Canada SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 41 Canada SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 42 Canada SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43 Canada SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 44 Canada SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 45 Europe SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 46 Europe SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 47 Europe SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 48 Europe SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 49 Europe SiC Ceramics Market Volume (Tons) Forecast, by Product Form 2020 to 2035

Table 50 Europe SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 51 Europe SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 52 Europe SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53 Europe SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 Europe SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 55 Europe SiC Ceramics Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 56 Europe SiC Ceramics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 57 Germany SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 58 Germany SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 59 Germany SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 60 Germany SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 61 Germany SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 62 Germany SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 63 Germany SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 64 Germany SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65 Germany SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 66 Germany SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 67 France SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 68 France SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 69 France SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 70 France SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 71 France SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 72 France SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 73 France SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 74 France SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 75 France SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 76 France SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 77 U.K. SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 78 U.K. SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 79 U.K. SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 80 U.K. SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 81 U.K. SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 82 U.K. SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 83 U.K. SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 84 U.K. SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 85 U.K. SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 86 U.K. SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 87 Italy SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 88 Italy SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 89 Italy SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 90 Italy SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 91 Italy SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 92 Italy SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 93 Italy SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 94 Italy SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 95 Italy SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 96 Italy SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 97 Spain SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 98 Spain SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 99 Spain SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 100 Spain SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 101 Spain SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 102 Spain SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 103 Spain SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 104 Spain SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105 Spain SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 106 Spain SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 107 Russia & CIS SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 108 Russia & CIS SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 109 Russia & CIS SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 110 Russia & CIS SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 111 Russia & CIS SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 112 Russia & CIS SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 113 Russia & CIS SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 114 Russia & CIS SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 115 Russia & CIS SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 116 Russia & CIS SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 117 Rest of Europe SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 118 Rest of Europe SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 119 Rest of Europe SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 120 Rest of Europe SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 121 Rest of Europe SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 122 Rest of Europe SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 123 Rest of Europe SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 124 Rest of Europe SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 125 Rest of Europe SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 126 Rest of Europe SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 127 Asia Pacific SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 128 Asia Pacific SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 129 Asia Pacific SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 130 Asia Pacific SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 131 Asia Pacific SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 132 Asia Pacific SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 133 Asia Pacific SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 134 Asia Pacific SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 135 Asia Pacific SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 136 Asia Pacific SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 137 Asia Pacific SiC Ceramics Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 138 Asia Pacific SiC Ceramics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 139 China SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 140 China SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type 2020 to 2035

Table 141 China SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 142 China SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 143 China SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 144 China SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 145 China SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 146 China SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 147 China SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 148 China SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 149 Japan SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 150 Japan SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 151 Japan SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 152 Japan SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 153 Japan SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 154 Japan SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 155 Japan SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 156 Japan SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 157 Japan SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 158 Japan SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 159 India SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 160 India SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 161 India SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 162 India SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 163 India SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 164 India SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 165 India SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 166 India SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 167 India SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 168 India SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 169 ASEAN SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 170 ASEAN SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 171 ASEAN SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 172 ASEAN SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 173 ASEAN SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 174 ASEAN SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 175 ASEAN SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 176 ASEAN SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 177 ASEAN SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 178 ASEAN SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 179 Rest of Asia Pacific SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 180 Rest of Asia Pacific SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 181 Rest of Asia Pacific SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 182 Rest of Asia Pacific SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 183 Rest of Asia Pacific SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 184 Rest of Asia Pacific SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 185 Rest of Asia Pacific SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 186 Rest of Asia Pacific SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 187 Rest of Asia Pacific SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 188 Rest of Asia Pacific SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 189 Latin America SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 190 Latin America SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 191 Latin America SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 192 Latin America SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 193 Latin America SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 194 Latin America SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 195 Latin America SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 196 Latin America SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 197 Latin America SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 198 Latin America SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 199 Latin America SiC Ceramics Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 200 Latin America SiC Ceramics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 201 Brazil SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 202 Brazil SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 203 Brazil SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 204 Brazil SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 205 Brazil SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 206 Brazil SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 207 Brazil SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 208 Brazil SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 209 Brazil SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 210 Brazil SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 211 Mexico SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 212 Mexico SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 213 Mexico SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 214 Mexico SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 215 Mexico SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 216 Mexico SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 217 Mexico SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 218 Mexico SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 219 Mexico SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 220 Mexico SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 221 Rest of Latin America SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 222 Rest of Latin America SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 223 Rest of Latin America SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 224 Rest of Latin America SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 225 Rest of Latin America SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 226 Rest of Latin America SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 227 Rest of Latin America SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 228 Rest of Latin America SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 229 Rest of Latin America SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 230 Rest of Latin America SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 231 Middle East & Africa SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 232 Middle East & Africa SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 233 Middle East & Africa SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 234 Middle East & Africa SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 235 Middle East & Africa SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 236 Middle East & Africa SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 237 Middle East & Africa SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 238 Middle East & Africa SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 239 Middle East & Africa SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 240 Middle East & Africa SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 241 Middle East & Africa SiC Ceramics Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 242 Middle East & Africa SiC Ceramics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 243 GCC SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 244 GCC SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 245 GCC SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 246 GCC SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 247 GCC SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 248 GCC SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 249 GCC SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 250 GCC SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 251 GCC SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 252 GCC SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 253 South Africa SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 254 South Africa SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 255 South Africa SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 256 South Africa SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 257 South Africa SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 258 South Africa SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 259 South Africa SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 260 South Africa SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 261 South Africa SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 262 South Africa SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 263 Rest of Middle East & Africa SiC Ceramics Market Volume (Tons) Forecast, by Material Type, 2020 to 2035

Table 264 Rest of Middle East & Africa SiC Ceramics Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 265 Rest of Middle East & Africa SiC Ceramics Market Volume (Tons) Forecast, by Phase, 2020 to 2035

Table 266 Rest of Middle East & Africa SiC Ceramics Market Value (US$ Bn) Forecast, by Phase, 2020 to 2035

Table 267 Rest of Middle East & Africa SiC Ceramics Market Volume (Tons) Forecast, by Product Form, 2020 to 2035

Table 268 Rest of Middle East & Africa SiC Ceramics Market Value (US$ Bn) Forecast, by Product Form, 2020 to 2035

Table 269 Rest of Middle East & Africa SiC Ceramics Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 270 Rest of Middle East & Africa SiC Ceramics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 271 Rest of Middle East & Africa SiC Ceramics Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 272 Rest of Middle East & Africa SiC Ceramics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Figure 1 Global SiC Ceramics Market Volume Share Analysis, by Material Type, 2024, 2028, and 2035

Figure 2 Global SiC Ceramics Market Attractiveness, by Material Type

Figure 3 Global SiC Ceramics Market Volume Share Analysis, by Phase, 2024, 2028, and 2035

Figure 4 Global SiC Ceramics Market Attractiveness, by Phase

Figure 5 Global SiC Ceramics Market Volume Share Analysis, by Product Form, 2024, 2028, and 2035

Figure 6 Global SiC Ceramics Market Attractiveness, by Product Form

Figure 7 Global SiC Ceramics Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 8 Global SiC Ceramics Market Attractiveness, by Application

Figure 9 Global SiC Ceramics Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 10 Global SiC Ceramics Market Attractiveness, by End-use

Figure 11 Global SiC Ceramics Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 12 Global SiC Ceramics Market Attractiveness, by Region

Figure 13 North America SiC Ceramics Market Volume Share Analysis, by Material Type, 2024, 2028, and 2035

Figure 14 North America SiC Ceramics Market Attractiveness, by Material Type

Figure 15 North America SiC Ceramics Market Volume Share Analysis, by Phase, 2024, 2028, and 2035

Figure 16 North America SiC Ceramics Market Attractiveness, by Phase

Figure 17 North America SiC Ceramics Market Volume Share Analysis, by Product Form, 2024, 2028, and 2035

Figure 18 North America SiC Ceramics Market Attractiveness, by Product Form

Figure 19 North America SiC Ceramics Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 20 North America SiC Ceramics Market Attractiveness, by Application

Figure 21 North America SiC Ceramics Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 22 North America SiC Ceramics Market Attractiveness, by End-use

Figure 23 North America SiC Ceramics Market Attractiveness, by Country and Sub-region

Figure 24 Europe SiC Ceramics Market Volume Share Analysis, by Material Type, 2024, 2028, and 2035

Figure 25 Europe SiC Ceramics Market Attractiveness, by Material Type

Figure 26 Europe SiC Ceramics Market Volume Share Analysis, by Phase, 2024, 2028, and 2035

Figure 27 Europe SiC Ceramics Market Attractiveness, by Phase

Figure 28 Europe SiC Ceramics Market Volume Share Analysis, by Product Form, 2024, 2028, and 2035

Figure 29 Europe SiC Ceramics Market Attractiveness, by Product Form

Figure 30 Europe SiC Ceramics Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 31 Europe SiC Ceramics Market Attractiveness, by Application

Figure 32 Europe SiC Ceramics Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 33 Europe SiC Ceramics Market Attractiveness, by End-use

Figure 34 Europe SiC Ceramics Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 35 Europe SiC Ceramics Market Attractiveness, by Country and Sub-region

Figure 36 Asia Pacific SiC Ceramics Market Volume Share Analysis, by Material Type, 2024, 2028, and 2035

Figure 37 Asia Pacific SiC Ceramics Market Attractiveness, by Material Type

Figure 38 Asia Pacific SiC Ceramics Market Volume Share Analysis, by Phase, 2024, 2028, and 2035

Figure 39 Asia Pacific SiC Ceramics Market Attractiveness, by Phase

Figure 40 Asia Pacific SiC Ceramics Market Volume Share Analysis, by Product Form, 2024, 2028, and 2035

Figure 41 Asia Pacific SiC Ceramics Market Attractiveness, by Product Form

Figure 42 Asia Pacific SiC Ceramics Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 43 Asia Pacific SiC Ceramics Market Attractiveness, by Application

Figure 44 Asia Pacific SiC Ceramics Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 45 Asia Pacific SiC Ceramics Market Attractiveness, by End-use

Figure 46 Asia Pacific SiC Ceramics Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 47 Asia Pacific SiC Ceramics Market Attractiveness, by Country and Sub-region

Figure 48 Latin America SiC Ceramics Market Volume Share Analysis, by Material Type, 2024, 2028, and 2035

Figure 49 Latin America SiC Ceramics Market Attractiveness, by Material Type

Figure 50 Latin America SiC Ceramics Market Volume Share Analysis, by Phase, 2024, 2028, and 2035

Figure 51 Latin America SiC Ceramics Market Attractiveness, by Phase

Figure 52 Latin America SiC Ceramics Market Volume Share Analysis, by Product Form, 2024, 2028, and 2035

Figure 53 Latin America SiC Ceramics Market Attractiveness, by Product Form

Figure 54 Latin America SiC Ceramics Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 55 Latin America SiC Ceramics Market Attractiveness, by Application

Figure 56 Latin America SiC Ceramics Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 57 Latin America SiC Ceramics Market Attractiveness, by End-use

Figure 58 Latin America SiC Ceramics Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 59 Latin America SiC Ceramics Market Attractiveness, by Country and Sub-region

Figure 60 Middle East & Africa SiC Ceramics Market Volume Share Analysis, by Material Type, 2024, 2028, and 2035

Figure 61 Middle East & Africa SiC Ceramics Market Attractiveness, by Material Type

Figure 62 Middle East & Africa SiC Ceramics Market Volume Share Analysis, by Phase, 2024, 2028, and 2035

Figure 63 Middle East & Africa SiC Ceramics Market Attractiveness, by Phase

Figure 64 Middle East & Africa SiC Ceramics Market Volume Share Analysis, by Product Form, 2024, 2028, and 2035

Figure 65 Middle East & Africa SiC Ceramics Market Attractiveness, by Product Form

Figure 66 Middle East & Africa SiC Ceramics Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 67 Middle East & Africa SiC Ceramics Market Attractiveness, by Application

Figure 68 Middle East & Africa SiC Ceramics Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 69 Middle East & Africa SiC Ceramics Market Attractiveness, by End-use

Figure 70 Middle East & Africa SiC Ceramics Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 71 Middle East & Africa SiC Ceramics Market Attractiveness, by Country and Sub-region