Reports

Reports

Analysts’ Viewpoint on Market Scenario

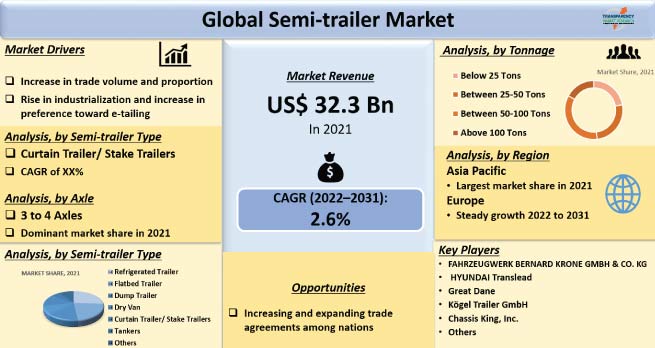

Timely delivery of goods and products is a major concern in freight transportation or shipping. However, road transportation that is capable of timely delivery and prompt service is likely to offer lucrative opportunities to the semi-trailer market during the forecast period. The transition and evolution of global transportation is primarily due to expansion of manufacturing and agriculture industries, which in turn fuels the demand for semi-trailer trucks that are extensively utilized via fleet management in order to transport goods and material from one place (especially ports) to another. These factors are primarily projected to fuel the market during the forecast period. Online shopping in majority of countries across the globe is witnessing significant expansion, owing to an increase in speedy internet access, which has led to rising preference toward e-tailing among consumers. Furthermore, demand for road transportation is significantly high in order to fulfill the demand for shipment, which in turn is anticipated to propel the market during the forecast period. Improper road infrastructure coupled with a lack of intent to improve transport facilities is expected to restrain the demand for road freight transportation and consequently, hamper the market during the forecast period. Moreover, several key players in the truck trailer manufacturing industry are focusing on high capacity expansions in their respective regions owing to the presence of good road connectivity and preference for road transportation. Expansion of the logistics industry in North America and Europe is likely to further boost the global market during the forecast period.

Demand for semi-trailers is likely to remain positive in the near future primarily due to the significant expansion witnessed by the road transport industry, owing to rise in volume of transportation of goods, metals, steel, textiles, iron, toys, food & beverages, medicines, cement, aluminum, electronics, and several other finished materials.

Rising industrialization and globalization are also boosting the demand for semi-trailers. Moreover, longer lifespan and reliability are further boosting the demand for semi trailer trucks, flat bed semi-trailers and van trailers. Demand for semi-trailers is rising significantly in developing countries owing to the expansion of the industrial sector in these countries. Increase in manufacturing activities, rise in urbanization, and need for effective transportation are boosting the logistics industry, which in turn has been a key factor driving the demand for semi trucks and trailer landing gear.

Increase and expansion of trade agreements among nations is anticipated to offer new opportunities to the semi-trailer industry in the near future. Additionally, significant investment by emerging economies in improving their road transport infrastructure coupled with the expansion of transport routes and increasing volumes of transport goods is another key factor that is estimated to drive the semi-trailer market size during the forecast period.

High volume of international trade has been witnessed in countries such as China, the U.S., the European Union, Japan, South Korea, India, Saudi Arabia, ASEAN countries, and GCC countries. This is projected to significantly boost the semi-trailers market during the forecast period. Global trade has expanded significantly in the last few years, thereby boosting and transforming the global economy completely. Currently, on a global scale, approximately 1/4th of the total global production is exported. Considering the factors mentioned above, the demand for semi-trailer truck is anticipated to rise in the near future and consequently boost the semi-trailer market during the forecast period.

Rise in industrialization and expansion of manufacturing and agriculture industries in majority of developing countries around the world have led to extensive usage of road freight transportation. Countries in Asia Pacific continue their transition toward greater economic integration, where expansion of manufacturing, agriculture, electronics, and textile & apparel industries is a prime force in their rapid economic development. Moreover, transportation of products and goods by means of roadways plays an integral role. Additionally, this mode of transport is cost-effective for door-to-door service, owing to improved road infrastructure. This is anticipated to propel the demand for semi-trailer truck and drive the semi-trailer market during the forecast period.

Online shopping in majority of countries across the globe is witnessing significant expansion, owing to an increase in speedy internet access, which has led to rising preference toward e-tailing among consumers. Furthermore, demand for road transportation is significantly high in order to fulfill the demand for shipment, which in turn is anticipated to propel the market share during the forecast period.

Based on semi-trailer type, the curtain/stake semi-trailer segment held a major share of the market. It is projected to maintain its leading position during the forecast period primarily due to the extensive use of stake trailers in developing and developed economics, as these trailers employ welded beams to form the frame. However, they do not cover the top or the sides entirely. Furthermore, the hook and drop capabilities of these skeletal trailers are not utilized entirely.

Based on end-use industry, the heavy industry segment dominated the semi-trailer market. It is projected to maintain its dominance during the forecast period owing to the expansion of manufacturing and construction industries, which leads to increased freight road transportation and increased usage of semi-trailer trucks.

Asia Pacific is expected to dominate the semi-trailer market. China accounted for a prominent share of the market in the region, as the country is home to a significant number of semi-trailers, especially stake trailers. The semi-trailer market in all the other countries and sub-regions of Asia Pacific expanded at a considerable pace, primarily due to a surge in urbanization and the associated rise in transport volume that makes new distribution networks with integrated logistics. Moreover, increase in trade volume and increase in bilateral trade among the countries in Asia Pacific have led to higher demand for road freight transportation, which in turn is projected to drive market during the forecast period.

North America was a highly attractive market for semi-trailer owing to the presence of significantly large logistics industry in the region. Good road connectivity in North America has been a major factor driving the road transport industry in the region.

The global semi-trailer market is primarily controlled by established and new joint venture companies. An in depth analysis of the trailer manufacturing industry statistics reveals that key companies hold the potential to drive the market, by adopting newer and advanced technologies and by making consistent changes to enhance their revenue share. However, key players are consolidating their market position by strategic mergers and acquisitions and development of product portfolios. Some of the manufacturers identified in the semi-trailer market across the globe are: ChassisKing, Inc., China International Marine Containers (Group) Ltd., FAHRZEUGWERK BERNARD KRONE GMBH & CO. KG, Great Dane, HYUNDAI Translead, Kögel Trailer GmbH, LAMBERET SAS, Schmitz Cargobull, Schwarzmüller Group, Shandong Arima group, Shandong Liang Shan Huayu Group, Wabash National Corporation, Utility Trailer Manufacturing Company, Dorsey Trailer, MANAC INC., Polar Tank, and Fontaine Commercial Trailer, Inc.

Key players have been profiled in the semi-trailer market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 32.3 Bn |

|

Market Forecast Value in 2031 |

US$ 41.7 Mn |

|

Growth Rate (CAGR) |

2.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market is valued at US$ 32.3 Bn in 2021.

The market is expected to grow at a CAGR of 2.6% by 2031.

The market would be worth US$ 41.7 Mn in 2031.

Increase in trade volume and proportion and rise in industrialization and increased preference for e-tailing.

Based on Axle, the 3 to 4 axle segment accounts for majority share of the semi-trailer market.

Asia Pacific is anticipated to be the highly lucrative region of the global semi-trailer market

ChassisKing, Inc., China International Marine Containers (Group) Ltd., FAHRZEUGWERK BERNARD KRONE GMBH & CO. KG, Great Dane, HYUNDAI Translead, Kögel Trailer GmbH, LAMBERET SAS, Schmitz Cargobull, Schwarzmüller Group, Shandong Arima group, Shandong Liang Shan Huayu Group, Wabash National Corporation, Utility Trailer Manufacturing Company, Dorsey Trailer, MANAC INC., Polar Tank, and Fontaine Commercial Trailer, Inc.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value US$ Mn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. COVID-19 Impact Analysis – Semi-trailer Market

4. Global Semi-trailer Market, By Semi-trailer Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Semi-trailer Market Size & Forecast, 2017-2031, By Semi-trailer Type

4.2.1. Refrigerated Trailer

4.2.2. Flatbed Trailer

4.2.3. Dump Trailer

4.2.4. Dry Van

4.2.5. Curtain Trailer/ Stake Trailers

4.2.6. Tankers

4.2.7. Others

5. Global Semi-trailer Market, By Tonnage

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Semi-trailer Market Size & Forecast, 2017-2031, By Tonnage

5.2.1. Below 25 Tons

5.2.2. Between 25-50 Tons

5.2.3. Between 50-100 Tons

5.2.4. Above 100 Tons

6. Global Semi-trailer Market, By Axle

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Semi-trailer Market Size & Forecast, 2017-2031, By Axle

6.2.1. Less than 3 Axles

6.2.2. 3 to 4 Axles

6.2.3. More than 4 Axles

7. Global Semi-trailer Market, By End-use Industry

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Semi-trailer Market Size & Forecast, 2017-2031, By End-use Industry

7.2.1. Heavy Industry

7.2.2. Construction

7.2.3. Medical

7.2.4. Food & Beverage

7.2.5. Oil & Gas

7.2.6. Textile Industry

7.2.7. Others

8. Global Semi-trailer Market, by Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Semi-trailer Market Size & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Semi-trailer Market

9.1. Market Snapshot

9.2. North America Semi-trailer Market Size & Forecast, 2017-2031, By Semi-trailer Type

9.2.1. Refrigerated Trailer

9.2.2. Flatbed Trailer

9.2.3. Dump Trailer

9.2.4. Dry Van

9.2.5. Curtain Trailer/ Stake Trailers

9.2.6. Tankers

9.2.7. Others

9.3. North America Semi-trailer Market Size & Forecast, 2017-2031, By Tonnage

9.3.1. Below 25 Tons

9.3.2. Between 25-50 Tons

9.3.3. Between 50-100 Tons

9.3.4. Above 100 Tons

9.4. North America Semi-trailer Market Size & Forecast, 2017-2031, By Axle

9.4.1. Less than 3 Axles

9.4.2. 3 to 4 Axles

9.4.3. More than 4 Axles

9.5. North America Semi-trailer Market Size & Forecast, 2017-2031, By End-use Industry

9.5.1. Heavy Industry

9.5.2. Construction

9.5.3. Medical

9.5.4. Food & Beverage

9.5.5. Oil & Gas

9.5.6. Textile Industry

9.5.7. Others

9.6. North America Semi-trailer Market Size & Forecast, 2017-2031, By Country

9.6.1. U. S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Semi-trailer Market

10.1. Market Snapshot

10.2. Europe Semi-trailer Market Size & Forecast, 2017-2031, By Semi-trailer Type

10.2.1. Refrigerated Trailer

10.2.2. Flatbed Trailer

10.2.3. Dump Trailer

10.2.4. Dry Van

10.2.5. Curtain Trailer/ Stake Trailers

10.2.6. Tankers

10.2.7. Others

10.3. Europe Semi-trailer Market Size & Forecast, 2017-2031, By Tonnage

10.3.1. Below 25 Tons

10.3.2. Between 25-50 Tons

10.3.3. Between 50-100 Tons

10.3.4. Above 100 Tons

10.4. Europe Semi-trailer Market Size & Forecast, 2017-2031, By Axle

10.4.1. Less than 3 Axles

10.4.2. 3 to 4 Axles

10.4.3. More than 4 Axles

10.5. Europe Semi-trailer Market Size & Forecast, 2017-2031, By End-use Industry

10.5.1. Heavy Industry

10.5.2. Construction

10.5.3. Medical

10.5.4. Food & Beverage

10.5.5. Oil & Gas

10.5.6. Textile Industry

10.5.7. Others

10.6. Europe Semi-trailer Market Size & Forecast, 2017-2031, By Country and Sub-region

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Semi-trailer Market

11.1. Market Snapshot

11.2. Asia Pacific Semi-trailer Market Size & Forecast, 2017-2031, By Semi-trailer Type

11.2.1. Refrigerated Trailer

11.2.2. Flatbed Trailer

11.2.3. Dump Trailer

11.2.4. Dry Van

11.2.5. Curtain Trailer/ Stake Trailers

11.2.6. Tankers

11.2.7. Others

11.3. Asia Pacific Semi-trailer Market Size & Forecast, 2017-2031, By Tonnage

11.3.1. Below 25 Tons

11.3.2. Between 25-50 Tons

11.3.3. Between 50-100 Tons

11.3.4. Above 100 Tons

11.4. Asia Pacific Semi-trailer Market Size & Forecast, 2017-2031, By Axle

11.4.1. Less than 3 Axles

11.4.2. 3 to 4 Axles

11.4.3. More than 4 Axles

11.5. Asia Pacific Semi-trailer Market Size & Forecast, 2017-2031, By End-use Industry

11.5.1. Heavy Industry

11.5.2. Construction

11.5.3. Medical

11.5.4. Food & Beverage

11.5.5. Oil & Gas

11.5.6. Textile Industry

11.5.7. Others

11.6. Asia Pacific Semi-trailer Market Size & Forecast, 2017-2031, By Country and Sub-region

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Semi-trailer Market

12.1. Market Snapshot

12.2. Middle East & Africa Semi-trailer Market Size & Forecast, 2017-2031, By Semi-trailer Type

12.2.1. Refrigerated Trailer

12.2.2. Flatbed Trailer

12.2.3. Dump Trailer

12.2.4. Dry Van

12.2.5. Curtain Trailer/ Stake Trailers

12.2.6. Tankers

12.2.7. Others

12.3. Middle East & Africa Semi-trailer Market Size & Forecast, 2017-2031, By Tonnage

12.3.1. Below 25 Tons

12.3.2. Between 25-50 Tons

12.3.3. Between 50-100 Tons

12.3.4. Above 100 Tons

12.4. Middle East & Africa Semi-trailer Market Size & Forecast, 2017-2031, By Axle

12.4.1. Less than 3 Axles

12.4.2. 3 to 4 Axles

12.4.3. More than 4 Axles

12.5. Middle East & Africa Semi-trailer Market Size & Forecast, 2017-2031, By End-use Industry

12.5.1. Heavy Industry

12.5.2. Construction

12.5.3. Medical

12.5.4. Food & Beverage

12.5.5. Oil & Gas

12.5.6. Textile Industry

12.5.7. Others

12.6. Middle East & Africa Semi-trailer Market Size & Forecast, 2017-2031, By Country and Sub-region

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Semi-trailer Market

13.1. Market Snapshot

13.2. South America Semi-trailer Market Size & Forecast, 2017-2031, By Semi-trailer Type

13.2.1. Refrigerated Trailer

13.2.2. Flatbed Trailer

13.2.3. Dump Trailer

13.2.4. Dry Van

13.2.5. Curtain Trailer/ Stake Trailers

13.2.6. Tankers

13.2.7. Others

13.3. South America Semi-trailer Market Size & Forecast, 2017-2031, By Tonnage

13.3.1. Below 25 Tons

13.3.2. Between 25-50 Tons

13.3.3. Between 50-100 Tons

13.3.4. Above 100 Tons

13.4. South America Semi-trailer Market Size & Forecast, 2017-2031, By Axle

13.4.1. Less than 3 Axles

13.4.2. 3 to 4 Axles

13.4.3. More than 4 Axles

13.5. South America Semi-trailer Market Size & Forecast, 2017-2031, By End-use Industry

13.5.1. Heavy Industry

13.5.2. Construction

13.5.3. Medical

13.5.4. Food & Beverage

13.5.5. Oil & Gas

13.5.6. Textile Industry

13.5.7. Others

13.6. South America Semi-trailer Market Size & Forecast, 2017-2031, By Country and Sub-region

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2021

14.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profile/ Key Players

15.1. ChassisKing, Inc.

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. China International Marine Containers (Group) Ltd.

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Production Locations

15.2.4. Product Portfolio

15.2.5. Competitors & Customers

15.2.6. Subsidiaries & Parent Organization

15.2.7. Recent Developments

15.2.8. Financial Analysis

15.2.9. Profitability

15.2.10. Revenue Share

15.3. Dorsey Trailer

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Production Locations

15.3.4. Product Portfolio

15.3.5. Competitors & Customers

15.3.6. Subsidiaries & Parent Organization

15.3.7. Recent Developments

15.3.8. Financial Analysis

15.3.9. Profitability

15.3.10. Revenue Share

15.4. FAHRZEUGWERK BERNARD KRONE GMBH & CO. KG

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Production Locations

15.4.4. Product Portfolio

15.4.5. Competitors & Customers

15.4.6. Subsidiaries & Parent Organization

15.4.7. Recent Developments

15.4.8. Financial Analysis

15.4.9. Profitability

15.4.10. Revenue Share

15.5. Fontaine Commercial Trailer, Inc.

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Production Locations

15.5.4. Product Portfolio

15.5.5. Competitors & Customers

15.5.6. Subsidiaries & Parent Organization

15.5.7. Recent Developments

15.5.8. Financial Analysis

15.5.9. Profitability

15.5.10. Revenue Share

15.6. Great Dane

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Production Locations

15.6.4. Product Portfolio

15.6.5. Competitors & Customers

15.6.6. Subsidiaries & Parent Organization

15.6.7. Recent Developments

15.6.8. Financial Analysis

15.6.9. Profitability

15.6.10. Revenue Share

15.7. HYUNDAI Translead

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Production Locations

15.7.4. Product Portfolio

15.7.5. Competitors & Customers

15.7.6. Subsidiaries & Parent Organization

15.7.7. Recent Developments

15.7.8. Financial Analysis

15.7.9. Profitability

15.7.10. Revenue Share

15.8. Kögel Trailer GmbH

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Production Locations

15.8.4. Product Portfolio

15.8.5. Competitors & Customers

15.8.6. Subsidiaries & Parent Organization

15.8.7. Recent Developments

15.8.8. Financial Analysis

15.8.9. Profitability

15.8.10. Revenue Share

15.9. LAMBERET SAS

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Production Locations

15.9.4. Product Portfolio

15.9.5. Competitors & Customers

15.9.6. Subsidiaries & Parent Organization

15.9.7. Recent Developments

15.9.8. Financial Analysis

15.9.9. Profitability

15.9.10. Revenue Share

15.10. MANAC INC.

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Production Locations

15.10.4. Product Portfolio

15.10.5. Competitors & Customers

15.10.6. Subsidiaries & Parent Organization

15.10.7. Recent Developments

15.10.8. Financial Analysis

15.10.9. Profitability

15.10.10. Revenue Share

15.11. Polar Tank

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Production Locations

15.11.4. Product Portfolio

15.11.5. Competitors & Customers

15.11.6. Subsidiaries & Parent Organization

15.11.7. Recent Developments

15.11.8. Financial Analysis

15.11.9. Profitability

15.11.10. Revenue Share

15.12. Schmitz Cargobull

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Production Locations

15.12.4. Product Portfolio

15.12.5. Competitors & Customers

15.12.6. Subsidiaries & Parent Organization

15.12.7. Recent Developments

15.12.8. Financial Analysis

15.12.9. Profitability

15.12.10. Revenue Share

15.13. Schwarzmüller Group

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Production Locations

15.13.4. Product Portfolio

15.13.5. Competitors & Customers

15.13.6. Subsidiaries & Parent Organization

15.13.7. Recent Developments

15.13.8. Financial Analysis

15.13.9. Profitability

15.13.10. Revenue Share

15.14. Shandong Arima group

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Production Locations

15.14.4. Product Portfolio

15.14.5. Competitors & Customers

15.14.6. Subsidiaries & Parent Organization

15.14.7. Recent Developments

15.14.8. Financial Analysis

15.14.9. Profitability

15.14.10. Revenue Share

15.15. Shandong Liang Shan Huayu Group

15.15.1. Company Overview

15.15.2. Company Footprints

15.15.3. Production Locations

15.15.4. Product Portfolio

15.15.5. Competitors & Customers

15.15.6. Subsidiaries & Parent Organization

15.15.7. Recent Developments

15.15.8. Financial Analysis

15.15.9. Profitability

15.15.10. Revenue Share

15.16. Utility Trailer Manufacturing Company

15.16.1. Company Overview

15.16.2. Company Footprints

15.16.3. Production Locations

15.16.4. Product Portfolio

15.16.5. Competitors & Customers

15.16.6. Subsidiaries & Parent Organization

15.16.7. Recent Developments

15.16.8. Financial Analysis

15.16.9. Profitability

15.16.10. Revenue Share

15.17. Wabash National Corporation

15.17.1. Company Overview

15.17.2. Company Footprints

15.17.3. Production Locations

15.17.4. Product Portfolio

15.17.5. Competitors & Customers

15.17.6. Subsidiaries & Parent Organization

15.17.7. Recent Developments

15.17.8. Financial Analysis

15.17.9. Profitability

15.17.10. Revenue Share

15.18. Other Key Players

15.18.1. Company Overview

15.18.2. Company Footprints

15.18.3. Production Locations

15.18.4. Product Portfolio

15.18.5. Competitors & Customers

15.18.6. Subsidiaries & Parent Organization

15.18.7. Recent Developments

15.18.8. Financial Analysis

15.18.9. Profitability

15.18.10. Revenue Share

List of Tables

Table 1: Global Semi-trailer Market Volume (Units) Forecast, by Semi-trailer Type, 2017-2031

Table 2: Global Semi-trailer Market Value (US$ Mn) Forecast, by Semi-trailer Type, 2017-2031

Table 3: Global Semi-trailer Market Volume (Units) Forecast, by Tonnage, 2017-2031

Table 4: Global Semi-trailer Market Value (US$ Mn) Forecast, by Tonnage, 2017-2031

Table 5: Global Semi-trailer Market Volume (Units) Forecast, by Axle, 2017-2031

Table 6: Global Semi-trailer Market Value (US$ Mn) Forecast, by Axle, 2017-2031

Table 7: Global Semi-trailer Market Volume (Units) Forecast, by End-use Industry, 2017-2031

Table 8: Global Semi-trailer Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Table 9: Global Semi-trailer Market Volume (Units) Forecast, by Region, 2017-2031

Table 10: Global Semi-trailer Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 11: North America Semi-trailer Market Volume (Units) Forecast, by Semi-trailer Type, 2017-2031

Table 12: North America Semi-trailer Market Value (US$ Mn) Forecast, by Semi-trailer Type, 2017-2031

Table 13: North America Semi-trailer Market Volume (Units) Forecast, by Tonnage, 2017-2031

Table 14: North America Semi-trailer Market Value (US$ Mn) Forecast, by Tonnage, 2017-2031

Table 15: North America Semi-trailer Market Volume (Units) Forecast, by Axle, 2017-2031

Table 16: North America Semi-trailer Market Value (US$ Mn) Forecast, by Axle, 2017-2031

Table 17: North America Semi-trailer Market Volume (Units) Forecast, by End-use Industry, 2017-2031

Table 18: North America Semi-trailer Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Table 19: North America Semi-trailer Market Volume (Units) Forecast, by Country, 2017-2031

Table 20: North America Semi-trailer Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 21: Europe Semi-trailer Market Volume (Units) Forecast, by Semi-trailer Type, 2017-2031

Table 22: Europe Semi-trailer Market Value (US$ Mn) Forecast, by Semi-trailer Type, 2017-2031

Table 23: Europe Semi-trailer Market Volume (Units) Forecast, by Tonnage, 2017-2031

Table 24: Europe Semi-trailer Market Value (US$ Mn) Forecast, by Tonnage, 2017-2031

Table 25: Europe Semi-trailer Market Volume (Units) Forecast, by Axle, 2017-2031

Table 26: Europe Semi-trailer Market Value (US$ Mn) Forecast, by Axle, 2017-2031

Table 27: Europe Semi-trailer Market Volume (Units) Forecast, by End-use Industry, 2017-2031

Table 28: Europe Semi-trailer Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Table 29: Europe Semi-trailer Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Table 30: Europe Semi-trailer Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Table 31: Asia Pacific Semi-trailer Market Volume (Units) Forecast, by Semi-trailer Type, 2017-2031

Table 32: Asia Pacific Semi-trailer Market Value (US$ Mn) Forecast, by Semi-trailer Type, 2017-2031

Table 33: Asia Pacific Semi-trailer Market Volume (Units) Forecast, by Tonnage, 2017-2031

Table 34: Asia Pacific Semi-trailer Market Value (US$ Mn) Forecast, by Tonnage, 2017-2031

Table 35: Asia Pacific Semi-trailer Market Volume (Units) Forecast, by Axle, 2017-2031

Table 36: Asia Pacific Semi-trailer Market Value (US$ Mn) Forecast, by Axle, 2017-2031

Table 37: Asia Pacific Semi-trailer Market Volume (Units) Forecast, by End-use Industry, 2017-2031

Table 38: Asia Pacific Semi-trailer Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Table 39: Asia Pacific Semi-trailer Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Table 40: Asia Pacific Semi-trailer Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Table 41: Middle East & Africa Semi-trailer Market Volume (Units) Forecast, by Semi-trailer Type, 2017-2031

Table 42: Middle East & Africa Semi-trailer Market Value (US$ Mn) Forecast, by Semi-trailer Type, 2017-2031

Table 43: Middle East & Africa Semi-trailer Market Volume (Units) Forecast, by Tonnage, 2017-2031

Table 44: Middle East & Africa Semi-trailer Market Value (US$ Mn) Forecast, by Tonnage, 2017-2031

Table 45: Middle East & Africa Semi-trailer Market Volume (Units) Forecast, by Axle, 2017-2031

Table 46: Middle East & Africa Semi-trailer Market Value (US$ Mn) Forecast, by Axle, 2017-2031

Table 47: Middle East & Africa Semi-trailer Market Volume (Units) Forecast, by End-use Industry, 2017-2031

Table 48: Middle East & Africa Semi-trailer Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Table 49: Middle East & Africa Semi-trailer Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Table 50: Middle East & Africa Semi-trailer Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Table 51: South America Semi-trailer Market Volume (Units) Forecast, by Semi-trailer Type, 2017-2031

Table 52: South America Semi-trailer Market Value (US$ Mn) Forecast, by Semi-trailer Type, 2017-2031

Table 53: South America Semi-trailer Market Volume (Units) Forecast, by Tonnage, 2017-2031

Table 54: South America Semi-trailer Market Value (US$ Mn) Forecast, by Tonnage, 2017-2031

Table 55: South America Semi-trailer Market Volume (Units) Forecast, by Axle, 2017-2031

Table 56: South America Semi-trailer Market Value (US$ Mn) Forecast, by Axle, 2017-2031

Table 57: South America Semi-trailer Market Volume (Units) Forecast, by End-use Industry, 2017-2031

Table 58: South America Semi-trailer Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Table 59: South America Semi-trailer Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Table 60: South America Semi-trailer Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 1: Global Semi-trailer Market Volume (Units) Forecast, by Semi-trailer Type, 2017-2031

Figure 2: Global Semi-trailer Market Value (US$ Mn) Forecast, by Semi-trailer Type, 2017-2031

Figure 3: Global Semi-trailer Market, Incremental Opportunity, by Semi-trailer Type, Value (US$ Mn), 2022-2031

Figure 4: Global Semi-trailer Market Volume (Units) Forecast, by Tonnage, 2017-2031

Figure 5: Global Semi-trailer Market Value (US$ Mn) Forecast, by Tonnage, 2017-2031

Figure 6: Global Semi-trailer Market, Incremental Opportunity, by Tonnage, Value (US$ Mn), 2022-2031

Figure 7: Global Semi-trailer Market Volume (Units) Forecast, by Axle, 2017-2031

Figure 8: Global Semi-trailer Market Value (US$ Mn) Forecast, by Axle, 2017-2031

Figure 9: Global Semi-trailer Market, Incremental Opportunity, by Axle, Value (US$ Mn), 2022-2031

Figure 10: Global Semi-trailer Market Volume (Units) Forecast, by End-use Industry, 2017-2031

Figure 11: Global Semi-trailer Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Figure 12: Global Semi-trailer Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2022-2031

Figure 13: Global Semi-trailer Market Volume (Units) Forecast, by Region, 2017-2031

Figure 14: Global Semi-trailer Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 15: Global Semi-trailer Market, Incremental Opportunity, by Region, Value (US$ Mn), 2022-2031

Figure 16: North America Semi-trailer Market Volume (Units) Forecast, by Semi-trailer Type, 2017-2031

Figure 17: North America Semi-trailer Market Value (US$ Mn) Forecast, by Semi-trailer Type, 2017-2031

Figure 18: North America Semi-trailer Market, Incremental Opportunity, by Semi-trailer Type, Value (US$ Mn), 2022-2031

Figure 19: North America Semi-trailer Market Volume (Units) Forecast, by Tonnage, 2017-2031

Figure 20: North America Semi-trailer Market Value (US$ Mn) Forecast, by Tonnage, 2017-2031

Figure 21: North America Semi-trailer Market, Incremental Opportunity, by Tonnage, Value (US$ Mn), 2022-2031

Figure 22: North America Semi-trailer Market Volume (Units) Forecast, by Axle, 2017-2031

Figure 23: North America Semi-trailer Market Value (US$ Mn) Forecast, by Axle, 2017-2031

Figure 24: North America Semi-trailer Market, Incremental Opportunity, by Axle, Value (US$ Mn), 2022-2031

Figure 25: North America Semi-trailer Market Volume (Units) Forecast, by End-use Industry, 2017-2031

Figure 26: North America Semi-trailer Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Figure 27: North America Semi-trailer Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2022-2031

Figure 28: North America Semi-trailer Market Volume (Units) Forecast, by Country, 2017-2031

Figure 29: North America Semi-trailer Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 30: North America Semi-trailer Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022-2031

Figure 31: Europe Semi-trailer Market Volume (Units) Forecast, by Semi-trailer Type, 2017-2031

Figure 32: Europe Semi-trailer Market Value (US$ Mn) Forecast, by Semi-trailer Type, 2017-2031

Figure 33: Europe Semi-trailer Market, Incremental Opportunity, by Semi-trailer Type, Value (US$ Mn), 2022-2031

Figure 34: Europe Semi-trailer Market Volume (Units) Forecast, by Tonnage, 2017-2031

Figure 35: Europe Semi-trailer Market Value (US$ Mn) Forecast, by Tonnage, 2017-2031

Figure 36: Europe Semi-trailer Market, Incremental Opportunity, by Tonnage, Value (US$ Mn), 2022-2031

Figure 37: Europe Semi-trailer Market Volume (Units) Forecast, by Axle, 2017-2031

Figure 38: Europe Semi-trailer Market Value (US$ Mn) Forecast, by Axle, 2017-2031

Figure 39: Europe Semi-trailer Market, Incremental Opportunity, by Axle, Value (US$ Mn), 2022-2031

Figure 40: Europe Semi-trailer Market Volume (Units) Forecast, by End-use Industry, 2017-2031

Figure 41: Europe Semi-trailer Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Figure 42: Europe Semi-trailer Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2022-2031

Figure 43: Europe Semi-trailer Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Figure 44: Europe Semi-trailer Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Figure 45: Europe Semi-trailer Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022-2031

Figure 46: Asia Pacific Semi-trailer Market Volume (Units) Forecast, by Semi-trailer Type, 2017-2031

Figure 47: Asia Pacific Semi-trailer Market Value (US$ Mn) Forecast, by Semi-trailer Type, 2017-2031

Figure 48: Asia Pacific Semi-trailer Market, Incremental Opportunity, by Semi-trailer Type, Value (US$ Mn), 2022-2031

Figure 49: Asia Pacific Semi-trailer Market Volume (Units) Forecast, by Tonnage, 2017-2031

Figure 50: Asia Pacific Semi-trailer Market Value (US$ Mn) Forecast, by Tonnage, 2017-2031

Figure 51: Asia Pacific Semi-trailer Market, Incremental Opportunity, by Tonnage, Value (US$ Mn), 2022-2031

Figure 52: Asia Pacific Semi-trailer Market Volume (Units) Forecast, by Axle, 2017-2031

Figure 53: Asia Pacific Semi-trailer Market Value (US$ Mn) Forecast, by Axle, 2017-2031

Figure 54: Asia Pacific Semi-trailer Market, Incremental Opportunity, by Axle, Value (US$ Mn), 2022-2031

Figure 55: Asia Pacific Semi-trailer Market Volume (Units) Forecast, by End-use Industry, 2017-2031

Figure 56: Asia Pacific Semi-trailer Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Figure 57: Asia Pacific Semi-trailer Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2022-2031

Figure 58: Asia Pacific Semi-trailer Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Figure 59: Asia Pacific Semi-trailer Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Figure 60: Asia Pacific Semi-trailer Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022-2031

Figure 61: Middle East & Africa Semi-trailer Market Volume (Units) Forecast, by Semi-trailer Type, 2017-2031

Figure 62: Middle East & Africa Semi-trailer Market Value (US$ Mn) Forecast, by Semi-trailer Type, 2017-2031

Figure 63: Middle East & Africa Semi-trailer Market, Incremental Opportunity, by Semi-trailer Type, Value (US$ Mn), 2022-2031

Figure 64: Middle East & Africa Semi-trailer Market Volume (Units) Forecast, by Tonnage, 2017-2031

Figure 65: Middle East & Africa Semi-trailer Market Value (US$ Mn) Forecast, by Tonnage, 2017-2031

Figure 66: Middle East & Africa Semi-trailer Market, Incremental Opportunity, by Tonnage, Value (US$ Mn), 2022-2031

Figure 67: Middle East & Africa Semi-trailer Market Volume (Units) Forecast, by Axle, 2017-2031

Figure 68: Middle East & Africa Semi-trailer Market Value (US$ Mn) Forecast, by Axle, 2017-2031

Figure 69: Middle East & Africa Semi-trailer Market, Incremental Opportunity, by Axle, Value (US$ Mn), 2022-2031

Figure 70: Middle East & Africa Semi-trailer Market Volume (Units) Forecast, by End-use Industry, 2017-2031

Figure 71: Middle East & Africa Semi-trailer Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Figure 72: Middle East & Africa Semi-trailer Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2022-2031

Figure 73: Middle East & Africa Semi-trailer Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Figure 74: Middle East & Africa Semi-trailer Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Figure 75: Middle East & Africa Semi-trailer Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022-2031

Figure 76: South America Semi-trailer Market Volume (Units) Forecast, by Semi-trailer Type, 2017-2031

Figure 77: South America Semi-trailer Market Value (US$ Mn) Forecast, by Semi-trailer Type, 2017-2031

Figure 78: South America Semi-trailer Market, Incremental Opportunity, by Semi-trailer Type, Value (US$ Mn), 2022-2031

Figure 79: South America Semi-trailer Market Volume (Units) Forecast, by Tonnage, 2017-2031

Figure 80: South America Semi-trailer Market Value (US$ Mn) Forecast, by Tonnage, 2017-2031

Figure 81: South America Semi-trailer Market, Incremental Opportunity, by Tonnage, Value (US$ Mn), 2022-2031

Figure 82: South America Semi-trailer Market Volume (Units) Forecast, by Axle, 2017-2031

Figure 83: South America Semi-trailer Market Value (US$ Mn) Forecast, by Axle, 2017-2031

Figure 84: South America Semi-trailer Market, Incremental Opportunity, by Axle, Value (US$ Mn), 2022-2031

Figure 85: South America Semi-trailer Market Volume (Units) Forecast, by End-use Industry, 2017-2031

Figure 86: South America Semi-trailer Market Value (US$ Mn) Forecast, by End-use Industry, 2017-2031

Figure 87: South America Semi-trailer Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2022-2031

Figure 88: South America Semi-trailer Market Volume (Units) Forecast, by Country and Sub-region, 2017-2031

Figure 89: South America Semi-trailer Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017-2031

Figure 90: South America Semi-trailer Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022-2031