Reports

Reports

Analysts’ Viewpoint

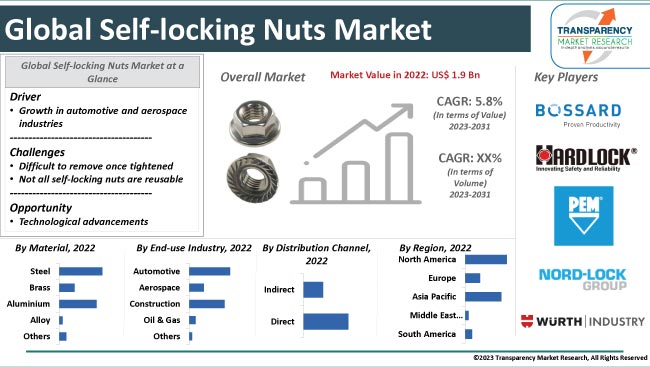

Growth in aerospace and automotive industries is a major factor contributing to the self-locking nuts market statistics. Moreover, applications of self-locking nuts are significantly rising in industrial machinery. This is a key factor that is anticipated to fuel market expansion during the forecast period.

Manufacturers operating in the global market are creating innovative products based on advanced technologies to tap value-grab opportunities. They are engaged in the development of aerospace nuts that are reusable and have a built-in self-locking mechanism. Companies in the market are also investing significantly in R&D to expand their global presence. Nylon insert lock nuts are gaining popularity due to their affordability and effectiveness in a wide range of environments. They are often used in domestic appliances and automotive repair.

Self-locking nuts, also known as aerotight locking nuts, offer resistance to becoming loose during service conditions, unlike traditional nuts. Self-locking nuts are used in applications where vibrations are common. These nuts are designed to provide a secure fix or joint. Self-locking nuts are commonly used in the automobile and aerospace manufacturing industries.

According to the latest self-locking nuts market forecast, increase in demand and production of vehicles has resulted in the global expansion of the automotive industry. This factor is positively impacting the demand for self-locking nuts. Self-locking nuts are useful components in automobile engines and other automotive parts.

As per the report by European Automobile Manufacturers Association, vehicle production in the European Union increased by 7.1% in 2022. The automotive industry in North America expanded by 10.3% in 2022, reaching 10.4 million units, primarily due to the strong demand for vehicles in the U.S.

Based on data from the China Association of Automobile Manufacturers (CAAM), in March 2023, vehicle production and sales volumes totaled up to 2.5 million units and 2.4 million units, up 15.3% and 9.7% year-over-year (y/y). Boosted by robust domestic demand and buyer certainty, in total, more than 68 million passenger cars were produced worldwide in 2022, a 7.9% increase from the previous year (2021).

Self-locking nuts are extensively used in the aerospace manufacturing industry. Airplane nuts can become loose due to vibrations. Therefore, several manufacturers, presently, are using self-locking nuts that would lock in place. Self-lock nuts play a crucial role in aircraft manufacturing and maintenance. Thus, self-locking nuts market demand in the aerospace sector is anticipated to rise in the near future.

According to the report published by the International Civil Aviation Organization (ICAO) on the Future of Aviation, aviation is a rapidly growing sector. The most recent estimates suggest that the global demand for air transport is likely to increase by an average of 4.3% per annum in the next 20 years.

Therefore, rise in popularity of air travel and growth in the aerospace sector are contributing to the market dynamics.

As per the self-locking nuts market research analysis, North America is anticipated to account for major share of the global industry during the forecast period, owing to expansion of the aerospace sector.

The U.S is the key consumer of self-locking nuts. According to the U.S. Airline Traffic Data, the U. S. has the world's second-largest air travel market. As per the Bureau of Transportation Statistics, U.S. airlines carried more than 194 million passengers in 2022 than in 2021, up 30% year-to-year. Hence, demand for self-locking nuts is high in the country.

Moreover, rise in customer concerns about safety and security is contributing to the increase in self-locking nuts market size in North America.

Furthermore, technological advancements, presence of prominent manufacturers, and expanding end-use industries are expected to propel the self-locking nuts industry growth in Asia Pacific.

The global market is highly stagnant and competitive, with the presence of various global and regional players that control majority of the self-locking nuts market share. Product development is a major strategy adopted by top players. Leading companies in the market are focusing on investment in R&D, product expansion, and merger & acquisition to tap incremental opportunities.

Accu Limited Company, Bossard Group, Chin Hsing Precision Industry Co., Ltd, HARD LOCK INDUSTRY CO., LTD., Huyett, National Bolt & Nut Corp, Nord-Lock International AB, Penn Engineering, STARWDH INDUSTRIAL CO. LTD, Würth Industrie Service GmbH & Co. KG, etc. are the leading players in the self-locking nuts market.

Manufacturers in the industry are following the emerging trends of the self-locking nuts market to strengthen their global presence.

Key players have been profiled in the self-locking nuts market report based on parameters such as product portfolio, financial overview, latest developments, business strategies, business segments, and company overview.

|

Attribute |

Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 1.9 Bn |

|

Market Forecast Value in 2031 |

US$ 3.1 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 1.9 Bn in 2022

It is projected to grow at a CAGR of 5.8% from 2023 to 2031

Growth in automotive sector and expansion of aerospace industry

The steel material segment accounted for significant share in 2022

Asia Pacific is likely to be one of the lucrative regions in the next few years

Accu Limited Company, Bossard Group, Chin Hsing Precision Industry Co., Ltd, HARD LOCK INDUSTRY CO., LTD., Huyett, National Bolt & Nut Corp., Nord-Lock International AB, Penn Engineering, STARWDH INDUSTRIAL CO. LTD, and Würth Industrie Service GmbH & Co. KG

1. Preface

1.1. Market Definitions and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Supply Side

5.3.2. Demand Side

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Raw Material Analysis

5.8. Global Self-locking Nuts Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projections (US$ Bn)

5.8.2. Market Volume Projections (Thousand Units)

6. Global Self-locking Nuts Market Analysis and Forecast, by Material

6.1. Self-locking Nuts Market (US$ Bn and Thousand Units), by Material, 2017 - 2031

6.1.1. Steel

6.1.2. Brass

6.1.3. Aluminum

6.1.4. Alloy

6.1.5. Others

6.2. Incremental Opportunity, by Material

7. Global Self-locking Nuts Market Analysis and Forecast, by End-use Industry

7.1. Self-locking Nuts Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

7.1.1. Automotive

7.1.2. Aerospace

7.1.3. Construction

7.1.4. Oil & Gas

7.1.5. Others

7.2. Incremental Opportunity, by End-use Industry

8. Global Self-locking Nuts Market Analysis and Forecast, by Distribution Channel

8.1. Self-locking Nuts Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

8.1.1. Direct

8.1.2. Indirect

8.1.2.1. Online Sales

8.1.2.2. Offline Sales

8.2. Incremental Opportunity, by Distribution Channel

9. Global Self-locking Nuts Market Analysis and Forecast, by Region

9.1. Self-locking Nuts Market (US$ Bn and Thousand Units), by Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Incremental Opportunity, by Region

10. North America Self-locking Nuts Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Trend Analysis

10.3. Price Trend Analysis

10.3.1. Weighted Average Selling Price (US$)

10.4. Key Supplier Analysis

10.5. Self-locking Nuts Market (US$ Bn and Thousand Units), by Material, 2017 - 2031

10.5.1. Steel

10.5.2. Brass

10.5.3. Aluminum

10.5.4. Alloy

10.5.5. Others

10.6. Self-locking Nuts Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

10.6.1. Automotive

10.6.2. Aerospace

10.6.3. Construction

10.6.4. Oil & Gas

10.6.5. Others

10.7. Self-locking Nuts Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

10.7.1. Direct

10.7.2. Indirect

10.7.2.1. Online Sales

10.7.2.2. Offline Sales

10.8. Self-locking Nuts Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

10.8.1. U.S.

10.8.2. Canada

10.8.3. Rest of North America

10.9. Incremental Opportunity Analysis

11. Europe Self-locking Nuts Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Trend Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price (US$)

11.4. Key Supplier Analysis

11.5. Self-locking Nuts Market (US$ Bn and Thousand Units), by Material, 2017 - 2031

11.5.1. Steel

11.5.2. Brass

11.5.3. Aluminum

11.5.4. Alloy

11.5.5. Others

11.6. Self-locking Nuts Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

11.6.1. Automotive

11.6.2. Aerospace

11.6.3. Construction

11.6.4. Oil & Gas

11.6.5. Others

11.7. Self-locking Nuts Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

11.7.1. Direct

11.7.2. Indirect

11.7.2.1. Online Sales

11.7.2.2. Offline Sales

11.8. Self-locking Nuts Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

11.8.1. Germany

11.8.2. UK

11.8.3. France

11.8.4. Rest of Europe

11.9. Incremental Opportunity Analysis

12. Asia Pacific Self-locking Nuts Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trend Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Key Supplier Analysis

12.5. Self-locking Nuts Market (US$ Bn and Thousand Units), by Material, 2017 - 2031

12.5.1. Steel

12.5.2. Brass

12.5.3. Aluminum

12.5.4. Alloy

12.5.5. Others

12.6. Self-locking Nuts Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

12.6.1. Automotive

12.6.2. Aerospace

12.6.3. Construction

12.6.4. Oil & Gas

12.6.5. Others

12.7. Self-locking Nuts Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

12.7.1. Direct

12.7.2. Indirect

12.7.2.1. Online Sales

12.7.2.2. Offline Sales

12.8. Self-locking Nuts Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

12.8.1. China

12.8.2. India

12.8.3. Japan

12.8.4. Rest of Asia Pacific

12.9. Incremental Opportunity Analysis

13. Middle East & Africa Self-locking Nuts Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trend Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Key Supplier Analysis

13.5. Self-locking Nuts Market (US$ Bn and Thousand Units), by Material, 2017 - 2031

13.5.1. Steel

13.5.2. Brass

13.5.3. Aluminum

13.5.4. Alloy

13.5.5. Others

13.6. Self-locking Nuts Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

13.6.1. Automotive

13.6.2. Aerospace

13.6.3. Construction

13.6.4. Oil & Gas

13.6.5. Others

13.7. Self-locking Nuts Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

13.7.1. Direct

13.7.2. Indirect

13.7.2.1. Online Sales

13.7.2.2. Offline Sales

13.8. Self-locking Nuts Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

13.8.1. GCC

13.8.2. South Africa

13.8.3. Rest of Middle East & Africa

13.9. Incremental Opportunity Analysis

14. South America Self-locking Nuts Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trend Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Key Supplier Analysis

14.5. Self-locking Nuts Market (US$ Bn and Thousand Units), by Material, 2017 - 2031

14.5.1. Steel

14.5.2. Brass

14.5.3. Aluminum

14.5.4. Alloy

14.5.5. Others

14.6. Self-locking Nuts Market (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

14.6.1. Automotive

14.6.2. Aerospace

14.6.3. Construction

14.6.4. Oil & Gas

14.6.5. Others

14.7. Self-locking Nuts Market (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

14.7.1. Direct

14.7.2. Indirect

14.7.2.1. Online Sales

14.7.2.2. Offline Sales

14.8. Self-locking Nuts Market (US$ Bn and Thousand Units) Forecast, By Country, 2017 - 2031

14.8.1. Brazil

14.8.2. Rest of South America

14.9. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player - Competition Dashboard

15.2. Market Revenue Share Analysis (%), (2022)

15.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

15.3.1. Accu Limited Company

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Revenue

15.3.1.4. Strategy & Business Overview

15.3.2. Bossard Group

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Revenue

15.3.2.4. Strategy & Business Overview

15.3.3. Chin Hsing Precision Industry Co., Ltd

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Revenue

15.3.3.4. Strategy & Business Overview

15.3.4. HARD LOCK INDUSTRY CO., LTD.

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Revenue

15.3.4.4. Strategy & Business Overview

15.3.5. Huyett

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Revenue

15.3.5.4. Strategy & Business Overview

15.3.6. National Bolt & Nut Corp.

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Revenue

15.3.6.4. Strategy & Business Overview

15.3.7. Nord-Lock International AB

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Revenue

15.3.7.4. Strategy & Business Overview

15.3.8. Penn Engineering

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Revenue

15.3.8.4. Strategy & Business Overview

15.3.9. STARWDH INDUSTRIAL CO., LTD

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Revenue

15.3.9.4. Strategy & Business Overview

15.3.10. Würth Industrie Service GmbH & Co. KG

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Revenue

15.3.10.4. Strategy & Business Overview

15.3.11. Others

15.3.11.1. Company Overview

15.3.11.2. Sales Area/Geographical Presence

15.3.11.3. Revenue

15.3.11.4. Strategy & Business Overview

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.1.1. By Material

16.1.2. By End-use Industry

16.1.3. By Distribution Channel

16.1.4. By Region

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Self-Locking Nuts Market Value (US$ Bn), by Material, 2017-2031

Table 2: Global Self-Locking Nuts Market Volume (Thousand Units), by Material 2017-2031

Table 3: Global Self-Locking Nuts Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 4: Global Self-Locking Nuts Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 5: Global Self-Locking Nuts Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 6: Global Self-Locking Nuts Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 7: Global Self-Locking Nuts Market Value (US$ Bn), by Region, 2017-2031

Table 8: Global Self-Locking Nuts Market Volume (Thousand Units), by Region 2017-2031

Table 9: North America Self-Locking Nuts Market Value (US$ Bn), by Material, 2017-2031

Table 10: North America Self-Locking Nuts Market Volume (Thousand Units), by Material 2017-2031

Table 11: North America Self-Locking Nuts Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 12: North America Self-Locking Nuts Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 13: North America Self-Locking Nuts Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 14: North America Self-Locking Nuts Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 15: North America Self-Locking Nuts Market Value (US$ Bn), by Region, 2017-2031

Table 16: North America Self-Locking Nuts Market Volume (Thousand Units), by Region 2017-2031

Table 17: Europe Self-Locking Nuts Market Value (US$ Bn), by Material, 2017-2031

Table 18: Europe Self-Locking Nuts Market Volume (Thousand Units), by Material 2017-2031

Table 19: Europe Self-Locking Nuts Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 20: Europe Self-Locking Nuts Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 21: Europe Self-Locking Nuts Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 22: Europe Self-Locking Nuts Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 23: Europe Self-Locking Nuts Market Value (US$ Bn), by Region, 2017-2031

Table 24: Europe Self-Locking Nuts Market Volume (Thousand Units), by Region 2017-2031

Table 25: Asia Pacific Self-Locking Nuts Market Value (US$ Bn), by Material, 2017-2031

Table 26: Asia Pacific Self-Locking Nuts Market Volume (Thousand Units), by Material 2017-2031

Table 27: Asia Pacific Self-Locking Nuts Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 28: Asia Pacific Self-Locking Nuts Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 29: Asia Pacific Self-Locking Nuts Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 30: Asia Pacific Self-Locking Nuts Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 31: Asia Pacific Self-Locking Nuts Market Value (US$ Bn), by Region, 2017-2031

Table 32: Asia Pacific Self-Locking Nuts Market Volume (Thousand Units), by Region 2017-2031

Table 33: Middle East & Africa Self-Locking Nuts Market Value (US$ Bn), by Material, 2017-2031

Table 34: Middle East & Africa Self-Locking Nuts Market Volume (Thousand Units), by Material 2017-2031

Table 35: Middle East & Africa Self-Locking Nuts Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 36: Middle East & Africa Self-Locking Nuts Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 37: Middle East & Africa Self-Locking Nuts Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 38: Middle East & Africa Self-Locking Nuts Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 39: Middle East & Africa Self-Locking Nuts Market Value (US$ Bn), by Region, 2017-2031

Table 40: Middle East & Africa Self-Locking Nuts Market Volume (Thousand Units), by Region 2017-2031

Table 41: South America Self-Locking Nuts Market Value (US$ Bn), by Material, 2017-2031

Table 42: South America Self-Locking Nuts Market Volume (Thousand Units), by Material 2017-2031

Table 43: South America Self-Locking Nuts Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 44: South America Self-Locking Nuts Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 45: South America Self-Locking Nuts Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 46: South America Self-Locking Nuts Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 47: South America Self-Locking Nuts Market Value (US$ Bn), by Region, 2017-2031

Table 48: South America Self-Locking Nuts Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global Self-locking Nuts Market Value (US$ Bn), by Material, 2017-2031

Figure 2: Global Self-locking Nuts Market Volume (Thousand Units), by Material 2017-2031

Figure 3: Global Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Material, 2023-2031

Figure 4: Global Self-locking Nuts Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 5: Global Self-locking Nuts Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 6: Global Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 7: Global Self-locking Nuts Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 8: Global Self-locking Nuts Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 9: Global Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 10: Global Self-locking Nuts Market Value (US$ Bn), by Region, 2017-2031

Figure 11: Global Self-locking Nuts Market Volume (Thousand Units), by Region 2017-2031

Figure 12: Global Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 13: North America Self-locking Nuts Market Value (US$ Bn), by Material, 2017-2031

Figure 14: North America Self-locking Nuts Market Volume (Thousand Units), by Material 2017-2031

Figure 15: North America Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Material, 2023-2031

Figure 16: North America Self-locking Nuts Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 17: North America Self-locking Nuts Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 18: North America Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 19: North America Self-locking Nuts Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 20: North America Self-locking Nuts Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 21: North America Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 22: North America Self-locking Nuts Market Value (US$ Bn), by Region, 2017-2031

Figure 23: North America Self-locking Nuts Market Volume (Thousand Units), by Region 2017-2031

Figure 24: North America Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 25: Europe Self-locking Nuts Market Value (US$ Bn), by Material, 2017-2031

Figure 26: Europe Self-locking Nuts Market Volume (Thousand Units), by Material 2017-2031

Figure 27: Europe Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Material, 2023-2031

Figure 28: Europe Self-locking Nuts Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 29: Europe Self-locking Nuts Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 30: Europe Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 31: Europe Self-locking Nuts Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 32: Europe Self-locking Nuts Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 33: Europe Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 34: Europe Self-locking Nuts Market Value (US$ Bn), by Region, 2017-2031

Figure 35: Europe Self-locking Nuts Market Volume (Thousand Units), by Region 2017-2031

Figure 36: Europe Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 37: Asia Pacific Self-locking Nuts Market Value (US$ Bn), by Material, 2017-2031

Figure 38: Asia Pacific Self-locking Nuts Market Volume (Thousand Units), by Material 2017-2031

Figure 39: Asia Pacific Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Material, 2023-2031

Figure 40: Asia Pacific Self-locking Nuts Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 41: Asia Pacific Self-locking Nuts Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 42: Asia Pacific Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 43: Asia Pacific Self-locking Nuts Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 44: Asia Pacific Self-locking Nuts Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 45: Asia Pacific Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 46: Asia Pacific Self-locking Nuts Market Value (US$ Bn), by Region, 2017-2031

Figure 47: Asia Pacific Self-locking Nuts Market Volume (Thousand Units), by Region 2017-2031

Figure 48: Asia Pacific Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 49: Middle East & Africa Self-locking Nuts Market Value (US$ Bn), by Material, 2017-2031

Figure 50: Middle East & Africa Self-locking Nuts Market Volume (Thousand Units), by Material 2017-2031

Figure 51: Middle East & Africa Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Material, 2023-2031

Figure 52: Middle East & Africa Self-locking Nuts Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 53: Middle East & Africa Self-locking Nuts Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 54: Middle East & Africa Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 55: Middle East & Africa Self-locking Nuts Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 56: Middle East & Africa Self-locking Nuts Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 57: Middle East & Africa Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 58: Middle East & Africa Self-locking Nuts Market Value (US$ Bn), by Region, 2017-2031

Figure 59: Middle East & Africa Self-locking Nuts Market Volume (Thousand Units), by Region 2017-2031

Figure 60: Middle East & Africa Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 61: South America Self-locking Nuts Market Value (US$ Bn), by Material, 2017-2031

Figure 62: South America Self-locking Nuts Market Volume (Thousand Units), by Material 2017-2031

Figure 63: South America Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Material, 2023-2031

Figure 64: South America Self-locking Nuts Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 65: South America Self-locking Nuts Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 66: South America Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 67: South America Self-locking Nuts Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 68: South America Self-locking Nuts Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 69: South America Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 70: South America Self-locking Nuts Market Value (US$ Bn), by Region, 2017-2031

Figure 71: South America Self-locking Nuts Market Volume (Thousand Units), by Region 2017-2031

Figure 72: South America Self-locking Nuts Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031