Reports

Reports

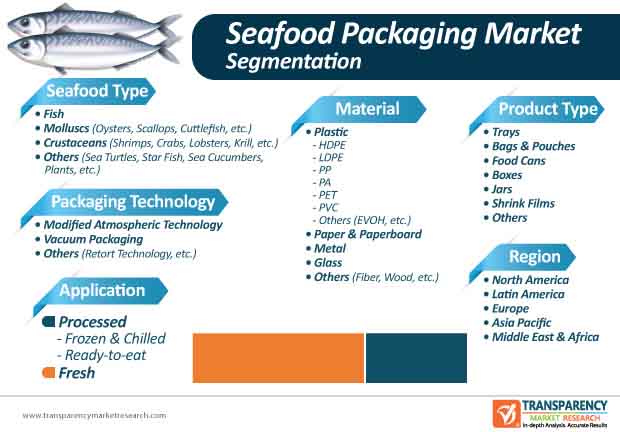

According to the Food and Agriculture Organization (FAO), fish production is set to grow by around 18% in the next 10 years. Investments in the seafood production sector continue to pour in to strengthen fisheries management regimes, minimizing waste, and mitigate losses during transportation. As seafood production is set for inevitable growth in the coming years, stakeholders in the seafood packaging market are continually finding new ways to preserve the freshness of fresh products and minimize exposure to external factors that hinder the same. Seafood packaging has thus, gained a significant amount of traction in recent years, wherein new technologies are being deployed to improve the quality and durability of new packaging solutions.

At present, modified atmosphere packaging and vacuum packaging technology are increasingly being used for seafood packaging. In the current scenario, the growing demand for fresh seafood, particularly in the Asia Pacific region has compelled stakeholders in the seafood packaging market landscape to deploy different types of seafood packaging products, including food cans, shrink films, boxes, and bags & pouches. Stakeholders in the current market landscape are also focused on offering effective seafood packaging solutions that are ideal for shipments across large distances. These factors coupled with a significant rise in consumer demand for high-quality seafood products is expected to drive the global seafood packaging market past ~US$ 6.5 Bn by the end of 2027.

Over the past decade, technological advancements in the packaging sector have opened the gates for new packaging solutions that are cost-effective and highly reliable. The development of new packaging alternatives in the seafood space, primarily aim to curb enzymatic reactions and improve the perishability of seafood products. At present, key participants of the seafood packaging market predominantly favor modified atmosphere packaging (MAP) and vacuum skin packaging. However, shortcomings of both these packaging technologies continue to pose a major challenge for seafood packaging companies. Moreover, due to the progress in vacuum packaging and modified atmosphere packaging, consumers can physically inspect the quality of the product-a direct influence on the purchase decisions of consumers.

While seafood products packaged using modified atmosphere packaging tend to soil after 15-20 days; on the other hand, vacuum skin packaging continues to incur heavy costs and is not ideal for long-distance transportation. Although the vacuum packaging technology will continue to dominate the seafood packaging market during the forecast period, alternative packaging technologies are gaining popularity.

Companies are largely focused on developing innovative seafood packaging solutions that align with regulations laid down by the food and drug administration (FDA). Due to the drawbacks of modified atmosphere packaging and vacuum packaging, the quest for new and innovative techniques as well as improving the current state of seafood packaging continues to gain momentum. Research and development activities have gradually paved the way for improved active packaging and intelligent packaging systems that are increasingly finding a place in the seafood packaging market worldwide. Sustainability is another key area of interest that has drawn the attention of the players in the seafood packaging market. Due to the mounting consumer demand for environmental sustainability, seafood packaging companies are increasingly using environment-friendly recyclable packaging materials. While plastic is expected to lead the material segment of the seafood packaging market during the forecast period, packaging solutions made from alternative materials, including paper & paperboard and metal are set to experience fast-paced adoption in the second half of the assessment period.

Due to the significant progress in the seafood packaging market, consumers across the world have access to an array of seafood products. Consumer requirements continue to witness waves of transition, and seafood packaging companies are expected to align their operations with these demands. The blend of sensory appeal and offering a convenient packaging solution without hindering the quality will continue to drive innovations in the seafood packaging market during the forecast period. In the coming years, seafood packaging companies are likely to focus on developing new packaging solutions that are cost-efficient and at the same time do not harm the environment. While the protein content of seafood will remain a vital factor, consumers are also expected to focus on innovative packaging designs and overall purchasing experience.

Analysts’ Viewpoint

The global seafood packaging market is expected to grow at a modest CAGR of ~5% during the forecast period. The market growth can be largely attributed to an array of factors out of which, advancements in MAP and vacuum packaging will remain pivotal. In addition, stakeholders in the global seafood packaging market should take interest in the development of sustainable packaging alternatives due to the rising demand for sustainability in the packaging sector. Consumer preferences, particularly in North America and Europe will lean toward sustainable packaging solutions due to which, seafood packaging companies should focus on other materials, including paper, metal, and glass.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. Analysis and Recommendations

1.4. Wheel of Opportunity

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Market Viewpoint

3.1. Global Packaging Market Overview

3.2. Macro-Economic Factors

3.3. Forecast Factors: Relevance and Impact

3.4. Trade Flow: fish, Molluscs, Crustaceans

3.5. Packaging Materials Properties Comparison

3.6. Key Regulations

3.7. Global Seafood Packaging Market Value Chain Analysis

3.7.1. Profitability Margins

3.7.2. List of Active Participants

3.7.2.1. Raw Material Supplier

3.7.2.2. Manufacturers

3.7.2.3. End Users

3.8. Market Dynamics

3.8.1. Drivers

3.8.2. Restraints

3.8.3. Opportunity Analysis

3.8.4. Trends

4. Market Forecast

4.1. Market Volume Projections

4.2. Pricing Analysis

4.3. Market Size Projections

4.3.1. Y-o-Y Projections

4.3.2. Absolute $ Opportunity Analysis

5. Global Seafood Packaging Market Analysis By Product

5.1. Introduction

5.1.1. Market Value Share Analysis By Product

5.1.2. Y-o-Y Growth Analysis By Product

5.2. Market Size (US$ Mn) and Volume (Tons) Forecast By Product 2014–2027

5.2.1. Trays

5.2.2. Bags & Pouches

5.2.3. Food Cans

5.2.4. Boxes

5.2.5. Jars

5.2.6. Shrink Films

5.2.7. Others

5.3. Market Attractiveness Analysis By Product

6. Global Seafood Packaging Market Analysis By Material

6.1. Introduction

6.1.1. Market Value Share Analysis By Material

6.1.2. Y-o-Y Growth Analysis By Material

6.2. Market Size (US$ Mn) and Volume (Tons) Forecast By Material 2014–2027

6.2.1. Plastic

6.2.1.1. High Density Polyethylene (HDPE)

6.2.1.2. Low Density Polyethylene (LDPE)

6.2.1.3. Polypropylene (PP)

6.2.1.4. Polyamide (PA)

6.2.1.5. Polyethylene Terephthalate (PET)

6.2.1.6. Poly Vinyl Chloride (PVC)

6.2.2. Paper & Paperboard

6.2.3. Metal

6.2.4. Glass

6.2.5. Others (Wood, Fabric, etc.)

6.3. Market Attractiveness Analysis By Material

7. Global Seafood Packaging Market Analysis By Packaging Technology

7.1. Introduction

7.1.1. Market Value Share Analysis By Packaging Technology

7.1.2. Y-o-Y Growth Analysis By Packaging Technology

7.2. Market Size (US$ Mn) and Volume (Tons) Forecast By Packaging Technology 2014–2027

7.2.1. Modified Atmospheric Packaging (MAP)

7.2.2. Vacuum Packaging

7.2.3. Retort Packaging

7.3. Market Attractiveness Analysis By Packaging Technology

8. Global Seafood Packaging Market Analysis By Application

8.1. Introduction

8.1.1. Market Value Share Analysis By Application

8.1.2. Y-o-Y Growth Analysis By Application

8.2. Market Size (US$ Mn) and Volume (Tons) Forecast By Application 2014–2027

8.2.1. Processed

8.2.1.1. Frozen & Chilled Sea Food

8.2.1.2. Ready To Eat (Value Added) Sea Food

8.2.2. Fresh Sea Food

8.3. Market Attractiveness Analysis By Application

9. Global Seafood Packaging Market Analysis By Seafood Type

9.1. Introduction

9.1.1. Market Value Share Analysis By Seafood Type

9.1.2. Y-o-Y Growth Analysis By Seafood Type

9.2. Market Size (US$ Mn) and Volume (Tons) Forecast By Seafood Type 2014–2027

9.2.1. Fish

9.2.2. Molluscs

9.2.3. Crustaceans

9.2.4. Others

9.3. Market Attractiveness Analysis By Seafood Type

10. Global Seafood Packaging Market Analysis By Region

10.1. Introduction

10.1.1. Market Value Share Analysis By Region

10.1.2. Y-o-Y Growth Analysis By Region

10.2. Market Size (US$ Mn) and Volume (Tons) Forecast By Region 2014–2027

10.2.1. North America

10.2.2. Latin America

10.2.3. Europe

10.2.4. Asia Pacific (APAC)

10.2.5. Middle East & Africa (MEA)

10.3. Market Attractiveness Analysis By Region

11. North America Seafood Packaging Market Analysis

11.1. Introduction

11.2. Pricing Analysis

11.3. Market Size (US$ Mn) and Volume (Tons) Forecast By Country, 2014–2027

11.3.1. U.S.

11.3.2. Canada

11.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Product 2014–2027

11.4.1. Trays

11.4.2. Bags & Pouches

11.4.3. Food Cans

11.4.4. Boxes

11.4.5. Jars

11.4.6. Shrink Films

11.4.7. Others

11.5. Market Size (US$ Mn) and Volume (Tons) Forecast By Material 2014–2027

11.5.1. Plastic

11.5.1.1. High Density Polyethylene (HDPE)

11.5.1.2. Low Density Polyethylene (LDPE)

11.5.1.3. Polypropylene (PP)

11.5.1.4. Polyamide (PA)

11.5.1.5. Polyethylene Terephthalate (PET)

11.5.1.6. Poly Vinyl Chloride (PVC)

11.5.2. Paper & Paperboard

11.5.3. Metal

11.5.4. Glass

11.5.5. Others (Wood, Fabric, etc.)

11.6. Market Size (US$ Mn) and Volume (Tons) Forecast By Packaging Technology 2014–2027

11.6.1. Modified Atmospheric Packaging (MAP)

11.6.2. Vacuum Packaging

11.6.3. Retort Packaging

11.7. Market Size (US$ Mn) and Volume (Tons) Forecast By Application 2014–2027

11.7.1. Processed

11.7.1.1. Frozen & Chilled Sea Food

11.7.1.2. Ready To Eat (Value Added) Sea Food

11.7.2. Fresh Sea Food

11.8. Market Size (US$ Mn) and Volume (Tons) Forecast By Seafood Type 2014–2027

11.8.1. Fish

11.8.2. Molluscs

11.8.3. Crustaceans

11.8.4. Others

11.9. Key Market Participants – Intensity Mapping

11.10. Drivers and Restraints – Impact Analysis

12. Europe Seafood Packaging Market Analysis

12.1. Introduction

12.2. Pricing Analysis

12.3. Market Size (US$ Mn) and Volume (Tons) Forecast By Country, 2014–2027

12.3.1. Germany

12.3.2. Italy

12.3.3. France

12.3.4. U.K.

12.3.5. Spain

12.3.6. Benelux

12.3.7. Nordic

12.3.8. Russia

12.3.9. Poland

12.3.10. Rest of Europe

12.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Product 2014–2027

12.4.1. Trays

12.4.2. Bags & Pouches

12.4.3. Food Cans

12.4.4. Boxes

12.4.5. Jars

12.4.6. Shrink Films

12.4.7. Others

12.5. Market Size (US$ Mn) and Volume (Tons) Forecast By Material 2014–2027

12.5.1. Plastic

12.5.1.1. High Density Polyethylene (HDPE)

12.5.1.2. Low Density Polyethylene (LDPE)

12.5.1.3. Polypropylene (PP)

12.5.1.4. Polyamide (PA)

12.5.1.5. Polyethylene Terephthalate (PET)

12.5.1.6. Poly Vinyl Chloride (PVC)

12.5.2. Paper & Paperboard

12.5.3. Metal

12.5.4. Glass

12.5.5. Others (Wood, Fabric, etc.)

12.6. Market Size (US$ Mn) and Volume (Tons) Forecast By Packaging Technology 2014–2027

12.6.1. Modified Atmospheric Packaging (MAP)

12.6.2. Vacuum Packaging

12.6.3. Retort Packaging

12.7. Market Size (US$ Mn) and Volume (Tons) Forecast By Application 2014–2027

12.7.1. Processed

12.7.1.1. Frozen & Chilled Sea Food

12.7.1.2. Ready To Eat (Value Added) Sea Food

12.7.2. Fresh Sea Food

12.8. Market Size (US$ Mn) and Volume (Tons) Forecast By Seafood Type 2014–2027

12.8.1. Fish

12.8.2. Molluscs

12.8.3. Crustaceans

12.8.4. Others

12.9. Key Market Participants – Intensity Mapping

12.10. Drivers and Restraints – Impact Analysis

13. APAC Seafood Packaging Market Analysis

13.1. Introduction

13.2. Pricing Analysis

13.3. Market Size (US$ Mn) and Volume (Tons) Forecast By Country, 2014–2027

13.3.1. China

13.3.2. India

13.3.3. ASEAN

13.3.4. Australia and New Zealand

13.3.5. Japan

13.3.6. Rest of APAC

13.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Product 2014–2027

13.4.1. Trays

13.4.2. Bags & Pouches

13.4.3. Food Cans

13.4.4. Boxes

13.4.5. Jars

13.4.6. Shrink Films

13.4.7. Others

13.5. Market Size (US$ Mn) and Volume (Tons) Forecast By Material 2014–2027

13.5.1. Plastic

13.5.1.1. High Density Polyethylene (HDPE)

13.5.1.2. Low Density Polyethylene (LDPE)

13.5.1.3. Polypropylene (PP)

13.5.1.4. Polyamide (PA)

13.5.1.5. Polyethylene Terephthalate (PET)

13.5.1.6. Poly Vinyl Chloride (PVC)

13.5.2. Paper & Paperboard

13.5.3. Metal

13.5.4. Glass

13.5.5. Others (Wood, Fabric, etc.)

13.6. Market Size (US$ Mn) and Volume (Tons) Forecast By Packaging Technology 2014–2027

13.6.1. Modified Atmospheric Packaging (MAP)

13.6.2. Vacuum Packaging

13.6.3. Retort Packaging

13.7. Market Size (US$ Mn) and Volume (Tons) Forecast By Application 2014–2027

13.7.1. Processed

13.7.1.1. Frozen & Chilled Sea Food

13.7.1.2. Ready To Eat (Value Added) Sea Food

13.7.2. Fresh Sea Food

13.8. Market Size (US$ Mn) and Volume (Tons) Forecast By Seafood Type 2014–2027

13.8.1. Fish

13.8.2. Molluscs

13.8.3. Crustaceans

13.8.4. Others

13.9. Key Market Participants – Intensity Mapping

13.10. Drivers and Restraints – Impact Analysis

14. Latin America Seafood Packaging Market Analysis

14.1. Introduction

14.2. Pricing Analysis

14.3. Market Size (US$ Mn) and Volume (Tons) Forecast By Country, 2014–2027

14.3.1. Brazil

14.3.2. Mexico

14.3.3. Argentina

14.3.4. Rest of Latin America

14.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Product 2014–2027

14.4.1. Trays

14.4.2. Bags & Pouches

14.4.3. Food Cans

14.4.4. Boxes

14.4.5. Jars

14.4.6. Shrink Films

14.4.7. Others

14.5. Market Size (US$ Mn) and Volume (Tons) Forecast By Material 2014–2027

14.5.1. Plastic

14.5.1.1. High Density Polyethylene (HDPE)

14.5.1.2. Low Density Polyethylene (LDPE)

14.5.1.3. Polypropylene (PP)

14.5.1.4. Polyamide (PA)

14.5.1.5. Polyethylene Terephthalate (PET)

14.5.1.6. Poly Vinyl Chloride (PVC)

14.5.2. Paper & Paperboard

14.5.3. Metal

14.5.4. Glass

14.5.5. Others (Wood, Fabric, etc.)

14.6. Market Size (US$ Mn) and Volume (Tons) Forecast By Packaging Technology 2014–2027

14.6.1. Modified Atmospheric Packaging (MAP)

14.6.2. Vacuum Packaging

14.6.3. Retort Packaging

14.7. Market Size (US$ Mn) and Volume (Tons) Forecast By Application 2014–2027

14.7.1. Processed

14.7.1.1. Frozen & Chilled Sea Food

14.7.1.2. Ready To Eat (Value Added) Sea Food

14.7.2. Fresh Sea Food

14.8. Market Size (US$ Mn) and Volume (Tons) Forecast By Seafood Type 2014–2027

14.8.1. Fish

14.8.2. Molluscs

14.8.3. Crustaceans

14.8.4. Others

14.9. Key Market Participants – Intensity Mapping

14.10. Drivers and Restraints – Impact Analysis

15. MEA Seafood Packaging Market Analysis

15.1. Introduction

15.2. Pricing Analysis

15.3. Market Size (US$ Mn) and Volume (Tons) Forecast By Country, 2014–2027

15.3.1. GCC

15.3.2. North Africa

15.3.3. South Africa

15.3.4. Rest of MEA

15.4. Market Size (US$ Mn) and Volume (Tons) Forecast By Product 2014–2027

15.4.1. Pouches

15.4.2. Bags

15.4.3. Trays

15.4.4. Bags & Pouches

15.4.5. Food Cans

15.4.6. Boxes

15.4.7. Jars

15.4.8. Shrink Films

15.4.9. Others

15.5. Market Size (US$ Mn) and Volume (Tons) Forecast By Material 2014–2027

15.5.1. Plastic

15.5.1.1. High Density Polyethylene (HDPE)

15.5.1.2. Low Density Polyethylene (LDPE)

15.5.1.3. Polypropylene (PP)

15.5.1.4. Polyamide (PA)

15.5.1.5. Polyethylene Terephthalate (PET)

15.5.1.6. Poly Vinyl Chloride (PVC)

15.5.2. Paper & Paperboard

15.5.3. Metal

15.5.4. Glass

15.5.5. Others (Wood, Fabric, etc.)

15.6. Market Size (US$ Mn) and Volume (Tons) Forecast By Packaging Technology 2014–2027

15.6.1. Modified Atmospheric Packaging (MAP)

15.6.2. Vacuum Packaging

15.6.3. Retort Packaging

15.7. Market Size (US$ Mn) and Volume (Tons) Forecast By Application 2014–2027

15.7.1. Processed

15.7.1.1. Frozen & Chilled Sea Food

15.7.1.2. Ready To Eat (Value Added) Sea Food

15.7.2. Fresh Sea Food

15.8. Market Size (US$ Mn) and Volume (Tons) Forecast By Seafood Type 2014–2027

15.8.1. Fish

15.8.2. Molluscs

15.8.3. Crustaceans

15.8.4. Others

15.9. Key Market Participants – Intensity Mapping

15.10. Drivers and Restraints – Impact Analysis

16. Market Structure Analysis

16.1. Market Concentration

16.2. Market Share Analysis of Top 10 Players

16.3. Market Presence Analysis

16.3.1. By Regional footprint of Players

16.3.2. Product foot print by Players

16.3.3. Channel Foot Print by Players

17. Competition Analysis

17.1. Competition Dashboard

17.2. Competition Benchmarking

17.3. Profitability and Gross Margin Analysis By Competition

17.4. Competition Developments

17.5. Competition Deep Dive

17.5.1. Amcor Plc

17.5.1.1. Overview

17.5.1.2. Product Portfolio

17.5.1.3. Profitability by Market Segments

17.5.1.4. Production Footprint

17.5.1.5. Sales Footprint

17.5.1.6. Channel Footprint

17.5.1.7. Competition Benchmarking

17.5.1.8. Strategy

17.5.1.8.1. Marketing Strategy

17.5.1.8.2. Product Strategy

17.5.1.8.3. Channel Strategy

17.5.2. Crown Holdings Inc.

17.5.2.1. Overview

17.5.2.2. Product Portfolio

17.5.2.3. Profitability by Market Segments

17.5.2.4. Production Footprint

17.5.2.5. Sales Footprint

17.5.2.6. Channel Footprint

17.5.2.7. Competition Benchmarking

17.5.2.8. Strategy

17.5.2.8.1. Marketing Strategy

17.5.2.8.2. Product Strategy

17.5.2.8.3. Channel Strategy

17.5.3. AEP Industries Inc.

17.5.3.1. Overview

17.5.3.2. Product Portfolio

17.5.3.3. Profitability by Market Segments

17.5.3.4. Production Footprint

17.5.3.5. Sales Footprint

17.5.3.6. Channel Footprint

17.5.3.7. Competition Benchmarking

17.5.3.8. Strategy

17.5.3.8.1. Marketing Strategy

17.5.3.8.2. Product Strategy

17.5.3.8.3. Channel Strategy

17.5.4. Smurfit Kappa Group

17.5.4.1. Overview

17.5.4.2. Product Portfolio

17.5.4.3. Profitability by Market Segments

17.5.4.4. Production Footprint

17.5.4.5. Sales Footprint

17.5.4.6. Channel Footprint

17.5.4.7. Competition Benchmarking

17.5.4.8. Strategy

17.5.4.8.1. Marketing Strategy

17.5.4.8.2. Product Strategy

17.5.4.8.3. Channel Strategy

17.5.5. Sealed Air Corp

17.5.5.1. Overview

17.5.5.2. Product Portfolio

17.5.5.3. Profitability by Market Segments

17.5.5.4. Production Footprint

17.5.5.5. Sales Footprint

17.5.5.6. Channel Footprint

17.5.5.7. Competition Benchmarking

17.5.5.8. Strategy

17.5.5.8.1. Marketing Strategy

17.5.5.8.2. Product Strategy

17.5.5.8.3. Channel Strategy

17.5.6. Winpak Ltd.

17.5.6.1. Overview

17.5.6.2. Product Portfolio

17.5.6.3. Profitability by Market Segments

17.5.6.4. Production Footprint

17.5.6.5. Sales Footprint

17.5.6.6. Channel Footprint

17.5.6.7. Competition Benchmarking

17.5.6.8. Strategy

17.5.6.8.1. Marketing Strategy

17.5.6.8.2. Product Strategy

17.5.6.8.3. Channel Strategy

17.5.7. DS Smith plc

17.5.7.1. Overview

17.5.7.2. Product Portfolio

17.5.7.3. Profitability by Market Segments

17.5.7.4. Production Footprint

17.5.7.5. Sales Footprint

17.5.7.6. Channel Footprint

17.5.7.7. Competition Benchmarking

17.5.7.8. Strategy

17.5.7.8.1. Marketing Strategy

17.5.7.8.2. Product Strategy

17.5.7.8.3. Channel Strategy

17.5.8. Visy Industries Holdings Pty Ltd

17.5.8.1. Overview

17.5.8.2. Product Portfolio

17.5.8.3. Profitability by Market Segments

17.5.8.4. Production Footprint

17.5.8.5. Sales Footprint

17.5.8.6. Channel Footprint

17.5.8.7. Competition Benchmarking

17.5.8.8. Strategy

17.5.8.8.1. Marketing Strategy

17.5.8.8.2. Product Strategy

17.5.8.8.3. Channel Strategy

17.5.9. Printpack Inc.

17.5.9.1. Overview

17.5.9.2. Product Portfolio

17.5.9.3. Profitability by Market Segments

17.5.9.4. Production Footprint

17.5.9.5. Sales Footprint

17.5.9.6. Channel Footprint

17.5.9.7. Competition Benchmarking

17.5.9.8. Strategy

17.5.9.8.1. Marketing Strategy

17.5.9.8.2. Product Strategy

17.5.9.8.3. Channel Strategy

17.5.10. Sirane Limited

17.5.10.1. Overview

17.5.10.2. Product Portfolio

17.5.10.3. Profitability by Market Segments

17.5.10.4. Production Footprint

17.5.10.5. Sales Footprint

17.5.10.6. Channel Footprint

17.5.10.7. Competition Benchmarking

17.5.10.8. Strategy

17.5.10.8.1. Marketing Strategy

17.5.10.8.2. Product Strategy

17.5.10.8.3. Channel Strategy

17.5.11. Silgan Holdings Inc.

17.5.11.1. Overview

17.5.11.2. Product Portfolio

17.5.11.3. Profitability by Market Segments

17.5.11.4. Production Footprint

17.5.11.5. Sales Footprint

17.5.11.6. Channel Footprint

17.5.11.7. Competition Benchmarking

17.5.11.8. Strategy

17.5.11.8.1. Marketing Strategy

17.5.11.8.2. Product Strategy

17.5.11.8.3. Channel Strategy

17.5.12. Toyo Seikan Group Holdings Ltd.

17.5.12.1. Overview

17.5.12.2. Product Portfolio

17.5.12.3. Profitability by Market Segments

17.5.12.4. Production Footprint

17.5.12.5. Sales Footprint

17.5.12.6. Channel Footprint

17.5.12.7. Competition Benchmarking

17.5.12.8. Strategy

17.5.12.8.1. Marketing Strategy

17.5.12.8.2. Product Strategy

17.5.12.8.3. Channel Strategy

17.5.13. Reynolds Group Holdings

17.5.13.1. Overview

17.5.13.2. Product Portfolio

17.5.13.3. Profitability by Market Segments

17.5.13.4. Production Footprint

17.5.13.5. Sales Footprint

17.5.13.6. Channel Footprint

17.5.13.7. Competition Benchmarking

17.5.13.8. Strategy

17.5.13.8.1. Marketing Strategy

17.5.13.8.2. Product Strategy

17.5.13.8.3. Channel Strategy

17.5.14. FFP Packaging Ltd.

17.5.14.1. Overview

17.5.14.2. Product Portfolio

17.5.14.3. Profitability by Market Segments

17.5.14.4. Production Footprint

17.5.14.5. Sales Footprint

17.5.14.6. Channel Footprint

17.5.14.7. Competition Benchmarking

17.5.14.8. Strategy

17.5.14.8.1. Marketing Strategy

17.5.14.8.2. Product Strategy

17.5.14.8.3. Channel Strategy

18. Assumptions and Acronyms Used

19. Research Methodology

List of Tables

Table No 1: Global Seafood Packaging Market, by Product Type

Table No 2: Global Seafood Packaging Market, by Material Type

Table No 3: Global Seafood Packaging Market, by Packaging Technology

Table No 4: Global Seafood Packaging Market, by Application

Table No 5: Global Seafood Packaging Market, by Seafood Type

Table No 6: Global Seafood Packaging Market, by Region

Table No 7: North America Seafood Packaging Market, by Volume (‘000 Tons)

Table No 8: North America Seafood Packaging Market, by Value (US$ Mn)

Table No 9: North America Seafood Packaging Market, by Country

Table No 10: Latin America Seafood Packaging Market, by Volume (‘000 Tons)

Table No 11: Latin America Seafood Packaging Market, by Value (US$ Mn)

Table No 12: Latin America Seafood Packaging Market, by Country

Table No 13: Europe Seafood Packaging Market, by Volume (‘000 Tons)

Table No 14: Europe Seafood Packaging Market, by Value (US$ Mn)

Table No 15: Europe Seafood Packaging Market, by Country

Table No 16: APAC Seafood Packaging Market, by Volume (‘000 Tons)

Table No 17: APAC Seafood Packaging Market, by Value (US$ Mn)

Table No 18: APAC Seafood Packaging Market, by Country

Table No 19: MEA Seafood Packaging Market, by Volume (‘000 Tons)

Table No 20: MEA Seafood Packaging Market, by Value (US$ Mn)

Table No 21: MEA Seafood Packaging Market, by Country

List of Figures

Figure 01: North America Seafood Packaging Market Share (%), by Product Type, Material, Packaging Technology, Application, Seafood type and Country 2019

Figure 02: North America Seafood Packaging Market Value (2019) & CAGR by Plastic Material

Figure 03: North America Seafood Packaging Market Attractiveness by Plastic Material

Figure 04: North America Seafood Packaging Market Value (2019) & CAGR by Processed Type

Figure 05: Latin America Seafood Packaging Market Share (%), Product Type, Material, Packaging Technology, Application, Seafood type and Country by 2019

Figure 06: Latin America Seafood Packaging Market Value (2019) & CAGR by Plastic Material

Figure 07: Latin America Seafood Packaging Market Attractiveness by Plastic Material

Figure 08: Latin America Seafood Packaging Market Value (2019) & CAGR by Processed Type

Figure 09: Europe Seafood Packaging Market Share (%), Product Type, Material, Packaging Technology, Application, Seafood type and Country by 2019

Figure 10: Europe Seafood Packaging Market Value (2019) & CAGR by Plastic Material

Figure 11: Europe Seafood Packaging Market Attractiveness by Plastic Material

Figure 12: Europe Seafood Packaging Market Value (2019) & CAGR by Processed Type

Figure 13: APAC Seafood Packaging Market Share (%), Product Type, Material, Packaging Technology, Application, Seafood type and Country by 2019

Figure 14: APAC Seafood Packaging Market Value (2019) & CAGR by Plastic Material

Figure 15: APAC Seafood Packaging Market Attractiveness by Plastic Material

Figure 16: APAC Seafood Packaging Market Value (2019) & CAGR by Processed Type

Figure 13: MEA Seafood Packaging Market Share (%), Product Type, Material, Packaging Technology, Application, Seafood type and Country by 2019

Figure 18: MEA Seafood Packaging Market Value (2019) & CAGR by Plastic Material

Figure 19: MEA Seafood Packaging Market Attractiveness by Plastic Material

Figure 20: MEA Seafood Packaging Market Value (2019) & CAGR by Processed Type