Reports

Reports

Analysts’ Viewpoint

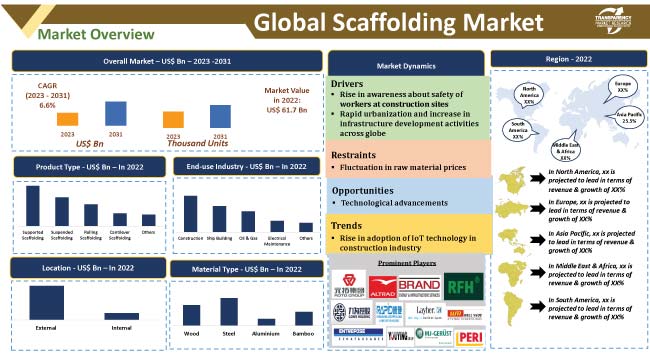

Rapid urbanization, industrialization, and growth in the construction industry are significantly driving the scaffolding market size. Rise in infrastructure development activities across the globe is further contributing to market expansion. Scaffolding is used for various activities such as cleaning, construction, industrial inspections, and maintenance. The market is increasingly being fueled by the rise in implementation of safety regulations at construction sites, owing to the increase in number of accidents at such locations.

Companies in the global industry are focusing on the development of efficient and lightweight scaffolding that offers advantages in establishing a safe work environment. Depending on the application, utilization of cutting-edge fabrication techniques has made it possible to create flexible structures. Manufacturers should increase their investment in R&D in order to tap into incremental scaffolding market opportunities and broaden their revenue streams.

Scaffolding or staging is a temporary structure used in the building & construction industry to support construction workers. Scaffolding is also utilized in the repair & maintenance of several manmade structures, including buildings and bridges, with the help of supporting work crews and materials. The various types of scaffoldings available in the market include supported scaffolding, suspended scaffolding, rolling scaffolding, and cantilever scaffolding. The material used in the manufacture of temporary scaffolding structures includes wood, steel, bamboo, and aluminum. Individualized scaffolding solutions are gaining popularity, as they can be quickly and easily created using modules. Rental scaffolding is a significant source of revenue for market players.

Growth in various industries, such as mining and construction, is estimated to boost the global scaffolding industry growth during the forecast period. Demand for scaffolding is increasing in these industries. The industry has witnessed a significant increase in the number of players supplying components to enhance the functionality of scaffolds. The Occupational Safety and Health Administration, or OSHA, set standards for preplanning, training, and the selection of components and designs. Flexible structures can currently be produced with the help of sophisticated fabrication techniques.

Additionally, particularly in developing economies, construction workers are more trained in building and dismantling structures safely. Manufacturers in scaffolding are focusing on innovations and upgrades, such as the use of modular components, and software for maintenance planning, process control, and regulatory compliance, to enhance efficiency and safety of workers.

Rapid urbanization and industrialization are also anticipated to boost the demand for scaffolds in construction, renovation, and mining industries in the next few years. Additionally, producers are emphasizing on integrated scaffolding systems to cater to the demand of the end-users.

Manufacturers are increasing R&D to develop highly efficient scaffolding products. Automation has become part and parcel of the global industrial landscape. Several organizations have started using mobile applications for maintenance of scaffoldings.

Adoption of scaffolding systems is rising in end-user industries, owing to an increase in awareness about the safety of laborers and implementation of strict rules and regulations for the construction industry. Market players are following the scaffolding market trends, such as adoption of augmented reality (AR)/virtual reality (VR) and artificial intelligence (AI) technologies, to develop innovative products in order to retain their scaffolding market share.

About 80% of the cost of scaffolding is consumed on installing, dismantling, and transportation of scaffolding products. Lightweight materials greatly increase the productivity of scaffolding products and enhance their transportation efficiency. For instance, German scaffolding manufacturer, Layher Holding GmbH & Co. KG, developed a lightweight, faster, and more cost-effective all-round scaffolding that can connect and support up to eight steel or aluminum tubes at various angles. All these factors are expected to drive the scaffolding market growth during the forecast period.

Based on product type, the global market segmentation comprises supported scaffolding, suspended scaffolding, rolling scaffolding, cantilever scaffolding, and others. The supported scaffolding segment is likely to dominate the market during the forecast period. These platforms are lightweight and easy to assemble or disassemble at construction sites. These scaffoldings require lesser materials to reach greater heights as compared to that required by other types.

According to the global scaffolding market report, Asia Pacific is expected to dominate the global industry during the forecast period, due to rapid industrialization and rise in number of infrastructure development projects in the region. Increase in government investment for the development of infrastructure in emerging economies is anticipated to fuel the Asia Pacific market progress in the near future. Rise in demand for steel and cement is further contributing to the scaffolding market development.

According to the World Steel Association AISBL, China is the largest steel manufacturer in the world, and India ranks third in manufacturing crude steel in the world.

Europe is likely to follow the market in Asia Pacific, while North America also accounted for a notable share of the global market in 2022 because a wide range of scaffoldings is used in diverse end-use industries, such as construction, shipbuilding, and oil & gas, in the region.

The global business is consolidated with a few large-scale manufacturers controlling majority of the share. Analysis of the global scaffolding market forecast report reveals that several organizations are spending significantly on comprehensive R&D activities, primarily to develop innovative scaffolding structures Development of innovative scaffolding structures and mergers & acquisitions are prominent strategies adopted by key players.

ADTO INDUSTRIAL GROUP CO., LTD., Altrad Group, Cangzhou Weisitai Scaffolding Co., Ltd., Entrepose échafaudages, Guangdong Youying Group, MJ-Gerüst GmbH, Rapid Scaffolding (Engineering) Co., Rizhao Fenghua Tools Co., Ltd., Layher Holding GmbH & Co. KG, and Wm-Scaffold are key players operating in the global market.

The global scaffolding market research report profiles key players based on parameters such as financial overview, product portfolio, recent developments, business segments, company overview, and business strategies.

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 61.7 Bn |

|

Market Forecast Value in 2031 |

US$ 108.9 Bn |

|

Growth Rate (CAGR) |

6.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes market drivers, restraints, market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global scaffolding market was valued at US$ 61.7 Bn in 2022

It is estimated to grow at a CAGR of 6.6% during the forecast period

Rise in awareness about safety of workers at construction sites, rapid urbanization, and increase in infrastructure development activities across globe

The supported scaffolding segment contributed to the largest share in 2022

Asia Pacific is a more attractive region for vendors

ADTO INDUSTRIAL GROUP CO., LTD., Altrad Group, Cangzhou Weisitai Scaffolding Co., Ltd., Entrepose échafaudages, Guangdong Youying Group, MJ-Gerüst GmbH, Rapid Scaffolding (Engineering) Co., Rizhao Fenghua Tools Co., Ltd., Layher Holding GmbH & Co. KG, and Wm-Scaffold

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Regulatory Framework

5.8. PESTLE Analysis

5.9. Global Scaffolding Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Revenue Projections (US$ Million)

6. Global Scaffolding Market Analysis and Forecast, by Product Type

6.1. Global Scaffolding Market (US$ Bn) Forecast, by Product Type, 2017 - 2031

6.1.1. Supported Scaffolding

6.1.1.1. Frame/Fabricated

6.1.1.2. Pole/Wood Pole

6.1.1.3. Mobile

6.1.1.4. Specialty

6.1.1.5. Others (Mast Climber, Pump Jack, etc.)

6.1.2. Suspended Scaffolding

6.1.3. Rolling Scaffolding

6.1.4. Cantilever Scaffolding

6.1.5. Others (Trestle Scaffolding, etc.)

6.2. Incremental Opportunity, by Product Type

7. Global Scaffolding Market Analysis and Forecast, by Material Type

7.1. Global Scaffolding Market (US$ Bn) Forecast, by Material Type, 2017 - 2031

7.1.1. Wood

7.1.2. Steel

7.1.3. Aluminum

7.1.4. Bamboo

7.2. Incremental Opportunity, by Material Type

8. Global Scaffolding Market Analysis and Forecast, by Location

8.1. Global Scaffolding Market (US$ Bn) Forecast, by Location, 2017 - 2031

8.1.1. External

8.1.2. Internal

8.2. Incremental Opportunity, by Location

9. Global Scaffolding Market Analysis and Forecast, by End-use Industry

9.1. Global Scaffolding Market (US$ Bn) Forecast, by End-use Industry, 2017 - 2031

9.1.1. Construction

9.1.2. Ship Building

9.1.3. Oil & Gas

9.1.4. Electrical Maintenance

9.1.5. Others (Temporary Stage, etc.)

9.2. Incremental Opportunity, by End-use Industry

10. Global Scaffolding Market Analysis and Forecast, by Region

10.1. Global Scaffolding Market (US$ Bn), by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Global Incremental Opportunity, by Region

11. North America Scaffolding Market Analysis and Forecast

11.1. Regional Snapshot

11.2. COVID 19 Impact Analysis

11.3. Key Trends Analysis

11.3.1. Demand Side

11.3.2. Supply Side

11.4. Key Supplier Analysis

11.5. Scaffolding Market (US$ Bn) Forecast, by Product Type, 2017 - 2031

11.5.1. Supported Scaffolding

11.5.1.1. Frame/Fabricated

11.5.1.2. Pole/Wood Pole

11.5.1.3. Mobile

11.5.1.4. Specialty

11.5.1.5. Others (Mast Climber, Pump Jack, etc.)

11.5.2. Suspended Scaffolding

11.5.3. Rolling Scaffolding

11.5.4. Cantilever Scaffolding

11.5.5. Others (Trestle Scaffolding, etc.)

11.6. Scaffolding Market (US$ Bn) Forecast, by Material Type, 2017 - 2031

11.6.1. Wood

11.6.2. Steel

11.6.3. Aluminum

11.6.4. Bamboo

11.7. Scaffolding Market (US$ Bn) Forecast, by Location, 2017 - 2031

11.7.1. External

11.7.2. Internal

11.8. Scaffolding Market (US$ Bn) Forecast, by End-use Industry, 2017 - 2031

11.8.1. Construction

11.8.2. Ship Building

11.8.3. Oil & Gas

11.8.4. Electrical Maintenance

11.8.5. Others (Temporary Stage, etc.)

11.9. Scaffolding Market (US$ Bn) Forecast, by Country, 2017 - 2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Global Scaffolding Market Analysis and Forecast

12.1. Regional Snapshot

12.2. COVID 19 Impact Analysis

12.3. Key Trends Analysis

12.3.1. Demand Side

12.3.2. Supply Side

12.4. Key Supplier Analysis

12.5. Scaffolding Market (US$ Bn) Forecast, by Product Type, 2017 - 2031

12.5.1. Supported Scaffolding

12.5.1.1. Frame/Fabricated

12.5.1.2. Pole/Wood Pole

12.5.1.3. Mobile

12.5.1.4. Specialty

12.5.1.5. Others (Mast Climber, Pump Jack, etc.)

12.5.2. Suspended Scaffolding

12.5.3. Rolling Scaffolding

12.5.4. Cantilever Scaffolding

12.5.5. Others (Trestle Scaffolding, etc.)

12.6. Scaffolding Market (US$ Bn) Forecast, by Material Type, 2017 - 2031

12.6.1. Wood

12.6.2. Steel

12.6.3. Aluminum

12.6.4. Bamboo

12.7. Scaffolding Market (US$ Bn) Forecast, by Location, 2017 - 2031

12.7.1. External

12.7.2. Internal

12.8. Scaffolding Market (US$ Bn) Forecast, by End-use Industry, 2017 - 2031

12.8.1. Construction

12.8.2. Ship Building

12.8.3. Oil & Gas

12.8.4. Electrical Maintenance

12.8.5. Others (Temporary Stage, etc.)

12.9. Scaffolding Market (US$ Bn) Forecast, by Country, 2017 - 2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Scaffolding Market Analysis and Forecast

13.1. Regional Snapshot

13.2. COVID 19 Impact Analysis

13.3. Key Trends Analysis

13.3.1. Demand Side

13.3.2. Supply Side

13.4. Key Supplier Analysis

13.5. Scaffolding Market (US$ Bn) Forecast, by Product Type, 2017 - 2031

13.5.1. Supported Scaffolding

13.5.1.1. Frame/Fabricated

13.5.1.2. Pole/Wood Pole

13.5.1.3. Mobile

13.5.1.4. Specialty

13.5.1.5. Others (Mast Climber, Pump Jack, etc.)

13.5.2. Suspended Scaffolding

13.5.3. Rolling Scaffolding

13.5.4. Cantilever Scaffolding

13.5.5. Others (Trestle Scaffolding, etc.)

13.6. Scaffolding Market (US$ Bn) Forecast, by Material Type, 2017 - 2031

13.6.1. Wood

13.6.2. Steel

13.6.3. Aluminum

13.6.4. Bamboo

13.7. Scaffolding Market (US$ Bn) Forecast, by Location, 2017 - 2031

13.7.1. External

13.7.2. Internal

13.8. Scaffolding Market (US$ Bn) Forecast, by End-use Industry, 2017 - 2031

13.8.1. Construction

13.8.2. Ship Building

13.8.3. Oil & Gas

13.8.4. Electrical Maintenance

13.8.5. Others (Temporary Stage, etc.)

13.9. Scaffolding Market (US$ Bn) Forecast, by Country, 2017 - 2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Scaffolding Market Analysis and Forecast

14.1. Regional Snapshot

14.2. COVID-19 Impact Analysis

14.3. Key Trends Analysis

14.3.1. Demand Side

14.3.2. Supply Side

14.4. Key Supplier Analysis

14.5. Scaffolding Market (US$ Bn) Forecast, by Product Type, 2017 - 2031

14.5.1. Supported Scaffolding

14.5.1.1. Frame/Fabricated

14.5.1.2. Pole/Wood Pole

14.5.1.3. Mobile

14.5.1.4. Specialty

14.5.1.5. Others (Mast Climber, Pump Jack, etc.)

14.5.2. Suspended Scaffolding

14.5.3. Rolling Scaffolding

14.5.4. Cantilever Scaffolding

14.5.5. Others (Trestle Scaffolding, etc.)

14.6. Scaffolding Market (US$ Bn) Forecast, by Material Type, 2017 - 2031

14.6.1. Wood

14.6.2. Steel

14.6.3. Aluminum

14.6.4. Bamboo

14.7. Scaffolding Market (US$ Bn) Forecast, by Location, 2017 - 2031

14.7.1. External

14.7.2. Internal

14.8. Scaffolding Market (US$ Bn) Forecast, by End-use Industry, 2017 - 2031

14.8.1. Construction

14.8.2. Ship Building

14.8.3. Oil & Gas

14.8.4. Electrical Maintenance

14.8.5. Others (Temporary Stage, etc.)

14.9. Scaffolding Market (US$ Bn) Forecast, by Country, 2017 - 2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Scaffolding Market Analysis and Forecast

15.1. Regional Snapshot

15.2. COVID 19 Impact Analysis

15.3. Key Trends Analysis

15.3.1. Demand Side

15.3.2. Supply Side

15.4. Key Supplier Analysis

15.5. Scaffolding Market (US$ Bn) Forecast, by Product Type, 2017 - 2031

15.5.1. Supported Scaffolding

15.5.1.1. Frame/Fabricated

15.5.1.2. Pole/Wood Pole

15.5.1.3. Mobile

15.5.1.4. Specialty

15.5.1.5. Others (Mast Climber, Pump Jack, etc.)

15.5.2. Suspended Scaffolding

15.5.3. Rolling Scaffolding

15.5.4. Cantilever Scaffolding

15.5.5. Others (Trestle Scaffolding, etc.)

15.6. Scaffolding Market (US$ Bn) Forecast, by Material Type, 2017 - 2031

15.6.1. Wood

15.6.2. Steel

15.6.3. Aluminum

15.6.4. Bamboo

15.7. Scaffolding Market (US$ Bn) Forecast, by Location, 2017 - 2031

15.7.1. External

15.7.2. Internal

15.8. Scaffolding Market (US$ Bn) Forecast, by End-use Industry, 2017 - 2031

15.8.1. Construction

15.8.2. Ship Building

15.8.3. Oil & Gas

15.8.4. Electrical Maintenance

15.8.5. Others (Temporary Stage, etc.)

15.9. Scaffolding Market (US$ Bn) Forecast, by Country, 2017 - 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Revenue Share Analysis (%), By Company, (2020)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. ADTO INDUSTRIAL GROUP CO., LTD.

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Altrad Group

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Cangzhou Weisitai Scaffolding Co.,Ltd.

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Entrepose échafaudages

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Guangdong Youying Group

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. MJ-Gerüst GmbH

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Rapid Scaffolding (Engineering) Co.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Rizhao Fenghua Tools Co., Ltd.

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Layher Holding GmbH & Co. KG

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Wm-Scaffold

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaway

17.1. Identification of Potential Market Spaces

17.1.1. Product Type

17.1.2. Material Type

17.1.3. Location

17.1.4. End-use Industry

17.1.5. Region

17.2. Understanding the Procurement Process of the Customers

17.3. Prevailing Market Risks

List of Tables

Table 1: Global Scaffolding Market Value (US$ Bn) Projection, by Product Type 2017-2031

Table 2: Global Scaffolding Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Table 3: Global Scaffolding Market Value (US$ Bn) Projection, by End-use Industry 2017-2031

Table 4: Global Scaffolding Market Volume (Thousand Units) Projection, by End-use Industry 2017-2031

Table 5: Global Scaffolding Market Value (US$ Bn) Projection, by Location 2017-2031

Table 6: Global Scaffolding Market Volume (Thousand Units) Projection, by Location 2017-2031

Table 7: Global Scaffolding Market Value (US$ Bn) Projection, by Material Type 2017-2031

Table 8: Global Scaffolding Market Volume (Thousand Units) Projection, by Material Type 2017-2031

Table 9: Global Scaffolding Market Value (US$ Bn) Projection, by Region 2017-2031

Table 10: Global Scaffolding Market Volume (Thousand Units) Projection, by Region 2017-2031

Table 11: North America Scaffolding Market Value (US$ Bn) Projection, by Product Type 2017-2031

Table 12: North America Scaffolding Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Table 13: North America Scaffolding Market Value (US$ Bn) Projection, by End-use Industry 2017-2031

Table 14: North America Scaffolding Market Volume (Thousand Units) Projection, by End-use Industry 2017-2031

Table 15: North America Scaffolding Market Value (US$ Bn) Projection, by Location 2017-2031

Table 16: North America Scaffolding Market Volume (Thousand Units) Projection, by Location 2017-2031

Table 17: North America Scaffolding Market Value (US$ Bn) Projection, by Material Type 2017-2031

Table 18: North America Scaffolding Market Volume (Thousand Units) Projection, by Material Type 2017-2031

Table 19: North America Scaffolding Market Value (US$ Bn) Projection, by Country 2017-2031

Table 20: North America Scaffolding Market Volume (Thousand Units) Projection, by Country 2017-2031

Table 21: Europe Scaffolding Market Value (US$ Bn) Projection, by Product Type 2017-2031

Table 22: Europe Scaffolding Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Table 23: Europe Scaffolding Market Value (US$ Bn) Projection, by End-use Industry 2017-2031

Table 24: Europe Scaffolding Market Volume (Thousand Units) Projection, by End-use Industry 2017-2031

Table 25: Europe Scaffolding Market Value (US$ Bn) Projection, by Location 2017-2031

Table 26: Europe Scaffolding Market Volume (Thousand Units) Projection, by Location 2017-2031

Table 27: Europe Scaffolding Market Value (US$ Bn) Projection, by Material Type 2017-2031

Table 28: Europe Scaffolding Market Volume (Thousand Units) Projection, by Material Type 2017-2031

Table 29: Europe Scaffolding Market Value (US$ Bn) Projection, by Country 2017-2031

Table 30: Europe Scaffolding Market Volume (Thousand Units) Projection, by Country 2017-2031

Table 31: Asia Pacific Scaffolding Market Value (US$ Bn) Projection, by Product Type 2017-2031

Table 32: Asia Pacific Scaffolding Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Table 33: Asia Pacific Scaffolding Market Value (US$ Bn) Projection, by End-use Industry 2017-2031

Table 34: Asia Pacific Scaffolding Market Volume (Thousand Units) Projection, by End-use Industry 2017-2031

Table 35: Asia Pacific Scaffolding Market Value (US$ Bn) Projection, by Location 2017-2031

Table 36: Asia Pacific Scaffolding Market Volume (Thousand Units) Projection, by Location 2017-2031

Table 37: Asia Pacific Scaffolding Market Value (US$ Bn) Projection, by Material Type 2017-2031

Table 38: Asia Pacific Scaffolding Market Volume (Thousand Units) Projection, by Material Type 2017-2031

Table 39: Asia Pacific Scaffolding Market Value (US$ Bn) Projection, by Country 2017-2031

Table 40: Asia Pacific Scaffolding Market Volume (Thousand Units) Projection, by Country 2017-2031

Table 41: Middle East & Africa Scaffolding Market Value (US$ Bn) Projection, by Product Type 2017-2031

Table 42: Middle East & Africa Scaffolding Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Table 43: Middle East & Africa Scaffolding Market Value (US$ Bn) Projection, by End-use Industry 2017-2031

Table 44: Middle East & Africa Scaffolding Market Volume (Thousand Units) Projection, by End-use Industry 2017-2031

Table 45: Middle East & Africa Scaffolding Market Value (US$ Bn) Projection, by Location 2017-2031

Table 46: Middle East & Africa Scaffolding Market Volume (Thousand Units) Projection, by Location 2017-2031

Table 47: Middle East & Africa Scaffolding Market Value (US$ Bn) Projection, by Material Type 2017-2031

Table 48: Middle East & Africa Scaffolding Market Volume (Thousand Units) Projection, by Material Type 2017-2031

Table 49: Middle East & Africa Scaffolding Market Value (US$ Bn) Projection, by Country 2017-2031

Table 50: Middle East & Africa Scaffolding Market Volume (Thousand Units) Projection, by Country 2017-2031

Table 51: South America Scaffolding Market Value (US$ Bn) Projection, by Product Type 2017-2031

Table 52: South America Scaffolding Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Table 53: South America Scaffolding Market Value (US$ Bn) Projection, by End-use Industry 2017-2031

Table 54: South America Scaffolding Market Volume (Thousand Units) Projection, by End-use Industry 2017-2031

Table 55: South America Scaffolding Market Value (US$ Bn) Projection, by Location 2017-2031

Table 56: South America Scaffolding Market Volume (Thousand Units) Projection, by Location 2017-2031

Table 57: South America Scaffolding Market Value (US$ Bn) Projection, by Material Type 2017-2031

Table 58: South America Scaffolding Market Volume (Thousand Units) Projection, by Material Type 2017-2031

Table 59: South America Scaffolding Market Value (US$ Bn) Projection, by Country 2017-2031

Table 60: South America Scaffolding Market Volume (Thousand Units) Projection, by Country 2017-2031

List of Figures

Figure 1: Global Scaffolding Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 2: Global Scaffolding Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 3: Global Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2023-2031

Figure 4: Global Scaffolding Market Value (US$ Bn) Projection, by End-use Industry 2017-2031

Figure 5: Global Scaffolding Market Volume (Thousand Units) Projection, by End-use Industry 2017-2031

Figure 6: Global Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by End-use Industry 2023-2031

Figure 7: Global Scaffolding Market Value (US$ Bn) Projection, by Location 2017-2031

Figure 8: Global Scaffolding Market Volume (Thousand Units) Projection, by Location 2017-2031

Figure 9: Global Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Location 2023-2031

Figure 10: Global Scaffolding Market Value (US$ Bn) Projection, by Material Type 2017-2031

Figure 11: Global Scaffolding Market Volume (Thousand Units) Projection, by Material Type 2017-2031

Figure 12: Global Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Material Type 2023-2031

Figure 13: Global Scaffolding Market Value (US$ Bn) Projection, by Region 2017-2031

Figure 14: Global Scaffolding Market Volume (Thousand Units) Projection, by Region 2017-2031

Figure 15: Global Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Region 2023-2031

Figure 16: North America Scaffolding Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 17: North America Scaffolding Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 18: North America Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2023-2031

Figure 19: North America Scaffolding Market Value (US$ Bn) Projection, by End-use Industry 2017-2031

Figure 20: North America Scaffolding Market Volume (Thousand Units) Projection, by End-use Industry 2017-2031

Figure 21: North America Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by End-use Industry 2023-2031

Figure 22: North America Scaffolding Market Value (US$ Bn) Projection, by Location 2017-2031

Figure 23: North America Scaffolding Market Volume (Thousand Units) Projection, by Location 2017-2031

Figure 24: North America Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Location 2023-2031

Figure 25: North America Scaffolding Market Value (US$ Bn) Projection, by Material Type 2017-2031

Figure 26: North America Scaffolding Market Volume (Thousand Units) Projection, by Material Type 2017-2031

Figure 27: North America Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Material Type 2023-2031

Figure 28: North America Scaffolding Market Value (US$ Bn) Projection, by Country 2017-2031

Figure 29: North America Scaffolding Market Volume (Thousand Units) Projection, by Country 2017-2031

Figure 30: North America Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Country 2023-2031

Figure 31: Europe Scaffolding Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 32: Europe Scaffolding Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 33: Europe Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2023-2031

Figure 34: Europe Scaffolding Market Value (US$ Bn) Projection, by End-use Industry 2017-2031

Figure 35: Europe Scaffolding Market Volume (Thousand Units) Projection, by End-use Industry 2017-2031

Figure 36: Europe Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by End-use Industry 2023-2031

Figure 37: Europe Scaffolding Market Value (US$ Bn) Projection, by Location 2017-2031

Figure 38: Europe Scaffolding Market Volume (Thousand Units) Projection, by Location 2017-2031

Figure 39: Europe Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Location 2023-2031

Figure 40: Europe Scaffolding Market Value (US$ Bn) Projection, by Material Type 2017-2031

Figure 41: Europe Scaffolding Market Volume (Thousand Units) Projection, by Material Type 2017-2031

Figure 42: Europe Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Material Type 2023-2031

Figure 43: Europe Scaffolding Market Value (US$ Bn) Projection, by Country 2017-2031

Figure 44: Europe Scaffolding Market Volume (Thousand Units) Projection, by Country 2017-2031

Figure 45: Europe Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Country 2023-2031

Figure 46: Asia Pacific Scaffolding Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 47: Asia Pacific Scaffolding Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 48: Asia Pacific Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2023-2031

Figure 49: Asia Pacific Scaffolding Market Value (US$ Bn) Projection, by End-use Industry 2017-2031

Figure 50: Asia Pacific Scaffolding Market Volume (Thousand Units) Projection, by End-use Industry 2017-2031

Figure 51: Asia Pacific Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by End-use Industry 2023-2031

Figure 52: Asia Pacific Scaffolding Market Value (US$ Bn) Projection, by Location 2017-2031

Figure 53: Asia Pacific Scaffolding Market Volume (Thousand Units) Projection, by Location 2017-2031

Figure 54: Asia Pacific Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Location 2023-2031

Figure 55: Asia Pacific Scaffolding Market Value (US$ Bn) Projection, by Material Type 2017-2031

Figure 56: Asia Pacific Scaffolding Market Volume (Thousand Units) Projection, by Material Type 2017-2031

Figure 57: Asia Pacific Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Material Type 2023-2031

Figure 58: Asia Pacific Scaffolding Market Value (US$ Bn) Projection, by Country 2017-2031

Figure 59: Asia Pacific Scaffolding Market Volume (Thousand Units) Projection, by Country 2017-2031

Figure 60: Asia Pacific Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Country 2023-2031

Figure 61: Middle East & Africa Scaffolding Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 62: Middle East & Africa Scaffolding Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 63: Middle East & Africa Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2023-2031

Figure 64: Middle East & Africa Scaffolding Market Value (US$ Bn) Projection, by End-use Industry 2017-2031

Figure 65: Middle East & Africa Scaffolding Market Volume (Thousand Units) Projection, by End-use Industry 2017-2031

Figure 66: Middle East & Africa Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by End-use Industry 2023-2031

Figure 67: Middle East & Africa Scaffolding Market Value (US$ Bn) Projection, by Location 2017-2031

Figure 68: Middle East & Africa Scaffolding Market Volume (Thousand Units) Projection, by Location 2017-2031

Figure 69: Middle East & Africa Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Location 2023-2031

Figure 70 Middle East & Africa Scaffolding Market Value (US$ Bn) Projection, by Material Type 2017-2031

Figure 71 Middle East & Africa Scaffolding Market Volume (Thousand Units) Projection, by Material Type 2017-2031

Figure 72 Middle East & Africa Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Material Type 2023-2031

Figure 73 Middle East & Africa Scaffolding Market Value (US$ Bn) Projection, by Country 2017-2031

Figure 74 Middle East & Africa Scaffolding Market Volume (Thousand Units) Projection, by Country 2017-2031

Figure 75 Middle East & Africa Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Country 2023-2031

Figure 76: South America Scaffolding Market Value (US$ Bn) Projection, by Product Type 2017-2031

Figure 77: South America Scaffolding Market Volume (Thousand Units) Projection, by Product Type 2017-2031

Figure 78: South America Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Product Type 2023-2031

Figure 79: South America Scaffolding Market Value (US$ Bn) Projection, by End-use Industry 2017-2031

Figure 80: South America Scaffolding Market Volume (Thousand Units) Projection, by End-use Industry 2017-2031

Figure 81: South America Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by End-use Industry 2023-2031

Figure 82: South America Scaffolding Market Value (US$ Bn) Projection, by Location 2017-2031

Figure 83: South America Scaffolding Market Volume (Thousand Units) Projection, by Location 2017-2031

Figure 84: South America Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Location 2023-2031

Figure 85: South America Scaffolding Market Value (US$ Bn) Projection, by Material Type 2017-2031

Figure 86: South America Scaffolding Market Volume (Thousand Units) Projection, by Material Type 2017-2031

Figure 87: South America Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Material Type 2023-2031

Figure 88: South America Scaffolding Market Value (US$ Bn) Projection, by Country 2017-2031

Figure 89: South America Scaffolding Market Volume (Thousand Units) Projection, by Country 2017-2031

Figure 90: South America Scaffolding Market, Incremental Opportunities (US$ Bn), Forecast, by Country 2023-2031