Reports

Reports

Russia Reciprocating Compressor Market: Snapshot

The oil and natural gas industry in Russia accounts for the majority of the country’s GDP and export earnings and the performance of this sector directly impacts the market for reciprocating compressors in Russia.

The Russian oil and natural gas sector boasts of the increased presence of blue chip companies. This has substantially raised the demand for equipment that is directly or indirectly involved in subsea applications in exploration and production (E&P) practices. Subsequently, the Russia market for reciprocating compressors has received a significant boost. The market is projected to rise from a value of US$227.1 mn in 2015 to reach US$352.6 mn by 2024. If these values hold true, the reciprocating compressors market is forecast to expand at a CAGR of 4.9% from 2016 to 2024.

Local manufacturers of reciprocating compressors in Russia have faced numerous hurdles owing to the lack of sustainability to cope up with international standards and quality benchmarks. Furthermore, the fragile political scenario has resulted in a significantly lower demand from local compressor manufacturers.

Transparency Market Research states that the reciprocating compressors market in Russia is anticipated to pick up pace only if manufacturers across the globe advance their technological innovations and develop maintenance-free compressors with greater efficiency.

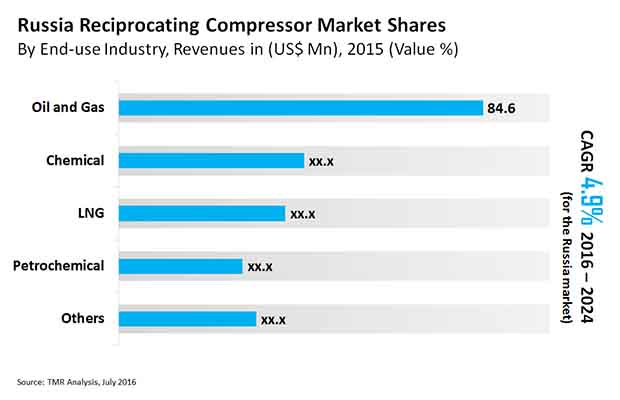

Oil and Gas Industry Leading End User despite Various Challenges

The oil and gas industry is by far the leading end user of reciprocating compressors in Russia and the share of this segment is pegged to be over 42% by 2024. This sector is also anticipated to register the highest CAGR during the forecast period – a healthy 6.4% from 2016 to 2024. However, the oil and gas sector in Russia has been facing a storm of challenges mainly due to the stagnant European market, expensive Asian projects, and strict Western sanctions. This has resulted in limited investments and innovations within key technological segments of the oil and gas industry.

The LNG industrial sector has been identified as highly opportunistic by Transparency Market Research. On the other hand, end users such as chemical, petrochemicals, industrial metallic tools, and metal processing are predicted to register mediocre growth over the course of the forecast period.

Industrial Process Gas Reciprocating Compressors Segment to Retain Lead Through 2024

Among the major types of compressors, industrial process gas reciprocating compressors took the lead in the Russia reciprocating compressor market in 2015 and this segment is likely to retain its top position through 2024. LNG reciprocating compressors, on the other hand, are likely to emerge as the fastest growing segment by type, expanding at a 5.3% CAGR from 2016 to 2024.

Some of the prominent players with a strong foothold in the Russia reciprocating compressors market are Atlas Copco AB, Kobelco Compressors Corporation, Dresser Rand Group Inc., Howden Group Ltd., and General Electric (Oil & Gas) Co. Other key players include Leobersdorfer Maschinenfabrik GmbH & Co.KG, Burckhardt Compression AG, Neuman & Esser Group, KwangShin Machinery Co. Ltd., BORSIG ZM Compression GmbH, Ariel Corporation, and SIAD Macchine Impianti S.p.A.

The worldwide Russia Reciprocating Compressor market worth is projected to reach USD US$ 352.6 million by the end of 2024.

The Russia Reciprocating Compressor market is expected to grow at a CAGR of 4.9% during 2021 – 2024.

Some of the prominent players with a strong foothold in the Russia reciprocating compressors market are Atlas Copco AB, Kobelco Compressors Corporation, Dresser Rand Group Inc., Howden Group Ltd., and General Electric (Oil & Gas) Co. Other key players include Leobersdorfer Maschinenfabrik GmbH & Co.KG, Burckhardt Compression AG, Neuman & Esser Group, KwangShin Machinery Co. Ltd., BORSIG ZM Compression GmbH, Ariel Corporation, and SIAD Macchine Impianti S.p.A.

TMR has segmented the Russia Reciprocating Compressor market by product by - Industrial Process Gas Reciprocating Compressor (API 618, High-speed Reciprocating Compressor), LNG Reciprocating Compressor, BOG Reciprocating Compressor; Based on end user, the Russia reciprocating compressor market is segmented into chemical, oil & gas, petrochemical, LNG and Others.

1. Preface

1.1. Report Description

1.2. Analysis Coverage

1.3. Research Methodology

2. Executive Summary

2.1. Russia Reciprocating Compressor Market Snapshot

2.2. Russia Reciprocating Compressor Market Revenue, 2014 – 2024 (US$ Mn), Year-on-Year Growth (%) and Market Dynamics

3. Russia Reciprocating Compressor Market Analysis, 2014 – 2024 (US$ Mn)

3.1. Key Trends Analysis

3.1.1. Localization Trends (Rules and Regulations Set by the Ministry of Industry and Trade of the Russian federation, and the Association of Compressor Manufacturers)

3.1.2. Support Programs for Investors

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.3. Opportunity Assessment, by End-use Industry

3.4. Value Chain Analysis: Supply Structure

3.5. Installed Base of Reciprocating Compressors in Russia

3.6. Russia Reciprocating Compressor Market Analysis, By Type, 2014 – 2024 (US$ Mn) Overview

3.6.1. Industrial Process Gas Reciprocating Compressors

3.6.1.1. API 618 (downstream)

3.6.1.2. High-speed compressors (upstream and midstream)

3.6.2. Liquefied natural Gas (LNG) Reciprocating Compressors

3.6.3. BOG Compressors

3.7. Russia Reciprocating Compressor Market Analysis, By End-use, 2014 – 2024 (US$ Mn)

3.7.1. Overview

3.7.2. Chemical

3.7.3. Oil & Gas

3.7.3.1. Upstream

3.7.3.2. Midstream

3.7.3.3. Downstream

3.7.4. Petrochemical

3.7.5. LNG

3.7.5.1. Small to Medium-sized Plants

3.7.5.2. Big and Giant-sized Plants

3.7.5.3. Others (Metal Processing, Industrial Metallic Tools, etc.)

3.8. Competitive Landscape

3.8.1. Market Positioning of Key Players, 2015

3.8.2. Competitive Strategies Adopted by Leading Players

4. Company Profiles

4.1. Atlas Copco AB

4.1.1. HQ, Foundation year, Number of Employees

4.1.2. Production Facilities

4.1.3. Representative office in Russia (Name, Address, Telephone, Email, Web-site)

4.1.4. Partners, Packagers and/or Facilities in Russia (Names, Addresses, Telephones, Emails, Web-sites)

4.1.5. Market Presence, By Segment and Geography

4.1.6. Range of products, applications and capacities

4.1.7. Revenue and Operating profits

4.1.8. Recent Developments

4.1.8.1. Latest actions and Strategic Plans (JV, Restructuration etc.)

4.1.9. Business Strategy

4.1.9.1. Key Investment Objectives for 2015 - 2020

4.2. Kobelco Compressors Corporation

4.2.1. HQ, Foundation year, Number of Employees

4.2.2. Production Facilities

4.2.3. Representative office in Russia (Name, Address, Telephone, Email, Web-site)

4.2.4. Partners, Packagers and/or Facilities in Russia (Names, Addresses, Telephones, Emails, Web-sites)

4.2.5. Market Presence, By Segment and Geography

4.2.6. Range of products, applications and capacities

4.2.7. Revenue and Operating profits

4.2.8. Recent Developments

4.2.8.1. Latest actions and Strategic Plans (JV, Restructuration etc.)

4.2.9. Business Strategy

4.2.9.1. Key Investment Objectives for 2015 - 2020

4.3. Dresser-Rand Group Inc.

4.3.1. HQ, Foundation year, Number of Employees

4.3.2. Production Facilities

4.3.3. Representative office in Russia (Name, Address, Telephone, Email, Web-site)

4.3.4. Partners, Packagers and/or Facilities in Russia (Names, Addresses, Telephones, Emails, Web-sites)

4.3.5. Market Presence, By Segment and Geography

4.3.6. Range of products, applications and capacities

4.3.7. Revenue and Operating profits

4.3.8. Recent Developments

4.3.8.1. Latest actions and Strategic Plans (JV, Restructuration etc.)

4.3.9. Business Strategy

4.3.9.1. Key Investment Objectives for 2015 - 2020

4.4. Leobersdorfer Maschinenfabrik GmbH & Co.KG

4.4.1. HQ, Foundation year, Number of Employees

4.4.2. Production Facilities

4.4.3. Representative office in Russia (Name, Address, Telephone, Email, Web-site)

4.4.4. Partners, Packagers and/or Facilities in Russia (Names, Addresses, Telephones, Emails, Web-sites)

4.4.5. Market Presence, By Segment and Geography

4.4.6. Range of products, applications and capacities

4.4.7. Revenue and Operating profits

4.4.8. Recent Developments

4.4.8.1. Latest actions and Strategic Plans (JV, Restructuration etc.)

4.4.9. Business Strategy

4.4.9.1. Key Investment Objectives for 2015 - 2020

4.5. Burckhardt Compression AG

4.5.1. HQ, Foundation year, Number of Employees

4.5.2. Production Facilities

4.5.3. Representative office in Russia (Name, Address, Telephone, Email, Web-site)

4.5.4. Partners, Packagers and/or Facilities in Russia (Names, Addresses, Telephones, Emails, Web-sites)

4.5.5. Market Presence, By Segment and Geography

4.5.6. Range of products, applications and capacities

4.5.7. Revenue and Operating profits

4.5.8. Recent Developments

4.5.8.1. Latest actions and Strategic Plans (JV, Restructuration etc.)

4.5.9. Business Strategy

4.5.9.1. Key Investment Objectives for 2015 - 2020

4.6. Howden Group Ltd.

4.6.1. HQ, Foundation year, Number of Employees

4.6.2. Production Facilities

4.6.3. Representative office in Russia (Name, Address, Telephone, Email, Web-site)

4.6.4. Partners, Packagers and/or Facilities in Russia (Names, Addresses, Telephones, Emails, Web-sites)

4.6.5. Market Presence, By Segment and Geography

4.6.6. Range of products, applications and capacities

4.6.7. Revenue and Operating profits

4.6.8. Recent Developments

4.6.8.1. Latest actions and Strategic Plans (JV, Restructuration etc.)

4.6.9. Business Strategy

4.6.9.1. Key Investment Objectives for 2015 - 2020

4.7. General Electric (Oil & Gas) Co.

4.7.1. HQ, Foundation year, Number of Employees

4.7.2. Production Facilities

4.7.3. Representative office in Russia (Name, Address, Telephone, Email, Web-site)

4.7.4. Partners, Packagers and/or Facilities in Russia (Names, Addresses, Telephones, Emails, Web-sites)

4.7.5. Market Presence, By Segment and Geography

4.7.6. Range of products, applications and capacities

4.7.7. Revenue and Operating profits

4.7.8. Recent Developments

4.7.8.1. Latest actions and Strategic Plans (JV, Restructuration etc.)

4.7.9. Business Strategy

4.7.10. Key Investment Objectives for 2015 - 2020

4.8. Neuman & Esser Group (Russia)

4.8.1. HQ, Foundation year, Number of Employees

4.8.2. Production Facilities

4.8.3. Representative office in Russia (Name, Address, Telephone, Email, Web-site)

4.8.4. Partners, Packagers and/or Facilities in Russia (Names, Addresses, Telephones, Emails, Web-sites)

4.8.5. Market Presence, By Segment and Geography

4.8.6. Range of products, applications and capacities

4.8.7. Revenue and Operating profits

4.8.8. Recent Developments

4.8.8.1. Latest actions and Strategic Plans (JV, Restructuration etc.)

4.8.9. Business Strategy

4.8.10. Key Investment Objectives for 2015 - 2020

4.9. KwangShin Machinery Co. Ltd.

4.9.1. HQ, Foundation year, Number of Employees

4.9.2. Production Facilities

4.9.3. Representative office in Russia (Name, Address, Telephone, Email, Web-site)

4.9.4. Partners, Packagers and/or Facilities in Russia (Names, Addresses, Telephones, Emails, Web-sites)

4.9.5. Market Presence, By Segment and Geography

4.9.6. Range of products, applications and capacities

4.9.7. Revenue and Operating profits

4.9.8. Recent Developments

4.9.8.1. Latest actions and Strategic Plans (JV, Restructuration etc.)

4.9.9. Business Strategy

4.9.10. Key Investment Objectives for 2015 - 2020

4.10. BORSIG ZM Compression GmbH

4.10.1. HQ, Foundation year, Number of Employees

4.10.2. Production Facilities

4.10.3. Representative office in Russia (Name, Address, Telephone, Email, Web-site)

4.10.4. Partners, Packagers and/or Facilities in Russia (Names, Addresses, Telephones, Emails, Web-sites)

4.10.5. Market Presence, By Segment and Geography

4.10.6. Range of products, applications and capacities

4.10.7. Revenue and Operating profits

4.10.8. Recent Developments

4.10.8.1. Latest actions and Strategic Plans (JV, Restructuration etc.)

4.10.9. Business Strategy

4.10.10. Key Investment Objectives for 2015 - 2020

4.11. Ariel Corporation

4.11.1. HQ, Foundation year, Number of Employees

4.11.2. Production Facilities

4.11.3. Representative office in Russia (Name, Address, Telephone, Email, Web-site)

4.11.4. Partners, Packagers and/or Facilities in Russia (Names, Addresses, Telephones, Emails, Web-sites)

4.11.5. Market Presence, By Segment and Geography

4.11.6. Range of products, applications and capacities

4.11.7. Revenue and Operating profits

4.11.8. Recent Developments

4.11.8.1. Latest actions and Strategic Plans (JV, Restructuration etc.)

4.11.9. Business Strategy

4.11.10. Key Investment Objectives for 2015 - 2020

4.12. SIAD Macchine Impianti S.p.A.

4.12.1. HQ, Foundation year, Number of Employees

4.12.2. Production Facilities

4.12.3. Representative office in Russia (Name, Address, Telephone, Email, Web-site)

4.12.4. Partners, Packagers and/or Facilities in Russia (Names, Addresses, Telephones, Emails, Web-sites)

4.12.5. Market Presence, By Segment and Geography

4.12.6. Range of products, applications and capacities

4.12.7. Revenue and Operating profits

4.12.8. Recent Developments

4.12.8.1. Latest actions and Strategic Plans (JV, Restructuration etc.)

4.12.9. Business Strategy

4.12.10. Key Investment Objectives for 2015 - 2020

List of Tables

Table 01: Market Snapshot

Table 02: Russia Reciprocating Compressor Market Analysis, By Type, 2014 – 2024 (US$ Mn)

Table 03: Russia Reciprocating Compressor Market Analysis, By End-use Industry, 2014 – 2024 (US$ Mn)

Table 04: Russia Reciprocating Compressor Market Analysis, By Oil and Gas Industry, 2014 – 2024 (US$ Mn)

Table 05: Russia Reciprocating Compressor Market Analysis, By LNG Industry, 2014 – 2024 (US$ Mn)

List of Figures

Figure 01: Russia Reciprocating Compressor Market Size (US$ Mn) and Year on Year Growth (%)

Figure 02: Russia Reciprocating Compressor Market Size, By Type, 2015 & 2024 (US$ Mn)

Figure 03: Russia Reciprocating Compressor Market Share, By Type, 2015 & 2024, (%)

Figure 04: Russia Industrial Process Gas Reciprocating Compressors Market Size, 2014 – 2024

Figure 05: Industrial Process Gas Reciprocating Compressor Growth Analysis

Figure 06: Russia API 618 Industrial Process Gas Reciprocating Compressors Market Size, 2014 – 2024

Figure 07: Russia High Speed Industrial Process Gas Reciprocating Compressors Market Size, 2014 – 2024

Figure 08: Market Share for API 618 & High-speed Reciprocating Compressor, 2015 & 2024 (%)

Figure 09: Russia Liquefied Natural Gas Reciprocating Compressors Market Size, 2014 – 2024

Figure 10: Liquefied Natural Gas Reciprocating Compressor Growth Analysis

Figure 11: Russia Boil of Gas (BOG) Reciprocating Compressors Market Size, 2014 – 2024

Figure 12: Boil of Gas (BOG) Reciprocating Compressor Growth Analysis

Figure 13: Russia Reciprocating Compressor Market Size, By End-use Industry, 2015 & 2024, (US$ Mn)

Figure 14: Russia Reciprocating Compressor Market Share, By End-use Industry, 2015 & 2024, (%)

Figure 15: Russia Reciprocating Compressor Market Size and Year on Year Growth (%), By Chemical Industry, 2014 – 2024

Figure 16: Reciprocating Compressors for Chemical Industry Growth Analysis

Figure 17: Russia Reciprocating Compressor Market Size and Year on Year Growth (%), By Oil & Gas Industry, 2014 – 2024

Figure 18: Reciprocating Compressors for Oil & Gas Industry Growth Analysis

Figure 19: Russia Reciprocating Compressor Market Share, By Oil & Gas Industry, 2015

Figure 20: Russia Reciprocating Compressor Market Share, By Oil & Gas Industry, 2024

Figure 21: Russia Reciprocating Compressor Market Size, By Oil & Gas Industry for Upstream Process, 2014 – 2024 (US$ Mn)

Figure 22: Russia Reciprocating Compressor Market Size, By Oil & Gas Industry for Downstream Process, 2014 – 2024 (US$ Mn)

Figure 23: Russia Reciprocating Compressor Market Size, By Oil & Gas Industry for Midstream Process, 2014 – 2024 (US$ Mn)

Figure 24: Russia Reciprocating Compressor Market Size, By Oil & Gas Industry, 2015 & 2024 (US$ Mn)

Figure 25: Russia Reciprocating Compressor Market Size and Year on Year Growth (%), By Petrochemical Industry, 2014 – 2024 (US$ Mn)

Figure 26: Reciprocating Compressors for Petrochemical Industry Growth Analysis

Figure 27: Russia Reciprocating Compressor Market Size and Year on Year Growth (%), By LNG Industry, 2014 – 2024 (US$ Mn)

Figure 28: Reciprocating Compressors for LNG Industry Growth Analysis

Figure 29: Russia Reciprocating Compressor Market Size, By LNG Industry, 2015 & 2024 (US$ Mn)

Figure 30: Russia Reciprocating Compressor Market Share, By LNG Industry, 2015 & 2024 (%)

Figure 31: Russia Reciprocating Compressor Market Size and Year on Year Growth (%), By Other Industries, 2014 – 2024 (US$ Mn)

Figure 32: Reciprocating Compressors for Other Industries Growth Analysis