Reports

Reports

Analysts’ Viewpoint

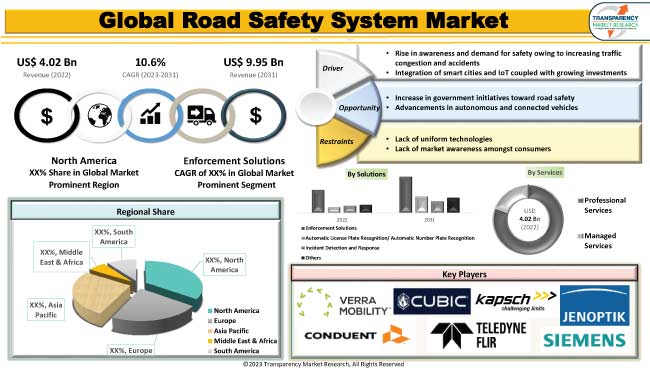

Public-private partnerships between governments, automotive manufacturers, technology companies, and infrastructure providers are driving innovation and deployment of road safety solutions. Rise in awareness and demand for safety due to increase in traffic congestion and accidents are propelling the global road safety system market. Intelligent traffic management systems, adaptive traffic signals, and smart intersections are being implemented to optimize traffic flow and prevent accidents. Furthermore, integration of smart cities & IoT and increase in investment are expected to bolster market expansion.

Advancements in AI, machine learning, sensor technology, and connectivity offer lucrative opportunities to market players. Companies are focusing on integrating ADAS technologies such as lane departure warning, adaptive cruise control, and automatic emergency braking in new vehicles to enhance road safety.

A road safety system refers to a comprehensive and integrated set of measures, technologies, policies, and practices designed to prevent accidents, minimize injuries, and reduce fatalities on roadways.

The primary objective of a road safety system is to create a safer environment for all road users, including pedestrians, cyclists, motorcyclists, and drivers. It involves a multidisciplinary approach that combines engineering, education, enforcement, and evaluation to address various factors contributing to road accidents and to enhance overall road safety.

Road safety systems often incorporate advanced technologies, data analysis, and collaboration between government agencies, private organizations, and the public to achieve their goals. V2X technology enables real-time communication between vehicles, infrastructure, pedestrians, and other road users, enhancing situational awareness and safety.

The development of self-driving vehicles and their integration with road safety systems holds the potential to significantly reduce accidents caused by human errors. Data-driven insights from traffic patterns, accident histories, and road conditions are used to identify high-risk areas and implement targeted safety measures.

Road safety system is a growing industry that focuses on developing and implementing technologies, solutions, and strategies to enhance road safety and reduce accidents, injuries, and fatalities on roadways.

Availability of a range of products and services designed to improve traffic management, monitor vehicle behavior, and provide real-time information to both drivers and authorities are expected to bolster the global road safety system market size.

Governments and regulatory bodies across the globe are implementing stricter safety regulations and standards for vehicles and road infrastructure. This has led to the adoption of advanced safety technologies such as adaptive cruise control, automatic emergency braking, lane departure warning, and more.

Awareness among consumers and fleet operators about the importance of road safety has increased in the past few years. This has driven demand for safety technologies that can prevent accidents and protect occupants.

Traffic congestion and accidents have become significant concerns due to surge in urbanization and rise in number of vehicles on the road. Road safety systems offer solutions to manage traffic flow efficiently, prevent collisions, and reduce the risk of accidents. Thus, rise in awareness and demand for safety owing to increasing traffic congestion and accidents are likely to drive the global road safety system market demand.

Both public and private sectors are investing in road safety infrastructure to prevent accidents and reduce the overall economic burden associated with accidents. Rapid advancements in technology, including sensor technology, artificial intelligence, machine learning, and vehicle-to-infrastructure communication, have enabled the development of more sophisticated and effective road safety systems.

The concept of smart cities involves the integration of various technologies to improve the quality of life for citizens. Road safety systems play a crucial role in this context by enabling better traffic management, real-time monitoring, and data-driven decision-making.

Rise in investment in the development of advanced road infrastructure, including smart traffic signals, intelligent intersections, and pedestrian safety systems, contributes to global road safety system market growth.

Emergence of automated and connected vehicles has opened up new opportunities for road safety systems. These vehicles can communicate with each other and with infrastructure, enhancing situational awareness and preventing accidents.

In terms of solutions, the enforcement solutions segment is projected to account for the largest global road safety system market share during the forecast period. Enforcement solutions play a crucial role in improving overall road safety by deterring dangerous driving practices and ensuring compliance with traffic laws.

Law enforcement agencies could deploy mobile units equipped with cameras and ANPR technology to monitor traffic violations across different locations. Speed cameras use radar or laser technology to monitor vehicle speeds and capture images of vehicles that exceed the speed limit. These cameras are placed strategically on roadways to discourage speeding and improve compliance with speed limits.

Red light cameras are installed at intersections to capture images of vehicles that run red lights. These cameras help reduce the likelihood of collisions caused by red light violations.

According to road safety system market analysis, North America dominated the global industry in 2022. The region has been a leader in adopting advanced road safety technologies, with a focus on ADAS and vehicle-to-vehicle (V2V) communication. The U.S., Canada, and Mexico have made significant strides in integrating these technologies into vehicles and infrastructure.

Europe is known for stringent road safety regulations and has been an early adopter of several road safety technologies. The European Union has promoted the development of intelligent transportation systems (ITS) to enhance road safety and traffic management.

As per road safety system market research, rapid urbanization and growing vehicle ownership in countries such as China and India have led to increased road safety concerns. These regions are investing in technologies such as traffic surveillance, vehicle safety, and pedestrian protection systems.

Some countries in Middle East & Africa are investing in road safety technologies, focusing on traffic management and surveillance systems. Countries in the region are working on improving road safety through awareness campaigns, infrastructure development, and the adoption of basic safety technologies.

The global road safety system industry exhibits significant presence of service providers accounting significant market share and major companies possessing the potential to increase the pace of growth through adoption of newer services. Expansion of product portfolio and merger & acquisition are the major strategies adopted by key players.

American Traffic Solutions (Verra Mobility), Conduent, Cubic Corporation, Dahua Technology, FLIR Services, Inc., IDEMIA, Jenoptik, Kapsch TraficCom, Motorola Solutions, Redflex Holdings, Sensys Gatso Group AB, Siemens, Swarco, Teledyne FLIR, Vitronic, Trifoil Kria, Syntell, and Simicon are the prominent players in the market.

Each of these players has been profiled in the road safety system market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 4.02 Bn |

|

Forecast (Value) in 2031 |

US$ 9.95 Bn |

|

Growth Rate (CAGR) |

10.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross-segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 4.02 Bn in 2022

It is projected to expand at a CAGR of 10.6% by 2031.

It is expected to reach US$ 9.95 Bn by 2031.

Rise in awareness & demand for safety owing to increasing traffic congestion & accidents and integration of smart cities & IoT coupled with growing investments

The enforcement solutions segment held leading share in 2022.

North America was the most lucrative region in 2022.

American Traffic Solutions (Verra Mobility), Conduent, Cubic Corporation, Dahua Technology, FLIR Services, Inc., IDEMIA, Jenoptik, Kapsch TraficCom, Motorola Solutions, Redflex Holdings, Sensys Gatso Group AB, Siemens, Swarco, Teledyne FLIR, Vitronic, Trifoil Kria, Syntell, and Simicon.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Value in US$ Mn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Go to Market Strategy

2.1. Demand & Supply Side Trends

2.1.1. GAP Analysis

2.2. Identification of Potential Market Spaces

2.3. Understanding the Buying Process of the Customers

2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Market Coverage / Taxonomy

3.2. Market Definition / Scope / Limitations

3.3. Market Dynamics

3.3.1. Drivers

3.3.2. Restraints

3.3.3. Opportunity

3.4. Market Factor Analysis

3.4.1. Porter’s Five Force Analysis

3.4.2. SWOT Analysis

3.5. Regulatory Scenario

3.6. Key Trend Analysis

3.7. Value Chain Analysis

3.8. Cost Structure Analysis

3.9. Profit Margin Analysis

4. Global Road Safety System Market, By Solutions

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Road Safety System Market Size & Forecast, 2017-2031, By Solutions

4.2.1. Enforcement Solutions

4.2.1.1. Red-light Enforcement

4.2.1.2. Speed Enforcement

4.2.1.3. Bus Lane Enforcement

4.2.1.4. Section Enforcement

4.2.2. Automatic License Plate Recognition/ Automatic Number Plate Recognition

4.2.3. Incident Detection and Response

4.2.4. Others

5. Global Road Safety System Market, By Services

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Road Safety System Market Size & Forecast, 2017-2031, By Services

5.2.1. Professional Services

5.2.1.1. Consulting and Training

5.2.1.2. System Integration and Deployment

5.2.1.3. Support and Maintenance

5.2.2. Managed Services

6. Global Road Safety System Market, By Components

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Road Safety System Market Size & Forecast, 2017-2031, By Components

6.2.1. Sensors and Cameras

6.2.2. Communication Infrastructure

6.2.3. Control and Processing Units

6.2.4. Algorithms and Software

6.2.5. Display Interfaces

6.2.6. Global Positioning System (GPS)

6.2.7. Emergency Response Integration

6.2.8. Vehicle Monitoring Systems

6.2.9. Traffic Sign Recognition

6.2.10. Others

7. Global Road Safety System Market, by Region

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Road Safety System Market Size & Forecast, 2017-2031, By Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Road Safety System Market

8.1. Market Snapshot

8.2. Road Safety System Market Size & Forecast, 2017-2031, By Solutions

8.2.1. Enforcement Solutions

8.2.1.1. Red-light Enforcement

8.2.1.2. Speed Enforcement

8.2.1.3. Bus Lane Enforcement

8.2.1.4. Section Enforcement

8.2.2. Automatic License Plate Recognition/ Automatic Number Plate Recognition

8.2.3. Incident Detection and Response

8.2.4. Others

8.3. Road Safety System Market Size & Forecast, 2017-2031, By Services

8.3.1. Professional Services

8.3.1.1. Consulting and Training

8.3.1.2. System Integration and Deployment

8.3.1.3. Support and Maintenance

8.3.2. Managed Services

8.4. Road Safety System Market Size & Forecast, 2017-2031, By Components

8.4.1. Sensors and Cameras

8.4.2. Communication Infrastructure

8.4.3. Control and Processing Units

8.4.4. Algorithms and Software

8.4.5. Display Interfaces

8.4.6. Global Positioning System (GPS)

8.4.7. Emergency Response Integration

8.4.8. Vehicle Monitoring Systems

8.4.9. Traffic Sign Recognition

8.4.10. Others

8.5. Road Safety System Market Size & Forecast, 2017-2031, By Country

8.5.1. U.S.

8.5.2. Canada

8.5.3. Mexico

9. Europe Road Safety System Market

9.1. Market Snapshot

9.2. Road Safety System Market Size & Forecast, 2017-2031, By Solutions

9.2.1. Enforcement Solutions

9.2.1.1. Red-light Enforcement

9.2.1.2. Speed Enforcement

9.2.1.3. Bus Lane Enforcement

9.2.1.4. Section Enforcement

9.2.2. Automatic License Plate Recognition/ Automatic Number Plate Recognition

9.2.3. Incident Detection and Response

9.2.4. Others

9.3. Road Safety System Market Size & Forecast, 2017-2031, By Services

9.3.1. Professional Services

9.3.1.1. Consulting and Training

9.3.1.2. System Integration and Deployment

9.3.1.3. Support and Maintenance

9.3.2. Managed Services

9.4. Road Safety System Market Size & Forecast, 2017-2031, By Components

9.4.1. Sensors and Cameras

9.4.2. Communication Infrastructure

9.4.3. Control and Processing Units

9.4.4. Algorithms and Software

9.4.5. Display Interfaces

9.4.6. Global Positioning System (GPS)

9.4.7. Emergency Response Integration

9.4.8. Vehicle Monitoring Systems

9.4.9. Traffic Sign Recognition

9.4.10. Others

9.5. Road Safety System Market Size & Forecast, 2017-2031, By Country

9.5.1. Germany

9.5.2. U.K.

9.5.3. France

9.5.4. Italy

9.5.5. Spain

9.5.6. Nordic Countries

9.5.7. Russia & CIS

9.5.8. Rest of Europe

10. Asia Pacific Road Safety System Market

10.1. Market Snapshot

10.2. Road Safety System Market Size & Forecast, 2017-2031, By Solutions

10.2.1. Enforcement Solutions

10.2.1.1. Red-light Enforcement

10.2.1.2. Speed Enforcement

10.2.1.3. Bus Lane Enforcement

10.2.1.4. Section Enforcement

10.2.2. Automatic License Plate Recognition/ Automatic Number Plate Recognition

10.2.3. Incident Detection and Response

10.2.4. Others

10.3. Road Safety System Market Size & Forecast, 2017-2031, By Services

10.3.1. Professional Services

10.3.1.1. Consulting and Training

10.3.1.2. System Integration and Deployment

10.3.1.3. Support and Maintenance

10.3.2. Managed Services

10.4. Road Safety System Market Size & Forecast, 2017-2031, By Components

10.4.1. Sensors and Cameras

10.4.2. Communication Infrastructure

10.4.3. Control and Processing Units

10.4.4. Algorithms and Software

10.4.5. Display Interfaces

10.4.6. Global Positioning System (GPS)

10.4.7. Emergency Response Integration

10.4.8. Vehicle Monitoring Systems

10.4.9. Traffic Sign Recognition

10.4.10. Others

10.5. Road Safety System Market Size & Forecast, 2017-2031, By Country

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. ASEAN Countries

10.5.5. South Korea

10.5.6. ANZ

10.5.7. Rest of Asia Pacific

11. Middle East & Africa Road Safety System Market

11.1. Market Snapshot

11.2. Road Safety System Market Size & Forecast, 2017-2031, By Solutions

11.2.1. Enforcement Solutions

11.2.1.1. Red-light Enforcement

11.2.1.2. Speed Enforcement

11.2.1.3. Bus Lane Enforcement

11.2.1.4. Section Enforcement

11.2.2. Automatic License Plate Recognition/ Automatic Number Plate Recognition

11.2.3. Incident Detection and Response

11.2.4. Others

11.3. Road Safety System Market Size & Forecast, 2017-2031, By Services

11.3.1. Professional Services

11.3.1.1. Consulting and Training

11.3.1.2. System Integration and Deployment

11.3.1.3. Support and Maintenance

11.3.2. Managed Services

11.4. Road Safety System Market Size & Forecast, 2017-2031, By Components

11.4.1. Sensors and Cameras

11.4.2. Communication Infrastructure

11.4.3. Control and Processing Units

11.4.4. Algorithms and Software

11.4.5. Display Interfaces

11.4.6. Global Positioning System (GPS)

11.4.7. Emergency Response Integration

11.4.8. Vehicle Monitoring Systems

11.4.9. Traffic Sign Recognition

11.4.10. Others

11.5. Road Safety System Market Size & Forecast, 2017-2031, By Country

11.5.1. GCC

11.5.2. South Africa

11.5.3. Turkey

11.5.4. Rest of Middle East & Africa

12. South America Road Safety System Market

12.1. Market Snapshot

12.2. Road Safety System Market Size & Forecast, 2017-2031, By Solutions

12.2.1. Enforcement Solutions

12.2.1.1. Red-light Enforcement

12.2.1.2. Speed Enforcement

12.2.1.3. Bus Lane Enforcement

12.2.1.4. Section Enforcement

12.2.2. Automatic License Plate Recognition/ Automatic Number Plate Recognition

12.2.3. Incident Detection and Response

12.2.4. Others

12.3. Road Safety System Market Size & Forecast, 2017-2031, By Services

12.3.1. Professional Services

12.3.1.1. Consulting and Training

12.3.1.2. System Integration and Deployment

12.3.1.3. Support and Maintenance

12.3.2. Managed Services

12.4. Road Safety System Market Size & Forecast, 2017-2031, By Components

12.4.1. Sensors and Cameras

12.4.2. Communication Infrastructure

12.4.3. Control and Processing Units

12.4.4. Algorithms and Software

12.4.5. Display Interfaces

12.4.6. Global Positioning System (GPS)

12.4.7. Emergency Response Integration

12.4.8. Vehicle Monitoring Systems

12.4.9. Traffic Sign Recognition

12.4.10. Others

12.5. Road Safety System Market Size & Forecast, 2017-2031, By Country

12.5.1. Brazil

12.5.2. Argentina

12.5.3. Rest of South America

13. Competitive Landscape

13.1. Company Share Analysis/ Brand Share Analysis, 2022

13.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

14. Company Profile/ Key Players

14.1. American Traffic Solutions (Verra Mobility)

14.1.1. Company Overview

14.1.2. Company Footprints

14.1.3. Production Locations

14.1.4. Product Portfolio

14.1.5. Competitors & Customers

14.1.6. Subsidiaries & Parent Organization

14.1.7. Recent Developments

14.1.8. Financial Analysis

14.1.9. Profitability

14.1.10. Revenue Share

14.2. Conduent

14.2.1. Company Overview

14.2.2. Company Footprints

14.2.3. Production Locations

14.2.4. Product Portfolio

14.2.5. Competitors & Customers

14.2.6. Subsidiaries & Parent Organization

14.2.7. Recent Developments

14.2.8. Financial Analysis

14.2.9. Profitability

14.2.10. Revenue Share

14.3. Cubic Corporation

14.3.1. Company Overview

14.3.2. Company Footprints

14.3.3. Production Locations

14.3.4. Product Portfolio

14.3.5. Competitors & Customers

14.3.6. Subsidiaries & Parent Organization

14.3.7. Recent Developments

14.3.8. Financial Analysis

14.3.9. Profitability

14.3.10. Revenue Share

14.4. Dahua Technology

14.4.1. Company Overview

14.4.2. Company Footprints

14.4.3. Production Locations

14.4.4. Product Portfolio

14.4.5. Competitors & Customers

14.4.6. Subsidiaries & Parent Organization

14.4.7. Recent Developments

14.4.8. Financial Analysis

14.4.9. Profitability

14.4.10. Revenue Share

14.5. FLIR Services, Inc.

14.5.1. Company Overview

14.5.2. Company Footprints

14.5.3. Production Locations

14.5.4. Product Portfolio

14.5.5. Competitors & Customers

14.5.6. Subsidiaries & Parent Organization

14.5.7. Recent Developments

14.5.8. Financial Analysis

14.5.9. Profitability

14.5.10. Revenue Share

14.6. IDEMIA

14.6.1. Company Overview

14.6.2. Company Footprints

14.6.3. Production Locations

14.6.4. Product Portfolio

14.6.5. Competitors & Customers

14.6.6. Subsidiaries & Parent Organization

14.6.7. Recent Developments

14.6.8. Financial Analysis

14.6.9. Profitability

14.6.10. Revenue Share

14.7. Jenoptik

14.7.1. Company Overview

14.7.2. Company Footprints

14.7.3. Production Locations

14.7.4. Product Portfolio

14.7.5. Competitors & Customers

14.7.6. Subsidiaries & Parent Organization

14.7.7. Recent Developments

14.7.8. Financial Analysis

14.7.9. Profitability

14.7.10. Revenue Share

14.8. Kapsch TraficCom

14.8.1. Company Overview

14.8.2. Company Footprints

14.8.3. Production Locations

14.8.4. Product Portfolio

14.8.5. Competitors & Customers

14.8.6. Subsidiaries & Parent Organization

14.8.7. Recent Developments

14.8.8. Financial Analysis

14.8.9. Profitability

14.8.10. Revenue Share

14.9. Motorola Solutions

14.9.1. Company Overview

14.9.2. Company Footprints

14.9.3. Production Locations

14.9.4. Product Portfolio

14.9.5. Competitors & Customers

14.9.6. Subsidiaries & Parent Organization

14.9.7. Recent Developments

14.9.8. Financial Analysis

14.9.9. Profitability

14.9.10. Revenue Share

14.10. Redflex Holdings

14.10.1. Company Overview

14.10.2. Company Footprints

14.10.3. Production Locations

14.10.4. Product Portfolio

14.10.5. Competitors & Customers

14.10.6. Subsidiaries & Parent Organization

14.10.7. Recent Developments

14.10.8. Financial Analysis

14.10.9. Profitability

14.10.10. Revenue Share

14.11. Sensys Gatso Group AB

14.11.1. Company Overview

14.11.2. Company Footprints

14.11.3. Production Locations

14.11.4. Product Portfolio

14.11.5. Competitors & Customers

14.11.6. Subsidiaries & Parent Organization

14.11.7. Recent Developments

14.11.8. Financial Analysis

14.11.9. Profitability

14.11.10. Revenue Share

14.12. Siemens

14.12.1. Company Overview

14.12.2. Company Footprints

14.12.3. Production Locations

14.12.4. Product Portfolio

14.12.5. Competitors & Customers

14.12.6. Subsidiaries & Parent Organization

14.12.7. Recent Developments

14.12.8. Financial Analysis

14.12.9. Profitability

14.12.10. Revenue Share

14.13. Swarco

14.13.1. Company Overview

14.13.2. Company Footprints

14.13.3. Production Locations

14.13.4. Product Portfolio

14.13.5. Competitors & Customers

14.13.6. Subsidiaries & Parent Organization

14.13.7. Recent Developments

14.13.8. Financial Analysis

14.13.9. Profitability

14.13.10. Revenue Share

14.14. Teledyne FLIR

14.14.1. Company Overview

14.14.2. Company Footprints

14.14.3. Production Locations

14.14.4. Product Portfolio

14.14.5. Competitors & Customers

14.14.6. Subsidiaries & Parent Organization

14.14.7. Recent Developments

14.14.8. Financial Analysis

14.14.9. Profitability

14.14.10. Revenue Share

14.15. Vitronic

14.15.1. Company Overview

14.15.2. Company Footprints

14.15.3. Production Locations

14.15.4. Product Portfolio

14.15.5. Competitors & Customers

14.15.6. Subsidiaries & Parent Organization

14.15.7. Recent Developments

14.15.8. Financial Analysis

14.15.9. Profitability

14.15.10. Revenue Share

14.16. Trifoil Kria

14.16.1. Company Overview

14.16.2. Company Footprints

14.16.3. Production Locations

14.16.4. Product Portfolio

14.16.5. Competitors & Customers

14.16.6. Subsidiaries & Parent Organization

14.16.7. Recent Developments

14.16.8. Financial Analysis

14.16.9. Profitability

14.16.10. Revenue Share

14.17. Syntell

14.17.1. Company Overview

14.17.2. Company Footprints

14.17.3. Production Locations

14.17.4. Product Portfolio

14.17.5. Competitors & Customers

14.17.6. Subsidiaries & Parent Organization

14.17.7. Recent Developments

14.17.8. Financial Analysis

14.17.9. Profitability

14.17.10. Revenue Share

14.18. Simicon

14.18.1. Company Overview

14.18.2. Company Footprints

14.18.3. Production Locations

14.18.4. Product Portfolio

14.18.5. Competitors & Customers

14.18.6. Subsidiaries & Parent Organization

14.18.7. Recent Developments

14.18.8. Financial Analysis

14.18.9. Profitability

14.18.10. Revenue Share

List of Tables

Table 1: Global Road Safety System Market Revenue (US$ Mn) Forecast, by Solutions, 2017-2031

Table 2: Global Road Safety System Market Revenue (US$ Mn) Forecast, by Services, 2017-2031

Table 3: Global Road Safety System Market Revenue (US$ Mn) Forecast, by Components, 2017-2031

Table 4: Global Road Safety System Market Revenue (US$ Mn) Forecast, by Region, 2017-2031

Table 5: North America Road Safety System Market Revenue (US$ Mn) Forecast, by Solutions, 2017-2031

Table 6: North America Road Safety System Market Revenue (US$ Mn) Forecast, by Services, 2017-2031

Table 7: North America Road Safety System Market Revenue (US$ Mn) Forecast, by Components, 2017-2031

Table 8: North America Road Safety System Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 9: Europe Road Safety System Market Revenue (US$ Mn) Forecast, by Solutions, 2017-2031

Table 10: Europe Road Safety System Market Revenue (US$ Mn) Forecast, by Services, 2017-2031

Table 11: Europe Road Safety System Market Revenue (US$ Mn) Forecast, by Components, 2017-2031

Table 12: Europe Road Safety System Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 13: Asia Pacific Road Safety System Market Revenue (US$ Mn) Forecast, by Solutions, 2017-2031

Table 14: Asia Pacific Road Safety System Market Revenue (US$ Mn) Forecast, by Services, 2017-2031

Table 15: Asia Pacific Road Safety System Market Revenue (US$ Mn) Forecast, by Components, 2017-2031

Table 16: Asia Pacific Road Safety System Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 17: Middle East & Africa Road Safety System Market Revenue (US$ Mn) Forecast, by Solutions, 2017-2031

Table 18: Middle East & Africa Road Safety System Market Revenue (US$ Mn) Forecast, by Services, 2017-2031

Table 19: Middle East & Africa Road Safety System Market Revenue (US$ Mn) Forecast, by Components, 2017-2031

Table 20: Middle East & Africa Road Safety System Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 21: South America Road Safety System Market Revenue (US$ Mn) Forecast, by Solutions, 2017-2031

Table 22: South America Road Safety System Market Revenue (US$ Mn) Forecast, by Services, 2017-2031

Table 23: South America Road Safety System Market Revenue (US$ Mn) Forecast, by Components, 2017-2031

Table 24: South America Road Safety System Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Road Safety System Market Revenue (US$ Mn) Forecast, by Solutions, 2017-2031

Figure 2: Global Road Safety System Market, Incremental Opportunity, by Solutions, Value (US$ Mn), 2023-2031

Figure 3: Global Road Safety System Market Revenue (US$ Mn) Forecast, by Services, 2017-2031

Figure 4: Global Road Safety System Market, Incremental Opportunity, by Services, Value (US$ Mn), 2023-2031

Figure 5: Global Road Safety System Market Revenue (US$ Mn) Forecast, by Components, 2017-2031

Figure 6: Global Road Safety System Market, Incremental Opportunity, by Components, Value (US$ Mn), 2023-2031

Figure 7: Global Road Safety System Market Revenue (US$ Mn) Forecast, by Region, 2017-2031

Figure 8: Global Road Safety System Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023-2031

Figure 9: North America Road Safety System Market Revenue (US$ Mn) Forecast, by Solutions, 2017-2031

Figure 10: North America Road Safety System Market, Incremental Opportunity, by Solutions, Value (US$ Mn), 2023-2031

Figure 11: North America Road Safety System Market Revenue (US$ Mn) Forecast, by Services, 2017-2031

Figure 12: North America Road Safety System Market, Incremental Opportunity, by Services, Value (US$ Mn), 2023-2031

Figure 13: North America Road Safety System Market Revenue (US$ Mn) Forecast, by Components, 2017-2031

Figure 14: North America Road Safety System Market, Incremental Opportunity, by Components, Value (US$ Mn), 2023-2031

Figure 15: North America Road Safety System Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 16: North America Road Safety System Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 17: Europe Road Safety System Market Revenue (US$ Mn) Forecast, by Solutions, 2017-2031

Figure 18: Europe Road Safety System Market, Incremental Opportunity, by Solutions, Value (US$ Mn), 2023-2031

Figure 19: Europe Road Safety System Market Revenue (US$ Mn) Forecast, by Services, 2017-2031

Figure 20: Europe Road Safety System Market, Incremental Opportunity, by Services, Value (US$ Mn), 2023-2031

Figure 21: Europe Road Safety System Market Revenue (US$ Mn) Forecast, by Components, 2017-2031

Figure 22: Europe Road Safety System Market, Incremental Opportunity, by Components, Value (US$ Mn), 2023-2031

Figure 23: Europe Road Safety System Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 24: Europe Road Safety System Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 25: Asia Pacific Road Safety System Market Revenue (US$ Mn) Forecast, by Solutions, 2017-2031

Figure 26: Asia Pacific Road Safety System Market, Incremental Opportunity, by Solutions, Value (US$ Mn), 2023-2031

Figure 27: Asia Pacific Road Safety System Market Revenue (US$ Mn) Forecast, by Services, 2017-2031

Figure 28: Asia Pacific Road Safety System Market, Incremental Opportunity, by Services, Value (US$ Mn), 2023-2031

Figure 29: Asia Pacific Road Safety System Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 30: Asia Pacific Road Safety System Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 31: Asia Pacific Road Safety System Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 32: Asia Pacific Road Safety System Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 33: Middle East & Africa Road Safety System Market Revenue (US$ Mn) Forecast, by Solutions, 2017-2031

Figure 34: Middle East & Africa Road Safety System Market, Incremental Opportunity, by Solutions, Value (US$ Mn), 2023-2031

Figure 35: Middle East & Africa Road Safety System Market Revenue (US$ Mn) Forecast, by Services, 2017-2031

Figure 36: Middle East & Africa Road Safety System Market, Incremental Opportunity, by Services, Value (US$ Mn), 2023-2031

Figure 37: Middle East & Africa Road Safety System Market Revenue (US$ Mn) Forecast, by Components, 2017-2031

Figure 38: Middle East & Africa Road Safety System Market, Incremental Opportunity, by Components, Value (US$ Mn), 2023-2031

Figure 39: Middle East & Africa Road Safety System Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 40: Middle East & Africa Road Safety System Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 41: South America Road Safety System Market Revenue (US$ Mn) Forecast, by Solutions, 2017-2031

Figure 42: South America Road Safety System Market, Incremental Opportunity, by Solutions, Value (US$ Mn), 2023-2031

Figure 43: South America Road Safety System Market Revenue (US$ Mn) Forecast, by Services, 2017-2031

Figure 44: South America Road Safety System Market, Incremental Opportunity, by Services, Value (US$ Mn), 2023-2031

Figure 45: South America Road Safety System Market Revenue (US$ Mn) Forecast, by Components, 2017-2031

Figure 46: South America Road Safety System Market, Incremental Opportunity, by Components, Value (US$ Mn), 2023-2031

Figure 47: South America Road Safety System Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 48: South America Road Safety System Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031