Reports

Reports

Analyst Viewpoint

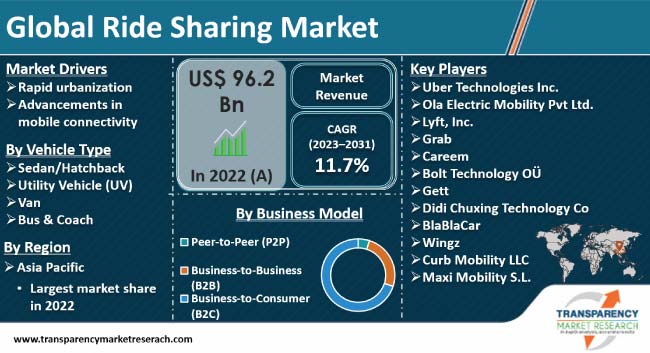

Surge in the rate of urbanization is a major factor driving the ride sharing market growth. Migration of the people to urban areas due to better economic opportunities and quality of life is leading to traffic congestion and lack of parking spaces. This is augmenting the ride sharing industry value, as car-sharing platforms offer a sustainable and convenient solution vis-à-vis conventional offerings.

Innovation in mobile connectivity is also propelling the ride sharing market size. Incorporation of AI and data analytics to predict demand, optimize routes, and offer dynamic pricing is fostering market development. Prominent players operating in the global market are engaging in sustainability practices to cater to the growing consciousness around the environment. Integration of multi-modality functions, which offer a hybrid solution along with public transit, is one of the recent market trends worldwide.

Ride sharing services or shared mobility are innovative transportation solutions that assist in connecting drivers with individuals seeking rides through mobile apps.

These services have become popular with the growth of platforms such as Uber, OLA, and Lyft, as they are cost-effective, convenient, and reliable with user-friendly interfaces.

Ride pooling platforms adopt the technology of global positioning systems (GPS), enhanced mobile connectivity, and advanced algorithm to offer a seamless and on-demand alternative to conventional taxis and public transportation offerings.

The popularity of such platforms can be attributed to a gradual shift toward sustainable transportation solutions and consistent efforts to curb the reliance on private vehicles.

Recent ride sharing market trends include the integration of electric and autonomous vehicles and micro-mobility services that combine public transit with ride sharing options.

Addressing inclusivity in ride sharing services while also offering shared commutes for senior citizens are boosting global market statistics.

Surge in the rate of urbanization is a global phenomenon that can be ascribed to factors such as migration from rural areas in search of a better quality of life and economic opportunities.

Migration to urban areas has led to a significant increase in urban population density. In turn, this has heightened concerns regarding traffic congestion and limited parking spaces.

These issues are leading to inefficiency in traditional urban transportation solutions such as subways, buses, and private vehicles. This is driving the adoption of ride sharing services across the globe.

According to the United Nations, by 2030, nearly 60% of the global population is set to live in cities, with a 1 billion increase in urban population to be witnessed in Asia and Africa.

Ride sharing platforms offer reliable and cost-effective alternative to vehicle ownership for the working class population. Several city dwellers also find supplementary or full-time income as drivers, thus contributing to the rising gig economy.

Thus, ride sharing service is a vital component of a modern rapidly urbanizing city.

Mobile connectivity is crucial to the functioning of ride sharing platforms, as it offers smooth booking of cabs and other services via smartphones.

Mobile connectivity facilitates real-time tracking, cashless transactions, and in-app navigation to optimize route planning and ensure accurate pick-ups and drop-offs conveniently and safely.

Innovations such as artificial intelligence and machine learning are also employed by the platforms to add features such as dynamic pricing and demand prediction.

Furthermore, data analytics plays an essential role in route planning, while the incorporation of emerging technologies such as electric vehicles showcases the industry’s commitment toward sustainability and development.

According to data updated in 2023, nearly 5.9 billion unique mobile owners exist worldwide, a statistic equivalent to about 76% of the world’s population. As per a recent report, worldwide unique smartphone users will reach five billion by 2030.

As per the recent ride sharing market analysis, Asia Pacific held the largest share of the global landscape in 2022. Surge in urban population density, presence of dominant global service providers, and relatively low rate of vehicle ownership are augmenting the ride sharing industry in the region.

According to a study published by Deloitte, nearly 57% of consumers in India prefer using ridesharing services over their own vehicles. Consumers in the country are more inclined to use rideshare apps such as OLA, Uber, and Rapido compared to other populous countries such as Japan, China, and South Korea.

According to the latest ride sharing market forecast, the industry in North America and Europe is projected to grow at a steady pace during the forecast period, led by the rise in awareness about the ill-effects of pollution and need for better urban transportation infrastructure.

Increase in congestion and implementation of green government policies are also driving the ride sharing market dynamics of Europe and North America.

As per an article by DemandSage, more than 5.4 million drivers work with Uber as of 2024. The U.S. accounts for nearly 1.5 million of these drivers.

Prominent companies operating in the global landscape are investing significantly in innovations in cooperative transportation and shared mobility to enhance the functionality of urban transportation.

Adoption of improved mobile integration and electric vehicles to meet the rising demand from the lucrative green transportation sector is a key growth strategy adopted by the leading companies to strengthen their market position.

Uber Technologies Inc., Ola Electric Mobility Pvt Ltd., Lyft, Inc., Grab, Careem, Bolt Technology OÜ, Gett, Didi Chuxing Technology Co, BlaBlaCar, Wingz, Curb Mobility LLC, and Maxi Mobility S.L. are key players that account for large global ride sharing market share.

These companies have been covered in the ride sharing market report in terms of parameters such as company overview, business strategies, product portfolio, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 96.2 Bn |

| Market Forecast Value in 2031 | US$ 260.7 Bn |

| Growth Rate (CAGR) | 11.7% |

| Forecast Period | 2023 to 2031 |

| Historical Data Available for | 2017 to 2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Prominent Players – Competition Dashboard and Revenue Share Analysis, 2022 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 96.2 Bn in 2022

It is projected to advance at a CAGR of 11.7% from 2023 to 2031

Rapid urbanization and advancements in mobile connectivity

The business-to-consumer (B2C) segment accounted for the largest share in 2022

Asia Pacific was the leading region in 2022

Uber Technologies Inc., Ola Electric Mobility Pvt Ltd., Lyft, Inc., Grab, Careem, Bolt Technology OÜ, Gett, Didi Chuxing Technology Co, BlaBlaCar, Wingz, Curb Mobility LLC, and Maxi Mobility S.L.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Value US$ Mn, 2017 - 2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding the Buying Process of Customers

1.2.4. Preferred Sales & Marketing Strategy

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Definition / Scope / Limitations

2.2. TMR Analysis and Recommendations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. Global Ride Sharing Market, By Commuting Distance

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Ride Sharing Market Size & Forecast, 2017 - 2031, By Commuting Distance

3.2.1. Intercity

3.2.2. Intra-city

4. Global Ride Sharing Market, By Autonomy Level

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Ride Sharing Market Size & Forecast, 2017 - 2031, By Autonomy Level

4.2.1. Manual

4.2.2. Autonomous

5. Global Ride Sharing Market, By Operating Body

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Ride Sharing Market Size & Forecast, 2017 - 2031, By Operating Body

5.2.1. Government

5.2.2. Private

6. Global Ride Sharing Market, By Electric Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Ride Sharing Market Size & Forecast, 2017 - 2031, By Electric Vehicle Type

6.2.1. Hybrid Electric Vehicle (HEV)

6.2.2. Plug-in Electric Vehicle (PEV)

7. Global Ride Sharing Market, By Service Provider

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Ride Sharing Market Size & Forecast, 2017 - 2031, By Service Provider

7.2.1. OEM

7.2.2. Private

7.2.3. OEM + Private

8. Global Ride Sharing Market, By Vehicle Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Ride Sharing Market Size & Forecast, 2017 - 2031, By Vehicle Type

8.2.1. Sedan/Hatchback

8.2.2. Utility Vehicle (UV)

8.2.3. Van

8.2.4. Bus & Coach

9. Global Ride Sharing Market, By Business Model

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Ride Sharing Market Size & Forecast, 2017 - 2031, By Business Model

9.2.1. Peer-to-Peer (P2P)

9.2.2. Business-to-Business (B2B)

9.2.3. Business-to-Consumer (B2C)

10. Global Ride Sharing Market, by Region

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Ride Sharing Market Size & Forecast, 2017 - 2031, By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Ride Sharing Market

11.1. Market Snapshot

11.2. North America Ride Sharing Market Size & Forecast, 2017 - 2031, By Commuting Distance

11.2.1. Intercity

11.2.2. Intra-city

11.3. North America Ride Sharing Market Size & Forecast, 2017 - 2031, By Autonomy Level

11.3.1. Manual

11.3.2. Autonomous

11.4. North America Ride Sharing Market Size & Forecast, 2017 - 2031, By Operating Body

11.4.1. Government

11.4.2. Private

11.5. North America Ride Sharing Market Size & Forecast, 2017 - 2031, By Electric Vehicle Type

11.5.1. Hybrid Electric Vehicle (HEV)

11.5.2. Plug-in Electric Vehicle (PEV)

11.6. North America Ride Sharing Market Size & Forecast, 2017 - 2031, By Service Provider

11.6.1. OEM

11.6.2. Private

11.6.3. OEM + Private

11.7. North America Ride Sharing Market Size & Forecast, 2017 - 2031, By Vehicle Type

11.7.1. Sedan/Hatchback

11.7.2. Utility Vehicle (UV)

11.7.3. Van

11.7.4. Bus & Coach

11.8. North America Ride Sharing Market Size & Forecast, 2017 - 2031, By Business Model

11.8.1. Peer-to-Peer (P2P)

11.8.2. Business-to-Business (B2B)

11.8.3. Business-to-Consumer (B2C)

11.9. North America Ride Sharing Market Size & Forecast, 2017 - 2031, By Country

11.9.1. The U. S.

11.9.2. Canada

11.9.3. Mexico

12. Europe Ride Sharing Market

12.1. Market Snapshot

12.2. Europe Ride Sharing Market Size & Forecast, 2017 - 2031, By Commuting Distance

12.2.1. Intercity

12.2.2. Intra-city

12.3. Europe Ride Sharing Market Size & Forecast, 2017 - 2031, By Autonomy Level

12.3.1. Manual

12.3.2. Autonomous

12.4. Europe Ride Sharing Market Size & Forecast, 2017 - 2031, By Operating Body

12.4.1. Government

12.4.2. Private

12.5. Europe Ride Sharing Market Size & Forecast, 2017 - 2031, By Electric Vehicle Type

12.5.1. Hybrid Electric Vehicle (HEV)

12.5.2. Plug-in Electric Vehicle (PEV)

12.6. Europe Ride Sharing Market Size & Forecast, 2017 - 2031, By Service Provider

12.6.1. OEM

12.6.2. Private

12.6.3. OEM + Private

12.7. Europe Ride Sharing Market Size & Forecast, 2017 - 2031, By Vehicle Type

12.7.1. Sedan/Hatchback

12.7.2. Utility Vehicle (UV)

12.7.3. Van

12.7.4. Bus & Coach

12.8. Europe Ride Sharing Market Size & Forecast, 2017 - 2031, By Business Model

12.8.1. Peer-to-Peer (P2P)

12.8.2. Business-to-Business (B2B)

12.8.3. Business-to-Consumer (B2C)

12.9. Europe Ride Sharing Market Size & Forecast, 2017 - 2031, By Country

12.9.1. Germany

12.9.2. U. K.

12.9.3. France

12.9.4. Italy

12.9.5. Spain

12.9.6. Nordic Countries

12.9.7. Russia & CIS

12.9.8. Rest of Europe

13. Asia Pacific Ride Sharing Market

13.1. Market Snapshot

13.2. Asia Pacific Ride Sharing Market Size & Forecast, 2017 - 2031, By Commuting Distance

13.2.1. Intercity

13.2.2. Intra-city

13.3. Asia Pacific Ride Sharing Market Size & Forecast, 2017 - 2031, By Autonomy Level

13.3.1. Manual

13.3.2. Autonomous

13.4. Asia Pacific Ride Sharing Market Size & Forecast, 2017 - 2031, By Operating Body

13.4.1. Government

13.4.2. Private

13.5. Asia Pacific Ride Sharing Market Size & Forecast, 2017 - 2031, By Electric Vehicle Type

13.5.1. Hybrid Electric Vehicle (HEV)

13.5.2. Plug-in Electric Vehicle (PEV)

13.6. Asia Pacific Ride Sharing Market Size & Forecast, 2017 - 2031, By Service Provider

13.6.1. OEM

13.6.2. Private

13.6.3. OEM + Private

13.7. Asia Pacific Ride Sharing Market Size & Forecast, 2017 - 2031, By Vehicle Type

13.7.1. Sedan/Hatchback

13.7.2. Utility Vehicle (UV)

13.7.3. Van

13.7.4. Bus & Coach

13.8. Asia Pacific Ride Sharing Market Size & Forecast, 2017 - 2031, By Business Model

13.8.1. Peer-to-Peer (P2P)

13.8.2. Business-to-Business (B2B)

13.8.3. Business-to-Consumer (B2C)

13.9. Asia Pacific Ride Sharing Market Size & Forecast, 2017 - 2031, By Country

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. ASEAN Countries

13.9.5. South Korea

13.9.6. ANZ

13.9.7. Rest of Asia Pacific

14. Middle East & Africa Ride Sharing Market

14.1. Market Snapshot

14.2. Middle East & Africa Ride Sharing Market Size & Forecast, 2017 - 2031, By Commuting Distance

14.2.1. Intercity

14.2.2. Intra-city

14.3. Middle East & Africa Ride Sharing Market Size & Forecast, 2017 - 2031, By Autonomy Level

14.3.1. Manual

14.3.2. Autonomous

14.4. Middle East & Africa Ride Sharing Market Size & Forecast, 2017 - 2031, By Operating Body

14.4.1. Government

14.4.2. Private

14.5. Middle East & Africa Ride Sharing Market Size & Forecast, 2017 - 2031, By Electric Vehicle Type

14.5.1. Hybrid Electric Vehicle (HEV)

14.5.2. Plug-in Electric Vehicle (PEV)

14.6. Middle East & Africa Ride Sharing Market Size & Forecast, 2017 - 2031, By Service Provider

14.6.1. OEM

14.6.2. Private

14.6.3. OEM + Private

14.7. Middle East & Africa Ride Sharing Market Size & Forecast, 2017 - 2031, By Vehicle Type

14.7.1. Sedan/Hatchback

14.7.2. Utility Vehicle (UV)

14.7.3. Van

14.7.4. Bus & Coach

14.8. Middle East & Africa Ride Sharing Market Size & Forecast, 2017 - 2031, By Business Model

14.8.1. Peer-to-Peer (P2P)

14.8.2. Business-to-Business (B2B)

14.8.3. Business-to-Consumer (B2C)

14.9. Middle East & Africa Ride Sharing Market Size & Forecast, 2017 - 2031, By Country

14.9.1. GCC

14.9.2. South Africa

14.9.3. Turkey

14.9.4. Rest of Middle East & Africa

15. South America Ride Sharing Market

15.1. Market Snapshot

15.2. South America Ride Sharing Market Size & Forecast, 2017 - 2031, By Commuting Distance

15.2.1. Intercity

15.2.2. Intra-city

15.3. South America Ride Sharing Market Size & Forecast, 2017 - 2031, By Autonomy Level

15.3.1. Manual

15.3.2. Autonomous

15.4. South America Ride Sharing Market Size & Forecast, 2017 - 2031, By Operating Body

15.4.1. Government

15.4.2. Private

15.5. South America Ride Sharing Market Size & Forecast, 2017 - 2031, By Electric Vehicle Type

15.5.1. Hybrid Electric Vehicle (HEV)

15.5.2. Plug-in Electric Vehicle (PEV)

15.6. South America Ride Sharing Market Size & Forecast, 2017 - 2031, By Service Provider

15.6.1. OEM

15.6.2. Private

15.6.3. OEM + Private

15.7. South America Ride Sharing Market Size & Forecast, 2017 - 2031, By Vehicle Type

15.7.1. Sedan/Hatchback

15.7.2. Utility Vehicle (UV)

15.7.3. Van

15.7.4. Bus & Coach

15.8. South America Ride Sharing Market Size & Forecast, 2017 - 2031, By Business Model

15.8.1. Peer-to-Peer (P2P)

15.8.2. Business-to-Business (B2B)

15.8.3. Business-to-Consumer (B2C)

15.9. South America Ride Sharing Market Size & Forecast, 2017 - 2031, By Country

15.9.1. Brazil

15.9.2. Argentina

15.9.3. Rest of South America

16. Competitive Landscape

16.1. Company Share Analysis/ Brand Share Analysis, 2022

16.2. Company Analysis for each player any Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share

17. Company Profile/ Key Players

17.1. Uber Technologies Inc.

17.1.1. Company Overview

17.1.2. Company Footprints

17.1.3. Production Locations

17.1.4. Product Portfolio

17.1.5. Competitors & Customers

17.1.6. Subsidiaries & Parent Organization

17.1.7. Recent Developments

17.1.8. Financial Analysis

17.1.9. Profitability

17.1.10. Revenue Share

17.2. Ola Electric Mobility Pvt Ltd.

17.2.1. Company Overview

17.2.2. Company Footprints

17.2.3. Production Locations

17.2.4. Product Portfolio

17.2.5. Competitors & Customers

17.2.6. Subsidiaries & Parent Organization

17.2.7. Recent Developments

17.2.8. Financial Analysis

17.2.9. Profitability

17.2.10. Revenue Share

17.3. Lyft, Inc.

17.3.1. Company Overview

17.3.2. Company Footprints

17.3.3. Production Locations

17.3.4. Product Portfolio

17.3.5. Competitors & Customers

17.3.6. Subsidiaries & Parent Organization

17.3.7. Recent Developments

17.3.8. Financial Analysis

17.3.9. Profitability

17.3.10. Revenue Share

17.4. Grab

17.4.1. Company Overview

17.4.2. Company Footprints

17.4.3. Production Locations

17.4.4. Product Portfolio

17.4.5. Competitors & Customers

17.4.6. Subsidiaries & Parent Organization

17.4.7. Recent Developments

17.4.8. Financial Analysis

17.4.9. Profitability

17.4.10. Revenue Share

17.5. Careem

17.5.1. Company Overview

17.5.2. Company Footprints

17.5.3. Production Locations

17.5.4. Product Portfolio

17.5.5. Competitors & Customers

17.5.6. Subsidiaries & Parent Organization

17.5.7. Recent Developments

17.5.8. Financial Analysis

17.5.9. Profitability

17.5.10. Revenue Share

17.6. Bolt Technology OÜ

17.6.1. Company Overview

17.6.2. Company Footprints

17.6.3. Production Locations

17.6.4. Product Portfolio

17.6.5. Competitors & Customers

17.6.6. Subsidiaries & Parent Organization

17.6.7. Recent Developments

17.6.8. Financial Analysis

17.6.9. Profitability

17.6.10. Revenue Share

17.7. Gett

17.7.1. Company Overview

17.7.2. Company Footprints

17.7.3. Production Locations

17.7.4. Product Portfolio

17.7.5. Competitors & Customers

17.7.6. Subsidiaries & Parent Organization

17.7.7. Recent Developments

17.7.8. Financial Analysis

17.7.9. Profitability

17.7.10. Revenue Share

17.8. Didi Chuxing Technology Co

17.8.1. Company Overview

17.8.2. Company Footprints

17.8.3. Production Locations

17.8.4. Product Portfolio

17.8.5. Competitors & Customers

17.8.6. Subsidiaries & Parent Organization

17.8.7. Recent Developments

17.8.8. Financial Analysis

17.8.9. Profitability

17.8.10. Revenue Share

17.9. BlaBlaCar

17.9.1. Company Overview

17.9.2. Company Footprints

17.9.3. Production Locations

17.9.4. Product Portfolio

17.9.5. Competitors & Customers

17.9.6. Subsidiaries & Parent Organization

17.9.7. Recent Developments

17.9.8. Financial Analysis

17.9.9. Profitability

17.9.10. Revenue Share

17.10. Wingz

17.10.1. Company Overview

17.10.2. Company Footprints

17.10.3. Production Locations

17.10.4. Product Portfolio

17.10.5. Competitors & Customers

17.10.6. Subsidiaries & Parent Organization

17.10.7. Recent Developments

17.10.8. Financial Analysis

17.10.9. Profitability

17.10.10. Revenue Share

17.11. Curb Mobility LLC

17.11.1. Company Overview

17.11.2. Company Footprints

17.11.3. Production Locations

17.11.4. Product Portfolio

17.11.5. Competitors & Customers

17.11.6. Subsidiaries & Parent Organization

17.11.7. Recent Developments

17.11.8. Financial Analysis

17.11.9. Profitability

17.11.10. Revenue Share

17.12. Maxi Mobility S.L.

17.12.1. Company Overview

17.12.2. Company Footprints

17.12.3. Production Locations

17.12.4. Product Portfolio

17.12.5. Competitors & Customers

17.12.6. Subsidiaries & Parent Organization

17.12.7. Recent Developments

17.12.8. Financial Analysis

17.12.9. Profitability

17.12.10. Revenue Share

List of Tables

Table 1: Global Ride Sharing Market Value (US$ Mn) Forecast, by Commuting Distance, 2017 - 2031

Table 2: Global Ride Sharing Market Value (US$ Mn) Forecast, by Service Provider, 2017 - 2031

Table 3: Global Ride Sharing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017 - 2031

Table 4: Global Ride Sharing Market Value (US$ Mn) Forecast, by Autonomy Level, 2017 - 2031

Table 5: Global Ride Sharing Market Value (US$ Mn) Forecast, by Operating Body, 2017 - 2031

Table 6: Global Ride Sharing Market Value (US$ Mn) Forecast, by Business Model, 2017 - 2031

Table 7: Global Ride Sharing Market Value (US$ Mn) Forecast, by Electric Vehicle Type , 2017 - 2031

Table 8: Global Ride Sharing Market Value (US$ Mn) Forecast, by Region, 2017 - 2031

Table 9: North America Ride Sharing Market Value (US$ Mn) Forecast, by Commuting Distance, 2017 - 2031

Table 10: North America Ride Sharing Market Value (US$ Mn) Forecast, by Service Provider, 2017 - 2031

Table 11: North America Ride Sharing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017 - 2031

Table 12: North America Ride Sharing Market Value (US$ Mn) Forecast, by Autonomy Level, 2017 - 2031

Table 13: North America Ride Sharing Market Value (US$ Mn) Forecast, by Operating Body, 2017 - 2031

Table 14: North America Ride Sharing Market Value (US$ Mn) Forecast, by Business Model, 2017 - 2031

Table 15: North America Ride Sharing Market Value (US$ Mn) Forecast, by Electric Vehicle Type, 2017 - 2031

Table 16: North America Ride Sharing Market Value (US$ Mn) Forecast, by Country, 2017 - 2031

Table 17: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Commuting Distance, 2017 - 2031

Table 18: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Service Provider, 2017 - 2031

Table 19: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017 - 2031

Table 20: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Autonomy Level, 2017 - 2031

Table 21: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Operating Body, 2017 - 2031

Table 22: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Business Model, 2017 - 2031

Table 23: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Electric Vehicle Type , 2017 - 2031

Table 24: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2031

Table 25: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Commuting Distance, 2017 - 2031

Table 26: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Service Provider, 2017 - 2031

Table 27: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017 - 2031

Table 28: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Autonomy Level, 2017 - 2031

Table 29: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Operating Body, 2017 - 2031

Table 30: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Business Model, 2017 - 2031

Table 31: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Electric Vehicle Type , 2017 - 2031

Table 32: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2031

Table 33: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Commuting Distance, 2017 - 2031

Table 34: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Service Provider, 2017 - 2031

Table 35: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017 - 2031

Table 36: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Autonomy Level, 2017 - 2031

Table 37: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Operating Body, 2017 - 2031

Table 38: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Business Model, 2017 - 2031

Table 39: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Electric Vehicle Type , 2017 - 2031

Table 40: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2031

Table 41: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Commuting Distance, 2017 - 2031

Table 42: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Service Provider, 2017 - 2031

Table 43: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017 - 2031

Table 44: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Autonomy Level, 2017 - 2031

Table 45: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Operating Body, 2017 - 2031

Table 46: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Business Model, 2017 - 2031

Table 47: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Electric Vehicle Type , 2017 - 2031

Table 48: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2031

List of Figures

Figure 1: Global Ride Sharing Market Value (US$ Mn) Forecast, by Commuting Distance, 2017 - 2031

Figure 2: Global Ride Sharing Market, Incremental Opportunity, by Commuting Distance, Value (US$ Mn), 2022 - 2031

Figure 3: Global Ride Sharing Market Value (US$ Mn) Forecast, by Service Provider, 2017 - 2031

Figure 4: Global Ride Sharing Market, Incremental Opportunity, by Service Provider, Value (US$ Mn), 2022 - 2031

Figure 5: Global Ride Sharing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017 - 2031

Figure 6: Global Ride Sharing Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022 - 2031

Figure 7: Global Ride Sharing Market Value (US$ Mn) Forecast, by Autonomy Level, 2017 - 2031

Figure 8: Global Ride Sharing Market, Incremental Opportunity, by Autonomy Level, Value (US$ Mn), 2022 - 2031

Figure 9: Global Ride Sharing Market Value (US$ Mn) Forecast, by Operating Body, 2017 - 2031

Figure 10: Global Ride Sharing Market, Incremental Opportunity, by Operating Body, Value (US$ Mn), 2022 - 2031

Figure 11: Global Ride Sharing Market Value (US$ Mn) Forecast, by Business Model, 2017 - 2031

Figure 12: Global Ride Sharing Market, Incremental Opportunity, by Business Model, Value (US$ Mn), 2022 - 2031

Figure 13: Global Ride Sharing Market Value (US$ Mn) Forecast, by Electric Vehicle Type , 2017 - 2031

Figure 14: Global Ride Sharing Market, Incremental Opportunity, by Electric Vehicle Type , Value (US$ Mn), 2022 - 2031

Figure 15: Global Ride Sharing Market Value (US$ Mn) Forecast, by Region, 2017 - 2031

Figure 16: Global Ride Sharing Market, Incremental Opportunity, by Region, Value (US$ Mn), 2022 - 2031

Figure 17: North America Ride Sharing Market Value (US$ Mn) Forecast, by Commuting Distance, 2017 - 2031

Figure 18: North America Ride Sharing Market, Incremental Opportunity, by Commuting Distance, Value (US$ Mn), 2022 - 2031

Figure 19: North America Ride Sharing Market Value (US$ Mn) Forecast, by Service Provider, 2017 - 2031

Figure 20: North America Ride Sharing Market, Incremental Opportunity, by Service Provider, Value (US$ Mn), 2022 - 2031

Figure 21: North America Ride Sharing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017 - 2031

Figure 22: North America Ride Sharing Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022 - 2031

Figure 23: North America Ride Sharing Market Value (US$ Mn) Forecast, by Autonomy Level, 2017 - 2031

Figure 24: North America Ride Sharing Market, Incremental Opportunity, by Autonomy Level, Value (US$ Mn), 2022 - 2031

Figure 25: North America Ride Sharing Market Value (US$ Mn) Forecast, by Operating Body, 2017 - 2031

Figure 26: North America Ride Sharing Market, Incremental Opportunity, by Operating Body, Value (US$ Mn), 2022 - 2031

Figure 27: North America Ride Sharing Market Value (US$ Mn) Forecast, by Business Model, 2017 - 2031

Figure 28: North America Ride Sharing Market, Incremental Opportunity, by Business Model, Value (US$ Mn), 2022 - 2031

Figure 29: North America Ride Sharing Market Value (US$ Mn) Forecast, by Electric Vehicle Type , 2017 - 2031

Figure 30: North America Ride Sharing Market, Incremental Opportunity, by Electric Vehicle Type , Value (US$ Mn), 2022 - 2031

Figure 31: North America Ride Sharing Market Value (US$ Mn) Forecast, by Country, 2017 - 2031

Figure 32: North America Ride Sharing Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022 - 2031

Figure 33: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Commuting Distance, 2017 - 2031

Figure 34: Latin America Ride Sharing Market, Incremental Opportunity, by Commuting Distance, Value (US$ Mn), 2022 - 2031

Figure 35: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Service Provider, 2017 - 2031

Figure 36: Latin America Ride Sharing Market, Incremental Opportunity, by Service Provider, Value (US$ Mn), 2022 - 2031

Figure 37: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017 - 2031

Figure 38: Latin America Ride Sharing Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022 - 2031

Figure 39: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Autonomy Level, 2017 - 2031

Figure 40: Latin America Ride Sharing Market, Incremental Opportunity, by Autonomy Level, Value (US$ Mn), 2022 - 2031

Figure 41: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Operating Body, 2017 - 2031

Figure 42: Latin America Ride Sharing Market, Incremental Opportunity, by Operating Body, Value (US$ Mn), 2022 - 2031

Figure 43: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Business Model, 2017 - 2031

Figure 44: Latin America Ride Sharing Market, Incremental Opportunity, by Business Model, Value (US$ Mn), 2022 - 2031

Figure 45: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Electric Vehicle Type , 2017 - 2031

Figure 46: Latin America Ride Sharing Market, Incremental Opportunity, by Electric Vehicle Type , Value (US$ Mn), 2022 - 2031

Figure 47: Latin America Ride Sharing Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2031

Figure 48: Latin America Ride Sharing Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022 - 2031

Figure 49: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Commuting Distance, 2017 - 2031

Figure 50: Europe Ride Sharing Market, Incremental Opportunity, by Commuting Distance, Value (US$ Mn), 2022 - 2031

Figure 51: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Service Provider, 2017 - 2031

Figure 52: Europe Ride Sharing Market, Incremental Opportunity, by Service Provider, Value (US$ Mn), 2022 - 2031

Figure 53: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017 - 2031

Figure 54: Europe Ride Sharing Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022 - 2031

Figure 55: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Autonomy Level, 2017 - 2031

Figure 56: Europe Ride Sharing Market, Incremental Opportunity, by Autonomy Level, Value (US$ Mn), 2022 - 2031

Figure 57: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Operating Body, 2017 - 2031

Figure 58: Europe Ride Sharing Market, Incremental Opportunity, by Operating Body, Value (US$ Mn), 2022 - 2031

Figure 59: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Business Model, 2017 - 2031

Figure 60: Europe Ride Sharing Market, Incremental Opportunity, by Business Model, Value (US$ Mn), 2022 - 2031

Figure 61: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Electric Vehicle Type , 2017 - 2031

Figure 62: Europe Ride Sharing Market, Incremental Opportunity, by Electric Vehicle Type , Value (US$ Mn), 2022 - 2031

Figure 63: Europe Ride Sharing Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2031

Figure 64: Europe Ride Sharing Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022 - 2031

Figure 65: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Commuting Distance, 2017 - 2031

Figure 66: Asia Pacific Ride Sharing Market, Incremental Opportunity, by Commuting Distance, Value (US$ Mn), 2022 - 2031

Figure 67: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Service Provider, 2017 - 2031

Figure 68: Asia Pacific Ride Sharing Market, Incremental Opportunity, by Service Provider, Value (US$ Mn), 2022 - 2031

Figure 69: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017 - 2031

Figure 70: Asia Pacific Ride Sharing Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022 - 2031

Figure 71: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Autonomy Level, 2017 - 2031

Figure 72: Asia Pacific Ride Sharing Market, Incremental Opportunity, by Autonomy Level, Value (US$ Mn), 2022 - 2031

Figure 73: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Operating Body, 2017 - 2031

Figure 74: Asia Pacific Ride Sharing Market, Incremental Opportunity, by Operating Body, Value (US$ Mn), 2022 - 2031

Figure 75: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Business Model, 2017 - 2031

Figure 76: Asia Pacific Ride Sharing Market, Incremental Opportunity, by Business Model, Value (US$ Mn), 2022 - 2031

Figure 77: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Electric Vehicle Type , 2017 - 2031

Figure 78: Asia Pacific Ride Sharing Market, Incremental Opportunity, by Electric Vehicle Type , Value (US$ Mn), 2022 - 2031

Figure 79: Asia Pacific Ride Sharing Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2031

Figure 80: Asia Pacific Ride Sharing Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022 - 2031

Figure 81: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Commuting Distance, 2017 - 2031

Figure 82: Middle East & Africa Ride Sharing Market, Incremental Opportunity, by Commuting Distance, Value (US$ Mn), 2022 - 2031

Figure 83: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Service Provider, 2017 - 2031

Figure 84: Middle East & Africa Ride Sharing Market, Incremental Opportunity, by Service Provider, Value (US$ Mn), 2022 - 2031

Figure 85: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Vehicle Type, 2017 - 2031

Figure 86: Middle East & Africa Ride Sharing Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022 - 2031

Figure 87: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Autonomy Level, 2017 - 2031

Figure 88: Middle East & Africa Ride Sharing Market, Incremental Opportunity, by Autonomy Level, Value (US$ Mn), 2022 - 2031

Figure 89: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Operating Body, 2017 - 2031

Figure 90: Middle East & Africa Ride Sharing Market, Incremental Opportunity, by Operating Body, Value (US$ Mn), 2022 - 2031

Figure 91: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Business Model, 2017 - 2031

Figure 92: Middle East & Africa Ride Sharing Market, Incremental Opportunity, by Business Model, Value (US$ Mn), 2022 - 2031

Figure 93: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Electric Vehicle Type , 2017 - 2031

Figure 94: Middle East & Africa Ride Sharing Market, Incremental Opportunity, by Electric Vehicle Type , Value (US$ Mn), 2022 - 2031

Figure 95: Middle East & Africa Ride Sharing Market Value (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2031

Figure 96: Middle East & Africa Ride Sharing Market, Incremental Opportunity, by Country and Sub-region, Value (US$ Mn), 2022 - 2031