Reports

Reports

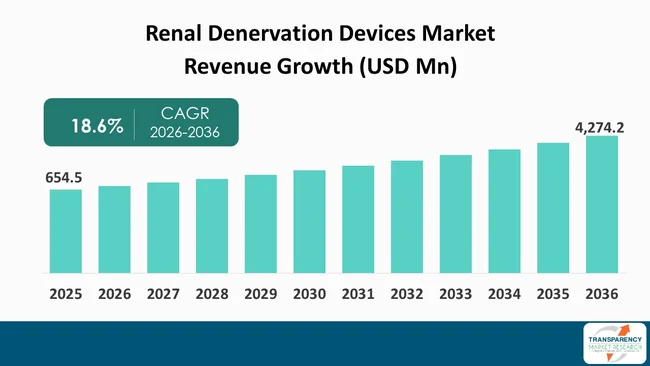

The global renal denervation devices market size was valued at US$ 654.5 Mn in 2025 and is projected to reach US$ 4,274.2 Mn by 2036, expanding at a CAGR of 18.6% from 2026 to 2036. The market growth is driven by rising prevalence of resistant and uncontrolled hypertension, increasing preference for minimally invasive procedures, favorable regulatory developments and approvals, and growing body of positive clinical evidence.

The renal denervation devices market is driven by increased incidences of hypertension, especially uncontrolled and resistant hypertension, which cannot be controlled using medication alone. There is renewed confidence among physicians about the efficacy and safety of the procedure, driven by the growing clinical evidence base from recent randomized controlled trials.

Technological advancements in catheter design and ultrasound and radiofrequency-based systems have also increased the precision of the procedure. The need for minimally-invasive treatment options and increased investments by key players in the market are also boosting the market.

The renal denervation devices market is undergoing several key trends. Firstly, a move toward more evidence-based clinical adoption has gained momentum after the release of many positive results from large randomized trials that have demonstrated long term reductions in blood pressure. Secondly, technology platforms such as radio frequency and ultrasound are being utilized along with new and emerging energy modalities that provide safer and more effective procedures.

Furthermore, manufacturers are increasingly focused on creating catheters that are simple to use and can be inserted with minimal trauma to the patient via minimally invasive techniques, as well as improving workflow with real-time imaging systems. Manufacturers are rapidly expanding into Asia and the other emerging regions due to the rise in the number of cases of hypertension globally and improvements in healthcare services in those areas. Moreover, increased partnerships among manufacturers, researchers, and the other healthcare organizations provide additional opportunities for use in clinical settings and reimbursement.

The minimally-invasive medical devices called renal denervating devices are intended to selectively disrupt the excessively active sympathetic nerve system, located along renal arteries and play an important role in blood pressure control. The renal denervation devices use energy-based methods delivered by catheter-based endovascular technologies to reduce renal sympathetic nerve activity, allowing for prolonged reductions in blood pressure. A primary clinical use of these devices is controlling hypertension, especially in patients who have either not benefited from or cannot tolerate pharmacological therapy.

| Attribute | Detail |

|---|---|

| Renal Denervation Devices Market Drivers |

|

The growing incidence of resistant and uncontrolled hypertension is a key growth driver to the renal denervation device market due to the significant unmet medical need for alternative therapeutic options.

Resistant hypertension is on the rise among the global population, especially among obese people and the elderly population. Despite the availability of pharmacological agents for the treatment of hypertension, there is a lack of response to antihypertensive drugs and noncompliance with drug regimens due to adverse effects and drug complexity.

Minimal-access renal-denervation is a catheter-based procedure that directly impacts hyper-sympathetic nerve presentation at the entrance to a renal artery and leads to significant and ongoing decreases in systolic blood pressure without requiring patient compliance with pharmacological treatment.

Many recent randomized controlled trials (RCTs) including SPYRAL HTN-OFF MED and RADIANCE-HTN support the efficacy of this approach for patients with resistant hypertension. Both of these RCTs indicate that physicians’ confidence regarding the efficacy of renal-denervation procedures has increased; therefore the growing adoption of renal-denervation by physicians will be enhanced by having supportive clinical data.

In addition, the increasing awareness of the risks associated with untreated or uncontrolled hypertension among patients, as well as healthcare practitioners, also fuels the demand for new, device-based treatment approaches. The increasing patient population with hypertension, limitations of pharmacological treatment, and the demonstrated efficacy of RDN devices combine to provide a compelling case for this treatment option, especially in regions with an exploding patient population with resistant hypertension. The increasing patient population with resistant hypertension and uncontrolled hypertension thus acts as a foundation for the RDN devices market.

The growing demand for minimally invasive procedures is another major growth driver to the renal denervation devices market. This is due to the growing preference for procedures that are less risky and require minimal recovery time. Surgical procedures for the treatment of hypertension-related complications are invasive and come with a higher risk of complications. They also require a longer recovery period and hospitalization.

On the other hand, the renal denervation procedure is a minimally invasive procedure that involves treating overactive sympathetic nerves surrounding the renal arteries for lowering blood pressure. This is done through endovascular access and involves minimal risk of complications like bleeding and infections. The minimally invasive nature of the RDN procedure reduces the risk of complications during the procedure.

The way patients are cared for has changed dramatically over the past several years due to the shift to patient-centric care with faster recovery times. As a part of this transition, doctors are now more open to studying and practicing with new treatments such as renal denervation since they can obtain results comparable to conventional medication while using less invasive methods to avoid all of the problems involved in completing the major surgeries.

Advancements in catheter design, imaging, and real-time feedback during procedures are contributing to renal denervation being more appealing for interventional radiologists, cardiologists, and nephrologists. Furthermore, physicians’ acceptance, patient demand, and healthcare system efficiency have all played a part in raising acceptance of renal denervation devices.

| Attribute | Detail |

|---|---|

| Renal Denervation Devices Market Opportunities |

|

Renal denervation’s expanded therapeutic potential is a major market growth opportunity as research continues to uncover its potential beyond the treatment of resistant hypertension.

There are also significant benefits to examine combative therapies&-combining RDN with an optimized pharmacological regimen-to help provide better treatment response in patients who only partially respond to medications. This combined method matches the shift toward personalized medicine and target-based treatment options that have been gaining prominence in modern health care. There is now an increasing number of global clinical trial studies for the expanded applications of RDN, and more providers desire to see RDN added as part of their multidisciplinary treatment plan.

There are also significant benefits to be realized by exploring combative therapies by integrating RDN with the best pharmacological intervention to assist in providing a better treatment outcome in patients who do not respond adequately to pharmacological therapy. This type of therapy aligns with the trend toward more personalized medicine and target-based therapy options that have been growing in popularity within modern medicine. There are now an increasing number of worldwide clinical trial studies for the expanded use of RDN therapy, and more practitioners want to see RDN integrated as a component of their treatment plan.

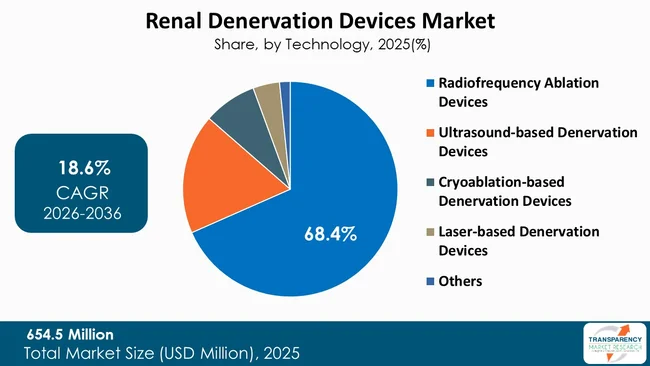

At present, the largest market segment for renal denervation devices is occupied by radiofrequency ablation devices due to its proven clinical efficacy and safety, and physicians’ comfort with the technology. Radiofrequency ablation devices have also been used to perform large-scale randomized clinical trials, such as the SPYRAL HTN OFF MED study, which demonstrate the ability to lower blood pressure in patients with resistant hypertension. Radiofrequency ablation catheters target the nerves precisely and avoid complications due to their catheter-based approach.

Furthermore, RF devices are extensively used by large medical device manufacturers in conjunction with the extensive clinical educational resources and the regulatory authorizations in the major markets, which build physicians' confidence in using RF devices. RF devices remain the most popular technique amongst healthcare providers worldwide when compared to the other newer technologies, as they provide similar efficacy, simplicity of the procedure, and evidenced efficacy over the period of time. Therefore, RF devices will continue to dominate the market regardless of the other competing technologies.

| Attribute | Detail |

|---|---|

| Leading Region |

|

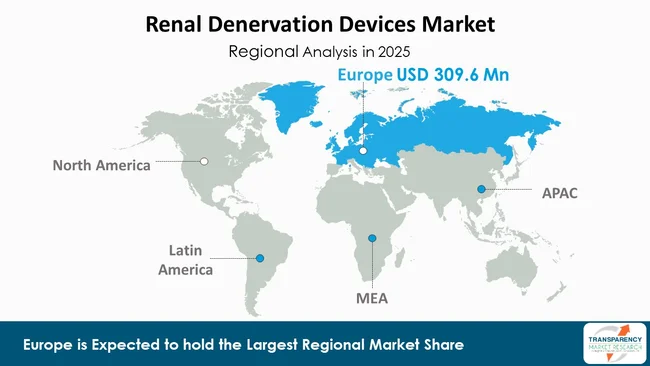

According to a new market outlook report for renal denervation devices, Europe is expected to hold 47.3% of the total market share in 2025.

Currently, the market share of the RDN devices market is dominated by the European region due to the presence of an already established healthcare system and the early adoption of innovative cardiovascular treatments. The region also has a high incidence rate of hypertension and resistant hypertension. This has led to an increased need for alternative treatments for hypertension. The region has the advantage of possessing advanced interventional cardiology and nephrology facilities. This has made the region suitable for the adoption of minimally invasive treatments.

The early and widespread approvals for the key RDN devices have also contributed to the dominance of the region. This is due to the CE marking of the RDN devices. The region also has a high level of clinical awareness and confidence among physicians due to the robust clinical trials conducted. This has been complemented by the presence of leading manufacturers of RDN devices. This has made the region the most lucrative market for the RDN devices.

The major initiatives in the renal denervation devices market include strategic partnerships, mergers and acquisitions, and collaborations with research organizations to improve clinical trials. The companies are investing in the development of new catheter technologies, geographical expansions, regulatory approvals, and training programs for physicians to improve the market position of the companies.

Medtronic, Boston Scientific Corporation, Recor Medical, Inc., Ablative Solutions, Inc., Terumo Corporation, Mercator MedSystems, Inc., Autonomix Medical, Inc., Koninklijke Philips N.V., SyMap Medical (Suzhou) Ltd., and Otsuka Medical Devices Co., Ltd. are some of the leading players operating in the global renal denervation devices market.

Each of these players has been profiled in the renal denervation devices market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | US$ 654.5 Mn |

| Forecast Value in 2036 | US$ 4,274.2 Mn |

| CAGR | 18.6% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2021-2024 |

| Quantitative Units | US$ Mn |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Technology

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global renal denervation devices market was valued at US$ 654.5 Mn in 2025

The global renal denervation devices industry is projected to reach more than US$ 4,274.2 Mn by the end of 2036

Rising prevalence of resistant and uncontrolled hypertension, increasing preference for minimally invasive procedures, favorable regulatory developments and approvals, and growing body of positive clinical evidence are some of the factors driving the expansion of renal denervation devices market.

The CAGR is anticipated to be 18.6% from 2026 to 2036

Medtronic, Boston Scientific Corporation, Recor Medical, Inc., Ablative Solutions, Inc., Terumo Corporation, Mercator MedSystems, Inc., Autonomix Medical, Inc., Koninklijke Philips N.V., SyMap Medical (Suzhou) Ltd., and Otsuka Medical Devices Co., Ltd.

Table 01: Global Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 02: Global Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 03: Global Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 04: Global Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 05: Global Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 06: Global Renal Denervation Devices Market Value (US$ Mn) Forecast, By Region, 2021 to 2036

Table 07: North America Renal Denervation Devices Market Value (US$ Mn) Forecast, by Country, 2021-2036

Table 08: North America Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 09: North America Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 10: North America Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 11: North America Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 12: North America Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 13: U.S. Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 14: U.S. Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 15: U.S. Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 16: U.S. Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 17: U.S. Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 18: Canada Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 19: Canada Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 20: Canada Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 21: Canada Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 22: Canada Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 23: Europe Renal Denervation Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2021-2036

Table 24: Europe Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 25: Europe Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 26: Europe Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 27: Europe Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 28: Europe Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 29: Germany Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 30: Germany Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 31: Germany Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 32: Germany Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 33: Germany Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 34: U.K. Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 35: U.K. Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 36: U.K. Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 37: U.K. Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 38: U.K. Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 39: France Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 40: France Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 41: France Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 42: France Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 43: France Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 44: Italy Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 45: Italy Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 46: Italy Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 47: Italy Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 48: Italy Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 49: Spain Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 50: Spain Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 51: Spain Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 52: Spain Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 53: Spain Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 54: The Netherlands Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 55: The Netherlands Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 56: The Netherlands Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 57: The Netherlands Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 58: The Netherlands Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 59: Rest of Europe Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 60: Rest of Europe Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 61: Rest of Europe Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 62: Rest of Europe Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 63: Rest of Europe Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 64: Asia Pacific Renal Denervation Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2021-2036

Table 65: Asia Pacific Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 66: Asia Pacific Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 67: Asia Pacific Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 68: Asia Pacific Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 69: Asia Pacific Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 70: China Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 71: China Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 72: China Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 73: China Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 74: China Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 75: India Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 76: India Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 77: India Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 78: India Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 79: India Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 80: Japan Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 81: Japan Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 82: Japan Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 83: Japan Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 84: Japan Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 85: South Korea Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 86: South Korea Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 87: South Korea Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 88: South Korea Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 89: South Korea Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 90: Australia & New Zealand Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 91: Australia & New Zealand Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 92: Australia & New Zealand Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 93: Australia & New Zealand Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 94: Australia & New Zealand Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 95: ASEAN Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 96: ASEAN Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 97: ASEAN Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 98: ASEAN Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 99: ASEAN Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 100: Rest of Asia Pacific Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 101: Rest of Asia Pacific Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 102: Rest of Asia Pacific Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 103: Rest of Asia Pacific Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 104: Rest of Asia Pacific Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 105: Latin America Renal Denervation Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2021-2036

Table 106: Latin America Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 107: Latin America Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 108: Latin America Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 109: Latin America Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 110: Latin America Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 111: Brazil Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 112: Brazil Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 113: Brazil Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 114: Brazil Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 115: Brazil Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 116: Argentina Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 117: Argentina Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 118: Argentina Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 119: Argentina Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 120: Argentina Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 121: Mexico Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 122: Mexico Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 123: Mexico Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 124: Mexico Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 125: Mexico Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 126: Rest of Latin America Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 127: Rest of Latin America Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 128: Rest of Latin America Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 129: Rest of Latin America Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 130: Rest of Latin America Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 131: Middle East & Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2021-2036

Table 132: Middle East & Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 133: Middle East & Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 134: Middle East & Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 135: Middle East & Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 136: Middle East & Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 137: GCC Countries Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 138: GCC Countries Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 139: GCC Countries Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 140: GCC Countries Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 141: GCC Countries Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 142: South Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 143: South Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 144: South Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 145: South Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 146: South Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Table 147: Rest of Middle East & Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By Technology, 2021 to 2036

Table 148: Rest of Middle East & Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By Product Type, 2021 to 2036

Table 149: Rest of Middle East & Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By Procedure Type, 2021 to 2036

Table 150: Rest of Middle East & Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By Indication, 2021 to 2036

Table 151: Rest of Middle East & Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, By End-user, 2021 to 2036

Figure 01: Global Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 02: Global Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 03: Global Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 04: Global Renal Denervation Devices Market Revenue (US$ Mn), by Radiofrequency Ablation Devices, 2021 to 2036

Figure 05: Global Renal Denervation Devices Market Revenue (US$ Mn), by Ultrasound-based Denervation Devices, 2021 to 2036

Figure 06: Global Renal Denervation Devices Market Revenue (US$ Mn), by Cryoablation-based Denervation Devices, 2021 to 2036

Figure 07: Global Renal Denervation Devices Market Revenue (US$ Mn), by Laser-based Denervation Devices, 2021 to 2036

Figure 08: Global Renal Denervation Devices Market Revenue (US$ Mn), by Others, 2021 to 2036

Figure 09: Global Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 10: Global Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 11: Global Renal Denervation Devices Market Revenue (US$ Mn), by Denervation Catheter Systems, 2021 to 2036

Figure 12: Global Renal Denervation Devices Market Revenue (US$ Mn), by Accessory & Consumables, 2021 to 2036

Figure 13: Global Renal Denervation Devices Market Revenue (US$ Mn), by Navigation / Imaging Support Tools, 2021 to 2036

Figure 14: Global Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 15: Global Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 16: Global Renal Denervation Devices Market Revenue (US$ Mn), by Unilateral Renal Denervation, 2021 to 2036

Figure 17: Global Renal Denervation Devices Market Revenue (US$ Mn), by Bilateral Renal Denervation, 2021 to 2036

Figure 18: Global Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 19: Global Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 20: Global Renal Denervation Devices Market Revenue (US$ Mn), by Resistant Hypertension, 2021 to 2036

Figure 21: Global Renal Denervation Devices Market Revenue (US$ Mn), by Chronic Kidney Disease (CKD)-Associated Hypertension, 2021 to 2036

Figure 22: Global Renal Denervation Devices Market Revenue (US$ Mn), by Heart Failure, 2021 to 2036

Figure 23: Global Renal Denervation Devices Market Revenue (US$ Mn), by Others, 2021 to 2036

Figure 24: Global Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 25: Global Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 26: Global Renal Denervation Devices Market Revenue (US$ Mn), by Hospitals, 2021 to 2036

Figure 27: Global Renal Denervation Devices Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2021 to 2036

Figure 28: Global Renal Denervation Devices Market Revenue (US$ Mn), by Cardiac & Specialty Clinics, 2021 to 2036

Figure 29: Global Renal Denervation Devices Market Revenue (US$ Mn), by Others, 2021 to 2036

Figure 30: Global Renal Denervation Devices Market Value Share Analysis, by Region, 2025 and 2036

Figure 31: Global Renal Denervation Devices Market Attractiveness Analysis, by Region, 2026 to 2036

Figure 32: North America Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 33: North America Renal Denervation Devices Market Value Share Analysis, by Country, 2025 and 2036

Figure 34: North America Renal Denervation Devices Market Attractiveness Analysis, by Country, 2026 to 2036

Figure 35: North America Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 36: North America Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 37: North America Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 38: North America Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 39: North America Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 40: North America Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 41: North America Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 42: North America Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 43: North America Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 44: North America Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 45: U.S. Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 46: U.S. Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 47: U.S. Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 48: U.S. Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 49: U.S. Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 50: U.S. Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 51: U.S. Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 52: U.S. Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 53: U.S. Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 54: U.S. Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 55: U.S. Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 56: Canada Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 57: Canada Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 58: Canada Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 59: Canada Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 60: Canada Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 61: Canada Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 62: Canada Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 63: Canada Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 64: Canada Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 65: Canada Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 66: Canada Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 67: Europe Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 68: Europe Renal Denervation Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 69: Europe Renal Denervation Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 70: Europe Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 71: Europe Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 72: Europe Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 73: Europe Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 74: Europe Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 75: Europe Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 76: Europe Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 77: Europe Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 78: Europe Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 79: Europe Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 80: Germany Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 81: Germany Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 82: Germany Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 83: Germany Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 84: Germany Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 85: Germany Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 86: Germany Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 87: Germany Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 88: Germany Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 89: Germany Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 90: Germany Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 91: U.K. Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 92: U.K. Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 93: U.K. Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 94: U.K. Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 95: U.K. Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 96: U.K. Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 97: U.K. Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 98: U.K. Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 99: U.K. Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 100: U.K. Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 101: U.K. Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 102: France Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 103: France Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 104: France Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 105: France Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 106: France Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 107: France Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 108: France Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 109: France Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 110: France Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 111: France Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 112: France Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 113: Italy Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 114: Italy Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 115: Italy Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 116: Italy Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 117: Italy Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 118: Italy Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 119: Italy Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 120: Italy Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 121: Italy Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 122: Italy Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 123: Italy Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 124: Spain Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 125: Spain Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 126: Spain Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 127: Spain Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 128: Spain Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 129: Spain Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 130: Spain Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 131: Spain Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 132: Spain Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 133: Spain Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 134: Spain Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 135: The Netherlands Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 136: The Netherlands Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 137: The Netherlands Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 138: The Netherlands Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 139: The Netherlands Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 140: The Netherlands Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 141: The Netherlands Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 142: The Netherlands Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 143: The Netherlands Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 144: The Netherlands Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 145: The Netherlands Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 146: Rest of Europe Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 147: Rest of Europe Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 148: Rest of Europe Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 149: Rest of Europe Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 150: Rest of Europe Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 151: Rest of Europe Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 152: Rest of Europe Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 153: Rest of Europe Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 154: Rest of Europe Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 155: Rest of Europe Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 156: Rest of Europe Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 157: Asia Pacific Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 158: Asia Pacific Renal Denervation Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 159: Asia Pacific Renal Denervation Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 160: Asia Pacific Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 161: Asia Pacific Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 162: Asia Pacific Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 163: Asia Pacific Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 164: Asia Pacific Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 165: Asia Pacific Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 166: Asia Pacific Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 167: Asia Pacific Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 168: Asia Pacific Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 169: Asia Pacific Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 170: China Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 171: China Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 172: China Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 173: China Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 174: China Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 175: China Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 176: China Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 177: China Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 178: China Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 179: China Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 180: China Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 181: India Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 182: India Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 183: India Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 184: India Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 185: India Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 186: India Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 187: India Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 188: India Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 189: India Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 190: India Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 191: India Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 192: Japan Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 193: Japan Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 194: Japan Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 195: Japan Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 196: Japan Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 197: Japan Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 198: Japan Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 199: Japan Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 200: Japan Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 201: Japan Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 202: Japan Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 203: South Korea Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 204: South Korea Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 205: South Korea Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 206: South Korea Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 207: South Korea Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 208: South Korea Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 209: South Korea Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 210: South Korea Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 211: South Korea Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 212: South Korea Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 213: South Korea Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 214: Australia & New Zealand Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 215: Australia & New Zealand Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 216: Australia & New Zealand Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 217: Australia & New Zealand Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 218: Australia & New Zealand Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 219: Australia & New Zealand Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 220: Australia & New Zealand Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 221: Australia & New Zealand Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 222: Australia & New Zealand Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 223: Australia & New Zealand Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 224: Australia & New Zealand Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 225: ASEAN Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 226: ASEAN Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 227: ASEAN Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 228: ASEAN Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 229: ASEAN Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 230: ASEAN Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 231: ASEAN Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 232: ASEAN Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 233: ASEAN Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 234: ASEAN Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 235: ASEAN Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 236: Rest of Asia Pacific Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 237: Rest of Asia Pacific Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 238: Rest of Asia Pacific Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 239: Rest of Asia Pacific Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 240: Rest of Asia Pacific Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 241: Rest of Asia Pacific Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 242: Rest of Asia Pacific Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 243: Rest of Asia Pacific Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 244: Rest of Asia Pacific Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 245: Rest of Asia Pacific Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 246: Rest of Asia Pacific Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 247: Latin America Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 248: Latin America Renal Denervation Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 249: Latin America Renal Denervation Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 250: Latin America Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 251: Latin America Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 252: Latin America Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 253: Latin America Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 254: Latin America Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 255: Latin America Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 256: Latin America Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 257: Latin America Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 258: Latin America Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 259: Latin America Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 260: Brazil Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 261: Brazil Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 262: Brazil Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 263: Brazil Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 264: Brazil Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 265: Brazil Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 266: Brazil Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 267: Brazil Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 268: Brazil Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 269: Brazil Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 270: Brazil Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 271: Argentina Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 272: Argentina Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 273: Argentina Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 274: Argentina Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 275: Argentina Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 276: Argentina Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 277: Argentina Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 278: Argentina Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 279: Argentina Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 280: Argentina Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 281: Argentina Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 282: Mexico Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 283: Mexico Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 284: Mexico Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 285: Mexico Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 286: Mexico Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 287: Mexico Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 288: Mexico Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 289: Mexico Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 290: Mexico Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 291: Mexico Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 292: Mexico Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 293: Rest of Latin America Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 294: Rest of Latin America Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 295: Rest of Latin America Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 296: Rest of Latin America Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 297: Rest of Latin America Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 298: Rest of Latin America Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 299: Rest of Latin America Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 300: Rest of Latin America Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 301: Rest of Latin America Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 302: Rest of Latin America Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 303: Rest of Latin America Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 304: Middle East & Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 305: Middle East & Africa Renal Denervation Devices Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 306: Middle East & Africa Renal Denervation Devices Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 307: Middle East & Africa Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 308: Middle East & Africa Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 309: Middle East & Africa Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 310: Middle East & Africa Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 311: Middle East & Africa Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 312: Middle East & Africa Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 313: Middle East & Africa Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 314: Middle East & Africa Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 315: Middle East & Africa Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 316: Middle East & Africa Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 317: GCC Countries Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 318: GCC Countries Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 319: GCC Countries Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 320: GCC Countries Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 321: GCC Countries Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 322: GCC Countries Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 323: GCC Countries Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 324: GCC Countries Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 325: GCC Countries Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 326: GCC Countries Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 327: GCC Countries Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 328: South Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 329: South Africa Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 330: South Africa Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 331: South Africa Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 332: South Africa Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 333: South Africa Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 334: South Africa Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 335: South Africa Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 336: South Africa Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 337: South Africa Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 338: South Africa Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 339: Rest of Middle East & Africa Renal Denervation Devices Market Value (US$ Mn) Forecast, 2021 to 2036

Figure 340: Rest of Middle East & Africa Renal Denervation Devices Market Value Share Analysis, by Technology, 2025 and 2036

Figure 341: Rest of Middle East & Africa Renal Denervation Devices Market Attractiveness Analysis, by Technology, 2026 to 2036

Figure 342: Rest of Middle East & Africa Renal Denervation Devices Market Value Share Analysis, by Product Type, 2025 and 2036

Figure 343: Rest of Middle East & Africa Renal Denervation Devices Market Attractiveness Analysis, by Product Type, 2026 to 2036

Figure 344: Rest of Middle East & Africa Renal Denervation Devices Market Value Share Analysis, by Procedure Type, 2025 and 2036

Figure 345: Rest of Middle East & Africa Renal Denervation Devices Market Attractiveness Analysis, by Procedure Type, 2026 to 2036

Figure 346: Rest of Middle East & Africa Renal Denervation Devices Market Value Share Analysis, by Indication, 2025 and 2036

Figure 347: Rest of Middle East & Africa Renal Denervation Devices Market Attractiveness Analysis, by Indication, 2026 to 2036

Figure 348: Rest of Middle East & Africa Renal Denervation Devices Market Value Share Analysis, by End-user, 2025 and 2036

Figure 349: Rest of Middle East & Africa Renal Denervation Devices Market Attractiveness Analysis, by End-user, 2026 to 2036