Reports

Reports

Companies worldwide are facing an unprecedented challenge due to the sudden coronavirus (COVID-19) outbreak. This pandemic has also affected stakeholders in the regulatory technology (RegTech) solutions market. Hence, companies in the market for regulatory technology (RegTech) solutions are resorting to the ‘work from home’ policy to safeguard the health of their employees. For instance, on March 19, 2020, BearingPoint RegTech— an expert in regulatory reporting, announced that the company has incorporated the work from home policy, which aligns with its IT Security policy to switch operations to home office.

Companies in the regulatory technology (RegTech) solutions market have halted international travels and reduced national travel to an absolute minimum to reduce the risk of spreading coronavirus. They are making informed decisions with due agreements with affected clients. Thus, the work from home policy has ensured certain amount of business continuity by strategizing on the delivery of new software releases. As such, the revenue of software is projected for exponential growth in the market for regulatory technology (RegTech) solutions.

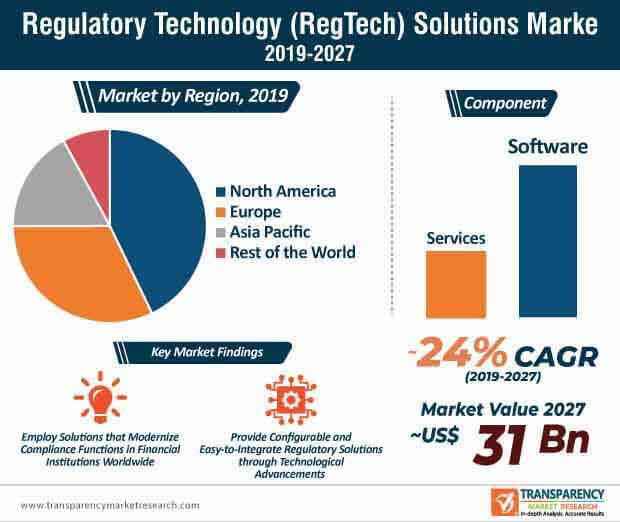

Strategic collaborations are setting the pace for stakeholders in the regulatory technology (RegTech) solutions market to track, map, and report regulatory compliance in case of any discrepancies. For instance, Governor Software Ltd.— a governance and oversight solutions provider, announced to enter into an agreement with Waymark Tech, a specialist in AI for regulatory compliance to become its global reseller of financial regulatory content. As such, the revenue of banking and insurance industries is estimated for aggressive growth in the regulatory technology (RegTech) solutions market, where the market is predicted to grow at an explosive CAGR of ~24% during the forecast period.

Compliance teams in various financial institutions of the regulatory technology (RegTech) solutions market can now track and report regulatory compliance discrepancies, as companies in the market for regulatory technology (RegTech) solutions set their collaborations wheels in motion. This trend is prominent in the U.K., since the Financial Conduct Authority (FCA) is utilizing unique visualization technologies offered by companies to improve search functions.

Financial crime rates have not only risen during the past few years in the regulatory technology (RegTech) solutions market, but also become more complicated and hard to detect. Hence, companies are overcoming these issues with heavy-handed governance and incorporation of stricter compliance requirements. However, with rapid growth of the fintech industry, companies in the market for regulatory technology (RegTech) solutions are pressured to keep pace with the ever-evolving industry needs. There is a need to find new guidelines that prevent financial crimes without stifling new industry expansion.

The regulatory technology (RegTech) solutions market is expected to reach ~US$ 31 Bn by the end of 2027. Hence, companies are adopting risk-based compliance measures instead of rule-based models to process large volumes of data that ensure operational efficiency. The market for regulatory technology (RegTech) solutions is witnessing change by switching to digital technologies.

Well-funded startups and imaginative use of technology for governance are some of the key focus points for companies in the regulatory technology (RegTech) solutions market in India. India, being one of the fastest growing economies and a home to one of the largest unicorn communities, is anticipated to contribute to the aggressive revenue growth of the market for regulatory technology (RegTech) solutions in the Asia Pacific region. Hence, regulators and policymakers are bearing clear identification of problems of regulatory compliance associated with online cab aggregators and food delivery services.

Companies in the regulatory technology (RegTech) solutions market are developing targeted regulatory and monitoring strategies to mitigate issues raised by technology-based models. Prioritizing risk-based and responsive regulatory approach plays a pivotal role in adopting technology-based models in regulatory governance.

Analysts’ Viewpoint

The unprecedented challenge of COVID-19 pandemic is encouraging companies in the regulatory technology (RegTech) solutions market to conduct web-based training sessions for employees for continuation of business activities. They are gaining global recognition by saving cost in complex regulatory requirements.

India is emerging as a hub for increased R&D activities and a test bed for product innovations, thus supporting the booming startup culture. However, there is a growing need to align government policy and regulatory framework to enable robust growth of technology-based models. Hence, companies should develop impactful innovation policies that fuel the process of creativity and inventive activities for emerging technologies such as gene editing, AI, drones and the likes.

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Regulatory Technology (RegTech) Solutions Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macroeconomic Factors Overview

4.2.1. World GDP Indicator – For Top Economies

4.2.2. Global ICT Spending (US$ Bn), 2013, 2019, 2023 and 2027

4.2.3. Parent Market Overview

4.3. Technology/ Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. Ecosystem Analysis

4.4.3. PESTEL Analysis

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers and Restraints

4.5. Adoption (%) and Investment Analysis of RegTech Technologies, 2018

4.5.1. Artificial Intelligence

4.5.2. Natural Language Processing

4.5.3. Blockchain

4.5.4. Big Data Analytics

4.5.5. Cloud Computing

4.6. Regulatory Compliance Management Cost Analysis

4.7. Global Regulatory Technology (RegTech) Solutions Market Analysis and Forecast, 2013 - 2027

4.7.1. Market Revenue Analysis (US$ Mn)

4.7.1.1. Historic Growth Trends, 2013-2018

4.7.1.2. Forecast Trends, 2019-2027

4.8. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Rest of the World)

4.8.1. By Region/ Country

4.8.2. By Application

4.8.3. By Component

4.8.4. By Enterprise Size

4.8.5. By Industry

4.9. Competitive Scenario and Trends

4.9.1. Regulatory Technology (RegTech) Solutions Market Concentration Rate

4.9.1.1. List of Emerging, Prominent and Leading Players

4.9.2. Mergers & Acquisitions, Expansions

4.9.3. Product Mapping of Regulatory Technology (RegTech), by Leading Players

4.10. Market Outlook

5. Global Regulatory Technology (RegTech) Solutions Market Competition Analysis, by Vendors

5.1. Global Regulatory Technology (RegTech) Solutions Market Average Price Analysis, by Vendors (2018)

6. Global Regulatory Technology (RegTech) Solutions Market Analysis and Forecast, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

6.3.1. Software

6.3.1.1. On-premise

6.3.1.2. Cloud

6.3.2. Services

6.3.2.1. Training & Implementation

6.3.2.2. Support & Maintenance

6.3.2.3. Consulting & Integration

7. Global Regulatory Technology (RegTech) Solutions Market Analysis and Forecast, by Application

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

7.3.1. Compliance Management

7.3.2. Risk Management

7.3.3. Identity Management & Control

7.3.4. Reporting & Data Analytics

7.3.5. Information and Asset Management

8. Global Regulatory Technology (RegTech) Solutions Market Analysis and Forecast, by Enterprise Size

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

8.3.1. Small & Medium Enterprise

8.3.2. Large Enterprise

9. Global Regulatory Technology (RegTech) Solutions Market Analysis and Forecast, by Industry

9.1. Overview

9.2. Key Segment Analysis

9.3. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

9.3.1. Banking

9.3.1.1. Retail Banking

9.3.1.2. Wholesale/Corporate Banking

9.3.1.3. Investment Banking

9.3.1.4. Private Banking

9.3.2. Insurance

9.3.2.1. Life & Pension

9.3.2.2. Property & Casualty

9.3.2.3. Health

9.3.2.4. Reinsurance

9.3.3. Healthcare

9.3.4. Transportation & Logistics

9.3.5. Industrial & Manufacturing

9.3.6. IT & Telecom

9.3.7. Professional Services

9.3.8. Government & Defense

9.3.9. Others (Food & Beverages, Retail, Energy & Utilities, Education, Media)

10. Global Regulatory Technology (RegTech) Solutions Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Emerging Markets/Countries

10.3. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

10.3.1. North America

10.3.2. Europe

10.3.3. Asia Pacific

10.3.4. Rest of the World

11. North America Regulatory Technology (RegTech) Solutions Market Analysis and Forecast

11.1. Regional Outlook

11.2. Key Findings

11.3. Impact Analysis of Drivers and Restraints

11.4. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

11.4.1. Software

11.4.1.1. On-premise

11.4.1.2. Cloud

11.4.2. Services

11.4.2.1. Training & Implementation

11.4.2.2. Support & Maintenance

11.4.2.3. Consulting & Integration

11.5. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

11.5.1. Compliance Management

11.5.2. Risk Management

11.5.3. Identity Management & Control

11.5.4. Reporting & Data Analytics

11.5.5. Information and Asset Management

11.6. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

11.6.1. Small & Medium Enterprise

11.6.2. Large Enterprise

11.7. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

11.7.1. Banking

11.7.1.1. Retail Banking

11.7.1.2. Wholesale/Corporate Banking

11.7.1.3. Investment Banking

11.7.1.4. Private Banking

11.7.2. Insurance

11.7.2.1. Life & Pension

11.7.2.2. Property & Casualty

11.7.2.3. Health

11.7.2.4. Reinsurance

11.7.3. Healthcare

11.7.4. Transportation & Logistics

11.7.5. Industrial & Manufacturing

11.7.6. IT & Telecom

11.7.7. Professional Services

11.7.8. Government & Defense

11.7.9. Others (Food & Beverages, Retail, Energy & Utilities, Education, Media)

11.8. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Country, 2017 - 2027

11.8.1. U.S.

11.8.2. Canada

11.8.3. Mexico

12. Europe Regulatory Technology (RegTech) Solutions Market Analysis and Forecast

12.1. Regional Outlook

12.2. Key Findings

12.3. Impact Analysis of Drivers and Restraints

12.4. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

12.4.1. Software

12.4.1.1. On-premise

12.4.1.2. Cloud

12.4.2. Services

12.4.2.1. Training & Implementation

12.4.2.2. Support & Maintenance

12.4.2.3. Consulting & Integration

12.5. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

12.5.1. Compliance Management

12.5.2. Risk Management

12.5.3. Identity Management & Control

12.5.4. Reporting & Data Analytics

12.5.5. Information and Asset Management

12.6. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

12.6.1. Small & Medium Enterprise

12.6.2. Large Enterprise

12.7. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

12.7.1. Banking

12.7.1.1. Retail Banking

12.7.1.2. Wholesale/Corporate Banking

12.7.1.3. Investment Banking

12.7.1.4. Private Banking

12.7.2. Insurance

12.7.2.1. Life & Pension

12.7.2.2. Property & Casualty

12.7.2.3. Health

12.7.2.4. Reinsurance

12.7.3. Healthcare

12.7.4. Transportation & Logistics

12.7.5. Industrial & Manufacturing

12.7.6. IT & Telecom

12.7.7. Professional Services

12.7.8. Government & Defense

12.7.9. Others (Food & Beverages, Retail, Energy & Utilities, Education, Media)

12.8. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Country, 2017 - 2027

12.8.1. Western Europe

12.8.1.1. Germany

12.8.1.2. U.K.

12.8.1.3. France

12.8.1.4. Spain

12.8.1.5. Rest of Western Europe

12.8.2. Eastern Europe

12.8.2.1. Russia

12.8.2.2. Poland

12.8.2.3. Rest of Eastern Europe

13. Asia Pacific Regulatory Technology (RegTech) Solutions Market Analysis and Forecast

13.1. Regional Outlook

13.2. Key Findings

13.3. Impact Analysis of Drivers and Restraints

13.4. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

13.4.1. Software

13.4.1.1. On-premise

13.4.1.2. Cloud

13.4.2. Services

13.4.2.1. Training & Implementation

13.4.2.2. Support & Maintenance

13.4.2.3. Consulting & Integration

13.5. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

13.5.1. Compliance Management

13.5.2. Risk Management

13.5.3. Identity Management & Control

13.5.4. Reporting & Data Analytics

13.5.5. Information and Asset Management

13.6. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

13.6.1. Small & Medium Enterprise

13.6.2. Large Enterprise

13.7. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

13.7.1. Banking

13.7.1.1. Retail Banking

13.7.1.2. Wholesale/Corporate Banking

13.7.1.3. Investment Banking

13.7.1.4. Private Banking

13.7.2. Insurance

13.7.2.1. Life & Pension

13.7.2.2. Property & Casualty

13.7.2.3. Health

13.7.2.4. Reinsurance

13.7.3. Healthcare

13.7.4. Transportation & Logistics

13.7.5. Industrial & Manufacturing

13.7.6. IT & Telecom

13.7.7. Professional Services

13.7.8. Government & Defense

13.7.9. Others (Food & Beverages, Retail, Energy & Utilities, Education, Media)

13.8. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Country and Sub-region, 2017 - 2027

13.8.1. China

13.8.2. Japan

13.8.3. India

13.8.4. Australia and New Zealand

13.8.5. South Korea

13.8.6. ASEAN

13.8.7. Rest of Asia Pacific

14. Rest of the World Regulatory Technology (RegTech) Solutions Market Analysis and Forecast

14.1. Regional Outlook

14.2. Key Findings

14.3. Impact Analysis of Drivers and Restraints

14.4. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Component, 2017 - 2027

14.4.1. Software

14.4.1.1. On-premise

14.4.1.2. Cloud

14.4.2. Services

14.4.2.1. Training & Implementation

14.4.2.2. Support & Maintenance

14.4.2.3. Consulting & Integration

14.5. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

14.5.1. Compliance Management

14.5.2. Risk Management

14.5.3. Identity Management & Control

14.5.4. Reporting & Data Analytics

14.5.5. Information and Asset Management

14.6. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017 - 2027

14.6.1. Small & Medium Enterprise

14.6.2. Large Enterprise

14.7. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

14.7.1. Banking

14.7.1.1. Retail Banking

14.7.1.2. Wholesale/Corporate Banking

14.7.1.3. Investment Banking

14.7.1.4. Private Banking

14.7.2. Insurance

14.7.2.1. Life & Pension

14.7.2.2. Property & Casualty

14.7.2.3. Health

14.7.2.4. Reinsurance

14.7.3. Healthcare

14.7.4. Transportation & Logistics

14.7.5. Industrial & Manufacturing

14.7.6. IT & Telecom

14.7.7. Professional Services

14.7.8. Government & Defense

14.7.9. Others (Food & Beverages, Retail, Energy & Utilities, Education, Media)

14.8. Regulatory Technology (RegTech) Solutions Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

14.8.1. Middle East & Africa

14.8.2. South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Market Revenue Share Analysis (%), by Leading Players (2018)

16. Company Profiles (Details – Business Overview, Geographical Presence, Key Competitors, Revenue and Strategy)

16.1. BearingPoint Holding BV

16.1.1. Company Revenue

16.1.2. Business Overview

16.1.3. Key Competitors

16.1.4. Geographic Footprint

16.1.5. Strategic Overview

16.2. Mitek Systems, Inc.

16.2.1. Company Revenue

16.2.2. Business Overview

16.2.3. Key Competitors

16.2.4. Geographic Footprint

16.2.5. Strategic Overview

16.3. Ascent Technologies, Inc.

16.3.1. Company Revenue

16.3.2. Business Overview

16.3.3. Key Competitors

16.3.4. Geographic Footprint

16.3.5. Strategic Overview

16.4. Ayasdi AI LLC

16.4.1. Company Revenue

16.4.2. Business Overview

16.4.3. Key Competitors

16.4.4. Geographic Footprint

16.4.5. Strategic Overview

16.5. Corlytics Ltd.

16.5.1. Company Revenue

16.5.2. Business Overview

16.5.3. Key Competitors

16.5.4. Geographic Footprint

16.5.5. Strategic Overview

16.6. IdentityMind Global

16.6.1. Company Revenue

16.6.2. Business Overview

16.6.3. Key Competitors

16.6.4. Geographic Footprint

16.6.5. Strategic Overview

16.7. Gecko Operating Ltd.

16.7.1. Company Revenue

16.7.2. Business Overview

16.7.3. Key Competitors

16.7.4. Geographic Footprint

16.7.5. Strategic Overview

16.8. Kompli-Holdings PLC

16.8.1. Company Revenue

16.8.2. Business Overview

16.8.3. Key Competitors

16.8.4. Geographic Footprint

16.8.5. Strategic Overview

16.9. Fortia Financial Solutions

16.9.1. Company Revenue

16.9.2. Business Overview

16.9.3. Key Competitors

16.9.4. Geographic Footprint

16.9.5. Strategic Overview

16.10. CXi Software Pty Ltd.

16.10.1. Company Revenue

16.10.2. Business Overview

16.10.3. Key Competitors

16.10.4. Geographic Footprint

16.10.5. Strategic Overview

16.11. Other Profile

16.11.1. Algorithmica

16.11.2. CheckRecipient Limited (tessian)

16.11.3. Cluster Seven Services Limited

16.11.4. Compliance Management.ai

16.11.5. Compliance Solutions Strategies (Silverfinch)

16.11.6. ComplyAdvantage

16.11.7. CUBE Content Governance Global Limited

16.11.8. DGS DATA GOVERNANCE SYSTEMS LLC

16.11.9. Promapp Solutions Ltd.

17. Key Takeaways

List of Tables

Table 1: Mergers & Acquisitions, Expansions

Table 2: Product Mapping of Regulatory Technology (RegTech), by Players

Table 3: Global Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, 2017 – 2027

Table 4: Global Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, by Software, 2017 – 2027

Table 5: Global Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, by Services, 2017 – 2027

Table 6: Global Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Application, 2017 – 2027

Table 7: Global Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Enterprise Size, 2017 – 2027

Table 8: Global Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, 2017 – 2027

Table 9: Global Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, by Banking, 2017 – 2027

Table 10: Global Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, by Insurance, 2017 – 2027

Table 11: Global Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Region, 2017 – 2027

Table 12: North America Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, 2017 – 2027

Table 13: North America Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, by Software, 2017 – 2027

Table 14: North America Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, by Services, 2017 – 2027

Table 15: North America Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Application, 2017 – 2027

Table 16: North America Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Enterprise Size, 2017 – 2027

Table 17: North America Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, 2017 – 2027

Table 18: North America Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, by Banking, 2017 – 2027

Table 19: North America Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, by Insurance, 2017 – 2027

Table 20: North America Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Country, 2017 – 2027

Table 21: Europe Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, 2017 – 2027

Table 22: Europe Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, by Software, 2017 – 2027

Table 23: Europe Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, by Services, 2017 – 2027

Table 24: Europe Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Application, 2017 – 2027

Table 25: Europe Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Enterprise Size, 2017 – 2027

Table 26: Europe Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, 2017 – 2027

Table 27: Europe Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, by Banking, 2017 – 2027

Table 28: Europe Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, by Insurance, 2017 – 2027

Table 29: Europe Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Country, 2017 – 2027

Table 30: Asia Pacific Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, 2017 – 2027

Table 31: Asia Pacific Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, by Software, 2017 – 2027

Table 32: Asia Pacific Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, by Services, 2017 – 2027

Table 33: Asia Pacific Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Application, 2017 – 2027

Table 34: Asia Pacific Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Enterprise Size, 2017 – 2027

Table 35: Asia Pacific Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, 2017 – 2027

Table 36: Asia Pacific Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, by Banking, 2017 – 2027

Table 37: Asia Pacific Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, by Insurance, 2017 – 2027

Table 38: Asia Pacific Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Country, 2017 – 2027

Table 39: Rest of the World Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, 2017 – 2027

Table 40: Rest of the World Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, by Software, 2017 – 2027

Table 41: Rest of the World Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Component, by Services, 2017 – 2027

Table 42: Rest of the World Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Application, 2017 – 2027

Table 43: Rest of the World Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Enterprise Size, 2017 – 2027

Table 44: Rest of the World Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, 2017 – 2027

Table 45: Rest of the World Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, by Banking, 2017 – 2027

Table 46: Rest of the World Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Industry, by Insurance, 2017 – 2027

Table 47: Rest of the World Regulatory Technology (RegTech) Solutions Market Value (US$ Mn) and Forecast, by Region, 2017 – 2027

List of Figures

Figure 1: Global Regulatory Technology Solutions Market Size (US$ Mn) Forecast, 2017 – 2027

Figure 2: Global Regulatory Technology Solutions Market Value (US$ Mn) Opportunity Assessment, by Region, 2019E

Figure 3: Top Segment Analysis

Figure 4: Global Regulatory Technology Solutions Market Value (US$ Mn) Opportunity Assessment, by Region, 2027F

Figure 5: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 6: Top Economies GDP Landscape, 2018

Figure 7: Global ICT Spending (US$ Bn), Regional Contribution, 2019E

Figure 8: Global ICT Spending (%), by Region, 2019E

Figure 9: Global ICT Spending (US$ Bn), Spending Type Contribution, 2019E

Figure 10: Global ICT Spending (%), by Type, 2019E

Figure 11: Adoption and Investment Analysis (%) of RegTech Technologies, 2018

Figure 12: Global Regulatory Technology (RegTech) Solutions Market Revenue (US$ Mn) Historic Trends, 2013 - 2018

Figure 13: Global Regulatory Technology (RegTech) Solutions Market Revenue Opportunity (US$ Mn) Historic Trends, 2013 - 2018

Figure 14: Global Regulatory Technology (RegTech) Solutions Market Revenue (US$ Mn) and Y-o-Y Growth (Value %) Forecast, 2019 - 2027

Figure 15: Global Regulatory Technology (RegTech) Solutions Market Revenue Opportunity (US$ Mn) Forecast, 2019 - 2027

Figure 16: Global Regulatory Technology (RegTech) Solutions Market Opportunity Assessment, by Component, 2019-2027

Figure 17: Global Regulatory Technology (RegTech) Solutions Market Opportunity Assessment, by Application, 2019-2027

Figure 18: Global Regulatory Technology (RegTech) Solutions Market Opportunity Assessment, by Enterprise Size, 2019-2027

Figure 19: Global Regulatory Technology (RegTech) Solutions Market Opportunity Assessment, by Industry, 2019-2027

Figure 20: Global Regulatory Technology (RegTech) Solutions Market Opportunity Assessment, by Region , 2019-2027

Figure 21: Global Regulatory Technology (RegTech) Solutions Market, by Component, CAGR (%) (2019 – 2027)

Figure 22: Global Regulatory Technology (RegTech) Solutions Market, by Application, CAGR (%) (2019 – 2027)

Figure 23: Global Regulatory Technology (RegTech) Solutions Market, by Enterprise Size, CAGR (%) (2019 – 2027)

Figure 24: Global Regulatory Technology (RegTech) Solutions Market, by Industry, CAGR (%) (2019 – 2027)

Figure 25: Global Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Component, 2019

Figure 26: Global Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Component, 2027

Figure 27: Global Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Application, 2019

Figure 28: Global Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Application, 2027

Figure 29: Global Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Enterprise Size, 2019

Figure 30: Global Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Enterprise Size, 2027

Figure 31: Global Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Industry, 2019

Figure 32: Global Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Industry, 2027

Figure 33: Global Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Region, 2019

Figure 34: Global Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Region, 2027

Figure 35: North America Regulatory Technology (RegTech) Solutions Market Opportunity Growth Analysis (US$ Mn) Forecast, 2018 – 2027

Figure 36: North America Regulatory Technology (RegTech) Solutions Market Y-o-Y Growth (Value %), 2018 - 2027

Figure 37: North America Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Component, 2019

Figure 38: North America Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Component, 2027

Figure 39: North America Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Application, 2019

Figure 40: North America Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Application, 2027

Figure 41: North America Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Enterprise Size, 2019

Figure 42: North America Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Enterprise Size, 2027

Figure 43: North America Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Industry, 2019

Figure 44: North America Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Industry, 2027

Figure 45: North America Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Country, 2019

Figure 46: North America Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Country, 2027

Figure 47: Europe Regulatory Technology (RegTech) Solutions Market Opportunity Growth Analysis (US$ Mn) Forecast, 2018 – 2027

Figure 48: Europe Regulatory Technology (RegTech) Solutions Market Y-o-Y Growth (Value %), 2018 - 2027

Figure 49: Europe Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Component, 2019

Figure 50: Europe Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Component, 2027

Figure 51: Europe Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Application, 2019

Figure 52: Europe Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Application, 2027

Figure 53: Europe Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Enterprise Size, 2019

Figure 54: Europe Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Enterprise Size, 2027

Figure 55: Europe Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Industry, 2019

Figure 56: Europe Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Industry, 2027

Figure 57: Europe Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Country, 2019

Figure 58: Europe Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Country, 2027

Figure 59: Asia Pacific Regulatory Technology (RegTech) Solutions Market Opportunity Growth Analysis (US$ Mn) Forecast, 2018 – 2027

Figure 60: Asia Pacific Regulatory Technology (RegTech) Solutions Market Y-o-Y Growth (Value %), 2018 - 2027

Figure 61: Asia Pacific Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Component, 2019

Figure 62: Asia Pacific Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Component, 2027

Figure 63: Asia Pacific Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Application, 2019

Figure 64: Asia Pacific Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Application, 2027

Figure 65: Asia Pacific Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Enterprise Size, 2019

Figure 66: Asia Pacific Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Enterprise Size, 2027

Figure 67: Asia Pacific Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Industry, 2019

Figure 68: Asia Pacific Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Industry, 2027

Figure 69: Asia Pacific Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Country, 2019

Figure 70: Asia Pacific Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Country, 2027

Figure 70 Rest of the World Regulatory Technology (RegTech) Solutions Market Opportunity Growth Analysis (US$ Mn) Forecast, 2018 – 2027

Figure 71: Rest of the World Regulatory Technology (RegTech) Solutions Market Y-o-Y Growth (Value %), 2018 - 2027

Figure 72: Rest of the World Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Component, 2019

Figure 73: Rest of the World Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Component, 2027

Figure 74: Rest of the World Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Application, 2019

Figure 75: Rest of the World Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Application, 2027

Figure 76: Rest of the World Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Enterprise Size, 2019

Figure 77: Rest of the World Regulatory Technology (RegTech) Solutions Market Outlook (Value %), by Enterprise Size, 2027

Figure 78: Rest of the World Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Industry, 2019

Figure 79: Rest of the World Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Industry, 2027

Figure 80: Rest of the World Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Region, 2019

Figure 81: Rest of the World Regulatory Technology (RegTech) Solutions Market Outlook (Volume %), by Region, 2027