Reports

Reports

Analysts’ Viewpoint

A thermal catalytic decomposition process, called pyrolysis, is commonly utilized to obtain recovered carbon black. The majority of recovered carbon black (rCB) is obtained from end-of-life tires, which are widely available and offer a consistent waste stream. Carbon black is an integral component of tire production, and also in other rubber goods, plastics, and coatings. rCB contains around 80% carbon black, with the remainder is made up of other materials such as silica and zinc. These other materials can also enhance the overall properties of rCB. Recovered carbon black manufacturers and providers of masterbatch (a solid additive used for coloring plastics) and rubber compounders gain both environmental and technical benefits of using a sustainable alternative as compared to virgin carbon black. Furthermore, abundance of recyclable tires is estimated to contribute to the recovered carbon black market growth in the near future.

Industrial soot, also called carbon black, is a black industrial material that is used worldwide. Carbon black consists of more than 95% carbon and is produced using a ‘furnace process’. Heavy oil fractions, which are extracted during the cracking processes in a refinery, are used as raw material in this process. Recovered carbon black can be classified into three types: reinforcing, semi-reinforcing, and specialty blacks. Reinforcing carbon black grades are valued for their abrasion resistance and elasticity.

Semi-reinforcing grades are used in items requiring flexibility and elasticity, such as tire sidewalls, hoses, belts, seals, and inner liners/inner tubes. Specialty blacks are used as black pigments and performance fillers in products such as plastic film and pipe, printing inks, inkjet toners, paints, and coatings.

Recovered carbon black (rCB) is increasingly being used in various end-use industries, including transportation, industrial, printing and packaging, building and construction. This is expected to fuel the global recovered carbon black industry.

rCB is extensively employed as a reinforcing agent to manufacture conveyor belts hoses, seals, rubber roofing, gaskets, and rubber sheets.

The recovered carbon black market size is estimated to witness considerable growth due to the expansion of the rubber sector. Furthermore, growth of the automotive market, along with increase in volume of tire wastes is also projected to boost the future market demand for recovered carbon black.

Recovered carbon black is an environment-friendly material that is primarily made from the pyrolysis of used tires during recycling. Utilizing and recycling used tires benefits both the environment and the economy.

The need for eco-friendly alternatives and lowering carbon footprints is estimated to offer lucrative growth opportunities for recovered carbon black market participants during the forecast period. Moreover, consistent focus on research and development activities by manufacturers is also anticipated to propel the global recovered carbon black market forecast in the next few years.

Recovered Carbon Black is renowned for its ability to reduce CO2 emissions and eco-friendliness. Virgin carbon black makes a good replacement for recovered carbon black. Therefore, recovering carbon black from raw carbon black produced through conventional furnace procedures greatly reduces carbon footprint. Several major tire manufacturers are attempting to use significantly more rCB, because it can reduce the carbon footprint by 80% when used alone.

Semi-reinforcing type carbon black has improved morphological features and excellent cleanliness. At similar loading, it provides better dispersion, easier processing, fast extrusion rate, and higher dimensional stability. Excellent cleanliness features results in higher screen life and significantly lower surface imperfections. Semi-reinforcing carbon black is employed for critical extrusion, specifically for applications such as weather stripping, hoses, and profiles, which provides quality equivalent to international benchmark grades.

It is primarily used in inner liners of tires and numerous industrial rubber goods. Semi-reinforcing solutions are also utilized in a wide range of tire applications and to optimize compound performance in industrial rubber product applications on multiple dimensions, including strength, resilience, part life, and high-quality extrudate surface finish.

The semi-reinforcing segment accounted for notable recovered carbon black market share in 2022. The segment is estimated to grow at an above average CAGR during the forecast period.

Based on application and performance requirements, rCB can replace between 10% and 100% of virgin carbon black (vCB) in various manufacturing processes.

The tire industry accounts for significant share of global carbon black consumption. However, the tire industry is slow to replace higher contents of vCB with rCB, or accept large quantities in their production, due to regulatory constraints, image, and supply concerns. However, analysis of the recovery carbon black market trends reveal that adoption of rCB is rising among tire manufacturers. For instance, Michelin has acquired a significant stake in a Sweden-based tire pyrolysis company and is planning rCB production plant in South America.

Growth of automotive & industrial rubber industries, sustainable production activities in Asia Pacific, and Environmental Protection Agency’s regulations on hazardous chemicals released from carbon black manufacturing facilities have boosted the demand for recovered carbon black in the region.

Countries such as China, India, and Japan are working on environmental concerns and enacting stringent government guidelines. Recycling plants have been established in China and India, which is estimated to make the region one of the fastest growing market for recovered carbon black (rCB) in the next few years.

The global recovered carbon black industry is dominated by a few large- and medium-sized players operating across the world. The top few players, cumulatively, accounted for more than 50% to 55% of recovered carbon black market share in 2022.

Key players focus on technological innovations, business expansion through acquisitions, financial restructuring and investments, capacity expansion, mergers and acquisitions to consolidate their presence and position in the global recovered carbon black business.

These are Pyrolyx AG, SR2O Holdings, Alpha Carbone, Scandinavian Enviro Systems AB, Integrated Resource Recovery, Delta-Energy Group, Bolder Industries, Black Bear Carbon B.V and DVA Renewable Energy JSC are a few prominent entities operating in the market.

Key players in the recovered carbon black market research report have been profiled based on parameters such as company overview, financial overview, product portfolio, business strategies, business segments, and recent developments.

|

Attribute |

Detail |

|

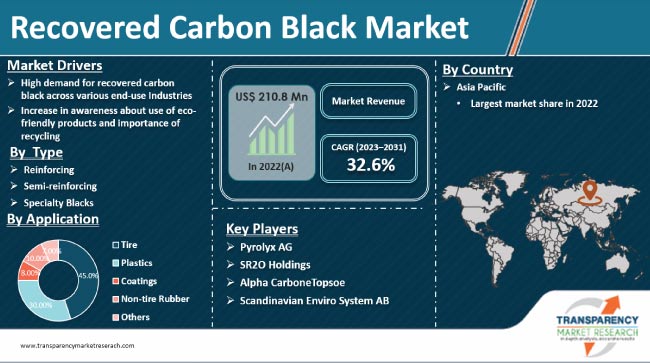

Recovered Carbon Black Market Value in 2022 |

US$ 210.8 Mn |

|

Recovered Carbon Black Market Forecast Value in 2031 |

US$ 2.7 Bn |

|

Recovered Carbon Black Growth Rate (CAGR) |

32.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2021 |

|

Quantitative Units |

US$ Mn/Bn for Value and Tons For Volume |

|

Recovered Carbon Black Market Analysis |

It includes cross segment analysis at Europe as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Recovered Carbon Black Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 210.8 Mn in 2022.

It is expected to grow at a CAGR of 32.6% from 2023 to 2031.

High demand for recovered carbon black across various end-use industries and increase in awareness about the use of eco-friendly products and importance of recycling.

Tire was the largest application segment in 2022.

Asia Pacific was the most lucrative region for vendors in 2022.

Pyrolyx AG, SR2O Holdings, Alpha Carbone, Scandinavian Enviro Systems AB, Integrated Resource Recovery, and Delta-Energy Group.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Recovered Carbon Black Market Analysis and Forecasts, 2023-2031

2.6.1. Global Recovered Carbon Black Market Volume (Tons)

2.6.2. Global Recovered Carbon Black Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Recovered Carbon Black

3.2. Impact on the Demand of Recovered Carbon Black– Pre & Post Crisis

4. Production Output Analysis (Tons), 2021

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East and Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis by Type

6.2. Price Trend Analysis by Region

7. Recovered Carbon Black Market Analysis and Forecast, by Type, 2023-2031

7.1. Introduction and Definitions

7.2. Global Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

7.2.1. Reinforcing

7.2.2. Semi-reinforcing

7.2.3. Specialty Blacks

7.3. Global Recovered Carbon Black Market Attractiveness, by Type

8. Global Recovered Carbon Black Market Analysis and Forecast, Application, 2023-2031

8.1. Introduction and Definitions

8.2. Global Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

8.2.1. Plastics

8.2.2. Tire

8.2.3. Coatings

8.2.4. Non-tire Rubber

8.2.5. Others

8.3. Global Recovered Carbon Black Market Attractiveness, by Application

9. Global Recovered Carbon Black Market Analysis and Forecast, by Region, 2023-2031

9.1. Key Findings

9.2. Global Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2023-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Recovered Carbon Black Market Attractiveness, by Region

10. North America Recovered Carbon Black Market Analysis and Forecast, 2023-2031

10.1. Key Findings

10.2. North America Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

10.3. North America Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

10.4. North America Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2023-2031

10.4.1. U.S. Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

10.4.2. U.S. Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

10.4.3. Canada Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

10.4.4. Canada Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

10.5. North America Recovered Carbon Black Market Attractiveness Analysis

11. Europe Recovered Carbon Black Market Analysis and Forecast, 2023-2031

11.1. Key Findings

11.2. Europe Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.3. Europe Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

11.4. Europe Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

11.4.1. Germany Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.4.2. Germany. Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

11.4.3. France Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.4.4. France. Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

11.4.5. U.K. Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.4.6. U.K. Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

11.4.7. Italy Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.4.8. Italy Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

11.4.9. Russia & CIS Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.4.10. Russia & CIS Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

11.4.11. Rest of Europe Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

11.4.12. Rest of Europe Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

11.5. Europe Recovered Carbon Black Market Attractiveness Analysis

12. Asia Pacific Recovered Carbon Black Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. Asia Pacific Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type

12.3. Asia Pacific Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.4. Asia Pacific Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

12.4.1. China Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.4.2. China Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

12.4.3. Japan Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.4.4. Japan Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

12.4.5. India Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.4.6. India Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

12.4.7. ASEAN Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.4.8. ASEAN Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

12.4.9. Rest of Asia Pacific Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.4.10. Rest of Asia Pacific Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

12.5. Asia Pacific Recovered Carbon Black Market Attractiveness Analysis

13. Latin America Recovered Carbon Black Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Latin America Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.3. Latin America Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.4. Latin America Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

13.4.1. Brazil Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.4.2. Brazil Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

13.4.3. Mexico Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.4.4. Mexico Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

13.4.5. Rest of Latin America Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.4.6. Rest of Latin America Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

13.5. Latin America Recovered Carbon Black Market Attractiveness Analysis

14. Middle East & Africa Recovered Carbon Black Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Middle East & Africa Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.3. Middle East & Africa Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.4. Middle East & Africa Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

14.4.1. GCC Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.4.2. GCC Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

14.4.3. South Africa Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.4.4. South Africa Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

14.4.5. Rest of Middle East & Africa Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.4.6. Rest of Middle East & Africa Recovered Carbon Black Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2023-2031

14.5. Middle East & Africa Recovered Carbon Black Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Recovered Carbon Black Company Market Share Analysis, 2021

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Pyrolyx AG

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.2. SR2O Holdings

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.3. Alpha Carbone.

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.4. Scandinavian Enviro System AB

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.5. Integrated Resource Recovery

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.6. Delta-Energy Group

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.7. Bolder Industries

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.8. Black Bear Carbon B.V

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.9. DVA Renewable Energy JSC

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 2: Global Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 3: Global Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 4: Global Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 5: Global Recovered Carbon Black Market Volume (Tons) Forecast, by Region, 2023-2031

Table 6: Global Recovered Carbon Black Market Value (US$ Mn) Forecast, by Region, 2023-2031

Table 7: North America Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 8: North America Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 9: North America Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 10: North America Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 11: North America Recovered Carbon Black Market Volume (Tons) Forecast, by Country, 2023-2031

Table 12: North America Recovered Carbon Black Market Value (US$ Mn) Forecast, by Country, 2023-2031

Table 13: U.S. Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 14: U.S. Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 15: U.S. Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 16: U.S. Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 17: Canada Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 18: Canada Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 19: Canada Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 20: Canada Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 21: Europe Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 22: Europe Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 23: Europe Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 24: Europe Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 25: Europe Recovered Carbon Black Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 26: Europe Recovered Carbon Black Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 27: Germany Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 28: Germany Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 29: Germany Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 30: Germany Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 31: France Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 32: France Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 33: France Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 34: France Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 35: U.K. Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 36: U.K. Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 37: U.K. Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 38: U.K. Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 39: Italy Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 40: Italy Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 41: Italy Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 42: Italy Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 43: Spain Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 44: Spain Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 45: Spain Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 46: Spain Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 47: Russia & CIS Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 48: Russia & CIS Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 49: Russia & CIS Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 50: Russia & CIS Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 51: Rest of Europe Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 52: Rest of Europe Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 53: Rest of Europe Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 54: Rest of Europe Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 55: Asia Pacific Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 56: Asia Pacific Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 57: Asia Pacific Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 58: Asia Pacific Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 59: Asia Pacific Recovered Carbon Black Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 60: Asia Pacific Recovered Carbon Black Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 61: China Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 62: China Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type 2023-2031

Table 63: China Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 64: China Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 65: Japan Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 66: Japan Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 67: Japan Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 68: Japan Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 69: India Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 70: India Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 71: India Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 72: India Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 73: ASEAN Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 74: ASEAN Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 75: ASEAN Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 76: ASEAN Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 77: Rest of Asia Pacific Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 78: Rest of Asia Pacific Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 79: Rest of Asia Pacific Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 80: Rest of Asia Pacific Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 81: Latin America Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 82: Latin America Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 83: Latin America Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 84: Latin America Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 85: Latin America Recovered Carbon Black Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 86: Latin America Recovered Carbon Black Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 87: Brazil Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 88: Brazil Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 89: Brazil Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 90: Brazil Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 91: Mexico Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 92: Mexico Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 93: Mexico Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 94: Mexico Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 95: Rest of Latin America Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 96: Rest of Latin America Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 97: Rest of Latin America Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 98: Rest of Latin America Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 99: Middle East & Africa Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 100: Middle East & Africa Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 101: Middle East & Africa Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 102: Middle East & Africa Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 103: Middle East & Africa Recovered Carbon Black Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 104: Middle East & Africa Recovered Carbon Black Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 105: GCC Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 106: GCC Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 107: GCC Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 108: GCC Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 109: South Africa Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 110: South Africa Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 111: South Africa Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 112: South Africa Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

Table 113: Rest of Middle East & Africa Recovered Carbon Black Market Volume (Tons) Forecast, by Type, 2023-2031

Table 114: Rest of Middle East & Africa Recovered Carbon Black Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 115: Rest of Middle East & Africa Recovered Carbon Black Market Volume (Tons) Forecast, by Application, 2023-2031

Table 116: Rest of Middle East & Africa Recovered Carbon Black Market Value (US$ Mn) Forecast, by Application 2023-2031

List of Figures

Figure 1: Global Recovered Carbon Black Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 2: Global Recovered Carbon Black Market Attractiveness, by Type

Figure 3: Global Recovered Carbon Black Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 4: Global Recovered Carbon Black Market Attractiveness, by Application

Figure 5: Global Recovered Carbon Black Market Volume Share Analysis, by Region, 2021, 2027, and 2031

Figure 6: Global Recovered Carbon Black Market Attractiveness, by Region

Figure 7: North America Recovered Carbon Black Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 8: North America Recovered Carbon Black Market Attractiveness, by Type

Figure 9: North America Recovered Carbon Black Market Attractiveness, by Type

Figure 10: North America Recovered Carbon Black Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 11: North America Recovered Carbon Black Market Attractiveness, by Application

Figure 12: North America Recovered Carbon Black Market Attractiveness, by Country and Sub-region

Figure 13: Europe Recovered Carbon Black Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 14: Europe Recovered Carbon Black Market Attractiveness, by Type

Figure 15: Europe Recovered Carbon Black Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 16: Europe Recovered Carbon Black Market Attractiveness, by Application

Figure 17: Europe Recovered Carbon Black Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 18: Europe Recovered Carbon Black Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Recovered Carbon Black Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 20: Asia Pacific Recovered Carbon Black Market Attractiveness, by Type

Figure 21: Asia Pacific Recovered Carbon Black Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 22: Asia Pacific Recovered Carbon Black Market Attractiveness, by Application

Figure 23: Asia Pacific Recovered Carbon Black Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 24: Asia Pacific Recovered Carbon Black Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Recovered Carbon Black Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 26: Latin America Recovered Carbon Black Market Attractiveness, by Type

Figure 27: Latin America Recovered Carbon Black Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 28: Latin America Recovered Carbon Black Market Attractiveness, by Application

Figure 29: Latin America Recovered Carbon Black Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 30: Latin America Recovered Carbon Black Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Recovered Carbon Black Market Volume Share Analysis, by Type, 2021, 2027, and 2031

Figure 32: Middle East & Africa Recovered Carbon Black Market Attractiveness, by Type

Figure 33: Middle East & Africa Recovered Carbon Black Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 34: Middle East & Africa Recovered Carbon Black Market Attractiveness, by Application

Figure 35: Middle East & Africa Recovered Carbon Black Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 36: Middle East & Africa Recovered Carbon Black Market Attractiveness, by Country and Sub-region