Chapter 1 Preface

1.1 Report description

1.2 Market segmentation

1.2.1 Global RCP market, by product and region

1.3 Research scope

1.3.1 Assumptions

1.4 Research methodology

Chapter 2 Executive summary

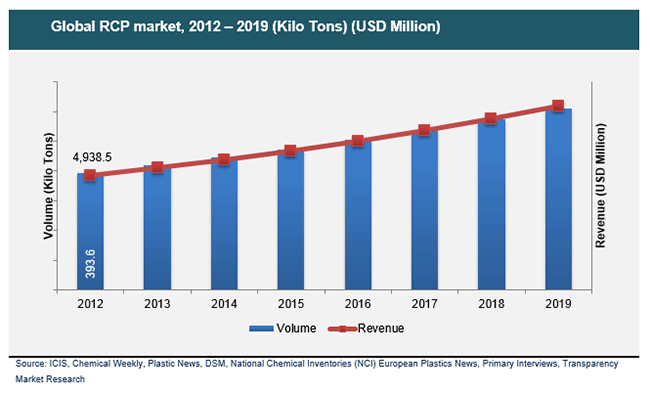

2.1 Global RCP market, 2012 – 2019 (Kilo Tons) (USD Million)

Chapter 3 Radiation Cured Products Market: Industry Analysis

3.1 Introduction

3.2 Value chain analysis

3.3 Market Drivers

3.3.1 Stringent environmental regulations encouraging environment-friendly technologies

3.3.2 North America carbon dioxide emissions for coating equivalent surface areas (Million MT)

3.3.3 Production benefits and cost advantage offered by radiation cured technology

3.3.4 North America annual energy usage for coating equivalent surface areas

3.3.5 Growing wood coatings market

3.3.6 Global wood coatings market, 2012 - 2019 (Kilo Tons) (USD Million)

3.4 Restraints

3.4.1 Escalating raw material prices

3.4.2 Stringent safe working environment requirements

3.5 Opportunities

3.5.1 Use of Bio-based material for RCP

3.5.2 New product developments

3.6 Porter’s five forces analysis

3.6.1 Bargaining power of suppliers

3.6.2 Bargaining power of buyers

3.6.3 Threat of new entrants

3.6.4 Threat from substitutes

3.6.5 Degree of competition

3.7 RCP: Market attractiveness analysis

Chapter 4 Global RCP Market: Product Segment Analysis

4.1 Global RCP market overview: by product type

4.1.1 Global RCP market share, by product type, 2012 & 2019

4.2 Radiation cured coatings

4.2.1 Global radiation cured coatings market, 2012 - 2019 (Kilo Tons) (USD Million)

4.3 Radiation cured inks

4.3.1 Global radiation cured inks market, 2012 - 2019 (Kilo Tons) (USD Million)

4.4 Radiation cured adhesives

4.4.1 Global radiation cured adhesives market, 2012 - 2019 (Kilo Tons) (USD Million)

Chapter 5 Global RCP Market: Regional Analysis

5.1 Global RCP market: Regional overview

5.1.1 Global RCP market share, by region, 2012 – 2019

5.2 North America

5.2.1 North America RCP market volume, by product type, 2012 -2019 (Kilo Tons)

5.2.2 North America RCP market revenue, by product type, 2012-2019 (USD Million)

5.3 Europe

5.3.1 Europe RCP market volume, by product type, 2012 -2019 (Kilo Tons)

5.3.2 Europe RCP market revenue, by product type, 2012- 2019 (USD Million)

5.4 Asia Pacific

5.4.1 Asia Pacific RCP market volume, by product type, 2012 - 2019 (Kilo Tons)

5.4.2 Asia Pacific RCP market revenue, by product type, 2012 -2019 (USD Million)

5.5 Rest of the World (RoW)

5.5.1 RoW RCP market volume, by product type, 2012 -2019 (Kilo Tons)

5.5.2 RoW RCP market revenue, by product type, 2012 - 2019 (USD Million)

Chapter 6 Company Profiles

6.1 Ashland Inc.

6.1.1 Company overview

6.1.2 Product Portfolio

6.1.3 Financial overview

6.1.4 Business strategy

6.1.5 SWOT Analysis

6.1.6 Recent developments

6.2 BASF SE

6.2.1 Company overview

6.2.2 Product Portfolio

6.2.3 Financial overview

6.2.4 Business strategy

6.2.5 SWOT Analysis

6.2.6 Recent developments

6.3 Bayer MaterialScience AG

6.3.1 Company overview

6.3.2 Product Portfolio

6.3.3 Financial Overview

6.3.4 Business strategy

6.3.5 SWOT Analysis

6.3.6 Recent developments

6.4 Cytec Industries Inc.

6.4.1 Company overview

6.4.2 Product Portfolio

6.4.3 Financial overview

6.4.4 Business strategy

6.4.5 SWOT Analysis

6.4.6 Recent developments

6.5 Dexerials Corporation

6.5.1 Company overview

6.5.2 Product portfolio

6.5.3 Financial overview

6.5.4 Business strategy

6.5.5 SWOT analysis

6.5.6 Recent developments

6.6 Dymax Corporation

6.6.1 Company overview

6.6.2 Product Portfolio

6.6.3 Business strategy

6.6.4 SWOT Analysis

6.6.5 Recent developments

6.7 DIC Corporation

6.7.1 Company overview

6.7.2 Product Portfolio

6.7.3 Financial Overview

6.7.4 Business strategy

6.7.5 SWOT Analysis

6.7.6 Recent developments

6.8 Electronics For Imaging Inc. (EFI)

6.8.1 Company overview

6.8.2 Product portfolio

6.8.3 Financial overview

6.8.4 Business strategy

6.8.5 SWOT analysis

6.8.6 Recent developments

6.9 Flint Group

6.9.1 Company overview

6.9.2 Financial overview

6.9.3 Business strategy

6.9.4 1.4.4 SWOT analysis

6.9.5 Recent developments

6.10 Fujifilm Sericol U.S.A Inc.

6.10.1 Company overview

6.10.2 Product portfolio

6.10.3 Business strategy

6.10.4 SWOT analysis

6.10.5 Recent developments

6.11 Lord Corporation

6.11.1 Company overview

6.11.2 Financial overview

6.11.3 Business strategy

6.11.4 SWOT analysis

6.11.5 Recent Developments

6.12 PPG Industries Inc.

6.12.1 Company overview

6.12.2 Product portfolio

6.12.3 Financial overview

6.12.4 Business strategy

6.12.5 SWOT analysis

6.12.6 Recent developments

6.13 Red Spot Paint & Varnish Company Inc.

6.13.1 Company overview

6.13.2 Product portfolio

6.13.3 Business strategy

6.13.4 SWOT analysis

6.13.5 Recent developments

6.14 Royal Adhesives & Sealants, LLC

6.14.1 Company overview

6.14.2 Product Portfolio

6.14.3 Business strategy

6.14.4 SWOT Analysis

6.14.5 Recent developments

6.15 Royal DSM N.V. Corporation

6.15.1 Company overview

6.15.2 Product portfolio

6.15.3 Financial overview

6.15.4 Business strategy

6.15.5 SWOT analysis

6.15.6 Recent developments

6.16 Toyo Ink SC Holdings Co. Ltd.

6.16.1 Company overview

6.16.2 Product portfolio

6.16.3 Financial overview

6.16.4 Business strategy

6.16.5 SWOT analysis

6.16.6 Recent developments

List of Tables

TABLE 1 Global RCP market: Snapshot

TABLE 2 North American carbon dioxide emissions for coating equivalent surface areas(Million MT)

TABLE 3 North America annual energy usage for coating equivalent surface areas

TABLE 4 North America RCP market volume, by product type, 2012 -2019 (Kilo Tons)

TABLE 5 North America RCP market revenue, by product type, 2012-2019 (USD Million)

TABLE 6 Europe RCP market volume, by product type, 2012 -2019 (Kilo Tons)

TABLE 7 Europe RCP market revenue, by product type, 2012- 2019 (USD Million)

TABLE 8 Asia Pacific RCP market volume, by product type, 2012 - 2019 (Kilo Tons)

TABLE 9 Asia Pacific RCP market revenue, by product type, 2012 -2019 (USD Million)

TABLE 10 RoW RCP market volume, by product type, 2012 -2019 (Kilo Tons)

TABLE 11 RoW RPC market revenue, by product type, 2012 - 2019 (USD Million)

List of Figures

FIG. 1 Global RCP market, by application and region

FIG. 2 Global RCP market, 2012 - 2019 (Kilo Tons) (USD Million)

FIG. 3 RCP : Value chain analysis

FIG. 4 Global wood coatings market, 2012 – 2019 (Kilo Tons), (USD Million)

FIG. 5 Porter’s five forces analysis for RCP market

FIG. 6 RCP: Market attractiveness analysis

FIG. 7 Global RCP market, 2012 – 2019

FIG. 8 Global radiation cured coatings market, 2012 – 2019 (Kilo Tons), (USD Million)

FIG. 9 Global radiation cured ink market, 2012 - 2019 (Kilo Tons) (USD Million)

FIG. 10 Global radiation cured adhesives market, 2012 - 2019 (Kilo Tons) (USD Million)

FIG. 11 Global RCP market volume share by geography, 2012 & 2019