Reports

Reports

Analyst Viewpoint

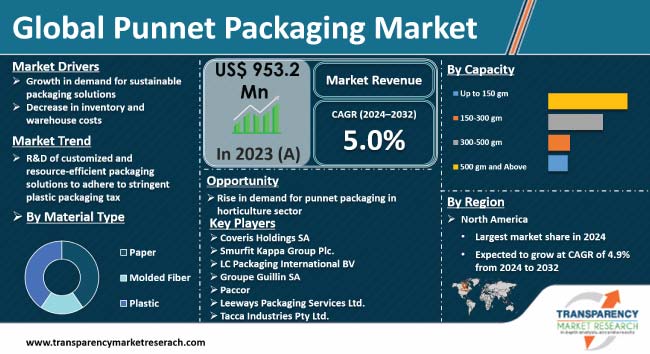

Growth in demand for sustainable packaging solutions and decrease in inventory and warehouse costs are fueling the punnet packaging market size. Punnet packaging is a cost-efficient medium for packaging as it requires low inventory and warehousing costs. Increase in demand for fruits and vegetables is boosting adoption of plastic and cardboard punnets.

Governments in various countries are implementing legislation to decrease the use of plastic products and promote the adoption of biodegradable packaging, which is positively impacting the punnet packaging market landscape. Companies operating in the global punnet packaging industry are introducing recycled plastic punnets to adhere to stringent plastic packaging tax. They are introducing biodegradable and eco-friendly options to increase their market revenue.

Punnets are compressed baskets that are utilized in the packaging of vegetables and soft fruits such as mushrooms, bell peppers, and grapes. Product packaging improves the self-life of vegetables and soft fruits by protecting them from squashing, bruising, and spoiling. Punnets are small and open containers that have ventilation slots to ensure optimal airflow, extending the freshness of fruits and vegetables.

Punnet packaging can be classified into different types depending on the materials used such as paper, plastic, and molded fiber. Vegetable and fruit punnets are cost-efficient, lightweight, and require less storage space. Plastic punnet packaging is employed by most fruit and vegetable vendors and also by some dairy, culinary, and agricultural food processors due to its efficient way of packaging and transit protection.

Punnets are small containers designed to protect and maintain the freshness of products. They also help enhance the visual appeal of products. Punnet containers have ventilation holes to allow airflow and minimize condensation for packaged items. There is a significant shift toward using biodegradable and recyclable materials. Consumers are actively seeking alternatives to plastic products due to increase in awareness about the environment and the harmful impact of plastic pollution. This trend is propelling the punnet packaging market development.

Punnet packaging manufacturers are adopting recyclable raw materials, such as molded pulp, recycled plastics, and bio-based materials, to reduce the impact of packaging on the environment. In July 2023, three fruit supply-chain companies, Angus Soft Fruits, Waddington Europe, and Produce Packaging, partnered to launch a range of innovative new strawberry punnets in the U.K. and Ireland in sizes up to 1kg that use less plastic and are fully recyclable. Hence, launch of fully recyclable products is expected to spur the punnet packaging market growth in the near future.

In January 2024, Sainsbury’s, a chain of supermarkets in the U.K., announced to move from plastic packaging to cardboard for all its own-brand mushrooms, saving over 775 tons of plastic a year. These new fully recyclable cardboard trays are projected to help customers cut down on plastic and recycle more at home.

Several governments worldwide are enacting laws to reduce plastic products and encourage biodegradable packaging, which is contributing to the punnet packaging market progress. In February 2020, the French government signed a decree to regulate the prohibition of plastic packaging for fruits and vegetables. By banning plastic packaging for fresh produce, the government aims to promote sustainable practices and encourage the adoption of eco-friendly alternatives.

Punnet packaging is a cost-efficient medium for packaging as it has a low disposable cost, requires less inventory and warehousing costs, and easy packaging process. It reduces the damage to fruits and vegetables during transit. Plastic and cardboard punnets are easy to store. Punnets are generally available in customized sizes and cost around US$ 50 per 1000 pieces. Punnet packaging is protective and has a see-through display, which provides a clear view of the product to consumers.

Increase in demand for fruits and vegetables is propelling the punnet packaging market trajectory. There is a significant rise in the demand for biodegradable punnet packaging solutions owing to the growing import and export of fruits and vegetables. Most countries export fruits and vegetables to European countries as there is an increasing demand and interest among European consumers. In Europe, exotic fruits and vegetables such as fresh lychees, passion fruit, carambola, and pitahaya, saw a 40% growth in import value over the previous five years, reaching US$ 162.08 Mn in 2019, according to the Centre for the Promotion of Imports from developing countries (CBI). The import of other exotic fruits, primarily pomegranates, increased by 21% in 2019, reaching a total value of US$ 230.56 Mn.

According to the latest punnet packaging market analysis, North America accounted for the largest share in 2023. Rise in focus on sustainability and surge in demand for eco-friendly packaging are fueling the market dynamics of the region.

Governments in Europe are encouraging manufacturers to choose sustainable and environmentally friendly materials, which is boosting the punnet packaging market share in the region. In February 2022, the U.K. government implemented the Plastic Packaging Tax. According to this new regulation, a £200 per ton fee will be levied on plastic packaging imported or produced in the U.K. containing less than 30% recycled plastic.

Key players are offering customized and resource-efficient packaging solutions to adhere to stringent plastic packaging tax. In 2022, AVI Global Plast, a manufacturer and exporter of PET punnets, introduced ready-to-use rPET (recycled PET) punnets with 30% post-consumer recycled content, sourced mainly from recycled bottles.

Coveris Holdings SA, Smurfit Kappa Group Plc, LC Packaging International BV, Groupe Guillin SA, Paccor, Leeways Packaging Services Ltd., Tacca Industries Pty Ltd., Raptis Pax Pty Ltd, Infia S.r.l, Mannok Pack, AVI Global, Royal Interpack Group, ALTA Packaging Inc., ILIP S.r.l., and T&B Containers Ltd. are key players operating in this market.

Each of these companies has been profiled in the punnet packaging market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2023 | US$ 953.2 Bn |

| Market Forecast (Value) in 2032 | US$ 1.5 Bn |

| Growth Rate (CAGR) | 5.0% |

| Forecast Period | 2024-2032 |

| Quantitative Units | US$ Mn/Bn for Value and Tons for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 953.2 Bn in 2023

It is anticipated to grow at a CAGR of 5.0% from 2024 to 2032

Growth in demand for sustainable packaging solutions and decrease in inventory and warehouse costs

North America was the leading region in 2023

Coveris Holdings SA, Smurfit Kappa Group Plc, LC Packaging International BV, Groupe Guillin SA, Paccor, Leeways Packaging Services Ltd., Tacca Industries Pty Ltd., Raptis Pax Pty Ltd, Infia S.r.l, Mannok Pack, AVI Global, Royal Interpack Group, ALTA Packaging Inc., ILIP S.r.l., and T&B Containers Ltd.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Punnet Packaging Market Overview

3.1. Global Packaging Market Overview

3.2. Macro-economic Factors – Correlation Analysis

3.3. Forecast Factors – Relevance & Impact

3.4. Punnet Packaging Market Value Chain Analysis

3.4.1. Exhaustive List of Active Participants

3.4.1.1. Raw Capacity Suppliers

3.4.1.2. Manufactures

3.4.1.3. Distributors/ Retailers

3.4.2. Profitability Margins

3.5. Cased Based Scenario Impact Analysis

3.6. Market Dynamics

3.6.1. Drivers

3.6.2. Restraints

3.6.3. Opportunity Analysis

3.6.4. Trends

4. Punnet Packaging Market Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Region

4.2. Market Size (US$ Mn) and Forecast

4.2.1. Market Size and Y-o-Y Growth

4.2.2. Absolute $ Opportunity

5. Global Punnet Packaging Market Analysis and Forecast, By Capacity

5.1. Introduction

5.1.1. Market Share and Basis Points (BPS) Analysis, By Capacity

5.1.2. Y-o-Y Growth Projections, By Capacity

5.2. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2023, By Capacity

5.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Capacity

5.3.1. Up to 150 gm

5.3.2. 150-300 gm

5.3.3. 300-500 gm

5.3.4. 500 gm and Above

5.4. Market Attractiveness Analysis, By Capacity

6. Global Punnet Packaging Market Analysis and Forecast, By Material

6.1. Introduction

6.1.1. Market Share and Basis Points (BPS) Analysis, By Material

6.1.2. Y-o-Y Growth Projections, By Material

6.2. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2023, By Material

6.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Material

6.3.1. Paper

6.3.2. Molded Fiber

6.3.3. Plastic

6.4. Market Attractiveness Analysis, By Material

6.5. Prominent Trends

7. Global Punnet Packaging Market Analysis and Forecast, By Product

7.1. Introduction

7.1.1. Market Share and Basis Points (BPS) Analysis, By Product

7.1.2. Y-o-Y Growth Projections, By Product

7.2. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2023, By Product

7.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Product

7.3.1. With Lid

7.3.2. Without Lid

7.4. Market Attractiveness Analysis, By Product

8. Global Punnet Packaging Market Analysis and Forecast, By Region

8.1. Introduction

8.1.1. Market Share and Basis Points (BPS) Analysis By Region

8.1.2. Y-o-Y Growth Projections By Region

8.2. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2023, By Region

8.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032 By Region

8.3.1. North America

8.3.2. Latin America

8.3.3. Europe

8.3.4. Asia Pacific

8.3.5. Middle East & Africa

8.4. Market Attractiveness Analysis By Region

8.5. Prominent Trends

9. North America Punnet Packaging Market Analysis and Forecast

9.1. Introduction

9.1.1. Market Share and Basis Points (BPS) Analysis, By Country

9.1.2. Y-o-Y Growth Projections, By Country

9.2. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2023, By Country

9.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Country

9.3.1. U.S.

9.3.2. Canada

9.4. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2023, By Capacity

9.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Capacity

9.5.1. Up to 150 gm

9.5.2. 150-300 gm

9.5.3. 300-500 gm

9.5.4. 500 gm and Above

9.6. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Material

9.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Material

9.7.1. Paper

9.7.2. Molded Fiber

9.7.3. Plastic

9.8. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Product

9.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Product

9.9.1. With Lid

9.9.2. Without Lid

9.10. Prominent Trends

9.11. Drivers and Restraints: Impact Analysis

10. Latin America Punnet Packaging Market Analysis and Forecast

10.1. Introduction

10.1.1. Market Share and Basis Points (BPS) Analysis, By Country

10.1.2. Y-o-Y Growth Projections, By Country

10.2. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2023, By Country

10.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032 By Country

10.3.1. Brazil

10.3.2. Mexico

10.3.3. Argentina

10.3.4. Rest of Latin America

10.4. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Capacity

10.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Capacity

10.5.1. Up to 150 gm

10.5.2. 150-300 gm

10.5.3. 300-500 gm

10.5.4. 500 gm and Above

10.6. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Material

10.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Material

10.7.1. Paper

10.7.2. Molded Fiber

10.7.3. Plastic

10.8. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Product

10.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Product

10.9.1. With Lid

10.9.2. Without Lid

10.10. Prominent Trends

10.11. Drivers and Restraints: Impact Analysis

11. Europe Punnet Packaging Market Analysis and Forecast

11.1. Introduction

11.1.1. Market Share and Basis Points (BPS) Analysis, By Country

11.1.2. Y-o-Y Growth Projections, By Country

11.2. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Country

11.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032 By Country

11.3.1. Germany

11.3.2. Spain

11.3.3. Italy

11.3.4. France

11.3.5. U.K.

11.3.6. BENELUX

11.3.7. Nordic

11.3.8. Russia

11.3.9. Poland

11.3.10. Rest of Europe

11.4. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Capacity

11.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Capacity

11.5.1. Up to 150 gm

11.5.2. 150-300 gm

11.5.3. 300-500 gm

11.5.4. 500 gm and Above

11.6. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Material

11.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Material

11.7.1. Paper

11.7.2. Molded Fiber

11.7.3. Plastic

11.8. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Product

11.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Product

11.9.1. With Lid

11.9.2. Without Lid

11.10. Prominent Trends

11.11. Drivers and Restraints: Impact Analysis

12. Asia Pacific Punnet Packaging Market Analysis and Forecast

12.1. Introduction

12.1.1. Market Share and Basis Points (BPS) Analysis, By Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Country

12.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032 By Country

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Australia and New Zealand

12.3.6. South Korea

12.3.7. Rest of Asia Pacific

12.4. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Capacity

12.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Capacity

12.5.1. Up to 150 gm

12.5.2. 150-300 gm

12.5.3. 300-500 gm

12.5.4. 500 gm and Above

12.6. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Material

12.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Material

12.7.1. Paper

12.7.2. Molded Fiber

12.7.3. Plastic

12.8. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Product

12.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Product

12.9.1. With Lid

12.9.2. Without Lid

12.10. Prominent Trends

12.11. Drivers and Restraints: Impact Analysis

13. Middle East & Africa Punnet Packaging Market Analysis and Forecast

13.1. Introduction

13.1.1. Market Share and Basis Points (BPS) Analysis, By Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Country

13.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Country

13.3.1. North Africa

13.3.2. GCC countries

13.3.3. South Africa

13.3.4. Türkiye

13.3.5. Rest of Middle East & Africa

13.4. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Capacity

13.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Capacity

13.5.1. Up to 150 gm

13.5.2. 150-300 gm

13.5.3. 300-500 gm

13.5.4. 500 gm and Above

13.6. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Material

13.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Material

13.7.1. Paper

13.7.2. Molded Fiber

13.8. Historical Market Value (US$ Mn) and Volume (Tons), 2019-2024, By Product

13.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2024-2032, By Product

13.9.1. With Lid

13.9.2. Without Lid

13.10. Prominent Trends

13.11. Drivers and Restraints: Impact Analysis

14. Competitive Landscape

14.1. Market Structure

14.2. Competition Dashboard

14.3. Company Market Share Analysis

14.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT Analysis)

14.5. Competition Deep Dive

14.5.1. Coveris Holdings SA

14.5.1.1. Overview

14.5.1.2. Financials

14.5.1.3. Strategy

14.5.1.4. Recent Developments

14.5.1.5. SWOT Analysis

14.5.2. Smurfit Kappa Group Plc.

14.5.2.1. Overview

14.5.2.2. Financials

14.5.2.3. Strategy

14.5.2.4. Recent Developments

14.5.2.5. SWOT Analysis

14.5.3. LC Packaging International BV

14.5.3.1. Overview

14.5.3.2. Financials

14.5.3.3. Strategy

14.5.3.4. Recent Developments

14.5.3.5. SWOT Analysis

14.5.4. Groupe Guillin SA

14.5.4.1. Overview

14.5.4.2. Financials

14.5.4.3. Strategy

14.5.4.4. Recent Developments

14.5.4.5. SWOT Analysis

14.5.5. Paccor

14.5.5.1. Overview

14.5.5.2. Financials

14.5.5.3. Strategy

14.5.5.4. Recent Developments

14.5.5.5. SWOT Analysis

14.5.6. Leeways Packaging Services Ltd.

14.5.6.1. Overview

14.5.6.2. Financials

14.5.6.3. Strategy

14.5.6.4. Recent Developments

14.5.6.5. SWOT Analysis

14.5.7. Tacca Industries Pty Ltd.

14.5.7.1. Overview

14.5.7.2. Financials

14.5.7.3. Strategy

14.5.7.4. Recent Developments

14.5.7.5. SWOT Analysis

14.5.8. Raptis Pax Pty Ltd.

14.5.8.1. Overview

14.5.8.2. Financials

14.5.8.3. Strategy

14.5.8.4. Recent Developments

14.5.8.5. SWOT Analysis

14.5.9. Infia S.r.l

14.5.9.1. Overview

14.5.9.2. Financials

14.5.9.3. Strategy

14.5.9.4. Recent Developments

14.5.9.5. SWOT Analysis

14.5.10. Mannok Pack

14.5.10.1. Overview

14.5.10.2. Financials

14.5.10.3. Strategy

14.5.10.4. Recent Developments

14.5.10.5. SWOT Analysis

14.5.11. AVI Global

14.5.11.1. Overview

14.5.11.2. Financials

14.5.11.3. Strategy

14.5.11.4. Recent Developments

14.5.11.5. SWOT Analysis

14.5.12. Royal Interpack Group

14.5.12.1. Overview

14.5.12.2. Financials

14.5.12.3. Strategy

14.5.12.4. Recent Developments

14.5.12.5. SWOT Analysis

14.5.13. ALTA Packaging Inc.

14.5.13.1. Overview

14.5.13.2. Financials

14.5.13.3. Strategy

14.5.13.4. Recent Developments

14.5.13.5. SWOT Analysis

14.5.14. ILIP S.r.l

14.5.14.1. Overview

14.5.14.2. Financials

14.5.14.3. Strategy

14.5.14.4. Recent Developments

14.5.14.5. SWOT Analysis

14.5.15. T&B Containers Ltd.

14.5.15.1. Overview

14.5.15.2. Financials

14.5.15.3. Strategy

14.5.15.4. Recent Developments

14.5.15.5. SWOT Analysis

15. Assumptions and Acronyms Used

16. Research Methodology

List of Tables

Table 01: Global Punnet Packaging Market Historic Value (US$ Mn), by Material, 2019(H)-2023(A)

Table 02: Global Punnet Packaging Market Forecast Value (US$ Mn), by Material, 2024(E)-2032(F)

Table 03: Global Punnet Packaging Market Historic Volume (Tons), by Material, 2019(H)-2023(A)

Table 04: Global Punnet Packaging Market Forecast Volume (Tons), by Material, 2024(E)-2032(F)

Table 05: Global Punnet Packaging Market Historic Value (US$ Mn), by Capacity, 2019(H)-2023(A)

Table 06: Global Punnet Packaging Market Forecast Value (US$ Mn), by Capacity, 2024(E)-2032(F)

Table 07: Global Punnet Packaging Market Historic Volume (Tons), by Capacity, 2019(H)-2023(A)

Table 08: Global Punnet Packaging Market Forecast Volume (Tons), by Capacity, 2024(E)-2032(F)

Table 09: Global Punnet Packaging Market Historic Value (US$ Mn), by Product, 2019(H)-2023(A)

Table 10: Global Punnet Packaging Market Forecast Value (US$ Mn), by Product, 2024(E)-2032(F)

Table 11: Global Punnet Packaging Market Historic Volume (Tons), by Product, 2019(H)-2023(A)

Table 12: Global Punnet Packaging Market Forecast Volume (Tons), by Product, 2024(E)-2032(F)

Table 13: Global Punnet Packaging Market Historic Value (US$ Mn), By Region, 2019(H)-2023(A)

Table 14: Global Punnet Packaging Market Forecast Value (US$ Mn), By Region, 2024(E)-2032(F)

Table 15: Global Punnet Packaging Market Historic Volume (Tons), By Region, 2019(H)-2023(A)

Table 16: Global Punnet Packaging Market Forecast Volume (Tons), By Region, 2024(E)-2032(F)

Table 17: North America Punnet Packaging Market Historic Value (US$ Mn), by Material, 2019(H)-2023(A)

Table 18: North America Punnet Packaging Market Forecast Value (US$ Mn), by Material, 2024(E)-2032(F)

Table 19: North America Punnet Packaging Market Historic Volume (Tons), by Material, 2019(H)-2023(A)

Table 20: North America Punnet Packaging Market Forecast Volume (Tons), by Material, 2024(E)-2032(F)

Table 21: North America Punnet Packaging Market Historic Value (US$ Mn), by Capacity, 2019(H)-2023(A)

Table 22: North America Punnet Packaging Market Forecast Value (US$ Mn), by Capacity, 2024(E)-2032(F)

Table 23: North America Punnet Packaging Market Historic Volume (Tons), by Capacity, 2019(H)-2023(A)

Table 24: North America Punnet Packaging Market Forecast Volume (Tons), by Capacity, 2024(E)-2032(F)

Table 25: North America Punnet Packaging Market Historic Value (US$ Mn), by Product, 2019(H)-2023(A)

Table 26: North America Punnet Packaging Market Forecast Value (US$ Mn), by Product, 2024(E)-2032(F)

Table 27: North America Punnet Packaging Market Historic Volume (Tons), by Product, 2019(H)-2023(A)

Table 28: North America Punnet Packaging Market Forecast Volume (Tons), by Product, 2024(E)-2032(F)

Table 29: North America Punnet Packaging Market Historic Value (US$ Mn), By Country, 2019(H)-2023(A)

Table 30: North America Punnet Packaging Market Forecast Value (US$ Mn), By Country, 2024(E)-2032(F)

Table 31: North America Punnet Packaging Market Historic Volume (Tons), By Country, 2019(H)-2023(A)

Table 32: North America Punnet Packaging Market Forecast Volume (Tons), By Country, 2024(E)-2032(F)

Table 33: Latin America Punnet Packaging Market Historic Value (US$ Mn), by Material, 2019(H)-2023(A)

Table 34: Latin America Punnet Packaging Market Forecast Value (US$ Mn), by Material, 2024(E)-2032(F)

Table 35: Latin America Punnet Packaging Market Historic Volume (Tons), by Material, 2019(H)-2023(A)

Table 36: Latin America Punnet Packaging Market Forecast Volume (Tons), by Material, 2024(E)-2032(F)

Table 37: Latin America Punnet Packaging Market Historic Value (US$ Mn), by Capacity, 2019(H)-2023(A)

Table 38: Latin America Punnet Packaging Market Forecast Value (US$ Mn), by Capacity, 2024(E)-2032(F)

Table 39: Latin America Punnet Packaging Market Historic Volume (Tons), by Capacity, 2019(H)-2023(A)

Table 40: Latin America Punnet Packaging Market Forecast Volume (Tons), by Capacity, 2024(E)-2032(F)

Table 41: Latin America Punnet Packaging Market Historic Value (US$ Mn), by Product, 2019(H)-2023(A)

Table 42: Latin America Punnet Packaging Market Forecast Value (US$ Mn), by Product, 2024(E)-2032(F)

Table 43: Latin America Punnet Packaging Market Historic Volume (Tons), by Product, 2019(H)-2023(A)

Table 44: Latin America Punnet Packaging Market Forecast Volume (Tons), by Product, 2024(E)-2032(F)

Table 45: Latin America Punnet Packaging Market Historic Value (US$ Mn), By Country, 2019(H)-2023(A)

Table 46: Latin America Punnet Packaging Market Forecast Value (US$ Mn), By Country, 2024(E)-2032(F)

Table 47: Latin America Punnet Packaging Market Historic Volume (Tons), By Country, 2019(H)-2023(A)

Table 48: Latin America Punnet Packaging Market Forecast Volume (Tons), By Country, 2024(E)-2032(F)

Table 49: Europe Punnet Packaging Market Historic Value (US$ Mn), by Material, 2019(H)-2023(A)

Table 50: Europe Punnet Packaging Market Forecast Value (US$ Mn), by Material, 2024(E)-2032(F)

Table 51: Europe Punnet Packaging Market Historic Volume (Tons), by Material, 2019(H)-2023(A)

Table 52: Europe Punnet Packaging Market Forecast Volume (Tons), by Material, 2024(E)-2032(F)

Table 53: Europe Punnet Packaging Market Historic Value (US$ Mn), by Capacity, 2019(H)-2023(A)

Table 54: Europe Punnet Packaging Market Forecast Value (US$ Mn), by Capacity, 2024(E)-2032(F)

Table 55: Europe Punnet Packaging Market Historic Volume (Tons), by Capacity, 2019(H)-2023(A)

Table 56: Europe Punnet Packaging Market Forecast Volume (Tons), by Capacity, 2024(E)-2032(F)

Table 57: Europe Punnet Packaging Market Historic Value (US$ Mn), by Product, 2019(H)-2023(A)

Table 58: Europe Punnet Packaging Market Forecast Value (US$ Mn), by Product, 2024(E)-2032(F)

Table 59: Europe Punnet Packaging Market Historic Volume (Tons), by Product, 2019(H)-2023(A)

Table 60: Europe Punnet Packaging Market Forecast Volume (Tons), by Product, 2024(E)-2032(F)

Table 61: Europe Punnet Packaging Market Historic Value (US$ Mn), By Country, 2019(H)-2023(A)

Table 62: Europe Punnet Packaging Market Forecast Value (US$ Mn), By Country, 2024(E)-2032(F)

Table 63: Europe Punnet Packaging Market Historic Volume (Tons), By Country, 2019(H)-2023(A)

Table 64: Europe Punnet Packaging Market Forecast Volume (Tons), By Country, 2024(E)-2032(F)

Table 65: Asia Pacific Punnet Packaging Market Historic Volume (Tons), by Material, 2019(H)-2023(A)

Table 66: Asia Pacific Punnet Packaging Market Forecast Volume (Tons), by Material, 2024(E)-2032(F)

Table 67: Asia Pacific Punnet Packaging Market Historic Value (US$ Mn), by Capacity, 2019(H)-2023(A)

Table 68: Asia Pacific Punnet Packaging Market Forecast Value (US$ Mn), by Capacity, 2024(E)-2032(F)

Table 69: Asia Pacific Punnet Packaging Market Historic Volume (Tons), by Capacity, 2019(H)-2023(A)

Table 70: Asia Pacific Punnet Packaging Market Forecast Volume (Tons), by Capacity, 2024(E)-2032(F)

Table 71: Asia Pacific Punnet Packaging Market Historic Value (US$ Mn), by Product, 2019(H)-2023(A)

Table 72: Asia Pacific Punnet Packaging Market Forecast Value (US$ Mn), by Product, 2024(E)-2032(F)

Table 73: Asia Pacific Punnet Packaging Market Historic Volume (Tons), by Product, 2019(H)-2023(A)

Table 74: Asia Pacific Punnet Packaging Market Forecast Volume (Tons), by Product, 2024(E)-2032(F)

Table 75: Asia Pacific Punnet Packaging Market Historic Value (US$ Mn), By Country, 2019(H)-2023(A)

Table 76: Asia Pacific Punnet Packaging Market Forecast Value (US$ Mn), By Country, 2024(E)-2032(F)

Table 77: Asia Pacific Punnet Packaging Market Historic Volume (Tons), By Country, 2019(H)-2023(A)

Table 78: Asia Pacific Punnet Packaging Market Forecast Volume (Tons), By Country, 2024(E)-2032(F)

Table 79: Middle East & Africa Punnet Packaging Market Historic Value (US$ Mn), by Material, 2019(H)-2023(A)

Table 80: Middle East & Africa Punnet Packaging Market Forecast Value (US$ Mn), by Material, 2024(E)-2032(F)

Table 81: Middle East & Africa Punnet Packaging Market Historic Volume (Tons), by Material, 2019(H)-2023(A)

Table 82: Middle East & Africa Punnet Packaging Market Forecast Volume (Tons), by Material, 2024(E)-2032(F)

Table 83: Middle East & Africa Punnet Packaging Market Historic Value (US$ Mn), by Capacity, 2019(H)-2023(A)

Table 84: Middle East & Africa Punnet Packaging Market Forecast Value (US$ Mn), by Capacity, 2024(E)-2032(F)

Table 85: Middle East & Africa Punnet Packaging Market Historic Volume (Tons), by Capacity, 2019(H)-2023(A)

Table 86: Middle East & Africa Punnet Packaging Market Forecast Volume (Tons), by Capacity, 2024(E)-2032(F)

Table 87: Middle East & Africa Punnet Packaging Market Historic Value (US$ Mn), by Product, 2019(H)-2023(A)

Table 88: Middle East & Africa Punnet Packaging Market Forecast Value (US$ Mn), by Product, 2024(E)-2032(F)

Table 89: Middle East & Africa Punnet Packaging Market Historic Volume (Tons), by Product, 2019(H)-2023(A)

Table 90: Middle East & Africa Punnet Packaging Market Forecast Volume (Tons), by Product, 2024(E)-2032(F)

Table 91: Middle East & Africa Punnet Packaging Market Historic Value (US$ Mn), By Country, 2019(H)-2023(A)

Table 92: Middle East & Africa Punnet Packaging Market Forecast Value (US$ Mn), By Country, 2024(E)-2032(F)

Table 93: Middle East & Africa Punnet Packaging Market Historic Volume (Tons), By Country, 2019(H)-2023(A)

Table 94: Middle East & Africa Punnet Packaging Market Forecast Volume (Tons), By Country, 2024(E)-2032(F)

List of Figures

Figure 01: Global Punnet Packaging Market Share Analysis, by Material, 2024E-2032F

Figure 02: Global Punnet Packaging Market Attractiveness Analysis, by Material, 2024E-2032F

Figure 03: Global Punnet Packaging Market Y-o-Y Analysis, by Material, 2019H-2032F

Figure 04: Global Punnet Packaging Market Share Analysis, by Capacity, 2024E-2032F

Figure 05: Global Punnet Packaging Market Attractiveness Analysis, by Capacity, 2024E-2032F

Figure 06: Global Punnet Packaging Market Y-o-Y Analysis, by Capacity, 2019H-2032F

Figure 07: Global Punnet Packaging Market Share Analysis, by Product, 2024E-2032F

Figure 08: Global Punnet Packaging Market Attractiveness Analysis, by Product, 2024E-2032F

Figure 09: Global Punnet Packaging Market Y-o-Y Analysis, by Product, 2019H-2032F

Figure 10: Global Punnet Packaging Market Share Analysis, by Region, 2024E-2032F

Figure 11: Global Punnet Packaging Market Attractiveness Analysis, by Region, 2024E-2032F

Figure 12: Global Punnet Packaging Market Y-o-Y Analysis, by Region, 2019H-2032F

Figure 13: North America Punnet Packaging Market Value Share Analysis, by Material, 2024(E)

Figure 14: North America Punnet Packaging Market Value Share Analysis, by Capacity, 2024(E)

Figure 15: North America Punnet Packaging Market Attractiveness Analysis, by Product, 2024E-2032F

Figure 16: North America Punnet Packaging Market Value Share Analysis, by Country, 2024(E)

Figure 17: Latin America Punnet Packaging Market Value Share Analysis, by Material, 2024(E)

Figure 18: Latin America Punnet Packaging Market Value Share Analysis, by Capacity, 2024(E)

Figure 19: Latin America Punnet Packaging Market Attractiveness Analysis, by Product, 2024E-2032F

Figure 20: Latin America Punnet Packaging Market Value Share Analysis, by Country, 2024(E)

Figure 21: Europe Punnet Packaging Market Value Share Analysis, by Material 2024(E)

Figure 22: Europe Punnet Packaging Market Value Share Analysis, by Capacity, 2024(E)

Figure 23: Europe Punnet Packaging Market Attractiveness Analysis, by Product, 2024E-2032F

Figure 24: Europe Punnet Packaging Market Value Share Analysis, by Country, 2024(E)

Figure 25: Asia Pacific Punnet Packaging Market Value Share Analysis, by Material 2024(E)

Figure 26: Asia Pacific Punnet Packaging Market Value Share Analysis, by Capacity, 2024(E)

Figure 27: Asia Pacific Punnet Packaging Market Attractiveness Analysis, by Product, 2024E-2032F

Figure 28: Asia Pacific Punnet Packaging Market Value Share Analysis, by Country, 2024(E)

Figure 29: Middle East & Africa Punnet Packaging Market Value Share Analysis, by Material, 2024(E)

Figure 30: Middle East & Africa Punnet Packaging Market Value Share Analysis, by Capacity, 2024(E)

Figure 31: Middle East & Africa Punnet Packaging Market Attractiveness Analysis, by Product, 2024E-2032F

Figure 32: Middle East & Africa Punnet Packaging Market Value Share Analysis, by Country, 2024(E)

Figure 33: U.S. Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 34: U.S. Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 35: U.S. Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 36: Canada Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 37: Canada Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 38: Canada Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 39: Brazil Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 40: Brazil Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 41: Brazil Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 42: Mexico Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 43: Mexico Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 44: Mexico Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 45: Germany Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 46: Germany Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 47: Germany Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 48: Spain Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 49: Spain Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 50: Spain Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 51: France Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 52: France Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 53: France Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 54: U.K. Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 55: U.K. Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 56: U.K. Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 57: Italy Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 58: Italy Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 59: Italy Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 60: Russia Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 61: Russia Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 62: Russia Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 63: China Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 64: China Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 65: China Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 66: India Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 67: India Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 68: India Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 69: Japan Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 70: Japan Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 71: Japan Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 72: GCC Countries Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 73: GCC Countries Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 74: GCC Countries Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F

Figure 75: South Africa Punnet Packaging Market Value Share Analysis, by Material, 2024E

Figure 76: South Africa Punnet Packaging Market Value Share Analysis, by Capacity, 2024E

Figure 77: South Africa Punnet Packaging Market Value Share Analysis, by Product, 2024E-2032F