Reports

Reports

The product lifecycle management (PLM) market is expanding at a rapid pace with the rising process complexity of product development activities in manufacturing, automotive, aerospace, and healthcare industries. Companies are increasingly using PLM solutions to automate tasks, reduce time-to-market, and enhance collaboration between remote teams. As the emphasis on digitalization increases, the PLM systems help firms combine product-centric information, offer value chain visibility, and curtail operation inefficiencies.

Additionally, the need for efficient product development processes and regulatory norms are compelling industry players to deploy PLM systems, thereby driving the market further.

Additionally, the product lifecycle management [PLM] market is driven by factors such as cost-efficiency and lifecycle elongation. Companies are investing in PLM tools to lower their resource consumption, optimize their supply chain processes, and minimize their production costs while maintaining product quality. One of the most compelling features of PLM solutions is their capability to provide complete data traceability throughout the product lifecycle. In addition, the rising need for cloud-based PLM systems has allowed for improved functionalities for effortless scalability and remote access, thus facilitating the deployment and management for small, medium, and large enterprises and, therefore, increasing the geographical spread of adoption.

In recent years, there have been several broad trends in the product lifecycle management [PLM] market that are further driving its expansion. One of them is the growing convergence of PLM with ERP (Enterprise Resource Planning), CRM (Customer Relationship Management), and MES (Manufacturing Execution System) toward developing integrated enterprise ecosystems.

The second trend is the rise of cloud-native and SaaS-based PLM models that are offering organizations flexibility, lower capital outlay, and rapid deployment. Greater sustainability pressure is also compelling companies to implement PLM solutions as usage and material management solutions that promote sustainability through minimizing energy consumption, and facilitating sustainable product designs.

The product lifecycle management [PLM] market is fiercely competitive and marked by continuous innovations as several companies strive to adapt to the ever-changing needs of the industry. The diverse and fast-changing needs of clients need call for user-friendly interfaces, modular solutions, and sector-specific functions to be delivered by market players.

Players also establish strategic partnerships and technological collaborations to expand solution capabilities and widen their geographical outreach. Additionally, these vendors guarantee that their solutions integrate cloud capabilities, address cybersecurity concerns, and ensure interoperability, thereby building more trust and confidence for adoption.

Product lifecycle management (PLM) is basically a strategy that weaves together people, procedure, and technology to bring a product from conception to disposal. PLM is a centralized outline that helps organizations with the automation of processes, streamlining collaborative work, and assisting decision-making.

With transparency in product value chain, it ensures that data is controlled appropriately. PLM thus discourages any unnecessary duplication or errors, thereby ensuring heightened efficiency and innovation. These solutions are specifically useful to those industries where highly sophisticated product development cycles are in process.

One of the most critical features of PLM is driving time-to-market without any compromise on regulatory compliance. With effective management of product data, organizations can minimize design iterations, maximize resource utilization, and improve supply chain integration. The cloud deployment of PLM solutions also provides organizations with the option to extend these advantages to remote entities and small-scale businesses. It is not only more economical but also enhances the organization’s competitiveness in highly dynamic market environment where product innovation is a continuous mandate.

PLM systems, in response to the increasing sustainability demands, are being increasingly adopted by organizations. Companies use PLM systems for handling eco-friendly materials, tracking carbon footprints, and generating designs for products with extended lifecycles or enhanced recyclability. All of this contributes toward the globally accepted sustainability goals and corporate social responsibility agendas.

Overall, PLM acts as the strategic catalyst for contemporary businesses as it makes the efficiency, collaboration, and visibility between the product development processes possible. Changes in PLM being integrated with the other enterprise systems and providing insights in real-time have manifested themselves as being among the most critical tools for fostering digitalization throughout domain industries and that helps in generating sustainable business values.

| Attribute | Detail |

|---|---|

| Product Lifecycle Management [PLM] Market Drivers |

|

One of the most significant product lifecycle management [PLM] market drivers is the incorporation of artificial intelligence with product lifecycle management (PLM), since it can potentially make product lifecycle more efficient and decision-based. AI-based PLM solutions are capable of managing enormous volumes of product data, thereby leading to quicker generation of precise insights on product development, designing, and manufacturing parameters. AI has the potential of minimizing repetitive work and lower human-labor, thereby minimizing errors, saving time, and optimizing resource utilization, thereby enhancing productivity and overall operational effectiveness.

Integration of artificial intelligence also improves predictive capability in PLM systems. Machine learning algorithms compare historic data with real-time statistics in order to identify potential design faults, maintenance, or supply chain disruption ahead of time. Predictive intelligence helps enterprises automate product designs, reduce downtime, and improve quality with lower operation costs. Pre-emptive management facilitates rapid deployment of products into the market while staying competitive along the life cycle of the product.

Another significant advantage AI and PLM integration is the burgeoning collaboration and innovation. Natural language processing and analysis offered by AI ease collaboration across geographically dispersed teams, while smart design tools enhance prototyping and simulation. This advancement encourages innovation avenues through generating more design options to evaluate among, making identification of the optimal solution easier.

AI is facilitating sophisticated customization capabilities and data-driven decision support, thereby, further driving the product lifecycle management [PLM] industry. AI and PLM can be tailored to react to the subtleties of particular industries, maximize customer-centric product designs, and facilitate sustainable initiatives like material optimization and lifecycle analysis. As companies launch digital transformation initiatives, the complementarity between AI and PLM keeps moving forward, hence creating AI-driven PLM as an enabling catalyst for next-generation product plans.

Increased demand for customized products is one of the key drivers to the product lifecycle management (PLM) market, with people now seeking products that have been customized to their unique needs and interests. The automotive, electronic, and consumer goods sectors are continually under pressure to come up with customized products without compromising on quality and efficiency. PLM technology possesses the capability to accommodate advanced variations of design, manage evolving customer needs, and enable the capability to design and supply engineered products with greater individualization within shorter cycles of time.

Customization does increase the complexity of product development owing to the need to process numerous combinations of designs, production variation, and supply chain configurations. PLM systems extend support to companies in coping with these complexities by centralizing product data, facilitating easy communication between departments, and ensuring consistency in product specifications. This allows businesses to be able to guarantee even product configurations while sustaining efficiency, lower costs, and timelines.

Increased customized products have, therefore, resulted in a heightened demand for on-demand product lifecycle visibility and responsiveness. Organizations dealing with PLM applications not only possess the capability to track changes in real time but also re-create their products and comply with the relevant regulation even when they are manufacturing customized products, through such an application. Such flexibility provides scope for faster product launches and has the benefit of acquiring and retaining customer loyalty.

Furthermore, customization is a key innovation driver, and PLM is the cornerstone of effective innovation management. PLM brings design, engineering, and manufacturing onto an integrated platform, thereby enabling companies to develop ideas for new products as well as test their scalability. Since the trend of customized products is not only anticipated to continue but also intensify in future, and poised to lead to the expansion of PLM market across the globe.

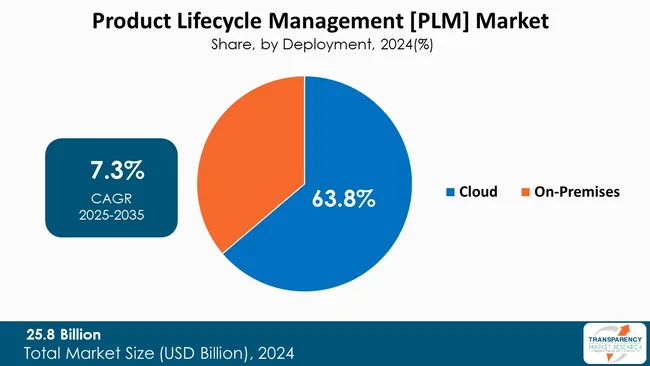

The cloud segment holds a significant market share in the product lifecycle management (PLM) market owing to its flexibility, scalability, and affordability. Cloud PLM solutions alleviate the need for investment in enormous infrastructure, thus being within reach for large companies as well as small and medium businesses. Such solutions make data access more convenient, provide collaboration in the same data environment, and enable rapid implementation as compared to the standard on-premises systems.

Besides, cloud-based PLM facilitates easy as well as efficient communications with the other enterprise tools, apart from offering the assurance that data can be centrally and securely managed from any place. The trend of telecommuting, the necessity for faster software updates, and the need for businesses to be always ready for changing requirements are some of the factors driving the demand for cloud-based PLM services.

| Attribute | Detail |

|---|---|

| Leading Region |

|

As per the latest product lifecycle management [PLM] market analysis, North America dominated in 2024. This is due to the presence of high number of advanced manufacturing sectors including automotive, aerospace, electronics, and consumer goods. Additionally, the companies headquartered in this region are considered to be early adopters of the digital technologies and they use PLM systems to manage the complex product designs, assure rapid customization, and also maintain the production to be efficient.

Moreover, customer-centric innovation and sustainability being at the core of the region's strategy are the major factors leading to the deployment of PLM platforms for bespoke product development. With the backing of strong R&D, well-qualified labor force and high application of cloud-based PLM solutions, the companies of North America are the first to meet the rising demand for the highly personalized products.

The players operating in the PLM market center their attention around planning measures such as increasing their cloud-based offerings, improving their compatibility with the other enterprise systems, and dedicating themselves to industry-specific solutions.

In addition, the firms are forging strategic partnerships, mergers, and acquisitions to increase their scope of services. Players are also focusing on research and development activities for strengthening innovation, environmental-friendliness features, and ease of use of their platforms for allowing wider global adoption.

Siemens, Dassault Systèmes, PTC, Autodesk Inc., SAP SE, Oracle, Aras, Infor, IBM, Cadence Design Systems, Inc., OpenBOM, Propel Software Solutions, Inc., Centric Software, Inc., Coats Digital, and ABB are some of the leading players operating in the global product lifecycle management [PLM] market.

Each of these players has been profiled in the product lifecycle management [PLM] market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

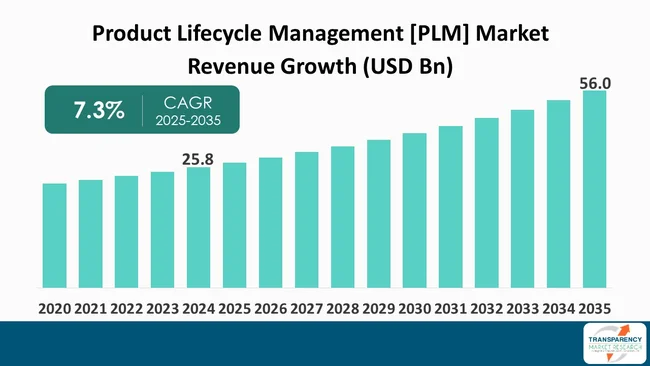

| Size in 2024 | US$ 25.8 Bn |

| Forecast Value in 2035 | US$ 56.0 Bn |

| CAGR | 7.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Product Lifecycle Management [PLM] Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Component

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global product lifecycle management [PLM] market was valued at US$ 25.8 Bn in 2024

The global product lifecycle management [PLM] industry is projected to reach more than US$ 56.0 Bn by the end of 2035

Increased demand for digitalization, smart products, and IoT integration, the need for streamlined product development and customization, stringent regulatory requirements, and heightened demand for sustainability across complex products and global supply chains are some of the factors driving the expansion of product lifecycle management [PLM] market.

The CAGR is anticipated to be 7.3% from 2025 to 2035

Siemens, Dassault Systèmes, PTC, Autodesk Inc., SAP SE, Oracle, Aras, Infor, IBM, Cadence Design Systems, Inc., OpenBOM, Propel Software Solutions, Inc., Centric Software, Inc., Coats Digital, and ABB

Table 01: Global Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 02: Global Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 03: Global Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 04: Global Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 05: Global Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 06: Global Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 07: Global Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 09: North America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 10: North America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 11: North America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 12: North America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 13: North America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 14: North America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 15: U.S. Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 16: U.S. Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 17: U.S. Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 18: U.S. Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 19: U.S. Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 20: U.S. Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 21: Canada Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 22: Canada Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 23: Canada Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 24: Canada Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 25: Canada Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 26: Canada Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 27: Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 28: Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 29: Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 30: Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 31: Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 32: Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 33: Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 34: UK Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 35: UK Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 36: UK Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 37: UK Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 38: UK Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 39: UK Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 40: Germany Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 41: Germany Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 42: Germany Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 43: Germany Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 44: Germany Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 45: Germany Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 46: France Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 47: France Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 48: France Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 49: France Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 50: France Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 51: France Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 52: Italy Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 53: Italy Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 54: Italy Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 55: Italy Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 56: Italy Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 57: Italy Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 58: Spain Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 59: Spain Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 60: Spain Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 61: Spain Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 62: Spain Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 63: Spain Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 64: The Netherlands Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 65: The Netherlands Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 66: The Netherlands Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 67: The Netherlands Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 68: The Netherlands Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 69: The Netherlands Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 70: Rest of Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 71: Rest of Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 72: Rest of Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 73: Rest of Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 74: Rest of Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 75: Rest of Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 76: Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 77: Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 78: Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 79: Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 80: Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 81: Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 82: Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 83: China Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 84: China Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 85: China Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 86: China Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 87: China Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 88: China Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 89: India Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 90: India Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 91: India Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 92: India Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 93: India Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 94: India Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 95: Japan Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 96: Japan Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 97: Japan Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 98: Japan Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 99: Japan Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 100: Japan Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 101: Australia Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 102: Australia Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 103: Australia Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 104: Australia Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 105: Australia Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 106: Australia Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 107: South Korea Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 108: South Korea Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 109: South Korea Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 110: South Korea Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 111: South Korea Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 112: South Korea Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 113: ASEAN Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 114: ASEAN Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 115: ASEAN Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 116: ASEAN Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 117: ASEAN Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 118: ASEAN Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 119: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 120: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 121: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 122: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 123: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 124: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 125: Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 126: Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 127: Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 128: Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 129: Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 130: Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 131: Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 132: Brazil Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 133: Brazil Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 134: Brazil Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 135: Brazil Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 136: Brazil Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 137: Brazil Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 138: Argentina Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 139: Argentina Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 140: Argentina Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 141: Argentina Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 142: Argentina Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 143: Argentina Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 144: Mexico Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 145: Mexico Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 146: Mexico Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 147: Mexico Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 148: Mexico Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 149: Mexico Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 150: Rest of Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 151: Rest of Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 152: Rest of Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 153: Rest of Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 154: Rest of Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 155: Rest of Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 156: Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 157: Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 158: Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 159: Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 160: Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 161: Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 162: Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 163: GCC Countries Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 164: GCC Countries Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 165: GCC Countries Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 166: GCC Countries Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 167: GCC Countries Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 168: GCC Countries Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 169: South Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 170: South Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 171: South Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 172: South Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 173: South Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 174: South Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Table 175: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 176: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 177: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 178: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 179: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By Enterprise Type, 2020 to 2035

Table 180: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, By End-User, 2020 to 2035

Figure 01: Global Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 02: Global Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 03: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 04: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 05: Global Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 06: Global Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 07: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by Cloud, 2020 to 2035

Figure 08: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by On-Premises, 2020 to 2035

Figure 09: Global Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 10: Global Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 11: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by Small and Mid-Sized Enterprises (SMEs), 2020 to 2035

Figure 12: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by Large Enterprises, 2020 to 2035

Figure 13: Global Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 14: Global Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 15: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by Aerospace & Defense, 2020 to 2035

Figure 16: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by Industrial, 2020 to 2035

Figure 17: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by Automotive & Transportation, 2020 to 2035

Figure 18: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by Healthcare, 2020 to 2035

Figure 19: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by IT & Telecom, 2020 to 2035

Figure 20: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by Industrial Equipment & Heavy Machinery, 2020 to 2035

Figure 21: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by Retail, 2020 to 2035

Figure 22: Global Product Lifecycle Management [PLM] Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 23: Global Product Lifecycle Management [PLM] Market Value Share Analysis, By Region, 2024 and 2035

Figure 24: Global Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 25: North America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 26: North America Product Lifecycle Management [PLM] Market Value Share Analysis, by Country, 2024 and 2035

Figure 27: North America Product Lifecycle Management [PLM] Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 28: North America Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 29: North America Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 30: North America Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 31: North America Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 32: North America Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 33: North America Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 34: North America Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 35: North America Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 36: U.S. Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 37: U.S. Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 38: U.S. Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 39: U.S. Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 40: U.S. Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 41: U.S. Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 42: U.S. Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 43: U.S. Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 44: U.S. Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 45: Canada Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 46: Canada Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 47: Canada Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 48: Canada Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 49: Canada Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 50: Canada Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 51: Canada Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 52: Canada Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 53: Canada Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 54: Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 55: Europe Product Lifecycle Management [PLM] Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 56: Europe Product Lifecycle Management [PLM] Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 57: Europe Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 58: Europe Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 59: Europe Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 60: Europe Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 61: Europe Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 62: Europe Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 63: Europe Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 64: Europe Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 65: UK Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 66: UK Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 67: UK Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 68: UK Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 69: UK Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 70: UK Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 71: UK Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 72: UK Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 73: UK Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 74: Germany Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 75: Germany Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 76: Germany Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 77: Germany Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 78: Germany Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 79: Germany Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 80: Germany Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 81: Germany Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 82: Germany Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 83: France Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 84: France Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 85: France Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 86: France Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 87: France Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 88: France Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 89: France Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 90: France Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 91: France Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 92: Italy Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 93: Italy Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 94: Italy Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 95: Italy Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 96: Italy Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 97: Italy Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 98: Italy Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 99: Italy Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 100: Italy Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 101: Spain Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 102: Spain Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 103: Spain Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 104: Spain Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 105: Spain Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 106: Spain Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 107: Spain Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 108: Spain Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 109: Spain Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 110: The Netherlands Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 111: The Netherlands Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 112: The Netherlands Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 113: The Netherlands Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 114: The Netherlands Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 115: The Netherlands Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 116: The Netherlands Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 117: The Netherlands Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 118: The Netherlands Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 119: Rest of Europe Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 120: Rest of Europe Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 121: Rest of Europe Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 122: Rest of Europe Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 123: Rest of Europe Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 124: Rest of Europe Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 125: Rest of Europe Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 126: Rest of Europe Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 127: Rest of Europe Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 128: Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 129: Asia Pacific Product Lifecycle Management [PLM] Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 130: Asia Pacific Product Lifecycle Management [PLM] Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 131: Asia Pacific Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 132: Asia Pacific Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 133: Asia Pacific Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 134: Asia Pacific Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 135: Asia Pacific Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 136: Asia Pacific Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 137: Asia Pacific Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 138: Asia Pacific Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 139: China Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 140: China Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 141: China Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 142: China Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 143: China Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 144: China Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 145: China Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 146: China Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 147: China Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 148: India Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 149: India Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 150: India Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 151: India Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 152: India Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 153: India Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 154: India Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 155: India Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 156: India Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 157: Japan Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 158: Japan Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 159: Japan Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 160: Japan Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 161: Japan Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 162: Japan Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 163: Japan Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 164: Japan Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 165: Japan Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 166: Australia Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 167: Australia Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 168: Australia Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 169: Australia Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 170: Australia Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 171: Australia Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 172: Australia Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 173: Australia Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 174: Australia Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 175: South Korea Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 176: South Korea Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 177: South Korea Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 178: South Korea Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 179: South Korea Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 180: South Korea Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 181: South Korea Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 182: South Korea Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 183: South Korea Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 184: ASEAN Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 185: ASEAN Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 186: ASEAN Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 187: ASEAN Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 188: ASEAN Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 189: ASEAN Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 190: ASEAN Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 191: ASEAN Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 192: ASEAN Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 193: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 194: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 195: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 196: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 197: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 198: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 199: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 200: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 201: Rest of Asia Pacific Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 202: Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 203: Latin America Product Lifecycle Management [PLM] Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 204: Latin America Product Lifecycle Management [PLM] Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 205: Latin America Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 206: Latin America Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 207: Latin America Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 208: Latin America Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 209: Latin America Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 210: Latin America Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 211: Latin America Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 212: Latin America Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 213: Brazil Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 214: Brazil Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 215: Brazil Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 216: Brazil Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 217: Brazil Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 218: Brazil Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 219: Brazil Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 220: Brazil Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 221: Brazil Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 222: Argentina Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 223: Argentina Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 224: Argentina Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 225: Argentina Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 226: Argentina Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 227: Argentina Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 228: Argentina Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 229: Argentina Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 230: Argentina Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 231: Mexico Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 232: Mexico Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 233: Mexico Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 234: Mexico Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 235: Mexico Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 236: Mexico Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 237: Mexico Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 238: Mexico Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 239: Mexico Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 240: Rest of Latin America Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 241: Rest of Latin America Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 242: Rest of Latin America Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 243: Rest of Latin America Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 244: Rest of Latin America Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 245: Rest of Latin America Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 246: Rest of Latin America Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 247: Rest of Latin America Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 248: Rest of Latin America Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 249: Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 250: Middle East & Africa Product Lifecycle Management [PLM] Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 251: Middle East & Africa Product Lifecycle Management [PLM] Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 252: Middle East & Africa Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 253: Middle East & Africa Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 254: Middle East & Africa Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 255: Middle East & Africa Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 256: Middle East & Africa Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 257: Middle East & Africa Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 258: Middle East & Africa Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 259: Middle East & Africa Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 260: GCC Countries Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 261: GCC Countries Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 262: GCC Countries Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 263: GCC Countries Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 264: GCC Countries Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 265: GCC Countries Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 266: GCC Countries Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 267: GCC Countries Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 268: GCC Countries Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 269: South Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 270: South Africa Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 271: South Africa Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 272: South Africa Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 273: South Africa Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 274: South Africa Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 275: South Africa Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 276: South Africa Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 277: South Africa Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035

Figure 278: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 279: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Value Share Analysis, By Component, 2024 and 2035

Figure 280: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 281: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 282: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 283: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Value Share Analysis, By Enterprise Type, 2024 and 2035

Figure 284: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Attractiveness Analysis, By Enterprise Type, 2025 to 2035

Figure 285: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Value Share Analysis, By End-User, 2024 and 2035

Figure 286: Rest of Middle East & Africa Product Lifecycle Management [PLM] Market Attractiveness Analysis, By End-User, 2025 to 2035