Reports

Reports

Printed electronics market is revolutionizing the electronic manufacturing industry through technological advancement, flexible consumer electronics, portable healthcare devices and cost-effective devices. The major factor that is driving the market is increased use of flexible electronic devices and environmentally-friendly approach. With advanced technologies, printed electronics is used in everything, right from HMI input devices to smart wearables and RFID.

Today printing electronics is expanding across the globe at a large scale. Printed electronics reduce the material waste and stretchable devices to biodegradable substrates such as paper. The market for printing electronics is penetrated by multiple key players.

Cost-effectiveness is another compelling driver to developing printing electronic market. With the rising cost of printing industry, consumers and providers are looking for solutions that are more affordable. Printing electronics gives cost-effective solution with environmentally-friendly approach. Modern technologies are less time-consuming and creating low-cost printed electronics.

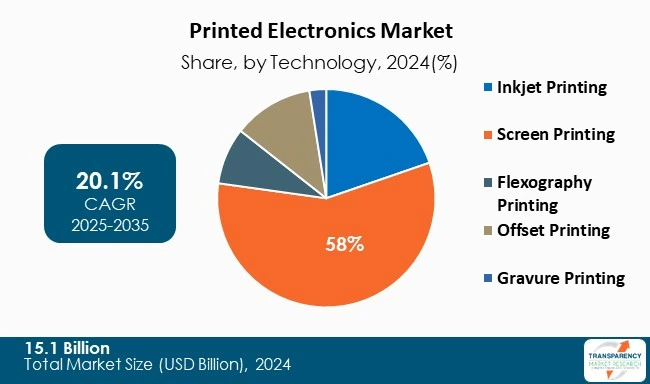

Printed electronics is a branch of electronic manufacturing that involves printing of electronic components such as thin film transistors, electronic circuits, sensor system, batteries, capacitors, large-scale printing screen or light panel. There are various printing techniques that generally involve printing electronics such as inkjet printing, screen printing, flexography printing, offset printing, and gravure printing to define the patterns on material.

Printing electronics techniques have different benefits and limitation. Flexography printing technique gives the thinnest printed layers, where screen printing and inkjet printing give the higher layer thickness. Screen printing is conducive to stacking multiple thick prints and contribute for the largest market share, while gravure and flexographic printing have more potential to become a means of mass production of printed electronics.

These days, printed electronics market is growing due to the rising demand for flexible consumer electronics and portable electronics wearables. Printed electronics technology has the capability to create material structures with defined chemistry, geometry, and properties on the organic substrate. Some key benefits of printed electronics are being lightweight, bendable, foldable/rollable, conformal, wearable, and offer the possibility of creating devices/sensors on a variety of substrates.

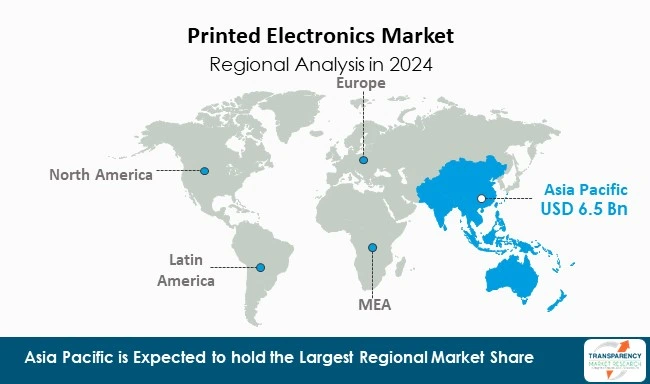

Additionally, the market for printed electronics witnesses the highest growth in APAC region with end-users of automotive, transportation, and healthcare. Printed electronics is cost-effective and flexible consumer electronics.

| Attribute | Detail |

|---|---|

| Printed Electronics Market Drivers |

|

Traditional manufacturing techniques for printed electronics can require complicated and costly tools for creating material structure. Printed electronics reduce the material waste and lower the cost of production. Biodegradable substrates and inks align with the growing emphasis on sustainability.

Additionally, printed electronics are lightweight, versatile, eco-friendly, and cost-effective, which drives the growth of printed electronics market by creating business opportunities to produce a wide range of applications, such as wearable technologies and smart packaging. For instance, in 2023, Komori Corporation established the Printed Electronics Elemental Technology Development Center on the premises of the Tsukuba Plant in Japan to develop elemental technologies for printed electronics. The company is expanding its focus on printed electronics.

Also, environmental and ethical impact of different electronic devices is creating market opportunities for printed electronics. Printed electronics reduce carbon emission that occurs during the manufacturing stage. Printed electronics allow companies to make flexible and wearable electronics appliances.

Printed electronics are flexible consumer electronics as they utilize conductive inks and flexible materials such as plastics, paper, and textiles. The flexibility of printed electronics is beneficial for application in wearables, smart packaging, medical devices, and automotive application.

These days, consumers are demanding lightweight and cost-effective technologies that can securely detect, store, and transmit information. The growth of IoT (Internet of Things) and Gen-AI leads the demand for flexible electronics that leverages the market of printed electronics. The next generation of technology is flexible. Devices that bend and stretch without compromising on performance are transforming healthcare, consumer electronics, and beyond.

Printed electronics are creating revolution in the market, where circuits are printed like ink or paper, creating scalable and cost-effective solution for a more adaptable future. These materials are far more flexible than the traditional ones, allowing for the electronics that bend and stretch.

Screen printing segment captures majority of market share in the global printed electronics market. Screen printing is a versatile and reliable method for creating electronic components such as sensors, circuits, and displays. This process involves transferring specialized conductive, dielectric, or resistive inks onto a substrate via a fine mesh screen and stencil, thereby ensuring precise pattern control and uniform thickness.

Additionally, screen printing ensures accurate control over ink layer thickness, which is necessary for applications needing uniform performance. The process of screen printing is scalable, versatile, and precise that makes innovative and cost-effective printed electronics. It creates low material wastage that make it an economical choice for producing large quantities.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific |

The Asia-Pacific region dominates the printed electronics industry as the major manufacturing center of the world, especially in the automotive, electronics and heavy machinery sectors. In 2024, the Asia-Pacific (APAC) region has emerged as the leading region in the global printed electronics industry driven by industrial, technological, and economic regional demand. The APAC region, being synonymous with its huge and still growing electronics manufacturing industry provides the combination of high volume manufacturing and ample key players in the APAC printed electronics space. The main countries of interest in APAC (China, Japan, and India) are all investing heavily in R&D and commercialization of printed electronics technologies. Technological advancements in specific areas, such as flexible displays, sensors, wearables, etc. has also driven uptick in use of printed electronics products in commercial applications including consumer electronics, automotive, healthcare, and packaging. Government support, from favorable policies, R&D tax credits and operational scale as well as community enablement all contribute to an environment ready for innovation and scaling of printed electronics technologies. All of these factors contributes to APAC predominating in as much as being the leading region in share of market in the global printed electronics marketplace as well as great opportunities in the future as an investment opportunity for all players in the sector.

Several companies engaged in the printed electronic industry for broadening their process technique to include flexible consumer electronics, low production cost, eco-friendly application by using paper, plastic, and textile.

Molex, LLC, BASF, Nissha Co., Samsung Display, LG Display Co., Ltd., NovaCentrix, E Ink Holdings Inc., Agfa-Gevaert Group, Palo Alto Research Center Incorporated (PARC), DuPont de Nemours Inc. are some of the leading players operating in the global printed electronics market.

Each of these players has been profiled in the printed electronics market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

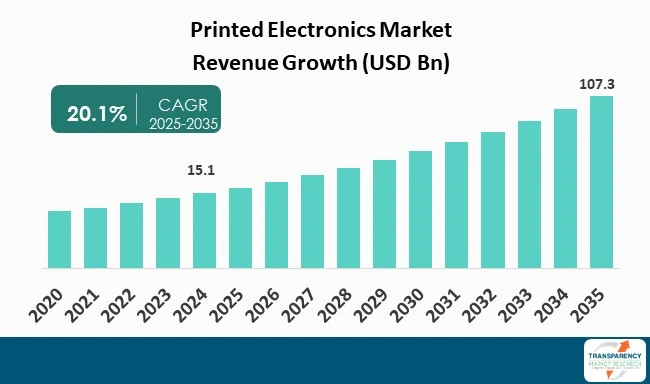

| Size in 2024 | US$ 15.1 Bn |

| Forecast Value in 2035 | US$ 107.3 Bn |

| CAGR | 20.1% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020–2023 |

| Quantitative Units | US$ Bn |

| Printed Electronics Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Technology

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global printed electronics market was valued at US$ 15.1 Bn in 2024

The global printed electronics industry is projected to reach more than US$ 107.3 Bn by 2035

Increasing demand for flexible consumer electronics, Cost effectiveness and save material waste with environment friendly approach are some of the factors driving the expansion of printed electronic market.

The CAGR is anticipated to be 20.1% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

Molex, LLC, BASF, Nissha Co., Samsung Display, LG Display Co., Ltd., NovaCentrix, E Ink Holdings Inc., Agfa-Gevaert Group, Palo Alto Research Center Incorporated (PARC), and DuPont de Nemours Inc. among others

Table 01: Global Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 02: Global Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 03: Global Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 04: Global Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 05: Global Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 06: North America Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 07: North America Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 08: North America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 09: North America Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 10: North America Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 11: U.S. Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 12: U.S. Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 13: U.S. Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 14: U.S. Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 15: Canada Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 16: Canada Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 17: Canada Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 18: Canada Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 19: Europe Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 20: Europe Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 21: Europe Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 22: Europe Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 23: Europe Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 24: Germany Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 25: Germany Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 26: Germany Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27: Germany Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 28: U.K. Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 29: U.K. Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 30: U.K. Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 31: U.K. Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 32: France Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 33: France Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 34: France Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 35: France Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 36: Italy Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 37: Italy Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 38: Italy Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 39: Italy Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 40: Spain Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 41: Spain Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 42: Spain Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43: Spain Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 44: Switzerland Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 45: Switzerland Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 46: Switzerland Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 47: Switzerland Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 48: The Netherlands Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 49: The Netherlands Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 50: The Netherlands Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 51: The Netherlands Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 52: Rest of Europe Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 53: Rest of Europe Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 54: Rest of Europe Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 55: Rest of Europe Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 56: Asia Pacific Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 57: Asia Pacific Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 58: Asia Pacific Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 59: Asia Pacific Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 60: Asia Pacific Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 61: China Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 62: China Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 63: China Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 64: China Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 65: Japan Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 66: Japan Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 67: Japan Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 68: Japan Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 69: India Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 70: India Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 71: India Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 72: India Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 73: South Korea Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 74: South Korea Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 75: South Korea Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 76: South Korea Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 77: Australia and New Zealand Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 78: Australia and New Zealand Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 79: Australia and New Zealand Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 80: Australia and New Zealand Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 81: Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 82: Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 83: Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 84: Rest of Asia Pacific Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 85: Latin America Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 86: Latin America Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 87: Latin America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 88: Latin America Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 89: Latin America Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 90: Brazil Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 91: Brazil Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 92: Brazil Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93: Brazil Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 94: Mexico Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 95: Mexico Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 96: Mexico Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 97: Mexico Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 98: Argentina Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 99: Argentina Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 100: Argentina Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 101: Argentina Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 102: Rest of Latin America Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 103: Rest of Latin America Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 104: Rest of Latin America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105: Rest of Latin America Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 106: Middle East and Africa Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 107: Middle East and Africa Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 108: Middle East and Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 109: Middle East and Africa Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 110: Middle East and Africa Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 111: GCC Countries Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 112: GCC Countries Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 113: GCC Countries Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 114: GCC Countries Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 115: South Africa Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 116: South Africa Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 117: South Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 118: South Africa Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 119: Rest of Middle East and Africa Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 120: Rest of Middle East and Africa Market Value (US$ Bn) Forecast, by Material, 2020 to 2035

Table 121: Rest of Middle East and Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 122: Rest of Middle East and Africa Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Market Value Share Analysis, by Technology, 2024 and 2035

Figure 03: Global Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 04: Global Market Revenue (US$ Bn), by Inkjet Printing, 2020 to 2035

Figure 05: Global Market Revenue (US$ Bn), by Screen Printing, 2020 to 2035

Figure 06: Global Market Revenue (US$ Bn), by Flexography Printing, 2020 to 2035

Figure 07: Global Market Revenue (US$ Bn), by Offset Printing, 2020 to 2035

Figure 08: Global Market Revenue (US$ Bn), by Gravure Printing, 2020 to 2035

Figure 09: Global Market Value Share Analysis, by Material, 2024 and 2035

Figure 10: Global Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 11: Global Market Revenue (US$ Bn), by Ink, 2020 to 2035

Figure 12: Global Market Revenue (US$ Bn), by Substrates, 2020 to 2035

Figure 13: Global Market Value Share Analysis, by Application, 2024 and 2035

Figure 14: Global Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 15: Global Market Revenue (US$ Bn), by Display, 2020 to 2035

Figure 16: Global Market Revenue (US$ Bn), by Photovoltaic, 2020 to 2035

Figure 17: Global Market Revenue (US$ Bn), by Lighting, 2020 to 2035

Figure 18: Global Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 19: Global Market Value Share Analysis, by End-user, 2024 and 2035

Figure 20: Global Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 21: Global Market Revenue (US$ Bn), by Automotive, 2020 to 2035

Figure 22: Global Market Revenue (US$ Bn), by Transportation, 2020 to 2035

Figure 23: Global Market Revenue (US$ Bn), by Consumer Electronics, 2020 to 2035

Figure 24: Global Market Revenue (US$ Bn), by Healthcare, 2020 to 2035

Figure 25: Global Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 26: Global Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 27: North America Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: North America Market Value Share Analysis, by Technology, 2024 and 2035

Figure 29: North America Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 30: North America Market Value Share Analysis, by Material, 2024 and 2035

Figure 31: North America Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 32: North America Market Value Share Analysis, by Application, 2024 and 2035

Figure 33: North America Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 34: North America Market Value Share Analysis, by End-user, 2024 and 2035

Figure 35: North America Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 36: North America Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 37: North America Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 38: U.S. Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: U.S. Market Value Share Analysis, by Technology, 2024 and 2035

Figure 40: U.S. Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 41: U.S. Market Value Share Analysis, by Material, 2024 and 2035

Figure 42: U.S. Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 43: U.S. Market Value Share Analysis, by Application, 2024 and 2035

Figure 44: U.S. Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 45: U.S. Market Value Share Analysis, by End-user, 2024 and 2035

Figure 46: U.S. Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 47: Canada Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Canada Market Value Share Analysis, by Technology, 2024 and 2035

Figure 49: Canada Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 50: Canada Market Value Share Analysis, by Material, 2024 and 2035

Figure 51: Canada Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 52: Canada Market Value Share Analysis, by Application, 2024 and 2035

Figure 53: Canada Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 54: Canada Market Value Share Analysis, by End-user, 2024 and 2035

Figure 55: Canada Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 56: Europe Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Europe Market Value Share Analysis, by Technology, 2024 and 2035

Figure 58: Europe Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 59: Europe Market Value Share Analysis, by Material, 2024 and 2035

Figure 60: Europe Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 61: Europe Market Value Share Analysis, by Application, 2024 and 2035

Figure 62: Europe Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 63: Europe Market Value Share Analysis, by End-user, 2024 and 2035

Figure 64: Europe Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 65: Europe Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 66: Europe Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 67: Germany Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 68: Germany Market Value Share Analysis, by Technology, 2024 and 2035

Figure 69: Germany Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 70: Germany Market Value Share Analysis, by Material, 2024 and 2035

Figure 71: Germany Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 72: Germany Market Value Share Analysis, by Application, 2024 and 2035

Figure 73: Germany Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 74: Germany Market Value Share Analysis, by End-user, 2024 and 2035

Figure 75: Germany Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 76: U.K. Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 77: U.K. Market Value Share Analysis, by Technology, 2024 and 2035

Figure 78: U.K. Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 79: U.K. Market Value Share Analysis, by Material, 2024 and 2035

Figure 80: U.K. Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 81: U.K. Market Value Share Analysis, by Application, 2024 and 2035

Figure 82: U.K. Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 83: U.K. Market Value Share Analysis, by End-user, 2024 and 2035

Figure 84: U.K. Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 85: France Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 86: France Market Value Share Analysis, by Technology, 2024 and 2035

Figure 87: France Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 88: France Market Value Share Analysis, by Material, 2024 and 2035

Figure 89: France Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 90: France Market Value Share Analysis, by Application, 2024 and 2035

Figure 91: France Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 92: France Market Value Share Analysis, by End-user, 2024 and 2035

Figure 93: France Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 94: Italy Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 95: Italy Market Value Share Analysis, by Technology, 2024 and 2035

Figure 96: Italy Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 97: Italy Market Value Share Analysis, by Material, 2024 and 2035

Figure 98: Italy Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 99: Italy Market Value Share Analysis, by Application, 2024 and 2035

Figure 100: Italy Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 101: Italy Market Value Share Analysis, by End-user, 2024 and 2035

Figure 102: Italy Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 103: Spain Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 104: Spain Market Value Share Analysis, by Technology, 2024 and 2035

Figure 105: Spain Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 106: Spain Market Value Share Analysis, by Material, 2024 and 2035

Figure 107: Spain Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 108: Spain Market Value Share Analysis, by Application, 2024 and 2035

Figure 109: Spain Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 110: Spain Market Value Share Analysis, by End-user, 2024 and 2035

Figure 111: Spain Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 112: Switzerland Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 113: Switzerland Market Value Share Analysis, by Technology, 2024 and 2035

Figure 114: Switzerland Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 115: Switzerland Market Value Share Analysis, by Material, 2024 and 2035

Figure 116: Switzerland Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 117: Switzerland Market Value Share Analysis, by Application, 2024 and 2035

Figure 118: Switzerland Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 119: Switzerland Market Value Share Analysis, by End-user, 2024 and 2035

Figure 120: Switzerland Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 121: The Netherlands Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 122: The Netherlands Market Value Share Analysis, by Technology, 2024 and 2035

Figure 123: The Netherlands Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 124: The Netherlands Market Value Share Analysis, by Material, 2024 and 2035

Figure 125: The Netherlands Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 126: The Netherlands Market Value Share Analysis, by Application, 2024 and 2035

Figure 127: The Netherlands Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 128: The Netherlands Market Value Share Analysis, by End-user, 2024 and 2035

Figure 129: The Netherlands Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 130: Rest of Europe Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 131: Rest of Europe Market Value Share Analysis, by Technology, 2024 and 2035

Figure 132: Rest of Europe Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 133: Rest of Europe Market Value Share Analysis, by Material, 2024 and 2035

Figure 134: Rest of Europe Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 135: Rest of Europe Market Value Share Analysis, by Application, 2024 and 2035

Figure 136: Rest of Europe Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 137: Rest of Europe Market Value Share Analysis, by End-user, 2024 and 2035

Figure 138: Rest of Europe Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 139: Asia Pacific Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 140: Asia Pacific Market Value Share Analysis, by Technology, 2024 and 2035

Figure 141: Asia Pacific Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 142: Asia Pacific Market Value Share Analysis, by Material, 2024 and 2035

Figure 143: Asia Pacific Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 144: Asia Pacific Market Value Share Analysis, by Application, 2024 and 2035

Figure 145: Asia Pacific Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 146: Asia Pacific Market Value Share Analysis, by End-user, 2024 and 2035

Figure 147: Asia Pacific Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 148: Asia Pacific Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 149: Asia Pacific Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 150: China Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 151: China Market Value Share Analysis, by Technology, 2024 and 2035

Figure 152: China Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 153: China Market Value Share Analysis, by Material, 2024 and 2035

Figure 154: China Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 155: China Market Value Share Analysis, by Application, 2024 and 2035

Figure 156: China Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 157: China Market Value Share Analysis, by End-user, 2024 and 2035

Figure 158: China Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 159: Japan Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 160: Japan Market Value Share Analysis, by Technology, 2024 and 2035

Figure 161: Japan Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 162: Japan Market Value Share Analysis, by Material, 2024 and 2035

Figure 163: Japan Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 164: Japan Market Value Share Analysis, by Application, 2024 and 2035

Figure 165: Japan Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 166: Japan Market Value Share Analysis, by End-user, 2024 and 2035

Figure 167: Japan Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 168: India Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 169: India Market Value Share Analysis, by Technology, 2024 and 2035

Figure 170: India Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 171: India Market Value Share Analysis, by Material, 2024 and 2035

Figure 172: India Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 173: India Market Value Share Analysis, by Application, 2024 and 2035

Figure 174: India Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 175: India Market Value Share Analysis, by End-user, 2024 and 2035

Figure 176: India Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 177: South Korea Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 178: South Korea Market Value Share Analysis, by Technology, 2024 and 2035

Figure 179: South Korea Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 180: South Korea Market Value Share Analysis, by Material, 2024 and 2035

Figure 181: South Korea Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 182: South Korea Market Value Share Analysis, by Application, 2024 and 2035

Figure 183: South Korea Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 184: South Korea Market Value Share Analysis, by End-user, 2024 and 2035

Figure 185: South Korea Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 186: Australia and New Zealand Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 187: Australia and New Zealand Market Value Share Analysis, by Technology, 2024 and 2035

Figure 188: Australia and New Zealand Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 189: Australia and New Zealand Market Value Share Analysis, by Material, 2024 and 2035

Figure 190: Australia and New Zealand Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 191: Australia and New Zealand Market Value Share Analysis, by Application, 2024 and 2035

Figure 192: Australia and New Zealand Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 193: Australia and New Zealand Market Value Share Analysis, by End-user, 2024 and 2035

Figure 194: Australia and New Zealand Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 195: Rest of Asia Pacific Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 196: Rest of Asia Pacific Market Value Share Analysis, by Technology, 2024 and 2035

Figure 197: Rest of Asia Pacific Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 198: Rest of Asia Pacific Market Value Share Analysis, by Material, 2024 and 2035

Figure 199: Rest of Asia Pacific Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 200: Rest of Asia Pacific Market Value Share Analysis, by Application, 2024 and 2035

Figure 201: Rest of Asia Pacific Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 202: Rest of Asia Pacific Market Value Share Analysis, by End-user, 2024 and 2035

Figure 203: Rest of Asia Pacific Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 204: Latin America Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 205: Latin America Market Value Share Analysis, by Technology, 2024 and 2035

Figure 206: Latin America Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 207: Latin America Market Value Share Analysis, by Material, 2024 and 2035

Figure 208: Latin America Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 209: Latin America Market Value Share Analysis, by Application, 2024 and 2035

Figure 210: Latin America Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 211: Latin America Market Value Share Analysis, by End-user, 2024 and 2035

Figure 212: Latin America Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 213: Latin America Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 214: Latin America Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 215: Brazil Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 216: Brazil Market Value Share Analysis, by Technology, 2024 and 2035

Figure 217: Brazil Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 218: Brazil Market Value Share Analysis, by Material, 2024 and 2035

Figure 219: Brazil Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 220: Brazil Market Value Share Analysis, by Application, 2024 and 2035

Figure 221: Brazil Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 222: Brazil Market Value Share Analysis, by End-user, 2024 and 2035

Figure 223: Brazil Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 224: Mexico Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 225: Mexico Market Value Share Analysis, by Technology, 2024 and 2035

Figure 226: Mexico Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 227: Mexico Market Value Share Analysis, by Material, 2024 and 2035

Figure 228: Mexico Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 229: Mexico Market Value Share Analysis, by Application, 2024 and 2035

Figure 230: Mexico Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 231: Mexico Market Value Share Analysis, by End-user, 2024 and 2035

Figure 232: Mexico Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 233: Argentina Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 234: Argentina Market Value Share Analysis, by Technology, 2024 and 2035

Figure 235: Argentina Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 236: Argentina Market Value Share Analysis, by Material, 2024 and 2035

Figure 237: Argentina Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 238: Argentina Market Value Share Analysis, by Application, 2024 and 2035

Figure 239: Argentina Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 240: Argentina Market Value Share Analysis, by End-user, 2024 and 2035

Figure 241: Argentina Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 242: Rest of Latin America Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 243: Rest of Latin America Market Value Share Analysis, by Technology, 2024 and 2035

Figure 244: Rest of Latin America Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 245: Rest of Latin America Market Value Share Analysis, by Material, 2024 and 2035

Figure 246: Rest of Latin America Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 247: Rest of Latin America Market Value Share Analysis, by Application, 2024 and 2035

Figure 248: Rest of Latin America Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 249: Rest of Latin America Market Value Share Analysis, by End-user, 2024 and 2035

Figure 250: Rest of Latin America Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 251: Middle East and Africa Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 252: Middle East and Africa Market Value Share Analysis, by Technology, 2024 and 2035

Figure 253: Middle East and Africa Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 254: Middle East and Africa Market Value Share Analysis, by Material, 2024 and 2035

Figure 255: Middle East and Africa Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 256: Middle East and Africa Market Value Share Analysis, by Application, 2024 and 2035

Figure 257: Middle East and Africa Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 258: Middle East and Africa Market Value Share Analysis, by End-user, 2024 and 2035

Figure 259: Middle East and Africa Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 260: Middle East and Africa Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 261: Middle East and Africa Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 262: GCC Countries Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 263: GCC Countries Market Value Share Analysis, by Technology, 2024 and 2035

Figure 264: GCC Countries Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 265: GCC Countries Market Value Share Analysis, by Material, 2024 and 2035

Figure 266: GCC Countries Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 267: GCC Countries Market Value Share Analysis, by Application, 2024 and 2035

Figure 268: GCC Countries Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 269: GCC Countries Market Value Share Analysis, by End-user, 2024 and 2035

Figure 270: GCC Countries Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 271: South Africa Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 272: South Africa Market Value Share Analysis, by Technology, 2024 and 2035

Figure 273: South Africa Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 274: South Africa Market Value Share Analysis, by Material, 2024 and 2035

Figure 275: South Africa Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 276: South Africa Market Value Share Analysis, by Application, 2024 and 2035

Figure 277: South Africa Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 278: South Africa Market Value Share Analysis, by End-user, 2024 and 2035

Figure 279: South Africa Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 280: Rest of Middle East and Africa Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 281: Rest of Middle East and Africa Market Value Share Analysis, by Technology, 2024 and 2035

Figure 282: Rest of Middle East and Africa Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 283: Rest of Middle East and Africa Market Value Share Analysis, by Material, 2024 and 2035

Figure 284: Rest of Middle East and Africa Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 285: Rest of Middle East and Africa Market Value Share Analysis, by Application, 2024 and 2035

Figure 286: Rest of Middle East and Africa Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 287: Rest of Middle East and Africa Market Value Share Analysis, by End-user, 2024 and 2035

Figure 288: Rest of Middle East and Africa Market Attractiveness Analysis, by End-user, 2025 to 2035