Reports

Reports

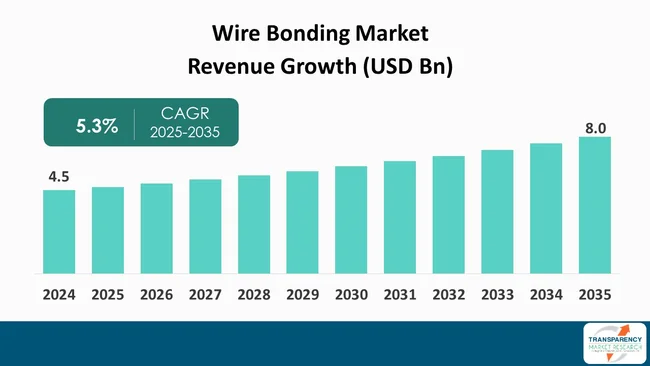

The global wire bonding market size was valued at US$ 4.5 Bn in 2024 and is projected to reach US$ 8.0 Bn by 2035, expanding at a CAGR of 5.3% from 2025 to 2035. The wire bonding industry experiences growth due to increasing semiconductor requirements for consumer electronics, automotive systems, and connected devices. The need for compact high-density components and better chip packaging solutions drives ongoing expansion in wire bonding technology adoption.

The global wire bonding market continues to show stable growth as semiconductors remain essential for consumer electronics, automotive systems, and telecommunications. Packaging technology advancements together with the industry drive for smaller yet more powerful chips maintain wire bonding as an affordable and dependable method for electrical connections. The adoption speed of advanced therapies depends on how pricing systems and reimbursement framework will evolve. The market's long-term prospects will become stronger through ongoing clinical research investment, which will result in new treatment options, and better patient results.

The semiconductor industry continues to use wire bonding as its main packaging solution because manufacturing facilities keep growing and investing in their operations. Wire bonding technologies are set for a prolonged growth period due to the rising production volumes in the Asia-Pacific region and the enlarged fabrication capacities globally.

Wire bonders will continue to lead due to their proven reliability and cost efficiency in high-volume production. The segment will maintain its competitive edge in advanced semiconductor packaging through continuous developments in automation, and fine-pitch bonding technologies.

The wire bonding market functions as a vital portion of semiconductor assembly operations as it stands as a primary technique for establishing electrical connections between integrated circuits and their packaging components. The manufacturing of consumer electronics, automotive electronics, telecommunications equipment, and industrial systems depends on this essential component.

Devices have become more compact while gaining increased power and complexity, so wire bonding remains essential as it delivers dependable performance at an affordable price, and works with multiple chip designs, and materials. The market maintains its significance because worldwide demand for advanced semiconductor components keeps growing.

Its widespread use across both developed and emerging packaging technologies further reinforces its position within semiconductor manufacturing. The market development and future expansion of the industry depend on continuous material improvements, automated systems, and high-density bonding methods.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The demand for advanced wire bonding solutions has increased as devices such as smartphones, wearables, and compact IoT products require both compact and more powerful components. The industry needs advanced wire bonding solutions to meet this demand as smartphones, wearables, and compact IoT products need both miniaturized parts and enhanced performance

The trend leads to the deployment of thinner wires and closer bond pitches, and advanced bonding techniques which enable the construction of 3D ICs and system-in-package designs. The shrinking size of electronic products together with increasing performance requirements makes wire bonding essential for creating dependable high-density connections.

These advancements allow manufacturers to integrate more functionality into limited space without compromising reliability or efficiency. The ongoing trend of producing small electronic devices with multiple functions keeps driving the use of fine-pitch, and advanced wire bonding methods. For instance, the European Union established the Chips Act regulation to create a unified policy that strengthens semiconductor supply chain resilience through investment attraction, research enhancement, and member state capacity development for advanced packaging and assembly.

The rapid growth of new technologies including IoT, 5G, and electric vehicles demands advanced semiconductor packaging solutions for complex and efficient operation. Connected devices need small power-efficient chips but 5G networks require high-performance components that operate at high frequencies through modern interconnection systems.

Electric vehicles create additional strain as they require stable power systems that deliver both high energy capacity and advanced control electronics. The combination of these technologies leads to widespread use of advanced packaging methods, which deliver enhanced functionality and durability, and superior performance within restricted space constraints.

The shift accelerates the development of advanced bonding methods which need to handle elevated thermal, electrical, and power levels. The growing global adoption and government investment for these technologies has created an increasing need for sophisticated semiconductor packaging solutions. For instance, the European Commission approved $672 million from the German government to build two semiconductor manufacturing plants, which will enhance the local chip manufacturing.

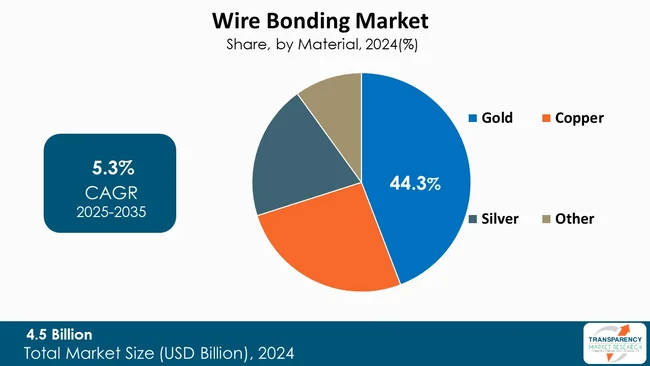

The gold segment leads the wire bonding market with 44.3% global share as it provides exceptional reliability, excellent electrical conductivity, and strong resistance to corrosion. These features make gold the ideal choice for high-performance and mission-critical semiconductor applications.

The established manufacturing ecosystem with consistent bonding quality and proven long-term performance across automotive, aerospace, and advanced electronics keeps the product at the top of the market. The Gold segment also benefits from strong adoption in fine-pitch and complex packaging technologies, where process stability is critical. Manufacturers choose gold as their preferred material because it delivers superior defect rates and high production yields, even though its material costs remain elevated.

The system operates at steady production efficiency as it works with advanced bonding equipment and mature supply chains. Stringent quality and reliability requirements in premium semiconductor applications continue to favor gold wire bonding. The technology maintains steady production performance through its compatibility with advanced bonding equipment and mature supply chains. Premium semiconductor applications require gold wire bonding because it meets their strict quality and reliability standards.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia-Pacific region leads the global wire bonding market with 51.0% share, as major semiconductor manufacturing centers exist in China, Taiwan, South Korea, and Japan. The region's production of consumer electronics, automotive electronics, and communication devices at high levels drives the need for wire bonding solutions. The Asia-Pacific region leads the market due to supportive government initiatives, robust infrastructure, and an increasing number of foundries and OSAT (Outsourced Semiconductor Assembly and Test) facilities.

Moreover, the market growth receives continuous support from rapid industrialization and the expanding semiconductor fabrication capacities in the region. Leading electronics manufacturers who operate in Asia-Pacific maintain a continuous need for advanced wire bonding technologies as they need to meet the growing demand for their products.

The region establishes its market leadership through research and development investments that focus on developing miniaturized, high-density packaging solutions. The Asia-Pacific region maintains its leadership in wire bonding through local businesses that form strategic partnerships with international technology organizations.

ASMPT, Kulicke and Soffa Industries, Inc., Besi, Palomar Technologies, Heraeus Electronics, TANAKA PRECIOUS METAL GROUP Co., Ltd., Hesse GmbH, Microchip Technology Inc., AMETEK, Inc., MKE.CO.KRALL, F & K DELVOTEC Bondtechnik GmbH, WestBond, Inc., Hybond, are some of the leading manufacturers operating in the global wire bonding market.

Each of these companies has been profiled in the Wire Bonding industry report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 4.5 Bn |

| Forecast Value in 2035 | US$ 8.0 Bn |

| CAGR | 5.3 % |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020–2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Device Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global wind bonding market was valued at US$ 4.5 Bn in 2024

The global wind bonding industry is projected to reach more than US$ 8.0 Bn by the end of 2035

Miniaturization & high-density packaging and emerging technologies (IoT, 5G, EVs) are some of the factors driving the expansion of wind bonding market.

The CAGR is anticipated to be 5.3 % from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

ASMPT, Kulicke and Soffa Industries, Inc., Besi, Palomar Technologies, Heraeus Electronics, TANAKA PRECIOUS METAL GROUP Co., Ltd., Hesse GmbH, Microchip Technology Inc., AMETEK, Inc., MKE.CO.KRALL, F & K DELVOTEC Bondtechnik GmbH, WestBond, Inc., Hybond, and other prominent players.

Table 01: Global Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 02: Global Wire Bonding Market Value & Volume (US$ Bn) Forecast, By Bonding Type, 2020 to 2035

Table 03: Global Wire Bonding Market Value & Volume (US$ Bn) Forecast, By Material, 2020 to 2035

Table 04: Global Wire Bonding Market Value & Volume (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Wire Bonding Market Value & Volume (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 08: North America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 09: North America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 10: North America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 11: U.S. Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 12: U.S. Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 13: U.S. Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 14: U.S. Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 15: Canada Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 16: Canada Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 17: Canada Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 18: Canada Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 19: Europe Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 20: Europe Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 21: Europe Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 22: Europe Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 23: Europe Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 24: Germany Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 25: Germany Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 26: Germany Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 27: Germany Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 28: U.K. Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 29: U.K. Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 30: U.K. Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 31: U.K. Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 32: France Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 33: France Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 34: France Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 35: France Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 36: Italy Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 37: Italy Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 38: Italy Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 39: Italy Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 40: Spain Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 41: Spain Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 42: Spain Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 43: Spain Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 44: The Netherlands Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 45: The Netherlands Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 46: The Netherlands Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 47: The Netherlands Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 48: Rest of Europe Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 49: Rest of Europe Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 50: Rest of Europe Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 51: Rest of Europe Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 52: Asia Pacific Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 53: Asia Pacific Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 54: Asia Pacific Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 55: Asia Pacific Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 56: Asia Pacific Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 57: China Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 58: China Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 59: China Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 60: China Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 61: India Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 62: India Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 63: India Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 64: India Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 65: Japan Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 66: Japan Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 67: Japan Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 68: Japan Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 69: South Korea Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 70: South Korea Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 71: South Korea Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 72: South Korea Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 73: Australia Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 74: Australia Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 75: Australia Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 76: Australia Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 77: ASEAN Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 78: ASEAN Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 79: ASEAN Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 80: ASEAN Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 81: Rest of Asia Pacific Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 82: Rest of Asia Pacific Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 83: Rest of Asia Pacific Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 84: Rest of Asia Pacific Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 85: Latin America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 86: Latin America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 87: Latin America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 88: Latin America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 89: Latin America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 90: Brazil Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 91: Brazil Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 92: Brazil Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 93: Brazil Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 94: Mexico Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 95: Mexico Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 96: Mexico Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 97: Mexico Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 98: Argentina Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 99: Argentina Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 100: Argentina Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 101: Argentina Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 102: Rest of Latin America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 103: Rest of Latin America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 104: Rest of Latin America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 105: Rest of Latin America Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 106: Middle East and Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 107: Middle East and Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 108: Middle East and Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 109: Middle East and Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 110: Middle East and Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 111: GCC Countries Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 112: GCC Countries Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 113: GCC Countries Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 114: GCC Countries Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 115: South Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 116: South Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 117: South Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 118: South Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 119: Rest of Middle East & Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Device Type, 2020 to 2035

Table 120: Rest of Middle East & Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Bonding Type, 2020 to 2035

Table 121: Rest of Middle East & Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, by Material, 2020 to 2035

Table 122: Rest of Middle East & Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 02: Global Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 03: Global Wire Bonding Market Revenue (US$ Bn), by Wire Bonder, 2020 to 2035

Figure 04: Global Wire Bonding Market Revenue (US$ Bn), by Die Bonder, 2020 to 2035

Figure 05: Global Wire Bonding Market Revenue (US$ Bn), by Eutectic Bonder, 2020 to 2035

Figure 06: Global Wire Bonding Market Value & Volume Share Analysis, by Bonding Type, 2024 and 2035

Figure 07: Global Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 08: Global Wire Bonding Market Revenue (US$ Bn), by Ball Bonding, 2020 to 2035

Figure 09: Global Wire Bonding Market Revenue (US$ Bn), by Ultrasonic Bonding, 2020 to 2035

Figure 10: Global Wire Bonding Market Revenue (US$ Bn), by Wedge Bonding, 2020 to 2035

Figure 11: Global Wire Bonding Market Revenue (US$ Bn), by Thermocompression Bonding, 2020 to 2035

Figure 12: Global Wire Bonding Market Value & Volume Share Analysis, by Material, 2024 and 2035

Figure 13: Global Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 14: Global Wire Bonding Market Revenue (US$ Bn), by Gold, 2020 to 2035

Figure 15: Global Wire Bonding Market Revenue (US$ Bn), by Copper, 2020 to 2035

Figure 16: Global Wire Bonding Market Revenue (US$ Bn), by Silver, 2020 to 2035

Figure 17: Global Wire Bonding Market Revenue (US$ Bn), by Aluminum, 2020 to 2035

Figure 18: Global Wire Bonding Market Revenue (US$ Bn), by Other, 2020 to 2035

Figure 19: Global Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 20: Global Wire Bonding Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 21: Global Wire Bonding Market Revenue (US$ Bn), by Semiconductor, 2025 to 2035

Figure 22: Global Wire Bonding Market Revenue (US$ Bn), by Automotive, 2020 to 2035

Figure 23: Global Wire Bonding Market Revenue (US$ Bn), by Telecommunication, 2020 to 2035

Figure 24: Global Wire Bonding Market Revenue (US$ Bn), by Consumer Electronics, 2020 to 2035

Figure 25: Global Wire Bonding Market Revenue (US$ Bn), by Other, 2020 to 2035

Figure 26: Global Wire Bonding Market Value & Volume Share Analysis, By Region, 2024 and 2035

Figure 27: Global Wire Bonding Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 28: North America Wire Bonding Market Value & Volume (US$ Bn) Forecast, 2020 to 2035

Figure 29: North America Wire Bonding Market Value & Volume Share Analysis, by Country, 2024 and 2035

Figure 30: North America Wire Bonding Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 31: North America Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 32: North America Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 33: North America Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 34: North America Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 35: North America Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 36: North America Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 37: North America Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 38: North America Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 39: U.S. Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 40: U.S. Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 41: U.S. Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 42: U.S. Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 43: U.S. Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 44: U.S. Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 45: U.S. Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 46: U.S. Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 47: Canada Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 48: Canada Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 49: Canada Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 50: Canada Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 51: Canada Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 52: Canada Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 53: Canada Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 54: Canada Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 55: Europe Wire Bonding Market Value & Volume (US$ Bn) Forecast, 2020 to 2035

Figure 56: Europe Wire Bonding Market Value & Volume Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 57: Europe Wire Bonding Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 58: Europe Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 59: Europe Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 60: Europe Wire Bonding Market Value & Volume Share Analysis, by Bonding Type, 2024 and 2035

Figure 61: Europe Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 62: Europe Wire Bonding Market Value & Volume Share Analysis, By Material, 2024 and 2035

Figure 63: Europe Wire Bonding Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 64: Europe Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 65: Europe Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 66: Germany Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 67: Germany Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 68: Germany Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 69: Germany Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 70: Germany Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 71: Germany Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 72: Germany Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 73: Germany Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 74: U.K. Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 75: U.K. Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 76: U.K. Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 77: U.K. Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 78: U.K. Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 79: U.K. Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 80: U.K. Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 81: U.K. Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 82: France Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 83: France Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 84: France Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 85: France Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 86: France Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 87: France Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 88: France Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 89: France Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 90: Italy Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 91: Italy Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 92: Italy Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 93: Italy Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 94: Italy Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 95: Italy Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 96: Italy Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 97: Italy Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 98: Spain Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 99: Spain Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 100: Spain Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 101: Spain Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 102: Spain Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 103: Spain Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 104: Spain Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 105: Spain Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 106: The Netherlands Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 107: The Netherlands Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 108: The Netherlands Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 109: The Netherlands Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 110: The Netherlands Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 111: The Netherlands Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 112: The Netherlands Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 113: The Netherlands Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 114: Rest of Europe Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 115: Rest of Europe Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 116: Rest of Europe Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 117: Rest of Europe Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 118: Rest of Europe Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 119: Rest of Europe Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 120: Rest of Europe Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 121: Rest of Europe Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 122: Asia Pacific Wire Bonding Market Value & Volume (US$ Bn) Forecast, 2020 to 2035

Figure 123: Asia Pacific Wire Bonding Market Value & Volume Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 124: Asia Pacific Wire Bonding Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 125: Asia Pacific Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 126: Asia Pacific Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 127: Asia Pacific Wire Bonding Market Value & Volume Share Analysis, by Bonding Type, 2024 and 2035

Figure 128: Asia Pacific Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 129: Asia Pacific Wire Bonding Market Value & Volume Share Analysis, By Material, 2024 and 2035

Figure 130: Asia Pacific Wire Bonding Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 131: Asia Pacific Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 132: Asia Pacific Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 133: China Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 134: China Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 135: China Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 136: China Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 137: China Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 138: China Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 139: China Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 140: China Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 141: India Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 142: India Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 143: India Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 144: India Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 145: India Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 146: India Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 147: India Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 148: India Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 149: Japan Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 150: Japan Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 151: Japan Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 152: Japan Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 153: Japan Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 154: Japan Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 155: Japan Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 156: Japan Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 157: South Korea Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 158: South Korea Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 159: South Korea Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 160: South Korea Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 161: South Korea Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 162: South Korea Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 163: South Korea Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 164: South Korea Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 165: Australia Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 166: Australia Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 167: Australia Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 168: Australia Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 169: Australia Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 170: Australia Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 171: Australia Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 172: Australia Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 173: ASEAN Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 174: ASEAN Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 175: ASEAN Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 176: ASEAN Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 177: ASEAN Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 178: ASEAN Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 179: ASEAN Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 180: ASEAN Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 181: Rest of Asia Pacific Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 182: Rest of Asia Pacific Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 183: Rest of Asia Pacific Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 184: Rest of Asia Pacific Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 185: Rest of Asia Pacific Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 186: Rest of Asia Pacific Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 187: Rest of Asia Pacific Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 188: Rest of Asia Pacific Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 189: Latin America Wire Bonding Market Value & Volume (US$ Bn) Forecast, 2020 to 2035

Figure 190: Latin America Wire Bonding Market Value & Volume Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 191: Latin America Wire Bonding Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 192: Latin America Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 193: Latin America Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 194: Latin America Wire Bonding Market Value & Volume Share Analysis, by Bonding Type, 2024 and 2035

Figure 195: Latin America Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 196: Latin America Wire Bonding Market Value & Volume Share Analysis, By Material, 2024 and 2035

Figure 197: Latin America Wire Bonding Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 198: Latin America Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 199: Latin America Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 200: Brazil Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 201: Brazil Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 202: Brazil Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 203: Brazil Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 204: Brazil Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 205: Brazil Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 206: Brazil Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 207: Brazil Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 208: Mexico Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 209: Mexico Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 210: Mexico Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 211: Mexico Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 212: Mexico Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 213: Mexico Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 214: Mexico Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 215: Mexico Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 216: Argentina Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 217: Argentina Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 218: Argentina Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 219: Argentina Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 220: Argentina Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 221: Argentina Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 222: Argentina Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 223: Argentina Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 224: Rest of Latin America Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 225: Rest of Latin America Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 226: Rest of Latin America Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 227: Rest of Latin America Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 228: Rest of Latin America Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 229: Rest of Latin America Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 230: Rest of Latin America Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 231: Rest of Latin America Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 232: Middle East and Africa Wire Bonding Market Value & Volume (US$ Bn) Forecast, 2020 to 2035

Figure 233: Middle East and Africa Wire Bonding Market Value & Volume Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 234: Middle East and Africa Wire Bonding Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 235: Middle East and Africa Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 236: Middle East and Africa Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 237: Middle East and Africa Wire Bonding Market Value & Volume Share Analysis, by Bonding Type, 2024 and 2035

Figure 238: Middle East and Africa Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 239: Middle East and Africa Wire Bonding Market Value & Volume Share Analysis, by Material, 2024 and 2035

Figure 240: Middle East and Africa Wire Bonding Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 241: Middle East and Africa Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 242: Middle East and Africa Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 243: GCC Countries Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 244: GCC Countries Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 245: GCC Countries Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 246: GCC Countries Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 247: GCC Countries Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 248: GCC Countries Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 249: GCC Countries Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 250: GCC Countries Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 251: South Africa Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 252: South Africa Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 253: South Africa Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 254: South Africa Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 255: South Africa Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 256: South Africa Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 257: South Africa Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 258: South Africa Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 259: Rest of Middle East & Africa Wire Bonding Market Value & Volume Share Analysis, by Device Type, 2024 and 2035

Figure 260: Rest of Middle East & Africa Wire Bonding Market Attractiveness Analysis, by Device Type, 2025 to 2035

Figure 261: Rest of Middle East & Africa Wire Bonding Value Share Analysis, by Bonding Type, 2025 to 2035

Figure 262: Rest of Middle East & Africa Wire Bonding Market Attractiveness Analysis, by Bonding Type, 2025 to 2035

Figure 263: Rest of Middle East & Africa Wire Bonding Market Value & Volume Share Analysis, by Material, 2025 to 2035

Figure 264: Rest of Middle East & Africa Wire Bonding Market Attractiveness Analysis, by Material, 2025 to 2035

Figure 265: Rest of Middle East & Africa Wire Bonding Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 266: Rest of Middle East & Africa Wire Bonding Market Attractiveness Analysis, by End-user, 2025 to 2035