Reports

Reports

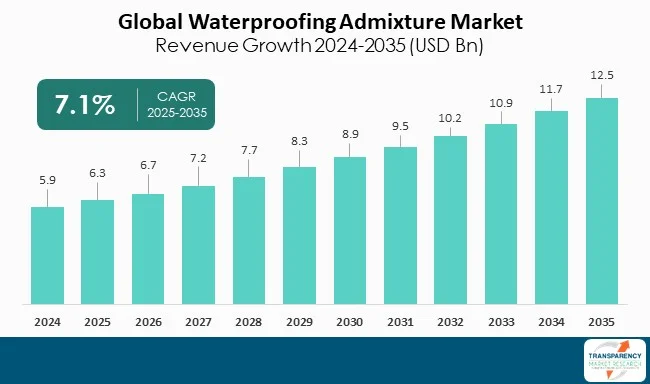

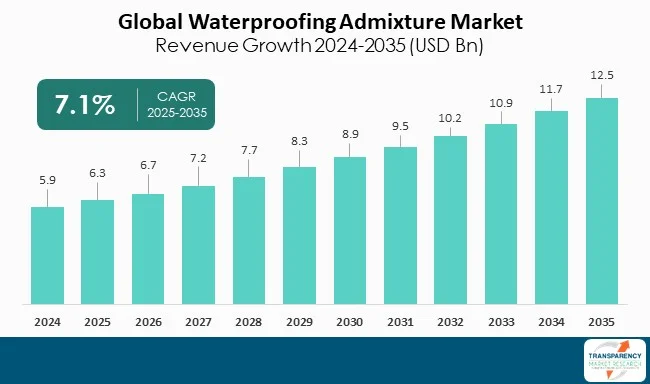

The waterproofing admixture market has a steady growth trajectory with ongoing increase in demand for durable, water-resistant construction products for residential, commercial, and industrial markets. Specific growth factors include increased rates of urbanization, infrastructure growth, and the growth of awareness and benefits around preventing water damage as a long- term cost and project benefit.

Waterproofing admixtures are added to construction products (e.g. concrete, mortar, plaster) at the place they are being batched, in order to increase the moisture resistance of the construction products, which allows buildings and structures to maintain their integrity over time. Admixtures form a critical role in construction products, thereby making buildings and structures more durable, especially in areas most exposed to moisture (high moisture exposure areas include basements, foundations, and tunnels).

The waterproofing admixture consists of materials for construction (e.g., concrete or mortar) that improve water resistance and durability. Waterproofing admixtures decrease permeability, restrict the entry of water, and protect structures from moisture damage. As waterproofing admixtures establish durability and minimize future repair costs in a water-laden environment, they are critical for today's construction. The waterproofing admixture market is steadily growing, driven by rising demand for durable, sustainable, and long-lasting construction solutions. Waterproofing admixtures are essential for strengthening both residential and commercial buildings.

Waterproofing admixtures are widely used in structures that are permanently exposed to water, such as basements, roofs, water tanks, tunnels, and bridges. Waterproofing admixtures are added directly to wet concrete or mortar. Waterproofing admixtures form an internal barrier to repel water and do not hinder the physical properties of concrete or mortar. Waterproofing can eliminate water seepage and reduce long-term repair and maintenance. Along with providing waterproofing, need to replace or repair prestressed concrete constructions due to leak and corrosion is a more sustainable practice, as it enhances the lifespan of that construction.

| Attribute | Detail |

|---|---|

| Waterproofing Admixture Market Drivers |

|

The increasing penetration of waterproofing admixtures in residential and commercial heavy construction is a factor primarily influencing this market growth. With the continuous urbanization the demand for high-quality durable building materials is increasing. Builders and developers are choosing higher-performance building products than ever before. Waterproofing admixtures are added directly into concrete, masonry, and various building materials to improve resistance to water intrusion, prevent leaks, and maintain structural integrity over time. Homeowners and developers are focusing on protecting the property from water intrusion related issues that lead to mold growth and deterioration to the building structure, particularly in areas where it rains frequently or has high humidity. Therefore, waterproofing admixtures’ value-added proposition, and benefits has expanded in foundations, basements, bathrooms, and rooftops contributing to the growth of the market.

Waterproofing admixtures have become even more prevalent in commercial projects due to increased need for durability, safety, and compliance with stringent regulations. Commercial clients such as office complexes, retail centers, and industrial locations need modern waterproofing solution that minimizes maintenance costs and provide better protection to the infrastructure. Further, the commercial uses for waterproofers, mixed-use development has created more opportunities for waterproofing admixtures in exclusive commercial settings.

With the continuation of sustainable construction practices it is becoming a more acceptable technology as part of residential, commercial, and infrastructure projects. Developers, contractors, and architects are all heading toward a more environmentally responsible measure of construction that minimizes waste of resources and carbon emissions while increasing durability. Waterproofing admixtures are an integral part of this sustainability shift which need less repairs and replacements when structures including roofs, basements, slabs, or walls are waterproofed. By mixing waterproofing admixtures directly into concrete materials and the other construction materials, builders will increase durability and decrease the requirement of additional coatings, membranes or chemical treatments that increases waste disposal from construction.

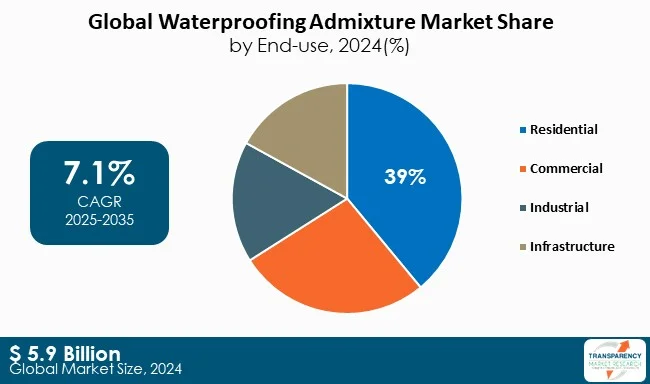

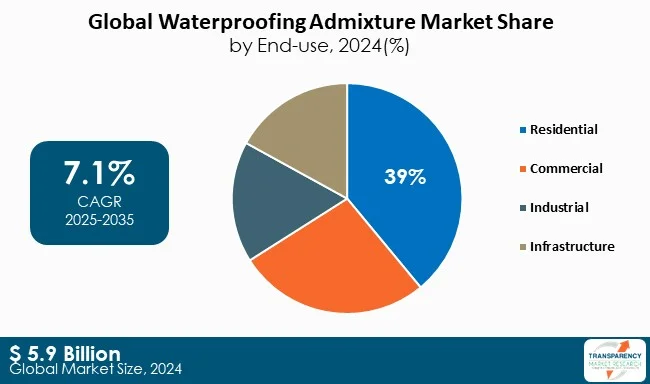

The residential sector dominates the waterproofing admixture market and has contributed toward the growth due to urbanization, demand for housing, and understanding of issues that water-related structures can experience. For both homeowners and builders, the priority to prevent leak, mold, or damage to structural integrity has increased the risk of homeowners using waterproofing to their roof, basement, and foundations.

| Attribute | Detail |

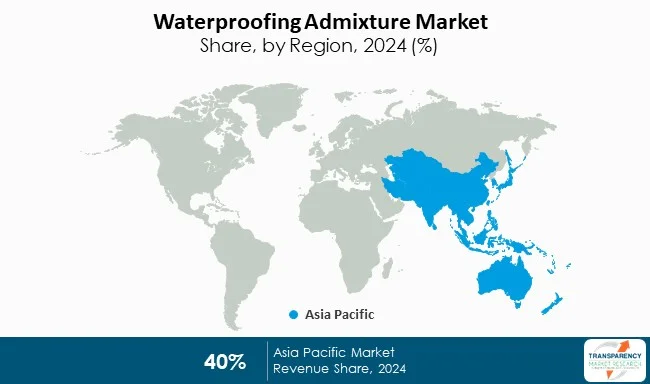

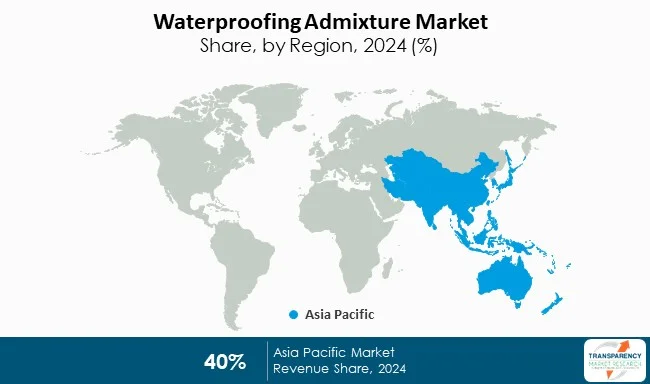

| Leading Region | Asia Pacific |

The Asia-Pacific region is the largest contributor as a result of rapid urbanization in response to mega infrastructure projects as well as increasing residential construction in China, India and Southeast Asia. Increased government spending to upgrade transportation networks, dams, and water systems is resulting in greater demand for durable concrete solutions. In addition, consumers in the region have disposable income available to invest into infrastructure while foreign entities provide investment into their construction sector while relying on inexpensive labor. There has also been an increase in awareness regarding structural protection against monsoons and flooding, which is translating into increasing utilization of waterproofing admixtures in both public and private sector.

Sika AG, BASF SE, RPM International Inc., and Saint-Gobain are the major participants in the waterproofing admixture marketplace that deliver sophisticated solutions to reduce permeability, increase concrete performance, and preserve and protect structures over the long term. Their patents support vital infrastructure, residential, and commercial constructions around the world.

Additionally, Mapei S.p.A., Pidilite Industries Ltd., Evonik, and Penetron play a major role in the consolidated waterproofing admixture market, with a competitive landscape governed by productivity and innovation.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 5.9 Bn |

| Market Forecast Value in 2035 | US$ 12.5 Bn |

| Growth Rate (CAGR) | 7.1% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | Tons For Volume and US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The waterproofing admixture market has a steady growth trajectory with ongoing increase in demand for durable, water-resistant construction products for residential, commercial, and industrial markets. Specific growth factors include increased rates of urbanization, infrastructure growth, and the growth of awareness and benefits around preventing water damage as a long- term cost and project benefit.

Waterproofing admixtures are added to construction products (e.g. concrete, mortar, plaster) at the place they are being batched, in order to increase the moisture resistance of the construction products, which allows buildings and structures to maintain their integrity over time. Admixtures form a critical role in construction products, thereby making buildings and structures more durable, especially in areas most exposed to moisture (high moisture exposure areas include basements, foundations, and tunnels).

The waterproofing admixture consists of materials for construction (e.g., concrete or mortar) that improve water resistance and durability. Waterproofing admixtures decrease permeability, restrict the entry of water, and protect structures from moisture damage. As waterproofing admixtures establish durability and minimize future repair costs in a water-laden environment, they are critical for today's construction. The waterproofing admixture market is steadily growing, driven by rising demand for durable, sustainable, and long-lasting construction solutions. Waterproofing admixtures are essential for strengthening both residential and commercial buildings.

Waterproofing admixtures are widely used in structures that are permanently exposed to water, such as basements, roofs, water tanks, tunnels, and bridges. Waterproofing admixtures are added directly to wet concrete or mortar. Waterproofing admixtures form an internal barrier to repel water and do not hinder the physical properties of concrete or mortar. Waterproofing can eliminate water seepage and reduce long-term repair and maintenance. Along with providing waterproofing, need to replace or repair prestressed concrete constructions due to leak and corrosion is a more sustainable practice, as it enhances the lifespan of that construction.

| Attribute | Detail |

|---|---|

| Waterproofing Admixture Market Drivers |

|

The increasing penetration of waterproofing admixtures in residential and commercial heavy construction is a factor primarily influencing this market growth. With the continuous urbanization the demand for high-quality durable building materials is increasing. Builders and developers are choosing higher-performance building products than ever before. Waterproofing admixtures are added directly into concrete, masonry, and various building materials to improve resistance to water intrusion, prevent leaks, and maintain structural integrity over time. Homeowners and developers are focusing on protecting the property from water intrusion related issues that lead to mold growth and deterioration to the building structure, particularly in areas where it rains frequently or has high humidity. Therefore, waterproofing admixtures’ value-added proposition, and benefits has expanded in foundations, basements, bathrooms, and rooftops contributing to the growth of the market.

Waterproofing admixtures have become even more prevalent in commercial projects due to increased need for durability, safety, and compliance with stringent regulations. Commercial clients such as office complexes, retail centers, and industrial locations need modern waterproofing solution that minimizes maintenance costs and provide better protection to the infrastructure. Further, the commercial uses for waterproofers, mixed-use development has created more opportunities for waterproofing admixtures in exclusive commercial settings.

With the continuation of sustainable construction practices it is becoming a more acceptable technology as part of residential, commercial, and infrastructure projects. Developers, contractors, and architects are all heading toward a more environmentally responsible measure of construction that minimizes waste of resources and carbon emissions while increasing durability. Waterproofing admixtures are an integral part of this sustainability shift which need less repairs and replacements when structures including roofs, basements, slabs, or walls are waterproofed. By mixing waterproofing admixtures directly into concrete materials and the other construction materials, builders will increase durability and decrease the requirement of additional coatings, membranes or chemical treatments that increases waste disposal from construction.

The residential sector dominates the waterproofing admixture market and has contributed toward the growth due to urbanization, demand for housing, and understanding of issues that water-related structures can experience. For both homeowners and builders, the priority to prevent leak, mold, or damage to structural integrity has increased the risk of homeowners using waterproofing to their roof, basement, and foundations.

| Attribute | Detail |

| Leading Region | Asia Pacific |

The Asia-Pacific region is the largest contributor as a result of rapid urbanization in response to mega infrastructure projects as well as increasing residential construction in China, India and Southeast Asia. Increased government spending to upgrade transportation networks, dams, and water systems is resulting in greater demand for durable concrete solutions. In addition, consumers in the region have disposable income available to invest into infrastructure while foreign entities provide investment into their construction sector while relying on inexpensive labor. There has also been an increase in awareness regarding structural protection against monsoons and flooding, which is translating into increasing utilization of waterproofing admixtures in both public and private sector.

Sika AG, BASF SE, RPM International Inc., and Saint-Gobain are the major participants in the waterproofing admixture marketplace that deliver sophisticated solutions to reduce permeability, increase concrete performance, and preserve and protect structures over the long term. Their patents support vital infrastructure, residential, and commercial constructions around the world.

Additionally, Mapei S.p.A., Pidilite Industries Ltd., Evonik, and Penetron play a major role in the consolidated waterproofing admixture market, with a competitive landscape governed by productivity and innovation.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 5.9 Bn |

| Market Forecast Value in 2035 | US$ 12.5 Bn |

| Growth Rate (CAGR) | 7.1% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | Tons For Volume and US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 5.9 Bn in 2024

The waterproofing admixture market is expected to grow at a CAGR of 7.1% from 2025 to 2035

Growing adoption in residential and commercial projects and Sustainable construction trends boost product utilization

Residential held the largest share under end-use segment in 2024

Asia Pacific was the most lucrative region of the waterproofing admixture market in 2024

Sika AG, Chembond Chemicals Limited, CHRYSO, Fosroc, Inc., GCP Applied Technologies Inc., Kryton International Inc., Mapei S.p.A., Penetron, Pidilite Industries Ltd., RPM International Inc., Xypex Chemical Corporation, and Evonik

Table 1 Global Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 2 Global Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 3 Global Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 4 Global Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 5 Global Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 6 Global Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 7 Global Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 8 Global Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 9 Global Waterproofing Admixture Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 10 Global Waterproofing Admixture Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 11 North America Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 12 North America Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 13 North America Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 14 North America Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 15 North America Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 16 North America Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 17 North America Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 18 North America Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 19 North America Waterproofing Admixture Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 20 North America Waterproofing Admixture Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 21 USA Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 22 USA Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 23 USA Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 24 USA Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 25 USA Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 26 USA Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27 USA Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 28 USA Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 29 Canada Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 30 Canada Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 31 Canada Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 32 Canada Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 33 Canada Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 34 Canada Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 35 Canada Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 36 Canada Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 37 Europe Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 38 Europe Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 39 Europe Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 40 Europe Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 41 Europe Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 42 Europe Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43 Europe Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 44 Europe Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 45 Europe Waterproofing Admixture Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 46 Europe Waterproofing Admixture Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 47 Germany Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 48 Germany Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 49 Germany Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 50 Germany Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 51 Germany Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 52 Germany Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53 Germany Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 Germany Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 55 France Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 56 France Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 57 France Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 58 France Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 59 France Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 60 France Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 61 France Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 62 France Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 63 UK Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 64 UK Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 65 UK Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 66 UK Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 67 UK Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 68 UK Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 69 UK Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 70 UK Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 71 Italy Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 72 Italy Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 73 Italy Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 74 Italy Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 75 Italy Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 76 Italy Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 77 Italy Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Italy Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 79 Spain Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 80 Spain Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 81 Spain Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 82 Spain Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 83 Spain Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 84 Spain Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 85 Spain Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 86 Spain Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 87 Russia & CIS Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 88 Russia & CIS Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 89 Russia & CIS Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 90 Russia & CIS Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 91 Russia & CIS Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 92 Russia & CIS Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93 Russia & CIS Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 94 Russia & CIS Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 95 Rest of Europe Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 96 Rest of Europe Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 97 Rest of Europe Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 98 Rest of Europe Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 99 Rest of Europe Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 100 Rest of Europe Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 101 Rest of Europe Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 102 Rest of Europe Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 103 Asia Pacific Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 104 Asia Pacific Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 105 Asia Pacific Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 106 Asia Pacific Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 107 Asia Pacific Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 108 Asia Pacific Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 109 Asia Pacific Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 110 Asia Pacific Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 111 Asia Pacific Waterproofing Admixture Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 112 Asia Pacific Waterproofing Admixture Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 113 China Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 114 China Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type 2020 to 2035

Table 115 China Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 116 China Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 117 China Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 118 China Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 119 China Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 120 China Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 121 Japan Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 122 Japan Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 123 Japan Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 124 Japan Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 125 Japan Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 126 Japan Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 127 Japan Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 128 Japan Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 129 India Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 130 India Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 131 India Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 132 India Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 133 India Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 134 India Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 135 India Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 136 India Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 137 ASEAN Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 138 ASEAN Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 139 ASEAN Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 140 ASEAN Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 141 ASEAN Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 142 ASEAN Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 143 ASEAN Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 144 ASEAN Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 145 Rest of Asia Pacific Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 146 Rest of Asia Pacific Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 147 Rest of Asia Pacific Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 148 Rest of Asia Pacific Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 149 Rest of Asia Pacific Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 150 Rest of Asia Pacific Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 151 Rest of Asia Pacific Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 152 Rest of Asia Pacific Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 153 Latin America Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 154 Latin America Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 155 Latin America Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 156 Latin America Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 157 Latin America Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 158 Latin America Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 159 Latin America Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 160 Latin America Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 161 Latin America Waterproofing Admixture Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 162 Latin America Waterproofing Admixture Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 163 Brazil Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 164 Brazil Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 165 Brazil Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 166 Brazil Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 167 Brazil Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 168 Brazil Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 169 Brazil Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 170 Brazil Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 171 Mexico Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 172 Mexico Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 173 Mexico Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 174 Mexico Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 175 Mexico Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 176 Mexico Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 177 Mexico Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 178 Mexico Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 179 Rest of Latin America Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 180 Rest of Latin America Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 181 Rest of Latin America Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 182 Rest of Latin America Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 183 Rest of Latin America Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 184 Rest of Latin America Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 185 Rest of Latin America Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 186 Rest of Latin America Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 187 Middle East & Africa Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 188 Middle East & Africa Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 189 Middle East & Africa Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 190 Middle East & Africa Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 191 Middle East & Africa Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 192 Middle East & Africa Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 193 Middle East & Africa Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 194 Middle East & Africa Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 195 Middle East & Africa Waterproofing Admixture Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 196 Middle East & Africa Waterproofing Admixture Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 197 GCC Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 198 GCC Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 199 GCC Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 200 GCC Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 201 GCC Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 202 GCC Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 203 GCC Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 204 GCC Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 205 South Africa Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 206 South Africa Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 207 South Africa Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 208 South Africa Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 209 South Africa Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 210 South Africa Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 211 South Africa Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 212 South Africa Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 213 Rest of Middle East & Africa Waterproofing Admixture Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 214 Rest of Middle East & Africa Waterproofing Admixture Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 215 Rest of Middle East & Africa Waterproofing Admixture Market Volume (Tons) Forecast, by Form, 2020 to 2035

Table 216 Rest of Middle East & Africa Waterproofing Admixture Market Value (US$ Bn) Forecast, by Form, 2020 to 2035

Table 217 Rest of Middle East & Africa Waterproofing Admixture Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 218 Rest of Middle East & Africa Waterproofing Admixture Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 219 Rest of Middle East & Africa Waterproofing Admixture Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 220 Rest of Middle East & Africa Waterproofing Admixture Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Figure 1 Global Waterproofing Admixture Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 2 Global Waterproofing Admixture Market Attractiveness, by Type

Figure 3 Global Waterproofing Admixture Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 4 Global Waterproofing Admixture Market Attractiveness, by Form

Figure 5 Global Waterproofing Admixture Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 6 Global Waterproofing Admixture Market Attractiveness, by Application

Figure 7 Global Waterproofing Admixture Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 8 Global Waterproofing Admixture Market Attractiveness, by End-use

Figure 9 Global Waterproofing Admixture Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 10 Global Waterproofing Admixture Market Attractiveness, by Region

Figure 11 North America Waterproofing Admixture Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 12 North America Waterproofing Admixture Market Attractiveness, by Type

Figure 13 North America Waterproofing Admixture Market Attractiveness, by Type

Figure 14 North America Waterproofing Admixture Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 15 North America Waterproofing Admixture Market Attractiveness, by Form

Figure 16 North America Waterproofing Admixture Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 17 North America Waterproofing Admixture Market Attractiveness, by Application

Figure 18 North America Waterproofing Admixture Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 19 North America Waterproofing Admixture Market Attractiveness, by End-use

Figure 20 North America Waterproofing Admixture Market Attractiveness, by Country and Sub-region

Figure 21 Europe Waterproofing Admixture Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 22 Europe Waterproofing Admixture Market Attractiveness, by Type

Figure 23 Europe Waterproofing Admixture Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 24 Europe Waterproofing Admixture Market Attractiveness, by Form

Figure 25 Europe Waterproofing Admixture Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 26 Europe Waterproofing Admixture Market Attractiveness, by Application

Figure 27 Europe Waterproofing Admixture Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 28 Europe Waterproofing Admixture Market Attractiveness, by End-use

Figure 29 Europe Waterproofing Admixture Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 30 Europe Waterproofing Admixture Market Attractiveness, by Country and Sub-region

Figure 31 Asia Pacific Waterproofing Admixture Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 32 Asia Pacific Waterproofing Admixture Market Attractiveness, by Type

Figure 33 Asia Pacific Waterproofing Admixture Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 34 Asia Pacific Waterproofing Admixture Market Attractiveness, by Form

Figure 35 Asia Pacific Waterproofing Admixture Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 36 Asia Pacific Waterproofing Admixture Market Attractiveness, by Application

Figure 33 Asia Pacific Waterproofing Admixture Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 34 Asia Pacific Waterproofing Admixture Market Attractiveness, by End-use

Figure 35 Asia Pacific Waterproofing Admixture Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 36 Asia Pacific Waterproofing Admixture Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Waterproofing Admixture Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 34 Latin America Waterproofing Admixture Market Attractiveness, by Type

Figure 35 Latin America Waterproofing Admixture Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 36 Latin America Waterproofing Admixture Market Attractiveness, by Form

Figure 37 Latin America Waterproofing Admixture Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 38 Latin America Waterproofing Admixture Market Attractiveness, by Application

Figure 39 Latin America Waterproofing Admixture Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 40 Latin America Waterproofing Admixture Market Attractiveness, by End-use

Figure 41 Latin America Waterproofing Admixture Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 42 Latin America Waterproofing Admixture Market Attractiveness, by Country and Sub-region

Figure 43 Middle East & Africa Waterproofing Admixture Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 44 Middle East & Africa Waterproofing Admixture Market Attractiveness, by Type

Figure 45 Middle East & Africa Waterproofing Admixture Market Volume Share Analysis, by Form, 2024, 2027, and 2035

Figure 46 Middle East & Africa Waterproofing Admixture Market Attractiveness, by Form

Figure 47 Middle East & Africa Waterproofing Admixture Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 48 Middle East & Africa Waterproofing Admixture Market Attractiveness, by Application

Figure 49 Middle East & Africa Waterproofing Admixture Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 50 Middle East & Africa Waterproofing Admixture Market Attractiveness, by End-use

Figure 51 Middle East & Africa Waterproofing Admixture Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 52 Middle East & Africa Waterproofing Admixture Market Attractiveness, by Country and Sub-region