Reports

Reports

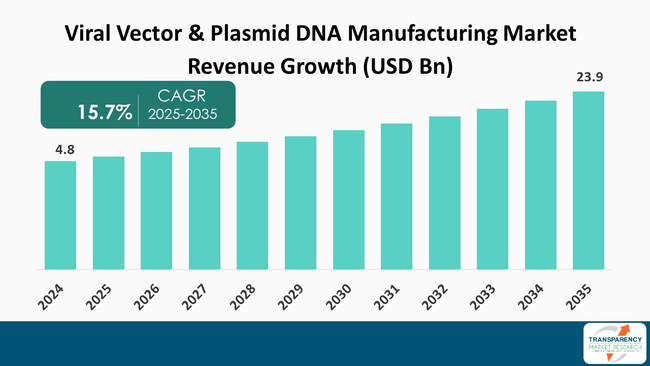

The global viral vector & plasmid DNA manufacturing market size was valued at US$ 4.8 billion in 2024 and is projected to reach US$ 23.9 billion by 2035, expanding at a CAGR of 15.7% from 2025 to 2035. The market growth is driven by increasing adoption of gene therapies for treatment of genetic and rare disorders, technological advancements in manufacturing processes, growing clinical trials and market approvals for gene-based products.

The viral vector and plasmid DNA manufacturing market is driven by the growing requirement of specialized therapies, such as gene therapies and vaccines. The growing prevalence of genetic disorders and infectious diseases results in rising demand for novel treatment solutions, further driving the market.

Regulatory pressures for stringent quality standards and detailed analytical characterization further propel investment in dedicated facilities and robust quality systems. The necessity for efficient impurity management and prolonged stability in the case of biologics and vaccine production are the other factors that remarkably influence market dynamics.

Growing partnerships between companies in the contract development and manufacturing organizations (CDMOs) and biopharmaceutical sector is another key driver to the viral vector and plasmid DNA manufacturing market.

Such partnerships provide optimized manufacturing operations as well as access to new technology, thereby boosting efficiency. Additionally, growing focus on personalized medicine is driving the demand for personalized therapy, which further generates the need for diverse production capabilities.

The ongoing trends imply a rapid implementation of flexible manufacturing technologies and customer-centered service models. In order to increase flexibility, mitigate risk of contamination, and shorten the time needed for changeover, single-use bioreactors, perfusion processes, and closed-system workflows are being utilized.

Advancements in downstream purification, facilitated by high-capacity chromatography and nuclease clearance, are further improving throughput and product purity. Contract manufacturers are offering comprehensive end-to-end solutions that combine plasmid supply, vector drug-substance production, and fill/finish connectivity. Regionalization and sustainability measures, such as waste reduction and energy saving, are being recognized as the differentiating factors among service providers in the market.

The competitive landscape is characterized by strategic investments in capacity, standardization, and collaborative partnerships. Market players are investing in the expansion of their multi-site geographical presence and modular facilities as a means of expand geographic presence and rapid response capacity.

The adoption of standardized platforms facilitates technology transfer and lowers regulatory risk, while flexible commercial agreements such as capacity reservation, tolling, and risk-sharing models are mainly used to align incentives. Moreover, the companies are implementing process analytics, automation, workforce upskilling, and proactive regulatory engagement for converting scaling-up into safe and efficient market launches.

Viral vector and plasmid DNA manufacturing implies the production of essential components of cell therapy, gene therapy, and vaccine technology. Viral vectors are referred to as the genetically modified viruses used for transferring genetic material into cells for providing therapeutic treatment for multiple diseases.

Plasmid DNA is also an essential component for gene expression and vaccine production. The production of viral vectors and plasmid DNA involves design, production, purification, and quality control of these biological reagents. As advancements in biotechnology continue to evolve, the sector plays an important role in addressing unmet medical needs and advancing personalized medicine.

Plasmid DNA manufacturing entails upstream the fermentation of bacterial cultures, especially E. coli, followed by downstream purification steps like lysis, chromatography, and filtration. This method produces highly supercoiled pure plasmid DNA under Good Manufacturing Practice (GMP) standards, thereby ascertaining compliance with regulations regarding uniformity and purity. This plasmid DNA serves as one of the fundamental raw materials for gene-based therapy products.

Viral vector manufacturing emphasizes manufacturing functional viral particles such as lentiviruses, adeno-associated viruses (AAV), and adenoviruses. The process involves introducing genes into host cells, isolation of vectors from the host, facilitation of replication of vectors, and certification of potency and safety. Such carriers are designed for enabling the delivery of therapeutic genes effectively into the patient's cells.

| Attribute | Detail |

|---|---|

| Viral Vector & Plasmid DNA Manufacturing Market Drivers |

|

The gene therapy pipeline has emerged as one of the major growth drivers to the viral vector and plasmid DNA manufacturing market. As biotechnology and pharmaceutical companies advance through increasing number of gene-based therapies into commercial and clinical pipelines, the demand for high-quality vectors and plasmid DNA continues to rise. Such genetic vectors are necessary for delivering therapeutic genes, thereby making their reliable supply crucial for the success of gene therapy programs.

New therapies require proprietary viral vectors and plasmid DNA for unique gene constructs, thereby improving the complexity of production and increase the volume of materials required. This translates into manufacturers increasing scalability, capacity, and standardization in the production processes. The rise in experimental therapeutics has also raised the desire for adaptable systems that are capable of handling diverse types of vectors such as lentivirus, AAV, and adenovirus.

Moreover, the demand for personalized manufacturing solutions is witnessing an upsurge, especially for gene therapies targeting oncology and rare diseases. Product developers are increasingly seeking collaborators who can enable fast GMP-compliant production to meet the rigorous regulatory standards. This trend is driving investments in advanced bioprocessing technologies and automation tools.

Increasing levels of gene and cell therapy product approvals and clinical trials are a key driver propelling the viral vector and plasmid DNA manufacturing market. With therapeutic products making advanced trials phases, the need for large-scale, GMP-grade manufacturing of viral vectors, and plasmid DNA increases. Such growth is associated with uniform quality, scalability, and adherence to global regulatory requirements.

Each newly approved treatment establishes elevated standards of product quality, safety, and manufacturing efficiency. Well-documented and certified procedures are required by the regulating agencies, thereby forcing manufacturers to invest in high-quality bioprocessing equipment and automation technologies. These investments enhance reproducibility and reliability in the clinical and commercial phases of manufacturing and minimizes the likelihood of bottlenecks in manufacture.

The increasing number of clinical trials is also a major factor in the diversification of manufacturing platforms, which are being designed to accommodate different vector types such as AAV, lentivirus, and adenovirus. Manufacturers are building flexible facilities that can handle various products and different batch sizes and complexities of products, thus ensuring fast supply for trials worldwide.

In conclusion, the escalation of clinical activities and product approvals is a great source of confidence for gene-based therapies and, therefore is a strong driver of the viral vector & plasmid DNA manufacturing industry growth. Besides, it allows therapy developers to enter into alliances with the contract manufacturers, thus gaining access to their technological expertise, capacity expansion, and process optimization in the viral vector and plasmid DNA manufacturing industry.

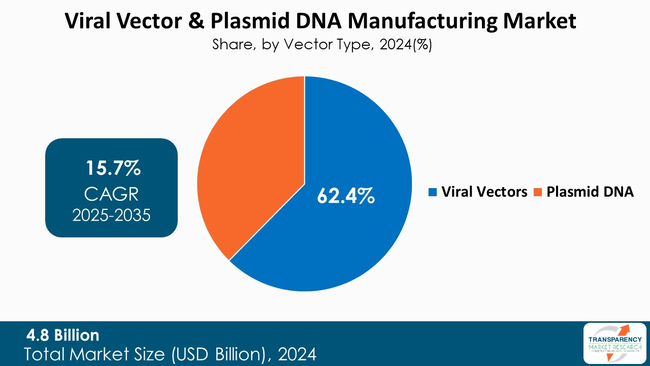

Viral vectors dominate the viral vector & plasmid DNA manufacturing market, serving as the primary delivery systems for most gene and cell therapies. In fact, their ability to perform therapeutic gene insertions into the target cells with high accuracy and long-term stability positions them as preferred treatment option for genetic and rare diseases.

Additionally, the utilization of viral vectors, adeno-associated viruses, and lentiviruses in the production of advanced therapies and vaccines is very significant, thereby attracting the demand for large-scale production. The ongoing innovation of vector design, the improved safety profile, as well as the unlimited number of clinical applications, are among the factors that contribute to the continued occupancy of the plasmid DNA by viral vectors in the global manufacturing landscape.

| Attribute | Detail |

|---|---|

| Leading Region |

|

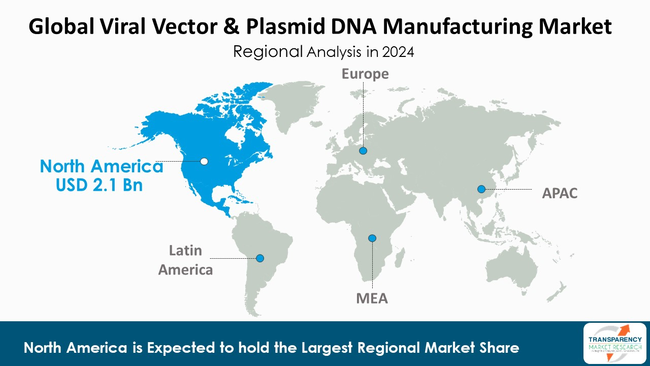

As per the latest viral vector & plasmid DNA manufacturing market analysis, North America dominated the market in 2024, capturing a market share of 43.8%. This is due to the strengths of the region's biotech ecosystem, its well-established research infrastructure, and massive investments in gene therapy. The region also boasts the presence of numerous biopharmaceutical companies and research institutions. These institutions actively engage in the development of innovative gene and cell therapies and, therefore, are the main drivers of the continuous need for large-scale vector and plasmid production.

Moreover, the supportive regulatory frameworks and heavy financing from both - the public and the private sector provide excellent conditions for manufacturing. The existence of high-quality GMP facilities, a well-trained labor force, and the growing collaboration between academia and industry have all contributed to further strengthen North America's position on this rapidly expanding market.

The players engaged in the viral vector & plasmid DNA manufacturing market are investing heavily in automation and advanced bioprocessing technologies for enhancing production scalability and efficiency. Firms are also emphasizing developing flexible manufacturing systems to accommodate personalized therapies and several vector types.

Thermo Fisher Scientific Inc., Lonza, Hillgene Biopharma Co., Ltd., Revvity, Merck KGaA, Aldevron LLC, VGXI, FUJIFILM Biotechnologies, WuXi Biologics, Takara Bio Inc., REGENXBIO Inc., AGC Biologics, Batavia Biosciences B.V., Sanofi, and Wacker Chemie AG are some of the leading players operating in the global viral vector & plasmid DNA manufacturing market.

Each of these players has been profiled in the viral vector & plasmid DNA manufacturing market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 4.8 Bn |

| Forecast Value in 2035 | US$ 23.9 Bn |

| CAGR | 15.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Viral Vector & Plasmid DNA Manufacturing Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Vector Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global viral vector & plasmid DNA manufacturing market was valued at US$ 4.8 Bn in 2024

The global viral vector & plasmid DNA manufacturing industry is projected to reach more than US$ 23.9 Bn by the end of 2035

The increasing adoption of gene therapies for treatment of genetic and rare disorders, technological advancements in manufacturing processes, growing clinical trials and market approvals for gene-based products, increased investment in biotechnology, and the growing need for novel vaccine development are some of the factors driving the expansion of viral vector & plasmid DNA manufacturing market.

The CAGR is anticipated to be 15.7% from 2025 to 2035

Thermo Fisher Scientific Inc., Lonza, Hillgene Biopharma Co., Ltd., Revvity, Merck KGaA, Aldevron LLC, VGXI, FUJIFILM Biotechnologies, WuXi Biologics, Takara Bio Inc., REGENXBIO Inc., AGC Biologics, Batavia Biosciences B.V., Sanofi, and Wacker Chemie AG

Table 01: Global Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Vector Type, 2020 to 2035

Table 02: Global Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Viral Vectors, 2020 to 2035

Table 03: Global Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Workflow, 2020 to 2035

Table 04: Global Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Upstream Manufacturing, 2020 to 2035

Table 05: Global Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Downstream Manufacturing, 2020 to 2035x

Table 06: Global Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 07: Global Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Scale of Manufacturing, 2020 to 2035

Table 08: Global Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 09: Global Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 10: North America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 11: North America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Vector Type, 2020 to 2035

Table 12: North America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Viral Vectors, 2020 to 2035

Table 13: North America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Workflow, 2020 to 2035

Table 14: North America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Upstream Manufacturing, 2020 to 2035

Table 15: North America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Downstream Manufacturing, 2020 to 2035

Table 16: North America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 17: North America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Scale of Manufacturing, 2020 to 2035

Table 18: North America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 19: Europe Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 20: Europe Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Vector Type, 2020 to 2035

Table 21: Europe Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Viral Vectors, 2020 to 2035

Table 22: Europe Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Workflow, 2020 to 2035

Table 23: Europe Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Upstream Manufacturing, 2020 to 2035

Table 24: Europe Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Downstream Manufacturing, 2020 to 2035

Table 25: Europe Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 26: Europe Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Scale of Manufacturing, 2020 to 2035

Table 27: Europe Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 28: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 29: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Vector Type, 2020 to 2035

Table 30: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Viral Vectors, 2020 to 2035

Table 31: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Workflow, 2020 to 2035

Table 32: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Upstream Manufacturing, 2020 to 2035

Table 33: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Downstream Manufacturing, 2020 to 2035

Table 34: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 35: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Scale of Manufacturing, 2020 to 2035

Table 36: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 37: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 38: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Vector Type, 2020 to 2035

Table 39: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Viral Vectors, 2020 to 2035

Table 40: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Workflow, 2020 to 2035

Table 41: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Upstream Manufacturing, 2020 to 2035

Table 42: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Downstream Manufacturing, 2020 to 2035

Table 43: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 44: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Scale of Manufacturing, 2020 to 2035

Table 45: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 46: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 47: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Vector Type, 2020 to 2035

Table 48: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Viral Vectors, 2020 to 2035

Table 49: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Workflow, 2020 to 2035

Table 50: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Upstream Manufacturing, 2020 to 2035

Table 51: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Downstream Manufacturing, 2020 to 2035

Table 52: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 53: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By Scale of Manufacturing, 2020 to 2035

Table 54: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Vector Type, 2024 and 2035

Figure 02: Global Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Vector Type, 2025 to 2035

Figure 03: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Viral Vectors, 2020 to 2035

Figure 04: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Plasmid DNA, 2020 to 2035

Figure 05: Global Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Workflow, 2024 and 2035

Figure 06: Global Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Workflow, 2025 to 2035

Figure 07: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Upstream Manufacturing, 2020 to 2035

Figure 08: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Downstream Manufacturing, 2020 to 2035

Figure 09: Global Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Application, 2024 and 2035

Figure 10: Global Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 11: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Cell and Gene Therapies, 2020 to 2035

Figure 12: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Vaccine Development, 2020 to 2035

Figure 13: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Antisense & RNAi Therapies, 2020 to 2035

Figure 14: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 15: Global Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Scale of Manufacturing, 2024 and 2035

Figure 16: Global Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Scale of Manufacturing, 2025 to 2035

Figure 17: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Preclinical, 2020 to 2035

Figure 18: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Clinical, 2020 to 2035

Figure 19: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Commercial, 2020 to 2035

Figure 20: Global Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 21: Global Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 22: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Pharmaceutical and Biotechnology Companies, 2020 to 2035

Figure 23: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Contract Manufacturing Organizations (CMOs), 2020 to 2035

Figure 24: Global Viral Vector & Plasmid DNA Manufacturing Market Revenue (US$ Bn), by Academic and Research Institutions, 2020 to 2035

Figure 25: Global Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Region, 2024 and 2035

Figure 26: Global Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 27: North America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: North America Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, by Country, 2024 and 2035

Figure 29: North America Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 30: North America Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Vector Type, 2024 and 2035

Figure 31: North America Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Vector Type, 2025 to 2035

Figure 32: North America Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Workflow, 2024 and 2035

Figure 33: North America Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Workflow, 2025 to 2035

Figure 34: North America Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Application, 2024 and 2035

Figure 35: North America Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 36: North America Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Scale of Manufacturing, 2024 and 2035

Figure 37: North America Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Scale of Manufacturing, 2025 to 2035

Figure 38: North America Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 39: North America Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 40: Europe Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 41: Europe Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 42: Europe Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 43: Europe Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Vector Type, 2024 and 2035

Figure 44: Europe Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Vector Type, 2025 to 2035

Figure 45: Europe Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Workflow, 2024 and 2035

Figure 46: Europe Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Workflow, 2025 to 2035

Figure 47: Europe Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Application, 2024 and 2035

Figure 48: Europe Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 49: Europe Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Scale of Manufacturing, 2024 and 2035

Figure 50: Europe Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Scale of Manufacturing, 2025 to 2035

Figure 51: Europe Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 52: Europe Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 53: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 54: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 55: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 56: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Vector Type, 2024 and 2035

Figure 57: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Vector Type, 2025 to 2035

Figure 58: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Workflow, 2024 and 2035

Figure 59: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Workflow, 2025 to 2035

Figure 60: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Application, 2024 and 2035

Figure 61: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 62: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Scale of Manufacturing, 2024 and 2035

Figure 63: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Scale of Manufacturing, 2025 to 2035

Figure 64: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 65: Asia Pacific Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 66: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 67: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 68: Latin America Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 69: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Vector Type, 2024 and 2035

Figure 70: Latin America Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Vector Type, 2025 to 2035

Figure 71: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Workflow, 2024 and 2035

Figure 72: Latin America Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Workflow, 2025 to 2035

Figure 73: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Application, 2024 and 2035

Figure 74: Latin America Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 75: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Scale of Manufacturing, 2024 and 2035

Figure 76: Latin America Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Scale of Manufacturing, 2025 to 2035

Figure 77: Latin America Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 78: Latin America Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 79: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 80: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 81: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 82: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Vector Type, 2024 and 2035

Figure 83: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Vector Type, 2025 to 2035

Figure 84: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Workflow, 2024 and 2035

Figure 85: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Workflow, 2025 to 2035

Figure 86: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Application, 2024 and 2035

Figure 87: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 88: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By Scale of Manufacturing, 2024 and 2035

Figure 89: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By Scale of Manufacturing, 2025 to 2035

Figure 90: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 91: Middle East & Africa Viral Vector & Plasmid DNA Manufacturing Market Attractiveness Analysis, By End-user, 2025 to 2035