Reports

Reports

Analysts’ Viewpoint

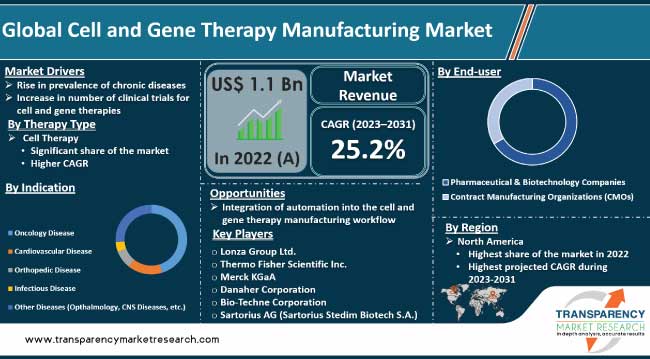

Scientific advancements and growing understanding of cellular & genetic mechanisms are driving the global cell and gene therapy manufacturing market. Cell and gene therapies offer tailored interventions that target the root cause of diseases at a cellular level. Advancements in manufacturing technologies and processes are enabling improved scalability and cost-effectiveness in the production of these therapies. Innovations such as automated bioreactors, closed-system processing, and novel gene delivery techniques are expected to propel the global cell and gene therapy manufacturing market size during the forecast period.

Approval of cell and gene therapies by regulatory agencies offers lucrative opportunities to market players. Pharmaceutical and biotechnology companies are entering into strategic collaborations to accelerate research, development, and commercialization of cell and gene therapies in order to increase market revenue and share.

Cell and gene therapy manufacturing stands at the forefront of medical innovation, and is poised to revolutionize the treatment landscape for various diseases. This cutting-edge field harnesses the power of cellular and genetic engineering to develop personalized and targeted therapies, holding immense promise for addressing unmet medical needs.

Unlike traditional pharmaceuticals, these therapies involve manipulating patients' own cells or genes to combat diseases at their root causes. Convergence of advanced biotechnology, precision medicine, and manufacturing expertise has paved the way for these therapies to become a reality, with remarkable successes observed in conditions such as cancer and genetic disorders.

Rise in prevalence of chronic diseases is fueling the cell and gene therapy manufacturing market growth. Chronic diseases, such as cancer, cardiovascular disorders, genetic anomalies, and autoimmune diseases, continue to burden healthcare systems across the world. According to the World Health Organization (WHO), 60% of adults globally have at least one chronic disease. This number is expected to rise to 70% by 2025.

Cell and gene therapies offer a revolutionary approach by utilizing patients' own cells or modifying their genetic makeup to provide personalized and targeted treatments. This paradigm shift from traditional therapies has spurred research and investment in manufacturing technologies to develop, scale, and deliver these advanced therapies to a wider population.

Rise in demand for such therapies has spurred collaborations between biotechnology firms, pharmaceutical companies, and research institutions to optimize production processes and ensure the delivery of safe and effective treatments. Consequently, the market has witnessed a surge in funding, technological advancements, and regulatory support to facilitate the development and commercialization of these therapies.

Global cell and gene therapy manufacturing market demand is poised for sustained expansion as chronic diseases continue to affect a larger proportion of the global population.

The cell and gene therapy manufacturing market is witnessing accelerated growth, driving the availability and affordability of these therapies for patients globally. The influx of funds signifies the industry's commitment to revolutionize medical treatment through personalized and targeted approaches. This offers hope for patients with challenging medical conditions.

The market is experiencing robust growth due to substantial investment by pharmaceutical and biotechnology companies. These investments play a pivotal role in advancing the field of regenerative medicine and personalized therapies.

The U.S. Government is the largest single investor in pharmaceutical and biotechnology research and development, providing over US$ 40 Bn annually. The FDA also provides funding for research, particularly in areas related to drug safety and efficacy.

Pharmaceutical and biotech firms are recognizing the transformative potential of cell and gene therapies to address previously untreatable diseases. Consequently, they are committing substantial resources to research, development, and production of these therapies. This financial support has enabled the expansion of manufacturing capabilities, leading to an increase in efficiency and scalability in producing these complex therapies.

Investments are being directed toward cutting-edge technologies, process optimization, and infrastructure development to overcome challenges associated with manufacturing cell and gene therapies. Automation, advanced bioreactors, and innovative techniques are being integrated to ensure consistent and high-quality production. These investments also aid in meeting regulatory requirements, which are crucial for bringing these therapies to market.

In terms of product type, the consumables segment accounted for the largest global cell and gene therapy manufacturing market share in 2022. This is ascribed to increase in demand for consumables, such as culture media and reagents, in the development of cell and gene therapies.

The combination of convenience, reliability, and the unique requirements of the cell and gene therapy manufacturing process contributed to the prominent share of the consumables segment.

Advancements in manufacturing technologies and regulatory compliance emphasize quality consumables. These factors collectively amplify the consumables segment's pivotal role in shaping the market's landscape.

The trend toward single-use technologies and increase in demand for cell and gene therapies are propelling the growth and dominance of the segment over equipment, software, and systems.

Based on indication, the oncology segment is poised to dominate the global market during the forecast period. Convergence of advanced biotechnology, personalized medicine, and innovative treatment approaches has propelled oncology to the forefront of this market.

Cell and gene therapies have demonstrated remarkable potential in revolutionizing cancer treatment, offering precise and targeted interventions that address the complexity and heterogeneity of various malignancies.

The unique challenges posed by cancer, coupled with the remarkable progress in understanding genetic and cellular mechanisms, have led to the development of cutting-edge therapies. CAR-T (Chimeric Antigen Receptor T-cell) therapies, for instance, have gained significant attention for their success in treating certain types of leukemia and lymphoma. These therapies involve modifying a patient's own T-cells to recognize and destroy cancer cells with unprecedented specificity.

The versatility of cell and gene therapies in targeting specific mutations, harnessing the immune system, and enhancing the body's natural defense mechanisms holds immense promise for creating personalized treatment regimens. Consequently, investment and research efforts in oncology-related cell and gene therapy manufacturing have surged, creating a dynamic landscape of collaborations, clinical trials, and commercial ventures.

In conclusion, the profound impact of cell and gene therapies on oncology, along with growing investment in research, development, and manufacturing, are expected to consolidate oncology's significant share in the market.

As these therapies continue to demonstrate their potential in addressing unmet medical needs and improving patient outcomes, the oncology segment is set to play a pivotal role in shaping the future of medicine.

In terms of end-user, the pharmaceutical & biotechnology companies segment is projected to account for the leading share of the global market during the forecast period. Pharmaceutical & biotechnology companies' extensive resources, research expertise, and established infrastructure uniquely position them to drive innovation, scale up production, and bring these transformative therapies to a broader patient population.

Increase in demand for personalized and targeted treatments has induced pharmaceutical and biotech companies to focus on developing and commercializing cell and gene therapies. Strategic integration of these therapies into their portfolios allows these companies to diversify their offerings and tap into a burgeoning market that addresses previously unmet medical needs.

These companies possess the capabilities to navigate the complex regulatory landscape and ensure compliance with stringent manufacturing requirements. Their experience in bringing traditional pharmaceuticals to market lends credibility and expertise to the development, manufacturing, and distribution of cell and gene therapies.

Collaborations and partnerships between pharmaceutical and biotechnology firms and academic institutions, research organizations, and manufacturing experts are also on the rise. These collaborations facilitate knowledge exchange, technology transfer, and accelerated development timelines, ultimately benefiting patients awaiting innovative treatment options.

As per cell and gene therapy manufacturing industry trends, North America dominated the global industry in 2022. The region is home to a robust and well-established pharmaceutical and biotechnology industry.

Rise in prevalence of chronic diseases has amplified the demand for advanced treatment options, driving investment and research in cell and gene therapies. Additionally, the region's well-established healthcare infrastructure and regulatory framework provide a conducive environment for developing and commercializing manufacturing processes.

Collaborations between academia, research institutions, and pharmaceutical companies are fostering innovation and knowledge sharing, accelerating the translation of scientific discoveries into marketable therapies. Surge in funding from both public and private sectors further supports research and infrastructure development, enabling scalability and efficiency in manufacturing processes.

Technological advancements play a pivotal role, with automation, data analytics, and process optimization enhancing productivity and quality control. As a result, industry players are attracted to investing in North America to harness the benefits of cutting-edge technologies.

According to cell and gene therapy manufacturing market forecast, the industry in Asia Pacific is expected to grow at a rapid pace during the forecast period. This can be ascribed to expanding healthcare infrastructure and increasing research & development investment in the region.

Favorable regulatory policies and streamlined approval processes in countries such as China, Japan, and South Korea facilitate quicker market entry for cell and gene therapy products. Moreover, a large population base and rise in prevalence of chronic diseases in the region drive demand for advanced treatment options, boosting the market's expansion.

Collaborations between academic institutions, biotech companies, and government bodies enhance expertise and knowledge sharing, propelling innovation. Availability of skilled workforce and cost-effective manufacturing capabilities further attract global biopharmaceutical players to set up production facilities in Asia Pacific, solidifying the region's position at the forefront of cell and gene therapy manufacturing.

The global cell and gene therapy manufacturing market is fragmented, with the presence of large a number of players. Increase in investment in R&D and merger & acquisition are the key strategies adopted by leading companies.

Lonza Group Ltd., Thermo Fisher Scientific, Inc., Merck KGaA, Danaher Corporation, Bio-Techne Corporation, Sartorius AG (Sartorius Stedim Biotech S.A.), Bio-Rad Laboratories, Inc., Becton, Dickinson and Company, Fresenius Medical Care AG & Co. KGaA, MaxCyte, Getinge AB, and GE HealthCare.

Each of these players has been profiled in the cell and gene therapy manufacturing market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 1.1 Bn |

| Forecast Value in 2031 | More than US$ 8.8 Bn |

| CAGR - 2022-2031 | 25.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.1 Bn in 2022

It is projected to reach more than US$ 8.8 Bn by 2031

The CAGR is anticipated to be 25.2% from 2023 to 2031

North America is expected to account for the largest share from 2023 to 2031

Lonza Group Ltd., Thermo Fisher Scientific, Inc., Merck KGaA, Danaher Corporation, Bio-Techne Corporation, Sartorius AG (Sartorius Stedim Biotech S.A.), Bio-Rad Laboratories, Inc., Becton, Dickinson and Company, Fresenius Medical Care AG & Co. KGaA, MaxCyte, Getinge AB, and GE HealthCare

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Cell and Gene Therapy Manufacturing Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Cell and Gene Therapy Manufacturing Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Technological Advancements

5.2. Reimbursement Scenario by Region/Globally

5.3. Regulatory Scenario by Region/globally

5.4. Disease Prevalence & Incidence Rate Globally With Key Countries

5.5. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Cell and Gene Therapy Manufacturing Market Analysis and Forecast, by Therapy Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Therapy Type, 2017-2031

6.3.1. Cell Therapy

6.3.1.1. Allogeneic

6.3.1.1.1. Mesenchymal Stem Cells

6.3.1.1.2. T-cells

6.3.1.1.3. Induced Pluripotent Stem Cells

6.3.1.1.4. Natural Killer Cells

6.3.1.1.5. Hematopoietic Stem Cells

6.3.1.1.6. Others

6.3.1.2. Autologous

6.3.1.2.1. T-cells

6.3.1.2.2. Hematopoietic Stem Cells

6.3.1.2.3. Mesenchymal Stem Cells

6.3.1.2.4. Natural Killer Cells

6.3.1.2.5. Others

6.3.2. Gene Therapy

6.3.2.1. Viral Vector

6.3.2.1.1. Lentiviral Vector

6.3.2.1.2. Adeno-associated Virus Vectors

6.3.2.1.3. Other Viral Vectors

6.3.2.2. Non-viral Vector

6.3.2.2.1. Electroporation

6.3.2.2.2. Other Non-viral Vectors

6.4. Market Attractiveness Analysis, by Therapy Type

7. Cell and Gene Therapy Manufacturing Market Analysis and Forecast, by Product Type

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Product Type, 2017-2031

7.3.1. Consumables

7.3.2. Equipment

7.3.2.1. Cell Processing Equipment

7.3.2.2. Single-use Equipment

7.3.2.3. Other Equipment

7.3.3. Software & Systems

7.4. Market Attractiveness Analysis, by Product Type

8. Cell and Gene Therapy Manufacturing Market Analysis and Forecast, by Technology

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Technology, 2017-2031

8.3.1. Cell Culture & Expansion

8.3.2. Viral Vector Production

8.3.3. Cell Sorting & Purification

8.3.4. Gene Editing

8.3.5. Others

8.4. Market Attractiveness Analysis, by Technology

9. Cell and Gene Therapy Manufacturing Market Analysis and Forecast, by Indication

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Indication, 2017-2031

9.3.1. Oncology Disease

9.3.2. Cardiovascular Disease

9.3.3. Orthopedic Disease

9.3.4. Infectious Disease

9.3.5. Others

9.4. Market Attractiveness Analysis, by Indication

10. Cell and Gene Therapy Manufacturing Market Analysis and Forecast, by End-user

10.1. Introduction & Definition

10.2. Key Findings/Developments

10.3. Market Value Forecast, by End-user, 2017-2031

10.3.1. Pharmaceutical & Biotechnology Companies

10.3.2. Contract Manufacturing Organizations (CMOs)

10.4. Market Attractiveness Analysis, by End-user

11. Cell and Gene Therapy Manufacturing Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Market Value Forecast, by Region, 2017-2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness Analysis, by Region

12. North America Cell and Gene Therapy Manufacturing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Therapy Type, 2017-2031

12.2.1. Cell Therapy

12.2.1.1. Allogeneic

12.2.1.1.1. Mesenchymal Stem Cells

12.2.1.1.2. T-cells

12.2.1.1.3. Induced Pluripotent Stem Cells

12.2.1.1.4. Natural Killer Cells

12.2.1.1.5. Hematopoietic Stem Cells

12.2.1.1.6. Others

12.2.1.2. Autologous

12.2.1.2.1. T-cells

12.2.1.2.2. Hematopoietic Stem Cells

12.2.1.2.3. Mesenchymal Stem Cells

12.2.1.2.4. Natural Killer Cells

12.2.1.2.5. Others

12.2.2. Gene Therapy

12.2.2.1. Viral Vector

12.2.2.1.1. Lentiviral Vector

12.2.2.1.2. Adeno-associated Virus Vectors

12.2.2.1.3. Other Viral Vectors

12.2.2.2. Non-viral Vector

12.2.2.2.1. Electroporation

12.2.2.2.2. Other Non-viral Vectors

12.3. Market Value Forecast, by Product Type, 2017-2031

12.3.1. Consumables

12.3.2. Equipment

12.3.2.1. Cell Processing Equipment

12.3.2.2. Single-use Equipment

12.3.2.3. Other Equipment

12.3.3. Software & Systems

12.4. Market Value Forecast, by Technology, 2017-2031

12.4.1. Cell Culture & Expansion

12.4.2. Viral Vector Production

12.4.3. Cell Sorting & Purification

12.4.4. Gene Editing

12.4.5. Others

12.5. Market Value Forecast, by Indication, 2017-2031

12.5.1. Oncology Disease

12.5.2. Cardiovascular Disease

12.5.3. Orthopedic Disease

12.5.4. Infectious Disease

12.5.5. Others

12.6. Market Value Forecast, by End-user, 2017-2031

12.6.1. Pharmaceutical & Biotechnology Companies

12.6.2. Contract Manufacturing Organizations (CMOs)

12.7. Market Value Forecast, by Country, 2017-2031

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Therapy Type

12.8.2. By Product Type

12.8.3. By Technology

12.8.4. By Indication

12.8.5. By End-user

12.8.6. By Country

13. Europe Cell and Gene Therapy Manufacturing Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Therapy Type, 2017-2031

13.2.1. Cell Therapy

13.2.1.1. Allogeneic

13.2.1.1.1. Mesenchymal Stem Cells

13.2.1.1.2. T-cells

13.2.1.1.3. Induced Pluripotent Stem Cells

13.2.1.1.4. Natural Killer Cells

13.2.1.1.5. Hematopoietic Stem Cells

13.2.1.1.6. Others

13.2.1.2. Autologous

13.2.1.2.1. T-cells

13.2.1.2.2. Hematopoietic Stem Cells

13.2.1.2.3. Mesenchymal Stem Cells

13.2.1.2.4. Natural Killer Cells

13.2.1.2.5. Others

13.2.2. Gene Therapy

13.2.2.1. Viral Vector

13.2.2.1.1. Lentiviral Vector

13.2.2.1.2. Adeno-associated Virus Vectors

13.2.2.1.3. Other Viral Vectors

13.2.2.2. Non-viral Vector

13.2.2.2.1. Electroporation

13.2.2.2.2. Other Non-viral Vectors

13.3. Market Value Forecast, by Product Type, 2017-2031

13.3.1. Consumables

13.3.2. Equipment

13.3.2.1. Cell Processing Equipment

13.3.2.2. Single-use Equipment

13.3.2.3. Other Equipment

13.3.3. Software & Systems

13.4. Market Value Forecast, by Technology, 2017-2031

13.4.1. Cell Culture & Expansion

13.4.2. Viral Vector Production

13.4.3. Cell Sorting & Purification

13.4.4. Gene Editing

13.4.5. Others

13.5. Market Value Forecast, by Indication, 2017-2031

13.5.1. Oncology Disease

13.5.2. Cardiovascular Disease

13.5.3. Orthopedic Disease

13.5.4. Infectious Disease

13.5.5. Others

13.6. Market Value Forecast, by End-user, 2017-2031

13.6.1. Pharmaceutical & Biotechnology Companies

13.6.2. Contract Manufacturing Organizations (CMOs)

13.7. Market Value Forecast, by Country/Sub-region, 2017-2031

13.7.1. Germany

13.7.2. U.K.

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Therapy Type

13.8.2. By Product Type

13.8.3. By Technology

13.8.4. By Indication

13.8.5. By End-user

13.8.6. By Country/Sub-region

14. Asia Pacific Cell and Gene Therapy Manufacturing Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Therapy Type, 2017-2031

14.2.1. Cell Therapy

14.2.1.1. Allogeneic

14.2.1.1.1. Mesenchymal Stem Cells

14.2.1.1.2. T-cells

14.2.1.1.3. Induced Pluripotent Stem Cells

14.2.1.1.4. Natural Killer Cells

14.2.1.1.5. Hematopoietic Stem Cells

14.2.1.1.6. Others

14.2.1.2. Autologous

14.2.1.2.1. T-cells

14.2.1.2.2. Hematopoietic Stem Cells

14.2.1.2.3. Mesenchymal Stem Cells

14.2.1.2.4. Natural Killer Cells

14.2.1.2.5. Others

14.2.2. Gene Therapy

14.2.2.1. Viral Vector

14.2.2.1.1. Lentiviral Vector

14.2.2.1.2. Adeno-associated Virus Vectors

14.2.2.1.3. Other Viral Vectors

14.2.2.2. Non-viral Vector

14.2.2.2.1. Electroporation

14.2.2.2.2. Other Non-viral Vectors

14.3. Market Value Forecast, by Product Type, 2017-2031

14.3.1. Consumables

14.3.2. Equipment

14.3.2.1. Cell Processing Equipment

14.3.2.2. Single-use Equipment

14.3.2.3. Other Equipment

14.3.3. Software & Systems

14.4. Market Value Forecast, by Technology, 2017-2031

14.4.1. Cell Culture & Expansion

14.4.2. Viral Vector Production

14.4.3. Cell Sorting & Purification

14.4.4. Gene Editing

14.4.5. Others

14.5. Market Value Forecast, by Indication, 2017-2031

14.5.1. Oncology Disease

14.5.2. Cardiovascular Disease

14.5.3. Orthopedic Disease

14.5.4. Infectious Disease

14.5.5. Others

14.6. Market Value Forecast, by End-user, 2017-2031

14.6.1. Pharmaceutical & Biotechnology Companies

14.6.2. Contract Manufacturing Organizations (CMOs)

14.7. Market Value Forecast, by Country/Sub-region, 2017-2031

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Therapy Type

14.8.2. By Product Type

14.8.3. By Technology

14.8.4. By Indication

14.8.5. By End-user

14.8.6. By Country/Sub-region

15. Latin America Cell and Gene Therapy Manufacturing Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Therapy Type, 2017-2031

15.2.1. Cell Therapy

15.2.1.1. Allogeneic

15.2.1.1.1. Mesenchymal Stem Cells

15.2.1.1.2. T-cells

15.2.1.1.3. Induced Pluripotent Stem Cells

15.2.1.1.4. Natural Killer Cells

15.2.1.1.5. Hematopoietic Stem Cells

15.2.1.1.6. Others

15.2.1.2. Autologous

15.2.1.2.1. T-cells

15.2.1.2.2. Hematopoietic Stem Cells

15.2.1.2.3. Mesenchymal Stem Cells

15.2.1.2.4. Natural Killer Cells

15.2.1.2.5. Others

15.2.2. Gene Therapy

15.2.2.1. Viral Vector

15.2.2.1.1. Lentiviral Vector

15.2.2.1.2. Adeno-associated Virus Vectors

15.2.2.1.3. Other Viral Vectors

15.2.2.2. Non-viral Vector

15.2.2.2.1. Electroporation

15.2.2.2.2. Other Non-viral Vectors

15.3. Market Value Forecast, by Product Type, 2017-2031

15.3.1. Consumables

15.3.2. Equipment

15.3.2.1. Cell Processing Equipment

15.3.2.2. Single-use Equipment

15.3.2.3. Other Equipment

15.3.3. Software & Systems

15.4. Market Value Forecast, by Technology, 2017-2031

15.4.1. Cell Culture & Expansion

15.4.2. Viral Vector Production

15.4.3. Cell Sorting & Purification

15.4.4. Gene Editing

15.4.5. Others

15.5. Market Value Forecast, by Indication, 2017-2031

15.5.1. Oncology Disease

15.5.2. Cardiovascular Disease

15.5.3. Orthopedic Disease

15.5.4. Infectious Disease

15.5.5. Others

15.6. Market Value Forecast, by End-user, 2017-2031

15.6.1. Pharmaceutical & Biotechnology Companies

15.6.2. Contract Manufacturing Organizations (CMOs)

15.7. Market Value Forecast, by Country/Sub-region, 2017-2031

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Therapy Type

15.8.2. By Product Type

15.8.3. By Technology

15.8.4. By Indication

15.8.5. By End-user

15.8.6. By Country/Sub-region

16. Middle East & Africa Cell and Gene Therapy Manufacturing Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Therapy Type, 2017-2031

16.2.1. Cell Therapy

16.2.1.1. Allogeneic

16.2.1.1.1. Mesenchymal Stem Cells

16.2.1.1.2. T-cells

16.2.1.1.3. Induced Pluripotent Stem Cells

16.2.1.1.4. Natural Killer Cells

16.2.1.1.5. Hematopoietic Stem Cells

16.2.1.1.6. Others

16.2.1.2. Autologous

16.2.1.2.1. T-cells

16.2.1.2.2. Hematopoietic Stem Cells

16.2.1.2.3. Mesenchymal Stem Cells

16.2.1.2.4. Natural Killer Cells

16.2.1.2.5. Others

16.2.2. Gene Therapy

16.2.2.1. Viral Vector

16.2.2.1.1. Lentiviral Vector

16.2.2.1.2. Adeno-associated Virus Vectors

16.2.2.1.3. Other Viral Vectors

16.2.2.2. Non-viral Vector

16.2.2.2.1. Electroporation

16.2.2.2.2. Other Non-viral Vectors

16.3. Market Value Forecast, by Product Type, 2017-2031

16.3.1. Consumables

16.3.2. Equipment

16.3.2.1. Cell Processing Equipment

16.3.2.2. Single-use Equipment

16.3.2.3. Other Equipment

16.3.3. Software & Systems

16.4. Market Value Forecast, by Technology, 2017-2031

16.4.1. Cell Culture & Expansion

16.4.2. Viral Vector Production

16.4.3. Cell Sorting & Purification

16.4.4. Gene Editing

16.4.5. Others

16.5. Market Value Forecast, by Indication, 2017-2031

16.5.1. Oncology Disease

16.5.2. Cardiovascular Disease

16.5.3. Orthopedic Disease

16.5.4. Infectious Disease

16.5.5. Others

16.6. Market Value Forecast, by End-user, 2017-2031

16.6.1. Pharmaceutical & Biotechnology Companies

16.6.2. Contract Manufacturing Organizations (CMOs)

16.7. Market Value Forecast, by Country/Sub-region, 2017-2031

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Therapy Type

16.8.2. By Product Type

16.8.3. By Technology

16.8.4. By Indication

16.8.5. By End-user

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player - Competition Matrix (By Tier and Size of Companies)

17.2. Market Share Analysis, by Company (2022)

17.3. Company Profiles

17.3.1. Becton, Dickinson and Company

17.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.1.2. Product Portfolio

17.3.1.3. Financial Overview

17.3.1.4. SWOT Analysis

17.3.1.5. Strategic Overview

17.3.2. Bio-Rad Laboratories, Inc.

17.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.2.2. Product Portfolio

17.3.2.3. Financial Overview

17.3.2.4. SWOT Analysis

17.3.2.5. Strategic Overview

17.3.3. Bio-Techne Corporation

17.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.3.2. Product Portfolio

17.3.3.3. Financial Overview

17.3.3.4. SWOT Analysis

17.3.3.5. Strategic Overview

17.3.4. Danaher Corporation

17.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.4.2. Product Portfolio

17.3.4.3. Financial Overview

17.3.4.4. SWOT Analysis

17.3.4.5. Strategic Overview

17.3.5. General Electric Company (GE Healthcare)

17.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.5.2. Product Portfolio

17.3.5.3. Financial Overview

17.3.5.4. SWOT Analysis

17.3.5.5. Strategic Overview

17.3.6. Getinge AB

17.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.6.2. Product Portfolio

17.3.6.3. Financial Overview

17.3.6.4. SWOT Analysis

17.3.6.5. Strategic Overview

17.3.7. Lonza Group Ltd.

17.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.7.2. Product Portfolio

17.3.7.3. Financial Overview

17.3.7.4. SWOT Analysis

17.3.7.5. Strategic Overview

17.3.8. Merck KGaA

17.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.8.2. Product Portfolio

17.3.8.3. Financial Overview

17.3.8.4. SWOT Analysis

17.3.8.5. Strategic Overview

17.3.9. Sartorius AG (Sartorius Stedim Biotech S.A.)

17.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.9.2. Product Portfolio

17.3.9.3. Financial Overview

17.3.9.4. SWOT Analysis

17.3.9.5. Strategic Overview

17.3.10. Thermo Fisher Scientific Inc.

17.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.10.2. Product Portfolio

17.3.10.3. Financial Overview

17.3.10.4. SWOT Analysis

17.3.10.5. Strategic Overview

17.3.11. MaxCyte

17.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.11.2. Product Portfolio

17.3.11.3. Financial Overview

17.3.11.4. SWOT Analysis

17.3.11.5. Strategic Overview

17.3.12. Fresenius Medical Care AG & Co. KGaA

17.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.12.2. Product Portfolio

17.3.12.3. Financial Overview

17.3.12.4. SWOT Analysis

17.3.12.5. Strategic Overview

List of Tables

Table 01: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Therapy Type, 2017-2031

Table 02: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Cell Therapy, 2017-2031

Table 03: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Allogeneic, 2017-2031

Table 04: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Autologous, 2017-2031

Table 05: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Gene Therapy, 2017-2031

Table 06: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Gene Therapy, 2017-2031

Table 07: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Viral Vector, 2017-2031

Table 08: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Non-viral Vector, 2017-2031

Table 09: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 10: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 11: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 12: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 13: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 14: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 15: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Therapy Type, 2017-2031

Table 16: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Cell Therapy, 2017-2031

Table 17: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Allogeneic, 2017-2031

Table 18: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Autologous, 2017-2031

Table 19: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Gene Therapy, 2017-2031

Table 20: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Viral Vector, 2017-2031

Table 21: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Non-viral Vector, 2017-2031

Table 22: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 23: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Equipment, 2017-2031

Table 24: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 25: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 26: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 27: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 28: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Therapy Type, 2017-2031

Table 29: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Cell Therapy, 2017-2031

Table 30: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Allogeneic, 2017-2031

Table 31: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Autologous, 2017-2031

Table 32: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Gene Therapy, 2017-2031

Table 33: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Viral Vector, 2017-2031

Table 34: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Non-viral Vector, 2017-2031

Table 35: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 36: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Equipment, 2017-2031

Table 37: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 38: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 39: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 40: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 41: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Therapy Type, 2017-2031

Table 42: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Cell Therapy, 2017-2031

Table 43: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Allogeneic, 2017-2031

Table 44: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Autologous, 2017-2031

Table 45: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Gene Therapy, 2017-2031

Table 46: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Viral Vector, 2017-2031

Table 47: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Non-viral Vector, 2017-2031

Table 48: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 49: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Equipment, 2017-2031

Table 50: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 51: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 52: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 53: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 54: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Therapy Type, 2017-2031

Table 55: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Cell Therapy, 2017-2031

Table 56: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Allogeneic, 2017-2031

Table 57: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Autologous, 2017-2031

Table 58: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Gene Therapy, 2017-2031

Table 59: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Viral Vector, 2017-2031

Table 60: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Non-viral Vector, 2017-2031

Table 61: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 62: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Equipment, 2017-2031

Table 63: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 64: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 65: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 66: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 67: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Therapy Type, 2017-2031

Table 68: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Cell Therapy, 2017-2031

Table 69: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Allogeneic, 2017-2031

Table 70: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Autologous, 2017-2031

Table 71: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Gene Therapy, 2017-2031

Table 72: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Viral Vector, 2017-2031

Table 73: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Non-viral Vector, 2017-2031

Table 74: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 75: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Equipment, 2017-2031

Table 76: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 77: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 78: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Cell and Gene Therapy Manufacturing Market Value Share, by Therapy Type, 2022

Figure 03: Global Cell and Gene Therapy Manufacturing Market Value Share, by Product Type, 2022

Figure 04: Global Cell and Gene Therapy Manufacturing Market Value Share, by Indication, 2022

Figure 05: Global Cell and Gene Therapy Manufacturing Market Value Share, by Technology, 2022

Figure 06: Global Cell and Gene Therapy Manufacturing Market Value Share, by End-user, 2022

Figure 07: Global Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Therapy Type, 2022 and 2031

Figure 08: Global Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Therapy Type, 2023-2031

Figure 09: Global Cell and Gene Therapy Manufacturing Market Revenue (US$ Mn), by Cell Therapy, 2017-2031

Figure 10: Global Cell and Gene Therapy Manufacturing Market Revenue (US$ Mn), by Gene Therapy, 2017-2031

Figure 11: Global Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 12: Global Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 13: Global Cell and Gene Therapy Manufacturing Market Revenue (US$ Mn), by Consumables, 2017-2031

Figure 14: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn), by Viral Vector Production, 2017‒2031

Figure 15: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn), by Others, 2017‒2031

Figure 16: Global Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 17: Global Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Technology 2023-2031

Figure 18: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn), by Cell Culture & Expansion, 2017‒2031

Figure 19: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn), by Viral Vector Production, 2017‒2031

Figure 20: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn), by Irreversible Cell Sorting & Purification, 2017‒2031

Figure 21: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn), by Gene Editing, 2017‒2031

Figure 22: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn), by Others, 2017‒2031

Figure 23: Global Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Indication, 2022 and 2031

Figure 24: Global Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, Indication, 2023-2031

Figure 25: Global Cell and Gene Therapy Manufacturing Market Revenue (US$ Mn), by Oncology, 2017-2031

Figure 26: Global Cell and Gene Therapy Manufacturing Market Revenue (US$ Mn), by Cardiovascular Disorders, 2017-2031

Figure 27: Global Cell and Gene Therapy Manufacturing Market Revenue (US$ Mn), by Orthopedic Disease, 2017-2031

Figure 28: Global Cell and Gene Therapy Manufacturing Market Revenue (US$ Mn), by Infectious Disease, 2017-2031

Figure 29: Global Cell and Gene Therapy Manufacturing Market Value (US$ Mn), by Others, 2017‒2031

Figure 30: Global Cell and Gene Therapy Manufacturing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 31: Global Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 32: Global Cell and Gene Therapy Manufacturing Market Revenue (US$ Mn), by Pharmaceutical & Biotechnology Companies, 2017-2031

Figure 33: Global Cell and Gene Therapy Manufacturing Market Revenue (US$ Mn), by Contract Manufacturing Organizations (CMOs), 2017-2031

Figure 34: Global Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Region, 2022 and 2031

Figure 35: Global Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Region, 2023-2031

Figure 36: North America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, 2017-2031

Figure 37: North America Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Country, 2022 and 2031

Figure 38: North America Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Country, 2023-2031

Figure 39: North America Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Therapy Type, 2022 and 2031

Figure 40: North America Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Therapy Type, 2023-2031

Figure 41: North America Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 42: North America Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 43: North America Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 44: North America Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Technology 2023-2031

Figure 45: North America Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Indication, 2022 and 2031

Figure 46: North America Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, Indication, 2023-2031

Figure 47: North America Cell and Gene Therapy Manufacturing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 48: North America Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 49: Europe Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, 2017-2031

Figure 50: Europe Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 51: Europe Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 52: Europe Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Therapy Type, 2022 and 2031

Figure 53: Europe Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Therapy Type, 2023-2031

Figure 54: Europe Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 55: Europe Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 56: Europe Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 57: Europe Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Technology 2023-2031

Figure 58: Europe Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Indication, 2022 and 2031

Figure 59: Europe Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, Indication, 2023-2031

Figure 60: Europe Cell and Gene Therapy Manufacturing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 61: Europe Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 62: Asia Pacific Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, 2017-2031

Figure 63: Asia Pacific Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 64: Asia Pacific Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 65: Asia Pacific Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Therapy Type, 2022 and 2031

Figure 66: Asia Pacific Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Therapy Type, 2023-2031

Figure 67: Asia Pacific Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 68: Asia Pacific Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 69: Asia Pacific Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 70: Asia Pacific Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Technology 2023-2031

Figure 71: Asia Pacific Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Indication, 2022 and 2031

Figure 72: Asia Pacific Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, Indication, 2023-2031

Figure 73: Asia Pacific Cell and Gene Therapy Manufacturing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 74: Asia Pacific Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 75: Latin America Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, 2017-2031

Figure 76: Latin America Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 77: Latin America Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 78: Latin America Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Therapy Type, 2022 and 2031

Figure 79: Latin America Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Therapy Type, 2023-2031

Figure 80: Latin America Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 81: Latin America Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 82: Latin America Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 83: Latin America Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Technology 2023-2031

Figure 84: Latin America Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Indication, 2022 and 2031

Figure 85: Latin America Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, Indication, 2023-2031

Figure 86: Latin America Cell and Gene Therapy Manufacturing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 87: Latin America Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by End-user, 2023-2031

Figure 88: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value (US$ Mn) Forecast, 2017-2031

Figure 89: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 90: Middle East & Africa Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 91: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Therapy Type, 2022 and 2031

Figure 92: Middle East & Africa Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Therapy Type, 2023-2031

Figure 93: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 94: Middle East & Africa Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 95: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Technology, 2022 and 2031

Figure 96: Middle East & Africa Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by Technology 2023-2031

Figure 97: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value Share Analysis, by Indication, 2022 and 2031

Figure 98: Middle East & Africa Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, Indication, 2023-2031

Figure 99: Middle East & Africa Cell and Gene Therapy Manufacturing Market Value Share Analysis, by End-user, 2022 and 2031

Figure 100: Middle East & Africa Cell and Gene Therapy Manufacturing Market Attractiveness Analysis, by End-user, 2023-2031